Get Dwp Budgeting Loan Application Form

Embarking on an application for a Budgeting Loan with the Department for Work and Pensions (DWP) opens a doorway to financial support for those on certain benefits, aiming to cover essential expenses without the burden of interest. Designed for individuals or families receiving Income Support, income-based Jobseeker’s Allowance, income-related Employment and Support Allowance, or Pension Credit for at least 26 weeks, these loans are a lifeline in times of need. Whether it's to secure housing through rent in advance, make home improvements, cover travel costs, maternity or funeral expenses, or even repay debts under specific conditions, the DWP Budgeting Loan offers a structured path to financial relief with caps based on familial status. The form also carefully outlines the repayment terms, emphasizing affordability and offering up to three repayment options to choose from. Furthermore, it highlights the impact of savings on eligibility and the upper limit of loan one can apply for if they have existing Social Fund debts. The straightforward application process calls for detailed personal information, ensuring all assistance. It's provided fairly, matching each applicant's situation. An invaluable resource, the application form and accompanying notes stand as a guide to navigate this beneficial scheme—offering not just financial support but also peace of mind for those in need.

Dwp Budgeting Loan Application Example

Budgeting Loans

from the Social Fund

We have many different ways we can communicate with you

If you would like Braille, British Sign Language, a hearing loop, translations, large print, audio or something else please tell us by phoning 0800 169 0140.

Notes sheet

Please read these notes carefully. They explain the circumstances when a budgeting loan can be paid.

Please read these notes carefully. They explain the circumstances when a budgeting loan can be paid.

Budgeting Loans

You may be able to get a Budgeting Loan if:

•you have been getting Income Support,

and

•you need help:

–to buy furniture or household equipment

–to buy clothing and footwear

–to pay rent in advance and/or removal expenses to secure fresh accommodation

–to pay for home improvements, maintenance or security

–with travelling, maternity and funeral expenses

–to pay for things to help you look for or start work

–to repay hire purchase (HP) or other debts that have been taken out

We cannot help with any other types of items or services.

Budgeting Loans have to be paid back but they are interest free.

SF500 10/19

Please turn over for more information ▶

Notes

You can have one of three rates of Budgeting Loan. The amount depends on whether you are single, a couple without children or qualifying young persons, or a one or two parent family with children or qualifying young persons. For a single person the maximum rate is £348, for a couple without children or qualifying young persons the maximum rate is £464, and for one or two parent families with children the maximum rate is £812. We cannot pay you more than these amounts.

The amount of Budgeting Loan you can have also depends on whether you still have any other Budgeting Loans or Crisis Loans you have not paid back to the Social Fund. We cannot make a payment for a loan if you already owe £1,500 or more to the Social Fund for any previous Crisis Loans or Budgeting Loans combined.

Savings

•If you and your partner are aged under 63, savings of more than £1,000 may affect the amount of money you can get.

•If you or your partner are aged 63 or over, savings of more than £2,000 may affect the amount of money you can get.

We cannot make a payment for a loan if you already owe £1,500 or more to the Social Fund.

We cannot pay a Budgeting Loan for expenses of less than £100.

How we decide what we can pay you

The decision maker will look at the relevant circumstances and decide the maximum size of Budgeting Loan you can have, if you have no existing Social Fund debt. Whether or not you can have a loan of up to that amount will depend on if you already have a budgeting loan debt.

How you pay back a loan

•We will look at what you can afford before we decide on the arrangements for repayments.

•If we can pay you a Budgeting Loan, we may make you up to three different offers. It will be up to you which of these offers you can afford to pay back. We may not be able to lower the repayment rate if you later feel

you cannot afford the rate you originally agree to.

•If we can pay you a Budgeting Loan, we will ask you to agree to repay it and also to agree the way you will repay it before we make the payment.

•We will take the money back in weekly repayments from your benefit. If you or your partner do not get any benefit, we will arrange for the loan to be repaid in another way.

•If you have problems later on making the repayments as originally agreed, we may be able to help, for example reducing your payments by extending the repayment period. Your local jobcentre can give you advice.

Help and advice

If you want more information:

•get in touch with Jobcentre Plus, phone 0800 169 0140. You can also get more information from www.gov.uk

or

•get in touch with an advice centre like Citizens Advice

We use partner to mean:

•a person you live with who is your husband, wife or civil partner, or

•a person you live with as if you are a married couple

We use child to mean a person aged under 16 who is living with you and you are getting Child Benefit for.

We use qualifying young person to mean a person aged 16, 17, 18 or 19 who is living with you, who you are getting Child Benefit for.

