Get Federal Loan Economic Hardship Request Form

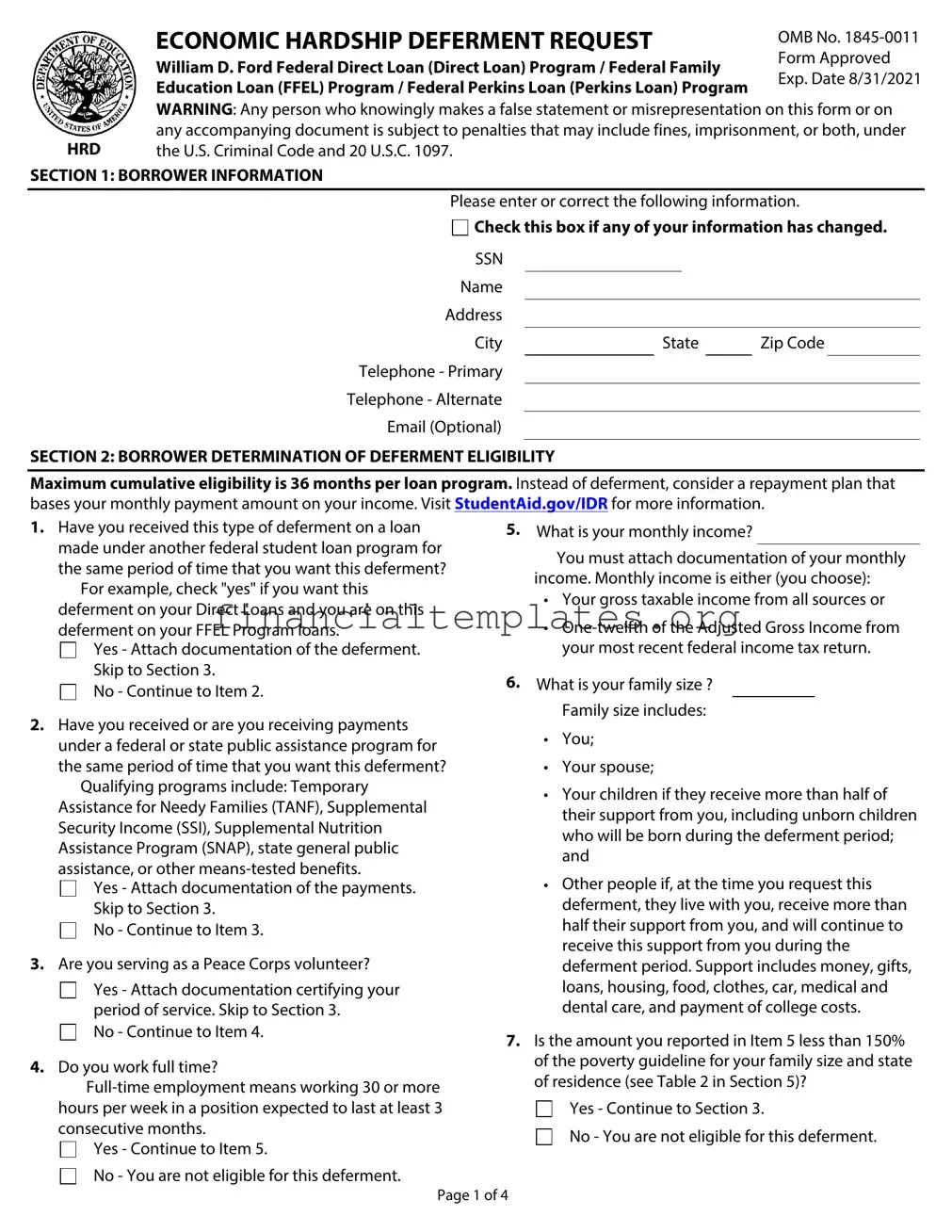

Navigating the complex terrain of managing federal student loans during tough economic times can seem daunting. For borrowers finding themselves in such predicaments, the Federal Loan Economic Hardship Deferment Request form serves as a critical tool. This form, applicable to those with William D. Ford Federal Direct Loans, Federal Family Education Loans, and Federal Perkins Loans, is designed to provide a temporary reprieve from loan repayments under specific hardship conditions. Borrowers are required to substantiate their eligibility through detailed personal and financial information, including income, family size, and current employment status. Moreover, the form outlines the consequences of providing false information – a stern reminder of the serious nature of this request. It also introduces alternative repayment plans based on income, potentially providing a longer-term solution for those struggling to keep up with payments. The deferment option is not infinite, capped at a total of 36 months, pushing borrowers to consider carefully when and how to utilize this option. Additionally, the documentation lays out the procedure for requesting deferment, the criteria for approval, and the implications of deferment on loan interest and repayment schedules, giving a comprehensive overview of the process and its consequences.

