Get Dc Estate Tax Return D 76 Form

Navigating the complexities of estate planning and taxation might seem overwhelming, but understanding the DC Estate Tax Return Form D-76, and its associated documents, is crucial for those administering estates in the District of Columbia for individuals who passed away on January 1, 2003, or later. This critical document, overseen by the District's Office of Tax and Revenue, outlines the requirements, instructions, and necessary forms for properly filing estate taxes in the jurisdiction. To ensure compliance and avoid penalties, personal representatives—those tasked with the estate's administration—must familiarize themselves with various aspects such as when and who must file, how to request an extension, and the importance of including accurate calculations for the estate's gross value and allowable deductions. Additionally, understanding the penalties for late filing or payment and the criteria for different types of returns (resident, nonresident, or alien) is paramount. With instructions detailing the need for supplementary documents like the IRS Form 706 schedules and the estate tax computation worksheet, as well as guidelines for amended returns or addressing federal changes, the D-76 form serves as an indispensable resource for navigating the estate tax filing process in Washington, DC.

Dc Estate Tax Return D 76 Example

Document Specifics

| Fact Name | Fact Description |

|---|---|

| Filing Threshold | A DC Estate Tax Return (Form D-76 or Form D-76 EZ) is required for estates exceeding $1,000,000 in gross estate value. |

| Filing Responsibility | The Personal Representative administering the estate must file the DC Estate Tax Return. |

| Filing Deadline | The tax return and any taxes due must be filed and paid within 10 months after the decedent's death. |

| Extension Option | A 6-month filing extension can be requested with Form FR-77, not the federal Form 4768. |

| Interest Rate | Interest is charged at 10% per year, compounded daily, starting from January 1, 2003. |

| Penalties | A 5% per month penalty, up to a maximum of 25%, is imposed for late filings and payments. |

| Filing Location | Returns and payments should be mailed to the Office of Tax and Revenue, Audit Division, Estate Tax Unit. |

| Required Supplements | Copies of the Application for Extension (if filed), pages 1-3 and Schedules A-O from IRS Form 706, and the Estate Tax Computation Worksheet. |