These notes give general guidance only and should not be treated as a complete and authoritative statement of the law.

Tear off this page to keep for your information ▶

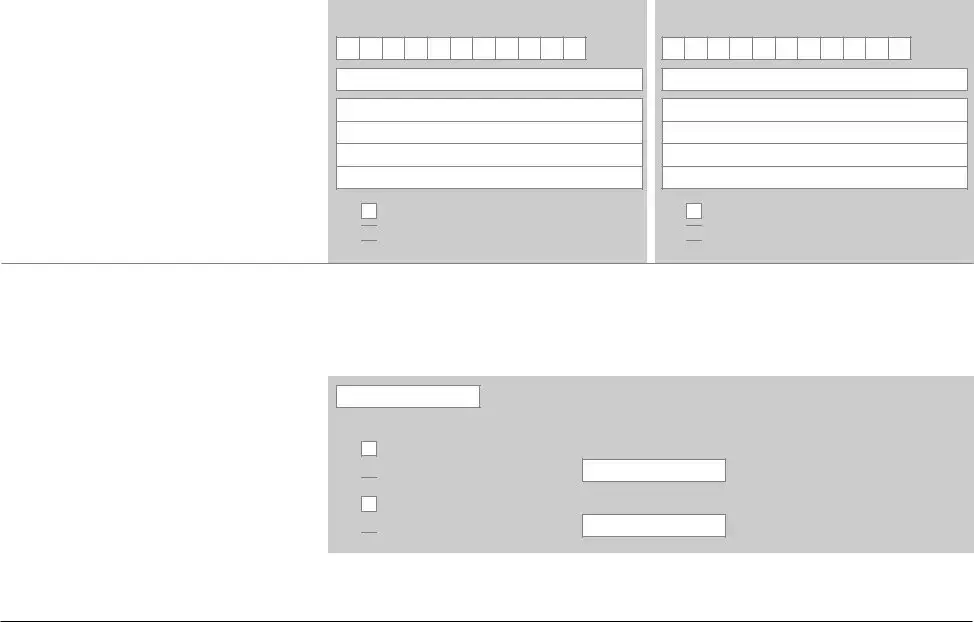

Part 1: About you and your partner

•Before you complete this form, please read the notes sheet which tells you about all types of help you can get from the Social Fund.

•Use this form to apply for a Budgeting Loan. Sign and date any alterations you make.

•If you are getting Income Support,

•Tell us about yourself and your partner, if you have one. We use partner to mean:

–a person you are married to or a person you live with as if you are married to them, or

–a civil partner or a person you live with as if you are civil partners

•Fill in the form fully by answering all the questions and requests for information. Your application may be delayed if we do not have all the information we need.

•Please fill in this form with BLACK INK and in CAPITALS.

National Insurance (NI) number

Surname or family name

Any other surnames or family names you have been known by

All other names, in full

Date of birth

Daytime phone number

We may need to contact you by phone to ask for further information, or when we have made a decision on your application. Please note that the number may display as an 0800, unknown or witheld number.

You |

|

|

|

|

|

|

|

|

Your partner |

|

|

|

|

|

|

|

|

||||||||||

Letters Numbers |

|

|

|

|

|

|

Letter |

Letters Numbers |

|

|

|

|

|

Letter |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You can find the number on a National Insurance (NI) numbercard, letters about benefit, or payslips.

Mr/Mrs/Miss/Ms |

|

Mr/Mrs/Miss/Ms |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

SF500 10/19 |

Part 1: About you and your partner continued

Mobile phone number, if you have one

Email address, if you have one

Address where you live now

Please tell us your current address, and your partner’s current address, if it is different.

Are you or your partner involved in a trade dispute? We use trade dispute to mean a strike,

