Get Denver Sales Tax Application Form

The Denver Sales Tax Application form is a critical document for all entrepreneurs and business owners in the City and County of Denver, Colorado, who are preparing to embark on the journey of selling goods, offering services, or otherwise engaging in commerce that requires collection of sales, use, lodger's tax, or occupational tax. This comprehensive application, which must be meticulously filled out and submitted to the Denver Treasury Division, encompasses a variety of sections including business information, ownership type, detailed contact information for owners or officers, and specific business location details. It requires applicants to specify the nature of their business, estimate the number of employees, and provide startup information which might include details of any business acquisition or relocation. Furthermore, the form delves into which tax types a business might be applicable for—ranging from occupational privilege tax, consumer use tax, sales tax, retailer's use tax, lodger’s tax, to the tourism improvement district tax for qualifying hotels. It also outlines license fee prorations, renewal periods, and provides specific instructions for making payment. As such, it serves not just as a formality for legal compliance, but as a foundational step in establishing the fiscal responsibilities of a business in Denver. Assistance and additional resources are offered through the Treasury Division’s helpline and website, ensuring that applicants can navigate this process with the necessary support. This application, demanding thoroughness in its completion, is essential for the lawful operation and fiscal health of Denver-based businesses.

Denver Sales Tax Application Example

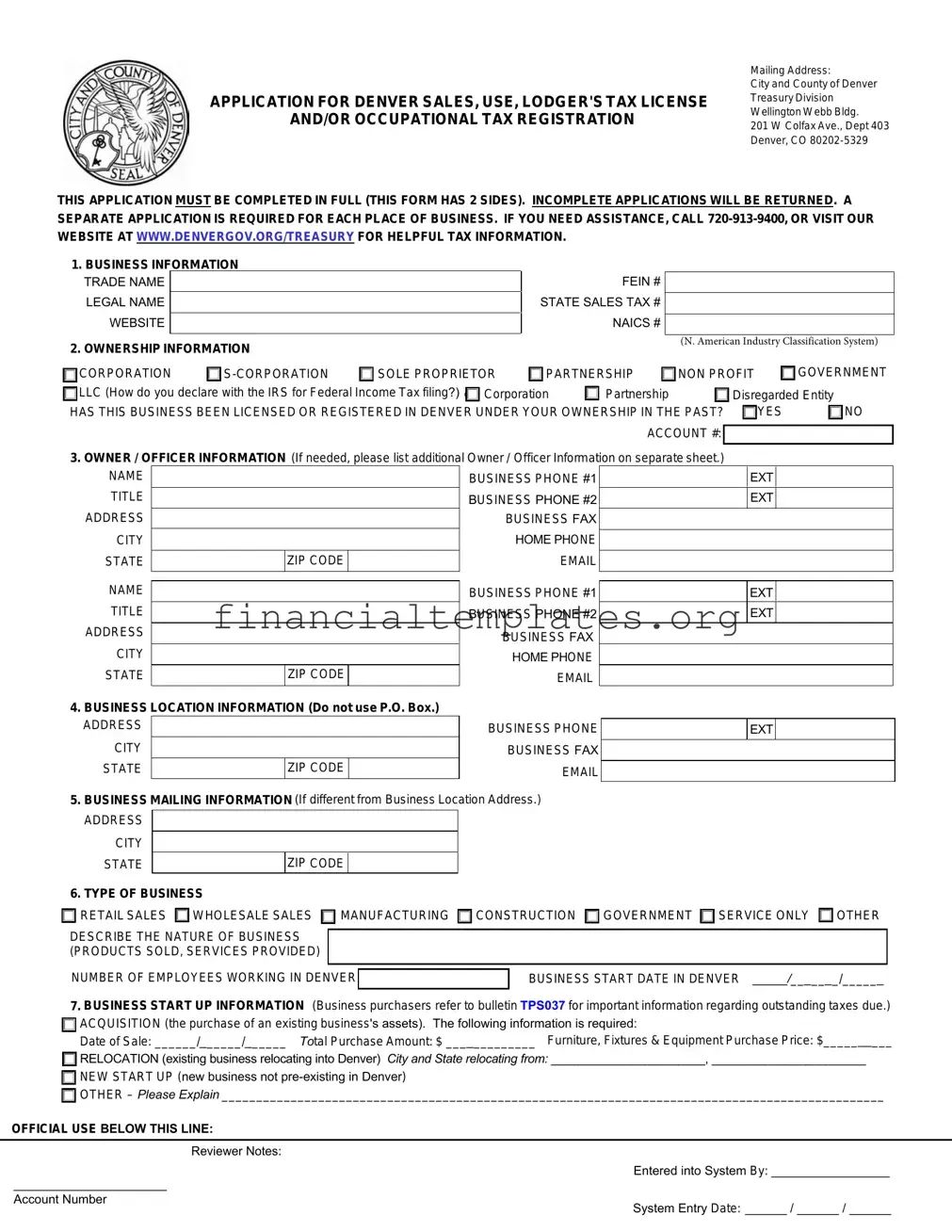

APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE

AND/OR OCCUPATIONAL TAX REGISTRATION

Mailing Address:

City and County of Denver

Treasury Division

Wellington Webb Bldg.

201 W Colfax Ave., Dept 403

Denver, CO

THIS APPLICATION MUST BE COMPLETED IN FULL (THIS FORM HAS 2 SIDES). INCOMPLETE APPLICATIONS WILL BE RETURNED. A SEPARATE APPLICATION IS REQUIRED FOR EACH PLACE OF BUSINESS. IF YOU NEED ASSISTANCE, CALL

1. BUSINESS INFORMATION |

FEIN # |

|

TRADE NAME |

|

|

LEGAL NAME |

|

STATE SALES TAX # |

WEBSITE |

|

NAICS # |

2. OWNERSHIP INFORMATION |

|

|

|

(N. American Industry Classification System) |