Federal Loan Economic Hardship Request Example

|

ECONOMIC HARDSHIP DEFERMENT REQUEST |

|

|

|

OMB No. |

|||

|

William D. Ford Federal Direct Loan (Direct Loan) Program / Federal Family |

Form Approved |

||||||

|

Exp. Date 8/31/2021 |

|||||||

|

Education Loan (FFEL) Program / Federal Perkins Loan (Perkins Loan) Program |

|||||||

|

|

|

|

|||||

|

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on |

|||||||

HRD |

any accompanying document is subject to penalties that may include fines, imprisonment, or both, under |

|||||||

the U.S. Criminal Code and 20 U.S.C. 1097. |

|

|

|

|

|

|

||

SECTION 1: BORROWER INFORMATION |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

Please enter or correct the following information. |

|||||||

|

Check this box if any of your information has changed. |

|||||||

|

SSN |

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip Code |

|

|

|

|

Telephone - Primary |

|

|

|

|

|

|

|

Telephone - Alternate

Email (Optional)

SECTION 2: BORROWER DETERMINATION OF DEFERMENT ELIGIBILITY

Maximum cumulative eligibility is 36 months per loan program. Instead of deferment, consider a repayment plan that bases your monthly payment amount on your income. Visit StudentAid.gov/IDR for more information.

1. Have you received this type of deferment on a loan |

5. |

What is your monthly income? |

|||||

made under another federal student loan program for |

|

|

|

|

|

|

|

|

|

You must attach documentation of your monthly |

|||||

the same period of time that you want this deferment? |

|

|

|||||

|

income. Monthly income is either (you choose): |

||||||

For example, check "yes" if you want this |

|

||||||

|

• Your gross taxable income from all sources or |

||||||

deferment on your Direct Loans and you are on this |

|

||||||

|

• |

||||||

deferment on your FFEL Program loans. |

|

||||||

Yes - Attach documentation of the deferment. |

|

|

your most recent federal income tax return. |

||||

Skip to Section 3. |

6. |

What is your family size ? |

|||||

No - Continue to Item 2. |

|||||||

|

|

|

|

|

|

||

2. Have you received or are you receiving payments |

|

|

Family size includes: |

||||

|

• |

You; |

|||||

under a federal or state public assistance program for |

|

||||||

|

|

|

|

|

|

||

the same period of time that you want this deferment? |

|

• |

Your spouse; |

||||

Qualifying programs include: Temporary |

|

• Your children if they receive more than half of |

|||||

Assistance for Needy Families (TANF), Supplemental |

|

||||||

|

|

their support from you, including unborn children |

|||||

Security Income (SSI), Supplemental Nutrition |

|

|

|||||

|

|

who will be born during the deferment period; |

|||||

Assistance Program (SNAP), state general public |

|

|

|||||

|

|

and |

|||||

assistance, or other |

|

|

|||||

|

• Other people if, at the time you request this |

||||||

Yes - Attach documentation of the payments. |

|

||||||

Skip to Section 3. |

|

|

deferment, they live with you, receive more than |

||||

No - Continue to Item 3. |

|

|

half their support from you, and will continue to |

||||

3. Are you serving as a Peace Corps volunteer? |

|

|

receive this support from you during the |

||||

|

|

deferment period. Support includes money, gifts, |

|||||

Yes - Attach documentation certifying your |

|

|

loans, housing, food, clothes, car, medical and |

||||

period of service. Skip to Section 3. |

|

|

dental care, and payment of college costs. |

||||

No - Continue to Item 4. |

7. Is the amount you reported in Item 5 less than 150% |

||||||

|

|||||||

4. Do you work full time? |

|

of the poverty guideline for your family size and state |

|||||

|

of residence (see Table 2 in Section 5)? |

||||||

|

|||||||

|

|

|

|

|

|

||

hours per week in a position expected to last at least 3 |

|

|

Yes - Continue to Section 3. |

||||

consecutive months. |

|

|

No - You are not eligible for this deferment. |

||||

Yes - Continue to Item 5. |

|

|

|||||

|

|

|

|

|

|

||

No - You are not eligible for this deferment. |

|

|

|

|

|

|

|

Page 1 of 4

Borrower Name |

|

Borrower SSN |

|

|

|

SECTION 3: BORROWER REQUESTS, UNDERSTANDINGS, CERTIFICATIONS, AND AUTHORIZATION

Irequest:

•To defer repayment of my loans for the period during which I have an economic hardship, as described in Section 2.

•That my deferment begin on:

• |

If checked, to make interest |

payments on my |

loans during my deferment. |

I understand that:

•I am not required to make payments of loan principal or interest during my deferment.

•My deferment will begin on the later of the date I became eligible or the date that I requested.

