Get First B Notice Form

At the heart of ensuring accurate tax reporting and compliance with the Internal Revenue Service (IRS) regulations lies the First B Notice, a crucial document that serves as a warning and a call to action for taxpayers whose taxpayer identification number (TIN) on an account does not match IRS records. This discrepancy might arise for various reasons, such as a name change not reported to the Social Security Administration (SSA) or incorrect information provided for an account, making it essential for the recipient to take swift action. The notice outlines the critical steps an individual or entity must take to correct the mismatch and avoid the onset of backup withholding — a situation where a portion of the interest, dividends, and certain other payments are deducted before they're paid out, currently at a rate of 28 percent. Additionally, failing to provide the correct name/TIN combination could attract a $50 penalty by the IRS. For individuals, it involves verifying and updating personal information or submitting a corrected Form W-9. Non-individuals and certain sole proprietors are also guided on how to rectify their records, emphasizing the universal necessity of ensuring accurate TIN information across all accounts to prevent future inconveniences and potential financial penalties.

First B Notice Example

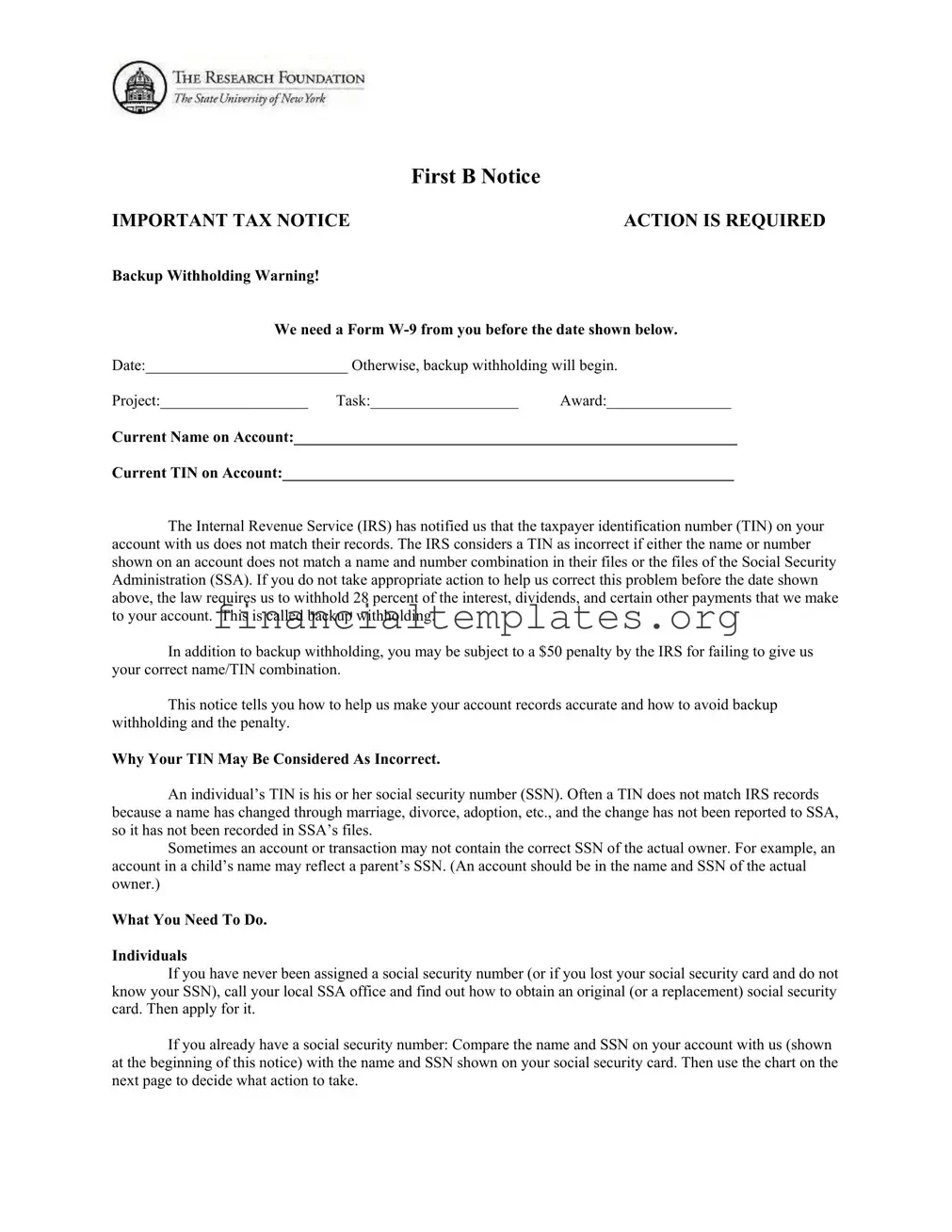

First B Notice

IMPORTANT TAX NOTICE |

ACTION IS REQUIRED |

Backup Withholding Warning!

We need a Form

Date:__________________________ Otherwise, backup withholding will begin.

Project:___________________ Task:___________________ Award:________________

Current Name on Account:_________________________________________________________

Current TIN on Account:__________________________________________________________

The Internal Revenue Service (IRS) has notified us that the taxpayer identification number (TIN) on your account with us does not match their records. The IRS considers a TIN as incorrect if either the name or number shown on an account does not match a name and number combination in their files or the files of the Social Security Administration (SSA). If you do not take appropriate action to help us correct this problem before the date shown above, the law requires us to withhold 28 percent of the interest, dividends, and certain other payments that we make to your account. This is called backup withholding.

In addition to backup withholding, you may be subject to a $50 penalty by the IRS for failing to give us your correct name/TIN combination.

This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty.

Why Your TIN May Be Considered As Incorrect.

