Get Eftps Payment Worksheet Form

The Electronic Federal Tax Payment System (EFTPS) Payment Worksheet form streamlines the process for employers and individuals to remit their 941 tax obligations efficiently. Aimed to facilitate ease of use, this form serves as a guide for making direct payments through a telephone system, highlighting the necessity of a prepared approach towards tax submission. It details the procedure starting with a call to a designated phone number, input of employer identification and a personal identification number (PIN), followed by the tax form number related specifically to the payment. Users are navigated through a voice response process, enabling them to select their tax payment period, indicate the payment amount, and confirm the transaction details. Importantly, the form underscores the reliance on utilizing a short-form version for those already familiar with the voice response system, simplifying the process further. With specifics on breaking down 941 taxes into categories like Social Security, Medicare, and federal withholding amounts, the form serves as a critical tool in ensuring accuracy and compliance. Additionally, it offers resources for further assistance, including customer service contact information for various needs. This structured approach assists taxpayers in meeting their obligations with precision, helping to avoid common pitfalls associated with tax payment submissions.

Eftps Payment Worksheet Example

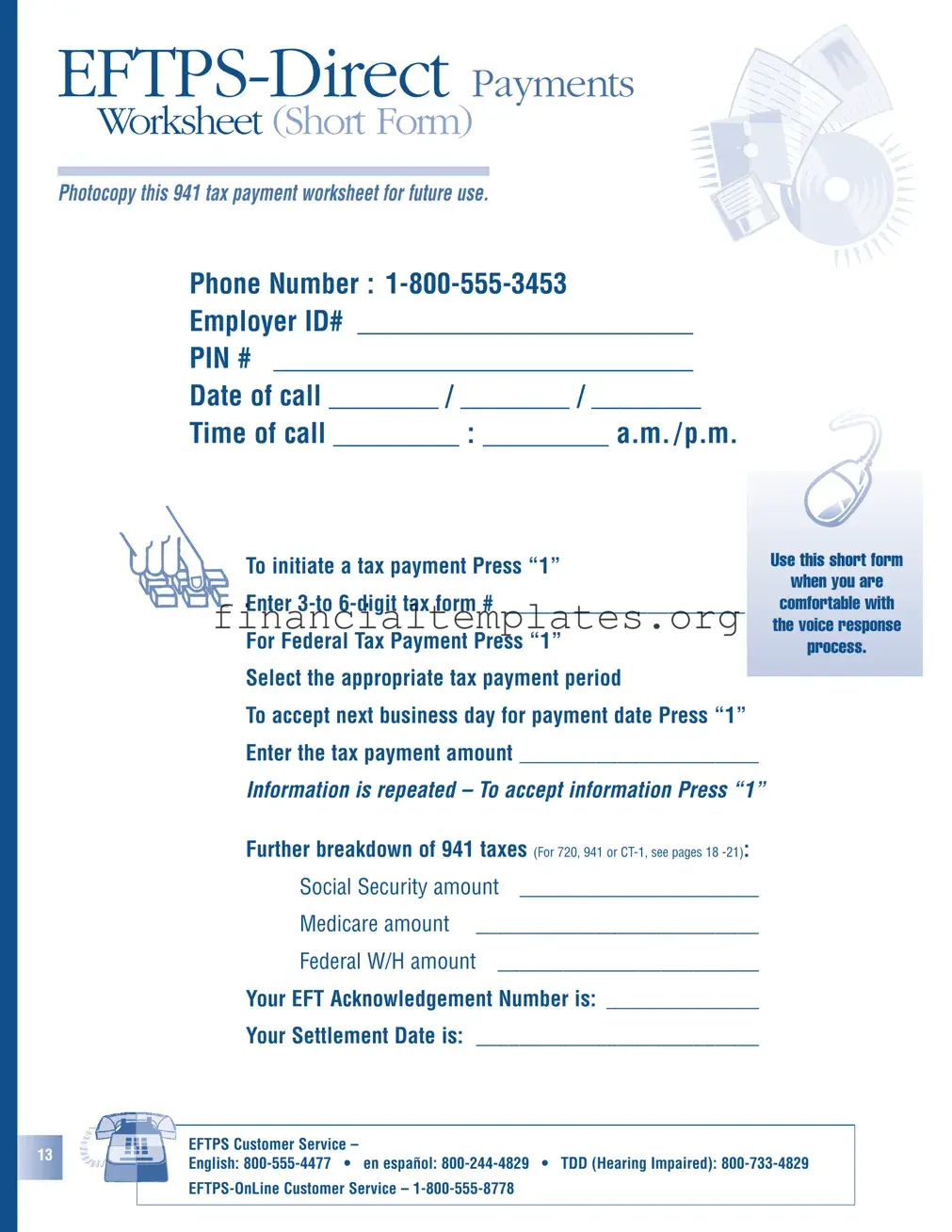

Worksheet (Short Form)

Photocopy this 941 tax payment worksheet for future use.