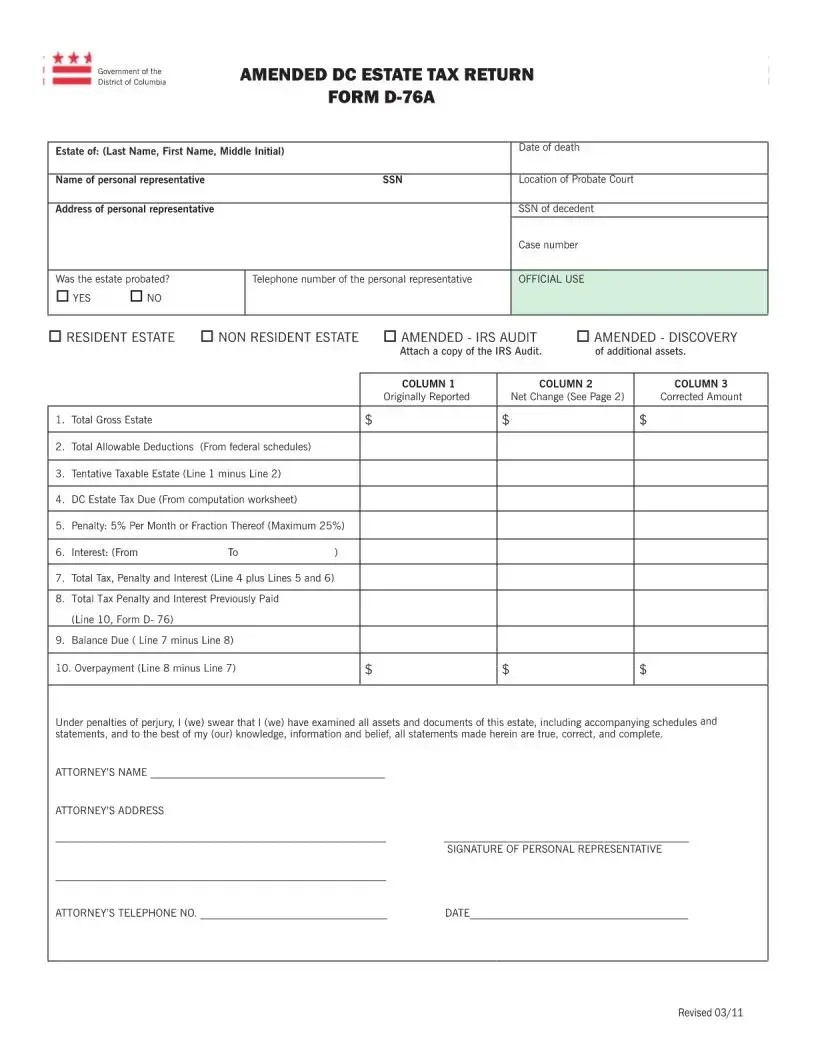

| Amended Returns | If an Amended Federal Estate Tax Return is filed, an Amended DC Estate Tax Return (D-76A) must also be filed. |

