Get First National Bank Statement Form

The First National Bank Statement form serves as a crucial document for individuals seeking to establish or maintain credit lines with the bank. Tailored to capture a comprehensive snapshot of one's financial condition, this form requires detailed information regarding personal assets, liabilities, income, and contingent liabilities. Applicants and co-applicants are prompted to furnish data ranging from cash reserves, securities, life insurance cash values, to details on closely held business investments and real estate owned, ensuring a thorough evaluation of financial health. The form also delves into personal details such as full names, social security numbers, addresses, employment history, and marital status, albeit with discretion advised for sensitive information relating to marital status in unsecured credit applications. Moreover, it encompasses schedules for other financial obligations, including loans, credit card debts, and any other liabilities, alongside contingent liabilities which could affect one's financial standing. Explicit instructions caution against submitting the completed form via unencrypted email for security purposes, underscoring the document's confidential nature. Equally important, it underscores the necessity for applicants to promptly report any significant changes in their financial condition to the bank. The form's meticulous design facilitates the bank's ability to make informed decisions regarding credit extension, reflecting its commitment to safeguarding both the financial interests of the institution and those of its clients.

First National Bank Statement Example

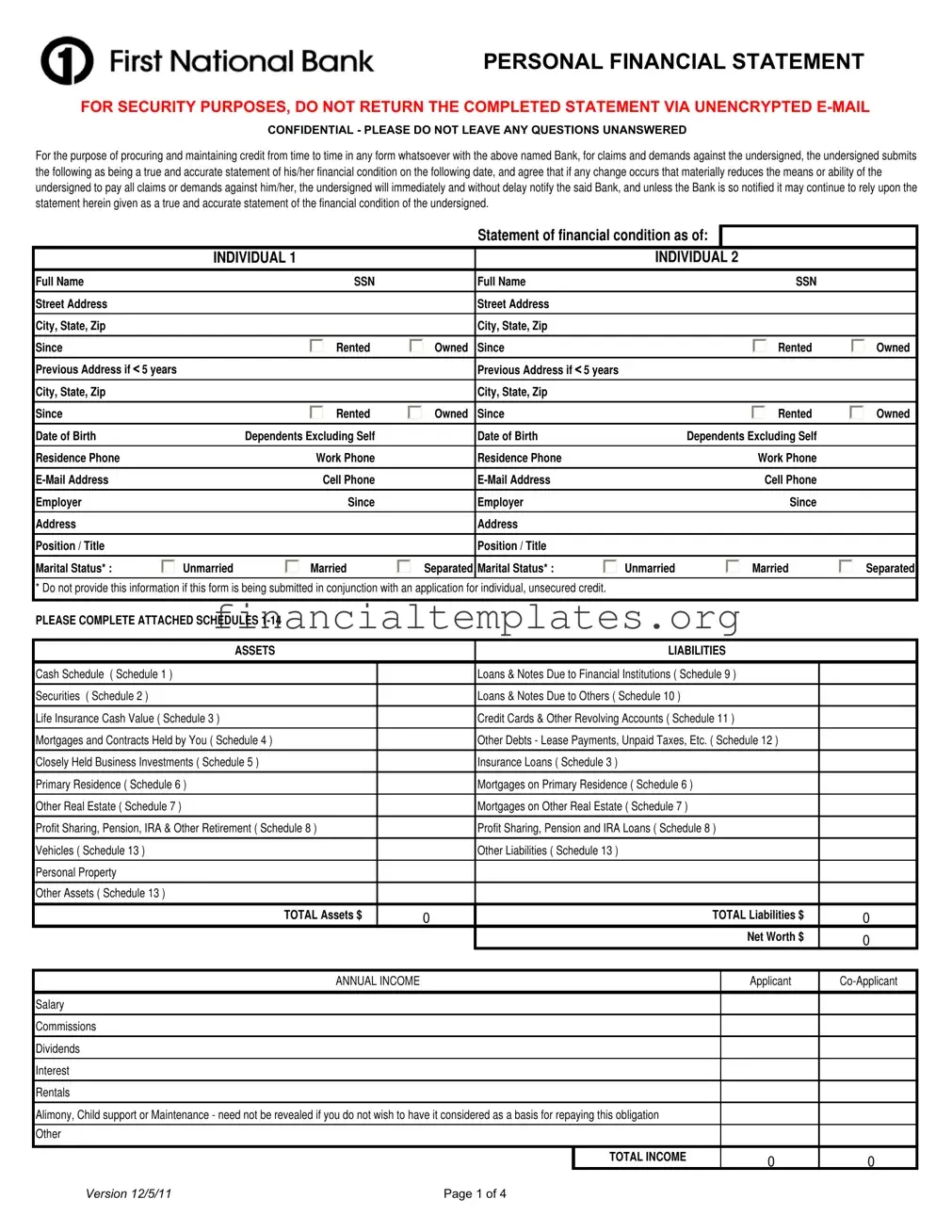

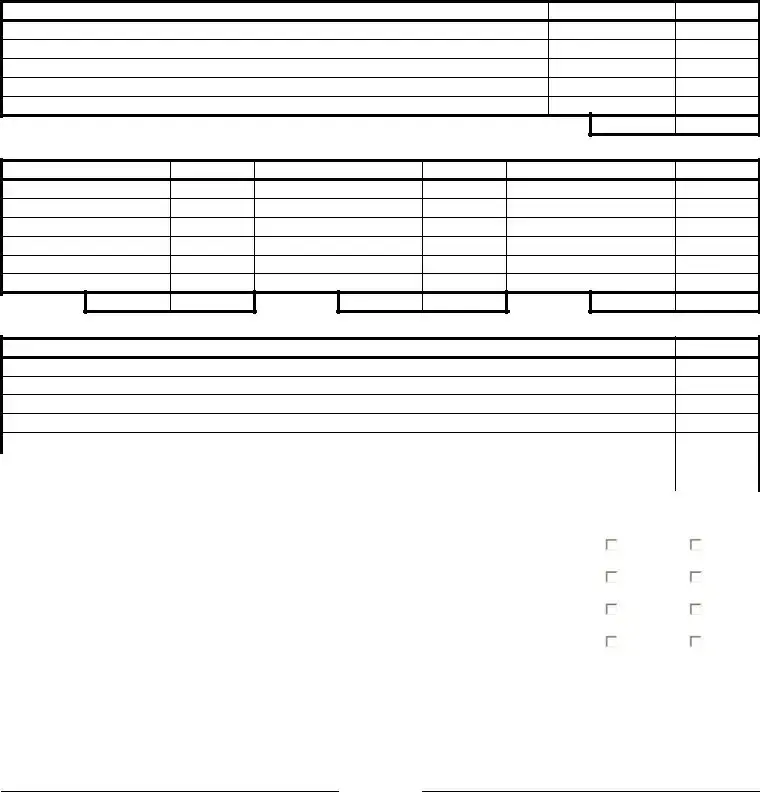

PERSONAL FINANCIAL STATEMENT

FOR SECURITY PURPOSES, DO NOT RETURN THE COMPLETED STATEMENT VIA UNENCRYPTED

CONFIDENTIAL - PLEASE DO NOT LEAVE ANY QUESTIONS UNANSWERED

