Get Co Severance Tax Form

The Colorado Severance Tax form, an essential document for individuals and entities generating taxable income from oil or gas production within the state, encompasses a thorough process outlined in the 2020 booklet. This detailed guide includes the DR 0021 Oil and Gas Severance Tax Return, the DR 0021D Oil and Gas Severance Tax Computation Schedule, and the DR 0021S Application for Extension of Time to File the Colorado Severance Tax Return. Focused on nonrenewable natural resources, this tax is based on the gross income from such sources, with specific conditions for those owning interests in oil, gas, or carbon dioxide productions. Notably, there are exemptions for low-producing wells, known as "stripper wells," and requirements for producers to withhold a percentage of gross income as pre-payment towards potential severance tax liabilities. The booklet also addresses the necessity for timely and accurate return filings, adhering to the same fiscal period as federal tax obligations, and emphasizes the interconnectedness with other tax responsibilities, such as estimated payments and implications for deceased persons' estates. Instructions for amendments, prior-year filings, and common errors provide a robust framework for compliance, ensuring clarity and ease in fulfilling Colorado's severance tax requirements.

Co Severance Tax Example

(11/03/21)

BOOKLET INCLUDES:

DR 0021 | DR 0021D | DR 0021S

2021

{ BOOK21

{

Colorado Severance Tax Booklet

Colorado Severance Tax Forms

THIS BOOK INCLUDES:

DR 0021 Oil and Gas Severance Tax Return

DR 0021D Oil and Gas Severance Tax Computation Schedule

DR 0021S Application for Extension of Time to File Colorado Severance Tax Return

Tax.Colorado.gov

MAIL Colorado Severance Tax Returns and Tax Payments to

With |

|

Colorado Department of Revenue |

|

||

Payment |

|

Denver, CO |

|

These addresses and zip codes are exclusive to the Colorado Department of Revenue, so a street address is not required.

Page 2

General Information

Colorado severance tax is imposed upon nonrenewable natural resources that are removed from the earth in Colorado. The tax related to oil and gas is calculated on the gross income from oil and gas and carbon dioxide production.

Who Must File Return DR 0021

Anyone who receives taxable income from oil or gas produced in Colorado. If you own a working interest, or a royalty interest in any oil or gas (including carbon dioxide) produced in Colorado, or if you receive royalties on Colorado oil shale, you must pay severance tax to the State

of Colorado. Severance tax might be due even though you do not realize a net profit on your investment.

A partnership, LLC or S Corporation must file at the entity level. Partners, members, or shareholders do not file a

severance tax return to report oil and gas income received by the

Oil and gas production from “stripper wells” is exempt from severance tax. This includes oil from a well that produces 15 barrels or less of crude oil per day or gas from a well that produces 90,000 cubic feet or less of gas per day, for the average of all producing days during the taxable year. Each commodity must be tested for each well to determine that

commodity’s stripper well status. More information about stripper well withholding and filing requirements can be

found by reading FYI Withholding 4 and FYI General 4 at Tax.Colorado.gov - the official Taxation web site.

Exception

It is not necessary to file a severance tax return if you meet both of the following conditions:

1.the total gross oil and gas withholding on form(s) DR 0021W for the calendar year is less than $250; and

2.the producer has withheld sufficiently from royalty or production payments to cover the severance tax liability.

Severance Withholding

Producers or first purchasers who disburse funds must withhold 1% of the gross income for each interest owner. This applies to any relevant interest owners, including those with royalty interest or working interest.

The producer or first purchaser is required to send the DR 0021W, Oil and Gas Withholding Statement, to interest owners by March 1 of each year. This form lists the gross income and the amount of severance tax the producer has withheld and paid to the state from your royalty or production

payments. If you own an interest in more than one well or field, you should receive a separate withholding statement from each producer or first purchaser. A copy of each

withholding statement must be included with your severance tax return (DR 0021).

The producer or first purchaser will also list your share of “ad valorem” taxes, if any, on the withholding statement. Ad valorem taxes are paid by the producer to local governments (cities and counties). You are allowed a credit against severance tax of 87.5% of your share of ad valorem taxes

paid or assessed on actual, taxable oil and gas production (not the tax on facilities or equipment). Ad valorem taxes on

production from “stripper wells” should not be included in the credit. Specific instructions for this deduction are

on the DR 0021D, Colorado Oil and Gas Severance Tax Schedule. You should verify that the withholding statements accurately report the same information as shown on your division of interest statements and revenue checks.

Filing Period

The Colorado severance tax filing period should match the tax year/filing period used for federal income tax purposes.

Filing Status

The Colorado filing status will generally match the filing status

from your federal income tax return. However, the Colorado severance tax filing status will always be joint if you are married - regardless of whether you file jointly or separately for federal income tax purposes. If you are filing as single or head of household for income tax purposes, you should file

a single status Colorado severance tax return.

Due Date

You must complete and file the DR 0021, Colorado Oil

and Gas Severance Tax Return, annually. The return (and payment, if any) are due by the 15th day of the fourth month after the close of your taxable year. Therefore, if your taxable year ends on December 31, your severance tax return is due April 15 of the following year. The envelope must be postmarked by the due date or the next business day if the deadline falls on a Saturday, Sunday or holiday.

