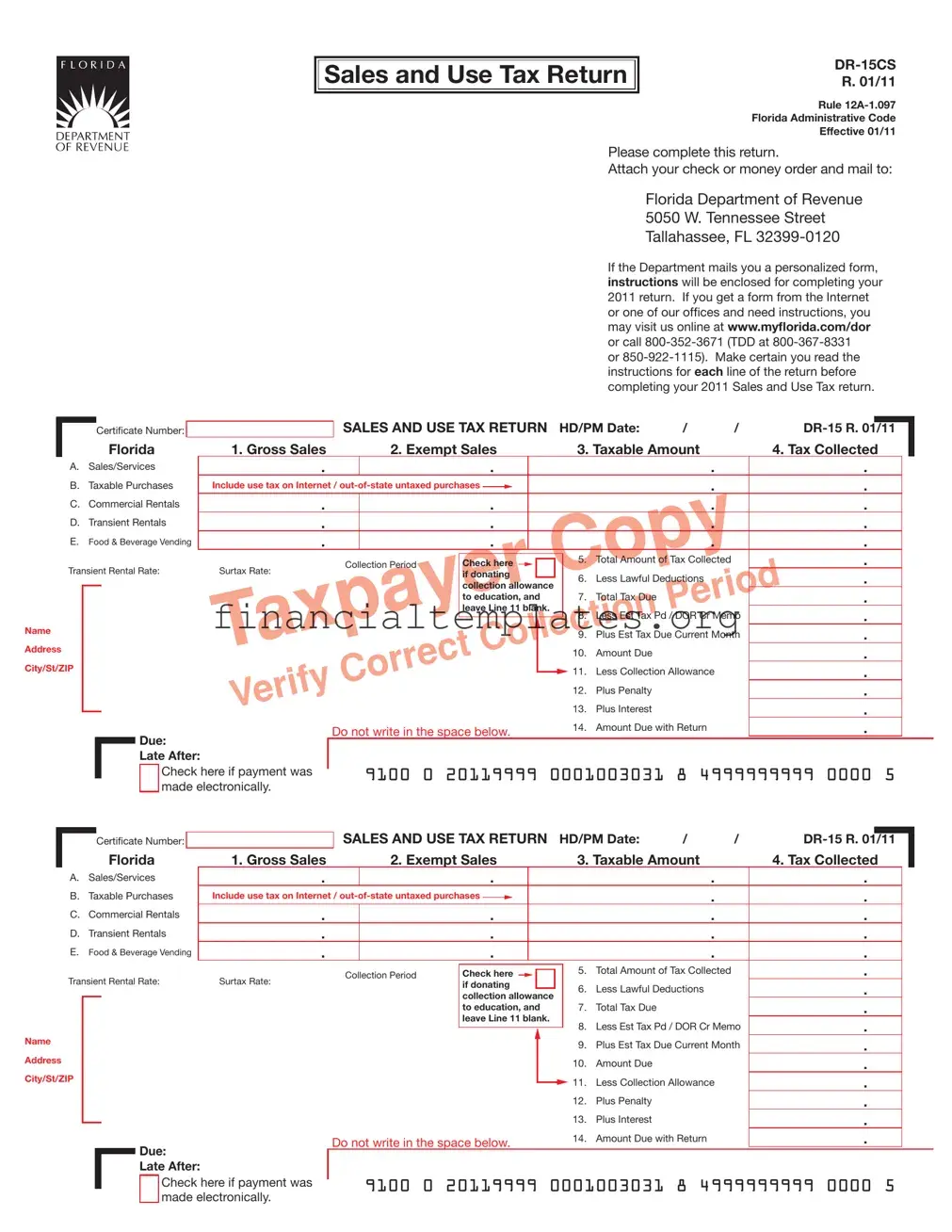

Get Florida Sales Tax Form

Understanding the nuances of the Florida Sales Tax form can prove to be vital for businesses operating within the state. This comprehensive document, officially recognized as DR-15, plays a crucial role in ensuring that companies accurately report both their taxable and exempt sales, among other financial transactions, to the Florida Department of Revenue. The form, which must be completed with precision, requires businesses to detail their gross sales, exempt sales, the taxable amount, tax collected, and deductions, to name but a few. It also addresses the inclusion of use tax for untaxed purchases made out-of-state or via the internet, incorporating various types of sales from services to transient rentals and even vending machine transactions. An interesting feature is the ability for businesses to donate their collection allowance to education, a gesture that promotes both compliance and community support. Additionally, the form delves into discretionary sales surtax rates that vary by county and are applied to certain transactions, highlighting the importance of understanding local tax obligations. Other notable sections cover penalties for fraud, tax credits for enterprise zones, and specific rates for unique items like dyed diesel fuel and electric power. Each line on the form comes with specific instructions, ensuring businesses can navigate their tax responsibilities accurately, reducing the risk of penalization for incorrect filings. Through proper completion and submission of this form, businesses not only adhere to legal requirements but also contribute to Florida's economic stability and growth.

Florida Sales Tax Example

Sales and Use Tax Return

Sales and Use Tax Return

R. 01/11

Rule

Florida Administrative Code

Effective 01/11

Please complete this return.

Attach your check or money order and mail to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida Department of Revenue |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5050 W. Tennessee Street |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tallahassee, FL |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If the Department mails you a personalized form, |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

instructions will be enclosed for completing your |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 return. If you get a form from the Internet |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or one of our ofices and need instructions, you |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

may visit us online at www.mylorida.com/dor |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or call |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

instructions for each line of the return before |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

completing your 2011 Sales and Use Tax return. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES AND USE TAX RETURN |

HD/PM Date: |

/ |

/ |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

Certiicate Number: |

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

Florida |

1. Gross Sales |

|

|

2. Exempt Sales |

|

|

3. Taxable Amount |

|

4. Tax Collected |

|

|

||||||||||||||||

|

|

A. |

Sales/Services |

|

. |

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