Guide to Writing Dc Estate Tax Return D 76

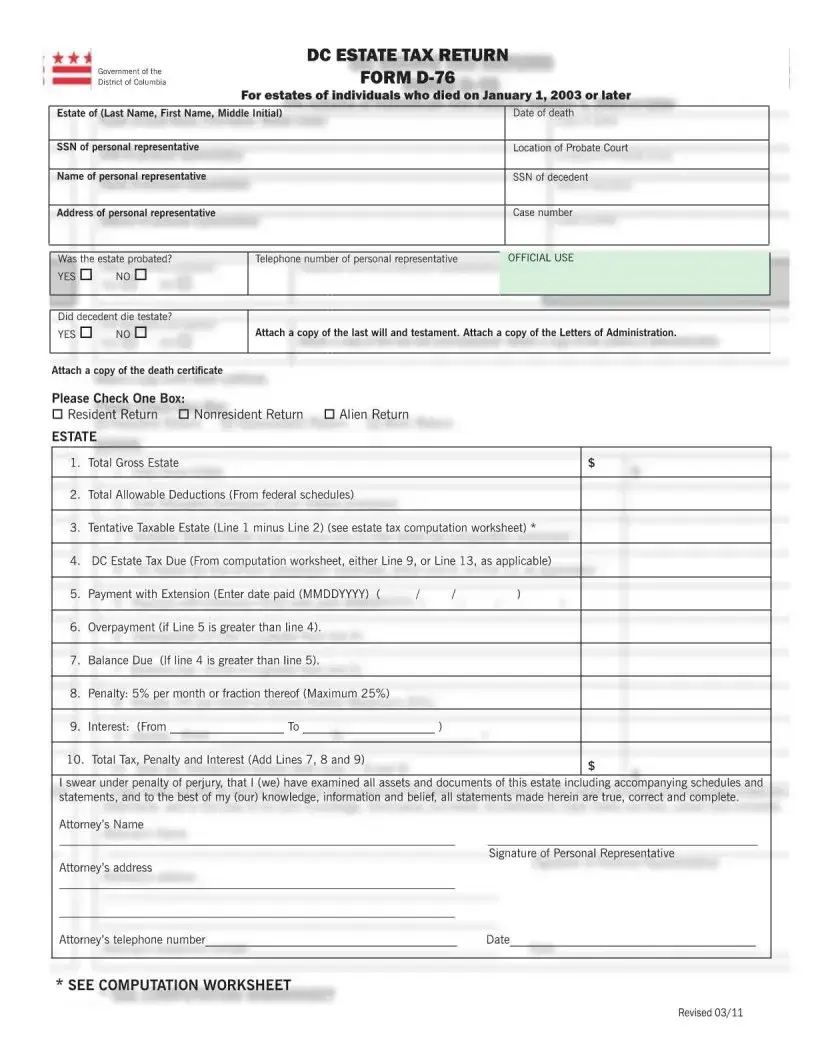

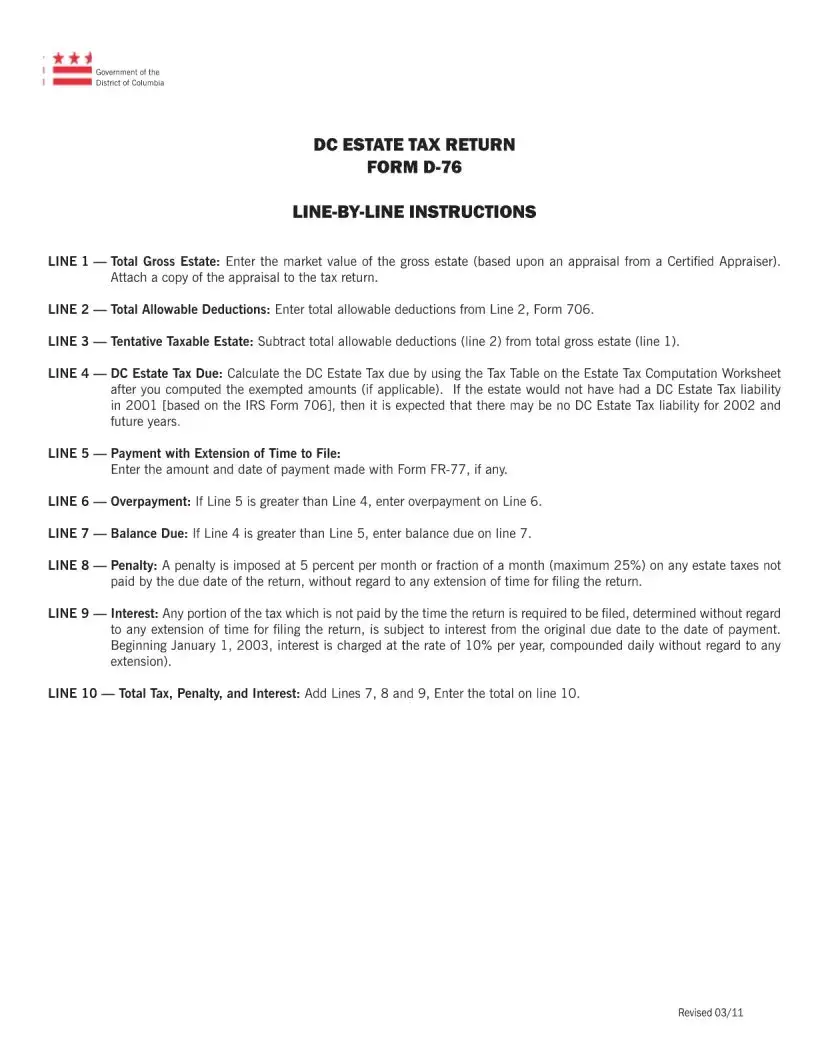

Filling out the DC Estate Tax Return Form D-76 requires careful attention to detail and completeness to ensure compliance with the District of Columbia's tax laws. The primary responsibility falls to the personal representative of the deceased's estate. It's important to accurately report all assets, deductions, and relevant tax calculations. Here are the essential steps to guide you through filling out the form.

- Gather all necessary documents, including the deceased's last will and testament, Letters of Administration, and the death certificate.

