Get Dgt 1 Tax Form

The DGT 1 Tax form is a critical document for individuals and entities seeking tax relief in Indonesia under the Double Taxation Convention (DTC). Specially designed by the Ministry of Finance of the Republic of Indonesia's Directorate General of Taxes, this form serves a specific group: those who are residents of countries that have a DTC with Indonesia and who seek relief from Indonesian income tax on earnings such as dividends, interest, royalties, income from services, and other similar revenant taxable by withholding in Indonesia. Importantly, this form does not apply to banking institutions or individuals looking for relief on income generated from the transfer of bonds or stocks traded on the Indonesian stock exchange. A complete and correctly signed form, certified by a competent authority or authorized tax office in the resident country, is mandatory before submission to the Indonesian withholding agent. This systematic arrangement ensures that all relevant information regarding the recipient's identity, the nature of income, and certification from the country of residence is accurately provided, facilitating a smoother process for claiming tax relief. This form is not just a document but a gateway for eligible non-residents to navigate through tax obligations in Indonesia more efficiently, proving its indispensability in the realm of international taxation.

Dgt 1 Tax Example

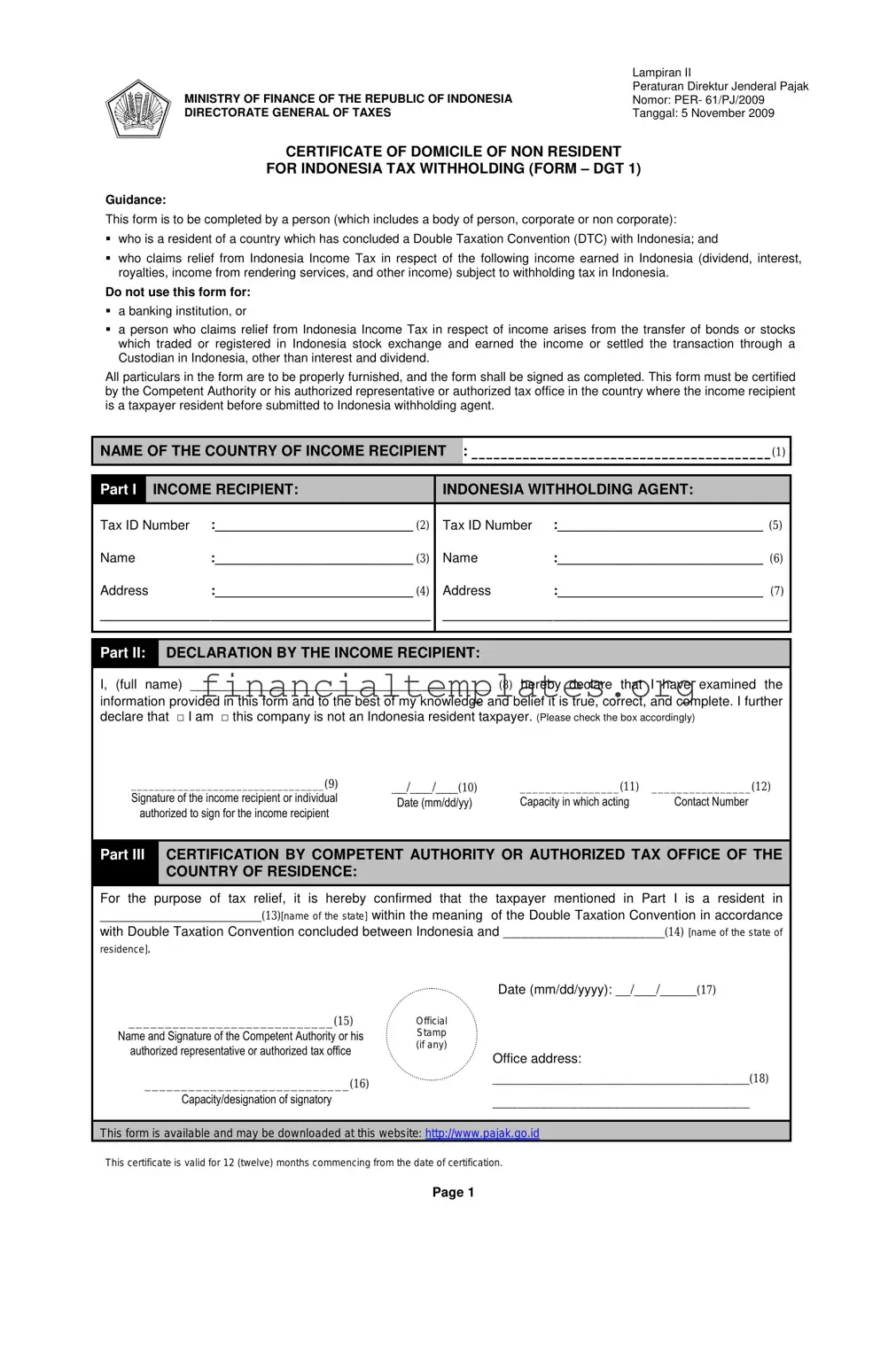

MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA DIRECTORATE GENERAL OF TAXES

Lampiran II

Peraturan Direktur Jenderal Pajak Nomor: PER- 61/PJ/2009 Tanggal: 5 November 2009

CERTIFICATE OF DOMICILE OF NON RESIDENT

FOR INDONESIA TAX WITHHOLDING (FORM – DGT 1)

Guidance:

This form is to be completed by a person (which includes a body of person, corporate or non corporate):

who is a resident of a country which has concluded a Double Taxation Convention (DTC) with Indonesia; and

who claims relief from Indonesia Income Tax in respect of the following income earned in Indonesia (dividend, interest, royalties, income from rendering services, and other income) subject to withholding tax in Indonesia.

Do not use this form for:

a banking institution, or

a person who claims relief from Indonesia Income Tax in respect of income arises from the transfer of bonds or stocks which traded or registered in Indonesia stock exchange and earned the income or settled the transaction through a Custodian in Indonesia, other than interest and dividend.

