Get Detroit Property Tax Hardship Form

In Detroit, homeowners facing financial difficulties have a beacon of hope to hold on to—the Detroit Property Tax Hardship Program. Administered by the City of Detroit Property Assessment Board of Review, located at the Coleman A. Young Municipal Building, this initiative is designed to offer relief to those grappling with property taxes they cannot afford due to economic hardships. Applicants are required to fill out a form, where they need to provide basic identification details such as name, address, zip code, and phone number. The most crucial part of this document is the section where individuals must explain the reasons behind their request for a poverty tax exemption. A clear statement of the circumstances causing financial strain is necessary to aid the board in making a fair decision. The process culminates with the applicant’s signature, marking the formal submission of their plea for exemption. Aimed at easing the financial burden for eligible homeowners, the form serves as a critical step towards obtaining much-needed tax relief.

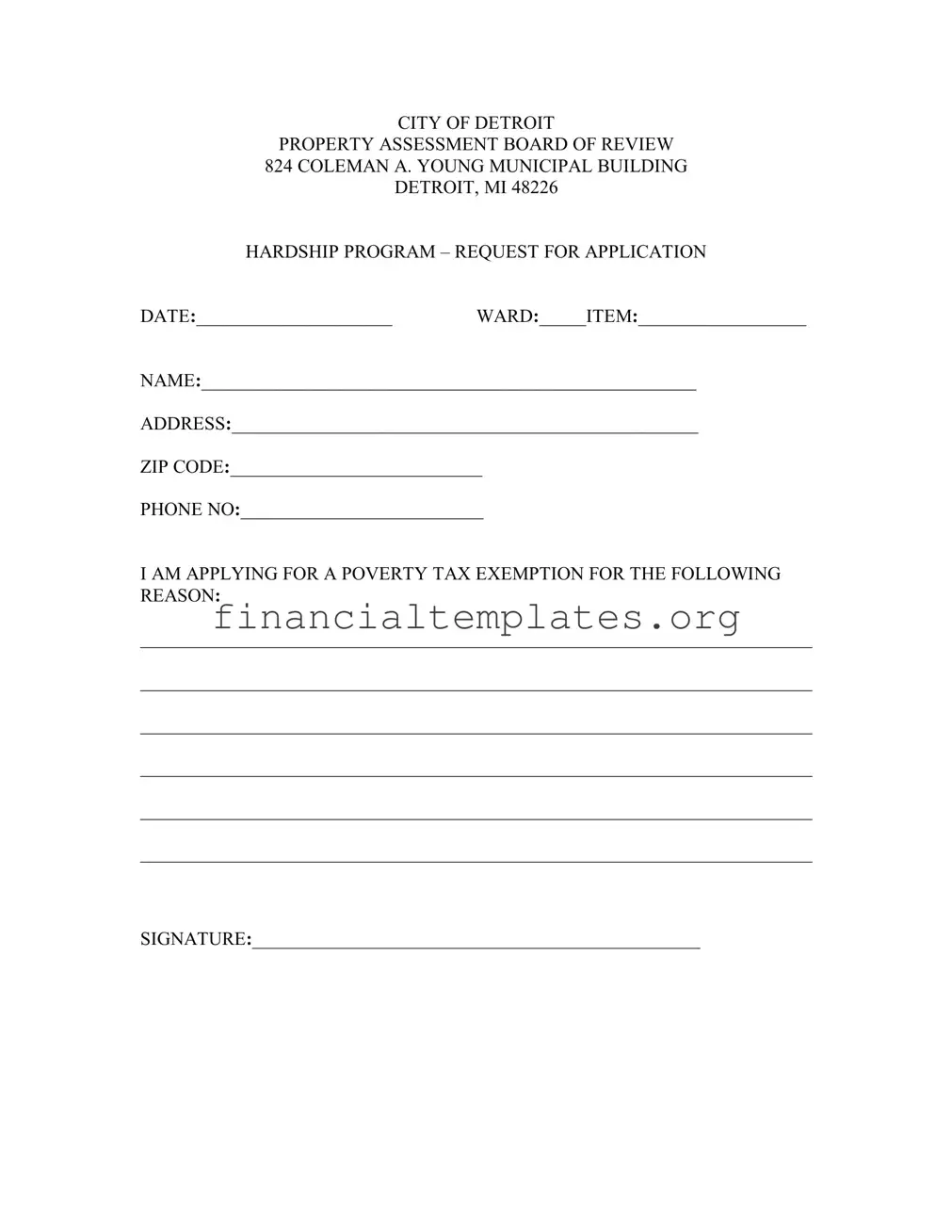

Detroit Property Tax Hardship Example

CITY OF DETROIT

PROPERTY ASSESSMENT BOARD OF REVIEW 824 COLEMAN A. YOUNG MUNICIPAL BUILDING DETROIT, MI 48226

HARDSHIP PROGRAM – REQUEST FOR APPLICATION

DATE:_____________________ WARD:_____ITEM:__________________

NAME:_____________________________________________________

ADDRESS:__________________________________________________

ZIP CODE:___________________________

PHONE NO:__________________________

I AM APPLYING FOR A POVERTY TAX EXEMPTION FOR THE FOLLOWING REASON:

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

SIGNATURE:________________________________________________

Document Specifics

| Fact Name | Description |

|---|---|

| Program Title | Detroit Property Tax Hardship Program |

| Location | 824 Coleman A. Young Municipal Building, Detroit, MI 48226 |

| Purpose | To provide a poverty tax exemption for eligible applicants |

| Application Requirement | Applicants must specify the reason for applying for the exemption |

| Contact Information Needed | Applicant's name, address, zip code, and phone number |

| Signature Requirement | Applicant must sign the request form |

| Governing Law | City of Detroit ordinances and Michigan state law regarding property taxes |

| Key Dates | Applicant must fill in the date of application |

Guide to Writing Detroit Property Tax Hardship