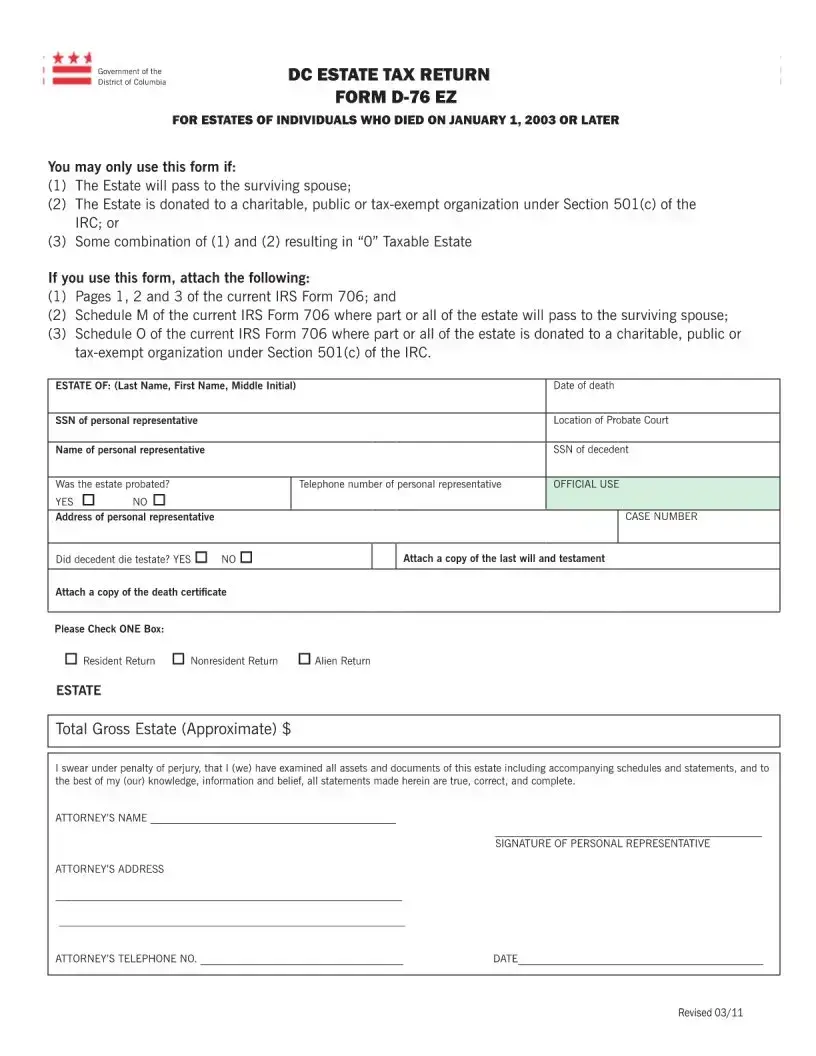

- Complete the top section of the Form D-76 by entering the estate and personal representative's information, including the estate of the deceased, social security numbers, the personal representative's name and address, and details about the estate's probate status.

- Indicate whether the decedent died testate (with a will) or intestate (without a will), and provide the date of death along with the probate court's location and case number.

- Check the appropriate box to identify the return as a Resident, Nonresident, or Alien Return.

- Calculate the Total Gross Estate value and enter it on Line 1.

- Refer to the Federal IRS Form 706 schedules to determine Total Allowable Deductions and enter this amount on Line 2.

- Follow instructions for the Estate Tax Computation Worksheet to determine Tentative Taxable Estate and DC Estate Tax Due. Enter these values on Lines 3 and 4, respectively.

- If any payment was made with an extension, enter the amount and date paid on Line 5.

- Calculate the Overpayment or Balance Due, if applicable, and record these on Lines 6 and 7.

- If penalties or interest apply, calculate these amounts and fill out Lines 8, 9, and 10 accordingly.

- The personal representative must sign the form, and if an attorney has been involved, include the attorney's name, address, and phone number.

- Attach all required supplemental documents, including any relevant IRS Form 706 pages and schedules, the death certificate, and if applicable, the FR-77 extension form.

- Mail the completed form and attachments, along with any due payment, to the DC Office of Tax and Revenue as specified in the instructions. Ensure the check or money order is payable to the DC Treasurer.

Accuracy and honesty are crucial when completing Form D-76. This process not only requires a thorough accounting of the estate's assets but also an adherence to deadlines to avoid penalties. By carefully following these steps, personal representatives can fulfill their duty in managing the decedent's estate tax obligations in the District of Columbia.

Understanding Dc Estate Tax Return D 76

When is the DC Estate Tax Return (Form D-76) required to be filed?