|||||||

|

|

B. |

Taxable Purchases |

|

Include use tax on Internet / |

|

|

|

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

C. |

Commercial Rentals |

|

. |

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

|||||||

|

|

D. |

Transient Rentals |

|

. |

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

|||||||

|

|

E. |

Food & Beverage Vending |

|

. |

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Amount of Tax Collected |

|

. |

|

|

|

|

|||||||

|

|

Transient Rental Rate: |

Surtax Rate: |

|

Collection Period |

Check here |

|

|

|

|

|

5. |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

if donating |

|

|

|

6. |

Less Lawful Deductions |

|

. |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

collection allowance |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to education, and |

|

7. |

Total Tax Due |

|

|

. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

leave Line 11 blank. |

|

|

|

|

|

|

|

|

|

|

|

||||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Less Est Tax Pd / DOR Cr Memo |

. |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Plus Est Tax Due Current Month |

. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Amount Due |

|

|

. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City/St/ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Less Collection Allowance |

|

. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Plus Penalty |

|

|

. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Plus Interest |

|

|

. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Due: |

|

Do not write in the space below. |

14. |

Amount Due with Return |

|

. |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

Late After: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Check here if payment was |

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

9100 0 20119999 0001003031 8 4999999999 0000 5 |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

made electronically. |

|

SALES AND USE TAX RETURN |

HD/PM Date: |

/ |

/ |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

Certiicate Number: |

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

Florida |

1. Gross Sales |

|

|

2. Exempt Sales |

|

|

3. Taxable Amount |

|

4. Tax Collected |

|

|

||||||||||||||||

|

|

A. |

Sales/Services |

|

. |

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

|||||||

|

|

B. |

Taxable Purchases |

|

Include use tax on Internet / |

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

C. |

Commercial Rentals |

|

. |

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

|||||||

|

|

D. |

Transient Rentals |

|

. |

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

|||||||

|

|

E. |

Food & Beverage Vending |

|

. |

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

|

. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Amount of Tax Collected |

|

. |

|

|

|

|

||||||||

|

|

Transient Rental Rate: |

Surtax Rate: |

|

Collection Period |

Check here |

|

|

|

|

5. |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

if donating |

|

|

6. |

Less Lawful Deductions |

|

. |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

collection allowance |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to education, and |