Mail Colorado severance tax returns and tax payments to:

Colorado Department of Revenue Denver, CO

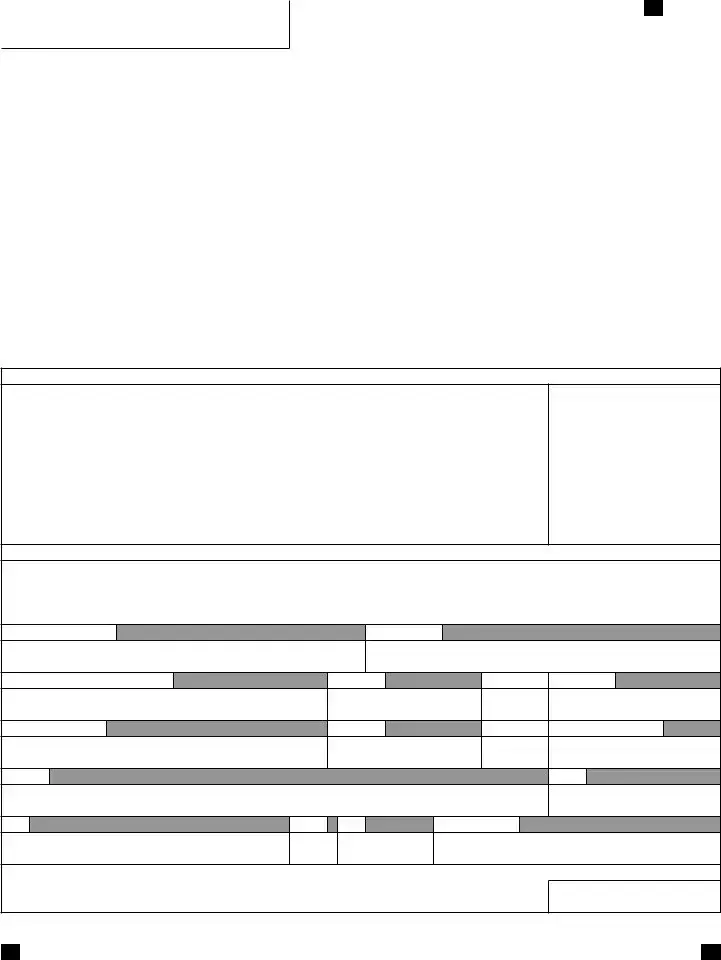

Filing Extension

An automatic

However, an extension of time to file is not an extension of time to pay the tax. If at least 90% of the net tax liability is not paid by the original due date of the return, penalty and interest will be assessed. If 90% or more of the net tax liability is paid by the original due date of the return and the balance is paid when the return is filed by the last day of the extension period, only interest will be assessed.

Use the DR 0021S to make a payment that must be made by the original due date of the return to meet the 90% requirement.

Amended Returns

To change or correct a Colorado severance tax return, you must file a DR 0021X. This form is available for download

from Tax.Colorado.gov.

Returns For Prior Years

Colorado severance tax returns for prior years can be filed at any time. However, the statute of limitations for claiming a severance tax refund is three years from the due date. Colorado severance tax returns for prior years are available

for download from Tax.Colorado.gov.

Estimated Severance Tax Payments

Corporations who expect their Colorado severance tax liability for the year to exceed their Colorado severance credits by $5,000 or more are required to make estimated tax payments. Estimated tax payments are due each month by the 15th day of that month and must be submitted by

Electronic Funds Transfer (EFT). A paper form for these tax payments is not required; the EFT transaction is the filing.

Visit

Individuals are not required to make estimated payments for severance tax.

Deceased Persons

Legal representatives and surviving spouses may file a return on behalf of a deceased person. Complete the return as usual. Write “Deceased” in large letters in the white space

above the tax year of the return, mark the deceased box for the appropriate person, and fill in the date of death. Write

“Filing as surviving spouse” or “Filing as legal representative”

after your signature, and include the DR 0102 (refunds only) and a copy of the death certificate.

Record Retention

Keep all documentation you used to prepare your return for at least three years after the due date or filing date of

your return, whichever is later. If your return is audited by the Colorado Department of Revenue, you must be able to provide

your return. Please note that you are not protected from audit adjustments to your severance tax return simply because

an operator or purchaser supplied the information. Also, the Department of Revenue may request copies of your federal and Colorado income tax return or other documentation in connection with your Colorado severance return.

Income Tax Filing Requirement

Severance tax is different from income tax. If you receive oil,

gas or CO2 income from Colorado sources you must also complete and file a Colorado state income tax return. Visit

Tax.Colorado.gov to download the DR 0104, which can be

filed electronically for free using Revenue Online. See the DR 0104 for details. Do not claim severance tax withholding as a tax credit on your Colorado income tax return.

Failure To File

If your severance tax account is open, or if you have severance income that is reported to the Colorado

Department of Revenue and you do not file a return for the tax period, the Department may file a return on your behalf. This does not apply if you meet the conditions

under the “Exception” section on page 2 of this booklet.

Any severance tax assessed if the Department does file on your behalf will remain due and payable until you file your return or close your account. If you are no longer

doing business in the State of Colorado, you are required to close your account by filing the DR 1102, Account Change or Closure Form.

Common Filing Errors

Be alert to the following filing tips to avoid delays in return processing, payments and refunds.

•Indicate the correct tax year or fiscal year when filing a

Colorado severance tax return.

Page 3

•Married couples must file jointly even if only one

spouse has oil and gas income or the couple uses a different filing status for income tax purposes.

•Taxpayers must complete the DR 0021D, Colorado Oil and Gas Severance Tax Schedule, and include it with the DR 0021 return. Both of these forms are in this booklet.

•Be sure to carry the correct totals from the DR 0021D schedule to the DR 0021 return.

•Include all DR 0021Ws (Oil and Gas Withholding Statement) with the DR 0021 return. Missing DR 0021Ws result in delayed refunds.

•Add up all the DR 0021W withholding statements, then round to the nearest dollar. Do not round each individual DR 0021W statement and then add them.

•Do not use a

•Do not claim a percentage of the withholding shown on the DR 0021W and do not create spreadsheets to show the ownership percentage. Use the amounts on the DR 0021W. The ownership percentage has already been calculated by the entity that issued the DR 0021W withholding statement.

•Do not claim all of the withholding but only part of the income.

•Do not deduct gross payments attributable to stripper well production if these are not shown as stripper well income on a DR 0021W.

•Taxpayers are either on an accrual basis or a cash

•If a return is filed on behalf of an entity such as partnership or limited liability company, do not try to file as an individual.

•Corporations that expect their Colorado severance tax liability for a tax year to exceed their Colorado severance tax credits by $5,000 or more are required to make estimated tax payments.

