Get Dlstfd Student Loan Form

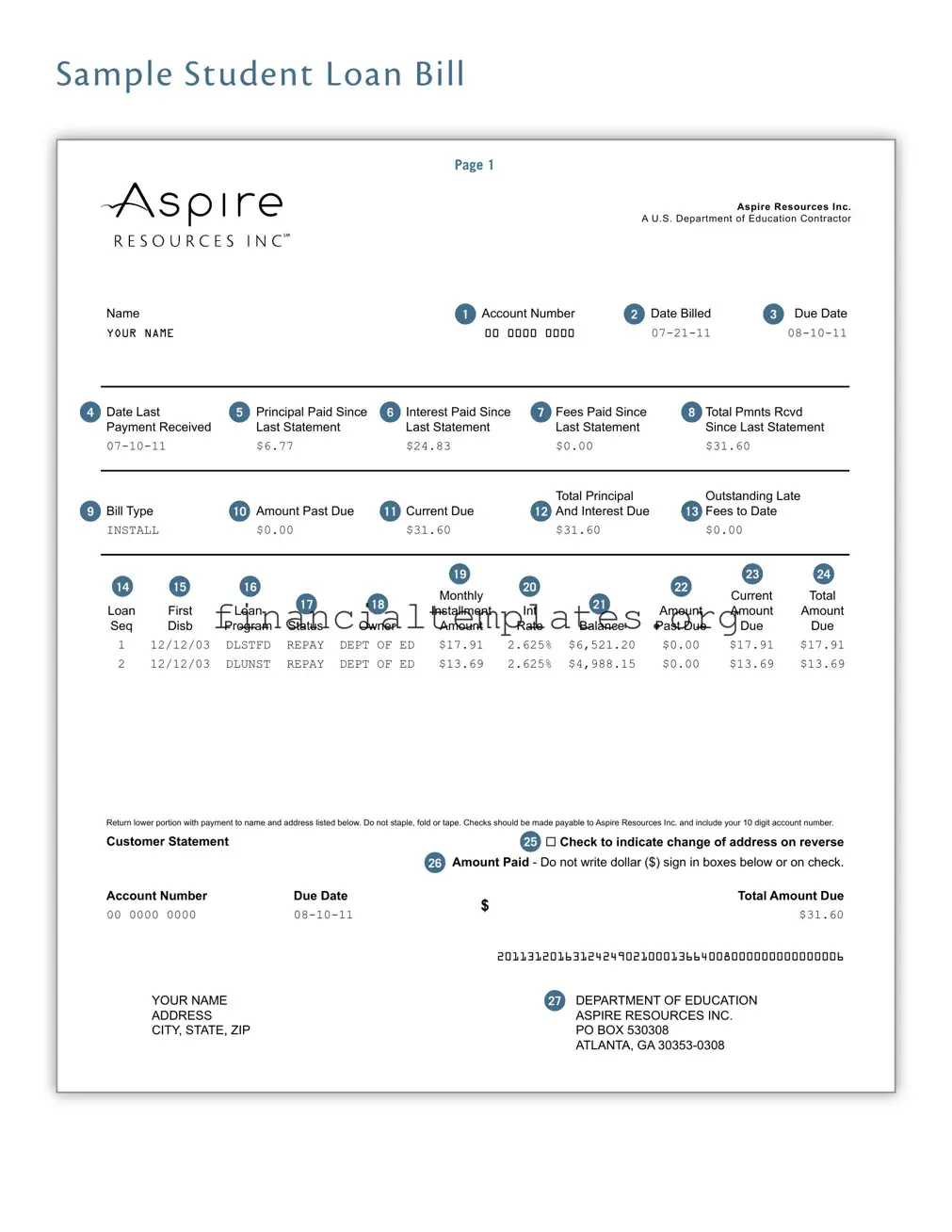

Navigating student loans can feel overwhelming, but understanding your loan statement is a vital step toward managing your financial future effectively. The Dlstfd Student Loan form, a sample student loan bill generated by Aspire Resources Inc., a contractor for the U.S. Department of Education, contains critical information including account number, billing and due dates, payments received, and the breakdown of principal, interest, and fees paid since the last statement. This comprehensive document also outlines the total outstanding principal, type of bill, current amounts due, and detailed loan information such as individual loan sequences, disbursement dates, and loan statuses. Whether the bill indicates a standard installment, highlights outstanding interest, or signals a change in repayment status - each section of this form plays an essential role in helping borrowers understand the specifics of their loans. Additionally, it guides on how to address changes in address and where to send payments to ensure they are processed without delay. Familiarizing oneself with these details not only aids in keeping track of payments and loan progress but also assists in planning ahead for financial stability.

Dlstfd Student Loan Example

Sample Student Loan Bill

Page 1

Aspire Resources Inc.

A U.S. Department of Education Contractor

Name |

1 Account Number |

2 Date Billed |

3 Due Date |

YOUR NAME |

00 0000 0000 |

4 |

Date Last |

5 |

Principal Paid Since |

6 |

Interest Paid Since |

7 |

Fees Paid Since |

8 |

Total Pmnts Rcvd |

|||||||

|

Payment Received |

|

Last Statement |

|

Last Statement |

|

|

Last Statement |

|

Since Last Statement |

||||||

|

|

$6.77 |

|

|

$24.83 |

|

|

$0.00 |

|

$31.60 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Total Principal |

|

Outstanding Late |

||

9 |

Bill Type |

10 |

Amount Past Due |

11 |

Current Due |

|

12 |

And Interest Due |

13 |

Fees to Date |

|

|||||

