Get Denver Occupational Privilege Tax Form

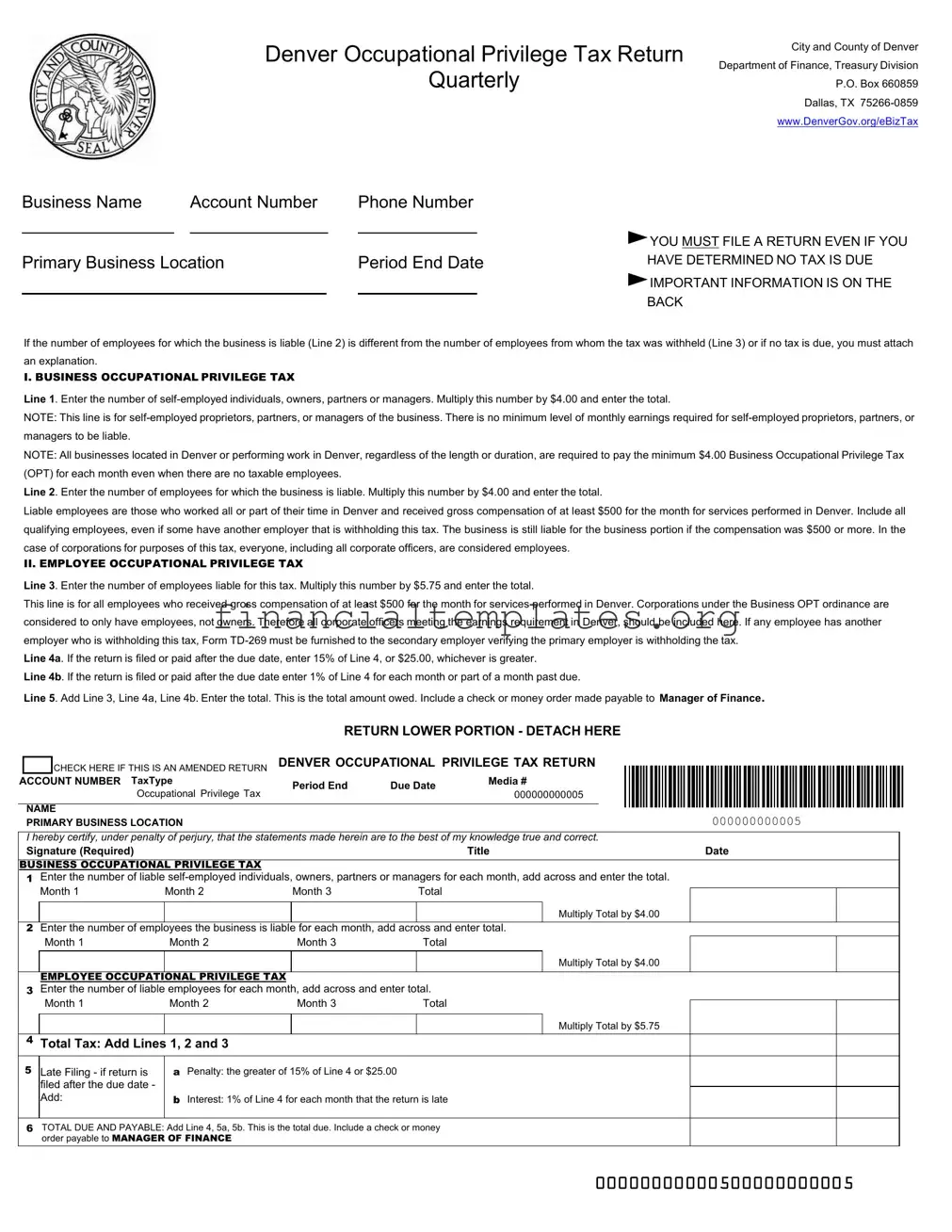

In the bustling city of Denver, businesses and their employees are subject to a unique fiscal obligation known as the Occupational Privilege Tax (OPT), which is meticulously outlined in the Denver Occupational Privilege Tax Return form. This document serves a crucial role for both the City and County of Denver's Department of Finance and businesses operating within Denver's jurisdiction. Essential for ensuring compliance, the form meticulously records and calculates the tax due from both employers and their employees, emphasizing the shared responsibility in catering to the city's financial stability. Businesses are responsible for a base rate for each owner, partner, or manager, as well as a per-employee rate for those earning over a certain threshold in Denver. Moreover, the form underscores the importance of timely submission, detailing penalties for late filings which include a percentage of the unpaid tax or a flat fee, alongside accruing interest. These elements together paint a clear picture of Denver's proactive approach to maintaining a well-funded city infrastructure, all while laying out an organized process for businesses to contribute their fair share through the Denver Occupational Privilege Tax Return form.