Phone Number :

Employer ID# ________________________

PIN # ______________________________

Date of call ________ / ________ / ________

Time of call _________ : _________ a.m. / p.m.

13

To initiate a tax payment Press “1” |

|

Use this short form |

||

|

when you are |

|||

Enter |

______________________ |

|

||

|

|

|||

|

comfortable with |

|||

For Federal Tax Payment Press “1” |

|

the voice response |

||

|

|

|||

|

process. |

|||

Select the appropriate tax payment period |

|

|

||

|

|

|||

|

|

|||

|

|

|||

To accept next business day for payment date Press “1” |

|

|||

Enter the tax payment amount ______________________ |

|

|||

Information is repeated – To accept information Press “1” |

|

|||

Further breakdown of 941 taxes (For 720, 941 or |

|

|||

Social Security amount |

______________________ |

|

||

Medicare amount |

__________________________ |

|

||

Federal W/H amount |

________________________ |

|

||

Your EFT Acknowledgement Number is: ______________

Your Settlement Date is: __________________________

EFTPS Customer Service –

English:

Document Specifics

| Fact | Description |

|---|---|

| Use Purpose | The EFTPS-Direct Payments Worksheet (Short Form) is designed for employers to prepare their 941 tax payments. |

| Contact Information | The form provides a dedicated phone number (1-800-555-3453) for initiating the tax payment process. |

| Authentication Required | Employers need to provide their Employer ID and PIN number to use the system. |

| Operation Time | Users must record the date and time of the call made to initiate the tax payment. |

| Procedure Step | The form instructs to press “1” to start the tax payment process, indicating a voice response system is used. |

| Tax Payment Identification | It requires entering a 3-to 6-digit tax form number to specify the type of federal tax payment. |

| Payment Timing | For setting the tax payment to the next business day, users need to press “1” as confirmation. |

| Tax Breakdown | The worksheet provides fields to specify amounts for Social Security, Medicare, and Federal Withholding (W/H). |

| Confirmation | After the payment process, an EFT Acknowledgement Number and Settlement Date are provided for record-keeping. |

Guide to Writing Eftps Payment Worksheet

When it comes to managing your business finances, staying on top of your tax payments is crucial. The Electronic Federal Tax Payment System (EFTPS) provides a streamlined way to make these payments. Before diving into the process, gather your employer ID number, PIN, and the tax payment amount. The EFTPS Payment Worksheet simplifies the process, guiding you through each step. Here's how to fill it out:

- Locate the section labeled "Employer ID#" and enter your unique Employer Identification Number.

- Enter your Personal Identification Number (PIN) in the field marked "PIN #".

- Fill in the date and time of your call in the "Date of call" and "Time of call" fields, ensuring you mark a.m. or p.m. appropriately.

- For initiating a tax payment, you'll notice the instruction to "Press '1'". Although this is designed for phone use, it indicates your intent to make a payment on the form.

- In the field labeled "Enter 3-to 6-digit tax form #", input the number of the tax form you are paying (e.g., 941).

- To select the appropriate tax payment period, follow the prompt which, in actual use, would require pressing '1'. On the worksheet, this will be part of your payment detail.

- When entering your tax payment amount, look for the line that says "Enter the tax payment amount" and fill in the total payment you're submitting.

- The form also allows for the breakdown of taxes, such as Social Security amount, Medicare amount, and Federal W/H amount. Fill in these fields if they apply to your tax payment.

- After submitting your payment through EFTPS, you'll receive an EFT Acknowledgement Number and a Settlement Date, which you should record in the respective fields for your records.

The form also comes with customer service numbers for different needs, which can be useful if you require assistance during the process. Remember, filling out this form is just one step in managing your tax payments. Always keep a copy of your completed worksheet and confirmation of your payment for future reference.

Understanding Eftps Payment Worksheet

- What is the EFTPS Direct Payments Worksheet (Short Form)?

- How do I use this worksheet to make a payment?

- Where can I find the phone number to initiate a tax payment?

- What should I do if I prefer to make payments online?

- What is the EFTPS Customer Service number?

- Can I use this form for taxes other than 941 payments?