|

INSTALL |

|

$0.00 |

|

|

$31.60 |

|

|

$31.60 |

|

$0.00 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

23 |

24 |

|

14 |

15 |

16 |

|

|

|

|

Monthly |

|

20 |

|

22 |

|

Current |

Total |

|

|

|

|

|

|

17 |

|

18 |

|

|

|

21 |

|

|

|||

|

Loan |

First |

Loan |

|

|

Installment |

|

Int |

Amount |

|

Amount |

Amount |

||||

|

|

|

|

|

|

|

|

|||||||||

|

Seq |

Disb |

Program |

Status |

Owner |

|

Amount |

|

Rate |

Balance |

Past Due |

Due |

Due |

|||

|

1 |

12/12/03 |

DLSTFD |

REPAY |

DEPT OF ED |

$17.91 |

2.625% |

$6,521.20 |

$0.00 |

|

$17.91 |

$17.91 |

||||

|

2 |

12/12/03 |

DLUNST |

REPAY |

DEPT OF ED |

$13.69 |

2.625% |

$4,988.15 |

$0.00 |

|

$13.69 |

$13.69 |

||||

Return lower portion with payment to name and address listed below. Do not staple, fold or tape. Checks should be made payable to Aspire Resources Inc. and include your 10 digit account number.

Customer Statement |

25 ¨ Check to indicate change of address on reverse |

26Amount Paid - Do not write dollar ($) sign in boxes below or on check.

Account Number |

Due Date |

$ |

Total Amount Due |

|

00 0000 0000 |

$31.60 |

|||

|

||||

|

|

|

2011312016312424902100013664008000000000000006 |

YOUR NAME |

27 DEPARTMENT OF EDUCATION |

ADDRESS |

ASPIRE RESOURCES INC. |

CITY, STATE, ZIP |

PO BOX 530308 |

|

ATLANTA, GA |

1.Account Number

Your

2.Date Billed

Date Aspire generated your bill.

3.Date Due

Date your payment is due to avoid delinquency.

4.Date Last Payment Received

Date Aspire received your last loan payment.

5.Principal Paid Since Last Statement

Amount applied to outstanding principal for loans listed on the bill since the previous bill was generated.

6.Interest Paid Since Last Statement

Amount applied to outstanding interest for loans listed on the bill since the previous bill was generated.

7.Fees Paid Since Last Statement

Amount applied to outstanding fees for loans listed on the bill since the previous bill was generated.

