Get F Payment Form

In the realm of real estate transactions within strata properties, the Form F Certificate of Payment plays a pivotal role, ensuring a smooth transition of property ownership. This document, rooted in the Strata Property Act, specifically section 115, serves as a testament to the financial standing of a property within a strata corporation. It certifies whether the current owner owes money to the strata corporation or not. The form presents two possibilities: either the owner is clear of any financial obligations (does not owe money), or there are outstanding dues. In cases where money is owed, the form further outlines that either the owed amount has been settled through payment into court or an arrangement acceptable to the strata corporation is in place for payment. This certification, required to be signed by a member of the council or a strata manager authorized by the strata corporation, is time-sensitive, holding validity for 60 days from its issuance date. The form's essence lies not only in its function of facilitating property sales by affirming an owner's financial obligations to the strata corporation have been met but also in its role in maintaining fiscal transparency and accountability within strata communities. This form is a crucial document, ensuring that all parties are informed of and agree on the financial status of strata lot transactions.

F Payment Example

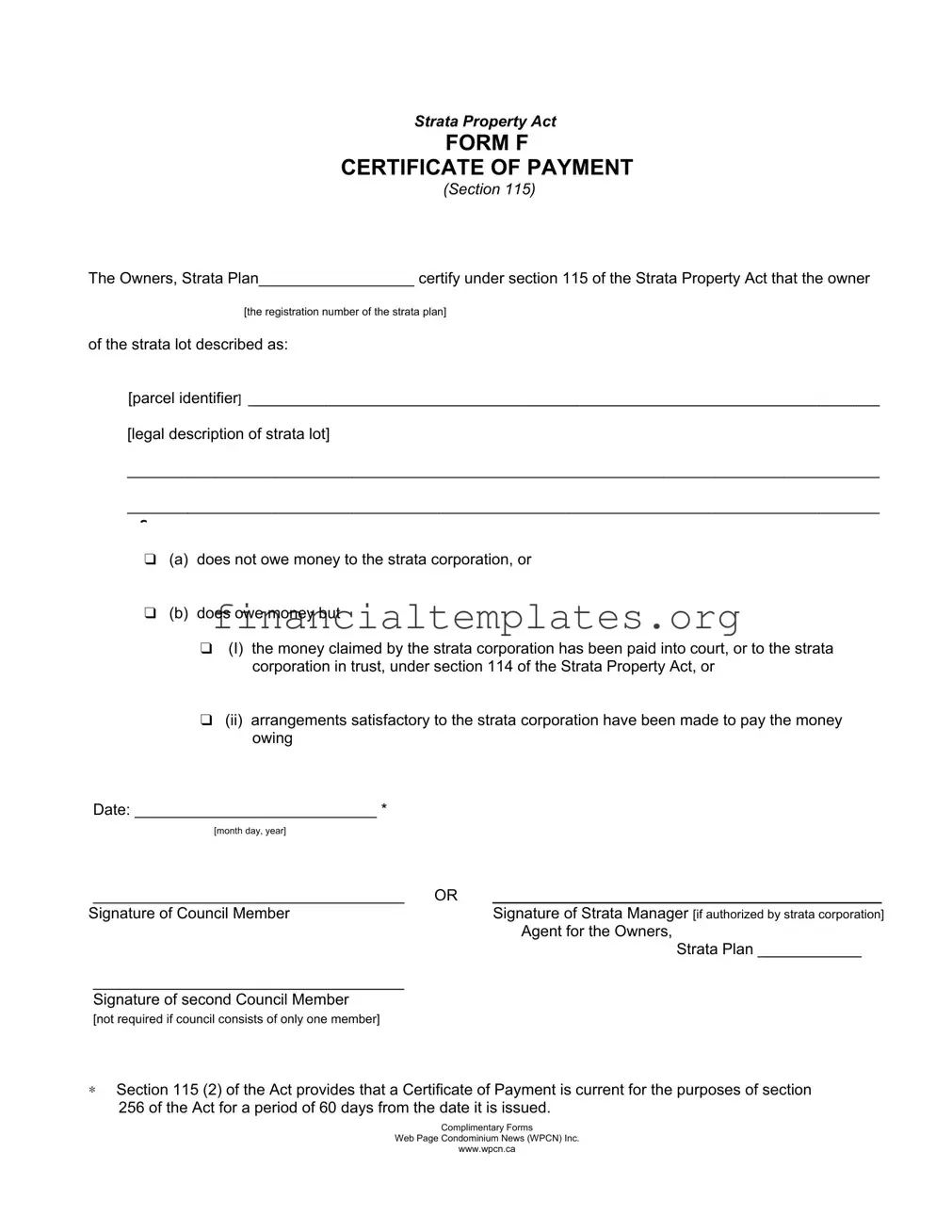

Strata Property Act

FORM F

CERTIFICATE OF PAYMENT

(Section 115)

