Get First Midwest Bank Direct Deposit Form

In today’s digitally driven financial landscape, the convenience of direct deposit has become a cornerstone for effective personal finance management. The First Midwest Bank Direct Deposit form offers a streamlined process for individuals to initiate or transfer direct deposit services for their employment compensation, thereby ensuring timely and secure access to their funds. This form serves as an authorization letter to the payroll department of one's employer, signaling the payee's decision to either establish a new direct deposit relationship or change their existing direct deposit details to First Midwest Bank. It meticulously captures essential employee information, including but not limited to, the individual's name, social security number, contact details, and specific bank account information such as the routing and account numbers. Additionally, the form permits the designation of the deposit type into either a checking or savings account and specifies the amount to be deposited. The inclusion of a signature attests to the authorization, indicating a comprehensive agreement for the employer to credit (and when necessary, adjust or debit in case of errors) the designated bank account as per the outlined instructions. Moreover, the provision to attach a voided check to the form reinforces the accuracy of the banking details provided, thereby minimizing the chances of transactional discrepancies. This form not only manifests a direct link between one’s employment and their bank of choice but also highlights the implicit trust and authorization granted to the employer to manage such transactions, underlining the importance of a clear, mutual understanding maintained until the agreement's termination.

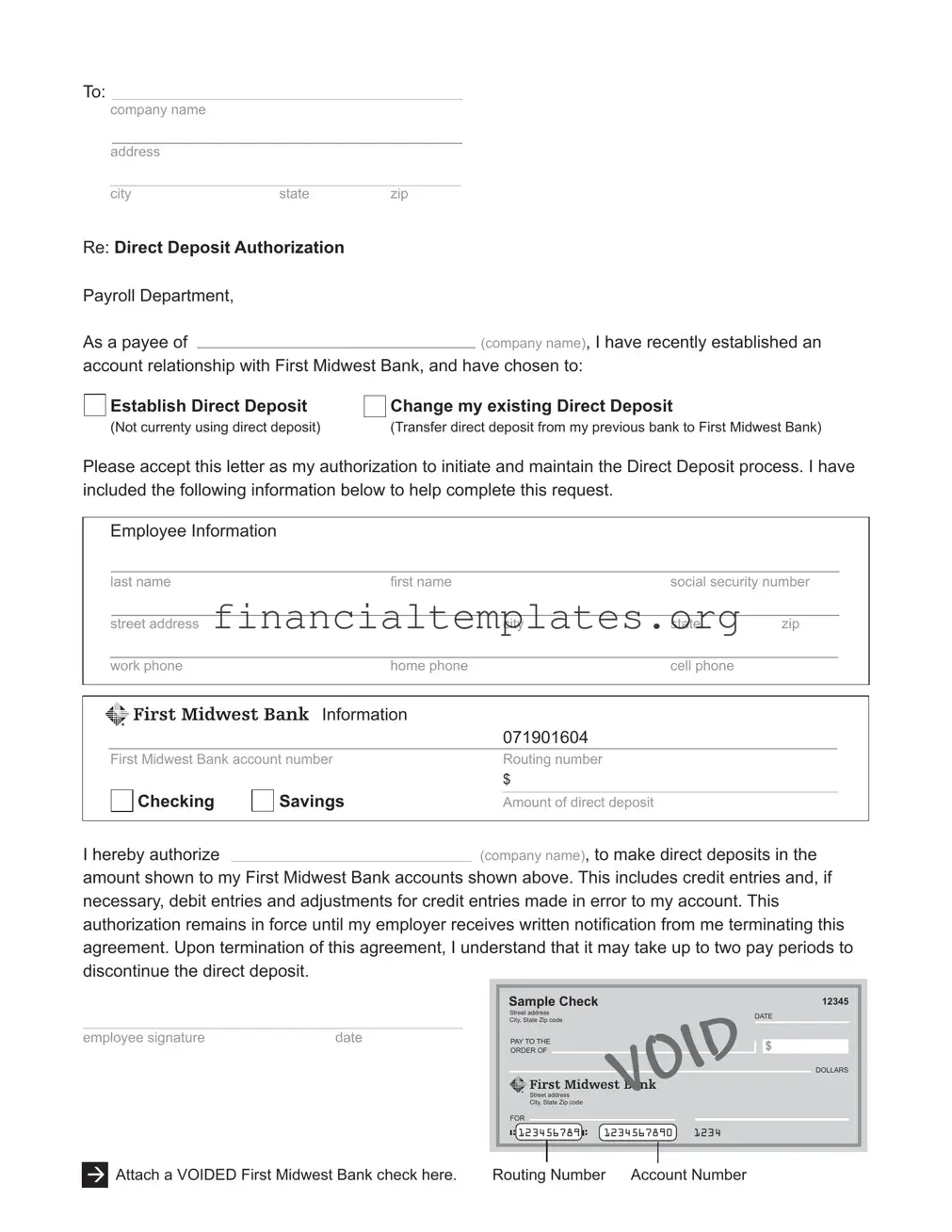

First Midwest Bank Direct Deposit Example

To:

company name

address

city |

state |

zip |

Re: Direct Deposit Authorization

Payroll Department,

As a payee of(company name), I have recently established an account relationship with First Midwest Bank, and have chosen to:

Establish Direct Deposit

(Not currenty using direct deposit)

Change my existing Direct Deposit

(Transfer direct deposit from my previous bank to First Midwest Bank)

Please accept this letter as my authorization to initiate and maintain the Direct Deposit process. I have included the following information below to help complete this request.

Employee Information

last name |

first name |

social security number |

|

|

|

|

|

street address |

city |

state |

zip |

|

|

|

|

work phone |

home phone |

cell phone |

|

Information

|

071901604 |

First Midwest Bank account number |

Routing number |

|

$ |

Checking

Savings |

Amount of direct deposit |

I hereby authorize(company name), to make direct deposits in the

