Get Equity Bank Loan Application Form

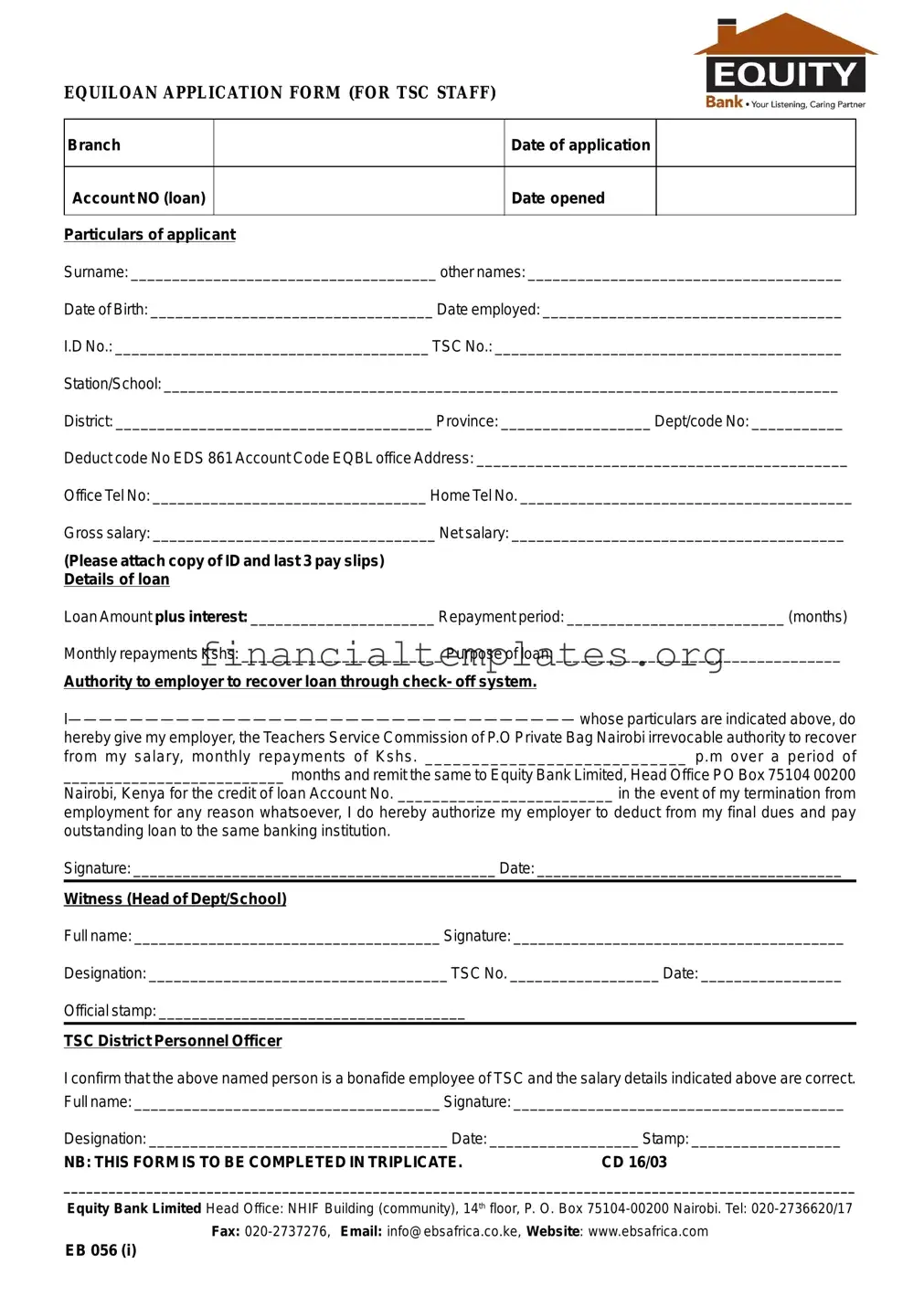

At the heart of the Equity Bank loan application process for Teachers Service Commission (TSC) staff lies the comprehensive EQUILOAN APPLICATION FORM. This document serves multiple functions starting from recording the basic personal and professional details of the applicant, including their name, date of birth, employment date, identification numbers, and contact information. It delves deeper by asking for specific employment details such as station or school, district, province, and various codes that are essential for the processing of the loan. Applicants must disclose their financial standing by providing information about their gross and net salary, and this must be backed with identifying documents and recent pay slips to ensure authenticity. The form stipulates the conditions for the loan requested including the amount, interest, repayment period, and the purpose for which the loan is sought. It incorporates a declaration giving the TSC irrevocable authority to deduct monthly repayments directly from the salary and outlines protocols for loan recovery in case of employment termination. Required to be completed in triplicate, this form also mandates endorsements from the applicant's Head of Department or School and the TSC District Personnel Officer to verify the applicant’s employment status and salary details. With Equity Bank's structured approach to loan applications, this document is a crucial step in securing financial assistance for TSC staff, ensuring a methodical and secure process. Through providing an exhaustive list of requirements and a clear path for both applying for and repaying the loan, the Equiloan Application Form epitomizes Equity Bank’s commitment to serving the financial needs of educators in Kenya.

Equity Bank Loan Application Example

EQUILOAN APPLICATION FORM (FOR TSC STAFF)

Branch |

|

Date of application |

|

|

|

|

|

Account NO (loan) |

|

Date opened |

|

|

|

|

|

Particulars of applicant |

|

|

|

Surname: _____________________________________ other names: ______________________________________

Date of Birth: __________________________________ Date employed: ____________________________________

I.D No.: ______________________________________ TSC No.: __________________________________________

Station/School: __________________________________________________________________________________

District: ______________________________________ Province: __________________ Dept/code No: ___________

Deduct code No EDS 861 Account Code EQBL office Address: ____________________________________________

Office Tel No: _________________________________ Home Tel No. ________________________________________