All particulars in the form are to be properly furnished, and the form shall be signed as completed. This form must be certified by the Competent Authority or his authorized representative or authorized tax office in the country where the income recipient is a taxpayer resident before submitted to Indonesia withholding agent.

NAME OF THE COUNTRY OF INCOME RECIPIENT : _________________________________________(1)

|

Part I |

INCOME RECIPIENT: |

INDONESIA WITHHOLDING AGENT: |

||

|

|

|

|

|

|

|

Tax ID Number |

:___________________________ (2) |

Tax ID Number |

:____________________________ (5) |

|

|

Name |

:___________________________ (3) |

Name |

:____________________________ (6) |

|

|

Address |

:___________________________ (4) |

Address |

:____________________________ (7) |

|

_____________________________________________ |

_______________________________________________ |

||||

|

|

|

|

|

|

Part II:

DECLARATION BY THE INCOME RECIPIENT:

I, (full name) _________________________________________ (8) hereby declare that I have examined the

information provided in this form and to the best of my knowledge and belief it is true, correct, and complete. I further declare that □ I am □ this company is not an Indonesia resident taxpayer.

_________________________________(9) |

__/___/___(10) |

________________(11) |

________________(12) |

|

|

|

|

Part III

CERTIFICATION BY COMPETENT AUTHORITY OR AUTHORIZED TAX OFFICE OF THE COUNTRY OF RESIDENCE:

For the purpose of tax relief, it is hereby confirmed that the taxpayer mentioned in Part I is a resident in

______________________(13)[name of the state] within the meaning of the Double Taxation Convention in accordance

with Double Taxation Convention concluded between Indonesia and ______________________(14) [name of the state of

residence].

Date (mm/dd/yyyy): __/___/_____(17)

____________________________(15) |

Official |

|

Stamp |

||

(if any) |

||

|

||

Office address: |

||

|

||

____________________________(16) |

___________________________________(18) |

|

___________________________________ |

This form is available and may be downloaded at this website: http://www.pajak.go.id

This certificate is valid for 12 (twelve) months commencing from the date of certification.