The Owners, Strata Plan__________________ certify under section 115 of the Strata Property Act that the owner

[the registration number of the strata plan]

of the strata lot described as:

[parcel identifier] _________________________________________________________________________

[legal description of strata lot]

_______________________________________________________________________________________

_______________________________________________________________________________________

s

❑(a) does not owe money to the strata corporation, or

❑(b) does owe money but

❑(I) the money claimed by the strata corporation has been paid into court, or to the strata corporation in trust, under section 114 of the Strata Property Act, or

❑(ii) arrangements satisfactory to the strata corporation have been made to pay the money owing

Date: ____________________________ *

[month day, year]

____________________________________ |

OR |

_____________________________________________ |

Signature of Council Member |

|

Signature of Strata Manager [if authorized by strata corporation] |

|

|

Agent for the Owners, |

|

|

Strata Plan ____________ |

____________________________________ |

|

|

Signature of second Council Member |

|

|

[not required if council consists of only one member] |

|

|

∗Section 115 (2) of the Act provides that a Certificate of Payment is current for the purposes of section 256 of the Act for a period of 60 days from the date it is issued.

Complimentary Forms

Web Page Condominium News (WPCN) Inc.

www.wpcn.ca

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The Form is known as FORM F CERTIFICATE OF PAYMENT. |

| 2 | It is governed by the Strata Property Act, specifically section 115. |

| 3 | This certificate certifies whether an owner owes money to the strata corporation or not. |

| 4 | Options included: the owner does not owe money, or the owner does owe money but has either paid it into court/trust or arranged to pay it. |

| 5 | It must be signed by a Council Member or a Strata Manager, if authorized. |

| 6 | The signature of a second Council Member is required unless the council consists of only one member. |

| 7 | Section 115(2) states that the Certificate of Payment is valid for 60 days from the date it's issued. |

| 8 | More information and forms can be found at the Complimentary Forms Web Page on Condominium News (WPCN) Inc. website www.wpcn.ca. |

Guide to Writing F Payment

Filling out the Form F, known as the Certificate of Payment under the Strata Property Act, is a critical step in ensuring that all financial obligations regarding a strata property are disclosed and accounted for. This form plays a pivotal role in the transfer or sale of strata properties by certifying whether or not the owner owes money to the strata corporation. Accurately completing this form ensures transparency and facilitates smoother transactions involving strata properties. Below, you'll find a simplified guide to filling out this form correctly.

- Start by identifying the "Strata Plan" number associated with the property. This is usually a unique identifier that can be found in official strata documents. Enter this number in the designated space at the top of the form.

- In the section labeled "the owner (the registration number of the strata plan) of the strata lot described as:", include the parcel identifier and the legal description of the strata lot. These details ensure that the certificate is accurately associated with the correct property and owner within the strata plan.

- Choose the appropriate checkbox to indicate the current financial status regarding the strata corporation:

- If the owner does not owe any money to the strata corporation, tick box (a).

- If the owner does owe money, tick box (b) and then further specify by ticking either:

- Box (I), if the owed money has been paid into court or to the strata corporation in trust, as per section 114 of the Strata Property Act.

- Or, box (ii), if arrangements satisfactory to the strata corporation have been made to pay the amount owed.

- Enter the date on which the form is being filled out in the space provided. The date format should include the month, day, and year.

- Signatures are necessary to validate the form. The form can be signed by:

- A Council Member of the Strata Corporation. Their signature is essential.

- A Strata Manager, but only if they are authorized by the strata corporation to sign on its behalf.

- If the council consists of more than one member, a second Council Member's signature is also required, unless the council consists of only one member.

- Keep in mind that, as per Section 115 (2) of the Act, the Certificate of Payment is considered current for 60 days from the date it is issued. It's imperative to manage timelines effectively regarding the use and submission of this certificate.