•My deferment will end on the earlier of the date that I exhaust my maximum eligibility, the certified deferment end date, or when I am no longer eligible for the deferment for another reason.

•If I am a Perkins Loan borrower, I will receive a

•Unless I am a Peace Corps volunteer, my deferment will be granted in increments of 1 year. If I continue to be eligible for an Economic Hardship Deferment after 1 year, I may reapply, subject to the cumulative maximum.

•My loan holder may grant me a forbearance while processing my form or to cover any period of delinquency that exists when I submit my form.

•Unpaid interest may capitalize on my loans during or at the expiration of my deferment or forbearance, but interest never capitalizes on Perkins Loans.

I certify that:

•The information I have provided on this form is true and correct.

•I will provide additional documentation to my loan holder, as required, to support my deferment eligibility.

•I will notify my loan holder immediately when my eligibility for the deferment ends.

•I have read, understand, and meet the eligibility requirements in Section 2.

I authorize the entity to which I submit this request and its agents to contact me regarding my request or my loans at any cellular telephone number that I provide now or in the future using automated telephone dialing equipment or artificial or prerecorded voice or text messages.

Borrower's Signature |

|

Date |

SECTION 4: INSTRUCTIONS FOR COMPLETING THE DEFERMENT REQUEST

Type or print using dark ink. Enter dates as

SECTION 5: DEFINITIONS

The William D. Ford Federal Direct Loan (Direct |

The Federal Family Education Loan (FFEL) Program |

|

Loan) Program includes Federal Direct Stafford/Ford |

includes Federal Stafford Loans, Federal PLUS Loans, Federal |

|

(Direct Subsidized) Loans, Federal Direct Unsubsidized |

Consolidation Loans, and Federal Supplemental Loans for |

|

Stafford/Ford (Direct Unsubsidized) Loans, Federal |

Students (SLS). |

|

Direct PLUS (Direct PLUS) Loans, and Federal Direct |

The Federal Perkins Loan (Perkins Loan) Program |

|

Consolidation (Direct Consolidation) Loans. |

||

includes Federal Perkins Loans, National Direct Student Loans |

||

|

||

|

(NDSL), and National Defense Student Loans (Defense Loans). |

Page 2 of 4

SECTION 5: DEFINITIONS (CONTINUED)

|

Capitalization is the addition of unpaid interest to |

|

A forbearance is a period during which you are permitted |

||||||||||||||

the principal balance of your loan. Capitalization causes |

|

to postpone making payments temporarily, allowed an |

|||||||||||||||

more interest to accrue over the life of your loan and |

|

extension of time for making payments, or temporarily |

|||||||||||||||

may cause your monthly payment amount to increase. |

|

allowed to make smaller payments than scheduled. |

|||||||||||||||

Interest never capitalizes on Perkins Loans. |

|

|

|

The holder of your Direct Loans is the Department. The |

|||||||||||||

|

Table 1 (below) provides an example of the monthly |

|

holder of your FFEL Program loans may be a lender, guaranty |

||||||||||||||

payments and the total amount repaid for a $30,000 |

|

agency, secondary market, or the Department. The holder of |

|||||||||||||||

unsubsidized loan. The example loan has a 6% interest |

|

your Perkins Loans is an institution of higher education or the |

|||||||||||||||

rate and the example deferment or forbearance lasts for |

|

Department. Your loan holder may use a servicer to handle |

|||||||||||||||

12 months and begins when the loan entered |

|

billing and other communications related to your loans. |

|||||||||||||||

repayment. The example compares the effects of paying |

|

References to “your loan holder” on this form mean either |

|||||||||||||||

the interest as it accrues or allowing it to capitalize. |

|

your loan holder or your servicer. |

|

|

|||||||||||||

|

A |

|

A subsidized loan is a Direct Subsidized Loan, a Direct |

||||||||||||||

joint borrowers on a Direct or Federal Consolidation |

|

||||||||||||||||

|

Subsidized Consolidation Loan, a Federal Subsidized Stafford |

||||||||||||||||

Loan or a Federal PLUS Loan. Both |

|

||||||||||||||||

|

Loan, portions of some Federal Consolidation Loans, a Federal |

||||||||||||||||

responsible for repayment the full amount of the loan. |

|

||||||||||||||||

|

Perkins Loan, an NDSL, and a Defense Loan. |

|

|

||||||||||||||

|

A deferment is a period during which you are |

|

|

|

|||||||||||||

|

|

An unsubsidized loan is a Direct Unsubsidized Loan, a |

|||||||||||||||

entitled to postpone repayment of your loans. Interest is |

|

||||||||||||||||

|

Direct Unsubsidized Consolidation Loan, a Direct PLUS Loan, a |

||||||||||||||||

not generally charged to you during a deferment on |

|

||||||||||||||||

|

Federal Unsubsidized Stafford Loan, a Federal PLUS Loan, a |

||||||||||||||||

your subsidized loans. Interest is always charged to you |

|

||||||||||||||||

|

Federal SLS, and portions of some Federal Consolidation |

||||||||||||||||

during a deferment on your unsubsidized loans. On |

|

||||||||||||||||

|

Loans. |

|

|

|

|

|

|

|

|

|

|||||||

loans made under the Perkins Loan Program, all |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

deferments are followed by a |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

period of 6 months, during which time you are not |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

required to make payments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1. Capitalization Chart |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Treatment of Interest with |