An individual’s TIN is his or her social security number (SSN). Often a TIN does not match IRS records because a name has changed through marriage, divorce, adoption, etc., and the change has not been reported to SSA, so it has not been recorded in SSA’s files.

Sometimes an account or transaction may not contain the correct SSN of the actual owner. For example, an account in a child’s name may reflect a parent’s SSN. (An account should be in the name and SSN of the actual owner.)

What You Need To Do.

Individuals

If you have never been assigned a social security number (or if you lost your social security card and do not know your SSN), call your local SSA office and find out how to obtain an original (or a replacement) social security card. Then apply for it.

If you already have a social security number: Compare the name and SSN on your account with us (shown at the beginning of this notice) with the name and SSN shown on your social security card. Then use the chart on the next page to decide what action to take.

IF

1.The last name and SSN on your account agree with the last name and SSN on your social security card

THEN

1.Contact your local SSA office to ascertain whether the information on SSA’s records is different from that on your social security card, and to resolve any problem.

Also, put your name and SSN on the enclosed Form

2.The SSN on your account is different from the SSN on your social security card, but the last name is the same

3.The last name on your account is different from the last name on your social security card, but the SSN is the same on both

4.Both the last name and SSN on your account are different from the last name on your social security card

2.Put your name and SSN, as shown on your social security card, on the enclosed Form

3.Take one of the following steps (but not both):

(a)If the last name on your account is correct, contact

SSA to correct the name on your social security card. Put your SSN and name shown on your account on the enclosed Form

(b)If the last name on your social security card is correct, put that name and your SSN on the enclosed Form

4.(a) If the last name and SSN on your social security card are correct, put that name and SSN on the enclosed Form

(b)If the last name on your account and the SSN on your social security card are correct, follow the procedure in section 3(a) above. Be sure to put the name shown on your account and the name on your social security card on the Form

Once you have resolved what your correct name and TIN combination is, you must provide this information to us (and all your other payors) for all of your accounts to avoid a problem in the future. If you are required to visit an SSA office, take this notice, your social security card, and any other related documents with you. Before you go, you should call SSA so that they can explain what other documents you need to bring.