8.Total Pmnts Rcvd Since Last Statement

Total amount applied to loans listed on the bill since the previous bill was generated.

9.Bill Type

Type of bill or statement. Bill types and their required actions are:

Install (Installment) — Make your regular monthly payment. Interest — Pay the outstanding interest amount to avoid interest capitalization.

Int Notice — No action needed, but this outstanding interest will capitalize if not paid.

10.Amount Past Due

Total unpaid amount from the previous billing cycle for all loans listed on the bill.

11.Current Due

Total amount you owe to Aspire for this billing cycle.

12.Total Principal and Interest Due Amount Past Due plus Current Due

13.Outstanding Late Fees to Date

Unpaid late fees for loans listed on the bill.

14.Loan Seq

Reference number for a specific loan.

15.First Disb

Date the first disbursement for this loan was made.

16.Loan Program

DLSTFD — Direct Subsidized Stafford Loan DLUNST — Direct Unsubsidized Stafford Loan DLPLGB — Direct Student PLUS Loan DLPLUS — Direct Parent PLUS Loan

DLSCNS — Direct Subsidized Consolidation Loan DLUCNS — Direct Unsubsidized Consolidation Loan DLCNSL — Direct Consolidation Loan

DLPCNS — Direct Parent Consolidation Loan

DLSSPL — Direct Subsidized Spousal Consolidation Loan DLUSPL — Direct Unsubsidized Spousal Consolidation Loan DLSPCN — Direct Spousal Consolidation Loan

TEACH — Direct TEACH Loan

STFFRD — FFEL Subsidized Stafford Loan

UNSTFD — FFEL Unsubsidized Stafford Loan PLUS — FFEL Parent PLUS Loan

PLUSGB — FFEL Graduate PLUS Loan

SUBCNS — FFEL Subsidized Consolidation Loan UNCNS — FFEL Unsubsidized Consolidation Loan CNSLDN — FFEL Consolidation Loan

SLS — FFEL Supplemental Loan for Students

17.Status

Current status of this loan:

Repay (Repayment) — Monthly payments required. Inter (Interim) — In school. No monthly payment required while attending school.

Defer (Deferment) — Regular monthly payments temporarily suspended. You are responsible for interest on unsubsidized loans.

Forb (Forbearance) — Regular monthly payments temporarily suspended. You are responsible for interest during forbearance.

Grace (Grace Period) — No monthly payment required for a period of time (usually six months) after leaving school. You may be responsible for interest on your loans during grace periods.

18.Owner

The entity that currently owns this loan.

19.Monthly Installment Amount

Amount you are required to pay each month on this loan.

20.Int Rate

The current fixed or variable interest rate for this loan.

21.Balance

The principal amount remaining to be paid on this loan. This does not include accrued interest and is not your payoff amount.

22.Amount Past Due

Unpaid amount from the previous billing cycle for this loan.

23.Current Amount Due

Amount you owe Aspire for this billing cycle for this loan.

24.Total Amount Due

Amount Past Due plus Current Amount Due for this loan.

25.Change of Address Checkbox

Indicate a change of address by checking this box and updating your contact information on the reverse. Sign in to your account to update your contact information online.

26.Amount Paid

Amount of your check or money order.

27.Address

Mail your payment to this address to avoid delays in processing.

Page 2

Name |

|

|

|

Account Number |

Date Billed |

Due Date |

||

YOUR NAME |

|

|

00 0000 0000 |

|||||

|

|

|

|

|

|

|

||

LOAN INFORMATION |

|

|

|

|

|

|

||

|

|

|

28 |

|

|

|

|

|

|

|

|

Original |

29 |

|

31 |

32 |

|

|

|

|

|

30 |

|

|

||

Loan |

First |

Loan |

Principal |

Total Interest |

Total Principal |

Aggregate |

||

|

||||||||

Seq |

Disb |

Program |

Amount |

Paid |

Total Fees Paid |

Paid |

Amount Paid |

|

1 |

12/12/03 |

DLSTFD |

$7,346.17 |

$1,170.99 |

$0.00 |

$1,174.11 |

$2,197.89 |

|

2 |

12/12/03 |

DLUNST |

$5,555.47 |

$885.88 |

$0.00 |

$888.24 |

$1,662.67 |

|

28.Original Prinicpal Amount

Amount you originally borrowed with this loan.

