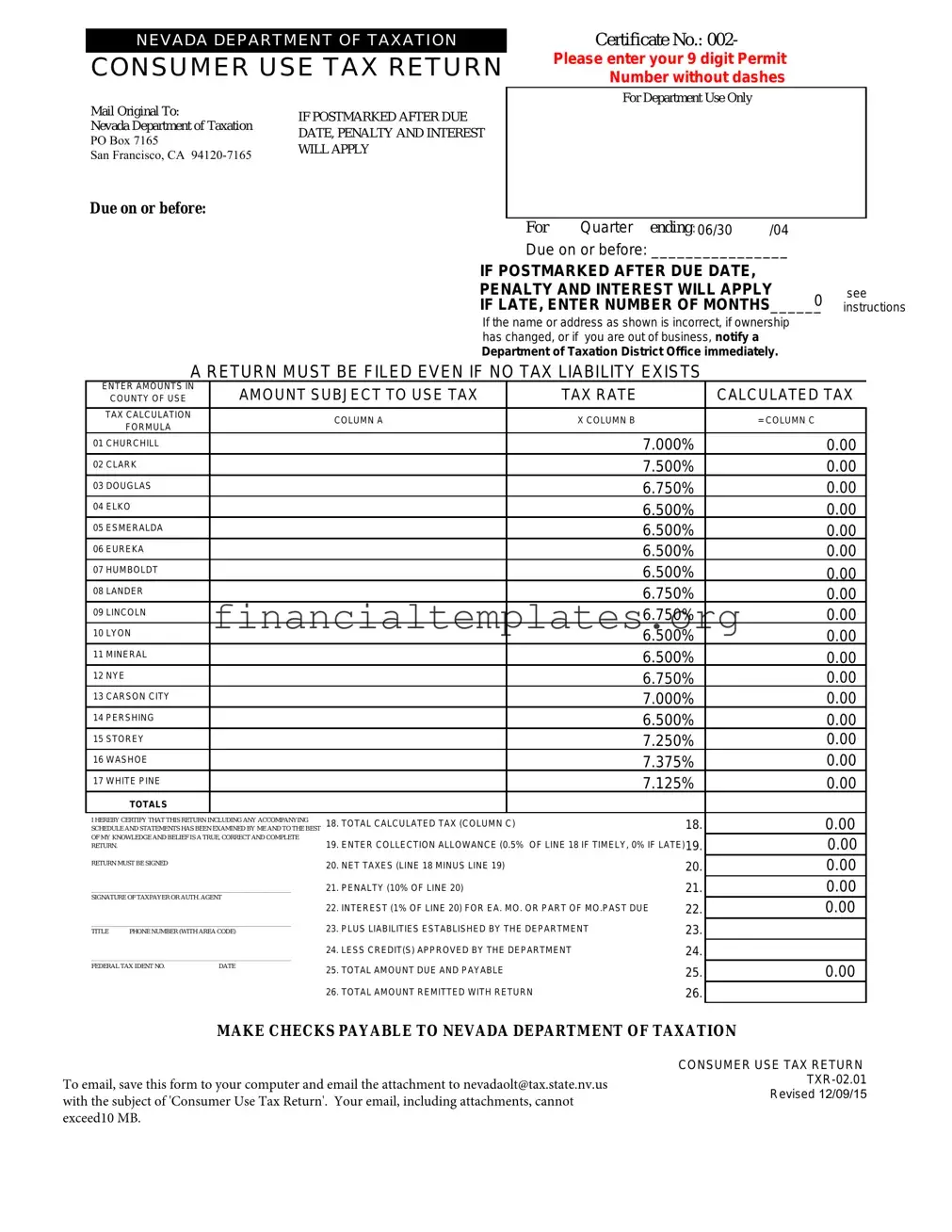

Get Consumer Use Tax Return Nevada Form

The Consumer Use Tax Return form, issued by the Nevada Department of Taxation, is an essential document for reporting and paying use tax on tangible personal property purchased without Nevada sales tax. This form requires detailed information, including the Certificate and Permit numbers of the filer, and mandates submission by specific quarterly deadlines to avoid penalties and interest charges. Accurate calculation of the tax due is essential, with the form providing a formula based on the amount subject to use tax, the tax rate, and the county of use. It also outlines the conditions under which penalties and interest are applied if the form is postmarked after the due date. Not only does this form include a section for calculating taxes due, but it also allows for adjustments based on previous overpayments or liabilities established by the Department of Taxation. To ensure compliance, the form emphasizes the necessity of filing even if no tax liability exists, underscoring the importance of understanding and correctly applying the various tax rates and exemptions that might apply. This comprehensive approach to tax reporting ensures that individuals and businesses accurately contribute to state revenues, reflecting an adherence to the principles of tax fairness and compliance.

Consumer Use Tax Return Nevada Example

NEVADA DEPARTMENT OF TAXATION

CONSUMER USE TAX RETURN

Mail Original To: |

IF POSTMARKED AFTER DUE |

Nevada Department of Taxation |

DATE, PENALTY AND INTEREST |

|

PO Box 7165 |

||

WILL APPLY |

||

San Francisco, CA |

||

|

Due on or before:

Certificate No.: 002-

Please enter your 9 digit Permit Number without dashes

For Department Use Only

For Quarter ending: 06/30 /04

Due on or before: ________________

IF POSTMARKED AFTER DUE DATE, PENALTY AND INTEREST WILL APPLY

IF LATE, ENTER NUMBER OF MONTHS 0

______

If the name or address as shown is incorrect, if ownership has changed, or if you are out of business, notify a

Department of Taxation District Office immediately.

see instructions

A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

ENTER AMOUNTS IN |

AMOUNT SUBJECT TO USE TAX |

|

TAX RATE |

|

|

CALCULATED TAX |

|

COUNTY OF USE |

|

|

|

||||

|

|

|

|

|

|

|

|

TAX CALCULATION |

|

COLUMN A |

|

X COLUMN B |

|

|

= COLUMN C |

FORMULA |

|

|

|

|

|||

|

|

|

|

|

|

|

|

01 CHURCHILL |

|

|

|

|

7.000% |

0.00 |

|

02 CLARK |

|

|

|

|

7.500% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

