Get Education Loan Form

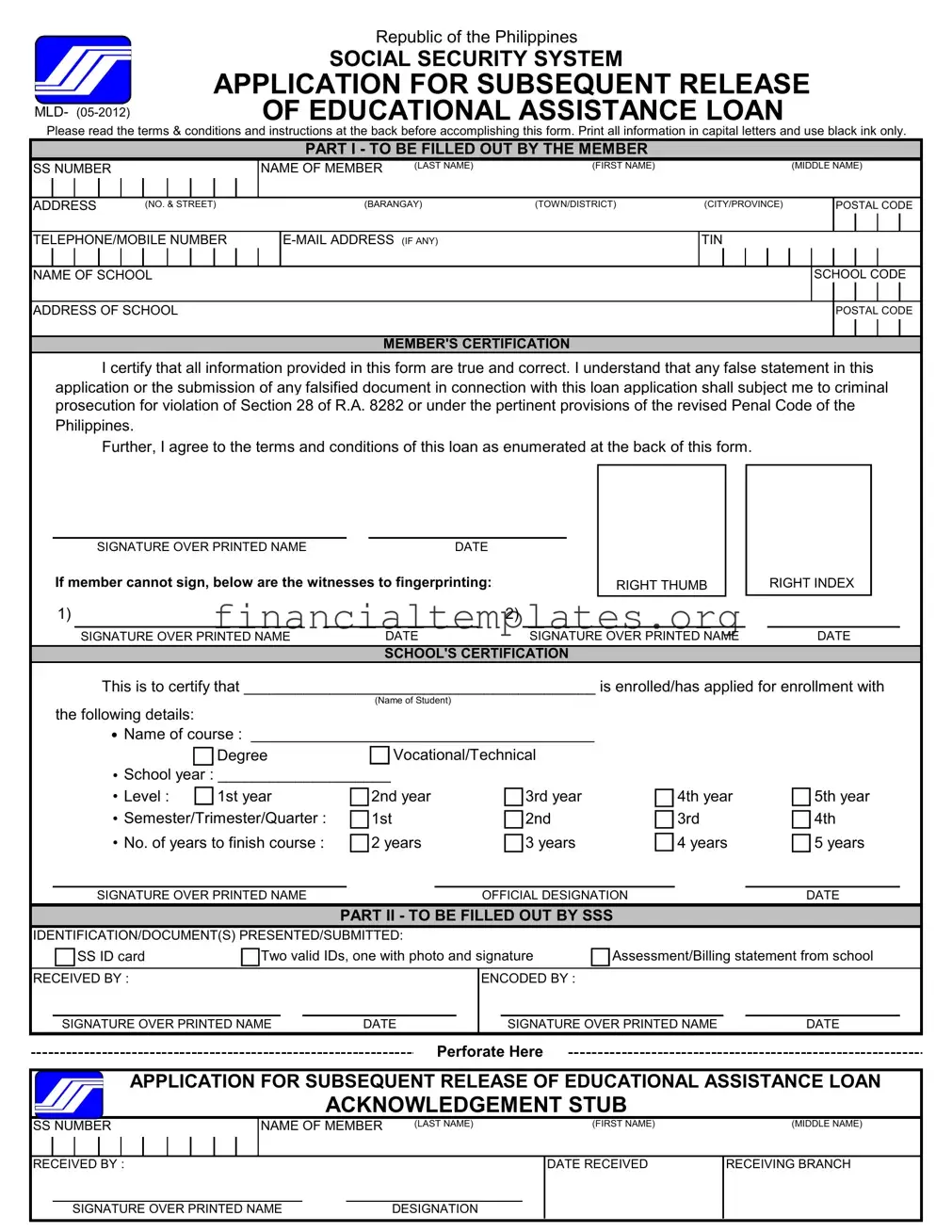

Navigating the terrain of education financing can be a complex journey for many. The Education Loan form, specifically designed by the Social Security System (SSS) of the Republic of the Philippines, serves as a crucial initial step in this journey. This meticulously crafted form is targeted at members seeking financial assistance for educational purposes, either for themselves or their dependents. The form, which must be filled out with the utmost attention to detail, mandates the use of capital letters and black ink, aiming to streamline the readability and processing of applications. Notably, it incorporates vital sections such as member details, school certification, and a comprehensive declaration of terms and conditions that encompass eligibility criteria for borrowers, loan amounts permissible, interest rates, and repayment instructions. Importantly, applicants are reminded of the legal implications tied to the accuracy of the information they provide, underscoring the form’s role not only as a financial tool but also as a document of legal significance. The procedural guidelines, alongside the explicit mention of terms like interest rates, penalties for late payments, and specific requirements for loan release, collectively outline a detailed map for applicants, guiding them from the initial application stage to the eventual repayment phase. This form thus embodies a critical intersection of educational aspirations and financial management within the framework of the SSS's support mechanisms for education.

