Get Client Tax Organizer Form

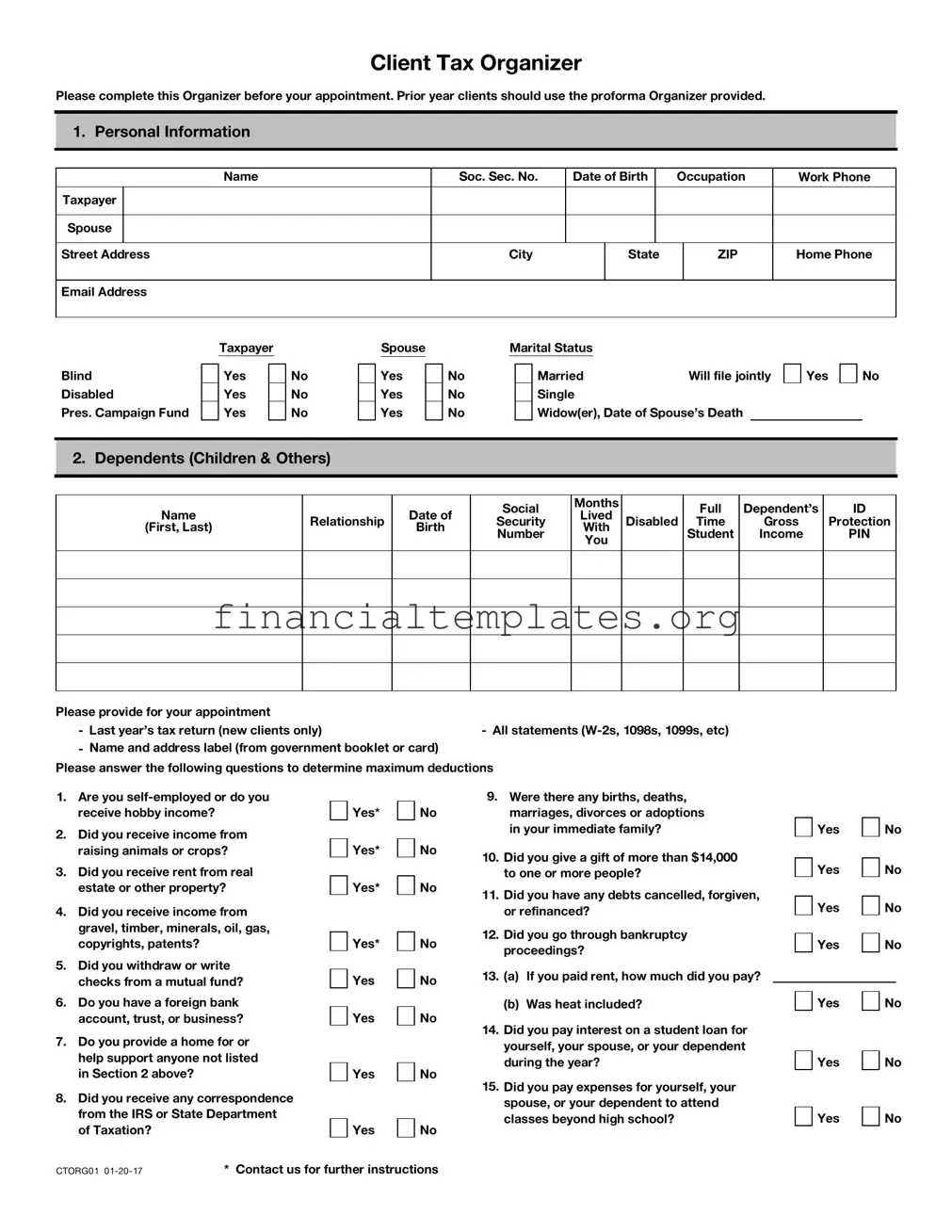

Every year, individuals and families face the task of gathering their financial documents to prepare for tax season, a process that can often seem daunting. The Client Tax Organizer form serves as a comprehensive tool to streamline this process, ensuring that taxpayers collect all necessary information before meeting with their tax preparer. Designed to be completed prior to an appointment, it aids in maximizing deductions and ensures a smooth filing experience. The form covers a wide range of topics, from personal information, dependents, and income types to deductions, credits, and detailed questions about specific financial situations. It prompts clients to provide details about employment, investments, educational expenses, and even life changes that could affect tax situations, such as marriage or the birth of a child. The form also includes sections on healthcare coverage and directs taxpayers on what documents to bring to their appointment, including last year's return and all relevant income statements. By systematically addressing each area of potential income and deductions, the Client Tax Organizer form plays a crucial role in demystifying the tax preparation process and empowering taxpayers with the confidence that they are filing their taxes both accurately and efficiently.

