Get Fccu Skip A Payment Form

At times, individuals may find themselves in financial situations requiring a temporary reprieve from loan payments. The FCCU Skip-A-Payment form serves as a crucial tool for members of the First Community Credit Union facing such circumstances. This form allows members to request a one-month suspension of payments on eligible loans by selecting a specific month for the skip. The detailed instructions require submission by a set date in the prior month to the desired skip. Member information, including name, number, and contact details, must be filled out alongside signatures from both the member and, if applicable, a co-maker. The process is designed to accommodate various loans by listing their numbers and associated payment details, authorizing FCCU to extend the loan’s current balance and acknowledging that interest will continue to accrue. With a $5 fee per skipped loan, this option is restricted to those not delinquent or skipped within the last six months, and it explicitly excludes types such as credit cards, mortgages, and any loan less than six months old. Additionally, it warns members with Guaranteed Asset Protection (GAP) that claim coverage does not extend to deferred payments, emphasizing the need for careful consideration and understanding of the terms. Through this mechanism, FCCU offers a valuable service, accommodating members' temporary financial challenges while ensuring the integrity and continuity of loan agreements.

Fccu Skip A Payment Example

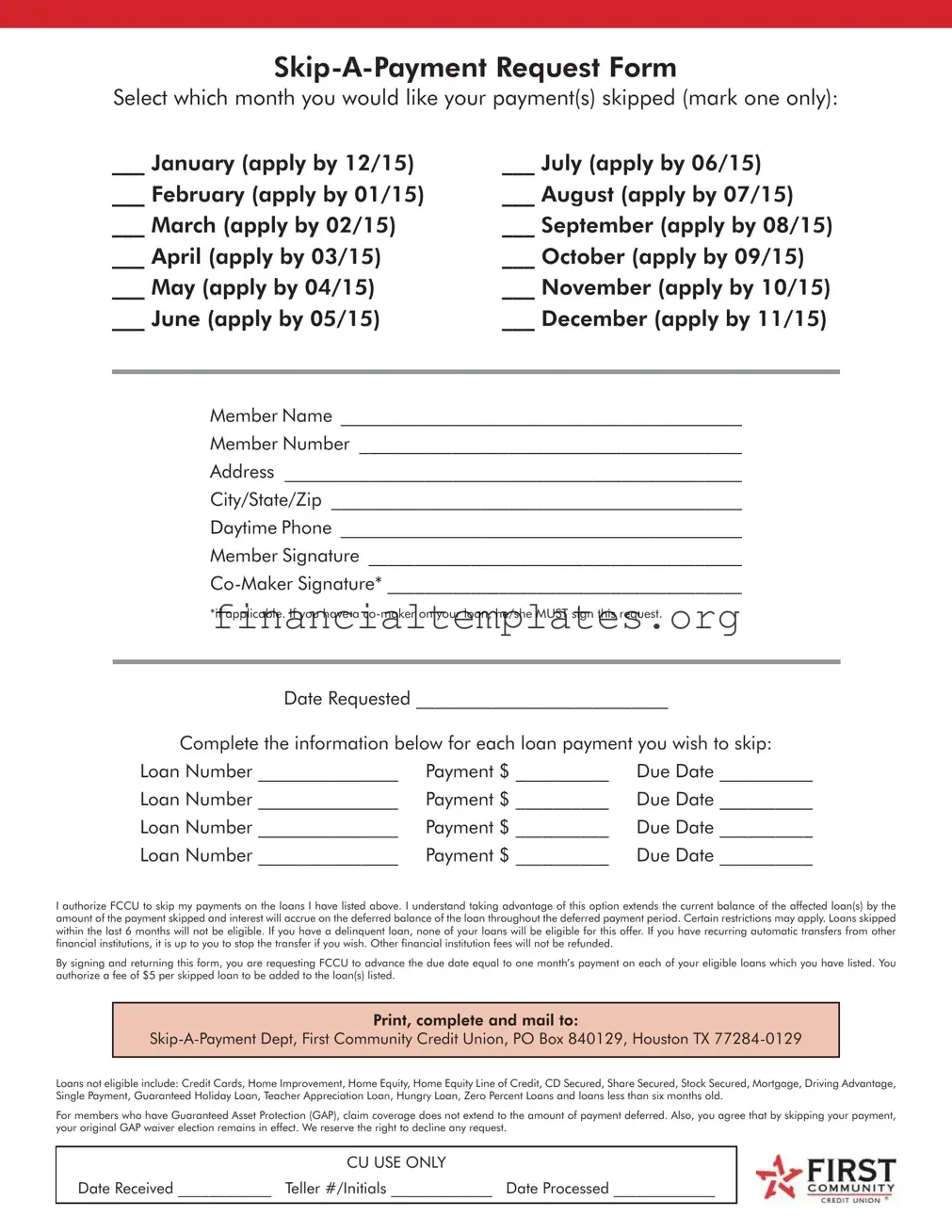

Select which month you would like your payment(s) skipped (mark one only):

___ January (apply by 12/15)

___ February (apply by 01/15)

___ March (apply by 02/15)

___ April (apply by 03/15)

___ May (apply by 04/15)

___ June (apply by 05/15)

___ July (apply by 06/15)

___ August (apply by 07/15)

___ September (apply by 08/15)

___ October (apply by 09/15)

___ November (apply by 10/15)

___ December (apply by 11/15)

Member Name ___________________________________________

Member Number _________________________________________

Address _________________________________________________

City/State/Zip ____________________________________________

Daytime Phone ___________________________________________

Member Signature ________________________________________

*if applicable. If you have a

Date Requested ___________________________

Complete the information below for each loan payment you wish to skip:

Loan Number _______________ |

Payment $ __________ |

Due Date __________ |

Loan Number _______________ |

Payment $ __________ |

Due Date __________ |

Loan Number _______________ |