|||

|

|

|

|

|

|

||

CORPORATION |

SOLE PROPRIETOR |

PARTNERSHIP |

NON PROFIT |

GOVERNMENT |

|||

LLC (How do you declare with the IRS for Federal Income Tax filing?) Corporation |

Partnership |

|

Disregarded Entity |

||||

HAS THIS BUSINESS BEEN LICENSED OR REGISTERED IN DENVER UNDER YOUR OWNERSHIP IN THE PAST? |

YES |

NO |

|||||

ACCOUNT #:

3.OWNER / OFFICER INFORMATION (If needed, please list additional Owner / Officer Information on separate sheet.)

NAME |

|

|

|

BUSINESS PHONE #1 |

|

EXT |

|

|

TITLE |

|

|

|

BUSINESS PHONE #2 |

|

EXT |

|

|

ADDRESS |

|

|

|

BUSINESS FAX |

|

|

|

|

CITY |

|

|

|

HOME PHONE |

|

|

|

|

STATE |

|

ZIP CODE |

|

|

|

|

|

|

NAME |

|

TITLE |

|

ADDRESS |

|

CITY |

|

STATE |

ZIP CODE |

4.BUSINESS LOCATION INFORMATION (Do not use P.O. Box.)

ADDRESS

CITY |

|

STATE |

ZIP CODE |

BUSINESS PHONE #1 BUSINESS PHONE #2 BUSINESS FAX HOME PHONE EMAIL

BUSINESS PHONE BUSINESS FAX EMAIL

EXT

EXT

EXT

5. BUSINESS MAILING INFORMATION (If different from Business Location Address.)

ADDRESS CITY STATE

ZIP CODE

6. TYPE OF BUSINESS |

|

|

|

|

|

|

RETAIL SALES |

WHOLESALE SALES |

MANUFACTURING |

CONSTRUCTION |

GOVERNMENT |

SERVICE ONLY |

OTHER |

DESCRIBE THE NATURE OF BUSINESS |

|

|

|

|

|

|

(PRODUCTS SOLD, SERVICES PROVIDED) |

|

|

|

|

|

|

NUMBER OF EMPLOYEES WORKING IN DENVER |

BUSINESS START DATE IN DENVER _____/_______/______ |

|||||

7.BUSINESS START UP INFORMATION (Business purchasers refer to bulletin TPS037 for important information regarding outstanding taxes due.)  ACQUISITION (the purchase of an existing business's assets). The following information is required:

ACQUISITION (the purchase of an existing business's assets). The following information is required:

Date of Sale: ______/______/______ Total Purchase Amount: $ _____________ Furniture, Fixtures & Equipment Purchase Price: $__________

RELOCATION (existing business relocating into Denver) City and State relocating from: _______________________, _______________________

RELOCATION (existing business relocating into Denver) City and State relocating from: _______________________, _______________________

NEW START UP (new business not

NEW START UP (new business not

OTHER – Please Explain ________________________________________________________________________________________________

