Get Dr 15Ez Sales Tax Form

For businesses operating in Florida, understanding and completing the Sales and Use Tax Return DR-15EZ form is a fundamental aspect of compliance with state tax laws. This particular form, updated in January 2020, serves as a streamlined method for small businesses to report and remit sales and use tax, including any applicable surtaxes. The Florida Department of Revenue mandates its use for qualifying businesses, providing a relatively simpler format compared to other tax return forms. The completion process involves reporting gross sales, exempt sales, taxable sales and purchases, including out-of-state and internet purchases, and calculating the total tax due, accounting for discretionary sales surtax and any lawful deductions. A unique feature of this form includes the opportunity for businesses to receive a collection allowance if taxes are paid timely and electronically, promoting efficiency and timely compliance. Penalties for late submissions or payments are explicitly outlined to ensure taxpayers understand the potential financial implications of non-compliance. Given its critical role in the state's tax administration, the DR-15EZ form warrants a thorough understanding to navigate its requirements successfully and avoid any unnecessary penalties.

Dr 15Ez Sales Tax Example

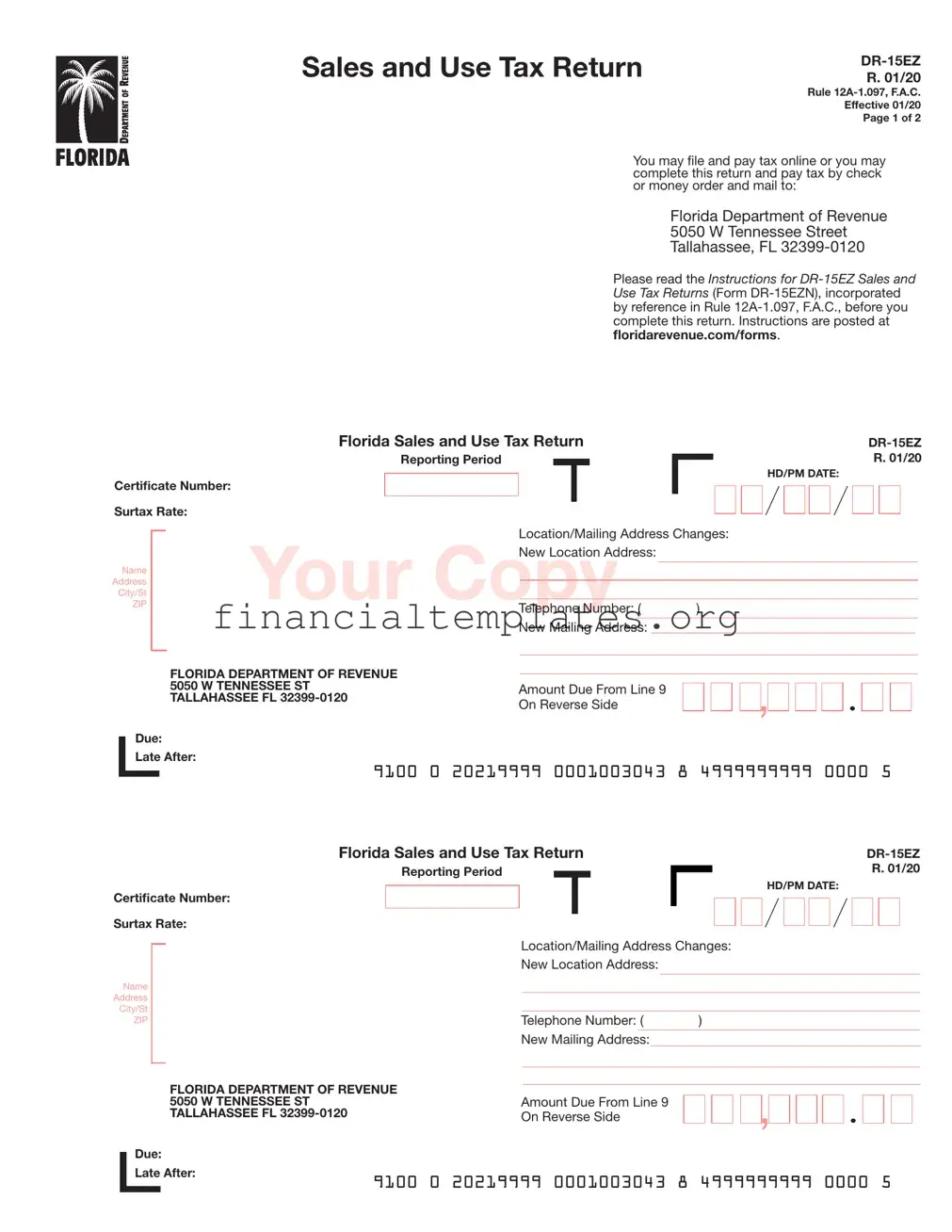

Sales and Use Tax Return

R. 01/20

Rule

Effective 01/20

Page 1 of 2

You may file and pay tax online or you may complete this return and pay tax by check or money order and mail to:

Florida Department of Revenue

5050 W Tennessee Street

Tallahassee, FL

Please read the Instructions for

Florida Sales and Use Tax Return

Reporting Period

Certificate Number:

Surtax Rate:

R. 01/20

HD/PM DATE:

Name

Address

City/St

ZIP

Location/Mailing Address Changes:

Your CopyNew Location Address:

Telephone Number: ( )

New Mailing Address:_________________________________________

FLORIDA DEPARTMENT OF REVENUE |

|

|

5050 W TENNESSEE ST |

Amount Due From Line 9 |

|

TALLAHASSEE FL |

