Blank Credit Card Payment Authorization Form

Handling financial transactions with care and authorization ensures a secure and trustworthy process for all parties involved. A crucial element in this process is the Credit Card Payment Authorization form, which plays a significant role in authorizing and documenting transactions. This form serves as a formal permission slip from the cardholder, allowing merchants to charge their credit card for the agreed-upon transactions. It covers various aspects, including the cardholder's details, transaction information, and the specific terms of authorization. By providing a clear and legal framework, it helps in preventing fraudulent activities, resolving disputes, and ensuring that all transactions are conducted within the bounds of consent. The importance of this form extends beyond a mere transactional necessity; it embodies the trust and safety measures essential in today's digital and fast-paced commerce environment.

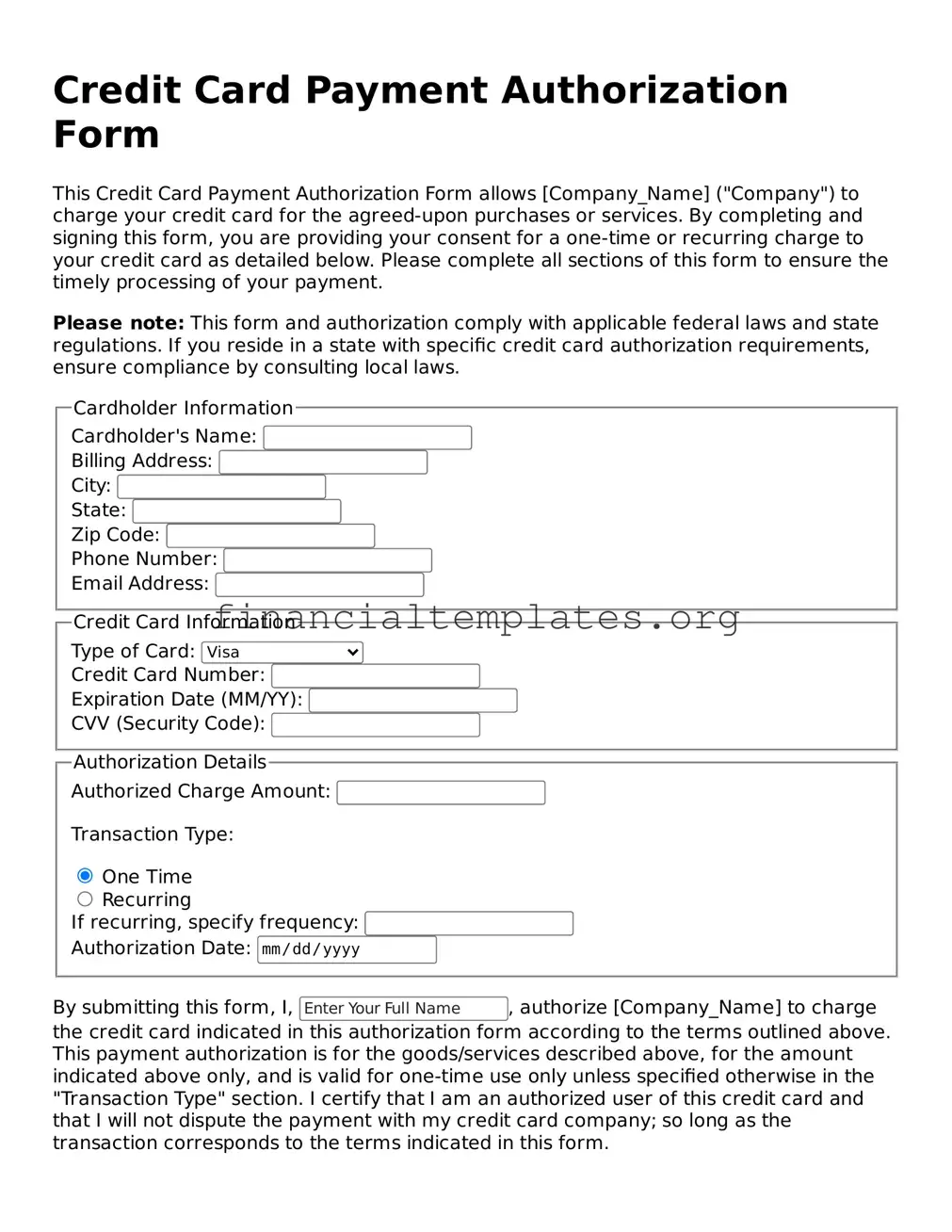

Credit Card Payment Authorization Example

Credit Card Payment Authorization Form

This Credit Card Payment Authorization Form allows [Company_Name] ("Company") to charge your credit card for the agreed-upon purchases or services. By completing and signing this form, you are providing your consent for a one-time or recurring charge to your credit card as detailed below. Please complete all sections of this form to ensure the timely processing of your payment.

Please note: This form and authorization comply with applicable federal laws and state regulations. If you reside in a state with specific credit card authorization requirements, ensure compliance by consulting local laws.

PDF Properties

| Fact Number | Detail |

|---|---|

| 1 | Allows one-time or recurring payments. |

| 2 | Requires cardholder's signature for authorization. |

| 3 | Includes cardholder's credit card information. |

| 4 | Specifies the amount to be charged. |

| 5 | Can be used for personal or business transactions. |

| 6 | Needs to be completed before any charge is made. |

| 7 | Protects the merchant from chargebacks. |

| 8 | May be governed by state and federal laws, depending on the jurisdiction. |

| 9 | Typically includes expiration date of the authorization. |

Guide to Writing Credit Card Payment Authorization

After completing a transaction or agreeing to recurring charges with a business, you might be asked to complete a Credit Card Payment Authorization form. This form legally authorizes the business to charge your credit card for the goods or services they provided. It serves as a crucial document that protects both the consumer and the service provider by ensuring that the charges have been approved. Careful completion of this form is essential to prevent any misunderstandings or unauthorized charges in the future. Below is a detailed guide on how to accurately fill out the form.

- Begin with your full legal name as it appears on your credit card, ensuring accuracy to avoid any issues with payment processing.