•To avoid underestimation penalties, corporations must make severance tax estimated payments by the 15th day of the month and payments must be submitted by EFT.

Please visit Tax.Colorado.gov for more information.

Page 4

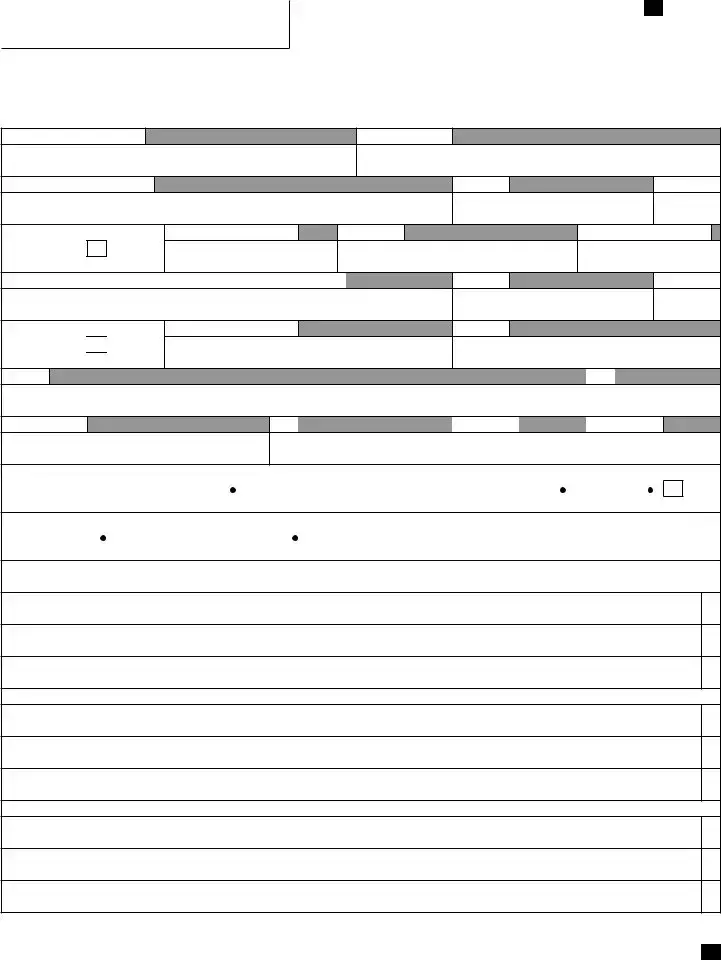

DR 0021 Instructions

Who Must File

Every individual, corporation, business trust, limited partnership, LLC, partner in a general partnership, association, estate, trust or any other legal entity that

received income from oil and gas produced in Colorado must file a severance tax return. The return must be made for the

same tax year used for federal income tax purposes and is due on or before the 15th day of the fourth month following the end of the taxable year. See General Information section for exception. If you are an oil and gas producer you must complete the DR 0021PD and retain for your records.

Controlled group: corporations, family group, or other type of group

In the case of a controlled group of corporations as

defined in section 613A of the Internal Revenue Code where more than one member of the group is subject to the severance tax, the tax must be jointly computed and the severance tax return must be jointly filed under the

name of the principal taxpaying corporation. DR 0021AS, available at Tax.Colorado.gov, must be included.

Joint Returns

When more than one member of a family is subject to the severance tax, they shall compute the severance tax on one

combined return. Note: parties to a Civil Union should refer to federal tax law to determine the correct filing status.

Social Security or Colorado Account Number

Individuals must use a Social Security number (SSN) or

Individual Taxpayer Identification number (ITIN) as the Colorado account number. Business entities must provide

the Colorado account number (CAN) and the Federal

Employer Identification number (FEIN). Whether you are

an individual or a business entity, once you have been assigned a Colorado account number by the Colorado Department of Revenue, use the Colorado account number on all returns and correspondence submitted to the Department. See Tax.Colorado.gov for Privacy Act Notice.

Tax and Credit

First, complete schedule DR 0021D to calculate your severance tax.

Line 1 Oil and Gas Severance Tax

Enter your net tax from line 5 of schedule DR 0021D.

Line 2 Impact Assistance Credit

A credit against the severance tax is allowed with respect to contributions to local government that are deemed to be necessary because of a new severance operation or the

increase in production at an existing operation. The amount of the credit must be certified by the Executive Director of the

Department of Local Affairs. Enter your impact assistance credit for the year on line 2.

Line 3 Net Tax

Subtract line 2 from line 1, and enter the difference on line 3. If line 2 is larger than line 1, enter zero.

Line 4 Severance Tax Withheld

Enter the total amount shown on all of your oil and gas withholding statements (DR 0021W) as Colorado severance tax withheld. Add all amounts, then round to the nearest

dollar. Be sure to include your DR 0021W forms with your return; missing DR 0021Ws will delay your refund. Do not claim credit for conservation tax or ad valorem taxes on this line.

Line 5 Estimated Tax and Extension Payments

Enter the total amount of your estimated tax and extension payments made for the taxable year.

Refund or Balance Due

Line 7 Overpayment

Subtract line 3 from line 6 and enter the difference on line 7.

Line 8 Refund

Enter the amount from line 7 that you wish to have refunded.

The Department can deposit your refund directly into your account at a U.S. bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United

States or the Department can send you a refund check.

Line 9 Refund Applied to Future Period

Enter on line 9 the amount of overpayment, if any, you wish credited to estimated severance tax payment for next year.

Line 10 Tax You Owe

If line 3 is more than line 6, you have additional tax to pay. Subtract line 6 from line 3 and enter the difference on line

10.This is the amount you owe. Include with your return a check or money order in this amount payable to the Colorado Department of Revenue. Be sure to write your Social

Security number or Colorado account number on your check or money order to ensure credit for your payment.