Denver Occupational Privilege Tax Example

Denver Occupational Privilege Tax Return

Quarterly

City and County of Denver

Department of Finance, Treasury Division

P.O. Box 660859

Dallas, TX

www.DenverGov.org/eBizTax

Business Name |

Account Number |

Phone Number |

|

|||

|

|

|

|

|

|

YOU MUST FILE A RETURN EVEN IF YOU |

|

|

|

|

|

|

|

Primary Business Location |

|

Period End Date |

HAVE DETERMINED NO TAX IS DUE |

|||

|

|

|

|

|

|

IMPORTANT INFORMATION IS ON THE |

BACK

If the number of employees for which the business is liable (Line 2) is different from the number of employees from whom the tax was withheld (Line 3) or if no tax is due, you must attach an explanation.

I. BUSINESS OCCUPATIONAL PRIVILEGE TAX

Line 1. Enter the number of

NOTE: This line is for

NOTE: All businesses located in Denver or performing work in Denver, regardless of the length or duration, are required to pay the minimum $4.00 Business Occupational Privilege Tax (OPT) for each month even when there are no taxable employees.

Line 2. Enter the number of employees for which the business is liable. Multiply this number by $4.00 and enter the total.

Liable employees are those who worked all or part of their time in Denver and received gross compensation of at least $500 for the month for services performed in Denver. Include all qualifying employees, even if some have another employer that is withholding this tax. The business is still liable for the business portion if the compensation was $500 or more. In the case of corporations for purposes of this tax, everyone, including all corporate officers, are considered employees.

II. EMPLOYEE OCCUPATIONAL PRIVILEGE TAX

Line 3. Enter the number of employees liable for this tax. Multiply this number by $5.75 and enter the total.

This line is for all employees who received gross compensation of at least $500 for the month for services performed in Denver. Corporations under the Business OPT ordinance are considered to only have employees, not owners. Therefore all corporate officers meeting the earnings requirement in Denver, should be included here. If any employee has another employer who is withholding this tax, Form

Line 4a. If the return is filed or paid after the due date, enter 15% of Line 4, or $25.00, whichever is greater.

Line 4b. If the return is filed or paid after the due date enter 1% of Line 4 for each month or part of a month past due.

Line 5. Add Line 3, Line 4a, Line 4b. Enter the total. This is the total amount owed. Include a check or money order made payable to Manager of Finance.

RETURN LOWER PORTION - DETACH HERE

|

|

CHECK HERE IF THIS IS AN AMENDED RETURN |

DENVER OCCUPATIONAL PRIVILEGE TAX RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ACCOUNT NUMBER TaxType |

Period End |

Due Date |

Media # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Occupational Privilege Tax |

000000000005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRIMARY BUSINESS LOCATION |

|

|

000000000005 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

I hereby certify, under penalty of perjury, that the statements made herein are to the best of my knowledge true and correct.

Signature (Required) |

Title |

Date |

BUSINESS OCCUPATIONAL PRIVILEGE TAX

1Enter the number of liable

MONTH 1 |

MONTH 2 |

MONTH 3 |

TOTAL |

2Enter the number of employees the business is liable for each month, add across and enter total.

Multiply Total by $4.00

MONTH 1 |

MONTH 2 |

MONTH 3 |

TOTAL |

Multiply Total by $4.00

EMPLOYEE OCCUPATIONAL PRIVILEGE TAX

3Enter the number of liable employees for each month, add across and enter total.