amount shown to my First Midwest Bank accounts shown above. This includes credit entries and, if necessary, debit entries and adjustments for credit entries made in error to my account. This authorization remains in force until my employer receives written notification from me terminating this agreement. Upon termination of this agreement, I understand that it may take up to two pay periods to discontinue the direct deposit.

employee signature |

date |

Sample Check |

|

12345 |

Street address |

|

DATE |

City, State Zip code |

|

|

|

|

|

PAY TO THE |

|

$ |

ORDER OF |

|

|

|

|

DOLLARS |

Street address |

|

|

City, State Zip code |

|

|

FOR |

|

|

:123456789 : |

1234567890 |

1234 |

Attach a VOIDED First Midwest Bank check here. |

Routing Number Account Number |

Document Specifics

| Fact Number | Fact Description |

|---|---|

| 1 | The First Midwest Bank Direct Deposit form is used for authorizing the initiation and maintenance of direct deposit transactions. |

| 2 | It can be utilized to either establish a new direct deposit or change an existing one to First Midwest Bank. |

| 3 | The form requires the employee's personal information, including their name, social security number, address, and phone numbers. |

| 4 | Banking details needed include the First Midwest Bank account number, routing number, and the type of account (checking or savings). |

| 5 | Employees must specify the amount of direct deposit desired to be transferred to the specified account. |

| 6 | The form permits the authorization of credit entries and, if necessary, debit entries and adjustments for any incorrectly made credit entries to the account. |

| 7 | This authorization will remain in effect until the employer is notified in writing by the employee to terminate the agreement. |

| 8 | After termination, it may require up to two pay periods to effectively discontinue the direct deposit. |

| 9 | A voided First Midwest Bank check must be attached to the form to provide a sample check for verification. |

| 10 | While the form is specific to First Midwest Bank, the process and requirements may be similar to those of other banks, but relevant state laws and bank policies might influence the exact process. |

Guide to Writing First Midwest Bank Direct Deposit

Embarking on the journey of setting up a Direct Deposit with First Midwest Bank heralds a significant step towards financial convenience. This seamless transition not only streamlines the process of receiving payments but also ensures the safety and immediate availability of funds. The meticulous completion of the First Midwest Bank Direct Deposit form paves the way for this transition, involving a series of straightforward steps designed to communicate your authorization clearly and effectively.