Line 11 Interest

If the return is filed after the due date, interest at the current statutory rate will accrue on any balance of tax due until paid. For the current interest rates, refer to publication FYI General

11.The regular rate will apply if we bill you and your payment is made more than 30 days after you receive your bill. If you pay your tax with your return or within 30 days of receiving a

bill, the discounted rate will apply. Enter the amount of late filing interest on line 11.

Line 12 Penalty

The penalty on any late filed return with a balance of tax due

is $30 or 30% of the balance of tax due, whichever is greater.

Enter the amount of late filing penalty on line 12.

Line 13 Estimated Tax Penalty

Corporations that underpay the estimated tax must enter the penalty due from the DR 0206.

Be sure to sign your return! If filing a joint return, both parties must sign.

To ensure proper processing, please include your account number on the return.

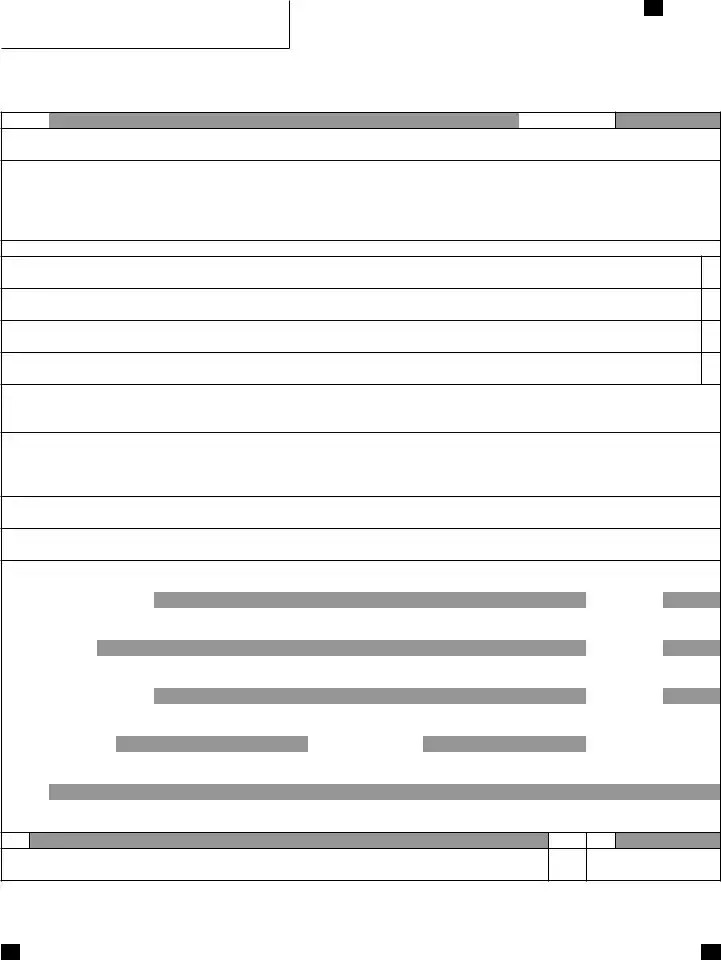

Instructions For Preparing Severance Tax Schedule DR 0021D

Use the DR 0021D to calculate the amount of Colorado severance tax to enter on line 1 of the DR 0021.

Based on your accounting method (cash or accrual basis), use the amounts listed on the DR 0021W you received to

complete DR 0021D. If you disagree with the information provided by a producer/first purchaser, you must request

a corrected DR 0021W prior to completing the DR 0021D.

Round all amounts to whole dollars.

Column

(A)Producer Name. Enter in column (A) the name of the producer/first purchaser from each DR 0021W. All information entered on form DR 0021D must have a form DR 0021W included with the return.

(B)Gross Income. Enter in column (B) the gross income as reported on DR 0021W. This is your share of the gross income received or accrued on oil or gas production.

(C)Gross Income Attributable To Stripper Well Production. Enter in column (C) the gross income attributable to stripper well production as reported on the DR 0021W.

(D)Net Gross Income. Enter in column (D) the net gross income by subtracting the stripper well gross income listed in column (C) from the gross income listed in column (B).

(E)Ad Valorem Tax. Enter in column (E) the ad valorem tax as reported on the DR 0021W. This is the amount paid or accrued to Colorado local governments in the taxable year on oil and gas production. Do not include ad valorem tax on buildings, improvements, or equipment. A percentage of ad valorem tax is allowed as a reduction to the severance tax.

(F)Ad Valorem Tax Attributable To Stripper Well Production. Enter in column (F) the ad valorem tax attributable to stripper well production as reported on the DR 0021W.

(G)Net Ad Valorem Tax. Enter in column (G) the net ad valorem tax by subtracting the stripper well ad valorem tax listed in column (F) from the ad valorem tax listed in column (E).

**Note** Reporting revenue and ad valorem taxes in the correct tax year is critical to filing a correct return. Please

review the following information.

Cash or Accrual Basis. Oil and gas revenue, along with

related ad valorem tax, must be reported on a basis consistent with the basis used for filing your federal income

tax return. Thus, if you are a cash basis federal taxpayer (this applies to most individuals), reporting income when received and deductions when paid, you must report the same way on the severance tax schedule (DR 0021D). You should include only the income received in the tax period. If you use the accrual basis (this applies to most corporations), you must report income from all production

Page 5

in the tax period whether you actually received the income or not, including deferred amounts if they are reported on the federal income tax return.

Cash Basis Taxpayers

Report only ad valorem tax (on production) actually paid to the county assessor during the severance tax year. Payments to operators of wells do not qualify. If a payment is skipped during a tax year (for example, delinquent), no claim for tax is allowed.

Accrual Basis Taxpayers

Report only ad valorem tax (on production) levied, or assessed, within the severance tax year. In November or December, depending upon the year, the Colorado counties set the mill levy for assessment of ad valorem tax on the prior year’s oil and gas production. The ad valorem tax is not

accruable until the amount is established on that date.

