Get First Energy 91 Form

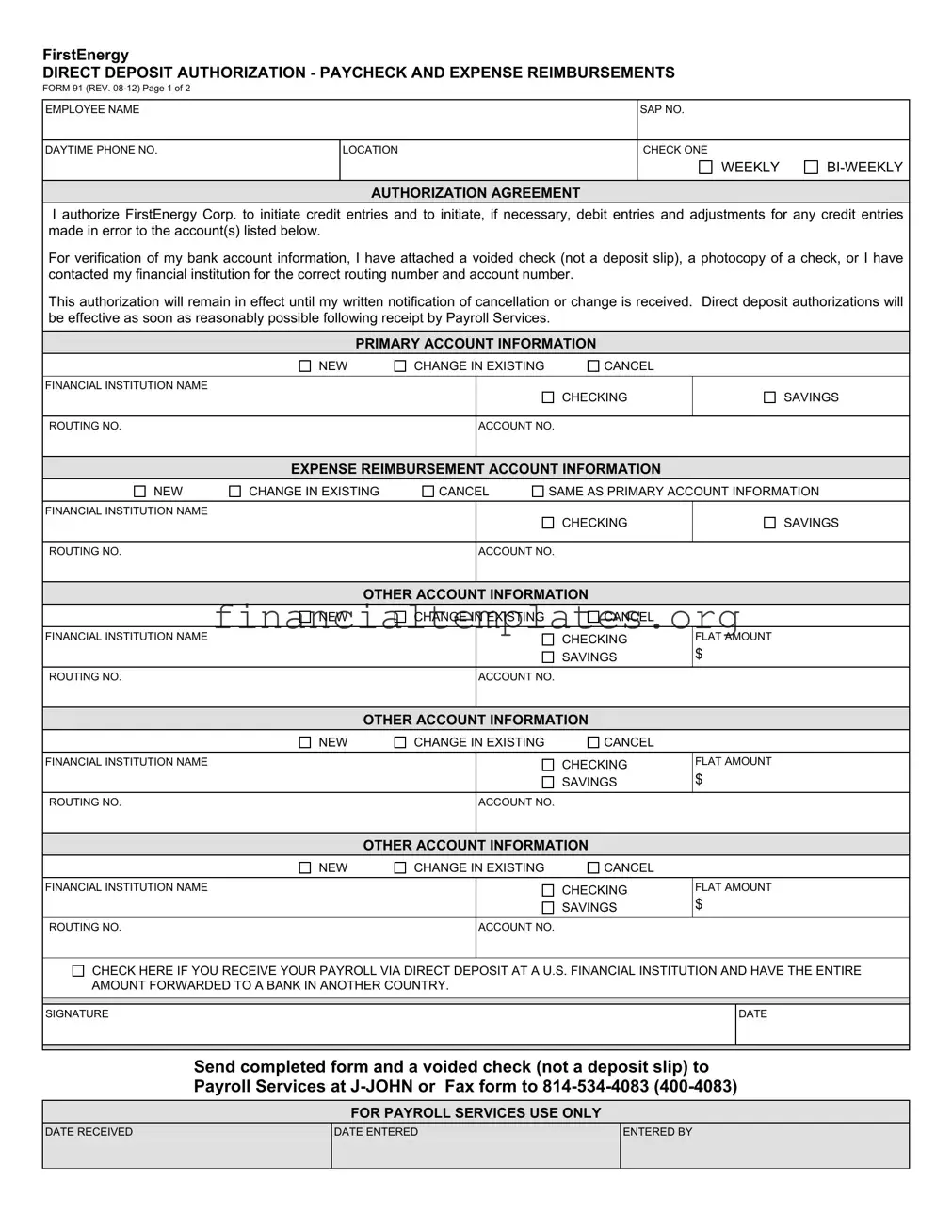

Streamlining financial transactions and ensuring the timely and accurate delivery of payroll and expense reimbursements is a vital component of employee satisfaction and operational efficiency in any organization. The FirstEnergy Direct Deposit Authorization - Paycheck and Expense Reimbursements Form 91 embodies this principle by offering FirstEnergy Corp. employees a structured and secure method to manage the direct deposit of their earnings and reimbursements. Revised in August 2012, this two-page document captures essential details including the employee's name, SAP number, contact information, and the designated frequency of their pay. It outlines an authorization agreement allowing FirstEnergy Corp. to credit and, if necessary, adjust debits to the employee's account(s) to correct errors. Moreover, it provides space for the employee to designate primary, expense reimbursement, and other accounts, each with options to add new entries, make changes, or cancel existing information. The form underscores the importance of attaching a voided check—or a photocopy of a check, not a deposit slip—for verifying bank account details. To enact or alter direct deposit instructions, employees are guided to complete the form attentively, sign it, and submit it to Payroll Services. The provision to forward the entire payroll amount to a bank in another country by checking a specific box further extends the form’s utility to employees working internationally. Simplifying the financial lives of FirstEnergy employees, this form stands as a testament to the company’s commitment to leveraging administrative procedures for enhancing worker satisfaction and streamlining payroll processes.

First Energy 91 Example

FirstEnergy

DIRECT DEPOSIT AUTHORIZATION - PAYCHECK AND EXPENSE REIMBURSEMENTS

FORM 91 (REV.

EMPLOYEE NAME

SAP NO.

DAYTIME PHONE NO.