|

7. |

Total Tax Due |

|

|

. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

leave Line 11 blank. |

|

|

|

|

|

|

|

|

|

|

|

||||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Less Est Tax Pd / DOR Cr Memo |

. |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Plus Est Tax Due Current Month |

. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Amount Due |

|

|

. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City/St/ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Less Collection Allowance |

|

. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Plus Penalty |

|

|

. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Plus Interest |

|

|

. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Due: |

|

Do not write in the space below. |

14. |

Amount Due with Return |

|

. |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

Late After: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Check here if payment was |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

9100 0 20119999 0001003031 8 4999999999 0000 5 |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

made electronically. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Proper Collection of Tax: Florida’s general sales tax rate is 6 percent; however, there is an established “bracket system” for calculating the tax due when any part of each total taxable sale is less than a whole dollar amount. Other rates may also apply. See instructions.

Discretionary Sales Surtax: Most counties levy a discretionary sales surtax on most transactions subject to sales and use tax. These taxes are distributed to local governments throughout the state. The amount of money distributed is based on how you complete your tax return, especially the lines on the back of the return. Dealers should impose discretionary sales surtax on taxable sales when delivery or use occurs in a county that imposes surtax. Please see Form

Fraud Penalties: There are speciic penalties imposed for fraud, fraudulent claim of exemption, failure to collect and pay over, or an attempt to evade or defeat the sales tax. Please see the instructions for detailed information regarding the penalties, ines, and punishments for certain sales tax offenses.

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true (sections 92.525(2), 212.12, and 837.06, Florida Statutes).

Signature of Taxpayer |

Date |

Signature of Preparer |

Date |

( ___________ ) ____________________________________________ |

|

( ___________ ) ____________________________________________ |

|

Telephone Number |

|

Telephone Number |

|

Discretionary Sales Surtax ( Lines 15(a) through 15(d) )

15(a). |

Exempt Amount of Items Over $5,000 (included in Column 3) |

15(a). _________________________________ |

15(b). |

Other Taxable Amounts NOT Subject to Surtax (included in Column 3) |

15(b). _________________________________ |

15(c). |

Amounts Subject to Surtax at a Rate Different Than Your County Surtax Rate (included in Column 3) |

15(c). _________________________________ |

15(d). |

Total Amount of Discretionary Sales Surtax Collected (included in Column 4) |

15(d). _________________________________ |

16. |

Total Enterprise Zone Jobs Credits (included in Line 6) |

16. _________________________________ |

17. |

Taxable Sales/Untaxed Purchases of Electric Power or Energy — 7% Rate (included in Line A) |

17. _________________________________ |

18. |

Taxable Sales/Untaxed Purchases of Dyed Diesel Fuel — 6% Rate (included in Line A) |

18. _________________________________ |

19. |

Taxable Sales from Amusement Machines (included in Line A) |

19. _________________________________ |

20. |

Rural and/or Urban High Crime Area Job Tax Credits |

20. _________________________________ |

21. |

Other Authorized Credits |

21. _________________________________ |

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true (sections 92.525(2), 212.12, and 837.06, Florida Statutes).