- Enter your full billing address, including the street address, city, state, and ZIP code. This should match the address associated with the credit card.

- Specify the type of credit card you are authorizing for use, such as Visa, MasterCard, American Express, or Discover.

- Provide the credit card number without spaces or dashes. It is crucial to ensure this information is correct to process the payment successfully.

- Include the expiration date of the credit card, typically found on the front of the card, listed as the month and year.

- Enter the three or four-digit Card Verification Value (CVV) code, located on the back of most cards and on the front for American Express.

- Indicate the authorized amount if you are authorizing a single transaction. For recurring charges, describe the payment terms, including the amount and frequency of charges.

- Specify the purpose of the payment or what the charges are for. Providing clear details helps in maintaining records and clarifying the charge for both parties.

- Include the date of authorization to establish when you agreed to these charges and to help keep accurate records of transactions.

- Finally, sign the form to verify that you authorize the charges as specified and that you have the authority to make this authorization. Your signature is the binding element that confirms your consent.

After completing the Credit Card Payment Authorization form, review all provided information to ensure its accuracy and completeness. This form should then be submitted to the requesting business or organization, according to their submission guidelines. Retain a copy for your records to have a reference of the authorization you provided. By following these steps carefully, you can help ensure a smooth transaction process and avoid potential disputes over authorized charges.

Understanding Credit Card Payment Authorization

-

What is a Credit Card Payment Authorization form?

A Credit Card Payment Authorization form is a document used by a cardholder to grant permission to a business to charge their credit card for a specific purpose. This form is crucial for transactions where the card is not present, ensuring that the merchant has explicit consent to process the payment.

-

Why do I need to complete a Credit Card Payment Authorization form?

Completing a Credit Card Payment Authorization form is essential for safeguarding your financial security. It serves as a formal record of your approval for specific charges, helping to prevent unauthorized transactions on your account. Additionally, it assists businesses in complying with credit card processing rules and regulations.

-

What information is required on this form?

The typical Credit Card Payment Authorization form requires the cardholder’s name, credit card number, expiration date, and the card’s security code. It also includes the amount to be charged, the specific dates of the authorized charges, and the signature of the cardholder to validate the authorization.

-

How do I cancel a Credit Card Payment Authorization form?