Client Tax Organizer Example

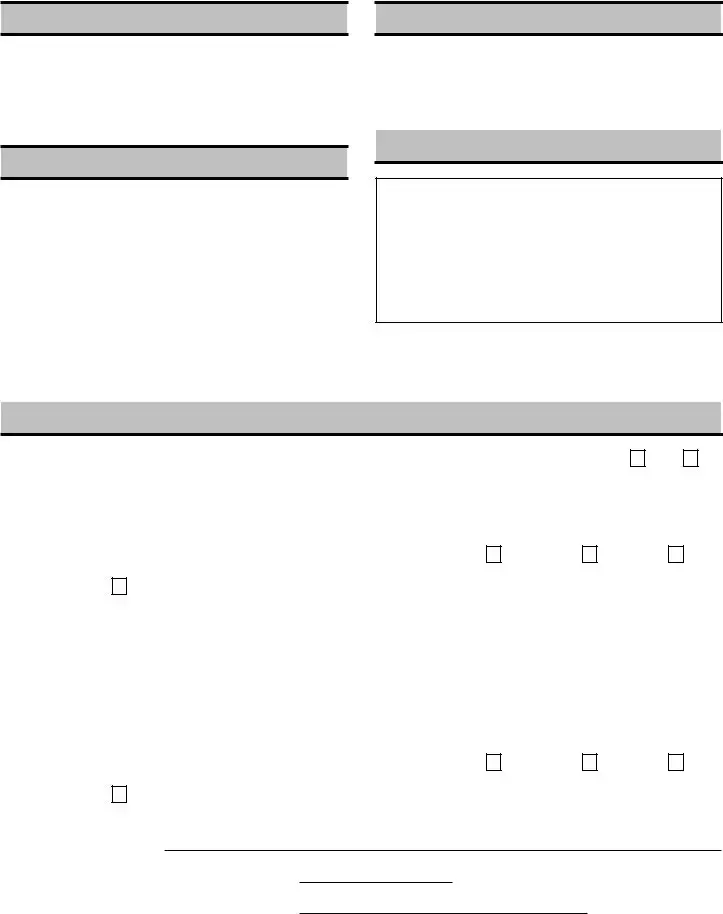

Client Tax Organizer

Please complete this Organizer before your appointment. Prior year clients should use the proforma Organizer provided.

1. Personal Information

|

Name |

Soc. Sec. No. |

Date of Birth |

|

Occupation |

Work Phone |

||

|

|

|

|

|

|

|

|

|

Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

City |

|

State |

|

ZIP |

Home Phone |

||

|

|

|

|

|

|

|

|

|

Email Address

Blind

Disabled

Pres. Campaign Fund

Taxpayer

Yes

Yes

Yes

No

No

No

Spouse

Yes

Yes

Yes

|

Marital Status |

|

||

No |

|

|

Married |

Will file jointly |

|

|

|||

No |

|

|

Single |

|

No |

|

|

Widow(er), Date of Spouse's Death |

|

Yes

No

2. Dependents (Children & Others)

Name

(First, Last)

Relationship

Date of

Birth

Social

Security

Number

Months

Lived

With

You

Disabled

Full

Time

Student

Dependent's

Gross

Income

ID

Protection

PIN

Please provide for your appointment

- |

Last year's tax return (new clients only) |

- All statements |

- |

Name and address label (from government booklet or card) |

|

Please answer the following questions to determine maximum deductions

1.Are you

2.Did you receive income from raising animals or crops?

3.Did you receive rent from real estate or other property?

4.Did you receive income from gravel, timber, minerals, oil, gas, copyrights, patents?

5.Did you withdraw or write checks from a mutual fund?