Instructions for Nonindividuals and Certain Sole Proprietors

For most nonindividuals (such as trusts, estates, partnerships, and similar entities), the TIN is the employer identification number (EIN). The EIN on your account may be incorrect because it does not contain the number of the actual owner of the account. For example, an account of an investment club or bowling league should reflect the organization’s own EIN and name, rather than the SSN of a member. Please put the name and EIN on the enclosed Form

A sole proprietor must furnish his or her individual name and either his or her SSN or the EIN for his or her sole proprietorship. In addition to his or her individual name, the sole proprietor may also furnish the business

name for the sole proprietorship, provided his or her individual name is listed before the business name. A sole proprietor must not furnish only the business name. Please put the individual name and SSN or EIN on the enclosed Form

Important Reminder!

YOU MUST SEND US A SIGNED IRS FORM

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of First B Notice | Notifies the recipient that the Taxpayer Identification Number (TIN) on their account does not match IRS records, requiring action to avoid backup withholding. |

| Requirement for Action | Recipients must provide a Form W-9 with the correct name/TIN combination before the specified date on the notice to avoid backup withholding. |

| Consequence of Non-Compliance | Failure to correctly update information will result in a 28% backup withholding on interest, dividends, and certain other payments. |

| Potential Penalty | A $50 penalty from the IRS may be assessed for failing to furnish the correct name/TIN combination. |

| Common Reasons for TIN Mismatch | A mismatch can occur due to a name change not reported to SSA, or the account or transaction not having the correct SSN of its actual owner. |

| Individual Action Steps | Individuals must compare and potentially update their name and SSN on their account to match their social security card, then submit a signed Form W-9. |

| Instructions for Nonindividuals | Nonindividual entities, such as trusts or partnerships, must provide their employer identification number (EIN) and name on the Form W-9. |

| Reminder on Form W-9 | Even if the account's name and number match the recipient's records, a signed IRS Form W-9 must be submitted before the notice's date to avoid backup withholding. |

Guide to Writing First B Notice

Once you receive the First B Notice, it's crucial to act swiftly to prevent any financial consequences, such as backup withholding or penalties. This notice is not just a formality; it's a mandatory requirement from the IRS signaling that the information linked to your TIN (Taxpayer Identification Number) doesn't match their records. The action you take next depends on whether your account details accurately reflect your current legal name and TIN. By carefully following the provided steps, you can ensure your account records are correct and avoid unnecessary withholding and penalties.

- Review the current name and TIN listed on the First B Notice against your social security card or EIN documentation.

- If you have never been assigned a social security number, or if you have lost your social security card, contact your local Social Security Administration (SSA) office to find out how to obtain an original or a replacement card.

- If your social security number is accurate but the name has changed (due to marriage, divorce, adoption, etc.), and you haven't updated this change with the SSA, do so at the earliest opportunity.

- For discrepancies with your social security number or name as follows, take the indicated action:

- If both last name and SSN on your account agree with your social security card, ensure that the SSA’s records are up-to-date. Then, fill out the enclosed Form W-9 with your correct information, sign it, and send it back.

- If your account's SSN differs from your social security card (but the last name is the same), simply fill out the Form W-9 with your correct SSN and send it back.

- If your account has a different last name but the same SSN as your social security card, you can either update your name with the SSA or provide both last names on the Form W-9 and send it back. Contacting SSA for a name update is advised for the future.

- If both the SSN and the last name on your account are incorrect, correct the information with the SSA if needed, then update the Form W-9 with the accurate details and return it.

- For nonindividual accounts, such as trusts or sole proprietorships, ensure the EIN is correct. Update the Form W-9 with the correct entity name and EIN before sending it back.

- For sole proprietors, include both your individual name and, if applicable, your business name on the Form W-9. Your individual name should come first, followed by your business name, along with the correct SSN or EIN.