OTHER – Please Explain ________________________________________________________________________________________________

OFFICIAL USE BELOW THIS LINE:

|

Reviewer Notes: |

______________________ |

Entered into System By: _________________ |

|

|

Account Number |

System Entry Date: ______ / ______ / ______ |

|

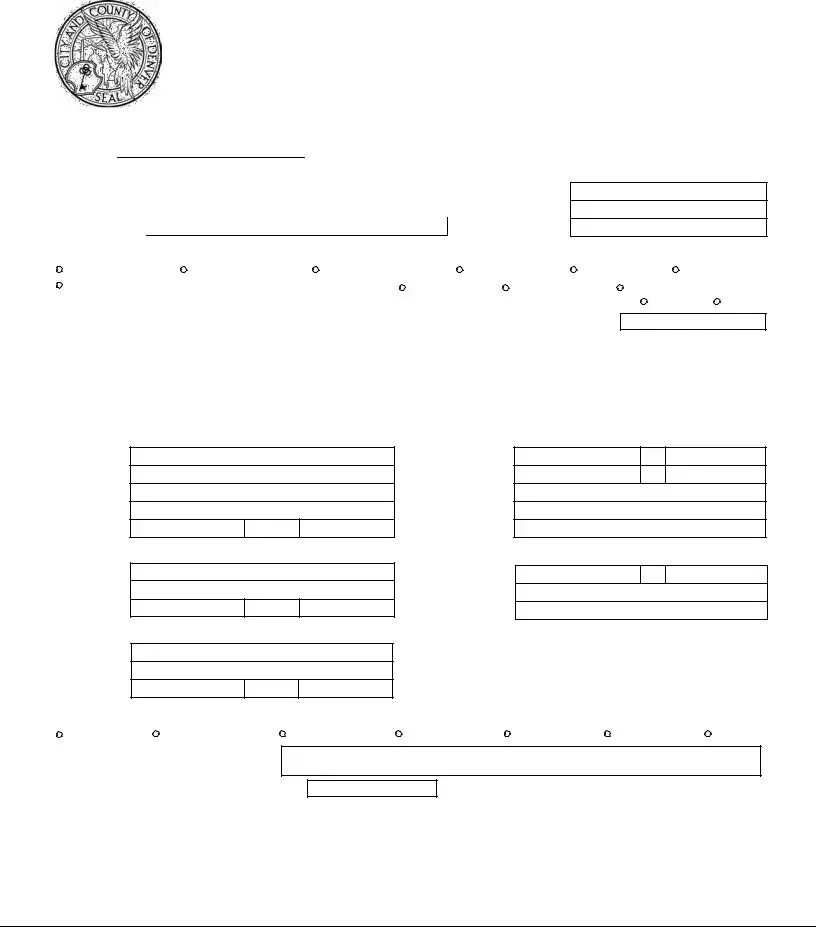

8.TAX TYPE INFORMATION

a)OCCUPATIONAL PRIVILEGE TAX ACCOUNT

THE CITY AND COUNTY OF DENVER IMPOSES AN OCCUPATIONAL PRIVILEGE TAX ON INDIVIDUALS WHO WORK WITHIN THE CITY LIMITS OF DENVER. THE EMPLOYEE NEED NOT LIVE IN DENVER AND THE BUSINESS NEED NOT BE BASED IN DENVER, THE PERSON NEED ONLY PERFORM SERVICES WITHIN THE CITY (REQUEST TPS003 FOR MORE INFORMATION).ANNUAL FILING IS ALLOWED ONLY FOR INDIVIDUALS, SOLE PROPRIETORS, AND PARTNERSHIPS WITHOUT ANY EMPLOYEES.UNQUALIFIED SELECTION OF THIS FILING FREQUENCY MAY RESULT IN THE ASSESSMENT OF LATE FILING PENALTIES AND INTEREST.

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY (MORE THAN 10 EMPLOYEES) |

|

3RD PARTY |

|

QUARTERLY (10 OR FEWER EMPLOYEES) |

b) CONSUMER USE TAX ACCOUNT (No License Fee.) |

|

ANNUALLY (SEE ABOVE) |

|

|

|

||

IF YOU BUY TANGIBLE PERSONAL PROPERTY FOR OWN USE AND THE VENDOR DOES NOT COLLECT DENVER SALES TAX ON THE INVOICE, THE TAX DUE TO DENVER MUST BE REPORTED AND PAID TO DENVER. THIS INCLUDES PERSONAL PROPERTY ACQUIRED WITH THE PURCHASE OF A BUSINESS (REQUEST TPS002 FOR MORE INFORMATION).