To cancel a Credit Card Payment Authorization, you should contact the merchant directly as soon as possible. Provide written notice of your intention to revoke the authorization, including your name, the date of the authorization, and details about the transaction. Keep a copy of this cancellation notice for your records.

-

Is the information on the form secure?

Businesses that require Credit Card Payment Authorization forms must comply with data protection laws and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS). These standards ensure that your credit card information is handled securely to protect against data breaches and fraud.

-

Can I authorize a payment over the phone?

Yes, a Credit Card Payment Authorization can be completed over the phone. Businesses will typically record the caller’s consent and may require them to subsequently complete a physical or digital form. This process still adheres to the strict guidelines for verbal authorization outlined by credit card companies.

-

What happens if I dispute a charge that I authorized?

If you dispute a charge you previously authorized, you should first attempt to resolve the issue with the merchant. If unsuccessful, you can contact your credit card issuer directly to file a dispute. Having a copy of the Authorization form can be helpful in this process.

-

Do I need to authorize each transaction?

For recurring payments, a single Credit Card Payment Authorization form can cover multiple transactions over an agreed period. However, for one-off payments or changes in the amount charged, a new authorization may be required. Always check the terms outlined in the form.

-

Where can I find a Credit Card Payment Authorization form?

Credit Card Payment Authorization forms are typically provided by the merchant requiring authorization. If unavailable, generic forms can also be downloaded from financial websites or created using templates from reputable online sources, ensuring they meet the necessary legal requirements.

Common mistakes

When filling out a Credit Card Payment Authorization form, accuracy and attention to detail are crucial. Unfortunately, errors can occur, which might lead to unnecessary delays or complications. Below are some of the most common mistakes people make:

Not filling in all required fields - Leaving a section blank can lead to the form being incomplete.

Entering incorrect credit card information - Mistakes in entering the card number, expiration date, or security code can cause the transaction to fail.

Misspelling names - The name on the form should match exactly with that on the credit card and official documents.

Forgetting to sign the form - A missing signature can make the authorization invalid.

Using outdated forms - Companies update their forms periodically, and using an old version might mean missing out on recent changes or requirements.

Mismatched information - The billing address entered should match the address associated with the credit card.

Choosing the wrong payment type - Indicating the incorrect type of payment can lead to processing errors.

Not specifying the currency - For international transactions, failing to indicate the currency can lead to incorrect amounts being processed.

Failing to include contact information - Without a way to contact the person, resolving issues becomes considerably harder.

Ignoring terms and conditions - Not acknowledging or understanding the terms could lead to disputes or dissatisfaction down the line.

Being mindful of these errors and taking the time to review all information can ensure the process goes smoothly. If there are uncertainties, it is always wise to ask for clarification to avoid any potential issues.

Documents used along the form

When handling transactions that require a Credit Card Payment Authorization form, there are usually several other documents and forms that play critical roles throughout the process. These documents ensure that transactions are processed efficiently and securely, adhering to legal and procedural standards. Each serves a unique purpose, complementing the authorization form to provide a comprehensive framework for managing credit card payments.

- Customer Information Form: This document collects basic information about the customer, such as name, address, and contact details. It's essential for establishing a record of who is making the payment.

- Service Agreement: Outlines the specific services or products being purchased. It includes pricing, delivery details, and the terms and conditions of the sale or service provision.

- Privacy Policy Acknowledgment: Ensures that the customer is aware of how their personal and payment information will be used and protected. This form is crucial for compliance with privacy laws and regulations.

- Return and Refund Policy: Clearly states the terms under which returns or refunds can be requested. This document helps manage customer expectations and reduces potential disputes.

- Transaction Receipt: Provides proof of payment and outlines the details of the transaction, including the date, amount, and items or services purchased. This is essential for both customer records and business accounting.

- Dispute Resolution Form: In case of any discrepancies or issues with the transaction, this form outlines the process for filing a complaint and seeking resolution. It's a proactive measure for handling potential disputes.

- Terms and Conditions of Credit Card Use: Details the responsibilities and requirements of using a credit card for transactions, such as fraud prevention measures and the user's liability. It's important for both legal compliance and consumer protection.

- Electronic Communication Consent Form: This form obtains the customer's permission to send transactional emails, receipts, and other communications electronically. It ensures compliance with laws governing electronic communications.