- What are the next steps after completing a tax payment using this worksheet?

The EFTPS Direct Payments Worksheet (Short Form) is a tool for individuals and businesses to prepare their federal tax payments electronically. Whether you're familiar with the voice response system or prefer using the online platform, this worksheet helps you organize information needed to make a payment, such as your Employer ID Number, PIN, and payment amounts for different tax categories like Social Security, Medicare, and federal withholding.

First, fill out the form with your Employer ID Number and PIN. Decide on the date and time you'll call the provided phone number to initiate your tax payment. During the call, you'll enter the tax form number related to your payment (for example, 941 for quarterly payroll taxes), select the tax payment period, and enter the specific tax payment amounts. Follow the prompts to complete your payment, and note down your EFT Acknowledgement Number and Settlement Date for your records.

The phone number to initiate a tax payment is 1-800-555-3453. This number connects you to the EFTPS Voice Response System, allowing you to make payments over the phone following the instructions on your worksheet.

If you prefer making payments online, visit the EFTPS website and log in to your account. If it's your first time, you'll need to enroll by providing your Employer ID Number and banking information. Once enrolled, you can schedule payments using the information you would have put on your worksheet, and the website will guide you through each step.

For assistance, EFTPS Customer Service can be reached at 800-555-4477. If you prefer assistance in Spanish, call 800-244-4829. For those who are hearing impaired, the TDD (Telecommunication Device for the Deaf) number is 800-733-4829. For online service issues, you can call EFTPS Online Customer Service at 1-800-555-8778.

Yes, the EFTPS Direct Payments Worksheet (Short Form) can also be used for other tax forms such as 720 (Quarterly Federal Excise Tax Return) and CT-1 (Employer's Annual Railroad Retirement Tax Return), in addition to Form 941. Just make sure to enter the correct 3-to 6-digit tax form number when prompted.

After making your tax payment, keep the completed worksheet, your EFT Acknowledgement Number, and the Settlement Date in your records. This information is essential for verifying that your payment was processed and for resolving any potential issues in the future. It's also a good idea to regularly check your EFTPS account online for payment history and confirmation.

Common mistakes

Filling out the EFTPS (Electronic Federal Tax Payment System) Payment Worksheet tends to be a straightforward process, but making mistakes can lead to complications in your tax payments. Here's a rundown of common missteps people might encounter:

Not double-checking the Employer ID Number (EIN). This number is crucial for identifying your business and ensuring your payment is applied correctly.

Entering the PIN incorrectly. The Personal Identification Number is a layer of security, and mistyping it can prevent you from proceeding with the transaction.

Inconsistencies with the date and time of call. Remember, these details help track your payment should any issues arise.

Neglecting to select the correct tax form number. This could lead to your payment being applied to the wrong type of tax.

Failing to properly indicate the tax payment period. Incorrect periods can create discrepancies in your tax records.

Typographical errors in the tax payment amount. An oversight here might result in underpayment or overpayment.

Miscalculating the breakdown of 941 taxes, including Social Security, Medicare, and Federal Withholding amounts. Such errors affect the accuracy of your tax liabilities.

Omitting the EFT Acknowledgement Number. This unique identifier is critical for confirming the transaction and resolving potential disputes.

Forgetting to note the Settlement Date. It's essential for your financial records to match IRS records.

Ignoring customer service numbers. Should issues arise, knowing whom to call can save time and stress.

Watch out for these common pitfalls to ensure your experience with EFTPS is as smooth as possible:

Always cross-check entered information for accuracy.

Keep records of all submitted payment details for future reference.

Utilize customer service when in doubt to prevent or resolve issues promptly.

By steering clear of these errors, you'll navigate the EFTPS system more effectively, maintaining compliance and ensuring your business's fiscal responsibilities are met accurately and on time.

Documents used along the form

When managing federal tax payments using the EFTPS (Electronic Federal Tax Payment System), the EFTPS Direct Payments Worksheet is a vital tool for ensuring accuracy and timeliness. However, this form often works in tandem with other important forms and documents. These complementary materials can streamline tax processing, enhance record-keeping, and help avoid compliance issues. Below is a list of forms and documents commonly used alongside the EFTPS Direct Payments Worksheet.

- IRS Form 941: Employers use this quarterly federal tax return to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks and to pay the employer's portion of Social Security or Medicare tax.

- IRS Form 1040-ES: For individuals, including sole proprietors, partners, and S corporation shareholders, this form is used to calculate and pay estimated taxes on a quarterly basis.