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY ($300 / MONTH OR MORE IS DUE) |

|

3RD PARTY |

|

QUARTERLY (LESS THAN $300 / MONTH IS DUE) |

c) SALES TAX LICENSE |

|

|

ANNUALLY (LESS THAN $15 / MONTH IS DUE) |

|

|

|

LICENSE IS REQUIRED IF YOU ARE A DENVER VENDOR. THE LICENSE AUTHORIZES YOU TO COLLECT AND REMIT SALES TAX YOU MAY OWE (REQUEST TPS001 FOR MORE INFORMATION). A TAX LICENSE IS NOT A LICENSE TO DO BUSINESS. ADDITIONAL BUSINESS LICENSES OR PERMITS MAY BE REQUIRED BY OTHER CITY DEPARTMENTS, EXCISE AND LICENSES DEPARTMENT

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY ($300 / MONTH OR MORE IS DUE) |

|

|

||

|

3RD PARTY |

|

QUARTERLY (LESS THAN $300 / MONTH IS DUE) |

d) RETAILER'S USE TAX LICENSE |

|

ANNUALLY (LESS THAN $15 / MONTH IS DUE) |

|

|

|

||

BUSINESSES LOCATED OUTSIDE OF DENVER MAY BE REQUIRED TO COLLECT RETAILER'S USE TAX (TAX ON DELIVERIES INTO DENVER AT THE SALES TAX RATE). IF REQUIRED TO COLLECT THE TAX, YOU MUST APPLY FOR A LICENSE.

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY ($300 / MONTH OR MORE IS DUE) |

|

3RD PARTY |

|

QUARTERLY (LESS THAN $300 / MONTH IS DUE) |

e) LODGER'S TAX LICENSE |

|

|

ANNUALLY (LESS THAN $15 / MONTH IS DUE) |

LICENSE IS REQUIRED, IF YOU FURNISH ROOMS OR ACCOMMODATIONS IN THE CITY OF DENVER FOR A PERIOD OF LESS THAN 30 CONSECUTIVE DAYS. A FEE IS REQUIRED, IF THE APPLICATION IS NOT COMBINED WITH A SALES TAX APPLICATION.

TAX WILL BE FILED BY: |

SELF |

FILING FREQUENCY: |

MONTHLY ($300 / MONTH OR MORE IS DUE) |

|

3RD PARTY |

|

QUARTERLY (LESS THAN $300 / MONTH IS DUE) |

f) TOURISM IMPROVEMENT DISTRICT TAX ACCOUNT (No License Fee) |

ANNUALLY (LESS THAN $15 / MONTH IS DUE) |

||

HOTELS WITH 50 OR MORE ROOMS ARE REQUIRED TO COLLECT THE TOURISM IMPROVEMENT DISTRICT TAX WHICH WILL BE FILED ON THE SAME RETURN AS LODGERS TAX. IF YOU ARE A HOTEL, PLEASE INDICATE HOW MANY ROOMS YOU HAVE.

50 OR MORE ROOMS NOTE: HOTELS WITH 50 OR MORE ROOMS ARE REQUIRED TO FILE ONLINE.

9. LICENSE FEE AND RENEWAL PERIOD

LICENSES WILL BE ISSUED FOR A

10. LICENSE FEE PRORATION SCHEDULE

TAX LICENSE TYPES |

|

MAKE CHECKS PAYABLE TO "MANAGER OF FINANCE" |

|||||

CIRCLE ONE ONLY |

Jan. 1. 2020 to |

July 1. 2020 to |

Jan. 1. 2021 to |

July 1. 2021 to |

|

(see mailing address on 1st page) |

|

June 30, 2020 |

Dec. 31, 2020 |

June 30, 2021 |

Dec. 31, 2021 |

|

LICENSE FEE REMITTED: |

||

|

|

||||||

SALES TAX |

$50.00 |

$37.50 |

$25.00 |

$12.50 |

|

|

|

SALES & LODGER'S TAX |

$50.00 |

$37.50 |

$25.00 |

$12.50 |

$ |

|

|

LODGER'S TAX |

$50.00 |

$37.50 |

$25.00 |

$12.50 |

|

|

|

|

|

|

|||||

RETAILER'S USE TAX |

$50.00 |

$37.50 |

$25.00 |

$12.50 |

|

|

|

11.CONTACTS (If different from Main Business Contact.)