6.Do you have a foreign bank account, trust, or business?

7.Do you provide a home for or help support anyone not listed in Section 2 above?

8.Did you receive any correspondence from the IRS or State Department of Taxation?

Yes*

Yes*

Yes*

Yes*

Yes

Yes

Yes

Yes

No

No

No

No

No

No

No

No

9.Were there any births, deaths, marriages, divorces or adoptions in your immediate family?

10.Did you give a gift of more than $14,000 to one or more people?

11.Did you have any debts cancelled, forgiven, or refinanced?

12.Did you go through bankruptcy proceedings?

13.(a) If you paid rent, how much did you pay?

(b)Was heat included?

14.Did you pay interest on a student loan for yourself, your spouse, or your dependent during the year?

15.Did you pay expenses for yourself, your spouse, or your dependent to attend classes beyond high school?

|

Yes |

No |

|

|

Yes |

No |

|

|

Yes |

No |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

Yes |

No |

|

|

Yes |

No |

|

CTORG01 |

* Contact us for further instructions |

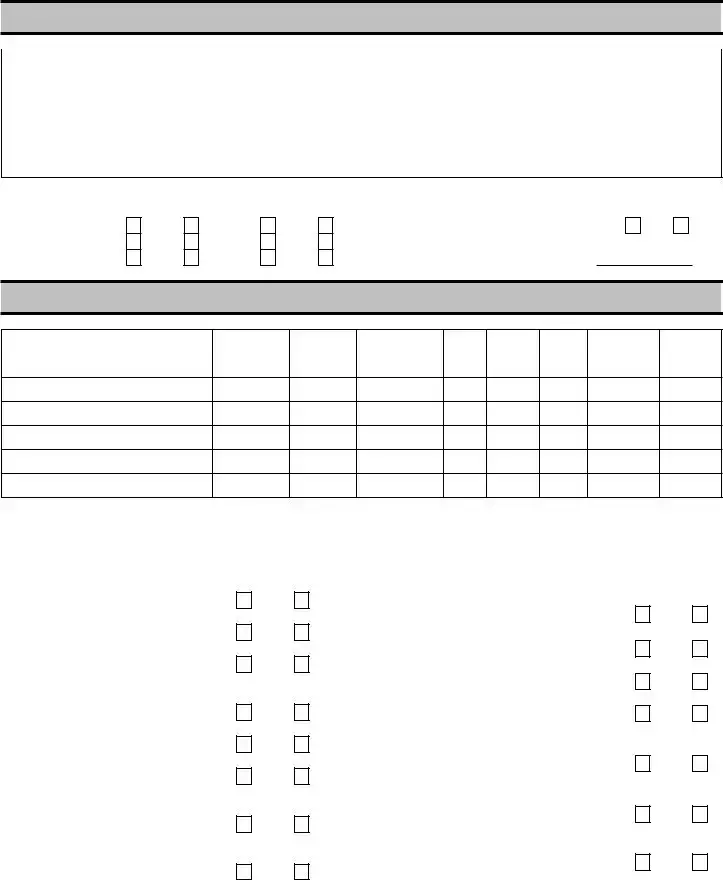

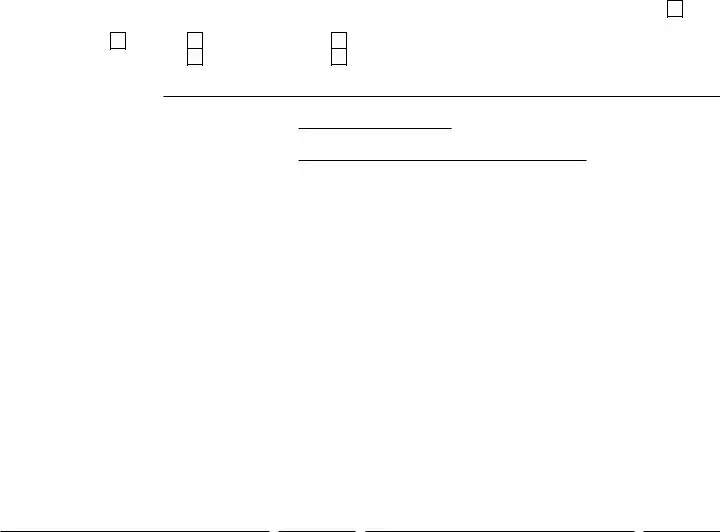

16. Did you have healthcare coverage (health |

|

|

|

|

insurance) for you, your spouse and |

|

|

|

|

dependents during this tax season? If yes, |

|

Yes |

|

No |

include Forms |

|

|

|

|

17.Did you apply for an exemption through the Marketplace /Exchange? If so, provide the exemption certificate number.