For the purpose of procuring and maintaining credit from time to time in any form whatsoever with the above named Bank, for claims and demands against the undersigned, the undersigned submits the following as being a true and accurate statement of his/her financial condition on the following date, and agree that if any change occurs that materially reduces the means or ability of the undersigned to pay all claims or demands against him/her, the undersigned will immediately and without delay notify the said Bank, and unless the Bank is so notified it may continue to rely upon the statement herein given as a true and accurate statement of the financial condition of the undersigned.

|

|

|

|

|

Statement of financial condition as of: |

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

INDIVIDUAL 1 |

|

|

|

INDIVIDUAL 2 |

|

||||

|

|

|

|

|

|

|

|

|

||

Full Name |

|

SSN |

|

Full Name |

|

|

SSN |

|

||

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip |

|

|

|

|

City, State, Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Since |

|

Rented |

Owned |

Since |

|

|

Rented |

Owned |

||

|

|

|

|

|

|

|

|

|

|

|

Previous Address if < 5 years |

|

|

|

|

Previous Address if < 5 years |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip |

|

|

|

|

City, State, Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Since |

|

Rented |

Owned |

Since |

|

|

Rented |

Owned |

||

|

|

|

|

|

|

|

|

|||

Date of Birth |

|

Dependents Excluding Self |

|

Date of Birth |

|

Dependents Excluding Self |

|

|||

Residence Phone |

|

Work Phone |

|

Residence Phone |

|

|

Work Phone |

|

||

|

|

|

|

|

|

|

|

|

||

|

Cell Phone |

|

|

|

Cell Phone |

|

||||

|

|

|

|

|

|

|

|

|

||

Employer |

|

Since |

|

Employer |

|

|

Since |

|

||

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position / Title |

|

|

|

|

Position / Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Marital Status* : |

Unmarried |

Married |

Separated |

Marital Status* : |

Unmarried |

|

Married |

Separated |

||

|

|

|

|

|

|

|

|

|||

* Do not provide this information if this form is being submitted in conjunction with an application for individual, unsecured credit. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||

PLEASE COMPLETE ATTACHED SCHEDULES |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