You

Postcode

No

Yes

Your partner

Postcode

No

Yes

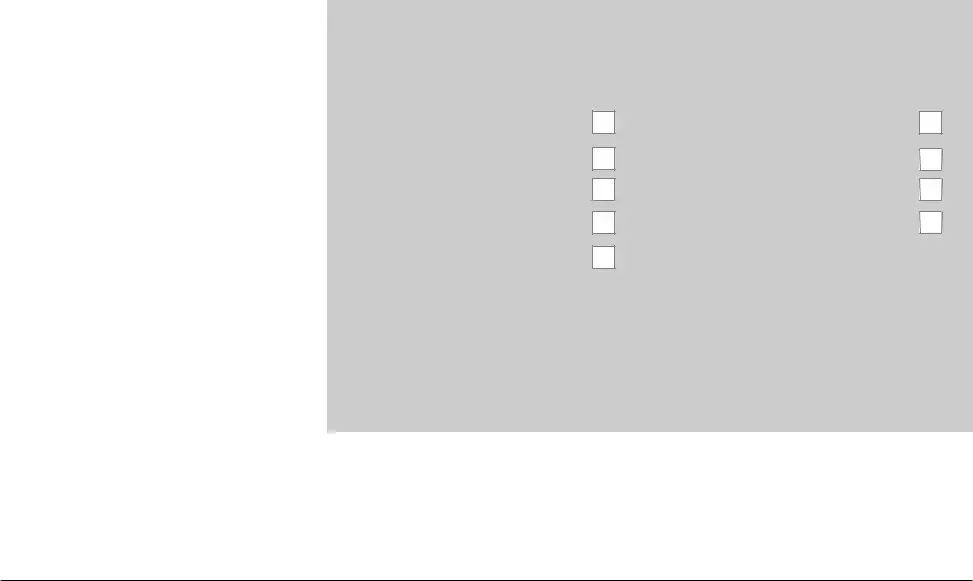

Part 2: About your children or qualifying young persons

•We use child to mean a person aged under 16 who you are getting Child Benefit for.

•We use qualifying young person to mean a person aged 16, 17, 18 or 19 who you are getting Child Benefit for.

How many children or qualifying young persons are in your household?

Are you getting Child Tax Credit for your children or qualifying young persons?

Are you getting Child Benefit for your children or qualifying young persons?

No

Yes

How much do you get a week?

How much do you get a week?

No

Yes

How much do you get a week?

How much do you get a week?

£

£

SF500 10/19 |

2 |

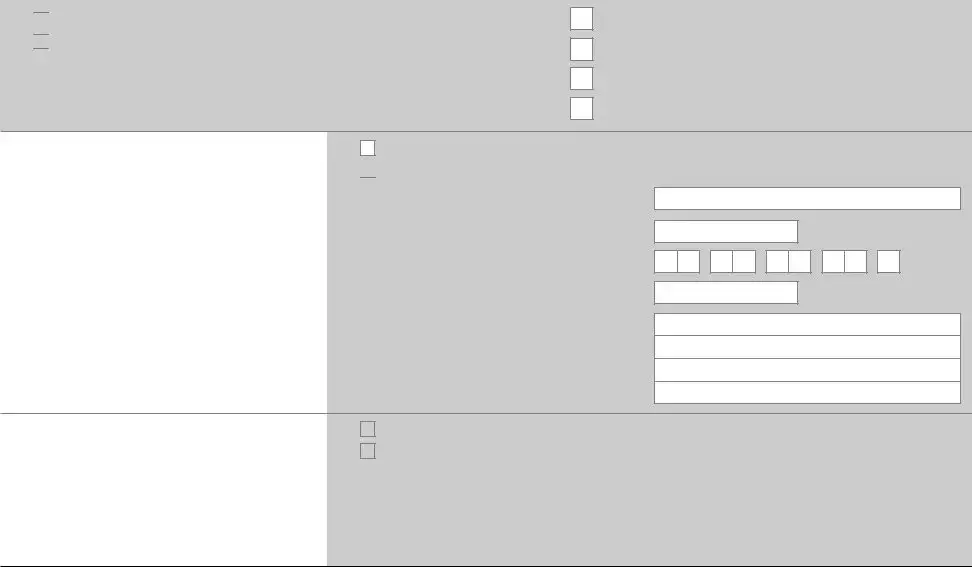

Part 3: About what you need

Budgeting Loans can only be given for the types of items or services listed in this part.

Please enter the total amount you need in the Total amount applied for box.

Please refer to the notes sheets for the maximum rates of Budgeting Loans depending on your circumstances.

Total amount applied for |

£ |

What items are you applying for?

Please tick the box (or boxes) that apply to you. Furniture and household equipment

Clothing and footwear

Rent in advance or removal expenses to secure fresh accommodation Improvement, maintenance and security of the home

Travelling expenses within the UK

Expenses associated with seeking or

Maternity expenses

Funeral expenses

Repaying Hire Purchase and other debts – for any items or expenses which are associated with the categories above

3 |

SF500 10/19 |

Part 4: About benefits and entitlements

Are you or your partner currently getting Income Support,

No  Yes

Yes

Go to Part 8.

Tell us which benefits or entitlements you are getting.

Income Support

Jobseeker’s Allowance

Employment and Support Allowance (income related)

Pension Credit

Has a partner or an

•Income Support

•

•

•Pension Credit, or

•payment on account of one of these benefits or entitlements

for you, in the last 26 weeks?