Education Loan Example

MLD-

Republic of the Philippines

SOCIAL SECURITY SYSTEM

APPLICATION FOR SUBSEQUENT RELEASE OF EDUCATIONAL ASSISTANCE LOAN

Please read the terms & conditions and instructions at the back before accomplishing this form. Print all information in capital letters and use black ink only.

PART I - TO BE FILLED OUT BY THE MEMBER

SS NUMBER

NAME OF MEMBER |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

|

|

|

ADDRESS |

(NO. & STREET) |

(BARANGAY) |

(TOWN/DISTRICT) |

(CITY/PROVINCE) |

POSTAL CODE

TELEPHONE/MOBILE NUMBER

TIN

NAME OF SCHOOL

SCHOOL CODE

ADDRESS OF SCHOOL

POSTAL CODE

MEMBER'S CERTIFICATION

I certify that all information provided in this form are true and correct. I understand that any false statement in this application or the submission of any falsified document in connection with this loan application shall subject me to criminal prosecution for violation of Section 28 of R.A. 8282 or under the pertinent provisions of the revised Penal Code of the Philippines.

Further, I agree to the terms and conditions of this loan as enumerated at the back of this form.

SIGNATURE OVER PRINTED NAMEDATE

If member cannot sign, below are the witnesses to fingerprinting:RIGHT THUMB RIGHT INDEX

|

1) |

|

|

|

2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

|

DATE |

|

SIGNATURE OVER PRINTED NAME |

|

DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHOOL'S CERTIFICATION |

|

|

|

||

This is to certify that _________________________________________ is enrolled/has applied for enrollment with

(Name of Student)

the following details:

•Name of course : ________________________________________

|

Degree |

Vocational/Technical |

|

|

|

• School year : ____________________ |

|

|

|

||

• Level : |

1st year |

2nd year |

3rd year |

4th year |

5th year |

• Semester/Trimester/Quarter : |

1st |

2nd |

3rd |

4th |

|

• No. of years to finish course : |

2 years |

3 years |

4 years |

5 years |

|

SIGNATURE OVER PRINTED NAMEOFFICIAL DESIGNATIONDATE

PART II - TO BE FILLED OUT BY SSS

IDENTIFICATION/DOCUMENT(S) PRESENTED/SUBMITTED: |

|

|

SS ID card |

Two valid IDs, one with photo and signature |

Assessment/Billing statement from school |

|

|

|

RECEIVED BY : |

ENCODED BY : |

|

SIGNATURE OVER PRINTED NAME |

DATE |

SIGNATURE OVER PRINTED NAME |

DATE |

Perforate Here

APPLICATION FOR SUBSEQUENT RELEASE OF EDUCATIONAL ASSISTANCE LOAN

ACKNOWLEDGEMENT STUB

SS NUMBER

NAME OF MEMBER |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

RECEIVED BY :

DATE RECEIVED

RECEIVING BRANCH

SIGNATURE OVER PRINTED NAME |

DESIGNATION |

TERMS AND CONDITIONS

I.ELIGIBLE BORROWERS

1.SSS Members who have paid at least 36 monthly contributions, three (3) of which should be within the last 12 months prior to the date of application for loan;

2.Members whose last posted Monthly Salary Credit (MSC) is Php15,000 or below, provided that their actual basic salary or income is not more than Php15,000 per month; and

3.Members who are

II.COVERED BENEFICIARIES

Member, legal spouse, child of SSS member (including illegitimate) and sibling of unmarried SSS member (including half- brother/sister).

III.AMOUNT OF LOAN

Degree course - Maximum of Php15,000 per semester/trimester/quarter term or actual tuition/miscellaneous fees, whichever is lower, rounded off to the next higher Php100.