Gross salary: __________________________________ Net salary: ________________________________________

(Please attach copy of ID and last 3 pay slips) Details of loan

Loan Amount plus interest: ______________________ Repayment period: __________________________ (months)

Monthly repayments Kshs: ________________________ Purpose of loan: __________________________________

Authority to employer to recover loan through check- off system.

hereby give my employer, the Teachers Service Commission of P.O Private Bag Nairobi irrevocable authority to recover from my salary, monthly repayments of Kshs. ____________________________ p.m over a period of

__________________________ months and remit the same to Equity Bank Limited, Head Office PO Box 75104 00200

Nairobi, Kenya for the credit of loan Account No. _________________________ in the event of my termination from

employment for any reason whatsoever, I do hereby authorize my employer to deduct from my final dues and pay outstanding loan to the same banking institution.

Signature: ____________________________________________ Date: _____________________________________

Witness (Head of Dept/School)

Full name: _____________________________________ Signature: ________________________________________

Designation: ____________________________________ TSC No. __________________ Date: _________________

Official stamp: _____________________________________

TSC District Personnel Officer

I confirm that the above named person is a bonafide employee of TSC and the salary details indicated above are correct.

Full name: _____________________________________ Signature: ________________________________________

Designation: ____________________________________ Date: __________________ Stamp: __________________

NB: THIS FORM IS TO BE COMPLETED IN TRIPLICATE. |

CD 16/03 |

_________________________________________________________________________________________________________

Equity Bank Limited Head Office: NHIF Building (community), 14th floor, P. O. Box

Fax:

EB 056 (i)

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Title | EQUILOAN APPLICATION FORM (FOR TSC STAFF) |

| Target Audience | Teachers Service Commission (TSC) Staff |

| Required Attachments | Copy of ID and last 3 pay slips |

| Loan Recovery Method | Authority to employer to recover loan through check-off system |

| Repayment Terms Agreement | Authorization to recover monthly repayments from salary and final dues in case of employment termination |

| Witness Requirement | Signature from Head of Dept/School with official stamp |

| Verification by TSC District Personnel Officer | Confirmation of employment and salary details by TSC District Personnel Officer with a signature and stamp |