Payment $ __________ |

Due Date __________ |

Loan Number _______________ |

Payment $ __________ |

Due Date __________ |

I authorize FCCU to skip my payments on the loans I have listed above. I understand taking advantage of this option extends the current balance of the affected loan(s) by the amount of the payment skipped and interest will accrue on the deferred balance of the loan throughout the deferred payment period. Certain restrictions may apply. Loans skipped within the last 6 months will not be eligible. If you have a delinquent loan, none of your loans will be eligible for this offer. If you have recurring automatic transfers from other financial institutions, it is up to you to stop the transfer if you wish. Other financial institution fees will not be refunded.

By signing and returning this form, you are requesting FCCU to advance the due date equal to one month’s payment on each of your eligible loans which you have listed. You authorize a fee of $5 per skipped loan to be added to the loan(s) listed.

Print, complete and mail to:

Loans not eligible include: Credit Cards, Home Improvement, Home Equity, Home Equity Line of Credit, CD Secured, Share Secured, Stock Secured, Mortgage, Driving Advantage, Single Payment, Guaranteed Holiday Loan, Teacher Appreciation Loan, Hungry Loan, Zero Percent Loans and loans less than six months old.

For members who have Guaranteed Asset Protection (GAP), claim coverage does not extend to the amount of payment deferred. Also, you agree that by skipping your payment, your original GAP waiver election remains in effect. We reserve the right to decline any request.

CU USE ONLY

Date Received ____________ Teller #/Initials _____________ Date Processed _____________

Document Specifics

| Fact Name | Description |

|---|---|

| Eligibility Period | Members can select to skip their payment for any month, given that they apply by the 15th day of the preceding month. |

| Application Requirement | Both the member and any co-maker on the loan must sign the Skip-A-Payment Request Form to be eligible. |

| Cost Involved | A fee of $5 per skipped loan is added to the loan(s) for which the payment is skipped. |

| Restrictions on Loans | Loans not eligible for the Skip-A-Payment include Credit Cards, Home Improvement, Home Equity, and others as detailed in the form. |

| Impact on Loan Duration and Interest | Opting to skip payment extends the loan duration by the amount of the payment skipped and interest continues to accrue during this period. |

| Effect on GAP | For members with Guaranteed Asset Protection (GAP), the coverage does not extend to the amount of payment deferred. |