29.Total Interest Paid

Total amount of interest paid on this loan since it has been serviced by Aspire.

30.Total Fees Paid

Total amount of fees paid on this loan since it has been serviced by Aspire.

31.Total Principal Paid

Total amount of principal paid on this loan since it has been serviced by Aspire.

32.Aggregate Amount Paid

Total amount paid on this loan since it has been serviced by Aspire, including amounts paid toward interest and fees and against principal.

Document Specifics

| Fact Name | Description |

|---|---|

| Account Information | Your 10-digit Aspire account number is used for identification and billing purposes. |

| Payment Details | Includes the dates billed and due, the last payment received, and details of payments towards principal, interest, and fees since the last statement. |

| Loan Status and Ownership | Information about the current status of each loan (e.g., Repay, Defer), the owner of the loan, and the amounts due for each loan including monthly installment and interest rate. |

| Payment Submission | Provides instructions on how to submit your payment to Aspire Resources Inc., including the address to which payments should be mailed, and highlights the importance of including your account number with your payment. |

Guide to Writing Dlstfd Student Loan

Filling out the Dlstfd Student Loan form requires precise attention to detail to ensure accurate submission of your student loan payment information. This guide simplifies the process, breaking down each of the critical sections of the form, making it easier for you to complete. Following this, your form will be ready for submission, moving you forward in managing your student loan efficiently.

- Account Number: Enter your 10-digit Aspire account number.

- Date Billed: Fill in the date Aspire generated your bill.

- Date Due: Input the date your payment is due to avoid delinquency.

- Date Last Payment Received: Mention the date Aspire received your last loan payment.

- Principal Paid Since Last Statement: State the amount applied to outstanding principal for loans listed on the bill since the previous bill was generated.

- Interest Paid Since Last Statement: Indicate the amount applied to outstanding interest for loans listed on the bill since the previous bill was generated.

- Fees Paid Since Last Statement: Specify the amount applied to outstanding fees for loans listed on the bill since the previous bill was generated.

- Total Payments Received Since Last Statement: Record the total amount applied to loans listed on the bill since the previous bill was generated.

- Bill Type: Choose the type of bill or statement from the provided options and act accordingly.

- Amount Past Due, Current Due, Total Principal and Interest Due, Outstanding Late Fees: Fill in the respective fields with the amounts as per your latest statement.

- Loan Details: For each loan, enter the Loan Sequence Number, First Disbursement Date, Loan Program, Status, Owner, Monthly Installment Amount, Interest Rate, Balance, Amount Past Due, and Current Amount Due.

- Original Loan Details: On the second page, under each loan, input the Original Principal Amount, Total Interest Paid, Total Fees Paid, Total Principal Paid, and Aggregate Amount Paid.

- Change of Address: If applicable, indicate a change of address by checking the designated box and updating your contact information on the reverse side of the form or online.

- Amount Paid: State the amount of your check or money order without including the currency symbol.

- Address: Note the Department of Education's payment processing address provided on the form to ensure your payment reaches the correct destination without any delays.

Upon completing the form carefully with the relevant information, review it to ensure all entered details are accurate and reflect your current loan payment situation. Ensuring accuracy is crucial to avoid any complications or misunderstandings with your loan repayments. Once confident in the form's completeness and accuracy, mail it to the provided address, making sure to include your payment. This step is vital in maintaining your loan's good standing and progressing toward repayment.

Understanding Dlstfd Student Loan

-

What is the significance of the account number on the Dlstfd Student Loan form?

The 10-digit Aspire account number uniquely identifies your student loan account. It's essential for ensuring that your payments are correctly applied to your account. Always include this number when making payments or contacting Aspire Resources Inc. for queries about your student loans.