Signature of Taxpayer |

Date |

Signature of Preparer |

Date |

( ___________ ) ____________________________________________ |

|

( ___________ ) ____________________________________________ |

|

Telephone Number |

|

Telephone Number |

|

Discretionary Sales Surtax ( Lines 15(a) through 15(d) )

15(a). |

Exempt Amount of Items Over $5,000 (included in Column 3) |

15(a). _________________________________ |

15(b). |

Other Taxable Amounts NOT Subject to Surtax (included in Column 3) |

15(b). _________________________________ |

15(c). |

Amounts Subject to Surtax at a Rate Different Than Your County Surtax Rate (included in Column 3) |

15(c). _________________________________ |

15(d). |

Total Amount of Discretionary Sales Surtax Collected (included in Column 4) |

15(d). _________________________________ |

16. |

Total Enterprise Zone Jobs Credits (included in Line 6) |

16. _________________________________ |

17. |

Taxable Sales/Untaxed Purchases of Electric Power or Energy — 7% Rate (included in Line A) |

17. _________________________________ |

18. |

Taxable Sales/Untaxed Purchases of Dyed Diesel Fuel — 6% Rate (included in Line A) |

18. _________________________________ |

19. |

Taxable Sales from Amusement Machines (included in Line A) |

19. _________________________________ |

20. |

Rural and/or Urban High Crime Area Job Tax Credits |

20. _________________________________ |

21. |

Other Authorized Credits |

21. _________________________________ |

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Identification | DR-15CS, Revision January 2011 |

| Governing Rule | Rule 12A-1.097, Florida Administrative Code |

| Form Purpose | Sales and Use Tax Return |

| Effective Date | January 2011 |

| Submission Address | Florida Department of Revenue 5050 W. Tennessee Street Tallahassee, FL 32399-0120 |

| Instructions Availability | Instructions are provided with personalized forms or can be found online / requested by phone |

| Electronic Payment Indicator | Option to indicate if payment was made electronically |

| General Sales Tax Rate | 6 percent, with specific bracket systems for partial dollar amounts |

| Discretionary Sales Surtax | Varies by county, applies to most transactions subject to sales and use tax |

| Fraud Penalties | Specific penalties, including fines and punishment, are imposed for fraud and related offenses |

| Legal Declaration | Signature required under penalties of perjury, affirming the truthfulness of the information provided |

Guide to Writing Florida Sales Tax

Filling out the Florida Sales Tax form, known as form DR-15CS, is a regulatory obligation for businesses operating within the state. This document ensures that sales and use taxes are properly reported and remitted to the Florida Department of Revenue. The collected tax plays a critical role in supporting local communities and infrastructure, thus accurate completion is not only a legal requirement but a contribution to the state's welfare. Here's a step-by-step breakdown of how to accurately complete this form.

- Start by entering the HD/PM Date and your Certificate Number at the top of the form.

- Under "Gross Sales," report the total amount of all sales before any deductions.

- Enter the total of all exempt sales in the "Exempt Sales" section.

- Determine the taxable amount and enter this in the "Taxable Amount" section.

- Breakdown your tax collected as follows:

- A. Sales/Services - List the tax collected for all sales and services.

- B. Taxable Purchases - Include taxes on Internet and out-of-state untaxed purchases.

- C. Commercial Rentals - Enter tax collected on commercial rentals.

- D. Transient Rentals - Tax collected on transient rentals goes here.

- E. Food & Beverage Vending - Enter tax collected from food and beverage vending.

- Add the total amount of tax collected from all sources and input this figure.

- If applicable, check the box to donate the collection allowance to education, leaving Line 11 blank.

- Subtract lawful deductions in the "Less Lawful Deductions" section to find your total tax due.

- Adjust for any estimated tax paid or DOR credit memo amounts and estimated tax due for the current month.

- Enter the amount due, which includes adjustments for previous payments, estimates, and allowances.

- Calculate any penalty and interest if the form is submitted late and add these to the "Plus Penalty" and "Plus Interest" sections.

- The final amount due with the return is recorded in the "Amount Due with Return" line, considering all deductions, allowances, penalties, and interest.

- Indicate if the payment was made electronically by checking the appropriate box.