Short Period Returns

Because severance tax requires filing periods consistent with federal income tax filing years, some companies may have to file short period severance tax returns to match their federal filings. The same ad valorem rules apply. If no payment (cash

basis) or accrual date (accrual basis) falls within the short tax period, no claim for ad valorem tax is allowed. If the levy or payment date does fall in the short period, all the tax applies to only that short period.

To expedite the processing of your severance tax return, include all documentation to support ad valorem taxes, gross income and severance tax withheld.

Mail your severance tax return and payment, if any, separately from your Colorado income tax return or any other tax return.

*210021==19999*

DR 0021 (06/25/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO

Tax.Colorado.gov

Page 1 of 2

(7001)

2021 Colorado Severance

Tax Year Beginning (MM/DD/21)

Ending (MM/DD/YY)

Last Name or Business Name

First Name

Middle Initial

Deceased

Yes

Date Deceased (MM/DD/YY)

SSN or ITIN

Colorado Account Number

If Joint, Spouse or Partner Last Name (see controlled group definition) |

First Name |

Date Deceased (MM/DD/YY) |

SSN or ITIN |

Deceased

Yes

Yes

Middle Initial

Address

Foreign Country

|

|

|

|

|

|

FEIN |

|

City |

|

State |

|

ZIP |

|

Phone Number |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

If this is a final return, check this box |

|

|

Are you a producer of Colorado Oil or Gas? |

|

Yes |

||||

|

|

|

|||||||

Check one: |

|

Cash Basis Filer |

|

|

|

|

Accrual Basis Filer |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

No

Tax and Credit – Complete schedule DR 0021D first. Include the DR 0021D with this |

Round To The |

|||

|

|

form when you file |

|

Nearest Dollar |

1. |

Oil and gas tax, enter amount from line 5, DR 0021D |

• 1 |

|

|

2. |

Impact assistance credit |

• 2 |

|

|

3. |

Net tax, line 1 minus line 2 but not less than zero |

3 |

|

|

|

|

Prepayments |

|

|

4. |

Severance tax withheld, include form(s) DR 0021W |

• 4 |

|

|

5. |

Estimated tax and extension payments |

• 5 |

|

|

6. |

Total prepayments, sum of lines 4 and 5 |

6 |

|

|

|

|

Refund |

|

|

7. |

If line 6 is larger than line 3, enter your overpayment |

7 |

|

|

8. |

Enter amount from line 7 you want refunded |

• 8 |

|

|

9. |

|

Enter amount from line 7, if any, you want credited to estimated tax for next year • 9 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

00

00

00

00

00

00

00

00

00

*210021==29999*

DR 0021 (06/25/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO

Tax.Colorado.gov

Page 2 of 2

2021 Colorado Severance

Name |

|

Account Number |

|

|

|

Direct |

Routing Number |

|

|

|

|

|

|

|

|

|

|

|

|

Type: |

|

Checking |

|

Savings |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Deposit Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

|

|

|

|||||||||

10. If line 3 is larger than line 6, enter the balance due here |

10 |

|

|

|

|

|

|||||||||||||||||

11. Interest on balance due |

|

|

|

|

|

|

|

|

|

|

•11 |

|

|

|

|

|

|||||||

12. Penalty on balance due |

|

|

|

|

|

|

|

|

|

|

•12 |

|

|

|

|

|

|||||||

13. Estimated tax penalty (corporations only) |

|

|

|

|

|

|

|

|

|

|

•13 |

|

|

|

|

|

|||||||

14. Total amount due, sum of lines 10, 11, 12 and 13 |

|

|

|

|

|

Paid by EFT |

•14 |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00

00

00

00

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank

account electronically.

Mail Your Severance Tax Return Separately From Your Income Tax Return.

Include Form DR 0021W Withholding Forms and Form DR 0021D Colorado Oil and Gas Severance Tax Schedule.

Mail to and make checks payable to: Colorado Department of Revenue

Denver, CO

Under penalty of perjury in the second degree, I declare that I have examined this return and to the best of my knowledge and belief it is true, correct, and complete.

Signature of Individual Taxpayer |

|

|

|

Date (MM/DD/YY) |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Signature |

|

|

|

|

|

Date (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Corporate Officer |

|

|

|

Date (MM/DD/YY) |

|

|||

|

|

|

|

|

|

|

||

Preparer’s Last Name |

|

|

Preparer’s First Name |

|

Preparer’s Phone Number |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

City

State ZIP

*210021S=19999*

DR 0021S (06/17/21) |

(7040) |

|

|

COLORADO DEPARTMENT OF REVENUE |

|

Denver CO |

|

Tax.Colorado.gov |

|

Page 1 of 1 |

|

2021 Extension Of Time For Filing Colorado

Oil And Gas Severance Tax Return

Colorado severance tax returns are due to be filed by the fifteenth day of the fourth month after the close of the tax year.

An automatic

Colorado severance tax return is allowed for all taxpayers.

However, an extension of time to file is not an extension of time to pay the tax. If at least 90% of the net tax liability is not paid by the original due date of the return, penalty and interest will be assessed. If 90% or more of the net tax

liability is paid by the original due date of the return and the balance is paid when the return is filed by the last day of the

extension period, only interest will be assessed.

Use the DR 0021S to make a payment that must be made by the original due date of the return to meet the 90% requirement.

If after the original due date of the return it is found that the

amount paid is insufficient to meet the 90% requirement,

additional payment should be made as soon as possible to reduce accumulation of penalty and interest. Make such payment with the DR 0021S.

Be sure to round your payment to the nearest dollar. The amount on the check and the amount entered on the payment form must be the same. This will help maintain accuracy in your tax account.

Submit the DR 0021S with payment to:

Colorado Department of Revenue

Denver, CO

Worksheet

1.Tentative amount of tax for the taxable year after reduction for the impact

|

assistance credit (if any) |

$ |

2. |

Less: (a) Severance tax withheld |

$ |

|

(b) Estimated tax payments |

$ |

|

(c) Total (a) and (b) |

$ |

3. |

Balance to be remitted with this request for extension, line 1 minus line 2 (c). |

|

|

Enter amount of payment below. Claim credit for this payment on line 5 of the DR 0021 |

$ |

If no payment is due, do not file the DR 0021S.