Vocational/Technical course (minimum of 2 years) – Maximum of Php7,500 per semester/trimester or actual tuition/miscellaneous fees, whichever is lower, rounded off to the next higher Php100.

A member shall be allowed to avail only once to defray educational expenses. No substitution of beneficiary shall be allowed.

All semestral/trimestral/quarter term releases shall be consolidated at the end of the

The loan shall be funded by National Government (NG) and SSS on a 50:50 basis.

IV. INTEREST RATE AND PENALTY

1.NG portion - 0 interest

SSS portion - 6% per annum based on diminishing principal balance until fully paid.

2.A 1% penalty per month shall be charged for any unpaid amortization.

V. REQUIREMENTS

1.SSS ID or two (2) valid IDs.

2. Accomplished application form.

3.Assessment/Billing statement issued by the school of member/beneficiary.

Any excess on the tuition fee and miscellaneous expenses shall be borne by the member/beneficiary.

VI. MANNER OF RELEASES

1.The check shall be payable to the school where the member/beneficiary is enrolled/has applied for enrollment and shall be released to the member/beneficiary.

2.Subsequent loan releases shall be made upon submission of another accomplished application form and corresponding assessment/billing statement from the school. Validation by the SSS may be done to ensure the continuous schooling of the member/beneficiary.

VII. REPAYMENT TERMS

Degree Course - The term is up to five (5) years and loan payment shall start after 18 months for semestral courses, 15 months for trimestral courses or 14 months & 15 days for quarter term courses from the scheduled last release date or from the date of last release for those who will not avail of the subsequent releases.

Vocational/Technical Course - The term is up to three (3) years and loan payment shall start after 18 months for semestral courses or 15 months for trimestral courses from the scheduled last release date or from the date of last release for those who will not avail of the subsequent release.

Any unpaid educational assistance loan shall be deducted from the future benefit of the member.

VIII. ELIGIBLE SCHOOLS

The school must be accredited by the Commission on Higher Education for degree courses and Technical Education and Skills Development Authority for vocational/technical courses.

IX. MISCELLANEOUS CONDITIONS

1.SSS number shall be issued to a

2.The SSS reserves the right to require additional documents as deemed necessary.

INSTRUCTIONS

1)Member to fill out “Member Details”.

2)Member must file application for educational assistance loan program personally and must present his Social Security card.

In the absence of the Social Security card, member is advised to apply immediately for said card and present two valid IDs, one with photo and signature.

3)If filed by member’s representative, the member's representative must present the following: (1) his Social Security card or any two of

the following IDs: unexpired driver’s license; PRC card; passport; postal ID; school or company ID; Tax Identification Number card (TIN); (2) borrower’s Social Security card and authorization letter (signed by both member and the representative).

Document Specifics

| Fact | Description |

|---|---|

| Form Identifier | MLD- (05-2012) Application for Subsequent Release of Educational Assistance Loan |

| Governing Law | Republic of the Philippines, under Section 28 of R.A. 8282 and provisions of the revised Penal Code of the Philippines. |

| Eligible Borrowers | SSS Members with at least 36 monthly contributions, whose last posted Monthly Salary Credit (MSC) is Php15,000 or below, and who are up-to-date in loan amortizations. |

| Covered Beneficiaries | Member, legal spouse, child (including illegitimate), and sibling (including half-siblings) of unmarried SSS member. |

| Maximum Loan Amount | Up to Php15,000 per term for degree courses and Php7,500 per term for vocational/technical courses, or actual fees, whichever is lower. |

| Interest and Penalty Rates | National Government portion incurs 0% interest; SSS portion - 6% per annum with a penalty of 1% per month for any unpaid amortization. |

| Repayment Terms | Up to 5 years for degree courses and up to 3 years for vocational/technical courses, with the start of repayment varying by the course type and term structure. |

| Eligible Schools | Schools accredited by the Commission on Higher Education for degree courses and Technical Education and Skills Development Authority for vocational/technical courses. |

Guide to Writing Education Loan

Filling out an Education Loan form is a vital process for members seeking financial assistance for educational purposes. This guide simplifies the steps needed to complete the form correctly. After understanding these instructions, applicants will ensure all necessary information is accurately provided, avoiding potential delays in the processing of their loan request. The process involves gathering required documents, filling in personal and educational details, and complying with the Social Security System's terms for loan applications.

- Ensure you have the latest version of the Education Loan form (MLD- 05-2012).