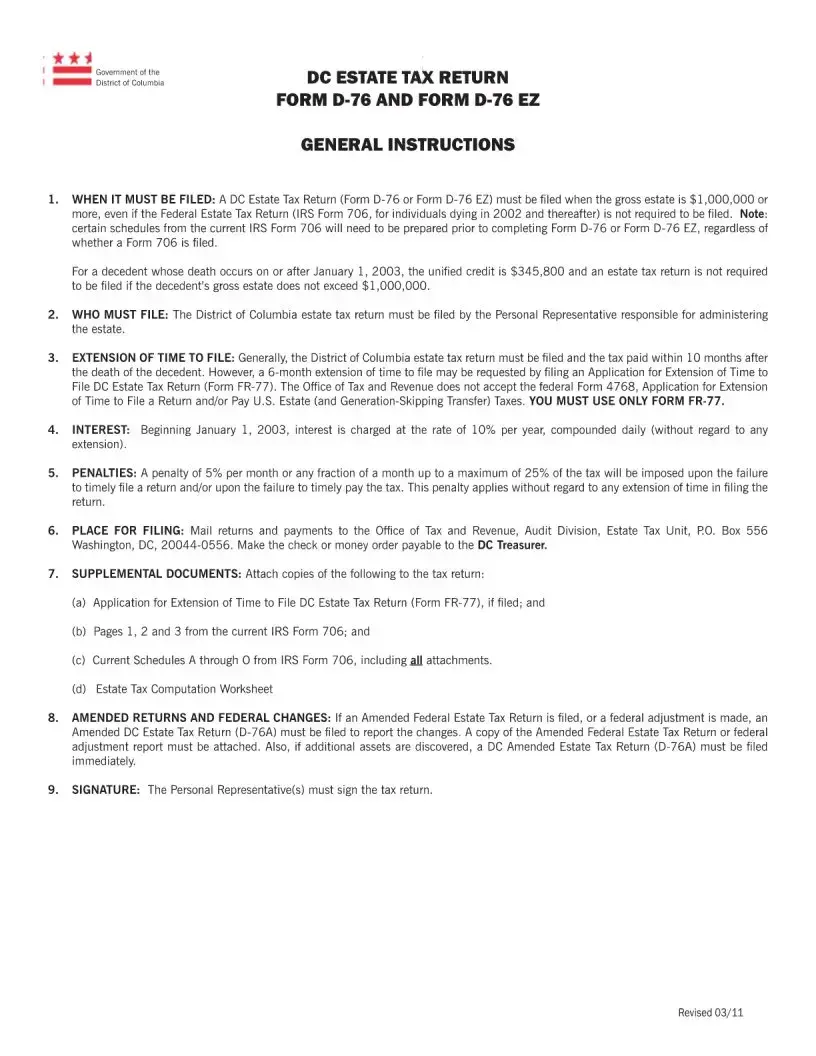

For estates of individuals who passed away on January 1, 2003, or later, a DC Estate Tax Return (Form D-76 or Form D-76 EZ) is mandatory when the gross estate amounts to $1,000,000 or more. This requirement stands even if there is no need to file a Federal Estate Tax Return (IRS Form 706, for individuals dying in 2002 and thereafter). Prior to completing Form D-76, certain schedules from the current IRS Form 706 must be prepared. If the gross estate does not exceed $1,000,000, taking into account the unified credit of $345,800, filing an estate tax return is not necessary.

Who is responsible for filing the DC Estate Tax Return?

The obligation to file the District of Columbia estate tax return falls to the Personal Representative in charge of administering the decedent's estate. This individual must ensure all necessary documents and payments are submitted within the specified deadlines.

Can an extension be granted for filing the DC Estate Tax Return?

Yes, a six-month extension to file can be requested by submitting an Application for Extension of Time to File DC Estate Tax Return (Form FR-77). It is critical to note that the federal Form 4768 cannot be used as a substitute. This extension provides additional time to file but does not extend the payment due date for any taxes owed.

What are the interest and penalties for late filing or payment?

Starting January 1, 2003, interest is calculated at an annual rate of 10%, compounded daily, on any unpaid taxes past the due date, regardless of any filing extension. Additionally, a failure-to-file or failure-to-pay penalty of 5% per month of the tax due (or fraction thereof) applies, with a cap at 25% of the outstanding tax. These penalties underscore the importance of timely compliance with filing and payment obligations.

