Get Completion Repairs Form

In the often complex landscape of property repairs following damage, the Completion Repairs form emerges as a pivotal document. This form not only signifies the culmination of necessary repairs but also stands as a testament to the restoration of a property’s pre-damage condition. For property owners grappling with the aftermath of unforeseen damages, the form acts as a beacon of resolution, assuring external parties—a crucial aspect for stakeholders such as insurance companies and financial institutions—that all repairs have been satisfactorily completed. It meticulously records the account number, property address, and the total claim amount, alongside a certification that all repairs, directly connected to a specified type of damage that occurred on a particular date, have been completed without exception. Furthermore, it underlines a pledge that no liens, arising out of labor performed or materials utilized, will encumber the property, thus safeguarding the interests of all parties involved. By necessitating signatures from both the mortgagor and co-mortgagor, the document encapsulates a formal agreement, ensuring that all financial obligations towards contractors, subcontractors, and material suppliers have been met or will be met through the final insurance disbursements. This form, therefore, secures the interconnected realms of property restoration, financial responsibility, and legal liability, making it a linchpin in the domain of property repair and insurance settlements.

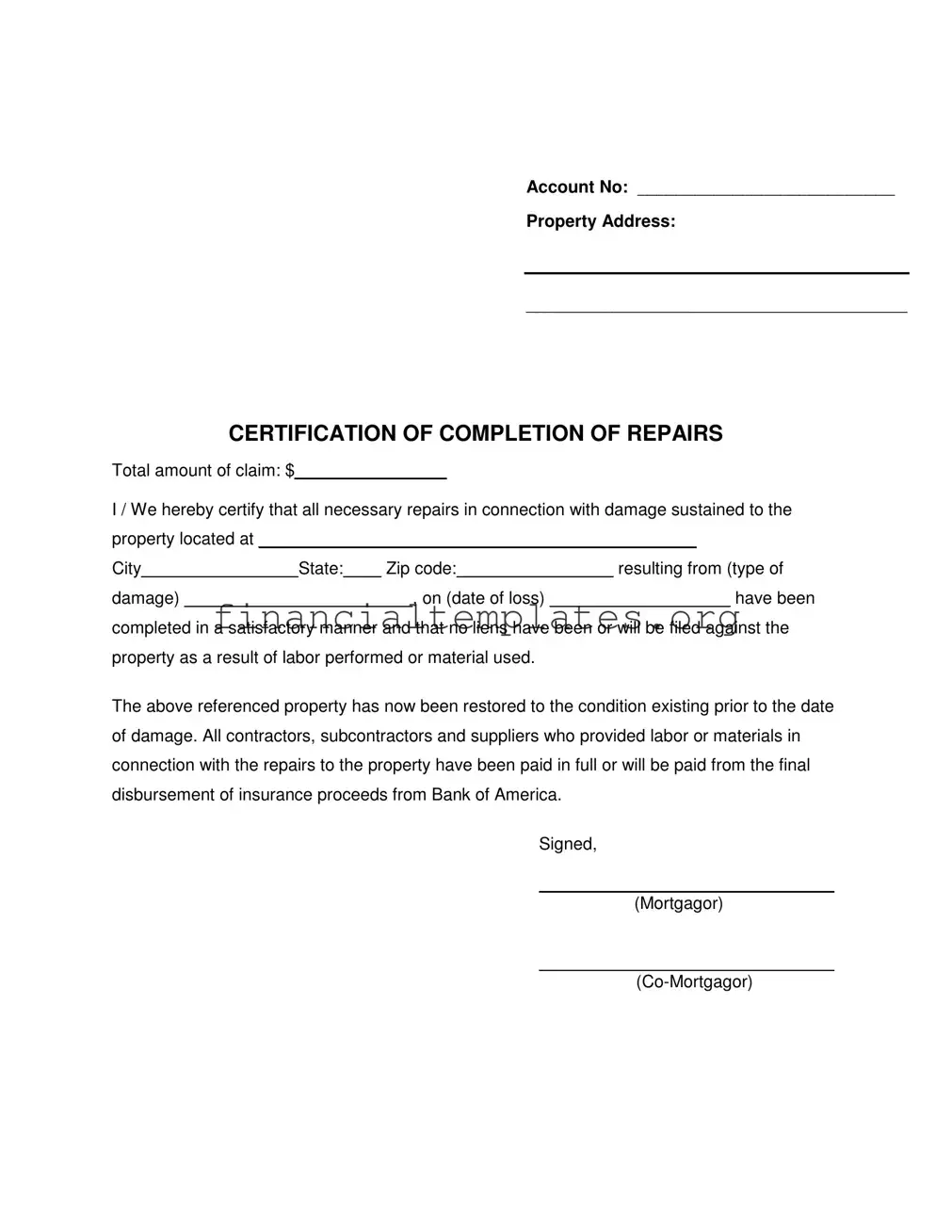

Completion Repairs Example

Account No: ___________________________

Property Address:

________________________________________

CERTIFICATION OF COMPLETION OF REPAIRS

Total amount of claim: $________________

I / We hereby certify that all necessary repairs in connection with damage sustained to the property located at ______________________________________________

City________________ State:____ Zip code: ________________ resulting from (type of

damage) ________________________, on (date of loss) ___________________ have been

completed in a satisfactory manner and that no liens have been or will be filed against the property as a result of labor performed or material used.

The above referenced property has now been restored to the condition existing prior to the date of damage. All contractors, subcontractors and suppliers who provided labor or materials in connection with the repairs to the property have been paid in full or will be paid from the final disbursement of insurance proceeds from Bank of America.

Signed,

_______________________________

(Mortgagor)

_______________________________

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form certifies that all necessary repairs from a specified damage to the property have been completed satisfactorily. |

| Lien Release Assurance | The form stipulates that no liens have or will be filed against the property as a result of labor or material used. |