Page 1

|

Part IV |

TO BE COMPLETED IF THE INCOME RECIPIENT IS AN INDIVIDUAL |

|

||

|

|

|

|

|

|

|

1. |

Name of Income Recipient : ___________________________________________________________________ (19) |

|

||

|

|

|

|

||

|

2. |

Date of birth (mm/dd/yyyy) : __/__/____ (20) |

3. Are you acting as an agent or a nominee? □ Yes □ No *) (21) |

|

|

|

|

|

|

|

|

4.Full address: __________________________________________________________________________________

____________________________________________________________________________________________(22)

5. |

Do you have permanent home in Indonesia? |

□ |

Yes |

□ No *) |

(23) |

|

6. |

In what country do you ordinarily reside? _________________________________________________________ (24) |

|||||

7. |

Have you ever been resided in Indonesia? |

□ |

Yes |

□ No*) |

If so, in what period? __/___/____ to __/__/____(25) |

|

|

Please provide the address _______________________________________________________________________ |

|||||

8. |

Do you have any office, or other place of business in Indonesia? |

□ Yes □ No *) |

(26) |

|||

|

If so, please provide the address __________________________________________________________________ |

|||||

Part V

TO BE COMPLETED IF THE INCOME RECIPIENT IS NON INDIVIDUAL

1.Country of registration/incorporation: ___________________________________________________________(27)

2.Which country does the place of management or control reside? _____________________________________(28)

3.Address of Head Office:_____________________________________________________________________________(29)

_____________________________________________________________________________________________________

4.Address of branches, offices, or other place of business in Indonesia (if any): __________________________________(30)

_____________________________________________________________________________________________________

5. |

Nature of business (i.e. Pension Fund, Insurance, Headquarters, Financing) |

|

|

|

(31) |

|

|

|

|

|

|

6. |

The company is listed in stock market and the shares are regularly traded. |

|

□ Yes |

□ No *) |

|

|

If yes, please provide the name of the stock market: ________________________________ (32) |

|

|

||

7. |

The creation of the entity and/or the transaction structure is not motivated by reasons to take |

|

□ Yes |

□ No*) |

|

|

advantage of benefit of the DTC. |

(33) |

|

|

|

8. |

The company has its own management to conduct the business and such management has an |

□ Yes |

□ No*) |

||

|

independent discretion. |

(34) |

|

|

|

9. |

The company employs sufficient qualified personnel. |

(35) |

□ Yes |

□ No*) |

|

10. |

The company engages in active conduct of a trade or business. |

(36) |

□ Yes |

□ No*) |

|

11. |

The earned income is subject to tax in your country. |

(37) |

□ Yes |

□ No*) |

|

12. |

No more than 50 per cent of the company’s income is used to satisfy claims by other persons |

□ Yes |

□ No*) |

||

|

(i.e. interest, royalties, other fees) |

(38) |

|

|

|

Part VI:

INCOME EARNED FROM INDONESIA IN RESPECT TO WHICH RELIEF IS CLAIMED

1. Dividend, Interest, or Royalties:

a. Type of Income: ______________________________________________________________________________(39)

b. Amount of Income liable to withholding tax under Indonesian Law: IDR ______________________________ (40)

2. Income from rendering services (including professional):

a. Type of incomes: |

______________________________________________________________________________ (41) |

|||

b. Amount of Income liable to withholding tax under Indonesian Law: |

IDR |

______________________________ (42) |

||

c. Period of engagement (mm/dd/yy): (43) |

|

|

|

|

►From: ___/___/_____ to ___/___/_____ |

►From: ___/___/_____ to ___/___/_____ |

|||

►From: ___/___/_____ to ___/___/_____ |

►From: ___/___/_____ to ___/___/_____ |

|||

|

|

|

|

|

3. Other Type of Income: |

|

|

|

|

a. Type of incomes: |

______________________________________________________________________________ (44) |

|||

b. Amount of Income liable to withholding tax under Indonesian Law: |

IDR |

______________________________ (45) |

||

|

|

|

|

|

This form is available and may be downloaded at this website: http://www.pajak.go.id

*) Please check the appropriate box

I declare that I have examined the information provided in this form and to the best of my knowledge and belief it is true, correct, and complete.