Filing for property tax relief through the Detroit Property Tax Hardship Program is a vital step for those who find themselves in difficult financial circumstances. It's important to complete the application thoroughly and accurately, as it's a key part of the process in potentially reducing or exempting property tax bills. After submitting the form, it will be reviewed by the City of Detroit Property Assessment Board of Review, who will then decide on the exemption status based on the provided information and supporting documents. It’s critical to ensure all details are correct and to submit the form before the deadline.

To accurately complete the Detroit Property Tax Hardship form, follow these steps:

- Begin with entering the current date on the line next to "DATE:".

- Fill in the ward number for your property location next to "WARD:".

- Next to "ITEM:", write down the specific item number or case number if you have one. If you don’t, leave this blank.

- Type your full name on the line following "NAME:", ensuring it matches the name on your property deeds.

- Enter your current address, including any apartment or unit numbers, on the line following "ADDRESS:".

- Provide the zip code for your address next to "ZIP CODE:".

- Next to "PHONE NO:", fill in your current telephone number where you can be reached for any follow-up.

- Under the statement "I AM APPLYING FOR A POVERTY TAX EXEMPTION FOR THE FOLLOWING REASON:", clearly state your reasons for applying for the hardship exemption. Be specific about your financial situation, any recent hardships, and why you believe you qualify for tax relief.

- After carefully reviewing your application and ensuring all the information provided is true and accurate, sign your name at the bottom of the form where it says "SIGNATURE:".

Once you have completed all the steps, review the document to ensure all information is accurate and legible. Gather any required supporting documentation specified in the form instructions or by the Property Assessment Board of Review. Submit the completed form and any additional documents to the address listed at the top of the form. Keep a copy of all submitted materials for your records. Following submission, await communication from the Board of Review regarding the status of your application. This decision will play a substantial role in managing your property tax commitments for the year ahead.

Understanding Detroit Property Tax Hardship

What is the Detroit Property Tax Hardship Program?

The Detroit Property Tax Hardship Program offers a chance for homeowners facing financial difficulties to apply for a poverty tax exemption. This means if you're struggling to make ends meet, you might qualify for a reduction or complete waiver of your property taxes.

Who is eligible to apply for the hardship exemption?

To be eligible, applicants must own and occupy their home as their primary residence in Detroit and meet specific income and asset guidelines that demonstrate financial hardship. Detailed requirements can vary, so it's crucial to check the latest guidelines provided by the City of Detroit.