- IRS Form 940: This form is necessary for employers to report their annual Federal Unemployment Tax Act (FUTA) tax. FUTA funds are allocated to paying unemployment compensation to workers who have lost jobs.

- IRS Form 990: Non-profit organizations utilize this form to provide the IRS with the annual financial information. It helps to maintain their tax-exempt status.

- Bank Account Information: Keeping bank account details on hand is essential for completing the EFTPS Payment Worksheet, as these details are required to execute the payment process.

- Payroll Records: Accurate and up-to-date payroll records ensure the correct amounts are paid for income taxes and contributions towards Social Security and Medicare.

- IRS Form W-2 and W-3: At the end of the year, employers must prepare a W-2 for each employee, showing the amount of taxes withheld from their paycheck for the year. The W-3 is the transmittal form summarizing all W-2s for the IRS.

- IRS Form 1099: Companies use this form to report income paid to a contractor or freelancer exceeding $600 in a year. It's crucial for individuals and businesses that work with independent contractors.

Together, these forms and documents provide a comprehensive framework for handling business and personal tax responsibilities efficiently. Utilizing the EFTPS alongside these forms ensures compliance with IRS requirements, minimizes errors, and streamlines the tax payment process. It's important for individuals and businesses to familiarize themselves with these documents to maintain accurate records and stay compliant with federal tax laws.

Similar forms

The Form 1040-ES, often used for estimating taxes by individuals, is similar to the EFTPS Payment Worksheet in that it helps taxpayers calculate and remit estimated tax payments to the IRS. Both forms facilitate proactive tax payments, but the 1040-ES is specifically designed for individual taxpayers to estimate their taxes on income not subject to withholding, similar to how the EFTPS worksheet aids in processing tax payments electronically for employers.

A Form 941, Employer’s Quarterly Federal Tax Return, closely aligns with the EFTPS Payment Worksheet, since the worksheet is used as an aid in making payments that could be related to the taxes reported on Form 941. Both documents are critical for employers in managing payroll taxes, including withholding, Social Security, and Medicare taxes, ensuring proper reporting and payment of employment taxes to the IRS on a quarterly basis.

The Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, shares a connection with the EFTPS Payment Worksheet in the context of facilitating employers’ fulfillment of their tax obligations. While Form 940 is specific to the reporting of yearly Federal Unemployment Tax Act taxes, the EFTPS Payment Worksheet can be used to remit these taxes, showcasing how both play a part in the process of tax payment and reporting for employment-related taxes.

Form W-2, Wage and Tax Statement, although primarily a form for reporting wages paid to employees and taxes withheld from them, indirectly relates to the EFTPS Payment Worksheet. The data on Form W-2, such as Social Security and Medicare taxes withheld, impacts the information and payments managed through the EFTPS Payment Worksheet, illustrating their interconnected roles in the payroll and tax reporting process.

The Form W-3, Transmittal of Wage and Tax Statements, serves to summarize the information from multiple Forms W-2 and is sent to the Social Security Administration. Like the EFTPS Payment Worksheet, it is part of the broader system of tax reporting by employers, although the Worksheet is more directly involved with the payment aspect, and Form W-3 with the reporting aspect of tax obligations.

State-specific unemployment tax forms also bear resemblance to the EFTPS Payment Worksheet, as these forms are used by employers to report and pay state unemployment taxes. While state forms vary, they align with the EFTPS worksheet's purpose of enabling tax payments, but on a state level, demonstrating how both federal and state tax obligations are managed through similar processes.

The Form 1120-W, Estimated Tax for Corporations, is akin to the EFTPS Payment Worksheet in its purpose of assisting with the estimated tax payments. However, Form 1120-W is specifically tailored for corporations, paralleling how the EFTPS worksheet facilitates tax payments but is adaptable for various types of taxes, including corporate taxes.

Form 1099 series, used for reporting various types of income other than wages, salaries, and tips, connects with the EFTPS Payment Worksheet through their collective involvement in tax payment and reporting. EFTPS may be used for remitting taxes on payments reported through Form 1099, tying both documents into the broader tax management ecosystem for individuals and businesses.

Finally, the Quarterly Federal Excise Tax Return (Form 720) shares its tax payment functionality with the EFTPS Payment Worksheet, as the worksheet can be used to make excise tax payments that are reported on Form 720. Both are essential for businesses subject to excise taxes, highlighting how specific tax obligations are facilitated through dedicated forms and payment systems.