LOCATION

CHECK ONE

WEEKLY

AUTHORIZATION AGREEMENT

I authorize FirstEnergy Corp. to initiate credit entries and to initiate, if necessary, debit entries and adjustments for any credit entries made in error to the account(s) listed below.

For verification of my bank account information, I have attached a voided check (not a deposit slip), a photocopy of a check, or I have contacted my financial institution for the correct routing number and account number.

This authorization will remain in effect until my written notification of cancellation or change is received. Direct deposit authorizations will be effective as soon as reasonably possible following receipt by Payroll Services.

PRIMARY ACCOUNT INFORMATION

NEW

CHANGE IN EXISTING

CANCEL

FINANCIAL INSTITUTION NAME

CHECKING

SAVINGS

ROUTING NO.

ACCOUNT NO.

EXPENSE REIMBURSEMENT ACCOUNT INFORMATION

NEW

CHANGE IN EXISTING

CANCEL

SAME AS PRIMARY ACCOUNT INFORMATION

FINANCIAL INSTITUTION NAME

CHECKING

SAVINGS

ROUTING NO.

ACCOUNT NO.

OTHER ACCOUNT INFORMATION

NEW |

CHANGE IN EXISTING |

CANCEL |

|

|

|

|

|

|

|

FINANCIAL INSTITUTION NAME |

|

|

CHECKING |

FLAT AMOUNT |

|

|

|

SAVINGS |

$ |

|

|

|

|

|

ROUTING NO. |

|

ACCOUNT NO. |

|

|

|

|

|

|

|

|

OTHER ACCOUNT INFORMATION |

|

||

NEW |

CHANGE IN EXISTING |

CANCEL |

|

|

|

|

|

|

|

FINANCIAL INSTITUTION NAME |

|

|

CHECKING |

FLAT AMOUNT |

|

|

|

SAVINGS |

$ |

|

|

|

|

|

ROUTING NO. |

|

ACCOUNT NO. |

|

|

|

|

|

|

|

|

OTHER ACCOUNT INFORMATION |

|

||

NEW |

CHANGE IN EXISTING |

CANCEL |

|

|

|

|

|

|

|

FINANCIAL INSTITUTION NAME |

|

|

CHECKING |

FLAT AMOUNT |

|

|

|

SAVINGS |

$ |

|

|

|

|

|

ROUTING NO. |

|

ACCOUNT NO. |

|

|

|

|

|

|

|

CHECK HERE IF YOU RECEIVE YOUR PAYROLL VIA DIRECT DEPOSIT AT A U.S. FINANCIAL INSTITUTION AND HAVE THE ENTIRE AMOUNT FORWARDED TO A BANK IN ANOTHER COUNTRY.