TAX TYPE |

OCCUPATIONAL PRIVILEGE TAX |

CONSUMER USE TAX |

SALES / RETAILER'S USE TAX |

LODGER'S TAX |

||||||||

CONTACT PERSON |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TITLE |

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS PHONE |

|

EXT |

|

|

EXT |

|

|

EXT |

|

|

EXT |

|

BUSINESS FAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.MAILING ADDRESSES (If different from Main Business Mailing Address.)

TAX TYPE |

OCCUPATIONAL PRIVILEGE TAX |

CONSUMER USE TAX |

SALES / RETAILER'S USE TAX |

LODGER'S TAX |

MAILING ADDRESS |

|

|

|

|

CITY |

|

|

|

|

STATE |

ZIP |

ZIP |

ZIP |

ZIP |

I HEREBY CERTIFY UNDER PENALTY OF PERJURY, THAT THE STATEMENTS MADE HEREIN ARE TO THE BEST OF MY KNOWLEDGE TRUE, CORRECT AND COMPLETE.

SIGNATURE OF APPLICANT |

|

TITLE |

|

DATE |

Document Specifics

| Fact | Detail |

|---|---|

| Form Title | Application for Denver Sales, Use, Lodger's Tax License and/or Occupational Tax Registration |

| Mailing Address for Submission | City and County of Denver Treasury Division, Wellington Webb Bldg, 201 W Colfax Ave., Dept 403, Denver, CO 80202-5329 |

| Assistance Information | Assistance available at 720-913-9400 or www.denvergov.org/treasury |

| Application Requirements | This application must be completed in full and is required for each place of business. |

| Ownership Types Included | Corporation, S-corporation, Sole Proprietor, Partnership, Non-Profit, Government, LLC |

| Tax Type Information Included | Occupational Privilege Tax Account, Consumer Use Tax Account, Sales Tax License, Retailer's Use Tax License, Lodger's Tax License, Tourism Improvement District Tax Account |

| License Fee and Renewal Period | Licenses are issued for a two-year period, renewable on a biennial basis by January 1 of even-numbered years. |

| License Fee Proration Schedule | Detailed proration schedule provided based on when the business begins within a specified six-month period. |

Guide to Writing Denver Sales Tax Application

Filling out the Denver Sales Tax Application form is a crucial step for businesses operating in Denver that need to comply with local tax laws. This process involves providing detailed information about your business, its ownership, and tax obligations. It ensures your business is registered for the appropriate taxes in Denver and avoids potential penalties for non-compliance. Follow these instructions carefully to complete your application.

- Start by providing your business information at the top of the form. Enter your Federal Employer Identification Number (FEIN), trade name, legal name, state sales tax number, website, and NAICS number (North American Industry Classification System).

- Under ownership information, select your business type (corporation, S-corporation, sole proprietor, partnership, non-profit, government, or LLC) and specify how you declare with the IRS for federal income tax filing. Indicate if your business has been licensed or registered in Denver under your ownership in the past, providing the account number if applicable.

- Fill out the owner/officer information section with the name, business phone numbers, address, city, state, zip code, and email of the primary owner or officer. Use a separate sheet if more information is needed.

- Provide business location information, ensuring not to use a P.O. Box for the address. Include all requested details, such as business and fax numbers.

- For business mailing information, enter the address if different from the business location address.

- Describe the type of business, including the nature of business (products sold, services provided), the number of employees working in Denver, and the business start date in Denver.

- In the business start-up information section, specify whether your business is an acquisition, relocation, new start-up, or other, providing relevant details.

- Select the appropriate tax type information for your business, indicating whether you're applying for an occupational privilege tax account, consumer use tax account, sales tax license, retailer's use tax license, lodger's tax license, or tourism improvement district tax account. Choose the filing frequency, and whether you'll be filing taxes yourself or using a third party.

- Determine the license fee and renewal period, noting that licenses are issued for a two-year period.

- According to the license fee proration schedule, calculate your due license fee based on when your business begins operation within the fiscal year. Make the check payable to "Manager of Finance."

- If your tax contacts are different from the main business contact, provide their information under the contacts section.

- For the mailing addresses section, list any different addresses for specific tax types if they vary from the main business mailing address.