03 DOUGLAS |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 ELKO |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

05 ESMERALDA |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

06 EUREKA |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

07 HUMBOLDT |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

08 LANDER |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|||

09 LINCOLN |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|||

10 LYON |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|

|

|

11 MINERAL |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

12 NYE |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|||

13 CARSON CITY |

|

|

|

|

7.000% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 PERSHING |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

15 STOREY |

|

|

|

|

7.250% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 WASHOE |

|

|

|

|

7.375% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 WHITE PINE |

|

|

|

|

7.125% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

I HEREBY CERTIFY THAT THIS RETURN INCLUDING ANY ACCOMPANYING |

18. TOTAL CALCULATED TAX (COLUMN C) |

|

|

18. |

0.00 |

||

SCHEDULE AND STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST |

|

|

|||||

OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE |

19. ENTER COLLECTION ALLOWANCE (0.5% OF LINE 18 IF TIMELY, 0% IF LATE)19. |

0.00 |

|||||

RETURN. |

|

||||||

RETURN MUST BE SIGNED |

|

20. NET TAXES (LINE 18 MINUS LINE 19) |

|

|

20. |

0.00 |

|

|

|

|

|

||||

_______________________________________________________________ |

21. PENALTY (10% OF LINE 20) |

|

|

21. |

0.00 |

||

SIGNATURE OF TAXPAYER OR AUTH. AGENT |

22. INTEREST (1% OF LINE 20) FOR EA. MO. OR PART OF MO.PAST DUE |

22. |

0.00 |

||||

|

|

||||||

_______________________________________________________________ |

23. PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT |

|

23. |

|

|||

TITLE PHONE NUMBER (WITH AREA CODE) |

|

|

|||||

_______________________________________________________________ |

24. LESS CREDIT(S) APPROVED BY THE DEPARTMENT |

|

24. |

|

|||

FEDERAL TAX IDENT NO. |

DATE |

25. TOTAL AMOUNT DUE AND PAYABLE |

|

|

25. |

0.00 |

|

|

|

|

|

||||

|

|

26. TOTAL AMOUNT REMITTED WITH RETURN |

|

|

26. |

|

|

MAKE CHECKS PAYABLE TO NEVADA DEPARTMENT OF TAXATION

*001063004000000*To email, save this form to your computer and email the attachment to nevadaolt@tax.state.nv.us with the subject of 'Consumer Use Tax Return'. Your email, including attachments, cannot exceed10 MB.