No

Yes

Tell us about this person:

Tell us about this person:

Their name

Date of birth

Their National Insurance (NI) number Date of separation

Their address

/ /

/ /

Postcode

Have you made this claim because you have separated from someone?

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

Tell us about the person you have separated from: |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Their name |

|

|

|

|

|

|

Date of birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

SF500 10/19 |

4 |

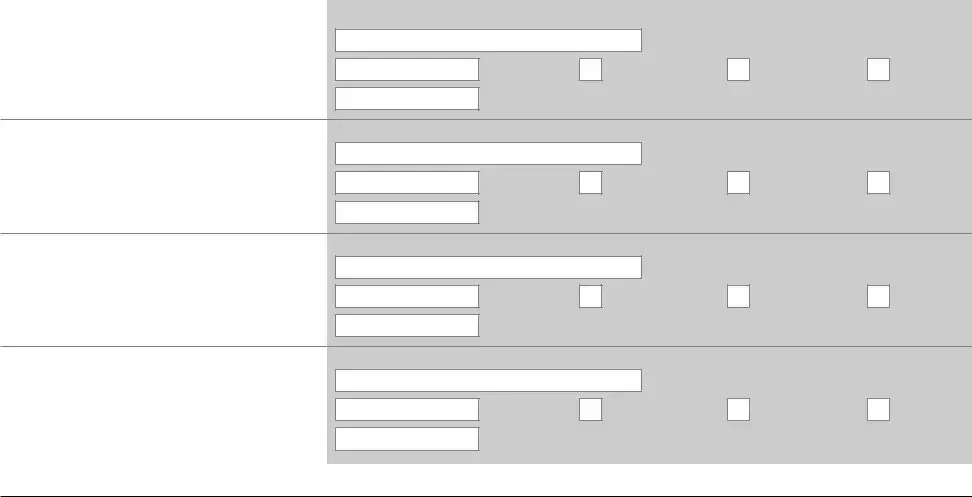

Part 5: About money you have to pay out

Please tell us about any money that you or your partner have to pay out regularly, but do not include normal living expenses like gas and electric charges or food bills.

Include things like catalogue money, hire purchase, loan payments and fines.

Please answer all the questions for each regular payment. If you do not give us all the information, we will not be able to decide this claim. The following responses will only be used to calculate your repayments if the offer of a loan is made.

Payment 1

Who do you pay the money to?

How much are you paying and how often? How much is owed?

£

£

every week

every fortnight

every month

Payment 2

Who do you pay the money to?

How much are you paying and how often? How much is owed?

£

£

every week

every fortnight

every month

Payment 3

Who do you pay the money to?

How much are you paying and how often? How much is owed?

£

£

every week

every fortnight

every month

Payment 4

Who do you pay the money to?

How much are you paying and how often? How much is owed?

£

£

every week

every fortnight

every month

5 |

SF500 10/19 |

Part 6: About your savings

Do you or your partner have any savings?

If you and your partner are both aged under 63, we may be able to disregard the first £1,000 of your savings. If either you or your partner are over 63, we may be able to disregard the first £2,000 of your savings.

Savings means any capital you and your partner have, including:

•any money you have at home, in the bank, in the building society or in a credit union account

•premium bonds

•investments, such as shares or unit trusts.

•the value of any property you or your partner own that you do not live in. For example,

a house you let out, a holiday home, or somewhere another member of your family lives

If you do not complete this part of the form your application may be delayed

No

Yes

How much savings do you have?

How much savings do you have?

£

SF500 10/19 |

6 |

Part 7: How we pay you

If you want to use the account you usually get your benefits paid into, please go straight to part 8

We normally pay your money directly into the same account as we pay your benefit into.

Many banks and building societies will let you collect your money at the Post Office.

We will tell you when your Social Fund payment will be made and how much it will be for.

Finding out how much we have paid into the account

You can check your payments on account statements. The statements may show your National Insurance (NI) number next to any payments we have made. If you think a payment is wrong, get in touch with the office that pays you straight away.

If we pay you too much money

If we pay you too much money we have the right to take back any money we pay that you are not entitled to. This may be because of the way the system works for payments into an account.

For example, you may give us some information which means you are entitled to less money. Sometimes we may not be able to change the amount we have already paid you. This means we will have paid you money that you are not entitled to.

We will contact you before we take back any money.

What to do now

•Go to Part 8, unless you want us to pay your Social Fund payment into a different account to the one we pay your benefit into.

•If you want us to pay your Social Fund payment into a different account, tell us about this on the next page. By giving us these account details you:

–agree that we will pay you into this account, and

–understand what we have told you above in the section If we pay you too much money

•If you are going to open an account, please tell us your account details as soon as you get them.