Guide to Writing Fccu Skip A Payment

Filling out the FCCU Skip-A-Payment request form is a straightforward process designed to provide temporary financial relief by allowing you to skip a monthly loan payment. This option can come in handy during months when expenses mount or in case of financial strain. It’s essential to consider that interest will still accrue during the skipped period, potentially extending the loan's term. To ensure a smooth experience, follow these step-by-step instructions carefully. Remember, certain loans and conditions may affect eligibility.

- Firstly, decide which month you wish to skip a payment for. Only one month can be chosen, and it is critical to apply before the deadline listed next to each month.

- In the provided space, write your full name as it appears on your FCCU account.

- Enter your Member Number accurately to avoid any processing delays.

- Fill in your full address, including city, state, and zip code, ensuring that it matches the information FCCU has on file.

- Provide your daytime phone number where you can be easily reached for any clarifications or additional information.

- For each loan you wish to skip a payment on, enter the loan number, the payment amount due, and the due date. Repeat this for up to four loans, if applicable.

- Read the authorization statement carefully. It outlines the implications of using the skip-a-payment option, such as the extension of your loan term and the accrual of interest during the skipped period. Understanding this information is crucial.

- If there is a co-maker on any of your loans, their signature is mandatory. Make sure the co-maker signs the form to validate the request.

- Sign the form yourself to indicate your agreement with the terms and your desire to proceed with the skip-a-payment request.

- Finally, mail the completed form to the Skip-A-Payment Dept at First Community Credit Union, using the provided address. Ensure this is done well before the deadline for the month you're aiming to skip to allow for processing time.

Upon receiving your request, FCCU will review it for eligibility. Remember, loans with recent skips, delinquencies, or specific types not listed as eligible will not qualify for this option. Continuous and clear communication with FCCU can help address any issues that may arise during the process. This proactive step can offer meaningful financial flexibility when it's most needed.

Understanding Fccu Skip A Payment

What is the FCCU Skip-A-Payment option, and how does it work?

The FCCU Skip-A-Payment option allows members to request a one-month pause on their loan payments. When you choose to skip a payment, the due date for your loan is advanced by one month. This means your current balance on the affected loan(s) remains, and interest will continue to accrue on the deferred balance throughout this period. A $5 fee per skipped loan is added to the loan(s) listed. It's important to note that this option extends the term of your loan by the period skipped.

How do I apply for the Skip-A-Payment option?

To apply, fill out the Skip-A-Payment Request Form. Indicate which month you'd like to skip the payment for and provide detailed information about yourself (name, member number, address, daytime phone) and your loan(s) (loan number, payment amount, due date). Both you and any co-maker, if applicable, must sign the form. Complete the form and mail it to the Skip-A-Payment Dept at First Community Credit Union, as directed on the form. Remember, applications must be submitted by the 15th of the month prior to the month you wish to skip.

Are there any restrictions on which loans can use the Skip-A-Payment option?

Yes, certain loans are not eligible for the Skip-A-Payment option. These include Credit Cards, Home Improvement Loans, Home Equity Loans, Home Equity Lines of Credit, CD Secured, Share Secured, Stock Secured, Mortgages, Driving Advantage, Single Payment Loans, Guaranteed Holiday Loans, Teacher Appreciation Loans, Hungry Loans, Zero Percent Loans, and loans less than six months old. Additionally, loans that have been skipped within the last 6 months, or any loans that are currently delinquent, are not eligible for this offer.

What happens if I have automatic transfers set up for my loan payments?

If you have automatic transfers set up from other financial institutions to make your loan payments, it’s your responsibility to stop these transfers for the month you're skipping a payment. FCCU will not refund any fees from other financial institutions that may be charged as a result of failing to stop these automatic transfers.