SIGNATURE

DATE

Send completed form and a voided check (not a deposit slip) to Payroll Services at

DATE RECEIVED

FOR PAYROLL SERVICES USE ONLY

DATE ENTERED |

ENTERED BY |

|

|

FirstEnergy

DIRECT DEPOSIT AUTHORIZATION - PAYCHECK AND EXPENSE REIMBURSEMENTS

FORM 91 (REV.

How to Complete the Direct Deposit Authorization Form

1.Complete Employee information

2.Read Authorization Agreement

3.Complete Primary/Expense Reimbursement/Other Account Information

Tips for Completing the Account Information

Select type of authorization (New, Change, Cancel)

Enter name of the Financial Institution for each account

Select type of account (Checking or Savings)

Enter Flat Amount if Other Account

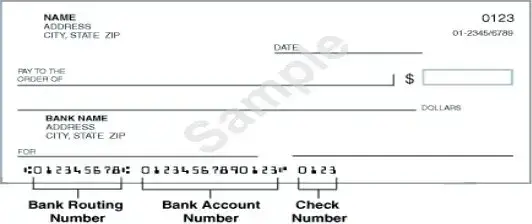

Enter 9 digit Bank Routing Number (see example below)

Enter Bank Account Number (see example below)

Note: Verify the Bank Routing Number and Bank Account Number with your Financial Institution

4.Sign and Date the form

5.Attach a voided check or a photocopy of a check (not a deposit slip)

6.Send completed form to:

Payroll Services at

Document Specifics

| Fact Name | Description |

|---|---|

| Form Number and Revision Date | The form is identified as FirstEnergy DIRECT DEPOSIT AUTHORIZATION - PAYCHECK AND EXPENSE REIMBURSEMENTS FORM 91 (REV. 08-12). |

| Page Count | This form spans across 2 pages. |

| Purpose | It is designed to authorize FirstEnergy Corp. to initiate credit and, if necessary, debit adjustments for payroll and expense reimbursement directly into the employee's specified bank account(s). |

| Authorization Flexibility | Employees can choose to start, change, or cancel direct deposit instructions for their primary account, expense reimbursement account, and other accounts. |

| Verification Requirement | Employees are required to provide a voided check (not a deposit slip) or bank account verification to confirm routing and account numbers. |

| Document Submission | Completed forms, along with a voided check or a photocopy, should be sent to Payroll Services at J-JOHN or faxed to 814-534-4083 (400-4083). |

Guide to Writing First Energy 91

Once you have decided to initiate or make changes to direct deposit for your paycheck or expense reimbursements with FirstEnergy, completing Form 91 is a necessary step. This process allows you to smoothly transition your payment method, ensuring your financial transactions are handled securely and efficiently. The form requires that you provide accurate banking details, choose between new setups or changes to existing information, and attach verification for your bank account, such as a voided check. Here are the steps to ensure your authorization is successfully submitted and processed.

- Enter your Employee Information, including your name, SAP number, daytime phone number, and location. Be sure the information is current and accurately reflects your personal details.

- Understand the Authorization Agreement. Review the terms which detail how FirstEnergy Corp will handle credit and, if necessary, debit transactions to correct errors.

- Select the frequency of your deposits by checking either Weekly or Bi-weekly under the authorization agreement.

- For the Primary Account Information, indicate whether you are providing new information, changing existing information, or cancelling. Include the name of your financial institution, and specify if your account is checking or savings. Then, enter the routing number and account number.

- If applicable, complete the Expense Reimbursement Account Information section. You can select "Same as Primary Account Information" if it applies, or fill in new details including institution name, account type, routing number, and account number for reimbursements.

- Under Other Account Information, again, select new, change, or cancel for any additional accounts you wish to include for deposits. If you are specifying a flat amount for deposits into this account, enter the amount, the financial institution’s name, account type, routing, and account numbers.