Guide to Writing Equity Bank Loan Application

Filling out the Equity Bank Loan Application form is crucial for TSC staff interested in securing a loan. This process, while detailed, is designed to gather necessary information about the applicant, their employment, and financial standings, as well as the details of the loan they wish to obtain. Follow the steps below to ensure that the application is completed accurately. After submission, the bank will process your application, where it will assess your financial eligibility and make a decision based on the information provided. Expect to attach additional documents, such as identification and pay slips, as part of the verification process.

- Enter the branch location of Equity Bank where you are applying for the loan.

- Fill in the date of the loan application next to the branch name.

- Provide your Equity Bank loan account number and the date it was opened.

- Under Particulars of the applicant, write your surname and other names as they appear in official documents.

- Insert your date of birth and the date you were employed.

- Type in your Identification Number (I.D No.) and your Teacher Service Commission Number (TSC No.).

- Specify your station or school, including the full address and the district and province it's located in.

- Include the Department/code No. and the Deduct code No EDS 861, followed by your Account Code.

- Enter your office address, office telephone number, and home telephone number.

- List your gross salary and your net salary. Ensure to attach a copy of your ID and the last three pay slips as required.

- Under Details of loan, indicate the loan amount plus interest you're applying for.

- Specify the repayment period in months and your proposed monthly repayment amount in Kenyan shillings (Kshs).

- Describe the purpose of the loan in the space provided.

- Fill out the Authority section to your employer, confirming the recovery plan through the check-off system. Sign and date this section.

- The Witness (Head of Dept/School) section should be filled by the head of your department or school, including their full name, signature, designation, TSC No., and official stamp.

- The TSC District Personnel Officer must confirm your employment status and salary details. Their full name, signature, designation, and official stamp need to be included.

Important: Remember, this form is to be completed in triplicate. Before submission, ensure all sections are filled accurately and that no necessary details have been omitted. Incomplete or inaccurate forms may lead to delays in your loan application process.

Understanding Equity Bank Loan Application

What is the purpose of the Equiloan Application Form for TSC Staff?

The Equiloan Application Form is designed for employees of the Teachers Service Commission (TSC) in Kenya who are seeking a loan. The form facilitates the loan application process with Equity Bank, providing a structured way for applicants to submit their personal and employment details, loan requirements, and an authorization for loan repayment through salary deductions.

What information do I need to provide on the Equiloan Application Form?

Applicants need to provide several details on the form, including their surname, other names, date of birth, date of employment, national ID number, TSC number, work station or school, district, province, department code, and office addresses. Additionally, details regarding the loan such as the amount plus interest, repayment period, and purpose of the loan are required. Applicants also need to attach a copy of their ID and the last 3 pay slips.

How does the repayment process work through the check-off system mentioned in the form?

Through the check-off system, the Teachers Service Commission (TSC) deducts monthly repayments directly from the borrower's salary. The specified amount is then remitted to Equity Bank Limited for the duration of the loan repayment period. In case of employment termination, the borrower authorizes the employer to deduct any outstanding loan balance from their final dues to settle the loan.

What are the steps involved in submitting the Equiloan Application Form?

To submit the Equiloan Application Form, applicants must complete it with the required information, attach the necessary documents (ID and pay slips), and then submit it to the designated officer for approval and witness. The form must be signed by the applicant, a witnessing head of department or school, and a TSC District Personnel Officer who confirms the applicant's employment and salary details. The completed form, in triplicate, is then sent to the mentioned Equity Bank address for processing.

Is there any witness requirement for the loan application form?

Yes, the loan application form requires a witness's signature. This witness should be the head of the department or school where the applicant is employed. The witness is required to provide their full name, signature, designation, and TSC number, along with the official stamp, to authenticate the application.