Loan |

Capitalized |

Outstanding |

|

Monthly |

Number of |

Total |

|||||||||

|

Deferment/Forbearance |

Amount |

Interest |

|

Principal |

|

Payment |

Payments |

Repaid |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest is paid |

$30,000 |

$0 |

|

|

$30,000 |

|

|

$333 |

120 |

$41,767 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest is capitalized at the |

$30,000 |

$1,800 |

|

$31,800 |

|

|

$353 |

120 |

$42,365 |

|

||||||

|

end |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest is capitalized |

$30,000 |

$1,841 |

|

$31,841 |

|

|

$354 |

120 |

$42,420 |

|

||||||

|

quarterly and at the end |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Table 2. 150% of the Poverty Guidelines for 2019 (Monthly) |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Family Size |

|

Alaska |

|

Hawaii |

|

|

All Others |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

1 |

|

$1,950.00 |

|

$1,797.50 |

$1,561.25 |

|

|

|

|||||

|

|

|

|

2 |

|

$2,641.25 |

|

$2,432.50 |

$2,113.75 |

|

|

|

|||||

|

|

|

|

3 |

|

$3,332.50 |

|

$3,067.50 |

$2,666.25 |

|

|

|

|||||

|

|

|

|

4 |

|

$4,023.75 |

|

$3,702.50 |

|

$3,218.75 |

|

|

|

||||

|

|

|

|

5 |

|

$4,715.00 |

|

$4,337.50 |

|

$3,771.25 |

|

|

|

||||

|

|

|

|

6 |

|

$5,406.25 |

|

$4,972.50 |

|

$4,323.75 |

|

|

|

||||

|

|

|

|

7 |

|

$6,097.50 |

|

$5,607.50 |

|

$4,876.25 |

|

|

|

||||

|

|

|

|

8 |

|

$6,788.75 |

|

$6,242.50 |

|

$5,428.75 |

|

|

|

||||

|

|

|

Each additional |

|

$691.25 |

|

$635.00 |

|

$552.50 |

|

|

|

|||||

|

|

|

person, add |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

If you do not live in the United States, use the poverty guideline amount in |

|

|

||||||||||||||

|

|

|

|

the column labeled "All Others". |

|

|

|

|

|

|

|

||||||

Page 3 of 4

SECTION 6: WHERE TO SEND THE COMPLETED DEFERMENT REQUEST

Return the completed form and any documentation to: (If no address is shown, return to your loan holder.)

If you need help completing this form, call:

(If no phone number is shown, call your loan holder.)