- If your payroll is directly deposited at a U.S. financial institution but the entire amount is forwarded to a bank in another country, check the indicated box.

- Sign and date the form to verify that the information provided is accurate and you agree to the direct deposit terms.

- Ensure to attach a voided check (or a photocopy of one, but not a deposit slip) for verification of your bank account information.

- Send the completed form and attached document either through interoffice mail to Payroll Services at J-JOHN, or fax it to 814-534-4083.

Upon submission, your form will be processed by Payroll Services. The changes will take effect as soon as reasonably possible, streamlining how you receive your payments and reimbursements. Ensuring accurate and complete information will facilitate a smooth transaction and avoid any delays in updating your payment method.

Understanding First Energy 91

What is the FirstEnergy 91 form?

The FirstEnergy 91 form is a Direct Deposit Authorization form used by FirstEnergy Corp. This form allows employees to set up, change, or cancel direct deposits for both their paychecks and expense reimbursements into their bank accounts.

How can I submit the FirstEnergy 91 form?

You can submit the completed FirstEnergy 91 form either by mailing it to Payroll Services at the designated J-JOHN address or by faxing it to 814-534-4083 (400-4083).

What should I attach with my FirstEnergy 91 form?

When submitting the FirstEnergy 91 form, attach a voided check or a photocopy of a check (not a deposit slip) for verification of your bank account information. This helps ensure that the direct deposit is set up accurately.

Is it possible to direct deposit my paycheck into multiple accounts?

Yes, the FirstEnergy 91 form provides sections for primary account information as well as for other accounts. This means you can allocate your paycheck and expense reimbursements into different checking or savings accounts, as well as specify flat amounts for certain accounts.

Can I forward my direct deposit to a bank in another country?

Yes, there is an option on the FirstEnergy 91 form to have your payroll directly deposited into a U.S. financial institution and then have the entire amount forwarded to a bank in another country. You need to check the specific box for this option when completing the form.

What information do I need to provide for setting up direct deposit?

To set up direct deposit, you need to provide the name of your financial institution, the type of account (checking or savings), the 9-digit bank routing number, and your bank account number. Always verify these numbers with your financial institution to prevent any errors.

How do I change my existing direct deposit information?

If you need to change your existing direct deposit setup, simply fill out the FirstEnergy 91 form, selecting the "Change in Existing" option for the relevant account sections, and submit it with the updated information.

How long does it take for direct deposit changes to become effective?

Direct deposit authorizations or changes will become effective as soon as reasonably possible following their receipt by Payroll Services. Timing may vary, so it’s a good idea to submit changes well in advance of your next paycheck or expense reimbursement if possible.

What should I do if I need to cancel my direct deposit?

To cancel direct deposit, complete the FirstEnergy 91 form, selecting the "Cancel" option for each account you wish to stop direct deposits for, and submit the form to Payroll Services.

Can I specify a flat amount to be deposited into one of my accounts?

Yes, the form allows you to specify a flat amount to be deposited into any of your accounts. Just select the "Flat Amount" option and specify the amount for the account you choose when filling out the account information section.

Common mistakes

Filling out the First Energy Form 91 for direct deposit can be straightforward, but it's easy to stumble over a few common mistakes. Let's break down nine errors that often trip people up, so you can avoid them and ensure a smooth process.

Not Checking the Authorization Type: One of the first steps is to select whether you're setting up a new direct deposit, changing an existing one, or cancelling it altogether. It's surprisingly easy to miss this step, but it's crucial for directing the action you want taken.

Forgetting to Attach a Voided Check: The form specifies that a voided check (not a deposit slip) should be attached. This helps verify your bank account information, yet it’s a commonly overlooked requirement.

Using a Deposit Slip Instead of a Check: This ties back to the previous point. A deposit slip may not have all the necessary information or could be outdated. Always use a voided check when you can.