- Double-check all entered information for accuracy, and send the signed Form W-9 before the deadline indicated on the First B Notice to avoid backup withholding.

- If a visit to the SSA office is necessary, take the First B Notice, your social security card, and any other related documents with you. Calling ahead to determine what specific documents are required can save time and ensure you bring everything needed.

Remember, sending a properly filled out and signed Form W-9 as soon as possible is the best way to mitigate the risk of backup withholding and penalties. Ensuring your account's name and TIN match those on file with the IRS is not just about compliance; it's about protecting your financial interests.

Understanding First B Notice

-

What is a First B Notice and why did I receive one?

A First B Notice is a notification from a financial institution or business indicating that the name and taxpayer identification number (TIN) on your account do not match the records of the Internal Revenue Service (IRS) or the Social Security Administration (SSA). The discrepancy may be because of a simple error, such as a misspelled name or an incorrect TIN, or it could be due to changes in personal circumstances such as marriage or divorce that have not been updated with the SSA. You received this notice because the IRS has alerted the sender that there is a mismatch requiring correction to avoid future tax withholding and possible penalties.

-

What are the consequences if I do not respond to the First B Notice?

If you do not take the necessary action before the date specified in the notice, the law mandates the business or financial institution to begin backup withholding at a rate of 28% on interest, dividends, and certain other payments made to your account. Furthermore, failing to supply the correct TIN could result in a $50 penalty from the IRS. To avoid withholding and the penalty, it's important to address the issue promptly by providing the requested documentation to correct the name/TIN combination on your account.

-

How do I correct the mismatch identified in the First B Notice?

Actions required to correct the mismatch vary based on your specific situation:

- If the name and SSN on your account match those on your Social Security card, you should contact your local SSA office to verify and correct any discrepancies in their records. Then, complete the enclosed Form W-9 with your name and SSN, sign it, and return it to the sender.

- If your SSN is incorrect but the last name matches, simply correct the SSN on the enclosed Form W-9, following the instructions, sign, and return it without contacting the SSA.

- If the last name on your account differs from your Social Security card or if both the name and SSN are incorrect, specific steps outlined in the notice should be followed to either update your information with the SSA or correct the information on the Form W-9 and return it.

For nonindividuals like trusts or sole proprietors, the instructions may involve providing or correcting an employer identification number (EIN) instead of a SSN.

-

What if I've already submitted a Form W-9 but still received a First B Notice?

If you have previously submitted a Form W-9 but received a First B Notice, it could mean that the submitted information did not resolve the mismatch or was not recorded correctly by the financial institution or business. Review the name and TIN or SSN on the Form W-9 you submitted against your Social Security card or IRS documents issuing your EIN to ensure accuracy. If discrepancies are found, submit a new Form W-9 with the correct information before the deadline mentioned in the First B Notice. If everything matches, contact the sender directly to discuss the discrepancy and ensure they have updated their records accordingly.

Common mistakes

Filling out the First B Notice form is a crucial step in ensuring your tax information is accurate and compliant. However, mistakes can happen. To help you navigate this process more smoothly, here are six common errors people make when filling out this form:

Not updating personal information: It's essential to compare the name and Social Security Number (SSN) on the notice with your current information. If there have been any changes, such as through marriage or divorce, and these changes haven't been reported to the Social Security Administration (SSA), your TIN may be considered incorrect.

Using the wrong TIN for the account type: For individual accounts, your TIN is your SSN. However, for non-individuals, such as trusts or estates, the TIN is the Employer Identification Number (EIN). Mixing these up can lead to discrepancies.

Ignoring the action steps based on the discrepancy: The notice outlines specific actions to take depending on how the information mismatches. Ignoring these steps or not following them correctly can lead to unnecessary withholding and penalties.

Omitting the signature on the Form W-9: Forgetting to sign the Form W-9 is a simple yet critical oversight. A signature is required to validate the information provided.