DR 0021S (06/17/21)

Return the DR 0021S with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-

0008. Write your Social Security number, ITIN, Colorado Account Number or Federal Employer Identification Number and

DR 0021S on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment with this form.

For Tax Period: (MM/21)

Ending: (MM/YY)

Your Last Name or Business Name

First Name

Middle Initial SSN or ITIN

Spouse’s Last Name

First Name

Middle Initial

Spouse’s SSN or ITIN

Address

FEIN

City

State ZIP

Foreign Country

If no payment is due, do not file this form.

The State may convert your check to a

same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected

funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

Amount Owed

$

Document Specifics

| Fact Name | Description |

|---|---|

| Required Forms | The booklet includes forms DR 0021, DR 0021D, and DR 0021S for filing Colorado Severance Tax related to oil, gas, and carbon dioxide production. |

| Who Must File | Any individual or entity receiving taxable income from oil or gas produced in Colorado must file a return, including owners of working or royalty interests. |

| Exemptions | Oil and gas production from “stripper wells” is exempt from severance tax. |

| Severance Withholding | Producers or first purchasers are required to withhold 1% of gross income for each interest owner and file DR 0021W. |

| Filing Period | The filing period for Colorado severance tax aligns with the federal income tax filing period. |

| Due Date | Returns and payments are due by the 15th day of the fourth month after the close of the taxable year. |

| Filing Extension | An extension to file can be requested with form DR 0021S, offering a six-month extension, but this does not extend the time to pay any due tax. |

| Amended Returns | To change or correct a filed return, one must submit form DR 0021X. |

| Estimated Severance Tax Payments | Corporations expecting to owe more than $5,000 in severance tax must make estimated payments via Electronic Funds Transfer (EFT). |

Guide to Writing Co Severance Tax

Filing a Colorado Severance Tax Return is a requirement for individuals or entities that receive taxable income from oil and gas produced in Colorado. This process involves accurately completing several forms that are bundled together in the Colorado Severance Tax Booklet. The booklet includes the forms needed to calculate and report your severance tax liability. To ensure that your severance tax return is filed correctly and on time, it is crucial to follow the outlined steps carefully. Below is a guide to help you fill out the required forms in the booklet.

- Collect all necessary documents. Before you start, make sure you have all your oil and gas withholding statements (DR 0021W), your federal income tax return, and any other relevant financial records related to your oil and gas income.

- Begin with the DR 0021D, Oil and Gas Severance Tax Computation Schedule. This form calculates your severance tax based on your gross income from oil and gas production.

- Enter your gross income from oil and gas production in the appropriate fields.

- Subtract any income from exempt stripper wells.

- Enter any ad valorem taxes you've paid that are eligible for credit against your severance tax.

- Complete the DR 0021, Oil and Gas Severance Tax Return, using the information from your DR 0021D computation.

- Enter your net tax from the DR 0021D.

- Claim any eligible credits, including impact assistance credits if applicable.

- Calculate your net tax after credits.

- Report the total severance tax withheld by producers or first purchasers on your behalf.

- If you are applying for an extension, complete the DR 0021S, Application for Extension of Time to File Colorado Severance Tax Return.

- Estimate the amount of severance tax you believe you owe and enter it on the form.

- Review your entries for accuracy. Check all calculations and ensure that the income and withholding amounts on your forms match those reported on your division of interest statements and revenue checks.

- Gather all required documents:

- Attach the DR 0021W withholding statements to your DR 0021 return.

- Include any documentation that supports your ad valorem tax credits.

- Mail your completed Colorado Severance Tax Return (DR 0021), including all necessary schedules and withholding statements, to the Colorado Department of Revenue at the address provided in the booklet.

- If you owe severance tax with your return, include a check or money order for the amount due. Ensure that your Social Security number or Colorado account number is written on your payment to facilitate accurate processing.

Properly filing your Colorado Severance Tax Return requires attention to detail and accurate record-keeping. By following the steps outlined above, you can fulfill your tax obligations correctly. Remember to retain copies of all submitted forms and correspondence with the Department of Revenue for your records.

Understanding Co Severance Tax

Who is required to file a Colorado Severance Tax Return (DR 0021)?

Individuals and entities that receive taxable income from oil, gas (including carbon dioxide), or oil shale produced in Colorado must file a severance tax return. This includes owners of a working interest or a royalty interest. Partnerships, LLCs, or S Corporations are required to file at the entity level, not by the individual members. Exceptions apply for stripper wells and cases where total withholding is less than $250 and the producer has sufficiently covered the severance tax liability.

What constitutes a stripper well for severance tax purposes?

A stripper well is an oil well that produces 15 barrels or less of crude oil per day or a gas well that produces 90,000 cubic feet or less of gas per day, averaged over all producing days during the taxable year. Production from stripper wells is exempt from Colorado severance tax.

How is severance tax withholding handled?

Producers or first purchasers must withhold 1% of gross income for each interest owner. This withheld amount, meant to cover the severance tax liability, is reported annually to the interest owners through the DR 0021W, Oil and Gas Withholding Statement.

What are the deadlines for filing Colorado Severance Tax Returns?

Returns and any owed payments must be submitted by the 15th day of the fourth month following the close of your taxable year. For example, if your taxable year ends on December 31, your severance tax return is due April 15 of the following year.

Can I receive an extension for filing my severance tax return?

Yes, you can request a six-month filing extension using the DR 0021S form if you anticipate owing severance tax. It is important to note that this extension applies only to the filing of the return and not to any payments due.

How do I correct a previously filed Colorado Severance Tax Return?

To make corrections to a filed return, use form DR 0021X. It's designed for amending previously submitted severance tax returns and is available for download at Tax.Colorado.gov.

Are estimated severance tax payments required?