- For transactions involving discretionary sales surtax, follow detailed instructions for lines 15(a) through 15(d) to accurately report surtax collected.

- Also, properly report any enterprise zone jobs credits, taxable sales or untaxed purchases of specific items like electric power or dyed diesel fuel, amusement machine sales, and other authorized credits.

- Lastly, ensure both the taxpayer and the preparer sign and date the form, providing telephone numbers for both parties. This attests the accuracy of the information under penalties of perjury.

In concluding, filling out the DR-15CS form is more than a tax obligation; it's a step toward fulfilling your civic duties, contributing to the prosperity and functionality of Florida's communities, and supporting the local economy. Ensure that the form is completed in detail, adhering to the instructions provided, to avoid any legal or financial penalties. Keeping accurate records and staying informed on tax laws can greatly simplify this process, promoting compliance and peace of mind.

Understanding Florida Sales Tax

-

What is the Florida Sales and Use Tax Return?

The Florida Sales and Use Tax Return, referenced as form DR-15CS, is a document that businesses must complete for the reporting and payment of collected sales tax as well as use tax. This form helps businesses to detail gross sales, exempt sales, taxable amounts, and the tax collected for a given period. It is vital for ensuring compliance with Florida’s tax regulations.

-

How can one obtain and submit the Florida Sales and Use Tax Return?

Businesses can obtain the form by either visiting the Florida Department of Revenue's website at www.myflorida.com/dor or by receiving a personalized form through mail from the Department. Once completed, it should be mailed along with any payment due to the Florida Department of Revenue, 5050 W. Tennessee Street, Tallahassee, FL 32399-0120. Electronic submission options are also available for convenience.

-

What are taxable purchases and how should they be reported?

Taxable purchases include not only sales and services provided but also use of tax on internet and out-of-state untaxed purchases, commercial and transient rentals, and food & beverage vending. These should be accurately reported under the respective sections of the form to calculate the total amount of tax collected correctly.

-

What is the significance of the collection allowance?

The collection allowance is a benefit for businesses, allowing them to retain a small percentage of the tax collected as compensation for the expense of collecting the tax. Businesses can choose to donate this allowance to education by checking the appropriate box on the form and leaving Line 11 blank.

-

How are penalties and interest calculated on late submissions?

If the return and payment are submitted after the due date, penalties and interest may apply. The form outlines specific lines to calculate these additional charges. The formula for penalties and interest is detailed in the instructions for the form, which are designed to encourage timely compliance with tax obligations.

-

What is the Discretionary Sales Surtax?

This surtax refers to an additional tax imposed by most counties on transactions subject to the general sales and use tax. Its rate varies by county and is directed towards local governments. The form DR-15DSS and the Department’s website provide details on each county’s surtax rates. It's crucial for businesses to apply the correct surtax rate when delivering goods or services within these counties.

-

How does one calculate tax on sales that are less than a whole dollar amount?

Florida employs a "bracket system" for calculating tax due on sales where the total taxable amount involves fractional parts of a dollar. This system is essential for ensuring the precise calculation of taxes due on such sales, and further details on how to apply this system can be found in the instruction section of the form.

Common mistakes

When filling out the Florida Sales Tax form, DR-15CS, individuals often make mistakes that can affect the accuracy and timeliness of their tax reporting. Below are seven common errors identified:

Not separating exempt sales from gross sales: People often mistakenly report total sales without subtracting exempt sales. It's critical to differentiate between the two to avoid overstating the taxable amount.

Incorrectly calculating the taxable amount: Not properly calculating the taxable amount can lead to underpayment or overpayment of taxes. This mistake usually results from not understanding which items are taxable and which are not.

Failing to account for out-of-state untaxed purchases: If purchases are made out of state or on the internet and tax was not collected, users often forget to include use tax for these transactions on the form.

Omitting discretionary sales surtax: Many counties impose a discretionary sales surtax. The correct surtax rate depends on the county where the delivery or use occurs, and not adding this or using the wrong rate can lead to discrepancies.