||

On Reverse Side |

||

|

,

,

Due: |

|

|

|

|

|

|

|

Late After: |

|

|

|

|

|

|

|

9100 |

0 |

20219999 |

0001003043 |

8 |

4999999999 |

0000 |

5 |

Florida Sales and Use Tax Return |

||||

|

Reporting Period |

|

R. 01/20 |

|

|

||||

|

|

|

|

HD/PM DATE: |

|

|

|

|

|

Certificate Number:

Surtax Rate:

Name

Address

City/St

ZIP

Location/Mailing Address Changes:

New Location Address:

Telephone Number: ( |

) |

|

|

|

|

New Mailing Address: |

|

|

FLORIDA DEPARTMENT OF REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5050 W TENNESSEE ST |

Amount Due From Line 9 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

||

TALLAHASSEE FL |

On Reverse Side |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due: |

|

|

|

|

|

|

|

|

Late After: |

9100 |

0 |

20219999 |

0001003043 |

8 |

4999999999 |

0000 |

5 |

|

R. 01/20

Page 2 of 2

File and Pay Online to Receive a Collection Allowance. When you electronically file your tax return and pay timely, you are entitled to deduct a collection allowance of 2.5% (.025) of the first $1,200 of tax due, not to exceed $30. To pay timely, you must initiate payment and receive a confirmation number, no later than 5:00 p.m. ET on the business day prior to the 20th. More information on filing and paying electronically, including aFlorida eServices Calendar of Electronic Payment Deadlines (Form

Due Dates. Returns and payments are due on the 1st and late after the 20th day of the month following each reporting period.

A return must be filed for each reporting period, even if no tax is due.If the 20th falls on a Saturday, Sunday, or a state or federal holiday, returns are timely if postmarked or hand delivered on the first business day following the 20th.

Penalty. If you file your return or pay tax late, a late penalty of 10% of the amount of tax owed, but not less than $50, may be charged. The $50 minimum penalty applies even if no tax is due. A floating rate of interest also applies to late payments and underpayments of tax.