LIABILITIES |

|

|||

|

|

|

|

|

|

|

|

|

||

Cash Schedule ( Schedule 1 ) |

|

|

|

|

Loans & Notes Due to Financial Institutions ( Schedule 9 ) |

|

||||

|

|

|

|

|

|

|

|

|

||

Securities ( Schedule 2 ) |

|

|

|

|

Loans & Notes Due to Others ( Schedule 10 ) |

|

|

|

||

Life Insurance Cash Value ( Schedule 3 ) |

|

|

|

Credit Cards & Other Revolving Accounts ( Schedule 11 ) |

|

|||||

|

|

|

|

|

||||||

Mortgages and Contracts Held by You ( Schedule 4 ) |

|

|

Other Debts - Lease Payments, Unpaid Taxes, Etc. ( Schedule 12 ) |

|

||||||

|

|

|

|

|

|

|

|

|||

Closely Held Business Investments ( Schedule 5 ) |

|

|

Insurance Loans ( Schedule 3 ) |

|

|

|

|

|||

|

|

|

|

|

|

|||||

Primary Residence ( Schedule 6 ) |

|

|

|

Mortgages on Primary Residence ( Schedule 6 ) |

|

|||||

|

|

|

|

|

|

|

||||

Other Real Estate ( Schedule 7 ) |

|

|

|

|

Mortgages on Other Real Estate ( Schedule 7 ) |

|

||||

|

|

|

|

|

||||||

Profit Sharing, Pension, IRA & Other Retirement ( Schedule 8 ) |

|

|

Profit Sharing, Pension and IRA Loans ( Schedule 8 ) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Vehicles ( Schedule 13 ) |

|

|

|

|

Other Liabilities ( Schedule 13 ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets ( Schedule 13 ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL Assets $ |

|

0 |

|

|

|

TOTAL Liabilities $ |

0 |

|

|

|

|

|

|

|

|

|

|

Net Worth $ |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL INCOME |

|

|

|

|

|

Applicant |

||

|

|

|

|

|

|

|

|

|

|

|

Salary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commissions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

|

|

|

Rentals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Alimony, Child support or Maintenance - need not be revealed if you do not wish to have it considered as a basis for repaying this obligation |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INCOME |