CONSUMER USE TAX RETURN

CONSUMER USE TAX RETURN INSTRUCTIONS

COLUMN A. Amount subject to Use Tax: Enter total purchases subject to use tax on appropriate county line. All purchases of tangible personal property on which no Nevada sales tax has been paid must be entered here.

COLUMN C. Calculated Tax: Multiply taxable amount(s) (Column A) by tax rate(s) (Column B) and enter in Column C.

Note: If you have a contract exemption, give contract exemption number.

TOTALS: Enter total amount of Column A.

LINE 18. Total calculated tax from column C

LINE 19. Collection allowance: Compute 1/2% (or .005) X Line 18 if return and taxes are paid as postmarked on or before the due date as shown on the face of the return. If not postmarked by the due date the collection allowance is not allowed.

LINE 20. Net Taxes Due: Subtract Line 19 from Line 18.

LINE 21. If this return will not be postmarked, and the taxes paid on or before the due date as shown on the face of this

return, a 10% penalty will be assessed. Enter 10% (or .10) times Line 20.

LINE 22. If this return will not be postmarked and the taxes paid on or before the due date as shown on the face of this return, enter 1.5% times line 20 for each month or fraction of a month late, prior to 7/1/99. After 7/1/99, use 1% for each month or fraction of a month late.

LINE 23. Enter any amount due for prior reporting periods for which you have received a Department of Taxation debit notice. Monthly notices received from the Department are not cumulative.

LINE 24. Enter amount due to you for overpayment made in prior reporting periods for which you have received a Department of Taxation credit notice. Monthly notices received from the Department are not cumulative. Do not take the credit if you have applied for a refund.

NOTE: Only credits established by the Department may be used.

LINE 25. Total Taxes Due and Payable: Add Line 20, 21, 22, and 23. Subtract amount on Line 24. Enter total.

LINE 26. Total Amount Remitted: Enter total amount paid with this return.

PLEASE COMPLETE THE SIGNATURE PORTION OF THE RETURN AND RETURN IN THE ENVELOPE PROVIDED.

If you have questions concerning this return, please call one of the Department of Taxation offices listed below.

Carson City (775) |

Las Vegas (702) |

Reno (775) |

CONSUMER USE TAX RETURN INSTRUCTIONS

Revised 12/09/15

Document Specifics

| Fact Name | Description |

|---|---|

| Document Title | Consumer Use Tax Return |

| Administration | Nevada Department of Taxation |

| Mailing Address | PO Box 7165, San Francisco, CA 94120-7165 |

| Penalties for Late Submission | Penalty and interest are applied if mailed after the due date. |

| Filing Requirement | A return must be filed even if no tax liability exists. |

| Tax Calculation Formula | Amount subject to use tax (Column A) x Tax Rate (Column B) = Calculated Tax (Column C) |

| Email Submission | Submit by emailing nevadaolt@tax.state.nv.us with 'Consumer Use Tax Return' as the subject. |

| Due Dates Specifics | Specific due dates are provided on the form, which vary by the quarter ending dates. |

| Interest and Penalties Details | Interest is set at 1.5% for each month or part of a month past due before 7/1/99 and 1% after. |

| Contact Information | Provided contact numbers for Carson City, Las Vegas, and Reno offices. |

| Governing Law | Nevada Sales and Use Tax Law |

Guide to Writing Consumer Use Tax Return Nevada

Filling out the Nevada Consumer Use Tax Return form is a straightforward process that involves reporting purchases of tangible personal property on which no Nevada sales tax has been paid. Below are the detailed steps to complete this form correctly and comply with Nevada taxation rules. Ensuring accuracy in this part of your financial affairs helps avoid unnecessary penalties and fines.