_________________________________ |

___/___/___ |

__________________ |

________________ |

|

|

||||

|

|

|

Page 2

INSTRUCTIONS

FOR CERTIFICATE OF DOMICILE OF NON RESIDENT FOR INDONESIA TAX WITHHOLDING (FORM – DGT 1)

Number 1:

Please fill in the name of the country of income recipient.

Part I Information of Income Recipient:

Number 2:

Please fill in the income recipient’s taxpayer identification number in country where the claimant is registered as a resident taxpayer.

Number 3:

Please fill in the income recipient’s name.

Number 4:

Please fill in the income recipient’s address.

Number 5:

Please fill in the Indonesia withholding agent’s taxpayer identification number.

Number 6:

Please fill in the Indonesia withholding agent’s name.

Number 7:

in relation with the income source in Indonesia. You are acting as a nominee if you are the legal owner of income or of assets that the income is generated and you are not the real owner of the income or assets.

Number 22:

Please fill in the income recipient’s address.

Number 23:

Please check the appropriate box. If your permanent home is in Indonesia, you are considered as Indonesian resident taxpayer according to the Income Tax Law and if you receive income from Indonesia, the Double Tax Conventions shall not be applied.

Number 24:

Please fill the name of country where you ordinarily reside.

Number 25:

Please check the appropriate box. In case you have ever been resided in Indonesia, please fill the period of your stay and address where you are resided.

Please fill in the Indonesia withholding agent’s address.

Part II Declaration by the Income Recipient:

Number 8:

In case the income recipient is not an individual this form shall be filled by the management of the income recipient. Please fill in the name of person authorized to sign on behalf the income recipient. If the income recipient is an individual, please fill in the name as stated in Number 3.

Number 9:

The income recipient or his representative (for non individual) shall sign this form.

Number 10:

Please fill in the place and date of signing.

Number 11:

Please fill in the capacity of the claimant or his representative who signs this form.

Number 12:

Please fill in the contact number of person who signs this form.

Part III Certification by Competent Authority or Authorized Tax Office of the Country of Residence:

Number 26:

Please check the appropriate box. In case you have any offices, or other place of business in Indonesia, please fill in the address of the offices, or other place of business in Indonesia.

Part V To be Completed if the Income Recipient is non Individual:

Number 27:

Please fill in the country where the entity is registered or incorporated.

Number 28:

Please fill in the country where the entity is controlled or where its management is situated.

Number 29:

Please fill in the address of the entity’s Head Office.

Number 30:

Please fill in the address of any branches, offices, or other place of business of the entity situated in Indonesia.

Number 13 and 14:

Please fill in the name of country where the income recipient is registered as a resident taxpayer.

Number 15 and 16

The Competent Authorities or his authorized representative or authorized tax office should certify this form by signing it. The position of the signor should be filled in Number 16.

Number 17:

Please fill in the date when the form is signed by the Competent Authorities or his authorized representative or authorized tax office.

Number 18:

Please fill in the office address of the Competent Authority or authorized representative or authorized tax office.

Part IV to be completed if the Income Recipient is an Individual:

Number 19:

Please fill in the income recipient’s full name.

Number 20:

Please fill in the income recipient’s date of birth.

Number 21:

Please check the appropriate box. You are acting as an agent if you act as an intermediary or act for and on behalf of other party

Number 31:

Please fill in the nature of business of the claimant.

Number

Please check the appropriate box in accordance with the claimant’s facts and circumstances.

Part VI for Income Earned from Indonesia in Respect to which relief is claimed:

Number 39:

Please fill in the type of income (e.g. dividend, interest, or royalties).

Number 40:

Please fill in the aggregate amount of Income liable to withholding tax under Indonesian Law within a period of month (Tax Period).

Number 41:

Please fill in the type of income from rendering services (including professional).

Number 42:

Please fill in the aggregate amount of Income liable to withholding tax under Indonesian Law within a period of month (Tax Period).