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

|

|

|

|

|

|

|

|

|

CENTS |

Under penalties of perjury, I declare that I have read this return and |

|

|

|

||||||||||||||||||||||||||||

1. |

Gross Sales |

|

|

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

the facts stated in it are true. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(Do not include tax) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Exempt Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(Include these in |

|

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Gross Sales, Line 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Taxpayer |

|

Date |

|

|

|

|

Telephone # |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

3. |

Taxable Sales/Purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

(Include |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Purchases) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Signature of Preparer |

|

Date |

|

|

|

|

Telephone # |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

4. |

Total Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

(Include Discretionary Sales Surtax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

from Line B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

5. |

Less Lawful Deductions |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discretionary Sales Surtax Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Taxable Sales and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Less DOR Credit Memo |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

Purchases NOT Subject |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to DISCRETIONARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES SURTAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Net Tax Due |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

B. Total Discretionary |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8. |

|

Less Collection Allowance or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Surtax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Plus Penalty and Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Amount Due With Return |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

Please do not fold or staple. |

|

|

|

|

|||||||||||||||||||||||||

|

|

(Enter this amount on front) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

|

|

|

|

|

|

|

|

|

CENTS |

|

Under penalties of perjury, I declare that I have read this return and |

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

1. |

Gross Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the facts stated in it are true. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

(Do not include tax) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Exempt Sales |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Include these in |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Gross Sales, Line 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Taxpayer |

Date |

|

|

|

|

Telephone # |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3. |

Taxable Sales/Purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(Include |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Purchases) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Signature of Preparer |

Date |

|

|

|

|

Telephone # |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

4. |

Total Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

(Include Discretionary Sales Surtax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

from Line B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5. |

Less Lawful Deductions |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discretionary Sales Surtax Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Taxable Sales and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Less DOR Credit Memo |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases NOT Subject |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to DISCRETIONARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

Net Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES SURTAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Total Discretionary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8. |

|

Less Collection Allowance or |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Surtax Due |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Plus Penalty and Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collection |

Allowance |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

9. |

Amount Due With Return |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please do not fold or staple. |

|

|

|

||||||||||||||||||||||||||

|

|

(Enter this amount on front) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specifics

| Fact | Detail |

|---|---|

| Form Type | Florida Sales and Use Tax Return DR-15EZ |

| Governing Rule | Rule 12A-1.097, F.A.C. |

| Effective Date | January 2020 (01/20) |

| Submission Options | Online filing and payment or by mail with check or money order |

| Electronic Benefits | E-filing and timely payment entitles the taxpayer to a collection allowance of 2.5%, up to $30. |

Guide to Writing Dr 15Ez Sales Tax

Filling out the DR-15EZ Sales Tax form is an essential task for businesses required to report their sales and use tax in Florida. This form helps in ensuring that all taxable sales, exempt sales, and applicable surtaxes are accurately reported to the Florida Department of Revenue. It's important for businesses to complete this form accurately and submit it along with the necessary payment by the due date to avoid penalties and interest. Here’s a step-by-step guide on how to complete the form:

- Begin by entering the reporting period and certificate number at the top of the form.

- Next, input the applicable surtax rate if it pertains to your reporting.

- Provide your business's name, address, city/state/ZIP, and if there are any, report changes to your location or mailing address.

- Indicate any new location addresses or new mailing addresses in the provided fields along with a current telephone number.

- Turn to the reverse side of the form to report financial figures starting with Line 1, your gross sales (do not include tax).

- For Line 2, detail your exempt sales, remembering to include these figures in your gross sales reported in Line 1.

- In Line 3, enter taxable sales or purchases, including internet and out-of-state purchases.

- Calculate and fill in the total tax due, including any discretionary sales surtax required, on Line 4.

- If applicable, deduct lawful deductions on Line 5.

- Subtract any DOR credit memo amounts in Line 6.

- Determine your net tax due and report this in Line 7.

- On Line 8, if you qualify for an electronic filing collection allowance or if there are penalties and interest, calculate and input these amounts.

- Finally, sum up the total amount due with the return on Line 9 and enter this on the front page at the designated area. Ensure you double-check your calculations to prevent discrepancies.