Together, these documents create a robust framework that supports the Credit Card Payment Authorization form. They not only ensure that the transaction process is smooth and clear for both parties but also help in meeting legal obligations and securing sensitive information. Keeping these forms organized and readily accessible is key to managing payments efficiently and maintaining high standards of customer service and compliance.

Similar forms

A Direct Debit Authorization form is notably similar to the Credit Card Payment Authorization form. Both serve the purpose of granting permission to withdraw funds from an individual's bank account automatically. While the Credit Card Payment Authorization form focuses specifically on credit card accounts, the Direct Debit Authorization concerns itself more broadly with any bank account. They offer a convenient method for recurring payments, reducing the hassle of manual submissions for each transaction.

Standing Order forms share a common objective with the Credit Card Payment Authorization form: they both authorize regular, automatic payments from an account. The key distinction lies in their operational scope; standing orders are primarily used for bank-to-bank transfers. This contrasts with the credit card form, which is dedicated to authorizing charges to a credit card by a third party. Standing Order forms are particularly popular for domestic bill payments, such as utilities or rent.

The Automated Clearing House (ACH) Authorization form is another document that parallels the Credit Card Payment Authorization form. It gives permission for companies to electronically withdraw money from a bank account or deposit money into it. The ACH network handles transactions such as payroll deposits and bill payments, similar to the automated nature of credit card transactions authorized by the Credit Card Payment Authorization form. However, ACH transactions can be more cost-effective for businesses compared to credit card processing fees.

A Loan Agreement is akin to the Credit Card Payment Authorization form in that both involve an agreement to financial terms between parties. In a Loan Agreement, the borrower commits to paying back a specified amount of money over time. The parallels lie in the authorization aspect, where the Credit Card Payment Authorization form also involves an agreement—albeit for the recurring or one-time charge to a cardholder’s account. Both documents formalize the terms under which money changes hands.

Payment Plan Agreements and Credit Card Payment Authorization forms share a foundation in setting up structured payments. Payment Plan Agreements are often used to outline a series of payments over time for goods or services, which resembles the recurring payment feature of the credit card authorization. Though the mechanics differ—payment plans don't necessarily require a credit card—the essence of allowing staggered payments over a period is a common thread.

A Merchant Services Agreement is closely related to the concept behind the Credit Card Payment Authorization form. This agreement is between merchants and payment processors or banks, outlining the terms under which transactions are processed, including fees, service terms, and dispute resolution processes. The Credit Card Payment Authorization form is a microcosm of this larger arrangement, empowering the actual charge on a customer’s credit card that the Merchant Services Agreement facilitates on a broader level.

Lastly, a Subscription Agreement mirrors the repetitive payment feature inherent in the Credit Card Payment Authorization form but in the realm of investment. It's a contract between an investor and a company, detailing the investor's purchase of a portion of the company's shares. Like the Credit Card Payment Authorization, it involves agreeing to financial transactions over time—albeit, in this case, the transaction is an investment rather than a payment for goods or services.

Dos and Don'ts

When it comes to managing your finances, using a Credit Card Payment Authorization form can be a smart way to ensure timely payments. However, filling out this form accurately is crucial to avoid any potential mishaps or misunderstandings. Below are lists of things you should and shouldn't do when completing the form.

What You Should Do:

- Double-check the credit card information: Before you submit the form, make sure the card number, expiration date, and CVV code are correct. An error here could lead to payment delays.

- Fill out all required fields: Don't leave any mandatory sections blank. Incomplete forms may not be processed, which could delay transactions.

- Sign the form: Your signature is necessary to authorize the payment. This step is crucial for verifying your identity and preventing fraud.

- Keep a copy for your records: After submitting the form, keep a copy for yourself. This will be helpful for tracking payments or resolving any future disputes.

- Update information as needed: If your credit card information changes (like getting a new card), make sure to update the authorization form. This prevents payment interruptions.

What You Shouldn't Do:

- Don't use outdated information: Using an expired credit card or old billing information can lead to payment errors. Always ensure the information is current.

- Don't forget to notify about cancellations: If you need to cancel the authorization for any reason, do so in writing. Don't just assume the merchant will automatically know.