18.Did you have any children under the age of

19 or 19 to 23 year old students with |

|

Yes |

|

No |

unearned income of more than $1050? |

|

|

||

|

|

|

|

19.Did you purchase a new alternative technology vehicle or electric vehicle?

20.Did you install any energy property to your residence such as solar water heaters, generators or fuel cells or energy efficient improvements such as exterior doors or windows, insulation, heat pumps, furnaces, central air conditioners or water heaters ?

21.Did you own $50,000 or more in foreign financial assets?

Yes

Yes

Yes

No

No

No

3. Wage, Salary Income

Attach |

|

Employer |

Taxpayer Spouse |

22.Have you or your spouse been a victim of identity theft and given an identity theft protection PIN by the IRS? If yes, enter the six digit identity protection PIN number.

TaxpayerSpouse

4. Interest Income

Attach |

|

Payer |

Amount |

Tax Exempt

5. Dividend Income

From Mutual Funds & Stocks - Attach |

|

||

|

|

Capital |

Non- |

Payer |

Ordinary |

Gains |

Taxable |

7. Property Sold

Attach

Property |

Date Acquired |

Cost & Imp. |

|

|

|

Personal Residence* |

|

|

Vacation Home |

|

|

Land |

|

|

Other |

|

|

*Provide information on improvements, prior sales of home, and cost of a new residence. Also see Section 17

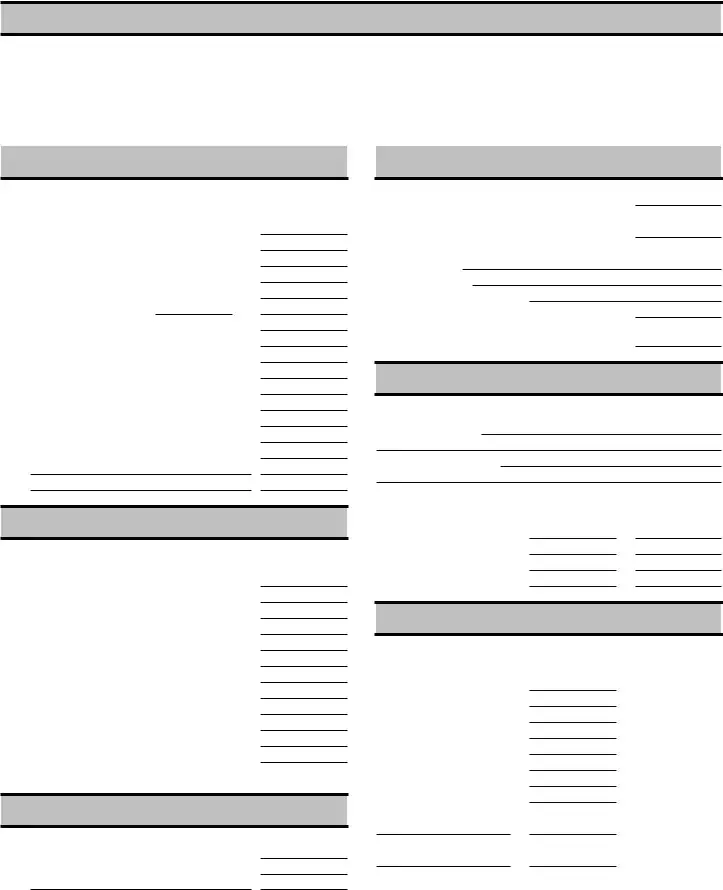

8. I.R.A. (Individual Retirement Acct.)

Contributions for tax year income |

|

|

|

|

U for |

||||

|

|

|

|

|

|

|

|

||

|

Amount |

Date |

Roth |

||||||

|

|

|

|||||||

Taxpayer |

|

|

|

|

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

|

Amounts withdrawn. Attach |

|

|

|

|

|

|

|||

Plan |

|

Reason for |

|

|

|

|

|

|

|

Trustee |

|

Withdrawal |

|

|

Reinvested? |

||||

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Pension, Annuity Income

6. Partnership, Trust, Estate Income

List payers of partnership, limited partnership,

CTORG02

Attach |

Reason for |

Payer* |

Withdrawal |

|

|

|

|

|

|

|

|

|

|

*Provide statements from employer or insurance company with information on cost of or contributions to plan.