- Sign and date the form, ensuring that both the taxpayer and preparer (if applicable) provide their signatures and telephone numbers.

Upon completing the form, remember to not fold or staple any documentation and mail it to the Florida Department of Revenue at the stated address before the due date. If eligible and to benefit from a collection allowance, consider filing and paying electronically before the specified deadline to ensure timely submission and receipt of any applicable discounts. Taking these steps promptly will maintain compliance and help avoid any unnecessary fines or penalties associated with late submissions.

Understanding Dr 15Ez Sales Tax

-

What is the DR-15EZ Sales and Use Tax Return?

The DR-15EZ Sales and Use Tax Return is a form businesses can use to report and pay sales and use taxes in Florida. This simplified version is designed for businesses with less complicated tax circumstances. It covers the total gross sales, exempt sales, taxable sales or purchases, and calculates the total tax due, including discretionary sales surtax if applicable. Businesses are encouraged to file and pay their taxes electronically to receive a collection allowance.

-

How can I file and pay for the DR-15EZ?

Businesses have the option to file and pay their DR-15EZ Sales and Use Tax electronically through the Florida Department of Revenue’s online system or by completing the paper form and mailing it with a check or money order. Filing electronically is recommended as it allows businesses to take advantage of a collection allowance, which is 2.5% of the first $1,200 of tax due, not exceeding $30. To ensure you pay timely and receive the collection allowance, initiate payment and obtain a confirmation number by 5:00 p.m. ET the business day before the 20th.

-

What are the due dates for submitting the DR-15EZ form?

Returns and payments for the DR-15EZ Sales and Use Tax are due on the 1st day and considered late after the 20th day of the month following each reporting period. It is important to submit a return for each period even if there’s no tax due. If the 20th falls on a weekend or a state or federal holiday, submissions are considered timely if they are postmarked or hand-delivered on the next business day.

-

What happens if I file the DR-15EZ or pay the tax late?

If a business files the DR-15EZ Sales and Use Tax Return or pays the tax after the deadline, a late penalty is assessed. This penalty is 10% of the tax owed but not less than $50, with the $50 minimum applying even if no tax was owed. Additionally, interest at a floating rate may also be charged on late payments and underpayments. It’s crucial to file and pay on time to avoid these extra charges.

Common mistakes

Filling out the DR-15EZ Sales Tax form is a routine task for many businesses in Florida. However, it's easy to make mistakes that can lead to problems with the Florida Department of Revenue. Here are ten common mistakes people frequently make when completing this form:

- Not checking the box for location and mailing address changes. It's essential to indicate if there has been any change to your business location or mailing address to ensure that all correspondence reaches you.

- Incorrectly reporting Gross Sales. Many people either overstate or understate their gross sales by mistakenly including tax amounts collected or failing to include taxable sales.

- Failing to properly identify Exempt Sales. This mistake happens when people do not accurately separate or identify sales that should not be taxed from those that are taxable.

- Omitting or incorrectly reporting Taxable Sales/Purchases, including Internet and Out-of-State Purchases. It's crucial to include all taxable transactions, especially those conducted online or purchased from out-of-state vendors.

- Miscalculating the Total Tax Due. This error can be due to simple mathematical mistakes or misunderstanding how to apply the discretionary sales surtax.

- Incorrect application of Lawful Deductions. Many filers do not take advantage of lawful deductions or mistakenly claim deductions they are not entitled to.

- Omitting the DOR Credit Memo. If you have a credit memo from the Department of Revenue, it should be deducted from your net tax due. Failing to do so can lead to overpayment.

- Missing the opportunity to deduct the Collection Allowance by not e-filing/e-paying. The collection allowance is only available for those who file and pay electronically and on time.

- Calculation errors in the Amount Due With Return section, often leading to either underpayment or overpayment of taxes.

- Forgetting to declare penalties or interest due for late filing or underpayment. This oversight can accumulate additional charges over time.