After completing the Form F, it's essential to submit it to the relevant parties involved in the transaction or legal proceeding to ensure compliance with the Strata Property Act. This form not only provides clarity on the financial standing of the owner within the strata corporation but also serves as a legal document facilitating the sale or transfer of strata properties. Ensuring the form is filled out accurately and submitted within the required timelines is crucial for the smooth completion of these processes.

Understanding F Payment

What is a Form F Certificate of Payment?

A Form F Certificate of Payment is a document required under the Strata Property Act, which certifies the financial status of an owner within a strata corporation. It specifically states whether the owner owes money to the strata corporation or not. The certification can affirm that the owner either has no outstanding debts to the strata, or if they do, that the funds have been duly paid into court or held in trust, or satisfactory arrangements have been made for payment. This form is critical during the sale of a strata lot, ensuring transparency about any financial obligations that could affect the transfer of property ownership.

What information is included in the Form F Certificate of Payment?

The form includes vital information about the strata lot and its owner, including the parcel identifier and the legal description of the strata lot. It also outlines the financial status of the owner in relation to the strata corporation by indicating one of two scenarios: either the owner does not owe any money to the strata corporation, or the owner does owe money but steps have been taken to address it. Additionally, it requires the signatures of council members or a strata manager acting as an agent for the owners' strata plan, alongside the date of issuance.

How long is the Certificate of Payment valid?

According to Section 115 (2) of the Strata Property Act, a Certificate of Payment is considered current and valid for a period of 60 days starting from the date it is issued. This means that the document offers a time-sensitive snapshot of the owner's financial standing with the strata corporation. Should dealings with the strata lot, such as a sale, occur beyond this 60-day frame, a new certificate may be required to ensure the accuracy of the owner's financial status.

Who can sign the Form F Certificate of Payment?

The Form F Certificate of Payment can be signed by either a member of the council of the strata corporation or by a strata manager, assuming they are authorized by the strata corporation to act as an agent for the owners' strata plan. In cases where the strata council consists of more than one member, the signature of a second council member is also required. This requirement ensures that the certificate is legitimately issued with the proper authority and oversight within the strata corporation.

Common mistakes

Failing to accurately complete the strata plan registration number can lead to confusion or misidentification. This number is critical for verifying the correct strata corporation involved.

Not providing a detailed legal description of the strata lot can result in ambiguities regarding which property the form refers to. This description is essential for the precise identification of the property in question.

Incorrectly indicating the financial status with the strata corporation can have serious implications. Whether money is owed or not, and the details of any arrangements made, must be clearly and correctly marked to reflect the current situation.

Omitting the date or providing an incorrect date can affect the form's validity. Since the Certificate is only current for 60 days from the issue date, accurate dating is imperative for legal purposes.

Leaving signature fields blank or not obtaining all required signatures, such as those from the council member(s) or the strata manager (if authorized), undermines the document's authenticity and can render it non-viable.

When individuals fill out the Form F Certificate of Payment, several mistakes commonly occur. Recognizing and avoiding these mistakes can streamline the process and ensure accurate communication between property owners and strata corporations. Below is a list of five common mistakes.

Conclusion: To ensure the Form F Certificate of Payment is filled out correctly, attention to detail is paramount. Each section should be reviewed carefully, with particular emphasis on the accuracy of the information provided, adherence to the specific requirements of the form, and the completion of all necessary signatures. By avoiding these common mistakes, individuals can facilitate smoother interactions with strata corporations and avoid potential legal or administrative complications.

Documents used along the form

The use of the Form F Certificate of Payment, as per the Strata Property Act, is a crucial step in ensuring that financial dealings regarding a strata property are properly documented and legally binding. However, this form usually doesn't stand alone. A number of other documents often accompany or are utilized alongside the Form F Certificate of Payment to ensure comprehensive coverage of the legal and financial aspects of strata property transactions. Below is a list of documents commonly associated with the Form F Certificate of Payment, each serving its specific purpose in the broader legal and administrative framework.

- Form B: Information Certificate - This document provides potential buyers with crucial information about the strata corporation's financial health, including details on maintenance fees, any pending lawsuits, and insurance coverage. It serves as a snapshot of the strata corporation's current status.