Did you receive: |

|

Taxpayer |

|

|

|

|

|

|

|

Social Security Benefits |

|

Yes |

|

No |

Railroad Retirement |

|

Yes |

|

No |

Attach SSA 1099, RRB 1099 |

|

|

|

|

Reinvested?

Yes |

|

No |

Yes |

|

No |

Yes |

|

No |

Yes |

|

No |

Spouse |

|

|

|

|

|

Yes |

|

No |

Yes |

|

No |

10. Investments Sold

Stocks, Bonds, Mutual Funds, Gold, Silver, Partnership interest - Attach

Investment |

|

|

Date Acquired/Sold |

Cost |

Sale Price |

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. Other Income

List All Other Income (including

Alimony Received Child Support Scholarship (Grants)

Unemployment Compensation (repaid) Prizes, Bonuses, Awards

Gambling, Lottery (expenses) Unreported Tips

Director / Executor's Fee Commissions

Jury Duty

Worker's Compensation Disability Income Veteran's Pension

Payments from Prior Installment Sale State Income Tax Refund

Other

Other

12. Medical/Dental Expenses

Medical Insurance Premiums (paid by you)

Prescription Drugs Insulin Glasses, Contacts Hearing Aids, Batteries Braces

Medical Equipment, Supplies Nursing Care

Medical Therapy Hospital Doctor/Dental/Orthodontist Mileage (no. of miles)

13. Taxes Paid

Real Property Tax (attach bills)

Personal Property Tax

Other

14. Interest Expense

Mortgage interest paid (attach 1098) Interest paid to individual for your home (include amortization schedule)

Paid to: Name Address

Social Security No.

Investment Interest

Premiums paid or accrued for qualified mortgage insurance

15. Casualty/Theft Loss

For property damaged by storm, water, fire, accident, or stolen. Location of Property

Description of Property

Other |

Federally Declared |

|

Disaster Losses |

||

|

Amount of Damage

Insurance Reimbursement

Repair Costs

Federal Grants Received

16. Charitable Contributions

Other

Church

United Way

Scouts

Telethons

University, Public TV/Radio

Heart, Lung, Cancer, etc.