Not utilizing available deductions: Some users do not take advantage of lawful deductions or credits, such as collection allowances or enterprise zone jobs credits, possibly because they are not aware of these benefits.

Misunderstanding the collection allowance option: Taxpayers often miss the opportunity to donate their collection allowance to education by checking the relevant box. This option, if chosen, should lead to leaving Line 11 blank.

Error in surtax calculation for items over $5,000: There is often confusion on how to report exempt amounts of items over $5,000 and other taxable amounts not subject to surtax. Incorrect reporting here affects the total amount of discretionary sales surtax due.

Awareness and careful attention to these points can reduce errors in filing the Florida Sales and Use Tax Return, ensuring compliance and avoiding potential penalties.

Documents used along the form

When businesses in Florida prepare to file their Sales and Use Tax Return, several additional forms and documents may also be of significance. These documents are integral to ensuring comprehensive compliance with tax regulations. Their purposes vary from reporting additional specific taxes to claiming exemptions or credits that may apply to a business. By understanding these components, entities can better navigate the nuances of Florida's tax landscape.

- Annual Resale Certificate for Sales Tax (Form DR-13): This certificate allows businesses to make tax-exempt purchases of goods and services that are intended for resale. The certificate needs to be presented to the vendor at the point of purchase to avoid the sales tax charge. It is valid for one calendar year, indicating the need for annual renewal.

- Discretionary Sales Surtax Information (Form DR-15DSS): This document supplements the Sales and Use Tax Return by offering detailed information about the discretionary sales surtax rates applicable in various counties. Businesses use this form to determine the correct surtax rate to collect from customers based on delivery or usage location.

- Application for Consumer's Certificate of Exemption (Form DR-5): Entities such as nonprofit organizations that qualify for sales tax exemption must file this form to receive a Consumer's Certificate of Exemption. The certificate allows them to purchase goods and services without paying sales tax, assuming the purchases qualify under the state’s exemption criteria.

- Florida Business Tax Application (Form DR-1): Though primarily used for registering a business for tax purposes, this form is a precursor to filing the Sales and Use Tax Return. It collects comprehensive information about the business, including its activities and locations, to determine its tax obligations across sales tax, use tax, and various other levies the business might be subject to.

Together, these documents form a framework that businesses must navigate when managing their sales and use tax responsibilities in Florida. Each form caters to specific facets of tax reporting and compliance, from establishing the business's initial tax registration to conducting day-to-day transactions in a manner that is congruent with state tax laws. Understanding and utilizing these forms correctly can significantly ease the administrative burden of tax compliance for businesses operating within the state.

Similar forms

The Federal Income Tax Return, commonly filed on Form 1040 by individuals in the United States, shares several similarities with the Florida Sales Tax Form. Both require detailed reporting of revenue—gross sales for businesses on the sales tax form and total income for individuals on the income tax return. Each form allows for deductions or exemptions that reduce the taxable amount, leading to a calculation of either tax due or a refund owed to the filer. The principle of subtracting allowable credits from gross income or sales to arrive at a net tax obligation is a core feature of both documents.

State Unemployment Tax Filing forms, which businesses use to report wages paid and unemployment taxes owed, bear resemblance to the Florida Sales Tax Form. Both types of forms necessitate the accurate reporting of financial transactions over a specific period. Furthermore, they both may result in either a payment due to the respective revenue department, based on the reported amounts, or a request for credit towards future filings.

The Commercial Rent Tax Return, specific to certain localities that impose additional taxes on rental property income, shares common ground with the Florida Sales Tax Form in terms of structure and purpose. Each form requires detailed accounting of gross receipts, permissible deductions, and the calculation of tax due. Both forms also have provisions for exemptions and credits that can affect the final tax liability.