-

How can I understand the due dates listed on the form?

The form lists two dates related to your payment schedule: the Date Billed, which is when Aspire generated your bill, and the Date Due, which is the deadline for your payment to avoid delinquency. Paying by the due date ensures that your loan doesn't fall into delinquency, which can have negative impacts on your credit score.

-

Could you explain the difference between principal, interest, and fees paid since last statement as mentioned on the form?

- Principal Paid Since Last Statement: This is the amount that has been applied to reduce the original amount borrowed for the loans listed on your bill since your last statement.

- Interest Paid Since Last Statement: This represents the amount applied to the interest that has accrued on your loan balances since the previous billing statement.

- Fees Paid Since Last Statement: This indicates any fees that have been paid off on your loans since the last bill. This amount does not include new fees incurred since the last statement.

Together, these payments affect your total loan balance and interest accrual over time.

-

What does "Bill Type" on my student loan statement signify?

The "Bill Type" on your statement indicates the kind of action required for the billing period. For example, "Install" means a regular installment payment is due, while "Interest" signifies outstanding interest that needs to be paid to avoid capitalization. "Int Notice" indicates no immediate action is needed, although unpaid interest could capitalize, adding to your loan's principal balance.

-

How are Total Principal and Interest Due calculated, and why is this important?

The Total Principal and Interest Due is the sum of any unpaid amount from the previous billing cycle (Amount Past Due) and the total amount you owe for the current billing cycle (Current Due). This figure is crucial as it represents the total amount needed to keep your account in good standing and avoid additional fees or the risk of delinquency. Keeping up with this payment helps manage your loan balance and reduces the amount of interest that can accrue over time.

Common mistakes

When filling out the Dlstfd Student Loan form, people often make several common mistakes that can potentially lead to complications or delays in the processing of their loans. Understanding these mistakes can help ensure that individuals provide the correct information and avoid unnecessary issues.

- Incorrect Account Number: Not including the correct 10-digit Aspire account number can lead to processing delays or the payment not being applied to the right account.

- Payment Amount Confusion: Failing to clearly indicate the total amount due, especially if paying something different from what's listed under "Current Due" or "Total Amount Due," can confuse the processing of the payment.

- Omitting Date Information: Neglecting to fill out the “Date Billed” and “Due Date” fields correctly can cause confusion about the timing and applicability of payments.

- Incorrect Loan Information: Misstating details about the loan such as the “Loan Seq,” “First Disb” (disbursement) date, or misunderstanding the statuses under “Loan Program” can impact the management and understanding of loan responsibilities.

- Failure to Report Changes: Not checking the “Change of Address” box and updating contact information can lead to missed communications from Aspire Resources Inc., potentially including important notices about loan changes or requirements.

- Amount Paid Errors: Writing the dollar ($) sign in the boxes where the "Amount Paid" is specified or on the check can cause processing issues, as the instructions clearly state to avoid doing so.

Here are some additional errors to be mindful of, although not as widely impactful, they can still cause inconvenience:

- Misreading the "Total Pmnts Rcvd Since Last Statement" as the amount they currently owe, whereas it represents total payments received, not the current balance due.

- Ignoring the details under the "Outstanding Late Fees to Date" can lead to accumulating fees that increase the total loan cost over time.

- Incorrectly identifying the "Owner" of the loan which can lead to sending payments to the wrong entity or misunderstanding who to contact for loan issues.

By being attentive to these details, individuals can ensure their Dlstfd Student Loan form submissions contribute to smoother management of their student loans.

Documents used along the form

When managing or repaying student loans, individuals often encounter various forms and documents besides just their monthly billing statement. Understanding these documents is crucial for effective loan management. Each serves a specific purpose and provides essential information or opportunities for the borrower to take action regarding their student loans.

- Income-Driven Repayment Plan Request: This form is used by borrowers seeking to adjust their monthly payment amount based on their income and family size. It's vital for those whose financial situation doesn't allow them to keep up with the standard repayment plan.