Steps to Fill Out the First Midwest Bank Direct Deposit Form:

- Start by addressing the letter to your company. Fill in your company's name, address, city, state, and zip code at the top of the form where indicated.

- Under the "Re: Direct Deposit Authorization" section, introduce the purpose of the letter. Clearly state that the letter serves as your authorization to establish or change an existing Direct Deposit to your account at First Midwest Bank.

- In the "Employee Information" section, provide your personal details including your last name, first name, social security number, full address, work phone number, home phone number, and cell phone number.

- Specify your intention by selecting one of the options: either to establish Direct Deposit (if you are not currently using direct deposit) or to change your existing Direct Deposit (if you are transferring direct deposit from another bank to First Midwest Bank).

- Enter the account and routing number of your First Midwest Bank in the spaces provided. The routing number for First Midwest Bank is already pre-filled as 071901604.

- Indicate the type of account the direct deposit will go into by selecting either "Checking" or "Savings" and specify the amount of the direct deposit if necessary.

- Sign and date the form at the bottom to provide your authorization. Make sure your signature is consistent with the signature the bank has on file for you.

- Attach a voided First Midwest Bank check to the form where indicated. This sample check is crucial as it contains both your account and routing number, and provides clear confirmation of your banking details.

After completing the above steps, your form is ready to be submitted to your employer's payroll department. It represents your consent for initiating or changing a direct deposit arrangement into your First Midwest Bank account. Remember, the activation of this service or any modifications to it might not be immediate and could take up to two pay periods to take effect. Ensuring the accuracy of the information provided on the form will help avoid any delays in this process.

Understanding First Midwest Bank Direct Deposit

How do I establish direct deposit with First Midwest Bank?

To establish direct deposit into your First Midwest Bank account, fill out the direct deposit authorization section indicating that you are not currently using direct deposit. Provide your employee information including your social security number, contact details, and account information—such as the First Midwest Bank account number, routing number, and whether the deposit should go into a checking or savings account. Attach a voided First Midwest Bank check to the form to provide your employer with the necessary banking details. Ensure you sign and date the form before submission.

Can I change my existing direct deposit to go to my First Midwest Bank account?

Yes, you can change your existing direct deposit to your First Midwest Bank account. On the direct deposit form, indicate that you wish to change your existing direct deposit by selecting the appropriate option. Provide all required personal and banking information, similar to setting up a new direct deposit. Don’t forget to attach a voided check from your First Midwest Bank account. This will give your employer the information needed to reroute your direct deposits to your new account.

What information do I need to provide for setting up or changing my direct deposit?

For both setting up a new direct deposit and changing an existing one to First Midwest Bank, you need to provide: your last name, first name, social security number, street address, city, state, zip code, work phone, home phone, cell phone, First Midwest Bank account number, routing number, and specify whether the account is a checking or savings account. Additionally, specify the amount for direct deposit if applicable. A voided First Midwest Bank check must be attached to provide your employer with your account and routing numbers.

How do I authorize my employer to start the direct deposit?

By filling out the direct deposit form with all necessary information and attaching a voided First Midwest Bank check, you are providing your employer with the authorization to start depositing your paychecks directly into your bank account. Ensure you select the appropriate authorization on the form, either to establish a new direct deposit or to change an existing one. The authorization takes effect once you sign and date the form, thereby authorizing your employer to make and, if necessary, adjust direct deposits to your account.

How long does it take for direct deposit changes to take effect?