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

||

VERSION 12/5/11 |

|

|

|

Page 1 of 4 |

|

|

|

|

||

FOR SECURITY PURPOSES, DO NOT RETURN THE COMPLETED STATEMENT VIA UNENCRYPTED

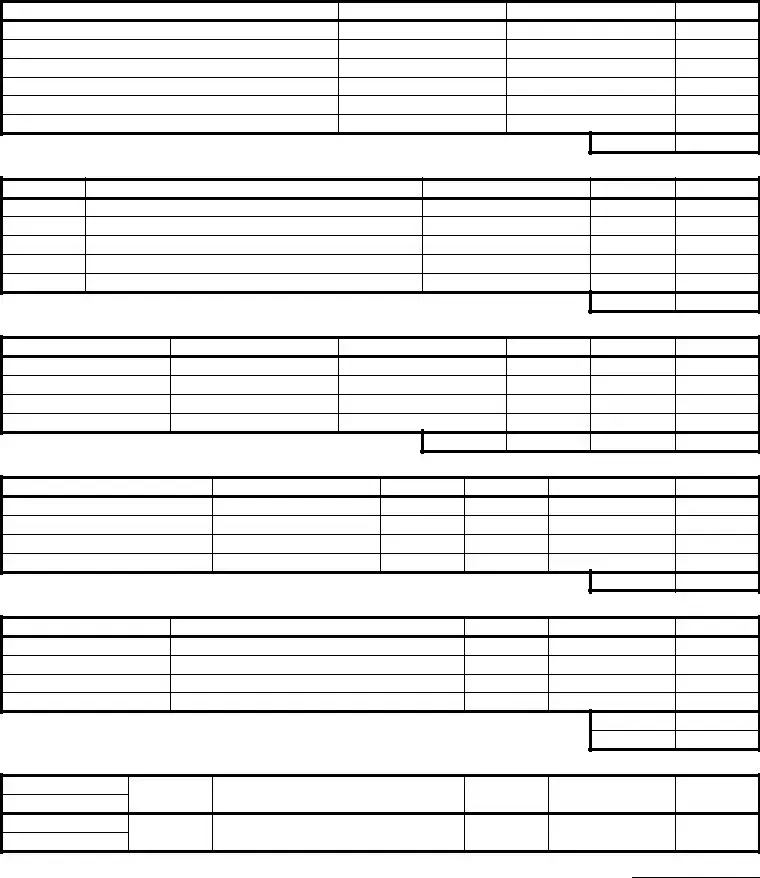

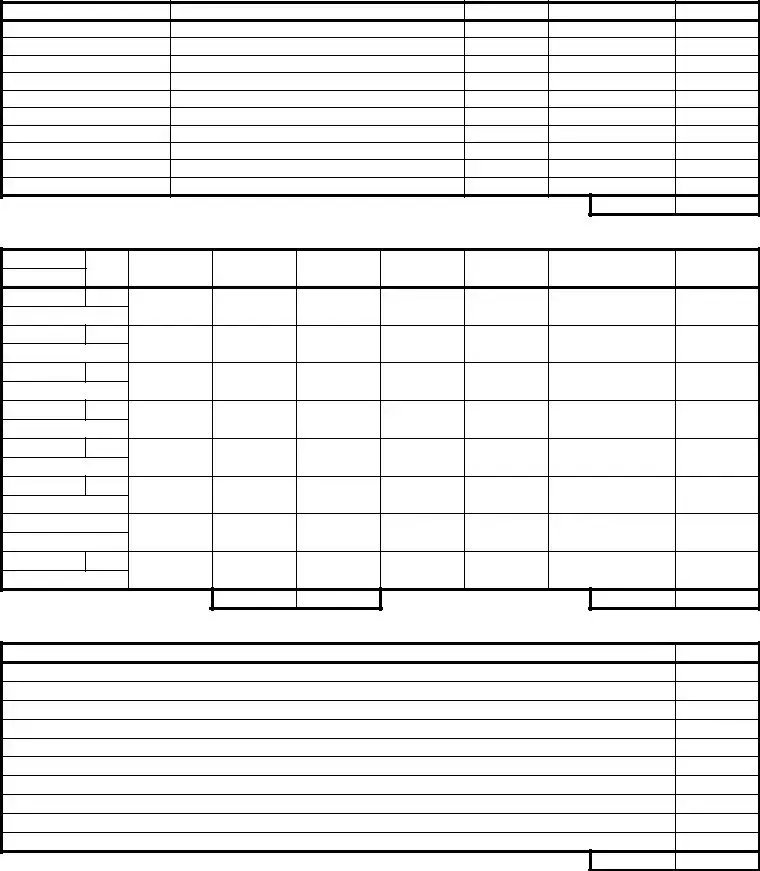

Schedule 1 / Cash, Savings, & Certificates of Deposit

Name of Bank or Financial Institution

How Owned JT, IND, Trust

Type of Account

Account Balance

TOTAL $

Schedule 2 / Securities Owned or Attach Brokerage Statements

0

No. of Shares

Description

Registered in Name(s) of

Listed / Unlisted

Current Market Value

TOTAL $

Schedule 3 / Life Insurance

0

Insurance Company

Insured

Beneficiary

Face Value of Policy Cash Value of Policy

Loans

TOTALS $

Schedule 4 / Receivables Due To Me on Mortgages and Contracts I Own

0

0

0

Name of Debtor

Description of Property

1st or 2nd Lien

Date of Maturity

Repayment Terms

Balance Due

TOTAL $

Schedule 5 / Closely Held Business Investments (attach additional schedule if necessary)

0

Company Name

Description of Business / Investment

Ownership (%)

Source of Value

Value

Attached Schedule

TOTAL $ |

0 |

Schedule 6 / Primary Residence

Year Acquired

Address

Name of Creditor

Purchase Price |

Mortgage Balance |

Maturity Date |

|

|

|

How Owned

JT, IND, Trust

Repayment Terms

Current Market

Value

Insurance Company |

|

Agent |

|

Phone |

|

|

|

|

|

VERSION 12/5/11 |

Page 2 of 4 |

FOR SECURITY PURPOSES, DO NOT RETURN THE COMPLETED STATEMENT VIA UNENCRYPTED

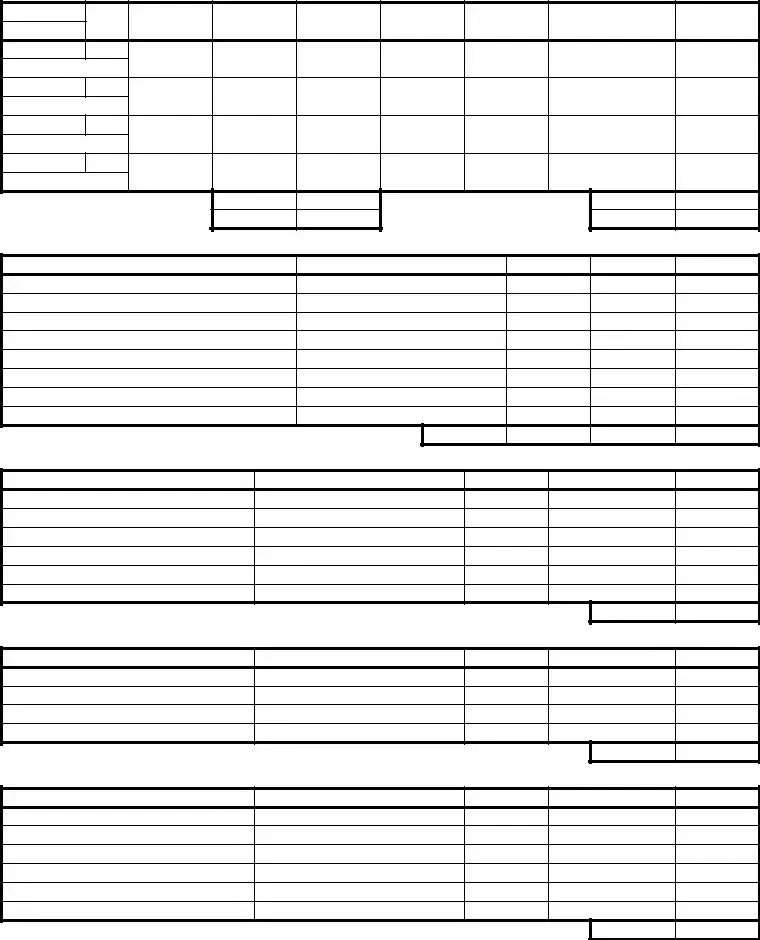

Schedule 7 / Other Real Estate Owned (attach additional schedule if necessary)