MONTH 1 |

MONTH 2 |

MONTH 3 |

TOTAL |

Multiply Total by $5.75

4Total Tax: Add Lines 1, 2 and 3

5

Late Filing - if return is filed after the due date - Add:

aPenalty: the greater of 15% of Line 4 or $25.00

bInterest: 1% of Line 4 for each month that the return is late

6TOTAL DUE AND PAYABLE: Add Line 4, 5a, 5b. This is the total due. Include a check or money order payable to MANAGER OF FINANCE

00000000000500000000005

Document Specifics

| Fact | Detail |

|---|---|

| Governing Law | The Denver Occupational Privilege Tax is governed by the laws of the City and County of Denver. |

| Objective | To collect tax from businesses and their employees operating within Denver. |

| Business Occupational Privilege Tax | Businesses in Denver are required to pay a minimum of $4.00 per month for each owner, partner, manager, or self-employed individual, regardless of earnings. |

| Employee Occupational Privilege Tax | Employees earning at least $500 for services performed in Denver must have $5.75 per month withheld for this tax. |

| Late Payment Penalties | If the payment or filing is late, penalties include 15% of the due tax or $25.00, whichever is greater, plus 1% of the due tax for each month or part thereof overdue. |

Guide to Writing Denver Occupational Privilege Tax

Filing the Denver Occupational Privilege Tax form accurately is crucial for all businesses operating within the city, ensuring they meet local tax obligations. This form helps calculate both the business and employee occupational privilege taxes that are due quarterly. It's designed to capture essential details about taxable individuals and amounts, highlighting the need for businesses to maintain accurate records. To simplify the process, follow these guided steps to fill out the form correctly and submit it on time to avoid any potential penalties.

- Begin by entering your Business Name, Account Number, and Phone Number at the top section of the form. This ensures your form is linked to the correct account for processing.

- Fill in your Primary Business Location and specify the Period End Date for the quarter you are reporting.

- Under I. BUSINESS OCCUPATIONAL PRIVILEGE TAX:

- For Line 1, enter the total number of self-employed individuals, owners, partners, or managers and multiply this number by $4.00. Write the total amount.

- In Line 2, list the number of employees liable for the tax, multiply by $4.00, and document the total.

- Moving to II. EMPLOYEE OCCUPATIONAL PRIVILEGE TAX:

- For Line 3, indicate the number of liable employees, multiply by $5.75, and enter the resulting total.

- If filing or paying after the due date, calculate and record penalties in Lines 4a and 4b as directed on the form.

- Line 5 requires you to add Line 3, Line 4a, and Line 4b to find the total amount owed. Write this figure in the space provided.

- Complete the certification section at the bottom. Sign and date the form to attest to the accuracy of your entries. Your title in the business should also be included here.

- Detach the lower portion of the form if instructed and include a check or money order for the total amount payable to the Manager of Finance.

- Finally, mail your completed form and payment to the address provided: Denver Department of Finance, Treasury Division, P.O. Box 660859, Dallas, TX 75266-0859.

Remember to keep a copy of the completed form and any payment records for your business's records. Timely and accurate filing helps ensure compliance with the City and County of Denver's tax requirements, preventing any unnecessary fines or penalties.

Understanding Denver Occupational Privilege Tax

Who needs to file the Denver Occupational Privilege Tax (OPT) form?

All businesses operating within Denver or those performing services in Denver must file the Occupational Privilege Tax form, regardless of the business's size or the number of employees. This includes self-employed individuals, owners, partners, or managers who are obligated to pay a monthly Business OPT of $4.00 each. Additionally, businesses must calculate and file the Employee OPT for any team member earning at least $500 per month for services rendered in Denver, at a rate of $5.75 per employee.

How is the tax calculated for both the business and the employees?

For the Business Occupational Privilege Tax, one needs to count the number of self-employed individuals, owners, partners, or managers and multiply that number by $4.00. There is no earnings threshold for this calculation; the flat rate is due monthly for each qualifying individual. On the employee side, the Employee Occupational Privilege Tax is calculated by counting the number of employees earning at least $500 in gross compensation for the month for work performed in Denver and multiplying that number by $5.75. This calculation must include all qualifying employees, even if they work part-time or have multiple employers from whom the tax is withheld.

What if I'm late in filing or paying the OPT?

If the Occupational Privilege Tax form is filed or the payment is made after the due date, the business is subject to penalties and interest. Initially, a penalty of 15% of the tax due or $25.00, whichever is greater, is applied. Furthermore, interest is charged at a rate of 1% of the tax due for each month or part of a month the return is late. To avoid these charges, businesses should ensure timely filing and payment of their OPT obligations.

Can amendments be made to a previously filed OPT return?

Yes, amendments to a previously filed Occupational Privilege Tax return are possible. If corrections are necessary or if previous filings contained errors, the bottom section of the form includes an option to mark the submission as an amended return. This allows businesses to correct their filings and ensure accurate reporting and compliance. When filing an amended return, it's crucial to include the corrected information and highlight the changes from the original submission to expedite the review process.