- Finally, certify the application by signing at the bottom. Include the signature of the applicant, title, and date to validate the form. Your application must be complete and accurate to be processed without delays.

After submitting the Denver Sales Tax Application form, the city's Treasury Division will review your application. Once processed, you will receive your tax license and account number, enabling you to comply with Denver's sales tax regulations. Ensure to keep a copy of the completed application for your records.

Understanding Denver Sales Tax Application

-

Who needs to complete the Denver Sales Tax Application form?

Any entity - including individuals, partnerships, corporations, and limited liability companies - that plans to conduct business activities in Denver which involve retail sales, wholesale sales, manufacturing, construction, or the provision of services, among others, is required to complete the Denver Sales Tax Application form. This form is necessary for obtaining the relevant tax licenses and/or registrations to legally operate within the City and County of Denver.

-

Is a separate application required for each business location?

Yes, if your business operates out of multiple locations within Denver, you must submit a separate Denver Sales Tax Application form for each distinct location. This ensures that each place of business is properly licensed and registered for tax purposes.

-

What information is needed to complete the application?

The application requires detailed information such as the Federal Employer Identification Number (FEIN), business name (trade and legal names), North American Industry Classification System (NAICS) number, type of business entity (e.g., corporation, partnership, sole proprietorship), ownership details, and information on the nature of the business, including the product sold or services provided. It also requires business location information, contact details, and specific tax type information relevant to your business operations.

-

Can I file my taxes online?

Yes, businesses, especially those with specific tax obligations like the Lodgers’ Tax for hotels with 50 or more rooms, are encouraged to file their taxes online. However, the application form provides options for tax filing frequency and method (self or third party), which vary based on the type of tax account and amount due, allowing for monthly, quarterly, or annual filings.

-

What happens if my application is incomplete?

Incomplete applications will be returned. It is crucial to ensure that all sections of the application are fully completed and that all necessary information is provided. This includes the selection of tax accounts required for your type of business, as well as the accurate reporting of ownership and contact details.

-

How are license fees determined?

License fees are determined based on the type of tax license(s) applied for and the date your business begins operation. The fees are prorated for businesses starting at different times throughout the year. These fees cover the administrative costs of establishing and maintaining tax accounts and are non-refundable.

-

What is the renewal process for my license?

Licenses are issued for a two-year period and must be renewed biennially by January 1 of even-numbered years. It is the responsibility of the licensee to submit a renewal form before the due date to ensure ongoing compliance with Denver's tax licensing requirements.

-

Where can I get assistance if I have questions about the application form?

If you have questions or need assistance with completing the Denver Sales Tax Application form, you can call 720-913-9400. Additionally, the City and County of Denver Treasury Division’s website provides helpful tax information and resources that can assist you in the application process.

Common mistakes

When people apply for a Denver Sales Tax Application, a few common mistakes can complicate the process. Recognizing and avoiding these errors can streamline your experience and ensure a smoother path to compliance. Here are seven mistakes people frequently make:

Failing to complete the application in full. Every section of the application is important. Incomplete applications are returned, causing delays.

Submitting a single application for multiple business locations. Each place of business requires its own application.

Incorrect classification of the business type. Whether you're a sole proprietor, an LLC, an S-corporation, etc., the way you classify your business affects your taxation and legal obligations.

Overlooking the requirement to indicate previous Denver licensure or registration under current ownership. This information is crucial for the city's records and can influence your application's processing.

Misunderstanding the tax type information section. Various taxes (occupational privilege, consumer use, sales tax, etc.) have different filing frequencies and requirements. Selecting the incorrect option may lead to penalties.

Neglecting to apply for the correct type of tax license. Denver offers several license types, including retailer's use tax license and lodger's tax license, each with specific criteria and obligations.

Inaccurate reporting of the number of employees working in Denver, which impacts the occupational privilege tax account selection and compliance.

By paying close attention to these areas, applicants can avoid common pitfalls and ensure their Denver Sales Tax Application process is both accurate and efficient.

Documents used along the form

Completing the Denver Sales Tax Application form is a fundamental step for businesses operating within the city, ensuring compliance with local tax obligations. However, this application often requires additional documentation to provide a more detailed understanding of the business's structure, financial obligations, and legal compliances. Here's an overview of up to 10 other forms and documents that are frequently used alongside this application, providing clarity and support to the process.

- Business License Application: Most businesses need a specific license to operate legally in Denver. This document details the business type, ownership, and location.