Will skipping a payment affect my loan insurance or Guaranteed Asset Protection (GAP) coverage?

Members with Guaranteed Asset Protection (GAP) should be aware that claim coverage does not extend to the amount of the payment deferred. However, your original GAP waiver election remains in effect even when you skip a payment. This is crucial to understand, as the deferred payment may affect the overall coverage and benefits.

Can my Skip-A-Payment request be denied?

Yes, First Community Credit Union reserves the right to decline any Skip-A-Payment request. Requests may be denied for several reasons, including but not limited to, loans not meeting the eligibility criteria, incomplete request forms, or the presence of a delinquent loan. It’s important to ensure all requirements are met and the information provided is complete and accurate to avoid denial of your request.

Common mistakes

When filling out the FCCU Skip-A-Payment request form, it's essential to pay close attention to the details to ensure the application process goes smoothly. People often make mistakes that could be easily avoided. Here, we'll discuss four common mistakes and how to prevent them.

Selecting Multiple Months: The form specifies that applicants must select only one month for which they wish to skip a payment. A common mistake is marking more than one month, either by misunderstanding the instructions or hoping to skip payments for multiple months at once. This can result in the form being returned or the request denied. It is crucial to carefully read the directions and mark only the single month you are applying for.

Missing Signatures: For loans with a co-maker, both the primary member and co-maker must sign the form. Oftentimes, applicants overlook this requirement. Without both signatures, the request cannot be processed, delaying the application. Ensure that both parties sign the form if your loan has a co-maker.

Forgetting to Adjust Automatic Transfers: Applicants who have set up automatic transfers from other financial institutions must remember to stop these transfers for the skipped payment month manually. Many people forget to do this, resulting in unnecessary transfers and potential fees that are not refunded. Always check if you have automatic transfers set up and make the necessary adjustments.

Applying for Ineligible Loans: The form lists various loans that do not qualify for the Skip-A-Payment option, including home equity loans, mortgage loans, and zero percent loans, among others. Some applicants, however, miss or ignore this section and submit requests for these types of loans. Before filling out the form, review the list of ineligible loans to ensure your loan qualifies for the program.

In summary, carefully reading and following the instructions provided on the FCCU Skip-A-Payment request form can help you avoid these common mistakes. Paying attention to the details, including eligibility requirements, signature needs, and managing automatic payments, will streamline the application process, helping you take advantage of this financial flexibility option more efficiently.

Documents used along the form

When members of credit unions or borrowers look into temporary relief options like the FCCU (First Community Credit Union) Skip-A-Payment program, it's essential to understand the broader constellation of documents and forms that might be required or beneficial to have in parallel. The Skip-A-Payment Request Form is a straightforward document allowing members to temporarily suspend loan payments without defaulting, under specific terms. However, effectively managing one's finances, especially in seeking payment relief, often involves more than just submitting a single form. Below is a description of other forms and documents that are frequently used or needed in tandem with the Skip-A-Payment form.

- Loan Modification Application: A detailed document submitted by a borrower requesting changes to the terms of their existing loan due to financial hardship. It typically requires supporting financial documents and a hardship letter.

- Hardship Letter: A personal letter provided by the borrower detailing the reasons for their financial difficulties and requesting support from the lender, like indulging in the Skip-A-Payment offer. This narrative complements the formal application forms by providing context.

- Proof of Income: Documents like recent pay stubs, tax returns, or benefit statements that prove the borrower's current income. These are crucial for reassessing the member's financial situation and what modifications or assistance they are eligible for.

- Authorization for Automatic Payment: If a member sets up an automatic payment again after skipping a payment, or if they had never set it up but now wish to, this form authorizes the credit union to automatically withdraw loan payments from a specific bank account.

- Amortization Schedule Request: After skipping a payment, some members might request an updated amortization schedule. This document outlines the remaining payment schedule, including principal and interest, extending the loan's life due to skipped payments.

- Account Status Letter: A document a borrower might request that outlines the current status of all loans and accounts with the credit union. This could be vital for members who wish to understand the full impact of skipping payments on their accounts.