Failure to contact the SSA when necessary: In cases where your social security card does not match the information the IRS has, it’s important to contact the SSA to resolve the discrepancy. Not doing so can delay the correction process.

Not sending the updated information before the deadline: Procrastinating or overlooking the need to send in the corrected information by the date indicated on the notice can trigger backup withholding and potential penalties.

By being aware of these common pitfalls, you can take the necessary steps to ensure your tax information is correct and avoid the consequences of backup withholding and penalties.

Documents used along the form

When handling the First B Notice, which is a critical document for addressing discrepancies in taxpayer identification information, several additional forms and documents are often used in conjunction to ensure accurate and compliant tax reporting. These forms range from confirming individual or entity identification to making corrections or updates to previously submitted information.

- Form W-9: Request for Taxpayer Identification Number and Certification. This form is used by individuals and entities to provide their correct taxpayer identification number (TIN) to the entity that is required to file an information return with the IRS. The form also certifies the TIN provided is correct and whether the individual or entity is subject to backup withholding.

- Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals). For individuals who are not U.S. persons, this form is used to certify foreign status and claim any applicable treaty benefits for reduced withholding.

- Form W-8BEN-E: Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). Similar to the W-8BEN for individuals, this form applies to entities declaring their foreign status and claiming tax treaty benefits.

- Form W-4: Employee's Withholding Certificate. While primarily used for employment purposes, this form can be relevant for adjusting withholding based on personal circumstances and might be related to discrepancies in tax withholdings highlighted by a First B Notice.

- Form 1099: Miscellaneous Income. For the reporting of various types of non-employment income. A discrepancy on a 1099 compared to the IRS records could trigger a First B Notice.

- Form 5498: IRA Contribution Information. This form reports contributions to retirement accounts, which could be relevant if discrepancies in account information are identified.

- Social Security Card: As a form of identification to verify an individual's correct name and social security number (SSN), which is necessary when resolving a mismatched TIN.

- Form 8822: Change of Address. Used to notify the IRS of a change in address, which can be crucial if a First B Notice is not received due to an outdated address on file.

- Form 1040: U.S. Individual Income Tax Return. Though primarily for filing annual income taxes, reviewing past filed 1040 forms can help individuals verify the information the IRS has on record, potentially identifying discrepancies causing a First B Notice.

Together, these forms and documents play a vital role in ensuring that individuals and entities provide accurate tax identification information, comply with IRS reporting requirements, and avoid unnecessary withholding or penalties. Handling these forms properly after receiving a First B Notice helps prevent future discrepancies and ensures smoother interactions with tax authorities.

Similar forms

The Form W-9, "Request for Taxpayer Identification Number and Certification," is one of the documents similar to the First B Notice form. Both serve important roles in ensuring the accuracy of taxpayer identification information for IRS purposes. The First B Notice alerts the recipient about a discrepancy between the provided TIN and IRS records, demanding action to correct it, whereas the Form W-9 is often the tool used for that correction, providing a standardized way for individuals and entities to supply their correct Taxpayer Identification Number (TIN) and certify the accuracy of the information.

Another document bearing resemblance to the First B Notice is the CP2100 or CP2100A notice from the IRS. This notice alerts payers about inaccuracies in the TINs reported on 1099 forms — signaling the need for payers to begin backup withholding on payments to the payees in question if correct information is not furnished. Similar to the First B Notice, it highlights discrepancies in tax records that need rectification to avoid financial penalties and withholding complications.

The W-8 series of forms, particularly the W-8BEN form, also share a connection with the First B Notice. These forms are used by foreign entities and individuals to certify their status and claim exemptions from the Foreign Account Tax Compliance Act (FATCA) and other withholding. Although intended for a non-U.S. audience, they similarly prevent withholding by providing the appropriate tax identification and certification, paralleling the objective of the First B Notice in avoiding backup withholding but from an international perspective.