- Articles of Incorporation: Required for corporations, this document outlines the company’s structure, purpose, and the rules it will operate under.

- Partnership Agreement: For businesses owned by two or more individuals, this document specifies the rights, responsibilities, and profit-sharing among partners.

- Operating Agreement: Utilized by LLCs, this outlines the management structure and operating procedures of the business.

- Proof of EIN (Employer Identification Number): Issued by the IRS, this confirms the business’s tax identification number, necessary for tax filing and employee payroll.

- Zoning Permit: Confirms the business location complies with local zoning laws, which regulate land and building use.

- Building Permit: Required if the business location needs renovations or construction to accommodate the business operations.

- Sales Tax License Certificate: Proves the business is registered to collect sales tax on goods sold directly to consumers within Denver.

- Special Event Permit: Necessary for businesses organizing temporary events in Denver that might affect the usual flow of traffic or demand city services.

- Signature Authorization Form: Identifies individuals authorized to handle tax documents and make declarations on behalf of the business.

By gathering and submitting the proper forms and documents along with the Denver Sales Tax Application, businesses can streamline their compliance process, avoid unnecessary delays, and contribute to a smooth operation. Each document plays a specific role in establishing the business’s legal and financial foundation, ensuring that both the city and the business benefit from a well-regulated commercial environment.

Similar forms

The Denver Sales Tax Application form closely resembles a Business License Application form that many cities and states require for operating a business legally within their jurisdiction. Both documents serve as the initial registration for businesses to comply with local regulations, including tax obligations. They collect comprehensive details about the business, such as ownership structure, type of business, estimated number of employees, and specific location information. This parallel structure ensures local governments can accurately tax and monitor businesses operating within their areas, and it helps businesses ensure they're meeting local requirements.

Similar to a State Sales Tax Registration form, the Denver Sales Tax Application requires businesses to provide detailed information about their operations to register for sales tax collection and remittance. Both forms are crucial for businesses that sell goods or services, as they authorize the business to collect sales tax on behalf of the government. They typically ask for details like the Federal Employer Identification Number (FEIN), business name, and the nature of the goods or services sold, ensuring compliance with tax laws.

The application also has similarities with an Employer Identification Number (EIN) Application, issued by the IRS. While the EIN Application is federal and focuses on identifying tax accounts for employers, the Denver form also collects identification and tax information for local purposes. Both are mandatory steps for most businesses, gathering essential information like business structure, ownership details, and operational specifics to properly classify and tax the entity.

Another comparable document is the Occupational Privilege Tax (OPT) registration forms used in jurisdictions that impose a tax on individuals for the privilege of working within their area. The Denver form includes a section for OPT, showing overlap with standalone OPT registration documents. Both require details on the business and its employees to calculate the tax due. This ensures that all businesses contributing to the local economy are also contributing fairly to local services through taxes.

Lastly, the form bears resemblance to a Zoning Permit application, which is necessary for ensuring that businesses operate in appropriate areas as per local zoning laws. Though the Denver Sales Tax Application doesn't directly authorize business location use, it requires detailed location information and business type that could be cross-referenced with zoning requirements. This ensures businesses are not only paying their due taxes but are also situated in locations that are aligned with city planning and development codes.

Dos and Don'ts

When engaging with the Denver Sales Tax Application form, it's paramount to navigate the process with care and attention to detail. The following guidelines aim to ensure an accurate and efficient submission.

Do:- Complete all sections: Ensure that no part of the application is left blank. Incomplete applications will be returned, delaying the process.

- Use accurate business information: Double-check your FEIN, trade name, legal name, state sales tax #, website, and NAICS # for correctness.

- Provide detailed ownership information: Whether your business is a corporation, partnership, or sole proprietorship, the ownership structure must be clear.

- Be thorough with owner/officer information: Each person holding a significant role in the business needs to be listed with accurate contact details.

- Select the correct tax type: Understand the distinctions between occupational privilege tax, consumer use tax, sales tax license, and others, selecting what's relevant to your business operations.

- Use a P.O. Box for business location information: Physical addresses provide the necessary validation for your business's location.

- Ignore the business start-up section: Whether it's a new startup, acquisition, or relocation, this section provides crucial context for your business's operational status in Denver.

- Forget about license fee and renewal details: Acknowledge the prorated fee schedule and renewal obligations to avoid unexpected lapses in your licensing.