SECTION 7: IMPORTANT NOTICES

Privacy Act Notice. The Privacy Act of 1974 (5 U.S.C. 552a) |

To assist program administrators with tracking refunds |

|

requires that the following notice be provided to you: |

and cancellations, disclosures may be made to guaranty |

|

The authorities for collecting the requested information |

agencies, to financial and educational institutions, or to |

|

federal or state agencies. To provide a standardized method |

||

from and about you are §421 et seq., §451 et seq., or §461 et |

||

for educational institutions to efficiently submit student |

||

seq. of the Higher Education Act of 1965, as amended (20 |

||

enrollment statuses, disclosures may be made to guaranty |

||

U.S.C. 1071 et seq., 20 U.S.C. 1087a et seq., or 20 U.S.C. 1087aa |

||

agencies or to financial and educational institutions. To |

||

et seq.) and the authorities for collecting and using your Social |

||

counsel you in repayment efforts, disclosures may be made |

||

Security Number (SSN) are §§428B(f) and 484(a)(4) of the HEA |

||

to guaranty agencies, to financial and educational |

||

(20 U.S.C. |

||

institutions, or to federal, state, or local agencies. |

||

Participating in the William D. Ford Federal Direct Loan (Direct |

||

|

||

Loan) Program, Federal Family Education Loan (FFEL) |

In the event of litigation, we may send records to the |

|

Program, or Federal Perkins Loan (Perkins Loan) Program and |

Department of Justice, a court, adjudicative body, counsel, |

|

giving us your SSN are voluntary, but you must provide the |

party, or witness if the disclosure is relevant and necessary |

|

requested information, including your SSN, to participate. |

to the litigation. If this information, either alone or with |

|

The principal purposes for collecting the information on |

other information, indicates a potential violation of law, we |

|

may send it to the appropriate authority for action. We may |

||

this form, including your SSN, are to verify your identity, to |

||

send information to members of Congress if you ask them |

||

determine your eligibility to receive a loan or a benefit on a |

||

to help you with federal student aid questions. In |

||

loan (such as a deferment, forbearance, discharge, or |

||

circumstances involving employment complaints, |

||

forgiveness) under the Direct Loan, FFEL, or Federal Perkins |

||

grievances, or disciplinary actions, we may disclose relevant |

||

Loan Programs, to permit the servicing of your loans, and, if it |

||

records to adjudicate or investigate the issues. If provided |

||

becomes necessary, to locate you and to collect and report on |

||

for by a collective bargaining agreement, we may disclose |

||

your loans if your loans become delinquent or default. We also |

||

records to a labor organization recognized under 5 U.S.C. |

||

use your SSN as an account identifier and to permit you to |

||

Chapter 71. Disclosures may be made to our contractors for |

||

access your account information electronically. |

||

the purpose of performing any programmatic function that |

||

The information in your file may be disclosed, on a case- |

||

requires disclosure of records. Before making any such |

||

disclosure, we will require the contractor to maintain Privacy |

||

parties as authorized under routine uses in the appropriate |

||

Act safeguards. Disclosures may also be made to qualified |

||

systems of records notices. The routine uses of this |

||

researchers under Privacy Act safeguards. |

||

information include, but are not limited to, its disclosure to |

||

Paperwork Reduction Notice. According to the |

||

federal, state, or local agencies, to private parties such as |

||

Paperwork Reduction Act of 1995, no persons are required |

||

relatives, present and former employers, business and |

||

to respond to a collection of information unless such |

||

personal associates, to consumer reporting agencies, to |

||

collection displays a valid OMB control number. The valid |

||

financial and educational institutions, and to guaranty |

||

OMB control number for this information collection is |

||

agencies in order to verify your identity, to determine your |

||

eligibility to receive a loan or a benefit on a loan, to permit the |

||

information is estimated to average 10 minutes per |

||

servicing or collection of your loans, to enforce the terms of |

||

response, including time for reviewing instructions, |

||

the loans, to investigate possible fraud and to verify |

||

searching existing data sources, gathering and maintaining |

||

compliance with federal student financial aid program |

||

the data needed, and completing and reviewing the |

||

regulations, or to locate you if you become delinquent in your |

||

collection of information. The obligation to respond to this |

||

loan payments or if you default. To provide default rate |

||

collection is required to obtain a benefit in accordance with |

||

calculations, disclosures may be made to guaranty agencies, |

||

34 CFR 674.34, 674.35, 674.36, 674.37, 682.210, or 685.204. |

||

to financial and educational institutions, or to state agencies. |

||

If you have comments or concerns regarding the |

||

To provide financial aid history information, disclosures may |

||

status of your individual submission of this form, please |

||

be made to educational institutions. |

||

contact your loan holder directly (see Section 6). |

||

|

Page 4 of 4

Document Specifics

| Fact Number | Detail |

|---|---|

| Fact 1 | The form is applicable for loans under the William D. Ford Federal Direct Loan Program, Federal Family Education Loan Program, and Federal Perkins Loan Program. |

| Fact 2 | The form's expiration date is August 31, 2021. |

| Fact 3 | The warning emphasizes that false statements or misrepresentations can lead to fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097. |

| Fact 4 | Economic Hardship Deferment is subject to a maximum cumulative eligibility of 36 months per loan program. |

| Fact 5 | Applicants can choose to report their monthly income as either their gross taxable income from all sources or one-twelfth of their Adjusted Gross Income from the most recent federal income tax return. |

| Fact 6 | Family size for determining deferment eligibility includes the applicant, their spouse, their dependent children, unborn children expected during the deferment period, and other dependents living with the applicant. |

| Fact 7 | To qualify for the deferment based on economic hardship, the reported income should be less than 150% of the poverty guideline for the borrower's family size and state of residence. |

Guide to Writing Federal Loan Economic Hardship Request

Filling out the Federal Loan Economic Hardship Request form is a critical step for borrowers facing financial challenges. This document helps in pausing or reducing loan payments under certain hardship conditions. The following steps ensure accurate completion and submission of the request.

- Locate and review all sections of the form, starting with SECTION 1: BORROWER INFORMATION. Enter your social security number (SSN), name, and contact information. If your information has changed, tick the box provided.

- Proceed to SECTION 2: BORROWER DETERMINATION OF DEFERMENT ELIGIBILITY. Answer the questions regarding your current economic situation, including details about any public assistance programs, full-time employment status, monthly income, and family size. Documentation supporting your economic hardship claim, such as income verification or program participation proof, may be required.