- Form D: Developer's Rental Disclosure Statement - This form outlines the developer's rental restrictions, if any, for a strata lot. It's essential for disclosing to buyers their ability to rent out their property.

- Title Search - Conducted to confirm the legal owner of the property and to identify any charges, liens, or covenants that may affect the property. It's a critical step in due diligence before any property transaction.

- Property Disclosure Statement - This form is filled out by the seller to disclose the condition of the property, including any known defects or issues that may not be immediately apparent during a physical inspection.

- Insurance Certificate - Details the strata corporation's insurance coverage, including the policy limits and deductible amounts. This document is crucial for understanding how much coverage the property has against various risks.

- Minutes of the Strata Corporation's Meetings - Provides insights into the past decisions, financial expenditures, and upcoming projects within the strata community. They help potential buyers gauge the community's health and management efficiency.

- Bylaws and Rules of the Strata Corporation - These documents outline the regulations governing the strata community, including restrictions on pets, noise, and renovations. They are essential for understanding the living conditions and restrictions within the strata.

- Engineer's or Depreciation Report - Provides a detailed analysis of the property's condition and the expected lifespan of major components. It is vital for assessing future maintenance costs and planning for long-term investment.

Together with the Form F Certificate of Payment, these documents provide a comprehensive view of the legal, financial, and structural aspects of a strata property, ensuring that potential buyers are fully informed and that transactions comply with relevant laws and regulations. For anyone involved in strata property transactions, understanding and utilizing these documents is essential for a smooth and legally compliant process.

Similar forms

The Form F Certificate of Payment is similar to the Lien Release Form, which is often used in various industries to confirm that a debt or obligation has been fully paid and that the lienholder agrees to release the claim on the asset or property. Just like Form F confirms that an owner does not owe money to the strata corporation or has made arrangements to settle any debts, a Lien Release Form serves as proof that the debtor has fulfilled their financial obligations, thereby removing any liens placed on property or assets.

Another comparable document is the Estoppel Certificate, commonly used in real estate transactions. This certificate is provided by a homeowner's association or a landlord and states the current status of dues or rent owed by a tenant or property owner. Similar to Form F, which certifies the payment status of the owner within a strata plan, an Estoppel Certificate delivers assurance to prospective buyers or lenders that no outstanding dues exist, ensuring transparency in real estate dealings.

The Notice of Satisfaction is also akin to the Form F Certificate of Payment. This document is typically used to indicate that a debtor has satisfied a judgment in full, thus informing the court or relevant authorities that the debtor's obligation is fully discharged. Similarly, Form F certifies to the strata corporation and prospective parties that the property owner is free from any financial encumbrances related to strata fees, reflecting the fulfillment of monetary obligations towards the strata corporation.

Similar functionalities can be seen with the Final Waiver of Lien, a document used in construction that signifies a contractor's, subcontractor's, or supplier's consent to waive their right to a lien on the property once they have received final payment. This document parallels the Form F Certificate of Payment in that it is used to confirm the settlement of owed amounts, thus preventing future claims against the property for those specific payments. Both documents play crucial roles in verifying that financial obligations have been met to protect the property against claims or liens.

Lastly, the Zero Balance Letter, often issued by creditors or financial institutions, confirms that an individual has paid off their debt and owes nothing more on their account. This letter shares its purpose with the Form F Certificate of Payment by providing proof of settled debts. However, while a Zero Balance Letter typically pertains to personal or business financial accounts, Form F is specifically related to the obligations of property owners within a strata corporation, ensuring clear ownership and transfer processes free from disputes over outstanding debts.

Dos and Don'ts

When filling out the Certificate of Payment as per the Strata Property Act Form F, there are important guidelines one should follow to ensure accuracy and compliance with the legal requirements. These do's and don'ts can help guide you through the process.

Do:- Ensure all the details are correct: Double-check the registration number of the strata plan, parcel identifier, and the legal description of the strata lot to prevent any errors.

- Clearly indicate the payment status: Mark the appropriate box to indicate whether the strata lot owner does or does not owe money to the strata corporation. This is a crucial detail that affects the legal standing of the strata lot owner.

- Complete the date section accurately: Fill in the date correctly, as the certificate is only valid for 60 days from the issue date. This is important for both the seller and the buyer in the context of property transactions.