Property Type

Address

Year

Acquired

Name of Creditor

Purchase Price

Mortgage Balance

Maturity Date

How Owned

JT, IND, Trust

Repayment Terms

Current Market

Value

Attached Schedule |

|

TOTAL $ |

0 |

Schedule 8 / Profit Sharing, Pension, IRA Accounts & Other Retirement Accounts

Attached Schedule |

|

TOTAL $ |

0 |

Name of Institution

Type of Account

Account Balance

Vested Balance

Loans

TOTALS $

Schedule 9 / Loans & Notes Due to Financial Institutions

0

0

0

Name of Creditor

Collateral

Maturity Date

Repayment Terms

Balance Due

TOTAL $

Schedule 10 / Loans & Notes Due to Others

0

Name of Creditor

Collateral

Maturity Date

Repayment Terms

Balance Due

TOTAL $

Schedule 11 / Credit Cards & Other Revolving Accounts

0

Name of Creditor

Collateral

Maturity Date

Repayment Terms

Balance Due

TOTAL $

0

VERSION 12/5/11 |

Page 3 of 4 |

FOR SECURITY PURPOSES, DO NOT RETURN THE COMPLETED STATEMENT VIA UNENCRYPTED

Schedule 12 / Other Debts - Lease Payments, Unpaid Taxes, Etc.

Description

Repayment Terms

Balance Due

TOTAL $

Schedule 13 / Vehicles, Other Assets, and Other Liabilities

0

Vehicles (Describe)

Value

Other Assets (describe)

Value

Other Liabilities (describe)

Balance

TOTAL $

0

TOTAL $

0

TOTAL $

0

Schedule 14 / Contingent Liabilities - Endorser, Grantor, Lawsuits, For Taxes, Other (attach additional schedule if necessary)

Contingent Liabilities ( Describe ) |

Amount |

|

|

|

|

|

|

Attached Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL $ |

0 |

Name of Accountant |

|

Attorney |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

In the last 7 years, have you had any unsatisfied judgments or declared bankruptcy ?……………………………………………………………… |

|

||||||

In the last 7 years, have you had property foreclosed upon or given title or deed in lieu thereof ?…………………………………………………. |

|

||||||

Do you have any unused credit facilities at any other institutions ?…………….……………………………………………………………………….. |

|

||||||

|

|

|

|

Year |

|

||

Have you prepared a will and / or estate plan ? |

What Year ?………………………..…………………………………… |

|

|||||

|

|

|

|

|

|

|

|

You certify that the information provided in this statement is true and correct. So long as you owe any sums to the bank, you agree to give the bank prompt written notice of any material change in your financial condition and upon request, you agree to provide the bank with an updated personal financial statement. The bank is authorized to retain this personal financial statement whether or not credit is approved and is further authorized to verify by whatever means it deems necessary your credit and employment history or any other information in this statement. The submission of this form does not obligate the bank to make any loan even if you meet the normal standards the bank considers in determining whether to approve or deny an extension of credit.

Individual 1 Signature |

Date |

Individual 2 Signature |

Date |

VERSION 12/5/11 |

Page 4 of 4 |

|

|

Statement of financial condition as of: |

|

|

|

|

|

|

|

INDIVIDUAL 1 |

|

INDIVIDUAL 2 |

|

|

|

|

|

|

|

Full Name |

SSN |

Full Name |

SSN |

|

|

|

|

|

|

Schedule 5 / Closely Held Business Investments (continuation from main schedule)

Company Name

Description of Business / Investment

Ownership (%)

Source of Value

Value

SUBTOTAL $

Schedule 7 / Other Real Estate Owned (continuation from main schedule)

0

Property Type

Address

Year

Acquired

Name of Creditor

Purchase Price

Mortgage Balance

Maturity Date

How Owned JT, IND, Trust

Repayment Terms

Current Market

Value

SUBTOTAL $

0

SUBTOTAL $

0

Schedule 14 / Contingent Liabilities - Endorser, Grantor, Lawsuits, For Taxes, Other (continuation from main schedule)

Contingent Liabilities ( Describe )

Amount

SUBTOTAL $

0

Document Specifics

| Fact Name | Detail |

|---|---|

| Confidentiality Instruction | For security purposes, completed statements should not be returned via unencrypted e-mail. |

| Responsibility for Updates | If any material change occurs that reduces the undersigned's ability to pay, the bank must be notified immediately. |

| Information Required | The form requests detailed personal and financial information, including assets, liabilities, income, and contingent liabilities. |

| Marital Status Disclosure | Marital status information is requested but should not be provided if the form is submitted for individual, unsecured credit applications. |

Guide to Writing First National Bank Statement

Filling out the First National Bank Statement form is an important step in managing one’s finances or securing credit. This form helps the bank assess an individual's financial health by detailing assets, liabilities, income, and other critical financial information. It's essential to provide accurate and comprehensive details to avoid any complications or delays in the bank’s assessment process. Here’s a straightforward guide to completing the form.