- In SECTION 3: BORROWER REQUESTS, UNDERSTANDINGS, CERTIFICATIONS, AND AUTHORIZATION, request the economic hardship deferment by providing the necessary information and consent. Carefully read and understand the certifications before signing and dating the form. Your signature attests to the accuracy of the information provided and your understanding of the terms.

- Refer to SECTION 4: INSTRUCTIONS FOR COMPLETING THE DEFERMENT REQUEST for any additional guidance required to fill out the form correctly. This may include proper documentation and attaching any required supplemental material.

- Review SECTION 5: DEFINITIONS for clarifications on terms used throughout the form. It provides essential definitions such as capitalization, forbearance, and the differences between subsidized and unsubsidized loans.

- After completing the form and gathering any necessary documentation, send it to the address listed in SECTION 6: WHERE TO SEND THE COMPLETED DEFERMENT REQUEST. If no specific address is provided, return the form to your loan holder. For assistance, use the contact information given in this section.

- Finally, acknowledge SECTION 7: IMPORTANT NOTICES, which covers the Privacy Act and Paperwork Reduction notices. This section explains how your information may be used and shared.

After submitting the form, your loan holder will review your request and determine your eligibility for economic hardship deferment. They may reach out for additional information or clarification. It's crucial to keep a copy of your completed form and any correspondence for your records.

Understanding Federal Loan Economic Hardship Request

What is an Economic Hardship Deferment Request?

An Economic Hardship Deferment Request is a form used by borrowers with William D. Ford Federal Direct Loan (Direct Loan) Program, Federal Family Education Loan (FFEL) Program, or Federal Perkins Loan (Perkins Loan) Program to request a temporary suspension of payment due to economic hardship. This deferment is available for a maximum of 36 months per loan program.Who is eligible for an Economic Hardship Deferment?

To be eligible for this deferment, borrowers must demonstrate economic hardship through specific criteria, such as receiving federal or state public assistance, serving as a Peace Corps volunteer, working full-time with income not exceeding 150% of the poverty guideline for their family size and state, or having received this deferment for the same period on another federal student loan program.What documentation is required to prove eligibility?

Documentation varies based on the eligibility criterion met, including proof of income, documentation from public assistance programs, or certification of Peace Corps volunteer service. Borrowers must also provide documentation if they previously received the same deferment on a different federal student loan program for the same period.How is family size determined for this deferment?

Family size includes the borrower, their spouse, their dependent children (including unborn children expected to be born during the deferment period), and other individuals who live with and receive more than half their support from the borrower during the deferment period.What happens if my income exceeds the threshold during the deferment period?

If your income exceeds 150% of the poverty guideline for your family size and state at any point during the deferment, you are required to inform your loan holder immediately as your eligibility for economic hardship deferment may end.Can interest accrue on my loans during this deferment?

Yes, interest may continue to accrue on unsubsidized loans during the deferment period. However, Perkins Loans do not capitalize interest. Borrowers have the option to pay interest during deferment to prevent capitalization on other loan types.What happens after the Economic Hardship Deferment ends?

Once the deferment ends, borrowers are required to resume making regular payments according to their loan's terms. Perkins Loan borrowers receive a six-month post-deferment grace period during which payments are not required.How do I submit my Economic Hardship Deferment Request?

Borrowers must complete the form with accurate information, attach any required documentation, and return the completed form to their loan holder. If loans are held by different loan holders, separate deferment requests must be submitted to each holder.

Common mistakes

Filling out the Federal Loan Economic Hardship Request form requires careful attention to detail. Common mistakes can delay or affect the deferment process. Here are ten errors to avoid:

- Not updating personal information at the start of the form if there have been any changes. It's crucial to check the box if any information has changed to ensure the loan servicer has the most current details.

- Selecting the incorrect type of documentation for monthly income. Borrowers must attach proof of their monthly income, choosing between gross taxable income from all sources or one-twelfth of the Adjusted Gross Income from their most recent federal income tax return.

- Failing to accurately include all family members in the family size count. This total should encompass the borrower, their spouse, their dependent children, any unborn children expected during the deferment, and other dependents living in the household.

- Misinterpreting the poverty guideline criteria relevant to the borrower’s family size and state of residence. This misunderstanding can lead to incorrectly assessing one’s eligibility for the deferment.

- Omitting required documentation that confirms receipt of benefits from qualifying federal or state public assistance programs or verifying Peace Corps volunteer status, when applicable.

- Incorrectly assessing one’s deferment eligibility based on full-time employment status without understanding that full-time is defined as working 30 or more hours per week in a position expected to last at least three consecutive months.

- Forgetting to sign and date the borrower certifications and authorization section, which is essential for the form to be processed.