| Payment Confirmation | It confirms that all contractors, subcontractors, and suppliers have been or will be paid in full from the final insurance disbursement. |

| Restoration Confirmation | Confirms that the property has been restored to its condition prior to the damage. |

| Legal Implication | Signatories affirm that the information is accurate, potentially subjecting them to legal penalties if found otherwise. |

| Governing Law(s) | While the form does not specify, the governing laws would typically relate to state-specific real estate and contract law provisions. |

Guide to Writing Completion Repairs

After navigating the uncertain waters of property repairs, filling out the Completion Repairs form represents a critical final step in ensuring that all parties are duly informed of the work's completion and the restoration status of your property. This formality seals the understanding between you, the financier (if your repairs were insurance-funded), and any other concerned entity by verifying that all predetermined repair work has been satisfactorily completed and financially settled. It’s a declaration of a return to normalcy and acts as a preventive measure against future legal entanglements relating to the repair work undertaken.

- Begin by accurately filling in the Account No. This number links the form to your specific case or insurance claim, serving as a unique identifier.

- Proceed to enter the Property Address in the designated space. This information should include the full address of the property that underwent repairs, ensuring there’s no ambiguity regarding the location in question.

- In the section titled CERTIFICATION OF COMPLETION OF REPAIRS, specify the Total amount of claim. This is the total financial figure that was agreed upon for the repair works, be it from an insurance claim, out-of-pocket expenses, or a combination of sources.

- Next, fill in the declaration part. Start by affirming your status with "I/We hereby certify.." This is where you declare that all necessary repairs have indeed been completed and specify the nature of the damage along with the date of loss and the actual location details again for reinforcement of the claim’s legitimacy.

- Make sure to reiterate the condition of the property post-repairs, emphasizing its restoration to the pre-damage state.

- Clarify the payment situation in the following section, ensuring it's understood that all involved parties (contractors, subcontractors, and suppliers) have been or will be fully compensated, highlighting the source of these funds, especially if they are being disbursed from insurance proceeds.

- Conclude your form filling by signing in the designated area for Mortgagor and Co-Mortgagor (if applicable). These signatures are pivotal, serving as your personal attestation to the accuracy of the information provided and the completion of the repair work.