Number 43:

In case your income is arising from rendering service, please fill in the period when the service is provided.

Number 44:

Please fill in the other type of income.

Number 45:

Please fill in the amount of Income liable to withholding tax under Indonesian Law.

Document Specifics

| Fact | Details |

|---|---|

| Form Usage | This form is used by non-residents of Indonesia who earn income from Indonesia and are from countries that have a Double Taxation Convention (DTC) with Indonesia. |

| Exclusions | It is not to be used by banking institutions or for claims relating to income from the transfer of bonds or stocks traded or registered in the Indonesia stock exchange. |

| Certification Requirement | The form must be certified by a Competent Authority or authorized tax office in the resident country of the income recipient. |

| Validity | The certificate is valid for 12 months from the date of certification. |

| Information Needed | Details such as Tax ID Numbers, names, and addresses of the income recipient and the Indonesian withholding agent are required. |

| Declaration and Certification Parts | Includes sections for declaration by the income recipient and certification by the Competent Authority or authorized tax office. |

| Form Sections for Individuals and Non-Individuals | The form has specific sections to be completed depending on whether the income recipient is an individual or a non-individual entity. |

| Income Types and Details | Specific information about the type of income earned in Indonesia and subject to withholding tax is requested. |

Guide to Writing Dgt 1 Tax

Filling out the DGT 1 tax form requires careful attention to detail. This form helps non-residents of Indonesia claim tax relief under the Double Taxation Convention (DTC) agreement Indonesia has with other countries. This step-by-step guide will help ensure that all necessary information is correctly provided and that the form is properly certified before being submitted to an Indonesian withholding agent.

- Identify the country of the income recipient and fill in the required field (1).

- In Part I, start with providing the tax ID number of the income recipient as registered in their country of residence (2).

- Enter the name of the income recipient (3).

- Provide the address of the income recipient (4).

- For the Indonesia withholding agent, fill in their tax ID number (5).

- Enter the name of the Indonesia withholding agent (6).

- Fill in the address of the Indonesia withholding agent in relation to the income source in Indonesia (7).

- Move to Part II for the Declaration by the Income Recipient and enter the full name of the individual or authorized person for non-individual entities (8).

- Sign the form to indicate the declaration is true and complete (9).

- Fill in the date of signing the form (10).

- Provide the capacity in which the individual is signing the form (11).

- Include a contact number for the person signing the form (12).

Part III requires certification by a Competent Authority or authorized representative in the income recipient's country of residence:

- Fill in the name of the state of residence of the taxpayer (13).

- State the name of the state with which Indonesia has the DTC (14).

- The Competent Authority must sign the form (15).

- Fill in the position of the signatory (16).

- Date the form when it's signed by the Competent Authority (17).

- Provide the office address of the Competent Authority or authorized representative (18).

Sections Part IV and Part V are to be completed based on whether the income recipient is an individual or not:

- For individuals, fill in full name, date of birth, and answer all subsequent queries as instructed, including the address and country of residence (19-26).

- For non-individual entities, detail the country of registration/incorporation, place of management, and complete the remaining sections as per the form’s guidelines (27-38).

Lastly, in Part VI:

- Describe the type and amount of income earned from Indonesia for which relief is claimed, including type of income, amount subject to withholding tax, and period of engagement (39-45).

Completing the form accurately and providing all required certifications will help ensure that your claim for tax relief is processed efficiently by the relevant Indonesian authorities.

Understanding Dgt 1 Tax

-

What is the DGT 1 Tax Form?

The DGT 1 Tax Form, or Certificate of Domicile of Non-Resident for Indonesia Tax Withholding, is a document used by non-residents of Indonesia who earn income from Indonesian sources and seek to claim relief from Indonesian income tax under the Double Taxation Convention (DTC) with their country of residence. This form must be properly filled out and certified by the Competent Authority or authorized representative in the taxpayer's country of residence.

-

Who needs to complete the DGT 1 Tax Form?

The form is intended for use by individuals or entities (corporate or non-corporate) who are residents of countries that have a DTC with Indonesia and are receiving income subject to Indonesian withholding tax, such as dividends, interest, royalties, income from rendering services, and other types of income. It is not applicable for banking institutions or for income arising from the transfer of bonds or stocks traded or registered on the Indonesian stock exchange.