- Start with the section titled "Statement of financial condition as of:" by entering the date you are completing the form.

- For "INDIVIDUAL 1" and "INDIVIDUAL 2," enter the full names and Social Security Numbers (SSNs) in the designated spaces.

- Fill in the street addresses, cities, states, zip codes, and check whether the residence is rented or owned. If you've been at your current address for less than five years, provide your previous address and mark the housing status accordingly.

- Enter your dates of birth and the number of dependents excluding yourself.

- Provide residence and work phone numbers, email addresses, and cell phone numbers.

- List your current employers, the length of your employment, employer addresses, and your positions or titles.

- Select your marital status. Remember, this field is optional if you are applying for individual, unsecured credit.

- Proceed to complete the attached schedules (1-14) as applicable to your situation. Schedule 1 starts with your cash, savings, and certificates of deposit. Be precise, entering names of banks, ownership details, account types, and balances.

- Continue through Schedules 2 through 14, providing detailed information about securities, life insurance cash values, receivables due, business investments, real estate, retirement accounts, vehicles, other assets, and liabilities including loans, credit cards, and others as requested.

- Summarize your total assets and liabilities at the end of the assets and liabilities sections to determine your net worth.

- Under "ANNUAL INCOME," list your and any co-applicant's salary, commissions, dividends, interest, rentals, alimony/child support/maintenance (if you choose), and other income to calculate the total income.

- For Schedules 1 through 14, fill in the details as instructed, including information about contingent liabilities in Schedule 14. If any schedule requires more space, attach an additional sheet following the form’s format.

- If applicable, indicate whether you've had any unsatisfied judgments, declared bankruptcy, had property foreclosed upon, have unused credit facilities, and include details about your will or estate plan.

- After reviewing the information, both individuals (if applicable) should sign and date the form where indicated on the last page.

- Remember: Do not return the completed form via unencrypted email for security purposes.

Completing the First National Bank Statement form with diligence ensures that the bank accurately evaluates your financial standing. This meticulous approach is crucial, whether you're seeking credit or aiming to keep your financial records with the bank up to date.

Understanding First National Bank Statement

Why is it important not to send the completed First National Bank Personal Financial Statement via unencrypted email?

Sending sensitive personal financial information over unencrypted email poses a significant risk of data breaches. Unencrypted emails can potentially be intercepted by unauthorized parties, leading to the risk of identity theft and financial fraud. First National Bank emphasizes the importance of protecting your personal information by advising against the submission of your financial statement through unencrypted email to safeguard your privacy and financial security.

What should I do if my financial condition changes after submitting my Personal Financial Statement to First National Bank?

If any change occurs that materially reduces your ability to meet financial obligations, you are required to notify First National Bank immediately. This notification allows the bank to reevaluate your financial standing and make informed decisions regarding the continuation or adjustment of credit terms. Promptly updating the bank about changes to your financial condition helps maintain a transparent and trust-based relationship between you and the bank.

Can I leave any questions unanswered on the Personal Financial Statement?

The instruction to not leave any questions unanswered underlines the importance of providing a complete overview of your financial situation. Every detail requested contributes to the bank's assessment of your financial health and creditworthiness. Hence, it is crucial to answer all questions comprehensively. In case of concerns about disclosing certain information, especially details that are not mandatory for unsecured individual credit applications, consider consulting with a bank representative for guidance.

What additional schedules are attached to the Personal Financial Statement, and why are they necessary?

- Schedule 1: Details about your cash, savings, and certificates of deposit.

- Schedule 2: Information on securities owned.

- Schedule 3: Life insurance cash value and loans.

- Other Schedules: Include details about mortgages, real estate owned, retirement accounts, debts, and contingent liabilities among others.

These schedules provide a detailed and structured format to present your assets, liabilities, and other financial information. They are necessary for the bank to accurately evaluate your net worth, liquidity, and overall financial stability. The thoroughness of this information directly influences the bank's lending decisions.

What happens after I submit my Personal Financial Statement to First National Bank?

Upon submission, First National Bank retains your personal financial statement, regardless of whether credit is approved. The bank may also verify the information you provided by checking your credit and employment history or any other relevant details. This process helps the bank in making informed decisions about providing, adjusting, or denying credit. Submitting the form does not automatically obligate the bank to extend credit, but rather, it initiates an evaluation process considering the bank's lending criteria and your financial situation.