- Read the terms, conditions, and instructions found on the back of the form thoroughly before starting.

- Use black ink and print all information in capital letters to fill out the form.

- In Part I, start by entering your Social Security number (SS number) in the designated space.

- Fill in your name (last name, first name, middle name) in the respective fields.

- Provide your complete address, including the number and street, barangay, town/district, city/province, and postal code.

- Enter your contact details: telephone or mobile number and e-mail address if available.

- Write down your Tax Identification Number (TIN).

- Specify the name and address of the school, including the school code and its postal code.

- Read the Member's Certification section carefully, then sign and date the form to signify your agreement and certification that all information provided is true and correct.

- If the member cannot sign, ensure that two witnesses sign and date below the fingerprinting section, providing their right thumb and right index fingerprints.

- In the School's Certification part, have the designated school official fill out and sign their portion, confirming your or your beneficiary’s enrollment details.

- Present the required identification documents and have the SSS personnel complete Part II upon submission.

- Retain the Acknowledgement Stub for your records, which is part of the form separated by a perforated line.

- After submissions, SSS officials will verify and process your application based on the provided information and attached documents.

Following these steps carefully will ensure that your application for Subsequent Release of Educational Assistance Loan is completed accurately and submitted properly. After the SSS processes your application, you will be informed about the status of your loan request and any further actions required.

Understanding Education Loan

-

Who is eligible for the Educational Assistance Loan?

Eligible borrowers include:

- SSS Members who have made at least 36 monthly contributions, three of which were within the last 12 months before applying for the loan.

- Members whose last posted Monthly Salary Credit (MSC) is Php15,000 or below, on the condition that their actual basic salary or income does not exceed Php15,000 per month.

- Members who are up-to-date in their payment of any salary or housing loan amortization. If there's an overdue amount, it must not exceed three monthly loan amortizations.

-

What are the terms of loan repayment?

The repayment terms vary based on the type of course:

- For a degree course, the term is up to five years, with loan payment starting after 18 months for semestral courses, 15 months for trimestral courses, or 14 months and 15 days for quarter term courses from the last release date or from the date of last release for those not availing subsequent releases.

- For a vocational/technical course, the term is up to three years, with loan payment starting after 18 months for semestral courses or 15 months for trimestral courses from the scheduled last release date or from the date of last release for those not availing subsequent releases.

-

What are the document requirements for applying for the loan?

The requirements include:

- SSS ID or two (2) valid IDs.

- An accomplished application form.

- Assessment/Billing statement issued by the school of the member or beneficiary.

Any excess on tuition fee and miscellaneous expenses will be the responsibility of the member or beneficiary.

-

How will the loan be released?

The check will be made payable to the school where the member or beneficiary is enrolled or has applied for enrollment and will be released to the member or beneficiary. For subsequent loan releases, the member must submit another completed application form along with the corresponding assessment/billing statement from the school. The SSS may validate the continuous schooling of the member or beneficiary as part of this process.

Common mistakes

Filling out the Education Loan form accurately is very important. Here are 8 common mistakes people make:

- Not reading the instructions carefully before starting to fill out the form. This can lead to misunderstanding the requirements.

- Using ink colors other than black, which is specified in the instructions.

- Filling out the form in lowercase letters instead of capital letters as instructed.

- Providing incomplete information, such as leaving out the middle name or not including the full address with the postal code.

- Entering incorrect information, like a wrong Social Security number or school code, which can cause delays.

- Forgetting to include the e-mail address, if available. This can be a crucial contact point.

- Omitting the signature and date, which are necessary for the form to be processed.

- Not attaching the required documents, such as the assessment/billing statement from the school, which is essential for processing the loan.

Avoiding these mistakes can make the process smoother and faster:

- Always read the instructions thoroughly.

- Print all information in capital letters using black ink.

- Double-check your information for completeness and accuracy.

- Make sure to sign and date the form.

- Attach all the required documents before submission.

Documents used along the form

When applying for an educational assistance loan, several documents often accompany the application form to provide a comprehensive context of the applicant's academic and financial situation. These documents are critical for validating the information provided in the application and assessing the applicant's eligibility and the terms of the loan.

- Proof of Admission: A letter or document from the educational institution confirming the applicant's admission or enrollment. This is crucial for verifying that the loan purpose aligns with the applicant's educational pursuits.