Corporate Income Tax Returns, while focusing on the income of corporations, align with the Florida Sales Tax Form through their mutual requirement for detailed financial disclosures, calculation of a base amount subject to tax, and subsequent adjustments based on allowable deductions and credits. Both documents determine an entity’s tax responsibility to the state and might include schedules for specific types of income or deductions.

Business and Occupation (B&O) Tax forms, required in some states, resemble the Florida Sales Tax Form by focusing on the gross receipts of a business. Each form calculates tax based not on profit but on the total amount of business conducted. They also accommodate deductions specific to the type of business and the nature of the taxable activities, affecting the final tax calculated.

The Use Tax Return, closely related to sales tax, is used for reporting purchases on which no sales tax was paid at the time of purchase. It mirrors the Florida Sales Tax Form in its focus on ensuring that tax is paid on all eligible transactions, regardless of where the purchase was made. Both forms close tax gaps by capturing revenue from previously untaxed sales, including out-of-state purchases.

Excise Tax Returns, which apply to specific goods such as alcohol, tobacco, and fuel, share similarities with the Florida Sales Tax Form in their focus on particular types of transactions. Though excise taxes are more narrowly focused, both forms require accurate reporting of taxable sales or usage, permit some deductions or exemptions, and calculate a tax due based on specific rates applicable to the goods or services being taxed.

Transient Rental Tax Returns, required for short-term lodging providers, and the Florida Sales Tax Form both deal with tax calculations based on gross receipts. They take into account exemptions and deductions specific to the industry, such as exempt stays or eligible deductions for the provider, leading to a computation of tax owed. The principle of itemizing gross income and subtracting specific allowances is central to both.

Gross Receipts Tax Forms, used by some states as a way to tax the total gross revenues of a company rather than its net income, parallel the Florida Sales Tax Form in their focus on top-line income. Both demand a comprehensive accounting of all revenue before deductions, and adjustments are made to arrive at the taxable amount. The overarching goal of capturing a broad snapshot of a business’s financial activities for tax purposes unites these forms.

Dos and Don'ts

Filling out the Florida Sales Tax Form, officially known as DR-15CS, is an important task for many businesses. To ensure accuracy and compliance with state laws, here are some essential dos and don'ts:

- Do thoroughly read the instructions provided with the form. This step is crucial for understanding how to correctly fill out each section, especially if it’s your first time or if there have been changes since the last filing.

- Do make sure to report all taxable and exempt sales accurately. Mistakes in reporting can lead to penalties or an audit by the Florida Department of Revenue.

- Do include use tax on Internet or out-of-state untaxed purchases, as failing to do so can result in interest and penalties.

- Do apply the correct sales surtax rates, which vary by county. Ensure you're up to date on these rates as they can change and affect your total tax due.

- Do check if you qualify for deductions or credits, such as the collection allowance, and apply them appropriately to reduce your tax liability.

- Don't forget to sign and date your return. An unsigned return is considered incomplete and may not be processed, potentially leading to late penalties.

- Don't leave any sections blank unless instructed. If a section does not apply, insert a “0” to indicate it was not overlooked.

- Don't send your payment separately from your return. They should be mailed together to the Florida Department of Revenue to ensure your payment is credited correctly.

- Don't ignore the deadlines for filing and payment. Late submissions are subject to penalties and interest charges, which can accumulate quickly.

By adhering to these guidelines, you can navigate the process of completing the Florida Sales Tax Form with confidence, ensuring timely and accurate filings that comply with state tax regulations.

Misconceptions

When it comes to navigating the complexities of the Florida Sales Tax form, several common misconceptions can lead to confusion. Understanding these can save time and prevent potential issues with tax submissions. Here’s a breakdown of six common misconceptions:

- Internet and out-of-state purchases aren't taxable: Many believe that if they buy products online or from another state where no sales tax is charged at the point of sale, they’re not liable to pay tax in Florida. However, the form explicitly requires the inclusion of use tax on these untaxed purchases, underlining the state's stance that tax is due on items used, consumed, or stored within Florida, regardless of where they were purchased.