Common mistakes

Filling out the Denver Occupational Privilege Tax form can be complex, and errors can easily occur if one is not attentive. Here are ten common mistakes people make while completing this form:

-

Not filing a return when no tax is due. It is essential to submit a return for each period, even if the business has determined that no tax is owed.

-

Failing to provide an explanation when the number of employees for which the business is liable differs from the number of employees from whom the tax was withheld.

-

Incorrectly entering the number of self-employed individuals, owners, partners, or managers or miscalculating the total tax for this category. Each self-employed proprietor, partner, or manager incurs a flat $4.00 Business Occupational Privilege Tax charge per month, regardless of income.

-

Overlooking the requirement to pay the minimum Business OPT for work performed in Denver, even if the business has no taxable employees for that month.

-

Misunderstanding which employees qualify as liable under the Business Occupational Privilege Tax and Employee Occupational Privilege Tax, particularly for those earning at least $500 in gross compensation for services rendered in Denver.

-

Omission of qualified employees under the Employee Occupational Privilege Tax, including corporate officers, when these individuals meet the earnings requirement.

-

Not furnishing Form TD-269 for employees with another employer who is withholding the tax, leading to inconsistencies and potential oversights in tax liability.

-

Incorrectly calculating penalties and interest for late filing and payments under lines 4a and 4b, either by choosing the wrong base amount or miscalculating the monthly interest rate.

-

Forgetting to add all pertinent lines to find the total amount owed (Line 5), which includes the sum of taxes due plus any applicable penalties and interest.

-

Failing to check the box indicating the submission is an amended return when necessary, leading to confusion and potential misprocessing of the form.

It is imperative to approach the Denver Occupational Privilege Tax form with careful attention to detail, ensuring that all data is accurate and complete. Businesses must thoroughly review each section to avoid these common mistakes, potentially saving time and avoiding penalties.

Documents used along the form

When handling the Denver Occupational Privilege Tax Return, there are several other forms and documents frequently required to ensure compliance with the City and County of Denver's tax requirements. Understanding these additional documents can provide a clearer picture of the overall process and aid in correct filing.

- W-9 Form (Request for Taxpayer Identification Number and Certification): This form is crucial for businesses as it provides the taxpayer identification number, an essential piece of information for accurate tax reporting and withholding. It's often needed when setting up accounts and verifying the identity of the business with the Department of Finance.

- Employee Wage Report: This detailed report lists all employees, their compensation levels, and the periods they worked within Denver. It's needed alongside the Occupational Privilege Tax Return to verify the taxable employee count and ensure proper tax calculations.

- TD-269 (Employer Withholding Tax Certificate): If an employee has multiple employers or changes jobs and the Occupational Privilege Tax has been withheld by a primary employer, this document certifies that the tax has already been accounted for. It helps prevent double taxation of employees.

- Quarterly Federal Tax Return: While not submitted to the City and County of Denver, this federal document often accompanies local tax filings as it provides a comprehensive overview of the payroll expenses and tax withholdings for a business. This can include Social Security, Medicare, and federal income tax withholdings.

- Denver Business License: A valid business license confirms that a business is legally allowed to operate within Denver. This document often accompanies tax documents to prove the business’s eligibility for certain tax rates or exemptions.

- Statement of Exemption: In certain situations, a business or individual may qualify for exemptions from the Occupational Privilege Tax. This document outlines the reasons for exemption and must be supported with appropriate evidence.

Collecting and correctly filing these forms and documents, alongside the Denver Occupational Privilege Tax Return, ensures compliance with local regulations and contributes to the smooth operation of business activities within Denver. Remaining organized and aware of these requirements can save businesses time and protect them from potential penalties associated with improper tax filing.

Similar forms

The IRS Form 941, Employer's Quarterly Federal Tax Return, bears similarity to the Denver Occupational Privilege Tax form. Both forms require businesses to report on their employees' earnings and calculate taxes due for a specific reporting period. Additionally, they both have provisions for calculating late filing penalties, emphasizing timely submission to avoid additional charges. The IRS Form 941 focuses on federal income, Social Security, and Medicare taxes, while the Denver form concentrates on local occupational taxes.