Where should the DC Estate Tax Return be sent?

All returns and payments must be mailed to the Office of Tax and Revenue, Audit Division, Estate Tax Unit, P.O. Box 556, Washington, DC, 20044-0556. Payments are to be made payable to the DC Treasurer. Ensuring the correct address and payment designation helps in avoiding unnecessary processing delays.

What documents are required to be attached to the DC Estate Tax Return?

When filing the return, several supplemental documents are required, including, if applicable, the Application for Extension of Time to File DC Estate Tax Return (Form FR-77), specific pages and schedules from the current IRS Form 706, and the Estate Tax Computation Worksheet. These documents provide necessary details for the accurate assessment and processing of the estate's tax obligations.

Common mistakes

Filling out the District of Columbia Estate Tax Return (Form D-76) requires careful attention to detail and a good understanding of tax law. Mistakes can lead to delays, penalties, or incorrect tax liabilities. Below are five common errors to avoid when completing this form:

Not attaching required documents: The form requires several attachments, including a copy of the decedent's last will and testament, letters of administration, and the death certificate. Failing to include these can result in processing delays or requests for additional information, slowing down the estate settlement process.

Incorrectly determining the taxable estate: Line 3 of the form requires the tentative taxable estate to be computed by subtracting allowable deductions from the total gross estate. Errors in calculating these figures can lead to an incorrect tax liability. This mistake often arises from misunderstanding which assets are included in the gross estate and which deductions are allowable under DC law.

Misclassifying the estate's residency status: The form differentiates between resident, nonresident, and alien returns. The correct classification affects the taxable estate's calculation and the applicable tax rate. Selecting the wrong residency status can lead to an incorrect tax computation.

Omitting necessary schedules and worksheets: Besides the primary form, supplemental documents, such as estate tax computation worksheets and schedules A through O from the IRS Form 706, are required. These provide detailed information on the estate's assets and deductions, and forgetting to attach them can cause delays or incorrect tax calculations.

Missing the filing deadline: The form must be filed, and any tax owed paid, within 10 months of the decedent's death, with a 6-month extension available upon request. Filing late without an extension can result in penalties and interest charges, significantly increasing the estate's tax burden.

Understanding these potential pitfalls can help ensure that the Estate Tax Return is completed accurately and submitted on time, helping to avoid unnecessary costs and delays in administering the estate.

Documents used along the form

When dealing with the complexities of estate matters, particularly in the District of Columbia, preparing a DC Estate Tax Return (Form D-76) is often just the beginning. There are several forms and documents that frequently accompany or are necessary to complete the process effectively. Here’s a brief overview of each to help you navigate through.

- IRS Form 706 (Federal Estate Tax Return): This federal form is essential for reporting the decedent's gross estate. Although the D-76 may require information from this form, it must be prepared regardless of the need to file it federally, depending on the estate's value.

- D-76EZ (DC Estate Tax Return EZ): A simplified version of the D-76 form for estates that meet certain criteria, making the filing process less complicated.

- D-76A (Amended DC Estate Tax Return): If there are any changes or additional assets discovered after the original submission, this form is necessary to amend the previously filed estate tax return.

- FR-77 (Application for Extension of Time to File DC Estate Tax Return): This form is used to request additional time to file the D-76 form, providing a six-month extension.

- Estate Tax Computation Worksheet: A worksheet to help calculate the estate tax due, ensuring that all deductions and values are accurately accounted for in the tax computation.

- Death Certificate: A certified copy of the decedent's death certificate is a crucial document that legally confirms the death.

- Copy of the Will/Testament: If the decedent had a will, a copy is usually required to understand the intentions for asset distribution and executor appointments.

- Letters of Administration: For estates without a will (intestate), these documents issued by the court authorize someone to act as the estate's administrator.

Handling an estate involves multiple steps and gathering a variety of forms and documents. Each plays a role in ensuring the estate is managed and taxed according to the law. Being prepared and understanding the purpose of each document can significantly smooth the process for personal representatives and their advisors.