- Don't leave your form unsecured: Treat your filled-out form like any other sensitive document. Store it securely and only share it with trusted parties.

- Don't use unclear handwriting: If filling out the form by hand, make sure your writing is legible. Misinterpretations can lead to incorrect processing.

- Don't skip reviewing the terms: Understand the terms of payment authorization. Knowing what you're agreeing to can help avoid surprises down the line.

Misconceptions

If you've ever had to handle transactions, you might be familiar with the Credit Card Payment Authorization form. It seems straightforward, but there's a swirl of misunderstandings surrounding it. Let's clear the air and debunk some of these misconceptions.

- Only businesses need it: Everyone thinks it's just for business transactions. Wrong. While businesses predominantly use it, freelancers and independent service providers can greatly benefit from having a formal authorization, adding a layer of security to their operations.

- It’s too complicated: A common myth. People often assume it's filled with legal jargon, making it too complex. In reality, it's a simple form designed to collect necessary payment details and authorization in clear, straightforward language.

- It provides unlimited access to funds: Some worry it gives the merchant a free pass to their funds. However, the form only authorizes a specific transaction or set of transactions, not carte blanche access to your credit card.

- It’s the same as a transaction receipt: There's a mix-up here. The form is a pre-transaction document giving permission to charge the card. A receipt, on the other hand, confirms that a transaction has already occurred.

- Signing one is irreversible: Many fear that once signed, there's no going back. Not true. Customers can always dispute unauthorized transactions with their bank or cancel a recurring authorization with proper notice.

- It’s only necessary for recurring payments: While it's crucial for recurring charges, it's also used for one-time transactions, particularly when services are rendered over time or delivered in the future.

- It guarantees payment: Wishful thinking! It does lower the risk of non-payment by confirming the customer's consent, but it can't stop chargebacks or disputes from happening.

- Emailing the form is enough: Just because it's convenient doesn't mean it's secure. Sensitive information like credit card details needs encryption or a secure method of transmission to protect against data breaches.

- Any template will do: Think of it like a suit—tailoring matters. A form should be customized to include all pertinent details and comply with legal requirements specific to your industry and region.

- It’s unnecessary with modern payment technology: Digital payments have indeed made transactions smoother, but they haven't eliminated the need for authorization, especially in documenting consent for recurring charges or higher-risk transactions.

Understanding these misconceptions can help you navigate credit transactions more confidently, ensuring both parties are protected. Whether you're a customer signing one or a business requiring it, knowledge is your best asset.

Key takeaways

Using a Credit Card Payment Authorization form is a handy way to give businesses permission to charge your credit card for services or products. It's a process that ensures payments are secure and authorized by the cardholder. Here are five key takeaways to keep in mind when filling out and using this form:

- Complete all required fields accurately: To avoid any delays or issues with the payment process, make sure you fill out every required section of the form. This often includes your full name as it appears on the card, the credit card number, expiration date, and the three-digit security code on the back of the card.

- Specify payment details clearly: Be explicit about the payment amount and the frequency of charges, if applicable. This is especially important for recurring payments, such as monthly subscriptions or memberships. Clearly indicating these details helps prevent any misunderstandings or unauthorized charges.

- Keep a copy for your records: Once you've filled out the Credit Card Payment Authorization form, make a copy for yourself before handing it over. This copy can serve as proof of your permission and the specific terms you agreed to, in case any disputes arise.

- Understand the terms and conditions: Before signing the form, make sure you read and understand the terms and conditions associated with the usage of the form. This includes knowing how to withdraw your authorization, under what circumstances your card may be charged, and how to dispute any charges you believe are incorrect.

- Be mindful of security: Only submit your Credit Card Payment Authorization form through secure channels. If you're sending it via email, ensure the connection is secure, or consider using encrypted email. When submitting a physical copy, hand it directly to a trusted individual or via a secure mailing method. Avoid sending sensitive information like your credit card details through unsecured or unencrypted communication channels.

Popular Documents

What Does Iou Stand for - An IOU form can be complemented by a more comprehensive loan agreement if the parties decide to formalize their arrangement further.

What Is a Transfer Tax - Confirmation of receipt and tax application procedures ensure transparency and accountability in the transfer tax process.