Once you submit your direct deposit change request to your employer, it may take up to two pay periods for the changes to take effect. This timeframe allows your employer to update their payroll system with your new banking information to ensure that your direct deposits are correctly rerouted to your First Midwest Bank account.

What happens if I need to terminate my direct deposit?

If you decide to terminate your direct deposit, you are required to notify your employer in writing. The notice should include your decision to discontinue direct deposits. Upon receipt of your termination request, it may take your employer up to two pay periods to process the changes and stop the direct deposit transfers to your First Midwest Bank account. It’s important to communicate with your employer about the termination process to understand any specific requirements on their end.

Common mistakes

One of the common mistakes is miswriting the bank's routing number. It is crucial to double-check that the routing number (071901604 for First Midwest Bank) is accurately recorded. This number guides where your money is supposed to go, and a single digit off can send your hard-earned cash astray.

Inputting an incorrect account number is another error often made on the First Midwest Bank Direct Deposit form. Your account number uniquely identifies your account with the bank. Any mistake here could mean that your deposit ends up in someone else's account.

Neglecting to specify the type of account can also lead to issues with the direct deposit. The form requires you to mark whether it's a checking or savings account, as the deposit process may differ slightly between the two.

Failing to properly authorize the transaction is a common oversight. Make sure the form includes a clear authorization for the company to deposit (and, if required, adjust or withdraw) funds by signing at the designated area. Without your signature, the form is not valid.

Another mistake involves the inclusion of inaccurate or incomplete personal information. This includes your full name, social security number, and complete address. Any errors or omissions can lead to a failure in processing the deposit as intended.

Finally, attaching a sample check is a step that is frequently overlooked. This sample check, which should be voided, provides the employer with a visual confirmation of the routing and account numbers, thereby reducing the chance of errors. Not including this could delay or complicate the setup of your direct deposit.

To avoid these common pitfalls, take a moment to review your form carefully before submission. Ensure that all information is accurate, complete, and legible. This will help in making the process smooth and ensure that your direct deposit is set up correctly and on time.

Documents used along the form

When setting up or changing direct deposit instructions with First Midwest Bank, a few other documents often accompany the Direct Deposit Authorization form. These forms help ensure the transaction is processed smoothly and accurately, safeguarding both the employer and employee's interests.

- Personal Identification: A copy of a government-issued photo ID (such as a driver's license or passport) to verify the identity of the account holder.

- Employment Verification Letter: A document from the employer confirming the individual's employment status, often required to validate the direct deposit request.

- Account Verification Letter: From First Midwest Bank, this document confirms the account details provided on the direct deposit form are correct and the account is in good standing.

- Payroll Change Form: Completed by the employee to request changes to their payroll details, this may include starting, stopping, or adjusting the amount of direct deposit.

- Last Pay Stub: This may be required to verify the previous payment amount and ensure the correctness of the new direct deposit set-up, especially when changing banks.

- Salary Increase Letter: If the direct deposit change is due to a salary increase, this document from the employer confirms the new salary amount to be deposited.

Combining the Direct Deposit Authorization form with these documents ensures a comprehensive approach to managing payroll direct deposits. It provides a solid foundation for both the employer and the bank to process and verify the direct deposit arrangements accurately, benefiting all parties involved.

Similar forms

The Automated Clearing House (ACH) Authorization Form is quite similar to the First Midwest Bank Direct Deposit form in its intent and structure. Both forms serve the purpose of authorizing electronic transfers of funds. The ACH Authorization Form is used not just for direct deposit of paychecks but also for automatic bill payments and other electronic payments. Like the First Midwest form, it requires the account holder's banking information, including the routing and account numbers, and a formal authorization to initiate and persist with the transactions specified.