Misreading the Routing and Account Numbers: Both numbers are crucial and must be accurate. However, it's easy to confuse them or enter them incorrectly. Double-checking with your bank can prevent this mistake.

Leaving the Financial Institution Name Blank: This might seem like a minor detail, but omitting the name of your bank or financial institution can delay processing.

Ignoring the Account Type: You need to specify whether your account is a checking or savings account. This information helps ensure your funds go to the right place.

Not Specifying a Flat Amount for Other Accounts: If you're allocating a fixed sum to an account other than your primary or expense reimbursement account, it's important to specify this amount. Neglecting to do so can create confusion or incorrect deposits.

Incomplete Signature or Date: Like any formal document, the form isn't complete without your signature and the date. This is your authorization, so don't forget this critical step.

Sending to the Wrong Fax Number or Address: Ensure you're sending your completed form to the correct fax number or address provided. A mistake here could mean your form never gets processed.

By steering clear of these common pitfalls, you'll streamline your direct deposit setup with First Energy. It's all about attention to detail and double-checking your information. A little bit of diligence goes a long way in making sure your paycheck lands in your account without a hitch.

Documents used along the form

When handling payroll and reimbursement procedures, such as those outlined in the FirstEnergy Direct Deposit Authorization - Paycheck and Expense Reimbursements Form 91, it's common to encounter a variety of other documents and forms that facilitate these processes efficiently and compliantly. Below is a brief description of such documents which frequently accompany or are used in conjunction with Form 91, ensuring a smooth workflow for both employees and finance departments.

- W-4 Form: Used for determining the amount of federal income tax to withhold from an employee's paycheck. Required for new hires and when an employee wants to adjust their withholding.

- I-9 Employment Eligibility Verification: This document is mandatory for verifying the identity and employment authorization of individuals hired for employment in the United States.

- State Tax Withholding Form: Similar to the federal W-4, this form is used for state tax withholding purposes. The requirements vary from state to state.

- Direct Deposit Enrollment/Change Form: While Form 91 serves this purpose for FirstEnergy, other organizations have similar forms for capturing or changing direct deposit information.

- Expense Report Form: Required for employees to itemize expenses for which they seek reimbursement. Typically used in conjunction with Form 91's expense reimbursement section.

- Voided Check or Bank Letter: Necessary for verifying the bank account information provided for direct deposit purposes. This is typically attached to the direct deposit authorization form.

- Payroll Change Form: Used when there are changes to an employee's pay rate, position, or personal information that might affect payroll processing.

- Time Sheet or Hours Worked Report: Necessary for calculating pay for hourly employees. This document records the number of hours worked in a pay period.

- Benefits Enrollment or Change Forms: Utilized when an employee wishes to enroll in or make changes to their benefit selections, which may also affect payroll deductions.

Each of these documents plays a vital role in the comprehensive approach to employee financial management, ensuring accuracy and legal compliance in both compensation and benefits handling. Whether managing tax withholdings, verifying work authorization, or enrolling in direct deposit, these forms complement each other to streamline administrative procedures and support an efficient payroll system.

Similar forms

The FirstEnergy Direct Deposit Authorization form, while unique to its company, shares similarities with several standard financial and employment documents. One such document is the generic Employee Direct Deposit Authorization form. This form, like the FirstEnergy version, allows employees to provide their banking details for receiving their paycheck through direct deposit. Both require the employee's bank account information, including the routing and account numbers, and both need authorization to start, change, or cancel this direct deposit service. The key goal is to streamline the payroll process by depositing funds directly into designated accounts.

Another related document is the Expense Reimbursement Form, often used in organizations to manage and process work-related expenses incurred by employees. Similar to the expense reimbursement section of the FirstEnergy Form 91, these forms typically collect banking information to facilitate the reimbursement through direct deposit. This similarity underscores the importance of efficient financial transactions between employers and employees, focusing on reimbursing out-of-pocket expenses promptly.