The State Unemployment Tax Act (SUTA) filings share features with the Denver Occupational Privilege Tax form, as they both involve reporting the earnings of employees to a government body for tax purposes. SUTA filings are necessary for state unemployment fund contributions, which vary by state. Like the Denver form, these filings are periodic and may result in penalties for late submissions, echoing the importance of compliance set by the Denver Occupational Privilege Tax.

W-2 forms, issued annually by employers, parallel the Denver Occupational Privilege Tax form in their focus on reporting employee earnings. Both documents require accurate records of what employees have earned, although for different purposes. W-2 forms are essential for employees to file their personal income taxes, incorporating both federal and state tax withholdings, similar to how the Denver form tracks occupational tax obligations at a local level.

The Sales and Use Tax Return found in many jurisdictions reflects the periodic reporting nature of the Denver Occupational Privilege Tax form. While the Sales and Use Tax Return focuses on sales generated and the tax collected from customers, both forms require businesses to report and remit taxes on a regular basis, often quarterly, and include penalties for late filings. This reinforces the ongoing responsibility businesses have for tax reporting and payment.

Form 1099, particularly the 1099-MISC version for miscellaneous income, relates to the Denver Occupational Privilege Tax form in its concern with reporting income earned. Although 1099 forms generally apply to freelance or independent contractor earnings outside the traditional employer-employee relationship, both forms play crucial roles in tax administration by documenting earnings for tax purposes, underlining their importance in maintaining accurate financial records.

The Business Personal Property Tax Return, applicable in many localities, aligns with the Denver Occupational Privilege Tax form as both necessitate annual reporting by businesses. Both documents assess taxes based on business operations, whether on employee earnings or business assets. This similarity underscores the variety of taxes businesses must manage and report accurately.

Local Business License Renewals, often requiring annual submission, echo the Denver Occupational Privilege Tax form's local focus. These renewals typically require businesses to report and often update their operational status to continue legally functioning within a municipality. Like the Denver Occupational Privilege Tax, failure to properly file and pay these renewals may result in penalties, emphasizing local compliance.

The Quarterly Federal Excise Tax Return (Form 720) has parallels with the Denver Occupational Privilege Tax form through its periodic tax reporting structure. Form 720 encompasses various excise taxes imposed on goods, services, and activities. Despite focusing on different tax types, both forms are integral to their respective tax collection systems, ensuring businesses contribute the correct amounts regularly.

Workers Compensation Insurance Reports resemble the Denver Occupational Privilege Tax form as they both involve reporting related to employment. These insurance reports ensure that businesses are properly covering their employees with the necessary insurance, just as the Denver form ensures businesses are meeting tax obligations for their employees. Both types of documentation are pivotal for protecting employee rights and adherence to regulations.

Finally, the Annual Information Return for Taxable Business Personal Property, required by many local tax jurisdictions, shares similarities with the Denver Occupational Privilege Tax form in its business-focused reporting. Both documents require businesses to report on aspects of their operation to calculate tax liabilities. While the specific focus of each form differs, their roles in ensuring businesses accurately report and pay necessary taxes are closely aligned, highlighting the broader responsibilities businesses face in tax compliance.

Dos and Don'ts

Filling out the Denver Occupational Privilege Tax form can be straightforward if you follow some simple dos and don’ts. This guide will help you navigate the process smoothly and ensure that your form is completed correctly.

Things You Should Do- Ensure accuracy: Double-check all the information you enter, especially the business name, account number, and the amounts calculated for taxes due. Accuracy is key to preventing delays or issues.

- Report all employees: Include every employee who meets the criteria for the Occupational Privilege Tax, including those who worked in Denver for any part of the month and earned at least $500.

- Attach necessary documentation: If there are discrepancies between the number of employees liable for the tax and those from whom it was withheld, attach an explanation as required.

- File on time: Submit your return by the due date to avoid late fees and penalties. Timeliness can save you money and hassle.

- Include payment: If you owe tax, include a check or money order payable to the Manager of Finance with your return, ensuring the proper amount is enclosed.

- Verify the period and end date: Confirm that you have reported the right period and that the period end date is accurate. This will ensure that your records match those of the Department of Finance.

- Sign the form: Your signature is required to certify that the information provided is true and correct to the best of your knowledge. Without your signature, the form is incomplete.

- Forget to file if no tax is due: Even if you determine that no tax is owed for a period, a return must still be filed. Non-filing can result in unnecessary complications.

- Omit information: Leaving out details about your employees, or failing to provide a required attachment, can lead to processing delays or questions from the Department of Finance.