- Direct PLUS Loan Application: Parents of dependent undergraduate students and graduate or professional students can use this form to apply for a PLUS loan, which can help cover education expenses not covered by other financial aid.

- Loan Consolidation Application: This document allows borrowers to combine multiple federal education loans into a single loan, often leading to a single monthly payment instead of multiple payments. It might result in a longer repayment period and more interest paid over time.

- Deferment Request Forms: These are used to request a temporary halt on loan payments due to specific life situations such as unemployment, economic hardship, enrollment in school, or military service. Interest may continue to accrue on certain types of loans during deferment.

- Forbearance Request: Borrowers can request forbearance to reduce or stop payments temporarily due to personal hardships, medical expenses, or changes in employment. Unlike deferment, interest accrues on all types of loans during forbearance.

Each of these documents plays a unique role in the management and repayment of student loans. Borrowers should familiarize themselves with these forms, understand when and how to use them, and recognize their implications on loan repayment. Careful consideration and timely use of these documents can significantly affect a borrower's financial well-being and progress towards loan repayment.

Similar forms

The Dlstfd Student Loan form shares similarities with a Mortgage Statement, which provides homeowners with details on their current loan balance, interest paid, principal paid, and any fees or penalties incurred since the last statement. Both documents offer a comprehensive overview of outstanding debts and include information on the interest rate, balance due, and payments received. Like the student loan form, a mortgage statement may indicate the amount past due and the total amount due, helping borrowers understand their financial responsibilities and progress toward paying off their debts.

Another document resembling the Dlstfd Student Loan form is the Credit Card Billing Statement. This statement outlines the charges made to the credit card, payments received, current balance, and any interest or fees applied. Similar to the student loan form, it details the billing period, due date for payments, and past payments towards the balance. Both documents aim to keep the borrower informed about their financial obligations and the status of their account, encouraging timely payments to avoid additional fees.

The Monthly Utility Bill also parallels the Dlstfd Student Loan form in structure and purpose. Utility bills list charges for services like electricity, water, and gas, indicating the amounts due, payments received since the last statement, and any outstanding fees. Though for different services, both documents provide a summary of financial activity over a billing cycle, including detailed breakdowns of charges, payments, and due dates, guiding consumers in managing their payments effectively.

Health Insurance Explanation of Benefits (EOB) is another document similar to the Dlstfd Student Loan form. The EOB breaks down the costs covered by insurance for medical services received, what the patient owes after insurance payments, including any deductibles, co-pays, or co-insurance fees. Both documents offer transparency in financial transactions related to a service, detailing what has been paid, what remains due, and any additional fees, ensuring individuals understand their financial responsibilities.

The Annual Tax Statement resembles the Dlstfd Student Loan form as well. This document provides an overview of an individual's income, taxes paid, and any refunds or amounts owed to the government. Like the student loan form, it includes detailed financial transactions over the year, helping individuals understand their tax obligations, prepare for future financial planning, and ensure compliance with tax legislation.

An Investment Account Statement, provided by brokerages or investment firms, shares similarities with the Dlstfd Student Loan form. It gives investors a snapshot of their portfolio, including the value of their investments, any gains or losses, and transactions made within the statement period. Both documents aim to keep the account holder informed about the current status of their financial investments or obligations, providing a basis for making informed decisions.

Lastly, a Car Loan Statement is akin to the Dlstfd Student Loan form, detailing the balance of the loan, interest and principal payments, and any fees incurred. It communicates the financial status of the borrower's account, progress toward paying off the car loan, and outlines the remaining balance and terms of repayment. Both documents are critical for individuals managing loans, ensuring they remain aware of their obligations and the progress they are making toward settling their debts.

Dos and Don'ts

When filling out the DLSTFD Student Loan form, it is essential to pay attention to details to ensure accuracy and avoid potential issues. Here are some crucial do's and don'ts to consider:

- Do review your personal information carefully to ensure your name, account number, and contact details are correct.

- Do check the amounts listed for principal, interest, and fees paid since the last statement to verify their accuracy.