The Bank Account Verification Form is also akin to the FirstEnergy form, particularly in the aspects of verifying bank details. Employers or financial institutions use these forms to ensure the accuracy of banking information provided by an individual, thus preventing errors in direct deposit transactions. Like the verification step suggested by attaching a voided check in the FirstEnergy form, the verification form serves a critical role in confirming bank account specifics to deter fraud and mistakes.

The Payroll Direct Deposit Cancellation Form shares similarities with the cancellation section of the FirstEnergy form. Employees who wish to stop receiving their pay via direct deposit use these forms to notify their employers of their intent to revert to paper checks or to switch their direct deposits to different bank accounts. Both the FirstEnergy form and a typical cancellation form make it necessary for employees to inform their payroll departments in writing to cease the direct deposit transaction.

A Change of Bank Account Form for Direct Deposit, often used when an employee wants to update their banking details due to a change of banks or account types, mirrors the change authorization in the FirstEnergy document. Both require the employee to provide new banking information and authorize the transfer of the direct deposit service to the new account, ensuring uninterrupted access to their paychecks and expense reimbursements.

The Authorization Agreement for Automatic Deposits (ACH Credits) is similar because it involves an individual granting a company or organization permission to make electronic deposits into a specified account. Much like FirstEnergy's form, this agreement is vital for setting up automated payments or deposits, requiring detailed account information and authorization to initiate these transactions.

The Direct Deposit Setup Form for Government Benefits closely parallels the FirstEnergy form by requiring recipients of government benefits to provide their bank account details to receive their benefits electronically. Although the payor differs (government vs. employer), the essence of providing accurate banking information and authorization to enable direct deposits remains the same.

An Employee Payroll Information Form often includes a section for direct deposit preferences alongside other personal and tax information. While it covers a broader range of topics, its direct deposit section converges with the purpose of the FirstEnergy form by collecting crucial banking details from employees to facilitate electronic wage payments.

Lastly, the Vendor Direct Deposit Authorization form, used by businesses to set up direct deposits for their vendors, parallels the FirstEnergy form in its essence of streamlining financial transactions. By allowing for direct deposit into specified accounts, these forms alike aim to expedite payments and enhance the efficiency of monetary transfers, albeit in a B2B context compared to the employer-employee dynamic of the FirstEnergy form.

Each of these documents, though tailored to different contexts and parties, shares the common goal of utilizing direct deposit as a secure, efficient means of transferring funds. From payroll and expense reimbursements to government benefits and vendor payments, the principles of authorizing and managing electronic funds transfers are universally applicable, underlining the versatility and reliability of direct deposit services.

Dos and Don'ts

When completing the FirstEnergy Direct Deposit Authorization - Paycheck and Expense Reimbursements Form 91, there are critical steps to follow and common pitfalls to avoid ensuring your direct deposit setup is accomplished smoothly and efficiently. The adherence to these guidelines is pivotal in safeguarding personal financial data and ensuring the accuracy of transactions.

- Do review the Authorization Agreement thoroughly. Understanding the terms and conditions you’re agreeing to is essential for ensuring that you’re comfortable with the arrangements for your direct deposits.

- Don't rush through filling out your account information. Accuracy is key in this section to prevent any misrouting of funds.

- Do verify your bank's routing number and your account number. This can typically be done by looking at a check corresponding to the account or by contacting the financial institution directly.

- Don't use a deposit slip as verification of your bank details. Deposit slips may not contain accurate routing numbers or could be misinterpreted, leading to errors in setting up your direct deposit.

- Do select the correct type of account authorization. Clearly indicating whether the setup is for a new account, a change in existing account details, or cancellation is crucial for processing.

- Don't neglect to attach a voided check or a photocopy of a check when submitting the form. This document serves as an additional verification of your account information and is a required part of the submission process.

- Do choose the correct account type – checking or savings. This specifies where the funds should be deposited in accordance with your preferences.

- Don't forget to sign and date the form. An unsigned form is incomplete and will lead to delays in processing your direct deposit authorization.

- Do send the completed form to the correct address or fax number. Ensuring that your form reaches the Payroll Services at the appropriate location is crucial for timely processing of your direct deposit request.