A Payroll Direct Deposit Enrollment Form, commonly used by employers, shares a strong resemblance to the First Midwest Bank Direct Deposit form. This form allows employees to request direct deposit of their paychecks into their bank accounts. It typically asks for the employee's personal and banking information, similar to the First Midwest form, and also includes sections for routing and account numbers alongside authorization to deposit the employee's paycheck directly into the indicated account(s).

The Social Security Direct Deposit Form, while specific to Social Security benefits, parallels the First Midwest Bank Direct Deposit form in functionality and data requirements. It facilitates the direct deposit of Social Security benefits into a beneficiary's bank account. The form captures the beneficiary's personal details, banking information such as the routing and account numbers, and includes an authorization section for the beneficiary to sign-off on, similar to the process outlined in the First Midwest form.

The IRS Direct Pay Form, used for making payments to the Internal Revenue Service (IRS), also shares similarities with the First Midwest Bank Direct Deposit form, albeit for outgoing payments rather than incoming deposits. It requires taxpayers to provide their banking information to authorize an electronic payment from their bank account to the IRS. Like the First Midwest form, it involves entering account and routing numbers and an authorization by the account holder for a specific transaction.

Bank Account Change Notification Letters are similar to the section in the First Midwest Bank Direct Deposit form where the account holder is changing their direct deposit information. These letters are addressed to entities with which the account holder has a recurring financial relationship, informing them of changes in banking details. The letter includes new banking information and authorizes the recipient to update their records and direct future transactions to the new account, resembling the change request in the First Midwest form.

The Electronic Funds Transfer (EFT) Authorization form serves a broad purpose but aligns closely with the First Midwest Bank Direct Deposit form in its core function. It authorizes the transfer of funds between bank accounts electronically and can be used for a variety of transactions, including direct deposits, bill payments, and other transfers. This form collects the account holder's banking and personal information and includes an authorization similar to that of the First Midwest form for initiating and sustaining electronic transfers as specified.

Finally, the Voided Check Submission for Direct Deposit bears similarity to the instruction in the First Midwest Bank Direct Deposit form that requests attaching a voided check. While not a form per se, the act of submitting a voided check for banking transactions ensures the correct banking information is provided for electronic fund transfers. Like the First Midwest form, a voided check is used to verify the account and routing numbers, thereby facilitating the accurate processing of direct deposits or other automatic transactions.

Dos and Don'ts

When it comes to managing your finances, setting up direct deposit is a convenient choice. Here are seven do's and don'ts to consider when filling out the First Midwest Bank Direct Deposit form:

Do:- Review the entire form before you start filling it out. This ensures that you understand all the required information.

- Use a black or blue ink pen for clearer legibility and to prevent any issues with scanning or photocopying the document.

- Include all necessary details such as your social security number, account number, and routing number accurately to avoid any delays in processing your direct deposit setup.

- Specify the type of account by indicating whether it is a checking or savings account to ensure your funds are deposited into the correct account.

- Attach a VOIDED First Midwest Bank check to the form, if required, as this will provide visual confirmation of your account details.

- Keep a copy of the completed form for your records. This can be helpful in resolving any issues that may arise.

- Inform your employer immediately if you wish to change or cancel the direct deposit arrangement.

- Use any colored ink other than black or blue, as this could cause issues with readability.

- Leave any sections blank. Incomplete forms may delay the processing time or result in your direct deposit not being setup correctly.

- Forget to sign and date the form. Your signature is a necessary part of the authorization process.

- Send the form without double-checking the information you've provided. Mistakes can lead to misdirected funds or other complications.

- Ignore the requirement to attach a voided check, if indicated. This step is crucial for verifying your banking information.

- Assume the process is instant. Remember, it may take up to two pay periods to initiate or discontinue the direct deposit service.

- Overlook the need to notify your employer in writing if you decide to terminate this agreement. A verbal notice may not be sufficient.

Misconceptions

The First Midwest Bank Direct Deposit form is a crucial document that enables employees to have their paychecks deposited directly into their bank accounts. Despite its straightforward nature, there exist several misconceptions about its use and requirements. By clarifying these misconceptions, individuals can better understand how to efficiently set up and manage their direct deposit arrangements.