In addition to these common errors, it's always a good practice to double-check all entered information before submitting the form. Ensuring accuracy in your DR-15EZ Sales Tax form not only helps in complying with tax regulations but also prevents unnecessary penalties and interest. If there are uncertainties or complexities in your tax situation, consulting with a tax professional may provide added clarity and guidance.

Documents used along the form

When filing the DR-15EZ Sales Tax Form, a meticulous approach ensures compliance and accurate tax reporting. This document is integral for businesses to correctly report their sales and use tax responsibilities to the Florida Department of Revenue. Alongside the DR-15EZ, there are additional forms and documents that often complement the filing process, providing a detailed financial landscape of the business operations for the specified period. Understanding each document's relevance can empower taxpayers, easing the burden of compliance and ensuring they meet all regulatory obligations efficiently.

- Form DR-15EZN Instructions: This document serves as a comprehensive guide for completing the DR-15EZ Sales and Use Tax Return. It elucidates each section of the return, offering step-by-step instructions to prevent common errors and ensure that the filer provides all the necessary details accurately.

- Form DR-659 Florida eServices Calendar of Electronic Payment Deadlines: Important for all taxpayers who opt to file and pay their taxes electronically. This calendar outlines critical dates, ensuring timely submissions and avoiding potential late fees and penalties by marking the electronic payment deadlines throughout the fiscal year.

- Form DR-1: Known as the Florida Business Tax Application, this form is generally used by businesses to register for a sales tax certificate. While not submitted with every tax return, it's a foundational document for any entity beginning to collect sales tax, signifying their formal acknowledgment of tax collection responsibilities.

- Form DR-15: The more detailed counterpart to the DR-15EZ, this Sales and Use Tax Return form is utilized by businesses with more complex tax reporting requirements. It may accompany the DR-15EZ in cases where additional documentation of sales activities and tax calculations is required for comprehensive compliance.

In conclusion, effectively navigating the intricacies of tax compliance demands familiarity with various forms and documents beyond the DR-15EZ. These additional forms ensure that businesses provide a full account of their taxable activities, facilitating a transparent and accurate tax filing process. Together, they form a structured framework within which businesses can confidently fulfill their tax obligations, contributing to the integrity of the tax system and the business community's sustained success.

Similar forms

The Form W-2, Wage and Tax Statement, bears similarity to the DR-15EZ form as both are required for tax reporting purposes. The W-2 form, used by employers to report wages paid and taxes withheld to their employees, overlaps in function with the DR-15EZ by necessitating accurate financial reporting to a governing tax authority. While the DR-15EZ details sales and use tax collected by businesses, the W-2 focuses on income tax, yet both play crucial roles in ensuring tax compliance.

Form 1040, the U.S. Individual Income Tax Return, also shares commonalities with the DR-15EZ form. Both documents are pivotal for tax reporting, albeit for different subjects; the 1040 for individual income taxes and the DR-15EZ for sales and use taxes by businesses. Each form requires detailed financial information to accurately calculate taxes due, underscoring their importance in the tax administration process.

The DR-15EZ's counterpart in the realm of corporate taxation is Form 1120, the U.S. Corporation Income Tax Return. This form is essential for corporations to report their income, gains, losses, deductions, and calculate their federal income tax liability. Like the DR-15EZ, which companies use to declare sales and use tax, Form 1120 is critical for corporate entities to fulfill their tax obligations.

Form 1099-NEC, Nonemployee Compensation, parallels the DR-15EZ through its role in the tax reporting ecosystem, specifically for independent contractors and freelancers. It documents income from non-employment-related services. Both forms facilitate compliance with tax laws, albeit targeting different types of income: the DR-15EZ for sales and the 1099-NEC for services rendered.

Another document, the State Unemployment Tax Act (SUTA) filings, intersects with the DR-15EZ's domain in the landscape of tax documentation. SUTA filings, required by state governments, involve reporting wages paid to employees for unemployment insurance purposes. Similarly, the DR-15EZ involves reporting sales-related figures but aimed at complying with sales and use tax laws at the state level.