- Only tangible goods are taxable: Some might think sales tax only applies to physical products. The form, however, indicates various categories, including services and rentals, highlighting the broader scope of what’s considered taxable, such as commercial rentals and transient rentals, not just tangible goods sold.

- Collection allowance is automatically applied: Another misunderstanding is that the collection allowance, which is a small compensation for the cost of collecting tax, is automatically deducted. Taxpayers must actively check a box to donate this allowance to education and leave Line 11 blank to benefit, showing that action is required to claim this allowance.

- The general sales tax rate applies to all: With Florida’s general sales tax rate at 6 percent, a common error is applying this flat rate across all taxable sales. The form instructs on the inclusion of discretionary sales surtax, varying by county, and a "bracket system" for partial dollar amounts, proving that multiple rates might apply and outlining that sales tax calculation can be more nuanced than applying a single statewide rate.

- All business types file the same: One might think all businesses in Florida use the same sales and use tax return form, neglecting that different forms or additional schedules might be required based on specific business activities, such as selling amusement machines or dealing in electricity and dyed diesel fuel. This variance necessitates a closer inspection of business activities against form requirements.

- Late submissions are the only reason for penalties: Lastly, it's wrongly believed that penalties are solely for late submissions. While this is a common reason, the form also mentions specific penalties for fraud, fraudulent claim of exemption, or attempts to evade the tax, underscoring the seriousness of accurate and honest filing beyond punctuality.

In dissecting these misconceptions, it becomes evident that a thorough understanding of the Florida Sales Tax form, careful attention to detail, and a proactive approach to tax liabilities are crucial for compliance. This not only ensures businesses operate within the law but also maximizes their financial efficiency through proper tax management.

Key takeaways

Filling out and utilizing the Florida Sales Tax form requires attention to detail and understanding of the state's tax regulations. Here are six key takeaways for businesses and individuals preparing this tax form:

- Understand the General Sales Tax Rate: Florida's sales tax rate sits at 6 percent. However, it's important to apply the "bracket system" for calculating taxes due on portions of sales that fall below a whole dollar. This ensures accurate tax computation and compliance with state laws.

- Account for Discretionary Sales Surtax: Many Florida counties impose an additional discretionary sales surtax. The rate of this surtax varies by county and applies to most transactions subject to sales and use tax. The form requires precise reporting in designated lines to ensure correct distribution to local governments.

- Reporting Exempt Sales: Correctly identifying and reporting sales that are exempt from taxes is crucial. Such exemptions might include certain types of organizations or sale transactions. Misreporting can lead to discrepancies and potential penalties.

- Include Internet and Out-of-State Purchases: For untaxed purchases made through the internet or from out-of-state, a use tax must be reported. This ensures compliance for goods that have not been taxed by a Florida vendor.

- Fraud Penalties: The form outlines specific penalties for fraud, including the fraudulent claim of exemptions, failure to collect or pay sales tax, and attempts to evade it. Understanding these penalties encourages accurate reporting and deters fraudulent behavior.

- Calculating and Claiming Credits: The form permits claiming certain credits, such as the Enterprise Zone Jobs Credits and credits for sales in rural or high-crime areas. Accurately calculating and claiming these credits can reduce the total tax burden.

It is essential for individuals and businesses to thoroughly review the instructions provided with the Florida Sales Tax form, or seek guidance online or through customer service lines to ensure accurate and compliant submissions. Mistakes or omissions can result in penalties, interest charges, or audits by the state. Taking the time to fill out the form accurately reflects a commitment to adhering to Florida's tax laws and supporting the proper functioning of local and state governments.

Popular PDF Documents

IRS 8853 - Ensure your medical savings work in your favor come tax season by effectively using IRS Form 8853 for reporting purposes.

Sba 1201 Loan Forgiveness - Emphasizes the employer's responsibility to certify the accuracy of the information provided under penalty of perjury.