- Do note the total amount due, including any past due amounts, and ensure you are prepared to cover these in your payment.

- Don't forget to mark the checkbox if your address has changed and update your address on the reverse or online to keep your information current.

- Don't write the dollar sign in the amount paid box or on your check; follow the form's instructions carefully.

- Don't staple, fold, or tape your payment or correspondence to avoid processing delays; ensure everything is clean and legible.

Adhering to these guidelines can help ensure your DLSTFD Student Loan form is filled out correctly, supporting smooth and timely processing of your student loan payments.

Misconceptions

When it comes to managing student loans, it's crucial to understand the details about your loan statement. Some misconceptions about the Dlstfd Student Loan form can lead to confusion. Let's clarify these points.

- Misconception 1: The account number is not important.

- Misconception 2: The "Date Due" is just a suggested payment date.

- Misconception 3: "Total Pmnts Rcvd Since Last Statement" reflects the total amount you've paid off your loan.

- Misconception 4: If there are no outstanding late fees listed, you're not accruing any.

- Misconception 5: The "Current Due" amount is the only amount you should pay.

- Misconception 6: The "Loan Program" names are interchangeable.

This is incorrect. Your 10-digit Aspire account number is critical for ensuring payments are credited to your account properly. Always include it when making payments.

The "Date Due" is the deadline for your payment to avoid delinquency. Always aim to pay on or before this date to keep your loan in good standing.

This figure actually shows the total amount applied to your loans listed on the bill since the previous bill was generated, not the total amount you've paid over the life of the loan.

Even if "Outstanding Late Fees to Date" shows $0.00, this means no unpaid late fees are currently due. It doesn't imply that no late fees can be assessed in the future if payments are late.

While the "Current Due" is what you owe for this billing cycle, paying more can reduce your principal faster and decrease the amount of interest accrued over time.

Each loan program has specific terms, conditions, and benefits. Knowing whether your loan is a DLSTFD (Direct Subsidized Stafford Loan) or another type affects your understanding of your obligations and benefits.

Understanding your student loan statement is important for effective loan management. Always review each section of your Dlstfd Student Loan bill carefully to ensure you are making payments correctly and are aware of how they are applied to your loan balance.

Key takeaways

Understanding your Dlstfd Student Loan form is crucial for effective loan management. Here are several key takeaways:

- Your 10-digit Aspire account number is essential for all transactions and communications regarding your loan.

- The Date Billed is when Aspire generated your bill, which is critical for tracking billing cycles.

- Ensuring you know the Date Due helps avoid late payments and potential penalties.

- Keeping track of the Date Last Payment Received allows you to monitor your loan's payment status.

- Understanding how your payments are applied—towards principal, interest, and any fees—informs you about your loan's progress.

- The Bill Type section indicates the required action for your bill, such as making regular monthly payments or paying outstanding interest.

- Knowing the specifics of your loan, like the loan sequence number, interest rate, and principal balance, helps in tracking each loan separately.

- If your address changes, it's important to check the Change of Address box and update your contact information to ensure you continue receiving important loan information.

- Mailing your payment to the correct address is crucial for timely processing. Include your account number on your check or money order for accurate application to your account.

Additionally, the breakdown of the loan components such as the original principal amount, total interest paid, fees paid, and total principal paid gives a comprehensive view of how much of your loan has been paid off and what remains.

Paying attention to the Status of each loan (e.g., Repayment, Deferment) and the Owner of the loan can be critical in understanding the terms of your loan and who to contact with questions or for servicing.

Lastly, being aware of the total amount due each billing cycle—including past due amounts and current dues—ensures you can plan your finances accordingly and avoid falling behind on payments.

Popular PDF Documents

Irs Online Transcript - Income section details wages, salaries, interest income, dividends, and other financial gains or losses.

Pa Real Estate Forms - Using this form helps ensure that all parties are aware of their obligations and entitlements regarding the real estate transfer tax.

Form 4797 Sales of Business Property - It caters to both short-term and long-term capital gains or losses on business assets, impacting your tax liabilities.