The Quarterly Federal Excise Tax Return, Form 720, shares the periodic tax reporting feature with the DR-15EZ. While Form 720 addresses the federal excise taxes on specific goods, services, and activities, the DR-15EZ focuses on state-level sales and use taxes. Both necessitate businesses to regularly report and remit taxes, showcasing their parallel functions in the tax compliance framework.

Form 940, the Employer’s Annual Federal Unemployment (FUTA) Tax Return, mirrors the DR-15EZ by requiring annual submissions to federal agencies. Form 940 calculates and reports unemployment taxes due by employers, akin to DR-15EZ's reporting of sales and use taxes. These documents ensure businesses contribute appropriately to government funds, be it for unemployment or taxation purposes.

The Business Property Tax Return, used in various localities to assess property tax on business assets, aligns with the DR-15EZ in its focus on business-related contributions to public coffers. While the DR-15EZ captures sales and use tax information, the Property Tax Return tallies taxable property to calculate due taxes, both pivotal for fiscal responsibility in commerce.

The Alcohol and Tobacco Tax and Trade Bureau (TTB) F 5000.24, Excise Tax Return, like the DR-15EZ, is specialized for a particular sector, documenting excise taxes on alcohol, tobacco, firearms, and ammunition. Its function of tax collection and compliance echoes the DR-15EZ's role in tracking sales and use taxes, illustrating the diverse landscapes of taxation across industries.

Lastly, the Use Tax Return forms utilized by individuals or businesses for declaring use tax on out-of-state purchases resemble the DR-15EZ in their aim to ensure tax compliance on transactions. Whereas the DR-15EZ concerns businesses selling goods and services, Use Tax Returns target consumers, highlighting the broad scope of tax obligations spanning both sellers and buyers in the economic ecosystem.

Dos and Don'ts

When filling out the DR-15EZ Sales Tax form, it's important to approach the task with careful attention to detail and an understanding of the applicable sales tax laws. Here are some essential dos and don'ts to guide you through the process:

Do:- Read the instructions for the DR-15EZ Sales and Use Tax Returns (Form DR-15EZN) thoroughly before starting.

- Ensure that your business information—like the name, address, and Certificate Number—is accurate and up to date.

- Include all necessary details in the Gross Sales, Exempt Sales, and Taxable Sales/Purchases sections to ensure an accurate calculation of tax due.

- Take advantage of the collection allowance by filing and paying electronically and on time, which allows you to retain 2.5% (.025) of the first $1,200 of the tax due.

- Sign and date the form, confirming that you've reviewed all the information and that it's correct to the best of your knowledge.

- Overlook the importance of timely filing and payment. Late submissions may result in penalties and interest charges.

- Forget to deduct the collection allowance if you are eligible because you filed and paid electronically by the deadline.

- Miss out on declaring exempt sales on your form; this can lead to an overestimation of the tax due.

- Ignore the surtax rates that might apply to your area when calculating your total tax due.

- Fold or staple your return if you're submitting via mail, as this can create issues with processing.

By adhering to these guidelines, you can simplify the tax return process and avoid common mistakes that could lead to penalties or delays. Remember, accurate and timely filing benefits both your business and the tax collection agency by keeping records straight and finances in order.

Misconceptions

When dealing with the DR-15EZ Sales Tax form in Florida, several misconceptions can cause confusion for businesses and individuals alike. Understanding these misconceptions is crucial to ensuring accurate and timely filing. Here are ten common misunderstandings:

Only retail businesses need to file. In reality, the DR-15EZ form is relevant to a wide range of businesses, not just retail. Any business that collects sales tax from customers in Florida is required to file, regardless of their industry.

The form is complicated and difficult to fill out. While tax documents can seem daunting, the DR-15EZ is designed to be more straightforward than its longer counterpart, the DR-15. Filing electronically can further simplify the process.

You can't file and pay the tax online. Contrary to this belief, Florida encourages online filing and payment. Doing so may even qualify you for a collection allowance, reducing the amount of tax owed.