- Academic Records: Transcripts or marksheets illustrating the applicant's academic performance. These records may be required for courses with specific entry requirements or for assessing merit-based loan considerations.

- Government-issued IDs: Official identification documents, such as a passport or driver's license, that serve to verify the applicant's identity.

- Income Proof: Documents such as salary slips, tax returns, or income certificates that provide a clear picture of the applicant's financial situation. These are used to assess the applicant's repayment capability.

- Collateral Documents: If the loan requires collateral, documents verifying the ownership and value of the collateral might be necessary. These could include property deeds, vehicle registration documents, or bank statements.

- Credit History: Reports or documents detailing the applicant's credit history, including loans taken and repayment track record. A solid credit history can enhance eligibility and possibly result in better loan terms.

- Co-applicant/Guarantor’s Details: If the loan application involves a co-applicant or guarantor, their identification, income proof, and in some cases, credit history documents are also needed. This ensures the lender has an alternate repayment source if needed.

- Bank Account Statements: Recent bank statements that give insight into the applicant's financial transactions, saving patterns, and financial health.

- Course and Fee Details: An itemized list of the course fees, including tuition, laboratory fees, library charges, etc., from the educational institution. This document helps in determining the exact loan amount required.

Each document plays a pivotal role in the loan application process, aiding lenders in making informed decisions while also safeguarding the interests of the applicants by ensuring loans are utilized for the intended educational purposes. Careful preparation and submission of these documents, alongside the educational loan form, can significantly streamline the loan approval process.

Similar forms

An education loan form shares similarities with a Mortgage Application. Both require personal information, financial details, and often involve a form of collateral—in the case of education loans, the future earnings of the graduate, and in the case of mortgages, the property being purchased. Each form assesses the applicant’s ability to repay the loan, and terms and conditions that outline repayment schedules, interest rates, and penalties for late payments are stipulated.

Similarly, a Car Loan Application closely resembles an education loan form as it also gathers comprehensive personal and financial information from the applicant. It includes details about the asset being financed (a vehicle, similar to how an education loan specifies the academic program) and outlines terms for repayment, including interest rates and the loan's tenure. Both forms also require the applicant's consent to abide by the terms through a signature.

The Credit Card Application process shares parallels with that of an education loan form too, as both evaluate the applicant's creditworthiness and ability to repay the borrowed amount. While one is for a revolving line of credit and the other for a term loan, both require personal identification, financial information, and involve agreements on interest rates and penalties for delinquency.

Personal Loan Applications, just like education loan forms, collect detailed personal and financial data to evaluate an applicant's loan repayment capabilities. They detail the loan amount, repayment plan, and interest rates, requiring the applicant's agreement to these terms through a signature. Both forms might also require supporting documents to verify the information provided by the applicant.

A Scholarship Application, while not a loan, has notable similarities to an education loan form, particularly in its collection of personal and educational information. Both aim to financially support the applicant's education but differ in their repayment expectations, with loans requiring repayment and scholarships typically not.

The Small Business Loan Application also mirrors the structure of education loan forms. It entails providing extensive details about the business (akin to academic information in education loans), financial statements, and a business plan, just as a student would outline their course and anticipated graduation. Terms of repayment, including interest rates and durations, are clearly defined in both contexts.

Lastly, a Rental Application shares the essence of gathering personal and financial information to assess the applicant's ability to meet financial obligations. Similar to an education loan form, a rental application may require references, proof of income, and a legally binding agreement upon signature that commits the applicant to a set of terms, including payments and penalties for non-compliance.

Dos and Don'ts

When filling out the Education Loan form, it's imperative to follow guidelines and avoid common mistakes to ensure the processing goes smoothly. Here are seven dos and don'ts:

- Do read all the terms, conditions, and instructions provided in the form thoroughly before starting to fill it out. This understanding will guide you through the process correctly.

- Do print all information in capital letters as instructed, which aids in preventing any misinterpretation of your handwriting.

- Do use black ink only, since this is a requirement. Black ink is more legible and ensures that all the details you provide are clear and easily readable.

- Do ensure every detail you provide is accurate and true. This includes personal information, contact details, and any required certifications or statements.

- Don't leave any necessary fields blank. Incomplete forms may cause delays in processing or even result in rejection of the application.

- Don't falsify any information or submit false documents. Doing so is a criminal offense that could lead to prosecution, as detailed in the form's member certification warning.