By meticulously following the detailed steps above and providing accurate, honest information, you ensure a smooth transition into the post-repair phase, effectively closing this chapter of the property’s history. It reinstates your property to its rightful status both legally and physically, allowing you to move forward with peace of mind, knowing that all necessary actions have been acknowledged and recorded.

Understanding Completion Repairs

What is the purpose of the Completion Repairs form?

The Completion Repairs form serves as a formal declaration by the property owners that all repairs needed due to specified damages to their property have been satisfactorily completed. It ensures that the property has been restored to its condition before the damage occurred and affirms that all parties involved in the repair process have been compensated or will be compensated, which prevents any liens from being placed on the property.

When should I submit the Completion Repairs form?

This form should be submitted after all repairs to the property have been completed but prior to the final disbursement of insurance proceeds by the bank. It’s crucial to time the submission correctly to both enable the release of any held funds and to ensure that the property is free of any potential liens from contractors, subcontractors, or suppliers.

Who needs to sign the Completion Repairs form?

Both the mortgagor and, if applicable, the co-mortgagor must sign the Completion Repairs form. Their signatures certify that the information provided on the form is accurate to the best of their knowledge and that the conditions stated regarding repairs and payments have been met.

What information do I need to complete the form?

You will need the following information: the account number associated with the property, the address of the property, the total amount of the claim, the type of damage sustained, the date of the loss, and the assurance that all necessary repairs have been made and paid for. Gathering all relevant details beforehand will facilitate a smoother completion process.

What is meant by "No liens have been or will be filed against the property"?

This statement guarantees that no legal claims (liens) have been or will be placed against the property for any unpaid labor or materials used in the repairs. This assures the bank and other stakeholders that the property title is clear of any financial obligations arising from the repair work.

What happens after I submit the form?

Upon submission, the bank will review the form as part of the process to release the final disbursement of insurance proceeds. This step is crucial for ensuring that all financial transactions related to the property’s repair are settled. Once approved, any remaining funds will be released, and the insurance claim process for that particular damage will be considered complete.

Is there a deadline for submitting the Completion Repairs form?

While specific deadlines may vary by bank or insurance policy, it is generally advisable to submit the form shortly after the completion of repairs. This ensures timely disbursement of any remaining insurance proceeds and helps avoid potential issues with liens. It's recommended to check with your bank for any specific deadline related to your claim.

Common mistakes

One common mistake is not filling out the Account No field. This is crucial for linking the form to the right account and ensuring that the completion of repairs is recorded correctly.

Another error is providing an incomplete or inaccurate Property Address. This address must match the property in question exactly, as discrepancies can cause delays or issues with the claim.

Not specifying the total amount of the claim can also be problematic. This figure is essential for calculating the final disbursement of insurance proceeds.

Some people forget to certify the repair work by neglecting to fill in the CERTIFICATION OF COMPLETION OF REPAIRS section. This certification is a necessary declaration that the repairs meet the required standards.

Omitting details such as the type of damage, date of loss, and completion of required repairs leaves the certification incomplete. These details are crucial for understanding the extent of the damage and the sufficiency of the repairs.

Failure to assert that no liens have been or will be filed against the property as a result of labor performed or material used is another common mistake. This assurance is vital for the protection of the property owner’s and the bank’s interests.

Last but not least, forgetting to have the form signed by both the Mortgagor and Co-Mortgagor (if applicable) renders the document unofficial. Signatures are required to validate the form.

When filling out the Completion Repairs form, attention to detail and accuracy are paramount. Avoiding these mistakes ensures a smoother process in certifying the completion of repairs, ultimately leading to the timely disbursement of funds.

Documents used along the form

When handling repairs for damages to a property, particularly in the context of an insurance claim, the Completion Repairs form is a vital document. However, this form is often just one piece of a larger paperwork puzzle. Several other documents typically accompany or precede the Completion Repairs form to ensure a comprehensive and compliant repair process. Here’s an overview of four such documents that might be used alongside the Completion Repairs form.

- Insurance Claim Form: This is usually the initial document filed by the property owner to report damage to the insurance company. It serves as an official request for coverage under the terms of the policy, detailing the nature, cause, and extent of the damage.