Similar forms

The Federal Estate Tax Return (IRS Form 706) is a document that bears similarity to the DC Estate Tax Return (Form D-76) in several aspects. Both forms are used to report the value of an estate after someone has passed away, to assess potential estate taxes owed to the government based on the total value of the deceased person's assets. They necessitate detailed listings of assets, deductions, and calculations to determine the taxable estate. However, while the D-76 form is specific to the District of Columbia, IRS Form 706 is used for federal estate tax filing purposes, applicable across all states.

The Application for Extension of Time to File (Form FR-77) in the DC estate tax context is comparable to the IRS Form 4768, which is used for requesting an extension of time to file the Federal Estate (and Generation-Skipping Transfer) Tax Return. Both documents serve the purpose of providing taxpayers extra time to prepare their estate tax returns, ensuring accuracy and completeness in reporting. Despite their similar roles, FR-77 is used specifically within the DC jurisdiction, while Form 4768 applies federally.

The Amended DC Estate Tax Return (Form D-76A) parallels the amended version of the Federal Estate Tax Return, allowing for corrections or updates to previously submitted information. Should discrepancies or omissions be discovered after the original filings, the respective forms for DC or the IRS can be submitted to rectify those mistakes. This ensures that the estate’s tax obligations are accurately reflected and correctly processed by the taxing authorities, whether at the municipal or federal level.

Finally, the Estate Tax Computation Worksheet included with the DC Estate Tax documents functions similarly to worksheets and calculators provided for federal estate tax preparation. These tools assist in the detailed and often complex computation of estate taxes due, guiding representatives through deductions, exemptions, and tax rates applicable to the estate’s value. They are integral to both the D-76 form and IRS Form 706 processes, simplifying the calculation steps and ensuring that estates are taxed appropriately in accordance with the law.

Dos and Don'ts

Filing the DC Estate Tax Return, Form D-76, is a crucial step in managing the estate of someone who has passed away. It requires careful attention to detail and adherence to specific instructions set forth by the District of Columbia's Office of Tax and Revenue. Here are essential dos and don'ts to help guide you through the process:

- Do gather all necessary documents before starting the form, including the deceased's death certificate, their last will and testament, and Letters of Administration if applicable.

- Don't rush through the form. Ensure every detail is accurate. Mistakes can lead to penalties or delay the processing time.

- Do ensure the estate is eligible for filing. As outlined, the DC Estate Tax Return must be filed for estates valued at $1,000,000 or more. Confirm the estate meets this criterion.

- Don't overlook the need for an extension if more time is required. Remember to file an Application for Extension of Time to File DC Estate Tax Return (Form FR-77) well before the deadline.

- Do check the decedent's residency status and file the correct form type—Resident, Nonresident, or Alien Return—as this affects tax calculations.

- Don't forget to sign the return. The form is not valid unless it's signed by the Personal Representative handling the estate.

- Do attach all required supplementary documents, including the appropriate schedules from the Federal Estate Tax Return (IRS Form 706) and the estate tax computation worksheet.

- Don't neglect to immediately amend the return if changes occur. If the federal return is amended or if additional assets are discovered, promptly file an Amended DC Estate Tax Return (D-76A).

Following these guidelines can help ensure the estate tax return process is as smooth and efficient as possible. Remember, it's not only about fulfilling legal obligations but also about honoring the decedent's legacy by ensuring their estate is properly managed and distributed.

Misconceptions

Understanding the intricacies of estate planning and taxation can be challenging, especially in the District of Columbia (DC), where residents must navigate both federal and local tax laws. When dealing with the DC Estate Tax Return Form D-76, a number of misconceptions can lead to confusion and errors in filing. This discussion aims to clarify some common misunderstandings related to this form.

- Misconception 1: The D-76 Form Is Only Required if Federal Estate Tax Is Due.

Many believe that the DC Estate Tax Return (Form D-76) needs to be filed only if there is a requirement to file a Federal Estate Tax Return (IRS Form 706). However, the D-76 must be submitted for estates valued at $1,000,000 or more, regardless of the necessity to file a federal return. This misunderstanding might result in non-compliance with DC tax obligations.