What should I do if I have questions about filling out the form or the loan process?

For questions regarding the loan application form or the loan process, applicants can contact Equity Bank directly using the contact information provided on the form. This includes the bank's phone number, fax number, email address, and website. It's advisable to seek clarification before submitting the application to ensure all requirements are met and to understand the terms of the loan agreement fully.

Common mistakes

Filling out a loan application form, such as the Equity Bank Loan Application form for TSC staff, involves providing detailed personal and financial information. Mistakes during this process can delay approval or result in the denial of the loan application. Below are six common mistakes applicants should avoid:

Not Double-Checking Personal Information: It's crucial to review the spelling of names, ID numbers, TSC numbers, and contact details. Inaccuracies in this section can cause significant delays in the processing of the application.

Omitting Required Attachments: Failing to attach a copy of an ID and the last three pay slips, as requested, is a common oversight. These documents are necessary for verifying the identity and income of the applicant.

Incorrect Financial Information: Entering inaccurate figures for gross and net salary or the loan amount and monthly repayments can lead to an unrealistic repayment plan or the outright rejection of the application.

Unclear Purpose of Loan: Providing vague or incomplete information about the purpose of the loan can raise questions about the applicant's intentions and financial responsibility.

Failure to Authorize the Loan Repayment: Neglecting to properly complete the authority to the employer to recover the loan through the check-off system might result in administrative issues, affecting the loan disbursement.

Skipping the Witness Section: Not having the form witnessed by the Head of Dept/School or neglecting to provide their full name, signature, designation, TSC No., and date can invalidate the application. This step is crucial for verifying the authenticity of the application.

To avoid these mistakes, applicants should carefully read through the entire form before beginning to fill it out, ensuring all fields are completed accurately and all required documents are attached. Prompt attention to detail can vastly improve the chances of a successful loan application.

Documents used along the form

Applying for a bank loan, especially with Equity Bank, necessitates the completion and submission of various documents, aimed at providing the lender with a comprehensive overview of the applicant's financial status and ability to repay the loan. These documents complement the Equity Bank Loan Application form, offering a deeper insight into the applicant's financial health, employment status, and collateral value. The significance of these documents cannot be understated; they play a crucial role in the approval process by mitigating the lender's risk and ensuring that loans are granted to eligible and reliable borrowers.

- Proof of Identity: This document is fundamental to any loan application. Often, a government-issued photo ID, such as a passport or driver's license, serves this purpose. It verifies the applicant's identity, ensuring they are who they claim to be.

- Proof of Income: Besides the last 3 pay slips required, additional documents like bank statements, tax returns, or employer letters might be needed. These papers provide a clearer picture of the applicant's financial standing and ability to meet monthly repayments.

- Credit Report: A summary of the applicant's credit history, scores, and standing, a credit report is crucial for lenders. It helps assess the risk of lending by showing how the applicant has managed debts and finances in the past.

- Property Documents: In cases where the loan is secured against property, documents verifying ownership, valuation, and legal status of the property are imperative. These assure the lender of the collateral's value and legal standing.

- Employment Verification Documents: Additional to the TSC No. and employment details provided, documents like an employment contract or a verification letter from the employer can be required. These confirm the applicant's current employment status and income stability.

- Loan Application History: Details of previous loans and their statuses, if any, can be required. This information helps lenders understand the applicant's borrowing history and repayment behavior.

- Guarantor Form: If applicable, a form detailing the guarantor's consent and financial information might be needed, adding an extra layer of security for the loan. This guarantees another source of repayment if the primary applicant fails to meet the obligations.

Each document listed serves a strategic purpose, painting a comprehensive picture of the applicant's financial and employment situation. It is in the interest of both the lender and borrower that these documents provide current, accurate, and complete information. A successful loan application not only satisfies immediate financial needs but also strengthens the borrower's creditworthiness for future financial endeavors. Understanding and preparing these documents meticulously can significantly streamline the loan application process, moving the applicant closer to achieving their financial goals with Equity Bank.