How do I apply for the program?

To apply, you need to fill out the Property Tax Hardship form, providing your name, address, contact information, and a detailed explanation of why you believe you qualify for the poverty tax exemption. Once completed, submit your application to the address listed on the form.

What documents are required alongside the hardship application?

Applicants typically need to submit proof of income (such as tax returns or pay stubs), proof of ownership, and residency (like a deed or voter registration), along with the completed hardship form. Additional documents may be required, so it’s advisable to check the exact requirements.

When should I submit my hardship application?

There are specific deadlines each year for submitting the hardship application. It’s important to submit your application as early as possible to ensure it's considered for the current tax year. Verify the deadline with the City of Detroit or on their official website to avoid missing out.

What happens after I submit the application?

Once submitted, your application will be reviewed by the Property Assessment Board of Review. They might request additional information or documents. If approved, you'll receive a notice detailing the exemption awarded. If denied, you'll be provided reasons and information on how to appeal the decision.

Does receiving a hardship exemption one year guarantee exemption in future years?

No, receiving a hardship exemption does not automatically qualify you for future years. You need to reapply each year, demonstrating your financial situation warrants the exemption annually.

Can I appeal if my application is denied?

Yes, if your application is denied, you have the right to appeal the decision. The notice of denial will include information on the appeal process and deadlines. It's critical to follow these instructions closely and submit your appeal within the given timeframe.

Where can I get help filling out my application?

Several local organizations and legal aid services in Detroit offer assistance with completing and submitting the hardship application. Additionally, the City of Detroit may provide resources or workshops to guide applicants through the process.

Is this program only available to homeowners in Detroit?

Yes, the Property Tax Hardship Program is specifically designed for homeowners residing in Detroit. However, other municipalities may offer similar programs tailored to their residents facing financial hardship, so it's worth checking with your local government if you live outside of Detroit.

Common mistakes

Completing the Detroit Property Tax Hardship form accurately is crucial for applicants seeking a poverty tax exemption. However, several common mistakes can compromise the effectiveness of your application. Below is an expanded list of mistakes often made during the application process:

Not fully completing every required field. Every part of the form needs to be filled out to ensure your application is evaluated properly. Incomplete applications may be delayed or rejected.

Failing to provide a detailed explanation for the hardship claim. The section asking for the reason behind your poverty tax exemption request should contain specific and comprehensive information to support your case.

Incorrectly addressing the form or sending it to the wrong department. It's important to send the form to the correct address listed at the top of the application to prevent any delays in processing.

Missing the deadline for submission. Being aware of and adhering to the deadline is critical, as late applications might not be considered.

Using pencil or non-permanent ink to fill out the form. All entries should be made in permanent ink to ensure legibility and permanence of the information provided.

Not signing the form. A missing signature can lead to an automatic disqualification because it is a necessary endorsement of the information provided.

Forgetting to include contact information or providing outdated or incorrect contact details. Accurate and current contact information is vital for any follow-up communication regarding the application.

Omitting supplementary documents that support the hardship claim. Often, additional documentation is required to substantiate the application details.

Lack of clarity or detail in the hardship explanation. The reason provided for applying must clearly demonstrate the need for a poverty tax exemption.

To avoid these common errors, applicants should:

Review the form thoroughly before submission to ensure no fields are missed.

Prepare all necessary documents ahead of time to accompany the form.

Ensure readability and clarity in every section of the application.

Double-check the address and submission deadlines relevant to the application cycle.

Seek assistance if there are any uncertainties about the application process or requirements.

Taking these steps can significantly increase the chances of a successful hardship application, enabling individuals and families in need to receive the support they require.

Documents used along the form

When applying for the Detroit Property Tax Hardship exemption, it's crucial to understand that this is not an isolated process. Several other forms and documents often accompany your application to provide a comprehensive overview of your financial situation. These supplementary documents are essential in supporting your claim and ensuring a smooth review process.

- Proof of Income: This can include recent pay stubs, social security income statements, pension statements, and any other verifiable income sources. These documents serve to establish your financial status and eligibility for the hardship exemption.