Dos and Don'ts

When approaching the task of filling out an EFTPS (Electronic Federal Tax Payment System) Payment Worksheet, especially the short form designed for those comfortable with the voice response system, it's important to follow guidelines to ensure accuracy and compliance. Here are several do's and don'ts to help you navigate this process smoothly.

- Do have your Employer Identification Number (EIN) ready before you begin. This number is crucial for identifying your business in the payment process.

- Do ensure your PIN (Personal Identification Number) is correct and available. You'll need this for authentication during the call.

- Do accurately record the date and time of your call. This can be important for tracking and verification purposes.

- Do clearly determine and enter the specific tax form number you are paying (e.g., 941) when prompted. This ensures your payment is applied correctly.

- Do verify the payment amounts, especially the breakdown for taxes such as Social Security, Medicare, and Federal Withholding. Mistakes here can lead to discrepancies with the IRS.

- Don’t rush through the process without double-checking the information both as you enter it and when it is repeated back to you. Confirming accuracy is critical.

- Don’t forget to record your EFT Acknowledgement Number and Settlement Date once provided. These are essential for your records and future reference.

- Don’t hesitate to use customer service numbers provided on the worksheet if you encounter confusion or issues. Whether it's your first time using the system or you have specific questions, help is available.

- Don’t ignore the option to photocopy the blank worksheet for future use. Having a physical template can streamline the process for subsequent payments.

Filling out the EFTPS Payment Worksheet correctly is vital for ensuring your tax payments are processed accurately and efficiently. By focusing on these do's and don'ts, you can navigate the system with greater ease and confidence.

Misconceptions

There are several misconceptions about the EFTPS Payment Worksheet that need clarifying to ensure accurate and efficient use. By dispelling these myths, users can navigate the process with confidence.

- It's only for large businesses: The worksheet is designed for businesses of all sizes. Small business owners as well as large corporations can use it to make their tax payments.

- You need a tax professional to fill it out: While having a tax professional can be helpful, the form is straightforward enough that any employer with a basic understanding of their taxes can complete it.

- It can only be submitted by phone: While the worksheet provides a phone number for making payments, it also includes information for making payments online or through other services offered by the EFTPS.

- It's a complicated process: The form is actually a simplified version of the tax payment process. It has clear instructions and is designed to be user-friendly.

- It’s only for 941 tax payments: Even though it provides specific instructions for 941 tax payments, the worksheet can be used for various federal tax payments by entering the appropriate tax form number.

- Payments can’t be scheduled in advance: The EFTPS system allows for tax payments to be scheduled in advance. Employers can select a future payment date that works for them.

- Immediate payment confirmation isn’t available: After completing the payment process, an EFT Acknowledgement Number and Settlement Date are provided, offering immediate confirmation of the transaction.

- The service is only available in English: EFTPS customer service is available in multiple languages, including Spanish, and there’s also support for the hearing impaired, ensuring broad accessibility.

Understanding the realities of the EFTPS Payment Worksheet empowers employers to use this tool effectively, ensuring their tax obligations are met accurately and on time.

Key takeaways

Understanding how to correctly fill out and use the EFTPS Payment Worksheet can be overwhelming. However, getting it right can significantly ease the process of making tax payments. Here are some key takeaways that can help:

- Photocopy the worksheet for future use, which saves time and ensures you’re always prepared.

- Always have your Employer ID Number (EIN) and Personal Identification Number (PIN) handy before you start filling out the form or making a call.

- Be precise with the date and time of your call, as it helps in keeping accurate records of your transactions.

- For initiating a tax payment, you'll need to press “1” and be comfortable with the voice response process, indicating a straightforward step for those familiar with automated systems.

- Remember to select the correct tax form number for your payment, entering the 3-to 6-digit code when prompted.

- For setting up a payment for the next business day, press “1” when instructed. This option is critical for maintaining timely payments.

- Break down your 941 taxes into Social Security, Medicare, and Federal Withholding amounts for a clear understanding of where your tax payments are going.

- Once you complete your transaction, note down the EFT Acknowledgement Number and Settlement Date. This information is crucial for your records and any future queries you may have.

- Customer Service numbers are available in English, Spanish, and TDD for the hearing impaired, ensuring support is readily available for all users.

By keeping these points in mind, you can navigate the EFTPS Payment Worksheet with more confidence and efficiency, making your tax payment process smoother and more manageable.

Popular PDF Documents

Tc-737 - Designed to authorize a representative to handle tax filings and discussions in Utah.

Irs Form 1040 Sr Instructions 2023 Printable - Appreciate the necessity of this form for taxpayers who need to itemize certain types of less common income and deductions.