By meticulously following these advisories, employees can foster a smooth transition or modification to their direct deposit arrangements, enhancing both the security and the efficiency of their financial dealings with FirstEnergy Corp.

Misconceptions

Many employees have misconceptions about the First Energy Form 91, a Direct Deposit Authorization form for both paychecks and expense reimbursements. Let's clear up the most common misunderstandings:

Needing a deposit slip is a common misconception. In fact, the form explicitly requires a voided check or a photocopy of a check, not a deposit slip, to verify bank account information. This ensures accurate entry of the routing and account numbers.

Direct deposit takes effect immediately is another misunderstanding. While the process is designed to be efficient, the authorization will become effective as soon as reasonably possible following receipt by Payroll Services, not instantaneously.

Some think the form is only for new direct deposit requests. However, the form accommodates multiple types of requests - new direct deposits, changes to existing information, and cancellations. It's a comprehensive tool for managing direct deposit details.

Another incorrect belief is that only checking accounts can be used. The form allows for both checking and savings accounts, as well as specifying different accounts for payroll and expense reimbursements. This provides flexibility for how and where employees receive their funds.

There’s a myth that the form cannot handle deposits to foreign banks. An option clearly exists for employees who receive their payroll at a U.S. financial institution and want the entire amount forwarded to a bank in another country, showing the form's versatility in accommodating diverse banking needs.

Finally, many employees incorrectly think the form is complicated to complete. The form outlines a straightforward process, including attaching a voided check for account verification and sending the completed form to a specified address or fax number. Clear instructions on the form simplify the process.

Understanding these points can help employees accurately complete the First Energy Form 91 for direct deposit, ensuring a smoother, error-free process.

Key takeaways

Filling out the FirstEnergy 91 form is crucial for employees or associates looking to authorize direct deposits for their paychecks and expense reimbursements. Understanding the key details and steps involved can help ensure the process is smooth and error-free. Here are several important takeaways:

- Understanding the purpose: The FirstEnergy 91 form is designed for the authorization of direct deposits. This includes both your regular paychecks and any expense reimbursements you’re entitled to.

- Completing the form correctly: It’s essential to fill out the employee information section accurately, including your SAP number, daytime phone number, and work location. Your selection between weekly and bi-weekly payment frequencies is also noted here.

- Bank account verification: Verification of your bank account is mandatory. For this, you’re required to attach a voided check (note: a deposit slip is not acceptable) or provide a photocopy of a check. Alternatively, bank account and routing numbers can be confirmed by contacting your financial institution directly.

- Authorization agreement: By signing the form, you authorize FirstEnergy Corp to initiate credit entries to your account. Importantly, this agreement also allows the correction of any errors through debit entries and adjustments if necessary.

- Account selection: You have the option to specify different financial institutions and account types (checking vs. savings) for your payroll and expense reimbursement funds. Additionally, you can also stipulate a flat amount to be deposited into any other accounts you might have.

- Changing or cancelling authorizations: The form caters to new, change in existing, or cancellation of direct deposit authorizations. This means you can manage your direct deposit details as your financial situation changes.

- Submission: Once completed and signed, the form, along with the required voided check, should be sent to Payroll Services at the specified address or fax number. This step is vital for activating the direct deposit authorization.

Ensuring that you have read and understood the authorization agreement before signing can't be overstressed, as it contains crucial information about the handling of your financial data and the transactions that will be made on your behalf. Following the steps outlined, including verifying banking details with your financial institution and choosing the right type of account, will help in the smooth processing of your direct deposits.

Popular PDF Documents

Budget Loan - An emphasis on the potential for multiple loan offers based on affordability underlines the DWP's flexible approach to financial aid.

Profits or Loss From Business - The bottom line of Schedule C impacts the income reported on your personal tax return.

Federal Estate Tax Exemption - Clarifies the interplay between federal estate tax filings and the specific requirements for DC estate tax submissions.