- Locate the form’s due date at the top section. This is crucial because late submissions attract penalties and interest.

- In the "Certificate No." field, enter your 9-digit Permit Number without dashes.

- For the quarter ending date, make sure it matches the period you're reporting for, as stated at the top of the form next to "For Quarter ending."

- If your business details (name or address) have changed, or if there's a change in ownership or closure, communicate this change to the Department of Taxation District Office promptly.

- In the "ENTER AMOUNTS IN" section, you’ll find a column for each county. Under "AMOUNT SUBJECT TO USE TAX" (Column A), enter the total of your purchases subject to use tax for the relevant county.

- Determine the applicable tax rate from "TAX RATE" (Column B) provided on the form for the county you are reporting. Nevada counties have varied tax rates, so ensure the rate corresponds to your location.

- For each entry, multiply the "AMOUNT SUBJECT TO USE TAX" by the "TAX RATE" to find the "CALCULATED TAX" (Column C). This requires you to perform a simple calculation for each county where purchases were made.

- Sum up all entries to find the total amount of "CALCULATED TAX" and enter this in the "TOTALS" row at the end of the tax calculation section.

- If applicable, determine the "Collection Allowance" by multiplying the total calculated tax by 0.5% (or 0% if the submission is late) and enter this in the designated field (Line 19).

- Subtract the "Collection Allowance" (Line 19) from the "TOTAL CALCULATED TAX" to find the "Net Taxes Due" and enter this in the designated field (Line 20).

- Calculate any penalty due (10% of the "Net Taxes Due" if late) and enter this in the designated field (Line 21).

- Calculate any interest due for late payment. The interest rate differs based on periods before and after 7/1/99. Apply the corresponding rate to the "Net Taxes Due" for each month or part thereof past the due date and enter this in the designated field (Line 22).

- Enter any liabilities from prior reporting periods as established by the Department in the designated field (Line 23).

- If you have credit from overpayments in previous periods, enter this amount in the designated field (Line 24). Only use credits approved by the Department.

- Add Lines 20, 21, 22, and subtract any credit on Line 24 to find the "Total Taxes Due and Payable." Enter this amount in the designated field (Line 25).

- Lastly, enter the "Total Amount Remitted" in the final field (Line 26), which is the total amount you are paying with this return.

- Provide the required signature, title, phone number, federal tax identification number, and date at the bottom of the form.

- Review the completed form for accuracy, then mail it to the Nevada Department of Taxation at the address provided on the form.

Remember, it's essential to keep a copy of the filled form and any related documents for your records.

Understanding Consumer Use Tax Return Nevada

What is the Consumer Use Tax Return in Nevada?

The Consumer Use Tax Return in Nevada is a form that must be filled out and submitted by taxpayers who have made purchases of tangible personal property for which no Nevada sales tax has been paid. This form helps report and pay the use tax owed on these purchases, ensuring compliance with state tax regulations.

When is the Consumer Use Tax Return due?

The due date for submitting the Consumer Use Tax Return is specified on the form itself. It is essential to mail the completed form to the Nevada Department of Taxation by this date to avoid penalties and interest charges for late submissions.

How is the tax calculated on the Consumer Use Tax Return?

To calculate the tax on the Consumer Use Tax Return, enter the total purchases subject to use tax on the appropriate county line in Column A. Then, multiply the taxable amount(s) by the tax rate(s) provided for each county (Column B) and enter the result in Column C. The total calculated tax from Column C is then adjusted for any collection allowance, penalties, and interest (if applicable) to determine the net taxes due.

What happens if the Consumer Use Tax Return is submitted late?

If the Consumer Use Tax Return is postmarked after the due date, a 10% penalty is assessed on the due taxes, and interest is charged at a rate of 1.5% for each month or a fraction of a month late if the return is submitted before 7/1/99. After 7/1/99, the interest rate is 1% per month or fraction thereof. Additionally, the collection allowance will not be granted for late submissions.

How can I avoid penalties and interest charges?