-

How is the DGT 1 Tax Form certified?

Certification of the DGT 1 Form must be performed by the Competent Authority, their authorized representative, or an authorized tax office in the country where the income recipient is a resident taxpayer. The form requires the competent authority's signature, official stamp (if any), and complete office address to be filled in its dedicated section.

-

What is the validity period of the DGT 1 Tax Form?

Once certified by the Competent Authority or authorized representative, the DGT 1 Tax Form is valid for 12 months starting from the date of certification. This period should be closely monitored to ensure continuous eligibility for tax relief under the DTC.

-

Where can I download the DGT 1 Tax Form?

The form is available for download from the official website of the Directorate General of Taxes of the Republic of Indonesia at http://www.pajak.go.id. It is important to download the latest version of the form to ensure compliance with any recent changes to tax regulations or requirements.

Common mistakes

When filling out the DGT 1 Tax Form, a fundamental document required for claiming tax relief for non-residents in Indonesia, individuals often stumble over several common errors. These mistakes can delay the process and potentially lead to the rejection of the application for tax relief under the Double Taxation Convention (DTC). Here are four of the most frequent mistakes to avoid:

Incorrect or Incomplete Name and Tax Identification Number: Ensuring that the income recipient's name and tax identification number are correctly filled out is crucial. This information must match the details registered in the taxpayer’s country of residence as well as with the Indonesian withholding agent’s records.

Failing to Properly Declare the Income Recipient's Status: The declaration that the income recipient or the company is not an Indonesian resident taxpayer must be correctly indicated. This involves checking the appropriate box but also understanding the implications of one’s residential status on tax liabilities.

Not Having the Form Certified by the Competent Authority: Before submission to the Indonesian withholding agent, the form requires certification by the Competent Authority or an authorized representative in the country where the income recipient is a taxpayer. Overlooking this step can invalidate the entire document.

Omitting Income Details or Filling Them Incorrectly in Part VI: Every income type—whether dividend, interest, royalties, income from rendering services, or other types—must be accurately declared, including the type, amount liable to withholding tax under Indonesian law, and the period of engagement if applicable. These details are pivotal in calculating the tax relief.

In ensuring accuracy and completeness when completing the DGT 1 Tax Form, avoid these common pitfalls. Thoroughness and attention to detail are your allies in successfully claiming tax relief under the DTC.

Documents used along the form

When processing the Certificate of Domicile for Non-Resident to avail tax withholding relief in Indonesia, as presented in the DGT 1 form, various documents and forms frequently accompany the primary application. These supplemental documents are essential for a comprehensive understanding of the applicant's tax status, ensuring compliance with Indonesian tax laws and facilitating the accurate assessment of tax reliefs under the Double Taxation Convention (DTC).

- Form 1721-A1: This form serves as the Annual Tax Return for individual income earned in Indonesia. It outlines the total income received by an individual within a fiscal year, acting as a detailed record that supports claims made in the DGT 1 form regarding income earned in Indonesia.

- Form 1770: For non-individuals, such as corporations, Form 1770 provides a comprehensive overview of the annual income tax due to the Indonesian government. It includes details on gross income, allowable deductions, and the net income subject to tax, laying a foundational base for any tax relief claims under the DTC.

- Power of Attorney: Often, a Power of Attorney (POA) document is required if the DGT 1 form is being submitted by a representative on behalf of the income recipient. The POA authorizes the representative to act on behalf of the applicant, submitting requests and receiving information pertinent to the tax withholding relief application.

- Copy of Double Taxation Avoidance Agreement (DTAA): A certified copy of the DTAA between Indonesia and the applicant's country of residence can be demanded for reference. This document outlines the terms and conditions under which tax relief is provided, serving as a critical reference to ensure the DGT 1 application aligns with these stipulated regulations.