•If you do not have an account, and do not intend to open one, please tick this box and we will contact you.

Fill in the rest of this form. You do not have to wait until you have opened an account or contacted us.

7 |

SF500 10/19 |

Part 7: How we pay you continued

If you want to use a different account, please tell us about the account you want to use for this payment

•You can use an account in your name, or a joint account.

•You can use someone else’s account if:

–the terms and conditions of their account allow this

–they agree to let you use their account, and

–you are sure they will use your money in the way you tell them.

•You can use a credit union account. You must tell us the credit union’s account details. Your credit union will be able to help you with this.

•If you are an appointee or a legal representative acting on behalf of the claimant, the account should be in your name only.

Please tell us your account details below.

It is very important you fill in all the boxes correctly, including the building society roll or reference number, if you have one. If you tell us the wrong account details your payment may be delayed or you may lose money.

You can find the account details on your chequebook or bank statements. If you do not know the account details, ask the bank or building society.

Name of the account holder

Please write the name of the account holder exactly as it is shown on the chequebook or statement.

Full name of bank or building society

Sort code

Please tell us all 6 numbers, for example:

Account number

Most account numbers are 8 numbers long. If your account number has fewer than 10 numbers, please fill in the numbers from the left.

Building society roll or reference number

If you are using a building society account you may need to tell us a roll or reference number. This may be made up of letters and numbers, and may be up to 18 characters long. If you are not sure if the account has a roll or reference number, ask the building society.

You may get other benefits and entitlements we do not pay into an account. If you want us to pay them into the above account, please tick this box.

SF500 10/19 |

8 |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | DWP Budgeting Loan Application Form |

| Purpose | For applying for an interest-free loan for essential expenses |

| Eligibility Criteria | Applicant must receive certain benefits for at least 26 weeks |

| Loan Uses | Furniture, clothing, rent, home improvements, work-related expenses, etc. |

| Repayment Terms | Repayments are interest-free, taken from benefits or arranged differently if not receiving benefits |

| Maximum Loan Amounts | Varies by applicant's circumstances, with limits for singles, couples, and families |

| Savings Impact | Savings over a certain amount may affect loan eligibility and amount |

| Form Reference Number | SF500 10/19 |

Guide to Writing Dwp Budgeting Loan Application

Filling out the DWP Budgeting Loan Application form is a straightforward process that requires attention to detail. This form is essential for those seeking financial assistance for essential expenses under specific categories. The following steps are designed to help applicants provide accurate information, ensuring their request is processed efficiently. It's vital to have all necessary personal information and details about the required loan on hand before starting.

- Begin by reading the notes sheet thoroughly to understand the eligibility criteria, maximum loan amounts, and repayment terms. Make sure you meet the qualifications for applying.

- Locate your National Insurance (NI) number. This can be found on a National Insurance card, letters about benefits, or payslips.

- Fill out the section "Part 1: About you and your partner" with your personal details including:

- National Insurance number

- Surname or family name and any other names you've been known by

- All other names in full

- Date of birth

- Daytime and mobile phone number

- Email address

- Current living address and whether you or your partner are involved in a trade dispute

- Proceed to "Part 2: About your children or qualifying young persons". Provide information about any children or young persons in your household, including:

- How many are in your household

- Whether you're receiving Child Tax Credit or Child Benefit for them, and the weekly amounts

- In "Part 3: About what you need", specify the amount of money you're applying for and tick the boxes next to the categories of expenses you need the loan for. Categories include items like furniture, clothing, rent in advance, and more based on the notes you previously read.

- Ensure all provided information is accurate and complete. Incomplete forms or incorrect information can delay the processing of your application.

- Sign and date the form. If you make any alterations while filling it out, ensure these are also signed and dated.

- Review your application for completeness and accuracy before submitting it to the DWP for processing.

After submitting the application, it will be reviewed by the DWP. The reviewing process includes evaluating your financial needs and determining the loan amount you're eligible for. If accepted, you will receive an offer which you can accept based on your repayment capability. Repayments are usually deducted from your benefits. If you encounter difficulties making repayments in the future, it's crucial to communicate with the DWP or your local Jobcentre Plus for assistance. For further information or help with the application, contacting Jobcentre Plus or an advice center like Citizens Advice is recommended.

Understanding Dwp Budgeting Loan Application

-

What is a Budgeting Loan from the Social Fund?

A Budgeting Loan is a government-provided, interest-free loan designed to help individuals on certain benefits with essential one-off expenses. These expenses can include buying furniture, clothing, paying for home improvements, or covering costs associated with moving home, among other necessities. To be eligible, you must have been receiving qualifying benefits for at least 26 weeks.