- Bank Statements: Current bank statements (usually for the past two to three months) can be useful in demonstrating your financial situation, including savings, checking accounts, and any other assets.

- Proof of Ownership: A copy of your deed or registration, proving you are the owner of the property in question.

- Property Tax Statements: Your most recent property tax bill(s) to confirm the property's tax status and identify any outstanding obligations.

- State Identification or Driver's License: A valid form of identification to verify your identity and residency within the city of Detroit.

- Employment Verification Letter: If employed, a letter from your employer may be required to verify employment status and income.

- Federal and State Tax Returns: Copies of your most recent tax returns to further support your financial claims and provide a comprehensive view of your annual earnings and tax contributions.

- Documentation of Hardship: Any applicable documents that can illustrate your need for a hardship exemption, such as medical bills, unemployment documentation, or other relevant paperwork.

Gathering these documents in advance can expedite the review process and improve your chances of qualifying for the hardship exemption. It's advisable to double-check with the City of Detroit or a legal advisor to ensure you have all necessary documents for your application, as requirements can be subject to change. The goal is to present a clear and complete picture of your financial situation, demonstrating beyond doubt your need for the Property Tax Hardship exemption.

Similar forms

The Homestead Property Tax Credit is a similar document to the Detroit Property Tax Hardship form. This credit helps homeowners with low to moderate incomes by reducing their property tax liability. Both forms assess the applicant's financial situation to determine eligibility for tax relief. They require information about the homeowner's income, property, and reasons for seeking assistance, focusing on providing financial relief linked to property taxes.

Another comparable form is the Mortgage Assistance Application used by many mortgage servicers and banks. This form is designed for homeowners facing financial difficulties that hinder their ability to make mortgage payments. Like the Detroit Property Tax Hardship form, it collects detailed personal and financial information to evaluate the applicant’s situation and determine eligibility for assistance programs, including loan modifications, forbearance, or other relief efforts.

The Utility Assistance Program application shares similarities with the Detroit Property Tax Hardship form as well. It targets individuals and families who struggle to pay their utility bills. Both forms require applicants to demonstrate financial hardship and provide personal information, such as income level and household size, to qualify for aid, whether for property taxes or utility expenses.

The Free Application for Federal Student Aid (FAFSA) is a federal document that, like the Detroit Property Tax Hardship form, aims to assess the financial needs of applicants. Although for a different purpose, education financing, it also gathers detailed financial and personal information to determine eligibility for federal aid. Both forms play pivotal roles in providing access to essential financial support services based on economic need.

Emergency Rental Assistance applications, offered by various housing agencies, are designed to help renters facing financial instability due to unforeseen circumstances. These applications, akin to the Detroit Property Tax Hardship form, assess an applicant's financial situation to provide temporary assistance, focusing on preventing eviction in this case, compared to tax relief.

The Supplemental Nutrition Assistance Program (SNAP) application is a federal form that assists individuals and families in affording food. Similar to the Detroit Property Tax Hardship form, it evaluates an applicant’s financial status to establish eligibility for benefits. Both aim to alleviate financial burdens, with one focusing on food insecurity and the other on property tax obligations.

Medicaid applications are designed for individuals and families with limited income and resources, offering health coverage. Comparable to the Detroit Property Tax Hardship form, Medicaid applications require detailed financial and personal information to ascertain eligibility for health benefits, both addressing essential needs based on financial situations.

The Income-Driven Repayment Plan Request form for federal student loans offers parallels to the Detroit Property Tax Hardship form as well. It allows borrowers with federal student loans to have their monthly payment amount adjusted based on income and family size. Both documents require thorough examination of the applicant's financial circumstances to provide relief aimed at reducing the financial burden, focusing on loan repayment in this instance versus property tax relief.

Dos and Don'ts

Filling out the Detroit Property Tax Hardship form requires careful attention to detail and completeness to ensure a successful submission. Here are some key dos and don'ts to keep in mind:

- Do carefully read all the instructions provided with the form to make sure you understand the requirements and eligibility criteria for the hardship program.

- Do gather all necessary documentation and evidence that supports your claim for a poverty tax exemption before you start filling out the form.

- Do print clearly in ink or type your responses to make sure all the information is legible and easy to understand.