- Ignore the backside instructions: Important information and instructions are provided on the back of the form. Neglecting them can lead to errors in filing.

- Miss including all liable individuals: Not just regular employees, but also self-employed individuals, owners, partners, or managers working in Denver must be reported if they meet the tax criteria.

- Delay the filing process: Avoid waiting until the last minute to gather your information or fill out the form. Procrastination can lead to missed deadlines and penalties.

- Send incomplete forms: An incomplete form can be as problematic as not filing at all. Ensure that every section that applies to you is filled out.

- Forget to detach the lower portion: Remember to detach and return the lower portion of the form, as instructed. The upper part is for your records.

By following these dos and don’ts, you can make the tax filing process more manageable and ensure compliance with the City and County of Denver’s regulations. Remember, when in doubt, reviewing the guidelines provided by the Department of Finance or consulting with a tax professional can provide clarity and assist in avoiding common mistakes.

Misconceptions

Understanding the Denver Occupational Privilege Tax form is crucial for businesses operating within the city. However, several misconceptions can lead to confusion or errors in filing. Let's clarify some common misunderstandings:

- Only employees physically working in Denver need to be included. This is a common misconception. In fact, all employees who perform services in Denver, even if part of their work is completed elsewhere, and their gross compensation is at least $500 for the month, must be accounted for on the form.

- Businesses only need to file a return if they owe tax. Regardless of whether tax is due, a return must be filed. This ensures compliance and helps maintain accurate records with the City and County of Denver.

- Corporate officers are not considered employees and are exempt from the Occupational Privilege Tax. In truth, for the purposes of this tax, corporate officers are considered employees if they receive gross compensation of at least $500 for services performed in Denver. They must be included in the Employee Occupational Privilege Tax calculation.

- If an employee has another employer who is withholding this tax, they should be excluded. Even if the Employee Occupational Privilege Tax is being withheld by another employer, Form TD-269 must be provided to the secondary employer to verify the primary employer has withheld the tax. This ensures all liable employees are correctly documented, preventing underreporting.

- Penalties and interest are a flat rate for late filings. The reality is, if the return is filed or paid after the due date, penalties and interest are calculated based on a percentage of the tax due—15% of the tax due or $25.00, whichever is greater, and an additional 1% of the tax due for each month or part of a month the return is late.

Correcting these misconceptions should provide a clearer understanding of the responsibilities and requirements for businesses regarding the Denver Occupational Privilege Tax. Maintaining compliance not only supports the communal infrastructure funded by these taxes but also ensures businesses operate without the hindrance of legal complications.

Key takeaways

Understanding the Denver Occupational Privilege Tax (OPT) form is crucial for businesses operating within the city limits. Here are key takeaways that simplify the process:

- Filing the OPT form is mandatory even if your business determines that no tax is due. This includes periods when your business might not have had any taxable employees.

- The OPT form comprises two main sections: the Business Occupational Privilege Tax and the Employee Occupational Privilege Tax, addressing both the employer's and employees’ tax liabilities, respectively.

- For the Business Occupational Privilege Tax, each self-employed individual, owner, partner, or manager must pay a monthly tax of $4.00, regardless of their earnings level.

- Regarding the Employee Occupational Privilege Tax, businesses are required to withhold $5.75 monthly from each employee earning at least $500 in gross compensation for services performed in Denver.

- It's important to make the distinction between employees and corporate officers; for the purpose of this tax, all corporate officers are considered employees if they meet the earnings requirement.

- If your return or payment is submitted after the due date, you must include a penalty of 15% of the total tax due or $25.00, whichever is greater, plus an additional 1% interest for each month or part of a month that the return is late.

- In cases where an employee is also employed elsewhere and the other employer is withholding the OPT, the form TD-269 must be provided to the business by the employee to verify the withholding by the primary employer.

Compliance with Denver’s Occupational Privilege Tax ensures that businesses contribute fairly to the city’s funding for public services. Timely and accurate filing helps avoid unnecessary penalties and interest due to late submissions.

Popular PDF Documents

Personal Property Tax California - Delve into the instructions for completing the general information section, which is crucial for a valid personal property tax return.

Allocation of Refund (Including Savings Bond Purchases) - The form allows for a seamless division of funds, streamlining the process of managing tax refunds.

Does Form 2848 Need to Be Notarized - This form can be revoked by the taxpayer at any time with a written notice to the IRS.