-

How much can I borrow through a Budgeting Loan?

The maximum amount you can borrow depends on your circumstances. Singles can receive up to £348, couples without children or qualifying young persons up to £464, and one or two parent families with children or qualifying young persons can receive up to £812. The actual amount you can borrow may vary based on existing debts to the Social Fund and your specific needs.

-

Can savings affect my Budgeting Loan amount?

Yes. If you or your partner are under 63 and have savings over £1,000, it may reduce the amount you can borrow. For those 63 or older, savings over £2,000 can have the same effect. Additionally, if you owe £1,500 or more to the Social Fund for previous loans, you may not be eligible for a Budgeting Loan.

-

How do I apply for a Budgeting Loan?

To apply, you must fill out the SF500 Budgeting Loan application form. Make sure to read the accompanying notes for guidance. You are required to provide personal information, details about your partner if applicable, information about children or qualifying young persons in your household, and the specific types of expenses you need assistance with. The form must be filled in with black ink and capitals.

-

What are the criteria for repaying a Budgeting Loan?

Repayments are calculated based on what you can afford. The Department for Work and Pensions (DWP) may offer up to three repayment offers from which you can choose. Repayments are typically deducted from your benefits. If later you find the repayments difficult to manage, you may be able to renegotiate to lower payments by extending the repayment period.

-

How soon will I need to start repaying the loan?

Details on the start of your repayment period will be provided when the loan is granted. Normally, repayments begin soon after the loan is disbursed, with specific arrangements made based on your financial situation and agreed upon before disbursement.

-

Can I apply for a Budgeting Loan if I have an existing Social Fund debt?

You can apply, but you may not receive a loan if your existing Social Fund debt is £1,500 or more. The decision will also take into account your current financial circumstances and the nature of your needs.

-

What can a Budgeting Loan not be used for?

A Budgeting Loan cannot be used for expenses unrelated to the specified categories such as non-essential and luxury items, ongoing household expenses, or to pay off debts not associated with the categories outlined in the eligibility criteria.

-

Where can I get help or advice about applying for a Budgeting Loan?

For more information or assistance, you can contact your local Jobcentre Plus office or call the helpline at 0800 169 0140. Additionally, organizations like Citizens Advice can provide guidance and support throughout the application process.

-

What happens if my application is denied?

If your application is denied, you will receive a letter explaining the reason for the decision. You have the right to ask for a review of the decision if you believe it was made in error or if your circumstances have changed.

Common mistakes

Filling out the DWP Budgeting Loan Application form is a critical step for those in need of financial assistance for essential items or services. However, applicants often make mistakes that can delay or negatively affect their application. Here are nine common mistakes:

- Not reading the notes sheet carefully: Many overlook the guidance provided, which leads to misunderstandings about eligibility and the types of expenses covered.

- Incomplete information: Failing to fill in all required sections or answer all questions can result in delays or the rejection of the application.

- Incorrect details: Entering wrong information, especially related to personal details like National Insurance numbers, can cause significant delays.

- Not using black ink and capital letters: The instruction to use black ink and write in capitals is often ignored, affecting the readability of the application.

- Applying for ineligible expenses: Some applicants request loans for items or services not covered by the Budgeting Loan scheme, leading to disappointment.

- Omitting information about dependents: Not providing details about children or qualifying young persons can affect the decision on the loan amount.

- Overlooking savings and existing debt: Applicants sometimes fail to accurately report savings or existing Social Fund debts, which are crucial for eligibility and the loan amount.

- Not specifying the loan amount needed: Failing to enter the total amount applied for can lead to delays, as the decision-makers need this information to process the application.

- Ignoring communication preferences: Not indicating a preferred method of communication can hinder the DWP's ability to reach out for additional information or to convey their decision.

Here are additional tips to avoid these mistakes:

- Always review the entire application form and the accompanying notes before starting.

- Ensure that all sections are filled out accurately and completely.

- Check and double-check personal information for errors.

- Refer to the list of eligible expenses to ensure your application aligns with acceptable uses for a Budgeting Loan.

- Be transparent about your financial situation, including savings and debts.

- Clearly indicate your preferred contact method for any follow-up communication.

By avoiding these common errors, you can improve the chances of your DWP Budgeting Loan Application being processed smoothly and receiving the financial help you need.

Documents used along the form

When applying for a DWP Budgeting Loan, several supporting documents and forms can streamline the application process, ensuring you receive the necessary financial assistance promptly. These documents play crucial roles, from establishing identity and financial necessity to justifying the loan's purpose.