Corporations expecting to owe more than $5,000 in Colorado severance tax after credits must make estimated payments monthly by electronic funds transfer (EFT). Individual interest owners are not required to make estimated payments.

What should be done if the interest owner is deceased?

Legal representatives or surviving spouses can file a return on behalf of the deceased by completing the return as usual, marking "Deceased" above the tax year, and including the date of death. They must also write "Filing as surviving spouse" or "Filing as legal representative" after their signature and attach any required documentation.

Common mistakes

Not indicating the correct tax or fiscal year when filing can lead to processing delays. It is essential to ensure that the Colorado severance tax return accurately reflects the correct period for which taxes are being reported.

Failing to file a joint return for married couples, even if only one spouse has oil and gas income. The state requires married couples to file jointly for Colorado severance tax purposes regardless of their federal income tax filing status.

Omitting the completion and inclusion of the DR 0021D, Colorado Oil and Gas Severance Tax Schedule, with the DR 0021 return. This schedule is critical for calculating the correct amount of severance tax owed.

Incorrectly carrying totals from the DR 0021D schedule to the DR 0021 return can result in inaccurate tax calculations and potential underpayment or overpayment of taxes.

Excluding any DR 0021W forms (Oil and Gas Withholding Statement) from the tax return package. Missing forms can delay refunds and may require additional correspondence with the tax authority.

Rounding each DR 0021W withholding statement individually instead of adding up all DR 0021W statements and then rounding to the nearest dollar. This common error can affect the total severance tax withheld calculation.

Using a 1099-MISC withholding document for severance tax filing is incorrect as 1099s are for income tax purposes and do not report severance tax withholding. This can lead to a denial of credit for withholding amounts.

Claiming a percentage of withholding shown on the DR 0021W or creating spreadsheets to show ownership percentages, instead of using the amounts on the DR 0021W directly, can lead to discrepancies in reported amounts. The ownership percentage is already calculated by the issuer of the DR 0021W.

Not adhering to the specific basis (accrual or cash) consistent with federal income tax filing when reporting income and deductions can cause errors in the reported severance tax amounts. This inconsistency can affect the accuracy and acceptance of the severance tax return.

Documents used along the form

When dealing with the complexities of Colorado's severance tax, it's important to understand not just the primary forms required but also the various supplementary documents that often need to be completed and filed alongside the main severance tax forms. These additional forms and documents play critical roles in ensuring compliance with Colorado’s taxation laws regarding nonrenewable natural resource extraction.

- DR 0021W - This is the Oil and Gas Withholding Statement. It's essential for anyone who needs to report gross income from oil or gas production in Colorado. This document outlines the gross income and the severance tax withheld by producers or first purchasers and is necessary to validate the amounts claimed on the severance tax return.

- DR 0102 - For instances involving deceased persons, this form accompanies the severance tax return. It is used when a legal representative or surviving spouse is filing on behalf of someone who has passed away, ensuring that the tax obligations are appropriately met.

- DR 0021X - Amended Colorado Severance Tax Return Form. This document is crucial for correcting or changing a previously submitted DR 0021. It's a way to rectify any inaccuracies or update the return with new information.

- DR 0021AS - This form is used in conjunction with the DR 0021 for situations involving a controlled group of corporations. It allows for the joint computation and filing of severance taxes under the principal taxpaying corporation’s name, ensuring that the tax responsibilities are centralized and accurately reported.

- DR 1102 - Account Change or Closure Form. This form is necessary for businesses that are closing or individuals ceasing to do business in Colorado. It formally notifies the Colorado Department of Revenue, helping to avoid unnecessary tax obligations in the future.

- DR 0206 - Estimated Severance Tax Penalty Computation. Corporations anticipating a severance tax liability exceeding their credits by a significant amount are required to make estimated tax payments. This form helps calculate any penalties due for underpayment of these estimated amounts.

- DR 0104 - Colorado Individual Income Tax Return. While not directly related to severance tax, individuals receiving income from oil, gas, or CO2 in Colorado must also file a state income tax return. This form ensures compliance with Colorado’s income tax requirements.

In conclusion, navigating the severance tax landscape in Colorado involves a comprehensive understanding of not just the primary return forms but also the various additional documents that might be required based on specific circumstances. Whether it's ensuring the correct withholding is reported, amending past returns, or dealing with the complexities of controlled groups and estate matters, each of these forms serves a vital function in the broader process. Ensuring all relevant documents are accurately completed and filed on time is crucial to fulfilling one's tax obligations and avoiding potential penalties.

Similar forms

The Co Severance Tax Form shares similarities with the Federal Income Tax Return in that both require taxpayers to report income for a specific tax year and calculate taxes due or refunds owed based on that income. Like the Federal Income Tax Return, the Co Severance Tax Form requires detailed financial information and supports deductions and credits, impacting the final tax liability.

Similar to the State Income Tax Return, the Co Severance Tax Form is specific to Colorado, requiring individuals and entities earning income within the state to file under the jurisdiction’s tax laws. Both forms adjust tax liability based on state-specific deductions, credits, and tax rates, reflecting the localized approach to taxation.

The Withholding Statement (Form W-2 or 1099), like the DR 0021W, provides taxpayers with the amount of income earned and taxes withheld. Both forms are crucial for accurately filling out tax returns and ensuring the correct tax amount is paid or refunded, serving as proof of income and tax payments throughout the tax year.

The Application for Extension of Time to File, similar to the DR 0021S, allows taxpayers who cannot meet the original filing deadline additional time to file their returns without penalty. These forms do not extend the time to pay taxes owed, highlighting the distinction between filing deadlines and payment obligations.

The Amended Tax Return, resembling the DR 0021X, offers a mechanism for taxpayers to correct or update their tax filings if errors were made or if new information affects their tax liability. Both forms ensure taxpayers can reconcile inaccuracies, thereby staying compliant with tax laws.

The Estimated Tax Payment Forms, similar in function to severance tax estimated payment requirements for corporations, facilitate the advance payment of taxes based on expected liability. This parallels the process by which taxpayers manage potential tax debts throughout the year, avoiding large lump-sum payments or underpayment penalties at year’s end.