Each of these documents plays a pivotal role in the meticulous process of applying for tax withholding relief in Indonesia. By furnishing these along with the DGT 1 form, applicants provide a detailed narrative of their income and tax status, ensuring a smoother evaluation process. It's crucial for applicants to ensure accuracy and completeness when submitting these documents to avoid delays or issues in the approval of their tax relief claims.

Similar forms

The Form W-8BEN, "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)," shares similarities with the DGT 1 Form. Both are utilized by non-residents to claim tax treaty benefits and to assert their status as non-residents in the filing jurisdiction. While the DGT 1 Form is specific to Indonesia, the W-8BEN applies to the U.S., aiming to prevent double taxation on foreign individuals.

The Form W-8BEN-E, "Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)," is the corporate counterpart to the W-8BEN and parallels the DGT 1 Form for non-individual entities. Like the DGT 1 Form, it serves entities claiming tax treaty benefits and verifying their non-U.S. residence status, reducing withholding taxes on income sourced from the U.S., similar to how DGT 1 applies for income sourced from Indonesia.

The Form 8833, "Treaty-Based Return Position Disclosure," though not a certificate of residence, aligns with the DGT 1 Form's purpose by identifying taxpayers claiming tax treaty benefits. Individuals and entities use Form 8833 to disclose positions taken on a tax return that are based on a tax treaty, which may include similar types of income as the DGT 1 Form addresses, like dividends or interest from U.S. sources.

The Form W-8ECI, "Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States," while distinct in intent from the DGT 1 Form, shares its role in tax withholding reduction. The primary difference lies in its application to income effectively connected with a U.S. trade or business, contrasting the DGT 1’s focus on non-resident income not subject to normal trade or business operations in Indonesia.

The Form 6166, a U.S. Residency Certification, although an American document, offers a functional similarity to the DGT 1 Form for U.S. residents doing business abroad. It is used to claim income tax treaty benefits and verify residency within the United States for the purpose of double taxation avoidance, mirroring the DGT 1's use for Indonesian tax purposes.

The Certificate of Residence from the Canada Revenue Agency serves a comparable purpose to non-Canadian entities and individuals as the DGT 1 Form does for those outside Indonesia. This certificate helps taxpayers claim benefits under a tax treaty between Canada and their country of residence, reducing or eliminating withholding tax in a manner akin to the DGT 1’s role within Indonesian taxation.

The HM Revenue and Customs (HMRC) Residency Certificate in the UK fulfills a role similar to that of the DGT 1 Form, helping UK residents claim double taxation relief abroad. By proving UK residency, individuals and entities can lower or negate withholding tax on foreign income, a goal paralleled by the DGT 1 Form for those with Indonesian income sources.

The Australian Taxation Office (ATO) Certificate of Residency is used by Australian residents to claim tax treaty benefits overseas, similar to how the DGT 1 Form is used in Indonesia. This certificate allows Australians to reduce or avoid double taxation on income earned outside Australia, employing a process reflective of the intentions behind Indonesia's DGT 1 Form.

Dos and Don'ts

When filling out the DGT 1 Tax Form, understanding the do's and don'ts can significantly streamline the process and ensure accuracy in your application for tax relief under the Double Taxation Convention (DTC) with Indonesia. Here are six essential guidelines to follow:

- Do ensure you are eligible to use the DGT 1 Form. This form should only be completed by non-resident individuals or entities claiming tax relief who are residents of countries that have a DTC with Indonesia.

- Do fill out every section of the form accurately. Particular attention should be paid to the sections requiring personal or entity details, the nature of income, and the specifics of the income earned in Indonesia.

- Do have the form certified by the Competent Authority or authorized tax office in your country of residence. This is a crucial step to validate your claim for tax relief.

- Don't leave any sections incomplete. Incomplete forms or missing information can lead to delays or rejection of your application for tax relief.

- Don't use this form if you are a banking institution or claiming relief for income arising from the transfer of bonds or stocks traded in the Indonesia stock exchange and settled through a custodian in Indonesia, other than interest and dividends.

- Don't sign the declaration if you are unsure or know the information provided is incorrect. The declaration asserts that all provided information is true, complete, and correct to the best of your knowledge.