- Misconception 2: Personal Representatives Can Ask for Extensions Using Federal Forms.

Another common mistake is the assumption that the federal Form 4768, which is an application for an extension of time to file an estate tax return, is also applicable in DC. In reality, DC requires its own form, FR-77, to request an extension. Relying on federal forms for DC-specific processes might lead to delays and penalties.

- Misconception 3: All Estate Assets Are Taxed Similarly.

It's often wrongly assumed that all assets within an estate are subject to the same tax rules in DC. The taxable status of assets actually varies based on their nature and location. Real estate, tangible personal property, and intangible personal property are each taxed according to specific situs rules which can significantly impact the estate's overall tax liability.

- Misconception 4: Amending Federal Tax Returns Does Not Affect the D-76.

Some might think that changes to a federal estate tax return do not necessitate any action regarding the D-76 form. However, if an Amended Federal Estate Tax Return is filed, or if there are federal adjustments, an Amended DC Estate Tax Return (Form D-76A) must also be filed. This ensures that the DC tax obligations accurately reflect any federal adjustments.

- Misconception 5: Interest and Penalties Are Waived with an Extension.

Securing an extension to file the D-76 form is sometimes mistakenly thought to also extend the deadline for tax payments without incurring interest or penalties. In reality, while an extension grants additional time to file, it does not stop interest from accruing. Moreover, penalties might still apply if taxes are not paid by the original deadline.

- Misconception 6: Only Residents of DC Must File the Form D-76.

A final misconception is that only residents of DC are required to file the D-76 Estate Tax Return. Nonresidents who own real estate or tangible personal property located in DC at the time of their death must also file, highlighting the importance of understanding local tax laws even for those who do not reside in DC.

Clearing up these misconceptions is crucial for personal representatives and estate planners to ensure compliance and minimize unnecessary liabilities. A thorough understanding of the D-76 form and its requirements can help avoid common pitfalls, ensuring that estates are managed efficiently and in accordance with DC's tax laws.

Key takeaways

Understanding the DC Estate Tax Return Form D-76 is crucial for personal representatives administrating the estate of a decedent. This form, along with its instructions, outlines the procedure and requirements for filing estate taxes within the District of Columbia. Here are key takeaways to remember:

- The need for filing a DC Estate Tax Return (Form D-76 or D-76 EZ) arises when the gross estate exceeds $1,000,000. This requirement stands regardless of whether a Federal Estate Tax Return is mandated.

- It is the personal representative's responsibility to file the DC estate tax return. This role is typically assigned to an executor or administrator of the estate.

- Filing and payment of the DC Estate Tax Return must be completed within 10 months following the death of the decedent. However, a six-month extension is available through the submission of Form FR-77.

- Interest on unpaid taxes will accrue at a rate of 10% per year, compounded daily. This interest charge applies even if an extension to file has been granted.

- Late filings and payments incur a penalty of 5% per month, or fraction thereof, up to a maximum of 25% of the owed tax.

- The designated place for filing the return and making payments is the Office of Tax and Revenue, Audit Division, Estate Tax Unit. Payments should be addressed to the DC Treasurer.

- A series of supplemental documents must be attached to the tax return. These include any filed extension applications, sections from the IRS Form 706, and the Estate Tax Computation Worksheet.

- If amendments are made to a Federal Estate Tax Return or adjustments are made by the IRS, an Amended DC Estate Tax Return (Form D-76A) must also be filed to reflect these changes.

In addition to these guidelines, it's important to note the taxable status of various assets and how they are influenced by the decedent's domicile and the location of the property. Real property, tangible personal property, and intangible personal property are treated differently under DC estate tax laws, with specific rules applied based on their location and connection to the District. Being informed and attentive to these details can significantly streamline the filing process.

Popular PDF Documents

IRS 8821 - The form must be filed with the IRS and contains sections for identifying the taxpayer, the appointee, the types of tax information allowed, and the validity period.

Tax Returns - The IRS 1040-NR form is used by nonresident aliens to file U.S. tax returns, detailing income earned in the U.S. and taxes owed.