Analogous to the Severance Tax Booklet's Record Retention recommendation, IRS guidance instructs taxpayers to keep records for at least three years. This practice aids in verifying income, deductions, and credits during audits, ensuring taxpayers can substantiate their returns’ claims.

The Schedule Forms, comparable to DR 0021D, detail specific types of income, deductions, or credits, affecting the overall tax calculation. Both require thorough documentation, supporting calculations that contribute to the taxpayer's financial obligations or refunds from the governing tax authority.

Dos and Don'ts

When preparing the Colorado Severance Tax form, it's important to follow specific guidelines to ensure accuracy and compliance. Below are seven things you should do and seven things you shouldn't do when filling out this form.

Things You Should Do:

- Verify that your filing period matches with your federal income tax filing period.

- Ensure you are using the correct Colorado account number or Social Security number on your severance tax return.

- Include all required forms, such as the DR 0021, DR 0021D, and, if applicable, DR 0021S for an extension.

- Attach all DR 0021W withholding statements you received from producers or first purchasers.

- Calculate your severance tax carefully, utilizing the DR 0021D schedule for accurate computation.

- If you're filing for a deceased person, mark “Deceased” clearly on the form and include the necessary documentation.

- Keep records and documentation used in preparing your return for at least three years after the filing date.

Things You Shouldn't Do:

- Don't file a severance tax return if the total gross withholding is less than $250, and the producer has withheld enough to cover the severance tax liability. This is the only exception.

- Don't forget to calculate and report estimated tax payments if your expected severance tax liability exceeds your credits by $5,000 or more.

- Don't use a 1099-MISC form for reporting severance tax withholding, as it's not applicable for this purpose.

- Don't claim a credit for the entire amount of withholding if you're reporting only a portion of the income.

- Don't round individual withholding amounts before totaling them on the DR 0021.

- Don't ignore the requirement to file a joint return if you are married, regardless of how you file for federal income tax purposes.

- Don't wait to request an extension until after the due date. File the DR 0021S form timely if you anticipate needing more time.

Misconceptions

When it comes to understanding the complexities of the Colorado Severance Tax Form, it’s easy to encounter misunderstandings. Below is a list of 10 common misconceptions and the truths behind them:

Every person with oil and gas income must file individually. This isn't true. While anyone receiving taxable income from oil or gas produced in Colorado does need to file a severance tax return, partnerships, LLCs, or S Corporations file at the entity level, not the individual level.

If you don’t profit, you don’t owe severance tax. Actually, severance tax may be due even if you do not realize a net profit on your investments in oil and gas production.

Severance tax only applies to high-producing wells. Oil and gas production from "stripper wells" is exempt from severance tax, which includes wells producing at lower thresholds.

A severance tax return isn’t necessary if withholding is under $250. This is true only if you meet specific conditions regarding gross oil and gas withholding and producer withholding that covers the tax liability.

Withholding from payments equals tax liability. Producers withhold 1% of gross income for each interest owner as an estimate. However, the actual tax liability could be different and must be calculated individually.

Filing and payment deadlines are flexible. Severance tax returns and payments have strict deadlines, usually the 15th day of the fourth month after your fiscal year ends. Extensions for filing do not extend the payment due date.

Extensions for income tax apply to severance tax. Filing extensions for federal or Colorado income tax do not apply to Colorado severance tax returns. Extensions must be filed separately using form DR 0021S.

Amended returns are discouraged. If your severance tax return has errors or requires updating, an amended return using form DR 0021X is not only permissible but necessary.

Estimated payments are suggested but not required. Corporations anticipating a severance tax liability exceeding their credits by $5,000 or more must make estimated tax payments. This clarification helps manage obligations more effectively.

Record retention is optional. It's crucial to keep documentation used to prepare your return for at least three years post the due or filing date, whichever is later, as audits can request these details.

Understanding these key points can ensure compliance with Colorado's severance tax requirements and help avoid common pitfalls related to the filing process.

Key takeaways

Understanding the process of filling out and using the Colorado Severance Tax form is crucial for anyone receiving taxable income from oil or gas produced in Colorado. Here are six key takeaways to guide you through this process:

- Filing Requirements: Most individuals or entities that receive income from oil and gas production in Colorado, including those owning a working interest or receiving royalties, must file a severance tax return. Particularly, this applies even if the income doesn't result in a net profit.

- Exemptions and Withholding: Oil and gas production from stripper wells is exempt from severance tax. Additionally, producers or first purchasers must withhold 1% of gross income for each interest owner and report this via DR 0021W, which is essential for completing your tax return.

- Ad Valorem Tax Credit: You're eligible for a credit against your severance tax for 87.5% of your share of ad valorem taxes paid on actual oil and gas production. This does not include taxes on equipment or facilities.

- Filing Deadline: The severance tax return is due annually by the 15th day of the fourth month following the close of your taxable year. For most, this means an April 15th deadline for calendar year taxpayers.

- Extension and Amendment: Extensions are available for those unable to file by the deadline, by submitting the DR 0021S form. However, any unpaid taxes are still due by the original deadline. To amend a return, you must file a DR 0021X.

- Documentation and Record Keeping: It's vital to keep all related documentation for at least three years after the due date or filing date of your return. This is essential for audit purposes or to correct any discrepancies in your return.

Ensuring accurate and timely filing of your Colorado Severance Tax can help avoid penalties and interest on late payments and filings. Visit Tax.Colorado.gov for more detailed information, forms, and instructions related to severance tax filing in Colorado.

Popular PDF Documents

Federal Form 1310 - Clarification via Form 1310 helps expedite the refund process by delineating the claimant's rights.

Power of Attorney Irs - It specifies the tax matters and years for which the representative has authority, ensuring clarity and limitation of power.

W-9s - For individuals paying interest on student loans, the W-9S form allows their lenders to report these payments to the IRS accurately, which can be beneficial for tax reporting purposes.