Following these guidelines will assist in the smooth processing of your DGT 1 Tax Form and ensure compliance with Indonesian tax laws for non-residents seeking tax relief.

Misconceptions

Understanding the DGT 1 Tax Form can sometimes be challenging, and there are common misconceptions that need to be clarified. Below are ten common misunderstandings and their explanations:

- Only individuals need to complete the DGT 1 Tax Form. This is incorrect. Both individuals and entities such as corporations that are residents of countries with a Double Taxation Convention (DTC) with Indonesia and earning income in Indonesia need to complete the form.

- The form is necessary for all types of income earned in Indonesia. This is not accurate. The DGT 1 form is specifically for certain types of income such as dividends, interest, royalties, income from rendering services, and other income subject to withholding tax. It does not apply to income from the transfer of bonds or stocks earned or settled through a Custodian in Indonesia.

- Banking institutions are required to fill out the DGT 1 form. In fact, banking institutions are exempt from using this form for claiming relief under the DTC.

- Submission without certification is acceptable. All forms must be certified by the Competent Authority or an authorized tax office in the country of residence before submission. Uncertified forms will not be processed.

- There is no validity period for the certification. The certificate of domicile provided by completing this form is valid for twelve months from the date of certification.

- Information accuracy is not crucial. The opposite is true. Information provided must be true, correct, and complete to the best knowledge and belief of the applicant. Any inaccuracy can lead to denial of tax relief.

- Resident taxpayers of Indonesia can use this form for tax relief. The DGT 1 form is exclusively for non-residents of Indonesia from countries that have a DTC with Indonesia. Indonesian resident taxpayers are not eligible for relief under this form.

- DGT 1 is the only form required for claiming tax relief. Depending on the nature of the income and the specifics of the DTC, other documentation may also be required by the Indonesian tax authorities.

- The form must be submitted in person. The form, along with the necessary certification, can often be submitted through appointed withholding agents or directly to the tax office, including by mail or electronically where permitted.

- Only income recipients need to declare their details on the form. While income recipients must provide their details, the Indonesian withholding agent’s details are also required and must be provided on the form.

Correct understanding and completion of the DGT 1 Tax Form are essential for ensuring compliance with tax obligations and for effectively claiming tax relief under Double Taxation Conventions.

Key takeaways

When filling out the DGT 1 Tax Form, careful attention to detail is required to ensure compliance and accuracy. Here are seven key takeaways that can guide users through the process:

- Eligibility Criteria: The DGT 1 form is specifically designed for non-residents of Indonesia who hail from countries that have a Double Taxation Convention (DTC) with Indonesia and are seeking tax relief for income earned within Indonesia.

- Comprehensive Filling: All fields in the form must be accurately completed, reflecting the claimant's correct information, including tax identification numbers, names, and addresses for both the income recipient and the Indonesian withholding agent.

- Declaration Requirement: The form requires a declaration by the income recipient affirming the truthfulness and completeness of the information provided. This section must be signed by the individual or, in the case of non-individuals, a representative of the entity.

- Competent Authority Certification: For the form to hold validity, it must be certified by a Competent Authority or an authorized representative from the income recipient's country of residence, confirming their tax residency status and eligibility under the DTC.

- Individual and Non-Individual Sections: The form distinguishes between individual and non-individual (entities like corporations) income recipients, each with specific sections to be completed relevant to their status.

- Income Specification: Part VI of the form demands detailed information about the type of income earned from Indonesia, such as dividends, interests, royalties, or income from rendering services, and the amount subject to Indonesian withholding tax.

- Validity Period: The certification provided by the DGT 1 form is valid for 12 months from the date of certification. This necessitates annual renewal for ongoing tax relief eligibility.

It is also essential for claimants to download the current form from the official website and check the appropriate boxes reflecting their situation, especially regarding their residential status, nature of income, and tax liabilities in their home country.

Popular PDF Documents

Efile W2c - In case of clerical errors like misspellings or incorrect addresses, a W-2c form is used for updates.

Berks County Tax Claim Bureau - Compliance with this form's requirements helps maintain tax integrity at the local level.