To avoid penalties and interest charges, ensure that the Consumer Use Tax Return and the associated payment are postmarked on or before the due date as indicated on the form. Paying on time also makes you eligible for a collection allowance, which can reduce the total amount owed.

What should I do if I have questions about filling out the form or about my use tax obligations?

If you have any questions regarding the Consumer Use Tax Return or your tax obligations, you can contact the Nevada Department of Taxation. Offices in Carson City, Las Vegas, and Reno are available for assistance. Contact details for these offices are provided at the end of the return instructions, ensuring that taxpayers can seek help when needed.

Common mistakes

Filling out the Consumer Use Tax Return for Nevada can sometimes trip people up. Here are ten common mistakes to avoid:

Not checking if the name or address as shown is correct. If there's a mistake, or if there has been a change in ownership, or if the business is no longer operating, it's important to notify the Department of Taxation right away.

Forgetting to enter the total purchases subject to use tax on the appropriate county line in Column A. Every purchase of tangible personal property on which no Nevada sales tax has been paid must be documented here.

Miscalculating the tax by incorrectly multiplying the taxable amount(s) in Column A by the tax rate(s) in Column B.

Omitting the contract exemption number if you have a contract exemption.

Failing to enter the total amount from Column A in the "TOTALS" section.

Overlooking the collection allowance computation. Remember, you can compute 0.5% (or .005) of Line 18 if the return and taxes are paid as postmarked on or before the due date. If not postmarked by the due date, the collection allowance is not allowed.

Missing the penalty calculation on Line 21 if the return will not be postmarked and the taxes paid by the due date.

Inaccurately calculating interest on overdue taxes on Line 22. The rate is 1.5% for each month or fraction of a month late, prior to 7/1/99. After 7/1/99, the rate is 1% per month or part of a month.

Forgetting to enter any amounts due for prior reporting periods (Line 23) and amounts due to you for overpayments made in prior reporting periods (Line 24).

Not signing the return. It's a small but critical mistake. The return must be signed by the taxpayer or their authorized agent.

Avoiding these pitfalls will help ensure your Consumer Use Tax Return is filled out correctly and submitted on time.

Documents used along the form

When it comes to staying compliant with Nevada's taxation requirements, the Consumer Use Tax Return form is an essential document for reporting purchases on which no Nevada sales tax has been paid. Alongside this primary form, there are several additional documents and forms that frequently come into play, helping taxpayers provide a comprehensive account of their tax liabilities.

- Business Registration Form: This form is necessary for any entity that conducts business in Nevada, serving as the initial step to obtaining a tax permit.

- Sales and Use Tax Permit: Required for businesses selling goods within Nevada, this permit allows for the collection and remittance of sales and use taxes.

- Exemption Certificate Forms: These documents are used to purchase goods tax-free for resale, for use in manufacturing, or for other qualified exemptions.

- Modified Business Tax Return: Applicable to businesses paying employee wages, this return reports and pays tax based on payroll expenditures.

- Commerce Tax Return: For businesses with gross revenue exceeding a certain threshold, this form reports annual gross revenue for commerce tax purposes.

- Annual Reconciliation of Sales and Use Tax Form: Compiled annually, this reconciliation ensures all sales and purchases have been accurately reported throughout the year.

Each of these documents plays a vital role in ensuring that businesses and individuals accurately report their financial activities and comply with Nevada's tax laws. Whether it's registering a new business, applying for tax-exempt status, or reconciling annual accounts, staying informed and prepared with the correct forms can streamline tax reporting and remittance processes. By understanding and utilizing these additional resources, taxpayers in Nevada can more easily navigate the state's tax system.

Similar forms

The Consumer Use Tax Return form from Nevada shares resemblances with the Sales and Use Tax Return, commonly utilized across various states. Both forms serve the purpose of declaring taxes owed on purchases. Where the Consumer Use Tax Return focuses on items bought without the Nevada sales tax applied, the Sales and Use Tax Return often encompasses broader categories of sales, services, or rentals. They calculate tax owed by applying specific rates to the purchase amounts, adjusting for county-specific tax rates where applicable. Despite different focal points—one on consumer purchases, the other on sales, services, or rentals—both forms ensure tax compliance on transactions not covered at the point of sale.