Common mistakes

When filling out the First National Bank Statement form, people often make mistakes that can affect their application process. Here are 10 common errors to avoid:

Not checking for completeness: Leaving questions unanswered can lead to unnecessary delays. Every section should be carefully reviewed to ensure no part of the form is overlooked.

Incorrect personal information: Mistakes in basic information, such as the wrong Social Security Number (SSN) or misspelled names, can lead to significant complications.

Overlooking previous addresses: If you have moved in the last five years, failing to include previous addresses can impact the bank's ability to verify your history.

Forgetting to list all assets and liabilities: All sources of income, properties, debts, and other financial obligations must be disclosed for an accurate evaluation.

Mismatched totals: The sum of assets and liabilities should accurately reflect your net worth. Inaccuracies here may suggest misinformation.

Underestimating or overestimating values: Whether it’s real estate, vehicles, or personal property, providing unrealistic assessments can affect your credibility.

Not updating marital status: Your marital status can impact your financial liabilities and assets, especially if you are separated but not legally divorced.

Ignoring contingent liabilities: Failing to include potential financial obligations like lawsuits or endorser responsibilities can misrepresent your financial condition.

Error in annual income calculation: Not accurately reporting income from all sources, including salaries, commissions, dividends, and alimony, skews your financial picture.

Using unencrypted email for submission: Sending sensitive financial information through unencrypted email exposes you to potential privacy and security risks.

Avoiding these mistakes can greatly improve the accuracy of your statement and help streamline the review process for your financial application.

Documents used along the form

When managing one's finances, particularly in dealings with financial institutions like First National Bank, several forms and documents often accompany the main Personal Financial Statement form. These documents are vital for providing a comprehensive view of an individual's financial status and for various banking transactions. It's important for individuals to understand the role and requirement of each document.

- Loan Application Form: This form is required when an individual applies for a new loan. It typically asks for detailed information about the borrower's employment, income, debts, and assets to assess their ability to repay the loan.

- Credit Report Authorization Form: Often used in conjunction with a loan application, this form gives the lender permission to request the applicant's credit report from a credit bureau. Credit reports are crucial for lenders to evaluate the creditworthiness of an applicant.

- Income Verification Documents: These documents, such as recent pay stubs, tax returns, or W-2 forms, are needed to confirm the income stated in the Personal Financial Statement or Loan Application Form. Lenders use this information to gauge an applicant's financial stability and repayment capability.

- Asset Documentation: This can include statements of accounts holding cash, savings, certificates of deposit, brokerage statements for securities, and documents for other significant assets. Asset documentation helps substantiate the value of one's assets as listed on the Personal Financial Statement.

- Liability Statements: Documents proving the current balances of loans, credit cards, and any other liabilities. These statements complement the liabilities section of the Personal Financial Statement, providing lenders with a full picture of an individual's financial obligations.

Together, these documents play critical roles in the banking and lending processes, providing transparency and ensuring that financial institutions have a clear, accurate understanding of an applicant's financial situation. Accurate and complete documentation can significantly influence the success of one's applications for credit, loans, or other banking services.

Similar forms

The First National Bank Statement form is closely related to a Credit Report, which is another critical document for assessing an individual's financial standing. Like the bank statement, a credit report provides a comprehensive overview of an individual's financial history, including debts, loans, and payment history. Both documents are instrumental in evaluating the creditworthiness of a person. However, while the bank statement focuses on current financial status, including assets and liabilities, a credit report offers a historical view of how an individual manages their credit over time.

Another document similar to the First National Bank Statement form is a Loan Application Form. The loan application requires detailed financial information from the applicant to assess their ability to repay the borrowed funds. This form similarly gathers extensive details about the applicant's financial resources, debts, and personal information, such as employment history and current financial status. Both forms are crucial for financial institutions to determine the risk involved in lending money to the applicant.

An Income Tax Return is also akin to the First National Bank Statement form in several ways. Both require detailed financial information, including income sources, investments, and assets, to calculate either tax liability or financial health. While the tax return focuses on the calculation of taxes owed to or refunded by the government based on annual income and deductions, the bank statement form assesses one's overall financial stability and net worth to establish creditworthiness.

Last but not least, a Balance Sheet used in business has similarities to the First National Bank Statement form, primarily used by individuals. A balance sheet summarizes a company's financial balances, including assets, liabilities, and shareholder equity, at a specific point in time. Similarly, the bank statement form provides a snapshot of an individual's financial positions, such as cash on hand, securities, real estate, debts, and other personal assets and liabilities. Both documents serve as fundamental tools for evaluating the financial condition of an entity or individual at a given time.

Dos and Don'ts

When completing the First National Bank Statement form, it’s crucial to approach the process with attention to detail and accuracy. Below are lists of what you should and shouldn't do to ensure the form is filled out correctly and securely.