Understanding and utilizing these documents can significantly enhance a borrower's ability to navigate financial challenges, making informed decisions that align with their long-term financial well-being. Engaging with the Skip-A-Payment program might be a vital step for some, but it's always best approached with a comprehensive view of one's financial situation, armed with the right documents and a clear understanding of the implications.

Similar forms

The Loan Modification Agreement shares similarities with the FCCU Skip A Payment form because both are used to alter the terms of an existing loan agreement. While the Skip A Payment form allows members to temporarily pause their loan payments for a specific month, a Loan Modification Agreement may adjust the loan's interest rate, principal amount, or repayment period. Both documents require the borrower's consent and potentially a co-maker's agreement, mirroring the need for signatures in the skip payment request.

Another document similar to the FCCU Skip A Payment form is the Deferment Request Form, commonly used in student loans and mortgages. Like the skip payment form, a deferment request allows borrowers to pause payments for a designated period due to financial hardship or other qualifying reasons. Both forms necessitate the borrower's detailed information and signature to process the request, emphasizing a formal agreement between the borrower and the lender to temporarily amend the payment schedule.

The Forbearance Agreement is also akin to the Skip A Payment form, providing borrowers with a temporary reduction or suspension of payments during times of financial difficulty. Both documents require detailed information regarding the loan and the borrower, including an acknowledgment that interest may continue to accumulate during the period of altered payment terms. This shows a mutual understanding that the relief provided is temporary and subject to specific conditions agreed upon by both parties.

Loan Extension Agreements bear resemblance to the Skip A Payment form because both offer a short-term solution for borrowers unable to meet their current payment obligations. Where the skip payment form allows for a one-month payment hiatus, a loan extension agreement might lengthen the loan's maturity date, thus spreading out payments over a longer period. Each document affects the repayment timeline and necessitates borrower consent, showing a negotiated alternation of the original loan agreement.

The Automatic Payment Change Form parallels the FCCU Skip A Payment form in that it deals with adjusting how or when loan payments are made. While the skip payment form specifically addresses pausing a payment, the automatic payment change form could be used to alter the account from which payments are drawn or to change payment dates. Both forms facilitate a modification to the existing payment schedule or method, requiring accurate and detailed borrower information to implement changes.

Lastly, the Hardship Withdrawal Request from a 401(k) or other retirement plan is conceptually similar to the FCCU Skip A Payment form, though it pertains to retirement savings instead of loan payments. Both are initiated by individuals facing financial difficulties who seek temporary relief via formal requests. Each requires detailed personal and financial information and an acknowledgment of the implications of the request, such as potential penalties or the understanding that taking such action may impact the individual's financial future.

Dos and Don'ts

When filling out the FCCU Skip-A-Payment form, navigating the process correctly is crucial for a smooth transaction. To ensure that you do this correctly, here are lists of things you should and shouldn't do.

Do:

- Read all the instructions carefully before you start filling out the form.

- Ensure you select only one month for the payment skip as stated in the form requirements.

- Fill out your member name, number, address, city/state/zip, and daytime phone accurately.

- Clearly list each loan number, the payment amount, and the due date for which you are requesting the skip.

- Sign the form. If your loan has a co-maker, make sure they also sign the form.

- Submit the form before the deadline for your selected month to ensure your request is processed in time.

- Double-check that your loans are eligible for the skip-a-payment option; review the excluded types of loans listed.

- Contact the credit union if you have automatic transfers set up for the payments to discuss stopping them for the skipped month.

- Consider the impact of the skipped payment on your loan term and interest.

- Keep a copy of the form for your records after mailing it.

Don't:

- Don’t skip the member signature or co-maker signature (if applicable).

- Don’t select more than one month for the payment skip.

- Don’t forget to check your loan’s eligibility for the program by reviewing the excluded loans list.

- Don’t ignore the fee of $5 per skipped loan, which will be added to your loan balance.

- Don’t omit any required information such as loan number, payment amount, or due date.