Similar to the Nevada Consumer Use Tax Return is the Income Tax Return, used by individuals and businesses across the United States. While the Consumer Use Tax Return addresses taxes on tangible personal property purchases, the Income Tax Return calculates tax based on earned income over the year. Both forms require the taxpayer to provide financial details, calculate the amount of tax owed, and account for any applicable deductions or allowances. Dedication to accuracy and timeliness is critical in both instances to avoid penalties and interest for late submissions. Though they cater to different aspects of taxation, each form plays a crucial role in the overarching tax system.

The Business License Renewal forms found in many jurisdictions bear resemblance to the Nevada Consumer Use Tax Return in their administrative purpose. These forms also need to be submitted periodically and often require calculations based on the business's activities, much like determining tax due on purchases. While the Business License Renewal typically calculates fees based on gross receipts, location, or business type, the Consumer Use Tax Return calculates tax based on untaxed purchases. Nonetheless, both types of forms are essential for compliance with local and state requirements, ensuring businesses can legally operate and that tax dues are accurately reported and paid.

Property Tax Declaration forms, required annually by property owners, share commonalities with the Nevada Consumer Use Tax Return through their focus on accurately reporting values subject to tax. Property taxes are based on the assessed value of real and sometimes personal property, whereas the Consumer Use Tax focuses on tangible personal property purchases. Each form requires the taxpayer to list values that determine their tax responsibility. Both are pivotal in the function of local governments, funding public services and infrastructure, underscoring the taxpayer's role in contributing to community resources.

Vehicle Registration forms, necessary for legally operating a vehicle on public roads, also parallel the Nevada Consumer Use Tax Return's function. These forms often require payment of taxes or fees based on vehicle type, value, and intended use—similar to how the use tax is determined by the value of the purchased goods. While one directly funds road maintenance and safety programs, the other compensates for tax not collected at the sale point, ensuring fair taxation across purchasing methods. The emphasis on declaring accurately and paying the appropriate amount is a shared aspect between these documents.

The Employee's Withholding Allowance Certificate, another staple in the tax document arsenal, indirectly relates to the Nevada Consumer Use Tax Return. It helps determine the amount of income tax to withhold from an employee's paycheck, impacting the individual's net income and indirectly their purchasing power. While the Consumer Use Tax Return reconciles untaxed purchases at the consumer level, the withholding certificate functions at the income level, both playing roles in the wider tax compliance landscape. The connection lies in the alignment of individual financial responsibility with state tax laws.

The Excise Tax Return, required for certain products or services that come with an added tax burden, like gasoline, tobacco, or alcohol, shares the goal of tax compliance with the Nevada Consumer Use Tax Return. Despite their focal differences—specific goods or services versus broad-based consumer purchases outside the state's sales tax—the intent to ensure taxes are fully and fairly collected remains the same. Both forms address segments of the tax system that could otherwise be prone to evasion, underscoring the importance of diverse forms in capturing necessary revenues for public services.

Dos and Don'ts

When filling out the Consumer Use Tax Return for Nevada, it's important to adhere to certain dos and don'ts to ensure the process is completed accurately and efficiently. Here are the essential points to keep in mind:

Do:

- Review your purchases to accurately report all tangible personal property acquired where Nevada sales tax was not paid. This thorough review prevents underreporting and possible penalties.

- Calculate the tax due correctly using the formula provided (Amount Subject to Use Tax x Tax Rate = Calculated Tax) for each county where the purchases will be used, ensuring the correct application of tax rates.

- Make sure to submit your return and payment by the due date to avoid penalties and interest. Timely submissions are crucial for compliance and can also offer a collection allowance benefit.

- Sign the return and include all necessary information, such as your permit number, contact details, and any applicable exemption or credit numbers. An unsigned return can lead to processing delays or be considered invalid.

Don't:

- Forget to enter the total amount of purchases subject to use tax on the appropriate county line. Omitting this information can result in an incomplete return and potential interest and penalties for unpaid tax.

- Overlook the collection allowance. If your return and payment are on time, calculate and deduct the allowance correctly (0.5% of Line 18 if timely). This can reduce the amount of tax due.