- Direct deposit is only for checking accounts: Many believe that direct deposits can only be made into checking accounts. However, the form clearly allows users to select either a checking or savings account for the deposit, providing greater flexibility in managing their finances.

- Setting up direct deposit is complicated: The form is designed to be simple and user-friendly. It requires basic information such as personal details, account number, and routing number, making the process straightforward for both the employee and employer.

- Personal phone numbers are optional: Contrary to what some might think, providing work, home, and cell phone numbers on the form is important. These contacts ensure there is a line of communication open for any issues or questions regarding the direct deposit.

- Authorization doesn’t allow for adjustments: A common misconception is that once the direct deposit is authorized, only credit entries can be made. The form explicitly states that it also authorizes debit entries and adjustments for any credit entries made in error, providing a safeguard for both parties.

- Changes to direct deposit take effect immediately: When changing direct deposit details, it's assumed to be instant. However, the form indicates it may take up to two pay periods for changes, such as switching banks, to be processed and take effect.

- Termination of direct deposit doesn’t require notice: The process to discontinue direct deposit is sometimes underestimated. The form necessitates written notification to terminate the service, emphasizing the importance of clear communication between the employee and employer.

- Any voided check can be used for account verification: It's essential to attach a voided check from First Midwest Bank specifically, not just any bank. This helps confirm the account details with the bank handling the direct deposits.

- The direct deposit is for payroll only: While the direct deposit form is primarily used for payroll, it's important to note that it can potentially be used for other types of direct deposits (like tax refunds or other payments), as long as the company or agency making the payment accepts the authorization format provided.

Understanding the true flexibility, security, and requirements of the First Midwest Bank Direct Deposit form can help employees and employers alike navigate the setup and management of direct deposits more effectively. Clearing up these misconceptions facilitates a smoother transition to electronic payments, benefiting all parties involved.

Key takeaways

Filling out and using the First Midwest Bank Direct Deposit form is an important process for managing your payroll efficiently. Here are some key takeaways to help guide you through this process:

- You need to decide whether you are establishing a new direct deposit or changing an existing one. This determines the purpose of filling out the form.

- Complete authorization is necessary for the company to start or change your direct deposit to First Midwest Bank. This is obtained through the Direct Deposit Authorization letter.

- Your employee information must be accurately filled out, including your name, social security number, address, and contact numbers. This ensures that the deposit goes to the correct account holder.

- The form requires your First Midwest Bank account information, including the routing number and account number, to accurately process the transactions.

- You have the option to specify whether you want the direct deposit to go into your checking or savings account. Making this distinction is crucial for managing your finances as you intend.

- The amount to be directly deposited needs to be indicated. This can be a specific dollar amount or a percentage of your paycheck, depending on your arrangement with your employer.

- Authorization for both credit and, if necessary, debit transactions must be given. This includes adjustments for any credit entries made in error to your account.

- This authorization agreement is ongoing and remains in effect until you notify your employer in writing to terminate it.

- Upon termination, be aware that it may take up to two pay periods for the direct deposit to be fully discontinued.

- A VOIDED First Midwest Bank check must be attached to your form. This provides a visual confirmation of your account and routing number, helping to prevent errors in the deposit process.

By carefully following these guidelines, you can ensure a smooth transition to or modification of your direct deposit arrangements with First Midwest Bank, allowing you more control over your financial management.

Popular PDF Documents

Philly Wage Tax Refund - The City of Philadelphia offers a streamlined process to petition for tax refunds, addressing everything from Wage Tax to Hotel Tax, through a singular form.

Efile Tax Return - This authorization is necessary for allowing another to manage your tax issues with your consent.

IRS Schedule A 1040 or 1040-SR - Personal state and local income taxes paid can be listed on Schedule A to reduce federal tax liability.