Similar forms

The Mortgage Application is closely similar to the Equity Bank Loan Application form, especially regarding the requirement for personal and financial information. Both forms require applicants to disclose their full names, addresses, employment details, and income. They also both necessitate the applicant's authorization for financial investigations and commitments related to loan repayment. The key difference lies in the loan's purpose, with one being specifically for home purchases or refinancing.

A Personal Loan Application shares many similarities with the Equity Bank Loan Application, as it also requires detailed personal information, employment and income verification, and information on the loan amount and repayment plan. The angle of approach might differ slightly, with personal loans often covering a broader range of purposes compared to the more specific teacher’s commission staff orientation of the Equity form.

The Credit Card Application process parallels that of the Equity Bank Loan Application by gathering comprehensive personal and financial data to assess creditworthiness. Applicants must provide their employment information, income details, and sometimes even authorize a credit check, similar to loan applications. However, the repayment terms and usage of credit differ markedly between a revolving credit account and a term loan.

Auto Loan Applications resemble the Equity Bank Loan Application form in their necessity for detailed personal, employment, and income information. Additionally, both forms often require the applicant's authorization to recover payments directly from their income or bank accounts. The significant divergence comes with the Auto Loan's collateral – the vehicle – and specifics related to its make, model, and valuation.

Business Loan Applications, while focusing on the financial needs of a business, share common ground with the Equity Bank Loan Application in terms of requiring owner or key stakeholders' personal and financial information. Both forms scrutinize the applicant’s ability to repay the loan, although the business loan also delves into business plans, earnings, and operational data.

The Student Loan Application process is quite comparable to the Equity Bank Loan Application as it collects extensive personal and financial information to assess eligibility and repayment capacity. Both necessitate disclosures about income and employment status, albeit student loans often consider academic records and future earning potential instead of current employment solely.

The Payday Loan Application is similar in its requirement for applicants to provide substantial personal and financial information, including employment status and income details. However, payday loans typically have much shorter repayment periods and higher interest rates compared to the more structured repayment schedule of the Equity Bank Loan Application.

The Home Equity Line of Credit (HELOC) Application, while designed for a different financial product, parallels the Equity Bank Loan Application in its requirement for personal and financial disclosures, including employment and income verification. The key difference lies in the HELOC leveraging the homeowner's equity as collateral against the line of credit.

The Debt Consolidation Loan Application form resembles the Equity Bank Loan Application through its collection of detailed personal, employment, and financial data to evaluate the borrower's capacity to manage a new, consolidated repayment plan. The primary aim diverges, focusing on settling existing debts rather than facilitating new purchases or investments.

Dos and Don'ts

When filling out the Equity Bank Loan Application form, especially for TSC staff, it is essential to follow a series of dos and don'ts to ensure the process goes smoothly and increases the chance of approval. Below are nine tips for completing the application:

- Do gather all necessary documents before starting the application, including your ID and the last 3 pay slips.

- Don't rush through the form without understanding each section; take your time to ensure accuracy in your responses.

- Do double-check your personal information, such as your TSC No., I.D. No., and account numbers, for accuracy.

- Don't leave any sections blank. If a section does not apply to you, write ‘N/A’ (not applicable) instead of leaving it empty.

- Do write clearly and legibly if you are filling out the form by hand to prevent any misunderstandings or processing delays.

- Don't sign the form without reading the terms, especially the authority to the employer to recover the loan through the check-off system.

- Do ensure the loan purpose is clearly and concisely explained, as it may impact the approval decision.

- Don't forget to make copies of the completed form for your records, as this document is crucial for future references.

- Do confirm that the witness (Head of Dept/School) and the TSC District Personnel Officer sign the form to validate your application.

By carefully following these recommendations, applicants can navigate the loan application process more efficiently, reducing errors and increasing the likelihood of a successful loan application with Equity Bank.