- Obtain the required signatures: Ensure that either a council member or an authorized strata manager signs the form. If the council consists of more than one member, a second signature is required unless specified otherwise.

- Leave any fields blank: Make sure to provide all the necessary information requested on the form. Incomplete forms may not be processed, potentially delaying transactions.

- Guess information: If uncertain about any detail, such as the legal description of the strata lot, seek clarification. Incorrect information can lead to disputes or the invalidation of the form.

- Post-date or pre-date the form: The date must accurately reflect when the form was filled out. Incorrect dates could invalidate the certificate, affecting its 60-day validity period.

- Forget to check the appropriate payment status box: Failing to indicate the strata lot owner's payment status can lead to misunderstandings. Whether the owner owes money or not, and any arrangements made, needs to be clearly stated.

Misconceptions

When dealing with the Strata Property Act Form F, also known as the Certificate of Payment, several misconceptions can arise. Understanding the true nature of this document is vital for property owners, strata councils, and potential buyers. Below are five common misunderstandings and the facts that dispel them.

It's only needed at the time of sale: While it's true that the Form F Certificate of Payment is often required during the sale of a strata property, its use extends beyond this scenario. It serves as proof at any point in time that the property owner is up to date with their financial obligations to the strata corporation or has made arrangements for outstanding dues.

Any strata member can sign it: This form must be signed by authorized individuals only. Typically, this includes members of the strata council or a strata manager specifically authorized by the strata corporation. Incorrectly signed forms are not legally valid.

It indicates compliance with all strata bylaws: The scope of the Certificate of Payment is specific to financial obligations under Section 115 of the Strata Property Act. It does not certify compliance with all strata bylaws or absolve owners of other responsibilities.

Payment arrangements are optional for the strata corporation: If the owner owes money, the form specifies that arrangements satisfactory to the strata corporation must be made, or the owed amount must be placed into court or held in trust. This clause ensures that there is a formal agreement or action taken regarding any outstanding dues, rather than leaving it to discretion alone.

The form's validity is indefinite: Once issued, the Certificate of Payment has a fixed validity period of 60 days as per Section 115 (2) of the Strata Property Act. This misconception may lead to complications in transactions if stakeholders are not aware of the need for a current document.

Clearing up these misconceptions empowers strata members, property owners, and potential purchasers with accurate information. It ensures that transactions involving strata properties are conducted with full knowledge of the parties' financial standing with the strata corporation, promoting transparency and trust in the community.

Key takeaways

The Form F Certificate of Payment is a crucial document under the Strata Property Act that plays a significant role in the real estate transactions involving strata properties. Understanding the proper way to fill out and use this form is essential for both strata corporations and owners. Here are six key takeaways to guide you through this process.

- Firstly, the Form F Certificate of Payment serves to certify whether an owner owes money to the strata corporation. This certification, made under section 115 of the Strata Property Act, is necessary for the completion of certain real estate transactions.

- The form asks for the strata plan's registration number and a detailed description of the strata lot. Accurate identification of the strata lot in question is critical to prevent any potential disputes or confusion.

- It presents two options: (a) the owner does not owe money to the strata corporation, or (b) the owner does owe money. If the latter is true, it further requires the submission that either the money has been paid into court or to the strata corporation in trust, or satisfactory arrangements have been made with the corporation.

- Completing the date section accurately is crucial. The date indicates when the form was filled out and signed. Given that the certificate is deemed current for 60 days from the date it is issued, as per section 115 (2) of the Act, the date also affects the document's validity period.

- Signatures are required to validate the form. The form must be signed by at least one council member of the strata corporation or by the strata manager if they are authorized by the strata corporation. If the council consists of more than one member, a second signature may be required.

- Lastly, it's important to note that the Certificate of Payment is current for the purposes of section 256 of the Act for a period of 60 days from the date it is issued. This means the information provided on the form should be considered within the context of its 60-day validity period.

Properly completing and understanding the F Payment form is vital for ensuring the smooth execution of transactions involving strata properties. By following the guidelines provided, users can navigate the process more effectively and ensure compliance with the relevant sections of the Strata Property Act.

Popular PDF Documents

Form 8888 Total Refund per Computer - It is important to double-check account numbers and routing numbers on Form 8888 to ensure correct deposit.

3,800 - This form is directly linked to a business’s financial health, impacting tax obligations.