The W-4 form, "Employee's Withholding Certificate," although primarily designed for determining the amount of federal income tax to withhold from an employee's paycheck, has similarities to the First B Notice. Both documents are integral to the tax withholding process, with the W-4 focusing on income tax while the First B Notice centers on backup withholding due to TIN discrepancies. The proactive completion of a W-4 by an employee aims to prevent excessive or insufficient withholding, analogous to resolving TIN issues to avoid unnecessary backup withholding.

The SS-4 form, used to apply for an Employer Identification Number (EIN), is indirectly related to the First B Notice because it deals with the accurate reporting and identification of taxpayer information for entities. Like the First B Notice emphasizes the need for accurate TINs for individuals, the SS-4 is crucial for entities to commence their tax responsibilities correctly and avoid future discrepancies that could lead to notices or penalties from the IRS.

The 1099 series, which are informational forms reporting non-employee compensation, interest, dividends, and various other types of payments, share a connection with the First B Notice. When payers file 1099 forms with incorrect TIN information, it can trigger the issuance of a First B Notice. Hence, accurate completion of 1099 forms is vital to prevent the cascading effect of tax reporting issues, embodying a proactive measure to surpass the challenges underscored by the First B Notice.

The 1040 U.S. Individual Income Tax Return form, while being the cornerstone document for individual tax filing, intersects with the core concern of the First B Notice: accurate taxpayer identification. Discrepancies in TINs that lead to a First B Notice can affect the processing of one's 1040 form, underscoring the reciprocal relationship between maintaining accurate TIN records and the seamless execution of tax responsibilities.

Last but not least, the "Letter 5071C" from the IRS, while not a form, is a communication similar to the First B Notice in its objective of verifying taxpayer identity. This letter is typically sent when the IRS needs more information to confirm a tax return's legitimacy. Like the First B Notice, it aims to rectify discrepancies and ensure the integrity of tax filings, although focusing more on identity verification to combat tax return fraud.

Dos and Don'ts

When completing the First B Notice form, there are specific steps that should and should not be followed to ensure accuracy and compliance. Following these guidelines can help avoid common mistakes and potential penalties.

Things to Do:

Review the current name and Taxpayer Identification Number (TIN) on your account indicated in the First B Notice and compare these with your social security card or official IRS documents.

For discrepancies in the last name or SSN, contact the Social Security Administration (SSA) to verify and correct any differences in their records.

Ensure to sign the enclosed IRS Form W-9 after filling it out with the accurate name and TIN as confirmed by your social security card or IRS documentation.

Send the signed Form W-9 back before the deadline mentioned in the First B Notice to avoid backup withholding.

For nonindividuals or sole proprietors, correctly provide the name and Employer Identification Number (EIN) or individual name and SSN, along with the sole proprietorship's business name if applicable.

Things Not to Do:

Do not ignore the deadline for sending the IRS Form W-9 as stated in the First B Notice to prevent the initiation of backup withholding.

Avoid using any name or TIN on the Form W-9 that does not match exactly with records held by the Social Security Administration or the IRS.

Do not send the Form W-9 without your signature, as an unsigned form may result in it being considered invalid.

Refrain from providing only the business name if you are a sole proprietor; always include your individual name followed by the business name, if applicable.

Avoid waiting to correct discrepancies in your records; immediate action is recommended to ensure all of your accounts reflect the accurate name/TIN combination.

Misconceptions

Many people have misconceptions about the First B Notice form. Understanding these inaccuracies can help taxpayers respond correctly and efficiently to the notice. Let's address some of the most common misconceptions.

It's only for individuals. Some think the First B Notice is only applicable to individual taxpayers. However, it also concerns entities like trusts, estates, partnerships, and sole proprietors. The action required varies slightly depending on whether an individual or an entity receives the notice.

It means you're being audited. Receiving a First B Notice does not imply an audit. It simply alerts you that the TIN or SSN provided to a payer doesn't match IRS records. The primary goal is to correct misinformation to avoid backup withholding.