Things You Should Do

- Review the entire form before starting to ensure you have all the necessary information ready.

- Answer all questions truthfully, providing a true and accurate statement of your financial condition as requested.

- Immediately notify the bank of any material changes that reduce your means or ability to pay, as agreed in the form.

- Securely attach all required schedules and documents needed for assets and liabilities sections.

- Sign and date the form to certify that the information provided is true and correct.

- Return the completed form through a secure method as directed by the First National Bank to protect your confidential information.

Things You Shouldn't Do

- Do not leave any questions unanswered. If a question is not applicable, indicate this clearly.

- Avoid estimating figures. Use actual data to provide the most accurate financial picture possible.

- Do not use unencrypted email to submit the form, as it contains sensitive personal and financial information.

- Do not forget to include documentation for all listed assets and liabilities to support the figures you’ve reported.

- Avoid signing the document without ensuring all sections are complete and accurate.

- Do not delay notification to the bank if your financial situation changes, as per the agreement.

Misconceptions

Many people harbor misconceptions about the First National Bank Statement form. Understanding what the form is—and what it isn't—can help individuals navigate the process of applying for credit more effectively. Here are ten common misconceptions:

The form is only for loan applications: While it is primarily used in the context of applying for credit, the form serves broader purposes, including detailing an individual's financial condition for various credit facilities.

Marital status doesn't impact the application: Marital status can be relevant, especially in jurisdictions with community property laws or when applying for joint credit, despite instructions not to include it for individual, unsecured credit applications.

All assets and liabilities must be jointly held: The form allows for the distinction between individually owned assets and liabilities and those held jointly, providing a clearer picture of financial standing.

Email submission is preferred: The form explicitly warns against returning it via unencrypted email due to the sensitive nature of the information, highlighting the importance of security.

Completing the form guarantees credit approval: Submission of the form does not obligate the bank to extend credit. It is merely the starting point for the bank to assess creditworthiness.

Only immediate debts need to be disclosed: The form requires disclosure of all liabilities, including contingent liabilities that could potentially impact financial standing.

Updating the form is unnecessary after initial submission: Individuals are required to promptly notify the bank of any material changes to their financial condition and may need to submit an updated statement upon request.

Income sources like alimony must always be disclosed: The form specifies that income such as alimony or child support need not be disclosed unless the applicant wishes it to be considered for repaying the obligation.

The bank retains the form for a short period: The bank is authorized to retain the personal financial statement, whether or not credit is approved, emphasizing the long-term relevance of the information provided.

Personal financial statements are less important for those with high incomes: Regardless of income level, a comprehensive financial statement is critical for assessing creditworthiness and determining the ability to meet credit obligations.

Correcting these misconceptions can help applicants approach the process with a better understanding and increased precision, potentially improving their chances of obtaining the desired credit facilities.

Key takeaways

When engaging with the First National Bank Statement form, it is crucial for individuals to provide a comprehensive and accurate representation of their financial status. This document plays a vital role in the process of seeking credit, highlighting the importance of a thorough and transparent submission. Here are key takeaways to ensure the form is completed effectively:

- For security reasons, it's strongly advised against sending the completed form via unencrypted email, safeguarding your personal and financial information against unauthorized access.

- The form serves a dual purpose: not only does it assist in the procurement of credit but it also functions as a means to maintain it, necessitating the disclosure of true and complete financial conditions.

- Immediate notification to the bank is required if there is any significant deterioration in your financial situation that might affect your ability to meet claims or demands, ensuring the bank has an up-to-date view of your financial health.

- A detailed account of both assets and liabilities is needed, including cash, savings, investments, insurance, property details, and outstanding debts, providing a full picture of your financial standing.

- Income sources, including salary, commissions, dividends, and other forms of income, must be reported to give the bank insight into your earning capacity and potential for repayment.

- Certain personal information, such as marital status, should not be provided if the form is submitted in relation to an unsecured individual credit application, respecting privacy and adhering to regulations concerning personal data.

- Completing attached schedules is mandatory, as these provide a detailed breakdown of financial assets and liabilities, enabling a deeper analysis of your financial condition.

- Prompt written notification of any material change in your financial circumstances is crucial, ensuring the bank's records are current and accurate.

- The authorization granted to the bank to retain the statement and verify the information provided, regardless of credit approval, underlines the need for accuracy and honesty in all disclosures.

In essence, the First National Bank Statement form is a comprehensive tool for evaluating financial standing, instrumental in the credit application process. Accurate and complete information, alongside timely updates on any changes to your financial situation, are vital components of a successful credit application and maintenance strategy.

Popular PDF Documents

I-9 Verification - The USCIS offers an E-Verify program that allows for digital verification of employment eligibility, connected to information on the I-9.

College Tax Form - The interest reported on the 1098-E form only includes amounts that qualify under the IRS guidelines for a student loan interest deduction.