- Don’t submit the form after the application deadline for your desired skip month.

- Don’t assume that the skip-a-payment request will automatically stop any automatic transfers from other financial institutions.

- Don’t disregard the potential implications on GAP coverage if you have it.

- Don’t neglect to consider how interest will accrue during the skip period.

- Don’t hesitate to contact FCCU for clarification or assistance if you have any questions or concerns about the form or process.

Misconceptions

When it comes to managing finances, options like the Skip-A-Payment program offered by First Community Credit Union (FCCU) can seem like a lifeline. However, there are several misconceptions about how the FCCU Skip-A-Payment form works. Let's clear up some of these misunderstandings.

Any loan can be skipped: A common misconception is that this option is available for all types of loans. In reality, certain loans such as Credit Cards, Mortgages, and Home Equity Loans, among others, are not eligible. This limitation ensures that the program is used responsibly and doesn't negatively impact more significant financial commitments.

No interest accrues during the skip: Another misunderstanding is that interest stops accruing on your loan during the skipped period. However, interest continues to accumulate on the deferred balance, which can slightly extend the loan's term and increase the total amount paid over time.

It’s an unlimited option: Some people may think they can skip a payment whenever they choose, multiple times a year. The truth is, loans skipped within the last 6 months are not eligible, emphasizing the program's design as a temporary relief rather than a regular banking feature.

Skipping payments doesn’t affect GAP coverage: Those with Guaranteed Asset Protection (GAP) might assume it extends to skipped payments. The fine print clarifies that GAP claim coverage does not include the amount of payment deferred, potentially impacting your coverage in the event of a claim.

Co-maker’s signature is optional: If a loan has a co-maker, their involvement in the decision to skip a payment might be seen as unnecessary. This is a misconception, as the form specifies that the co-maker must also sign, ensuring all parties involved are informed and agree to the change in payment schedule.

Automatic transfers stop automatically: Some assume if they skip a payment, automated transfers from other institutions will pause too. Borrowers are responsible for stopping these transfers manually to avoid unwanted fees or payments.

Understanding these nuances ensures that members of FCCU make informed decisions about managing their loan payments, especially when considering the Skip-A-Payment option. It’s always beneficial to review the terms and communicate with your credit union for any financial decision.

Key takeaways

When considering the option to skip a payment with First Community Credit Union (FCCU), understanding the limitations and requirements is crucial. Here are five key takeaways regarding filling out and using the FCCU Skip-A-Payment form:

- Application Deadlines: To skip a payment for a specific month, your application must be submitted by a certain deadline. For instance, to skip a January payment, your form must be received by December 15th. Each month has its corresponding deadline, so planning ahead is essential.

- Eligible Loans: Not all loans qualify for the Skip-A-Payment option. Exclusions include Credit Cards, Home Improvement Loans, Home Equity Loans, CD Secured Loans, and several more. It's important to check if your loan type is eligible before applying.

- Co-Maker Signature: If your loan has a co-maker, their signature is required on the Skip-A-Payment request form. This ensures both parties agree to the terms of skipping a payment.

- Fees and Interest: A nominal fee of $5 per skipped loan is applied. Furthermore, interest will continue to accrue on the loan during the skip period, which can affect the total amount paid over the life of the loan.

- Restrictions and Considerations: Loans that have been skipped in the last 6 months or are currently delinquent are not eligible. Additionally, if you have automatic transfers set up, it's your responsibility to stop them. It's also worth noting that skipping a payment may affect Guaranteed Asset Protection (GAP) coverage, should you have it.

Understanding these key points ensures that you are well-informed before deciding to skip a payment on your loan with FCCU. Always consider the financial implications and ensure that all requirements are met before submitting your Skip-A-Payment request form.

Popular PDF Documents

IRS 8888 - Form 8888 ensures the precise allocation of funds according to the taxpayer’s specifications.

What Is Commercial Lending - Equips commercial loan applicants with a clear understanding of the documentation requirements for successful applications.