- Don't forget to sign and date the form where required. An unsigned application is considered incomplete and will not be processed.

Adhering to these guidelines not only facilitates a smoother application process but also helps in avoiding potential legal issues or delays. Remember to check for any updates or additional requirements that may be introduced after the form's indicated revision date.

Misconceptions

Understanding the intricacies of applying for an Education Loan through the Education Assistance Loan Program can be a complex process. Misconceptions abound, often leading to confusion or missteps. Ensuring clarity, below are nine common misconceptions about the application form and process, debunked and simplified.

- Only the Member Can Apply: While it’s true that the loan application must be submitted by the SSS member, in cases where the member cannot personally apply, a representative armed with the proper documentation (including an authorization letter and valid IDs) can process the application on the member's behalf.

- Unlimited Loan Amounts: The loan amount is not unlimited or based solely on need; rather, it has a maximum limit depending on the type of course. For degree courses, the maximum is Php15,000 per term, and for vocational/technical courses, it’s up to Php7,500 per term.

- Loan Use Is Unrestricted: It's commonly misunderstood that loan proceeds can be used for any education-related expense. However, the loan is specifically intended to cover tuition and miscellaneous fees, with any excess fees becoming the responsibility of the member or beneficiary.

- Interest-Free Loan: The loan is not entirely interest-free. The National Government covers half of the loan without interest, but the other half, provided by SSS, accrues interest at 6% per annum.

- No Repayment Schedule: There's a structured repayment schedule that begins after a grace period post-completion of the course. The schedule varies by the length and type of course the beneficiary is enrolled in.

- Eligibility Is Automatic: Eligibility for the loan requires that the SSS member meet specific criteria, including a minimum number of monthly contributions and income threshold, among others.

- All Schools Qualify: Not all educational institutions are eligible. Only those accredited by the Commission on Higher Education for degree courses or by the Technical Education and Skills Development Authority for vocational/technical courses qualify.

- No Impact on Future Benefits: It is mistakenly believed that defaulting on an educational assistance loan will have no consequences on future SSS benefits. In contrast, any unpaid balances will be deducted from future benefits the member might be entitled to.

- Beneficiary Substitution Permitted: Once the loan is granted, changing the beneficiary is not allowed, ensuring the original nominated beneficiary is the one who benefits from the funded education.

Understanding these points can significantly streamline the application process, ensuring that members and their beneficiaries fully benefit from the Social Security System's Education Assistance Loan Program.

Key takeaways

Understanding the process of filling out and using the Education Loan form from the Social Security System is crucial for individuals seeking educational assistance. The following key takeaways provide guidance on how to navigate this important financial resource:

- Ensure accuracy in filling out the form by using capital letters and black ink only, as this helps in making the information clear and readable, reducing the chances of errors and delays.

- Applicants must be members of the Social Security System who have made at least 36 monthly contributions, including three within the last 12 months, to qualify for the loan, emphasizing the importance of regular contributions to the system.

- Eligibility extends to the member, their legal spouse, children (including illegitimate), and siblings (including half-brother/sister) who are unmarried, indicating the loan's broad coverage to support the educational needs of the member's family.

- The loan amount varies depending on the course, with a cap set for degree and vocational/technical courses, underlining the need to assess the financial requirements against the potential loan received.

- Submission of valid identification and a completed application form alongside the assessment/billing statement from the school confirms the procedural necessities for the loan application.

- Loan disbursement is designed to be directly payable to the educational institution, streamlining the process for applicants and ensuring the funds are utilized for their intended purpose.

- Repayment terms offer a period of grace post-completion of the course, providing graduates with time to secure employment before commencing loan repayment, which is a supportive feature for loan beneficiaries.

Applicants are encouraged to thoroughly review the terms and conditions provided in the loan form to fully understand their rights and responsibilities. Compliance with these terms is essential not only for securing the loan but also for maintaining good standing with the Social Security System. It's important to provide true and correct information to avoid any penalties or legal repercussions. Finally, timely and consistent communication with the Social Security System will ensure smooth processing and handling of the Educational Assistance Loan application.

Popular PDF Documents

Airsev Application For Employment - By asking about previous employment with Air Serv Corporation, the form seeks to identify returning or internal candidates for potential rehire.

What Is Amt Depreciation - Filing this form can help some taxpayers identify additional credits or deductions eligible under AMT rules.