- Do review your application for completeness and accuracy before submitting it, ensuring that you have answered every question and attached all required documents.

- Don't leave any sections blank. If a question does not apply to you, it's better to write "N/A" (not applicable) instead of leaving the space empty.

- Don't underestimate the importance of the application's narrative section. Use this opportunity to clearly explain your situation and why you are requesting the tax exemption.

- Don't forget to sign and date the form. An unsigned application can delay processing or result in a denial.

- Don't hesitate to seek assistance if you encounter difficulties in filling out the form. Help from a legal advisor, community organization, or the city's assessment office can clarify the process and improve your chances of approval.

By following these guidelines, applicants can increase the likelihood of a favorable outcome. Remember, the goal is to present a clear, complete, and compelling case for why you qualify for the Detroit Property Tax Hardship exception.

Misconceptions

Understanding the Detroit Property Tax Hardship form requires dispelling some common misconceptions. These misunderstandings can lead to confusion and prevent eligible residents from applying. Below are five such misconceptions explained in detail:

- Only homeowners with extremely low income qualify. While the program targets those in financial need, the definition of "financial need" is broader than many assume. Eligibility is not solely based on income but also on other financial hardships that make it difficult to pay property taxes.

- The process is too complicated. While any form of application involving city bureaucracy can seem daunting, the Detroit Property Tax Hardship form is designed to be straightforward. Applicants are required to provide basic information about themselves and the reason for their application, which the city uses to assess eligibility.

- Approval is rare. There is a misconception that applications for hardship exemptions are often denied. In reality, many applications are approved every year. The key is providing accurate and complete information that clearly demonstrates financial hardship.

- Applying can affect credit scores. Some people worry that applying for a property tax hardship exemption will negatively affect their credit score. However, applying for this exemption has no direct impact on one's credit score, as it is a request for relief from property taxes, not a form of credit or loan.

- It's only for the primary residence. While the exemption is primarily designed to help homeowners with their primary residence, applicants should not assume that properties other than their primary home are automatically ineligible. The important factor is demonstrating the property in question is experiencing financial hardship under the owner's current circumstances.

Dispelling these misconceptions is crucial for Detroit residents who may be struggling with their property taxes. Understanding the facts can encourage more eligible homeowners to apply, potentially easing their financial burdens.

Key takeaways

Understanding the Detroit Property Tax Hardship form is essential for residents seeking financial relief from property taxes due to poverty or financial hardship. This concise guide provides key takeaways to ensure the application process is navigated correctly.

- Eligibility for the Poverty Tax Exemption is determined based on specific financial hardship reasons provided by the applicant, making clarity and accuracy in these explanations of utmost importance.

- Applicants must complete the form with their full legal name, address, zip code, and phone number, ensuring that all provided information is current and verifiable.

- Signing the form is a mandatory step that legalizes the request for application. It acts as a personal affirmation of the information's accuracy and the seriousness of the hardship claim.

- The provided address must correspond with the property for which the tax hardship exemption is requested, highlighting the form's property-specific intent.

- Applicants are required to specify the reason(s) for applying for the exemption in detail, which allows the Property Assessment Board of Review to understand the applicant's financial situation better.

- Incorrect or incomplete forms may delay or invalidate the process, stressing the importance of double-checking all entered information before submission.

- Submission deadlines are critical, and applicants should ensure their forms are submitted within the timeframe specified by the City of Detroit to qualify for consideration.

- Understanding the guidelines and requirements set by the City of Detroit for the hardship program helps in preparing a strong application.

- It may be beneficial for applicants to seek advice or assistance when filling out the form to ensure all necessary documentation is accurate and fully completed.

- The decision by the Property Assessment Board of Review is final, making it critical for applicants to provide a comprehensive and truthful account of their financial hardship situation.

Note: Always verify the most current form and guidelines provided by the City of Detroit or consult legal assistance to ensure compliance and accuracy in the application process.

Popular PDF Documents

IRS 4506 - Accountants and tax professionals frequently use this form to help clients reconstruct lost or damaged financial records.

W8 Ben E Form 2023 - Pre-requisite for foreign entities to receive payments from U.S. sources without excessive withholding.