No hurry to respond. There's a misconception about the urgency in responding to this notice. Timely action is crucial because failure to submit the necessary Form W-9 before the specified date will trigger backup withholding on future payments.

Only individuals need to submit Form W-9. This misconception can lead to confusion. In reality, the requirement to submit a Form W-9 after receiving a First B Notice applies to both individuals and various entities, including certain sole proprietors who must use their individual name and SSN or EIN.

Backup withholding isn't a big deal. Some might underestimate the impact of backup withholding. It involves the payer deducting 28 percent from your payment as tax to the IRS. This can significantly affect your immediate cash flow and financial planning.

Submitting any name on Form W-9 will suffice. The name and TIN (or SSN for individuals) provided on Form W-9 must match the official records with the SSA or IRS. Sole proprietors need to ensure their individual name precedes any business name on the form.

Correcting your SSN or TIN with SSA or IRS is optional. When discrepancies are identified, resolving these issues with the SSA (for individuals) or updating records with the IRS (for entities) is not optional. It is a necessary step to avoid future discrepancies and withholding issues.

If your account information is correct, no action is needed. Even if you believe your information matches IRS records, failing to send a signed Form W-9 before the specified deadline can lead to backup withholding. It's a mandatory step once the First B Notice is received.

Penalty avoidance is the sole benefit of responding. Beyond avoiding a $50 penalty from the IRS for failure to furnish correct TIN or SSN information, responding promptly prevents backup withholding. It also helps ensure that future tax documents and returns are accurate, preventing possible complications or additional IRS inquiries.

Addressing the First B Notice with accurate information and prompt action is crucial for taxpayers to avoid unnecessary penalties and withholding. Clearing up these misconceptions ensures that taxpayers are better prepared to respond appropriately.

Key takeaways

Filling out and using the First B Notice correctly is crucial to avoid unnecessary headaches with the IRS. Here are four key takeaways that will guide you through this process:

- Immediate Action Required: Upon receiving a First B Notice, it’s important to act swiftly. The notice includes a deadline by which a Form W-9 must be provided to the requesting party to avoid backup withholding. Backup withholding involves the deduction of 28 percent of interest, dividends, and specific other payments, which could have a significant impact on your finances.

- Verifying Personal Information: The discrepancy that triggers a First B Notice often stems from a mismatch between the name or taxpayer identification number (TIN) on an account and the information the IRS has on file. Individuals should compare the name and TIN (typically a Social Security Number for individuals) on their account with what's on their Social Security card. If there are differences, steps must be taken to align the information, which might include contacting the Social Security Administration (SSA) or correcting the information on the Form W-9 itself.

- Instructions for Resolving Discrepancies: The notice provides detailed instructions tailored to the nature of the discrepancy. For individuals, this may involve contacting the SSA, amending information directly on the Form W-9, or both. Nonindividual entities, such as trusts and partnerships, might need to verify or update their employer identification number (EIN). All procedures aim at ensuring the name and TIN combination on the account aligns with official records.

- Compliance is Not Optional: Compliance with a First B Notice is not merely a suggestion; it's a legal requirement. Failing to provide a corrected Form W-9 by the deadline specified in the notice will lead to mandatory backup withholding. Additionally, there is a potential $50 penalty from the IRS for failing to furnish the correct name/TIN combination. Beyond financial penalties, this situation can complicate your financial accounts and future dealings with the IRS.

Dealing carefully with a First B Notice can prevent unnecessary penalties and financial disruption. By verifying personal information, correcting discrepancies promptly, and understanding the implications of non-compliance, individuals and entities can navigate these requirements more effectively.

Popular PDF Documents

Irs 8332 - IRS Form 8332 must accompany the tax return of the parent claiming the child to be considered valid and effective for the tax year in question.

Gi Bill Verification - Its structured format prevents discrepancies in reporting, a key aspect of financial stewardship within Virginia's child care subsidy efforts.