Misconceptions

When it comes to applying for a loan through Equity Bank, specifically for TSC staff, there are several misconceptions that can lead to confusion. It's important to clarify these misunderstandings to make the loan application process smoother and more transparent.

Only TSC staff with permanent positions can apply: This misconception might deter temporary or contract employees from applying. However, the application form does not specify that only permanent staff are eligible. All TSC staff should consider verifying their eligibility with the bank directly.

The process is lengthy and complicated: The form itself is straightforward, requesting basic personal information, employment details, and the purpose of the loan. With the necessary documents ready, such as ID and pay slips, the application process can be quite seamless.

High-interest rates deter applicants: Many assume that loans from banks, including Equity Bank, come with exorbitant interest rates. While rates can vary, Equity Bank offers competitive terms, which should encourage potential borrowers to seek exact figures directly from the bank.

A superior's endorsement is a guarantee for approval: The witness section requires a head of department or school's signature. Some might think this acts as a guarantor for loan approval. However, the witness signature is mainly for identity and employment verification purposes, not an assurance of loan approval.

Salaried teachers do not qualify for substantial loan amounts: There's a false belief that teachers’ salaries limit them to small loan amounts. Loan amounts plus interest are determined by several factors, including the applicant's salary, net income, and the bank's lending policies. Teachers are encouraged to apply for the amount they need and let the bank assess their eligibility based on its criteria.

Understanding the real aspects of the Equity Bank Loan Application can help TSC staff manage their expectations and prepare adequately for the application process. Always seeking clarification directly from the bank can also dispel any doubts and provide the most accurate and helpful information.

Key takeaways

When filling out the Equity Bank Loan Application form, especially designed for TSC (Teachers Service Commission) staff, it is crucial to approach this document with attention and care to facilitate a smooth processing experience. Here are key takeaways that can guide an applicant through this process:

- Complete all sections with accurate information: Providing correct information about your personal details, employment background, and financial status is essential. Ensure that your name, ID number, TSC number, station or school, district, and province are filled out as per official records.

- Understand the loan details: Be clear about the amount you're borrowing, the interest rate applied, the total repayment amount, and your repayment period. This understanding is crucial for financial planning and commitment.

- Attach required documents: The form necessitates attaching a copy of your ID and the last three pay slips. These documents are vital for verifying the information provided and assessing your loan repayment capability.

- Consider your repayment capability: Reflect on your gross and net salary as entered in the form to ensure that the monthly repayment amount is manageable within your budget.

- Authority to employer for loan recovery: By signing the form, you give your employer, the TSC, the authority to deduct your loan repayments directly from your salary. This check-off system is a commitment that should not be taken lightly.

- Implications of employment termination: Understand that in the event of employment termination for any reason, you are authorizing your employer to deduct any outstanding loan amount from your final dues. It’s imperative to consider the long-term commitment you are entering into with this loan.

- Witness and official verification needed: The application process requires a witness, preferably the Head of Department or School, and verification from a TSC District Personnel Officer that you are a bona fide employee with accurate salary details. This step is crucial for the credibility of your application.

- Form completion in triplicate: Remember to complete the form in triplicate, which means you should fill out three copies. This is often a standard practice for official documents to ensure all relevant parties have a copy, promoting transparency and accountability in the loan processing.

Approaching the Equity Bank Loan Application with detailed attention to these areas will facilitate a smoother process for TSC staff seeking financial assistance. It is always recommended to thoroughly review and understand all sections of the form before submission, ensuring that commitments made are well within one's financial capacity.

Popular PDF Documents

Non Profit Donation Receipt Example - Highlights the charitable registration number for The Salvation Army, ensuring transparency and trustworthiness in donation processing.

Do I Need a Resale Certificate for Every State - Each participating state has particular stipulations regarding the use of this certificate, underscoring the importance of familiarizing oneself with relevant state-specific tax laws.