- Overlook the certification statement: Signing under penalty of perjury means ensuring every piece of information provided is true, correct, and complete.

Adhering to these dos and don'ts will not only streamline your application process but also fortify compliance with Denver's tax regulations, safeguarding your business from potential setbacks.

Misconceptions

When approaching the Denver Sales Tax Application process, individuals often hold misconceptions that can complicate their application process. Understanding these misconceptions is crucial to ensure a smooth and compliant engagement with city tax obligations.

One application covers all business locations: A common misunderstanding is that one Denver Sales Tax Application is sufficient for all of a business's locations within Denver. In reality, the city requires a separate application for each business location to accurately manage tax obligations and records.

Online businesses are exempt: Many believe that if their business operates solely online with no physical presence in Denver, they are not required to file. However, Denver mandates that online businesses selling to Denver residents must comply with sales tax regulations, highlighting the city's commitment to fair tax practices across both brick-and-mortar and online sales.

Lodger's tax applies only to hotels: The Lodger's Tax section is often misunderstood to apply strictly to traditional hotel accommodations. In fact, any business providing rooms or accommodations for periods of less than 30 consecutive days, including short-term rental properties and bed-and-breakfasts, must comply with the Lodger's Tax License requirements.

Consumer Use Tax is automatically calculated: Some applicants assume that the Consumer Use Tax, pertaining to tangible personal property purchased for business use without Denver sales tax, is automatically calculated or monitored by vendors. Businesses are responsible for accurately reporting and paying this tax based on their own records and purchases.

Application assistance is hard to get: The misconception that finding help with the application process is difficult can deter some from applying. However, the City and County of Denver Treasury Division provides assistance through a hotline and offers comprehensive tax information on their website, making it easier for businesses to understand and fulfill their tax obligations.

No penalties for late applications: Finally, a critical misconception is that there are no repercussions for submitting a Denver Sales Tax Application late. Delay in application can lead to penalties and interest charges, underscoring the importance of timely filing to avoid unnecessary financial burdens.

Dispelling these misconceptions is essential for business owners and operators in Denver. Accurate understanding and compliance with the city’s tax application process can not only prevent legal complications but also contribute to the seamless operation of business activities within this vibrant community.

Key takeaways

Filling out the Denver Sales Tax Application requires careful attention to detail and an understanding of your business's specific needs. Here are ten key takeaways to guide you through the process:

- Every section of the application must be completed fully; otherwise, it will be returned. This ensures that all necessary information is provided for the processing of your tax license.

- A separate application is necessary for each place of business. This is crucial for businesses operating in multiple locations within Denver.

- Assistance is available both by phone at 720-913-9400 and online at the Denver Treasury website, offering resources and further tax information.

- The application asks for detailed ownership and business information, including the Federal Employer Identification Number (FEIN) and the type of ownership (e.g., LLC, corporation). This information helps categorize your business correctly for tax purposes.

- Ownership Information must include how the entity declares with the IRS for federal income tax filings, which impacts your tax obligations and filings.

- Applicants must disclose whether the business has been previously licensed or registered under your ownership in Denver, indicating a continuation or change in business operations that could affect tax responsibilities.

- The form accommodates various business operations (e.g., retail sales, manufacturing, services) and requires a description of the nature of your business. This description helps determine the specific tax licenses and accounts required.

- Denver imposes different taxes, such as Occupational Privilege Tax, Consumer Use Tax, Sales Tax, Retailer's Use Tax, and Lodger’s Tax, depending on business activities. Identifying the correct tax type is essential for compliance.

- Licenses are issued for a two-year period and need to be renewed biennially by January 1, underscoring the importance of maintaining up-to-date licensure for uninterrupted business operations.

- License fees are prorated based on when the business starts its operation within the two-year cycle, making the timing of your application financially consequential.

Approaching the Denver Sales Tax Application with a thorough understanding of these key aspects will streamline the process, ensuring compliance with local tax obligations and contributing to a smoother operation of your Denver-based business activities.

Popular PDF Documents

IRS W-3 - HR departments must familiarize themselves with the W-3 form to ensure compliance with federal tax reporting requirements.

What Does G Mean on Costco Receipt - Tips for ensuring your sales tax exemption claim is accepted by Costco, focusing on the correct submission of forms and documentation.

Irsc Rn Program - The detailed eligibility requirements on the IRSC-68 form serve as a guideline for aspiring Dual Enrollment students, aiding in self-assessment before application.