There's no benefit to filing online. Filing electronically not only streamlines the process but also entitles you to a collection allowance of 2.5% of the first $1,200 of tax due, as long as the filing is timely and made through the proper channels.

If no tax is collected, filing isn't necessary. Even if a business does not collect any sales tax during a reporting period, a "zero" return must still be filed for that period to avoid penalties.

Late penalties are negotiable. The Florida Department of Revenue imposes a strict late penalty of 10% of the tax owed or $50, whichever is greater. This penalty is firm and not subject to negotiation if you miss the deadline.

All sales are subject to sales tax. Actually, certain sales are exempt from tax, and these exemptions should be accurately reported on the form to avoid overpaying tax or underreporting taxable sales.

The discretionary sales surtax applies uniformly across Florida. The surtax rate can vary by county, so it's important to know the rate applicable to your county and correctly calculate this additional tax if it applies.

Only in-state purchases are taxable. The DR-15EZ form specifically asks filers to include internet and out-of-state purchases that are taxable, highlighting the requirement to report and pay sales tax on items bought outside of Florida for use within the state.

The form is the same each year. Tax laws and rates can change, and the Department of Revenue may update forms accordingly. It's important to use the most current version of the DR-15EZ form to ensure compliance with the latest tax regulations.

Correcting these misconceptions helps ensure that businesses comply with state tax laws, avoiding penalties and benefiting from available allowances. For the most accurate and up-to-date information, visiting the Florida Department of Revenue's website or consulting with a tax professional is advised.

Key takeaways

Filling out and using the DR-15EZ Sales Tax form in Florida is crucial for businesses to comply with state tax regulations. This form allows businesses to report and pay sales and use taxes to the Florida Department of Revenue. To ensure accuracy and avoid penalties, here are five key takeaways to consider:

Electronic Filing Benefits: When you file the DR-15EZ Sales Tax form electronically and make your payment on time, you're eligible for a collection allowance. This allowance is 2.5% of the first $1,200 of tax due, with a maximum benefit of $30. To qualify, ensure that payment is initiated and a confirmation number is received no later than 5:00 p.m. ET on the business day before the 20th of the month.

Due Dates Are Critical: The DR-15EZ form and its accompanying payment are due on the 1st day after the reporting period ends and are considered late after the 20th of the following month. If the 20th falls on a weekend or a public holiday, the deadline is extended to the next business day. Ensure that all filings are postmarked or hand-delivered by these dates to avoid penalties.

Accuracy in Reporting: The form requires detailed information about gross sales, exempt sales, and taxable sales or purchases, including internet and out-of-state purchases. It's important to review and correctly report these figures to reflect your business activities accurately and maintain compliance with state tax laws.

Penalties for Late Filing or Payment: Late submissions of the DR-15EZ form or late payments will incur a penalty of 10% of the tax owed but not less than $50. This minimum penalty applies even if no tax was due for the reporting period. Additionally, interest charges apply to late payments and underpayments of tax, based on a floating rate.

Understanding Exemptions and Deductions: The form allows businesses to report exempt sales and to claim lawful deductions. It's vital to understand which sales are exempt from tax and what deductions are allowable to ensure that your business does not overpay taxes or underreport taxable sales.

By keeping these key points in mind and diligently preparing your DR-15EZ Sales Tax form, you can help ensure that your business stays compliant with Florida's sales and use tax laws. Always stay abreast of any changes to tax legislation or reporting requirements to avoid unexpected penalties and to take full advantage of any allowable deductions or incentives.

Popular PDF Documents

Full Payment Certificate - This form is part of Chicago's process to ensure all property transfers are officially recorded and appropriately charged.

IRS 4136 - This form allows businesses to recover taxes paid on fuel that was not used for its taxable purpose.

Maryland Boat Bill of Sale - Adheres to the state’s legal requirements, ensuring that the sale abides by all applicable laws and regulations.