- Delay your submission past the due date. Late returns are subject to penalties (10% of Net Taxes Due) and interest (1% of Line 20 for each month or part of a month past due), which can add significant costs to your tax bill.

- Ignore any debit or credit notices from the Nevada Department of Taxation related to prior reporting periods. These amounts need to be accurately reflected in your return to ensure proper payment or credit for past discrepancies.

Misconceptions

Understanding the Consumer Use Tax Return in Nevada involves navigating common misconceptions. Here's a look at ten of them and why they don't hold up:

It's only for businesses: A common misunderstanding is that the Consumer Use Tax Return is just for businesses. In reality, it applies to both businesses and individuals who have purchased tangible personal property without paying Nevada sales tax. This includes online, out-of-state, or unreported purchases that are used, stored, or consumed within Nevada.

If I don't owe taxes, I don't need to file: Even if you don't owe any use taxes for the period, you're still required to file a return. This ensures compliance and helps avoid any penalties for not filing.

The tax rate is the same statewide: Tax rates actually vary by county, as shown on the form. It's important to apply the correct tax rate for the county in which the goods are used, stored, or consumed.

Late penalties are negotiable: If a return is postmarked after the due date, a penalty and interest automatically apply. These penalties and interest rates are mandated by law and aren't subject to negotiation.

Email is an acceptable form of submission: While the form mentions emailing for assistance, the return itself must be mailed to the Nevada Department of Taxation. Emailing the return is not a valid submission method.

The form is too complicated for an individual to complete: Though the form may appear daunting, it comes with instructions designed to guide individuals through the process step-by-step, making it manageable to complete on one's own.

Collection allowance is always available: The collection allowance, which is a small percentage of the taxes owed, is only available if the return and payment are submitted on time. It's not granted for late submissions.

I can estimate the amounts: The Department of Taxation expects accurate reporting of taxable purchases. Estimations could lead to discrepancies and potential audits.

Credits or overpayments will automatically apply: If you have a credit or have overpaid in a prior period, it will not automatically apply to your current return. You must explicitly enter this information in the designated section of the return.

The signature is optional: The return must be signed by the taxpayer or their authorized agent. An unsigned return is considered incomplete and could result in penalties.

By demystifying these common misconceptions, individuals and businesses can navigate the Consumer Use Tax Return process in Nevada with more confidence and compliance.

Key takeaways

When filing the Consumer Use Tax Return in Nevada, individuals and businesses must include purchases of tangible personal property where no Nevada sales tax has been paid. This process involves accurately entering data into specific sections of the form to ensure compliance and calculate the correct tax due. Below are key takeaways to guide you through filling out and using the form effectively:

- Ensure that the 9-digit Permit Number is entered correctly without any dashes.

- The form is due based on a quarterly schedule with specific dates; late submissions will incur penalties and interest charges.

- Changes in name, address, or ownership, as well as cessation of business, must be reported to the Nevada Department of Taxation District Office immediately.

- A return must be filed even if there is no tax liability for the period.

- Each county has a different tax rate, and taxpayers should apply the correct rate based on the county of use when calculating the tax amount due.

- The calculated tax is determined by multiplying the total amount subject to use tax by the applicable county tax rate.

- If a taxpayer files and pays by the due date, they are entitled to a collection allowance calculated as 0.5% of the total calculated tax.

- If payments are late, penalties of 10% of the net taxes due are assessed, and interest is charged monthly at a rate of 1% per month or part of a month until the debt is settled.

- To submit the return, it can be mailed to the designated address or, for added convenience, emailed to the Nevada Department of Taxation with the file saved to your computer and attached to the email.

It's important for taxpayers to review their purchases and ensure that all necessary transactions are reported to avoid potential penalties. Accurate and timely filing supports compliance with Nevada's tax laws and contributes to the state's fiscal well-being.

Popular PDF Documents

IRS 8582 - This form is a tool for achieving tax efficiency through the strategic utilization of passive losses.

What Is Form 8879 - With Form 8879, the IRS provides a secure and verified method to electronically sign and submit tax returns, embracing the digital age.