- Adjuster’s Report: After an insurance claim is filed, an adjuster is sent by the insurance company to inspect the damage. They prepare a report which outlines the scope of damage, recommended repairs, and an estimate of the costs involved. This report is crucial for determining the amount of money the insurance company will disburse for repairs.

- Contractor’s Estimate/Quote: Before repairs can begin, a contractor will need to provide an estimate or quote for the work to be done. This document outlines the specific repairs needed, materials required, and the total cost for labor and supplies. It’s essential for budgeting and ensuring the insurance funds cover the necessary repairs.

- Lien Waiver: Upon completion of repairs, before the final insurance payments are released, a lien waiver may be required. This document, signed by contractors and subcontractors, verifies that they have been paid in full for their services and agree not to place a lien on the property for any claimed unpaid work or materials.

Together, these documents form a detailed and documented path from the initial damage report to the finalizing of repairs, safeguarding the interests of all parties involved. For homeowners navigating the aftermath of property damage, understanding these documents and their roles in the repair process can help ensure a smoother, more efficient path to restoration.

Similar forms

The "Lien Waiver" form closely resembles the "Completion Repairs" form, primarily in its aim to certify that all financial obligations related to construction or repair work have been met. A lien waiver is a document from a contractor, subcontractor, or materials supplier involved in a construction project, stating they have received payment and waive any future lien rights to the property. This document, similar to the Completion Repairs form, helps ensure the property owner is protected from any potential claims or liens against the property after the completion of the work, affirming that the property is free from claims related to labor or materials.

A "Certificate of Occupancy" is another document sharing similarities with the Completion Repairs form, particularly in its function of signifying a property’s compliance with certain standards or conditions. This certificate is issued by a local government agency or building department, certifying a building's compliance with applicable building codes and other laws, and indicating it is in a condition suitable for occupancy. While the Certificate of Occupancy focuses more on the legal habitability of a property, both documents serve as formal attestations that a property meets specified criteria following construction or repairs.

The "Property Inspection Report" has parallels with the Completion Repairs form, especially in documenting the condition of a property. This report, typically generated by a professional property inspector, details the state of a property at a specific point in time, highlighting any defects or areas in need of repair. Similar to how the Completion Repairs form confirms that all necessary repairs have been satisfactorily completed, the Property Inspection Report provides evidence of the property's condition before or after repairs, which can be crucial for insurance claims or property sales.

The "Mechanic’s Lien" contrasts with but is related to the Completion Repairs form. It is a security interest in the title to property for the benefit of those who have supplied labor or materials that improve the property. The form itself signifies potential financial risk—a claim made against the property by contractors or suppliers who have not received payment. Conversely, the Completion Repairs form seeks to affirm that all such financial liabilities have been settled, aiming to prevent any mechanic's liens from being validly filed against the property.

Lastly, the "Builder’s Risk Insurance Policy" shares objectives with the Completion Repairs form, as both aim to mitigate the risks associated with property construction or renovation. This insurance policy protects against the risks specifically associated with construction, including damage to the property while under construction. It speaks to a broader scope of protection by covering loss or damage prior to completion, whereas the Completion Repairs form serves as a declaration that any damage or losses presumed under such a policy or other circumstance have been fully rectified and paid for upon the project’s conclusion.

Dos and Don'ts

When filling out the Completion Repairs form, there are critical steps to follow and certain missteps to avoid ensuring the process goes smoothly. Here's what you should and shouldn't do:

Do:

- Verify all the details: Ensure that the Account Number and Property Address are correctly entered, matching those on your insurance and property documents.

- Complete the Certification of Completion of Repairs section fully, making sure to describe accurately the type of damage, date of loss, and certify the completion status of the repairs.

- Ensure that the total amount claimed matches the invoices and receipts from the contractors, subcontractors, and suppliers involved in the repairs.

- Confirm that all parties providing labor or materials have been paid or have a clear agreement on when they will be paid from the final insurance disbursement.

- Both the mortgagor and co-mortgagor (if applicable) must sign the form to validate the completion of repairs and the accuracy of the information provided.