- Overlooking the need to submit separate deferment requests for loans held by different loan servicers. Borrowers often do not realize that each servicer requires a unique submission.

- Incorrectly filling out dates or using the wrong format, as the form specifies that dates should be in the month-day-year format.

- Failing to include the borrower’s name and account number on all documents that are attached, making it difficult for servicers to match the documentation to the deferment request.

Each of these mistakes can significantly delay the deferment process or result in the denial of a request. It is essential for borrowers to read the form carefully, gather all necessary documentation before filling out the form, and review their submission for accuracy and completeness.

Documents used along the form

When requesting a Federal Loan Economic Hardship Deferment, it's vital to be aware of and prepared with several other forms and documents that can support your application. Below are four key documents typically used in conjunction with the Economic Hardship Request form:

- Income Tax Return Transcript: This document provides a detailed record of your prior year’s income as reported to the IRS. An essential piece for substantiating your financial status, it helps to affirm the income details provided on the Economic Hardship Request form.

- Proof of Benefits Statements: If you receive payments under federal or state public assistance programs, such as SNAP or SSI, providing official statements can serve as evidence for these benefits. These documents corroborate your need for economic hardship consideration.

- Pay Stubs: For applicants employed full-time, the most recent pay stubs can act as immediate proof of earnings. Submitting these allows for a straightforward comparison between current income levels and the financial thresholds set for deferment eligibility.

- Documentation of Unemployment Benefits: If your economic hardship is due to unemployment, official documentation or letters from the state unemployment office can serve as evidence. These documents typically outline the benefits period and amount, directly supporting your deferment request.

Collecting and presenting these documents accurately is crucial for a successful deferral request. The specific requirements and procedures can vary, so it's advisable to seek detailed guidance from the loan servicer or a financial advisor to ensure compliance and adequacy of your application materials.

Similar forms

The Federal Loan Unemployment Deferment Request form is similar to the Economic Hardship Request form as it also allows borrowers to postpone loan payments due to specific life circumstances, in this case, unemployment. Both forms require borrowers to demonstrate their current situation, such as unemployment status or economic hardship, and both offer temporary relief from loan payments.

The Income-Driven Repayment Plan Request form echoes the Economic Hardship Request form by taking the borrower's financial situation into account to adjust loan payment amounts. While the Economic Hardship Request form temporarily suspends payments, the Income-Driven Repayment Plan Request potentially lowers monthly payments based on the borrower's income and family size.

The Parent PLUS Borrower Deferment Request form relates closely to the Economic Hardship Request form by targeting a specific group undergoing financial difficulties. It specifically addresses parents who have taken out PLUS loans for their children's education and, similar to the Economic Hardship form, suspends loan payments during periods of unemployment or financial hardship.

The Total and Permanent Disability Discharge application shares a purpose with the Economic Hardship Request form by providing relief from federal loan obligations, but under much more severe circumstances. This form requires proof of a disability that prevents the borrower from engaging in gainful employment, leading to loan discharge rather than temporary deferment.

The Teacher Loan Forgiveness Application can be associated with the Economic Hardship Request form as it offers a form of financial relief for federal loan borrowers. This forgiveness is granted to teachers who have worked for five complete and consecutive academic years in certain elementary and secondary schools serving low-income families, reducing or eradicating their loan balance.

The Public Service Loan Forgiveness (PSLF) Application also provides long-term financial relief from student loans, akin to the temporary assistance offered by the Economic Hardship Request form. Through the PSLF program, borrowers working in public service may have their remaining loan balance forgiven after making 120 qualifying payments, acknowledging their contribution to society.

The Loan Consolidation Application bears similarity to the Economic Hardship Request by offering a solution to manage federal student loan debt. It allows borrowers to combine multiple federal education loans into one, potentially lowering monthly payments or extending the repayment period, which can indirectly relieve financial pressure.

The Forbearance Request form, often used in situations not covered by deferment options like the Economic Hardship Request, permits the temporary suspension or reduction of payments. It provides a short-term solution during financial difficulties, though interest continues to accrue, affecting the total loan cost.

The Closed School Discharge Application provides relief by discharging loans for borrowers unable to complete their program due to a school's closure. This form, while circumstance-specific, similarly alleviates the financial burden on students, much like the Economic Hardship Deferment does in times of financial struggle.

The Borrower's Defense to Repayment Application offers a way for borrowers to seek loan forgiveness if their school misled them or engaged in other misconduct in violation of certain laws. This form, paralleling the Economic Hardship Request’s aim to alleviate undue financial stress, addresses the financial ramifications of academic institutions' actions against the borrower's interests.