- Proof of Identity: Documents like a passport, driver’s license, or birth certificate help confirm the applicant's identity, which is fundamental in the application process.

- Proof of Address: Utility bills, rent agreement, or council tax bills serve as proof of residency, which is essential for establishing local ties and need.

- Income Statements: Recent pay slips or income statements demonstrate the applicant's financial situation, proving the necessity for a budgeting loan.

- Benefit Letters: Official letters or notifications of the benefits currently being received (e.g., Income Support or Jobseeker’s Allowance) confirm eligibility for a Budgeting Loan.

- Bank Statements: Recent statements provide insight into the applicant's financial behavior and current financial situation, supporting the need for assistance.

- Rent Agreements or Mortgage Statements: Documents indicating housing costs can justify requests related to housing expenses, such as rent in advance or home improvements.

- Quotes or Estimates: For expenses related to home improvements, maintenance, or the purchase of furniture, quotes from businesses can specify the loan amount needed.

- Debt Repayment Statements: If the loan is partly for repaying existing debts, statements or letters from creditors detailing the amounts owe can be crucial.

- Child Benefit Letters: These confirm the number of children in a household, which can affect the loan amount an applicant is eligible for, especially for expenses related to children or qualifying young persons.

Collecting and submitting these documents with the DWP Budgeting Loan application can significantly enhance the application's clarity and the likelihood of approval. It allows decision-makers to assess accurately and efficiently the applicant’s needs and their eligibility for financial assistance. While the process may seem daunting, each document provides a piece of the overall picture of the applicant's financial health and needs, forming the basis for a fair and informed decision.

Similar forms

The Department for Work and Pensions (DWP) Universal Credit application form shares similarities with the Budgeting Loan application form. Both forms are designed for individuals seeking financial assistance from the government. The Universal Credit application assesses eligibility for regular income support, while the Budgeting Loan application evaluates eligibility for a one-time loan for specific expenses. Each requires detailed personal information and financial circumstances to determine eligibility.

A Jobseeker's Allowance (JSA) claim form is another document that bears resemblance to the Budgeting Loan application. Both forms cater to individuals within a specific income bracket and require evidence of financial need. The JSA form focuses on those who are unemployed and actively seeking work, offering periodic payments, whereas the Budgeting Loan provides a lump sum for immediate necessary expenses.

The Employment and Support Allowance (ESA) claim form, like the Budgeting Loan application, assists individuals facing financial difficulties due to health or disability constraints. Both require detailed personal health and financial information to assess eligibility and the level of support needed, though the ESA focuses on income replacement for those unable to work, and the Budgeting Loan addresses specific expense needs.

The Crisis Loan application form, previously offered by the Social Fund, is structurally and purposefully similar to the Budgeting Loan form. Crisis Loans were designed for emergencies and disasters, providing immediate assistance for living expenses. Though Crisis Loans are now phased out, its form echoed the Budgeting Loan’s focus on urgent financial need, with an emphasis on repayable financial assistance.

The Pension Credit application form shares the objective of supplementing the income of the applicant, similar to the Budgeting Loan form, which is aimed at providing immediate financial assistance for certain expenses. Both forms cater to a demographic that might be financially vulnerable, with Pension Credit targeting older citizens and the Budgeting Loan open to various recipients of benefits, including Pension Credit recipients.

The Housing Benefit application form, while primarily focused on assistance with rental costs, overlaps with the Budgeting Loan form in terms of the financial assessments conducted. Applicants must disclose income and savings, similar to the Budgeting Loan’s requirements, to establish the level of need and assistance required, although Housing Benefit provides ongoing support instead of a one-off payment.

A Local Council Support Scheme application form, often specific to each local authority, resembles the Budgeting Loan application in its aim to help individuals facing financial hardship. While varying widely in scope and eligibility criteria, these forms often assess financial situation to provide assistance for essentials, similar to the specific expense categories listed within the Budgeting Loan form.

The Access to Work grant application form, though designed to support individuals with a disability or health condition in taking up or retaining employment, has conceptual parallels with the Budgeting Loan application. Both forms assess personal circumstances and financial need to provide support, but the Access to Work form is specifically aimed at overcoming work-related obstacles.

A Child Benefit application form, targeting financial assistance towards families, indirectly relates to the Budgeting Loan form. Through assessing family size and income, both aim to alleviate financial pressures, although through different means: ongoing support versus a lump sum for specific needs. The Budgeting Loan form also references Child Benefit as part of its eligibility criteria.