Don't:

- Leave blanks in the form. If a section does not apply, consider writing 'N/A' (not applicable) instead of leaving it empty to avoid any ambiguity.

- Forget to mention any subcontractors or suppliers that contributed to the repair work. Their acknowledgment ensures transparency and helps in preventing potential liens against your property.

- Rush through reading the certification statement. Understand all its conditions, as it is a legal acknowledgment that repairs have been satisfactorily completed and all participants compensated.

- Submit the form without double-checking all the details for accuracy and completeness. Mistakes can cause delays or disputes with the insurance company or bank.

- Ignore the importance of keeping copies of the completed form and all related repair documents. These documents can be crucial for any future claims or discrepancies.

Misconceptions

Understanding the Completion Repairs form is essential for homeowners dealing with property damage. However, misconceptions can complicate the process. Here, we address some common misunderstandings to clarify the use and importance of this form.

Only major repairs need to be certified: Some believe that only significant or major repairs require certification through the Completion Repairs form. However, this form is necessary for certifying the completion of all repairs related to the insured damage, regardless of their size or cost. It ensures that all work has been satisfactorily completed.

The form isn't legally binding: Many homeowners think this form is a mere formality without legal implications. In reality, signing the Completion Repairs form is a legal declaration that repairs have been completed, and all parties involved have been or will be compensated, which can have legal consequences if misrepresented.

Filing a lien is still an option: The statement within the form that "no liens have been or will be filed" is often misunderstood. Once this form is signed, homeowners and contractors are affirming that there are no outstanding payments for labor or materials, effectively waiving the right to file a lien against the property for those repairs.

Any contractor can sign off on repairs: A common misconception is that any contractor involved can sign the form. It's important that homeowners themselves sign the form, certifying the satisfaction and completion of work. This provides a direct declaration from the property owner rather than third-party contractors.

Insurance payment is immediate: There's a belief that insurance payments for repairs will happen immediately upon form submission. While completing and submitting the form is a critical step towards finalizing claims, processing times can vary, and there may be additional verifications required by the insurance company before disbursement.

The form only relates to insurance claims: While insurance claims are a common reason for using this form, its purpose extends beyond just insurance. It serves to legally document the completion of repairs, satisfaction of work, and fulfillment of financial obligations, which is beneficial in various scenarios beyond filing an insurance claim.

Clarifying these misconceptions is vital for homeowners navigating through the repair and insurance claims process. Understanding the true purpose and implications of the Completion Repairs form can help streamline the recovery and rebuilding process after property damage.

Key takeaways

Filling out and using the Completion Repairs form is a critical step in ensuring that all repairs made to a property after damage are recognized, accounted for, and officially noted. Here are some key takeaways to keep in mind:

- Accuracy is essential: It's crucial to fill out the form with complete accuracy, including the account number, property address, and the total amount of the claim. This information is used to verify and process the repairs officially, ensuring that the property owner's records are up-to-date and accurate.

- Certification of Completion: By signing the form, the property owners certify that all necessary repairs have been satisfactorily completed. This includes restoring the property to its condition before the damage occurred. It's a formal acknowledgement that the property has been fixed according to the required standards.

- Confirmation of Payment: The form requires a declaration that all contractors, subcontractors, and suppliers have been fully paid or will be paid from the final insurance proceeds. This is an important step to prevent any potential liens against the property. Having a lien filed can complicate future financial transactions or the sale of the property.

- Preventing Future Complications: Completing and submitting this form helps prevent future complications by documenting that all repairs have been made and all parties have been compensated. This could be critical if there are later disputes about the quality of the work or the payment of services.

Overall, the Completion Repairs form serves as a vital document in the repair process, ensuring that all parties are accountable and that the property's value is maintained through proper documentation and certification of repairs.

Popular PDF Documents

How Much Does It Cost to Register a Business in Texas - Select your preferred method of payment on the Texas SOS Payment 807 form, with options including major credit cards and checks.

IRS 1094-C - The 1094-C not only demonstrates compliance with health coverage regulations but also helps in the overall administration of employer responsibilities under the ACA.

Cdp Hearing - A vital tool in the arsenal of taxpayers facing adverse collection actions by the IRS.