Dos and Don'ts

Filling out the Federal Loan Economic Hardship Request form is a critical step for those experiencing financial difficulty and looking for relief on federal student loan payments. It's essential to approach this process methodically to ensure eligibility for deferment. Here are four things you should do and four things you shouldn't do when completing the form:

Do:

- Read instructions carefully: Ensure that you fully understand the requirements and instructions before starting to fill out the form. This minimizes errors and improves the likelihood of your request being processed smoothly.

- Provide accurate information: All personal details, financial information, and supporting documentation must be accurate and truthful. Misrepresentation can lead to severe consequences, including fines or imprisonment.

- Attach required documentation: Various sections of the form require documentation (e.g., proof of monthly income, documentation of deferment on other loans). Ensure these documents are attached and clearly legible to support your deferment request.

- Notify of changes: If your situation changes during the deferment period (e.g., an improvement in financial circumstances), promptly notify your loan holder to ensure compliance and avoid any issues.

Don't:

- Leave sections incomplete: Failing to fill out all required sections can result in processing delays or denial of your deferment request. If a section doesn't apply, note it accordingly.

- Guess on figures or facts: Estimating income or not being specific about your financial hardship can impact the assessment of your request. Use actual figures and provide a clear explanation of your economic situation.

- Use outdated information: The poverty guidelines and eligibility criteria can change. Ensure you're using the most current version of the form and guidelines, which can typically be found on the official website of the Federal Student Aid.

- Forget to sign and date the form: An unsigned form is incomplete, and your request cannot be processed until it's signed. Double-check that you've also dated the form when signing.

Misconceptions

There are several misconceptions about the Federal Loan Economic Hardship Deferment Request form that many borrowers have. Understanding these misconceptions can help borrowers make informed decisions regarding their federal student loans during times of financial difficulty.

- Misconception 1: You cannot apply if you're employed. Actually, employment does not automatically disqualify you. Eligibility depends on your income relative to your family size and poverty guidelines.

- Misconception 2: It automatically forgives your student loans. This is incorrect. The deferment merely postpones your payments during times of economic hardship. You're still responsible for repaying the loan balance afterward.

- Misconception 3: Interest will not accrue on any loans during deferment. Subsidized loans do not accrue interest during deferment, but unsubsidized loans will continue to accumulate interest.

- Misconception 4: It's a lengthy and complicated process. While the form requires specific information and documentation, following the provided instructions carefully can simplify the process.

- Misconception 5: You need to submit separate forms for each loan. If your loans are with the same loan servicer, you can request a deferment for all of them with a single form.

- Misconception 6: There's no limit to how long you can defer payments. There is a maximum cumulative eligibility of 36 months per loan program for economic hardship deferments.

- Misconception 7: Approval is guaranteed. Approval depends on meeting specific eligibility criteria related to your income, family size, and employment status.

- Misconception 8: All federal student loans qualify. Only loans under the Direct Loan, FFEL, and Perkins Loan Programs are eligible for economic hardship deferment.

It's crucial for borrowers to carefully read the form and instructions, understand the eligibility requirements, and consider how a deferment fits into their overall financial plan for repaying student loans.

Key takeaways

Filling out the Federal Loan Economic Hardship Request form is an important step if you're facing financial difficulties. Here are some key takeaways to keep in mind:

- Provide accurate and complete borrower information in Section 1, including any changes to your contact details.

- Understand the criteria for deferment eligibility detailed in Section 2, which includes receiving assistance from federal or state programs, serving as a Peace Corps volunteer, working full-time, and having an income below a certain threshold related to your family size and state.

- Documentation is crucial; you must attach proof of your monthly income (either gross taxable income or adjusted gross income from your tax return) and, if applicable, evidence of receiving public assistance or being a Peace Corps volunteer.

- The form allows for a maximum cumulative deferment of 36 months per loan program. However, it’s encouraged to consider an income-driven repayment plan as an alternative.

- Complete understanding and correct certification in Section 3 are essential. By signing the form, you are certifying that all the information provided is true and that you agree to inform your loan holder if your deferment eligibility changes.

- Detailed instructions in Section 4 guide you through filling out the form, including how to submit the form and any required supporting documentation.

- The form warns against making false statements, reminding you that penalties may include fines, imprisonment, or both.

- Your submission is not only about requesting a deferment. It also involves authorizing your loan holder to contact you regarding your loans using automated systems for voice or text messages.

It's imperative to return the completed form and any necessary documentation to the address provided in Section 6 or to your specific loan holder. If you need assistance, contact details are provided in the form.

Popular PDF Documents

What Is Foreign Tax Credit - Directions are provided for how to proceed if the filer's income does not surpass the threshold, leading to potential full credit eligibility.

Power of Attorney Rhode Island - A practical solution for assigning tax duties to a professional, ensuring your Rhode Island tax affairs are managed appropriately.

How to Calculate Trust Accounting Income - An indispensable tool for financial clarity, showing how distributions from estates or trusts affect personal taxes.