Lastly, the Discretionary Assistance Fund application form, available in certain parts of the UK, offers grants and loans similar to the Budgeting Loan for urgent financial needs. Both forms evaluate financial situations and urgent need, but the Discretionary Assistance Fund may cover a wider range of emergencies, reflecting regional variations in support schemes.

Dos and Don'ts

Do's and Don'ts When Filling Out the DWP Budgeting Loan Application Form

When you're applying for a Budgeting Loan, it's essential to follow the instructions carefully to ensure your application is processed smoothly. Here are some crucial do's and don'ts:

- Do make sure you are eligible before filling out the form. You must have been receiving certain benefits for at least 26 weeks.

- Do fill in the form with black ink and in capitals to make sure it's legible.

- Do include all required information about you and your partner, if applicable, to avoid any delays in processing your application.

- Do sign and date any alterations you make on the form to verify the changes.

- Don't request a loan for expenses less than £100 or more than the maximum allowed amount based on your circumstances.

- Don't omit details of existing Budgeting Loans or Crisis Loans you have not yet repaid to the Social Fund, as this will affect your application.

- Don't forget to check your savings and provide accurate information, as savings over a certain amount may affect the loan amount you can receive.

- Don't ignore the repayment terms. Understand what you're agreeing to in terms of repayment before accepting the loan offer.

Misconceptions

There are several misconceptions about the Department for Work and Pensions (DWP) Budgeting Loan application process. Understanding these can help applicants more effectively navigate the system and improve their chances of a successful application. Here's a look at ten common misunderstandings:

- Eligibility is based solely on current financial need. In reality, eligibility also depends on having received certain benefits for at least 26 weeks.

- You can borrow any amount you wish. The amount you can borrow is subject to maximum limits based on your circumstances, such as being single or having a family.

- Savings don't impact your application. Savings over £1,000 (or £2,000 for those aged 63 and over) can indeed affect the amount you're eligible to borrow.

- The loan can cover any type of expense. Loans are only awarded for specific needs such as household items, rent, travel expenses for job interviews, and more.

- You need to repay the loan immediately. Repayment terms consider your ability to pay, often involving deductions from future benefits.

- Applying guarantees you'll get a loan. Each application is assessed on individual circumstances, and not all applications are approved.

- Interest is added to the repayments. Budgeting Loans are interest-free, making them a cost-effective option for eligible applicants.

- You can have multiple loans at the same time. You cannot be awarded a new loan if you already owe £1,500 or more in combined Crisis Loans and Budgeting Loans.

- You can only apply by filling out a paper form. While the SF500 form is common, there are various ways to communicate with the DWP, including requests for assistance in alternative formats.

- Repayment terms are non-negotiable. If you encounter difficulties with repayments, it's possible to have them adjusted based on your financial situation.

Understanding these points can demystify the process of applying for a Budgeting Loan, helping applicants manage their expectations and prepare their applications more effectively. Misconceptions can lead to unnecessary stress or confusion, but with clear, accurate information, individuals can make well-informed decisions regarding their financial assistance options.

Key takeaways

Understanding the prerequisites and guidelines for applying for a Dwp Budgeting Loan is crucial for a successful application. Here are key takeaways that can guide applicants through the process:

- Eligibility requirements are strict; applicants must have been receiving specific benefits like Income Support or Pension Credit for at least 26 weeks when their application is processed.

- Budgeting Loans are designed to cover essential expenses such as furniture, clothing, moving costs, or expenses linked to employment, but cannot be used for any other types of items or services.

- The maximum loan amount varies based on the applicant's circumstances, such as being single, part of a couple, or having children, with specific caps in place to prevent overborrowing.

- Repayment terms are flexible and based on what the applicant can afford, with options to adjust payments if financial situations change, ensuring the loan does not become a financial burden.

Ensuring all information is provided accurately and understanding the terms of repayment are vital steps in managing a Budgeting Loan responsibly. It's also important to note that savings and existing debts to the Social Fund can affect eligibility and borrowing capacity.

For further clarification or assistance, contacting Jobcentre Plus or consulting with an advice center can provide valuable guidance, ensuring applicants are well-informed before proceeding with their Budgeting Loan application.

Popular PDF Documents

IRS Schedule 1 1040 or 1040-SR - Discover the key to unlocking tax-saving adjustments, such as alimony paid or moving expenses, all meticulously detailed for your convenience.

Can a Bank Reverse an Ach Payment - Outlines the criteria for submitting a stop payment order, including it must be delivered at least three banking days before the scheduled debit.

Claiming Tax Back at the Airport - Integrally designed to assist passengers in reclaiming funds for travel taxes under qualifying conditions.