Wildlife Fund

Salvation Army, Goodwill

Other

Volunteer (no. of miles) |

|

@ .14 |

$0.00 |

CTORG03

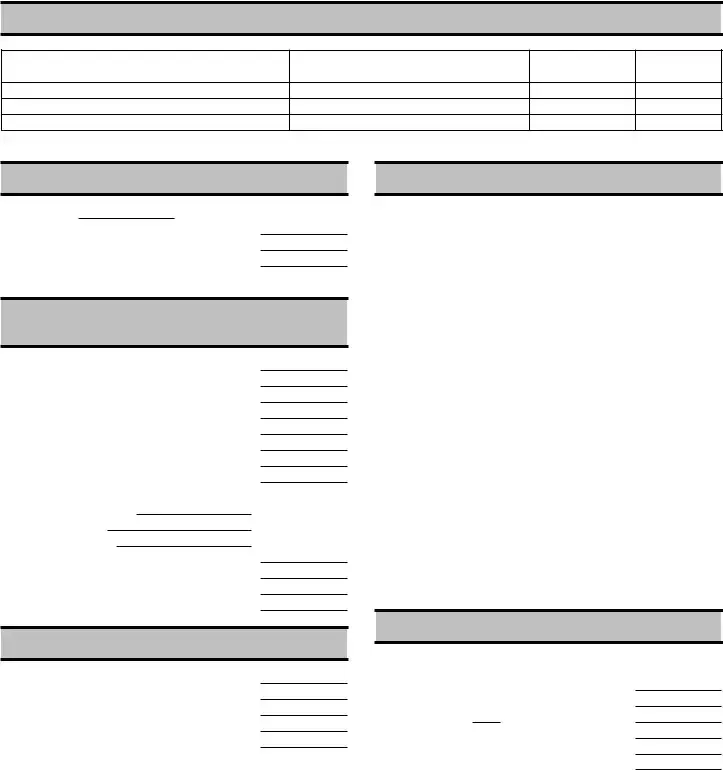

17. Child & Other Dependent Care Expenses

Name of Care Provider

Address

Soc. Sec. No. or

Employer ID

Amount

Paid

Also complete this section if you receive dependent care benefits from your employer.

18.

Date of move

Move Household Goods

Lodging During Move

Travel to New Home (no. of miles)

19.Employment Related Expenses That You Paid (Not

Dues - Union, Professional Books, Subscriptions, Supplies Licenses

Tools, Equipment, Safety Equipment Uniforms (include cleaning)

Sales Expense, Gifts Tuition, Books (work related) Entertainment

Office in home:

In Square a) Total home

Feet b) Office c) Storage

Rent Insurance Utilities Maintenance

20.

Tax Preparation Fee

Safe Deposit Box Rental

Mutual Fund Fee

Investment Counselor

Other

21. Business Mileage

Do you have written records? |

|

Yes |

|

No |

|

Did you sell or trade in a car used |

|

|

|

|

|

for business? |

|

Yes |

|

No |

|

If yes, attach a copy of purchase agreement |

|

|

|

|

|

Make/Year Vehicle |

|

|

|

|

|

Date purchased |

|

|

|

|

|

Total miles (personal & business) |

|

|

|

|

|

Business miles (not to and from work) |

|

|

|

|

|

From first to second job |

|

|

|

|

|

Education (one way, work to school) |

|

|

|

|

|

Job Seeking |

|

|

|

|

|

Other Business |

|

|

|

|

|

Round Trip commuting distance |

|

|

|

|

|

Gas, Oil, Lubrication |

|

|

|

|

|

Batteries, Tires, etc. |

|

|

|

|

|

Repairs |

|

|

|

|

|

Wash |

|

|

|

|

|

Insurance |

|

|

|

|

|

Interest |

|

|

|

|

|

Lease payments |

|

|

|

|

|

Garage Rent |

|

|

|

|

|

22. Business Travel

If you are not reimbursed for exact amount, give total expenses.

Airfare, Train, etc.

Lodging

Meals (no. of days )

Taxi, Car Rental

Other

Reimbursement Received

CTORG04

23. Estimated Tax Paid

Due Date |

Date Paid |

Federal |

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. Other Deductions

Alimony Paid to |

|

|

|

|

|

Social Security No. |

|

|

$ |

|

|

Student Interest Paid |

$ |

|

|||

Health Savings Account Contributions |

$ |

|

|||

Archer Medical Savings Acct. Contributions |

$ |

|

|||

|

|

|

|

|

|

25. Education Expenses

Student's Name |

Type of Expense |

Amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. Questions, Comments, & Other Information

Residence: |

|

|

|

|

||

Town |

|

|

County |

|

||

Village |

|

|

School District |

|

||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

27. Direct Deposit of Refund / or Savings Bond Purchases

Would you like to have your refund(s) directly deposited into your account?

(The IRS will allow you to deposit your federal tax refund into up to three different accounts. If so, please provide the following information.)

Yes

No

ACCOUNT 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner of account |

|

|

|

|

|

|

|

|

Taxpayer |

Spouse |

Joint |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of account |

MyRA |

|

Checking |

|

Traditional Savings |

|

|

Traditional IRA |

|

Roth IRA |

||||

Name of financial institution |

|

|

Archer MSA Savings |

|

Coverdell Education Savings |

|

|

HSA Savings |

|

SEP IRA |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Financial Institution Routing Transit Number (if known) |

|

|

|

|

|

|

|

|

|

|

||||

Your account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner of account |

|

|

|

|

|

|

|

|

Taxpayer |

Spouse |

Joint |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Type of account |

MyRA |

|

Checking |

|

Traditional Savings |

|

|

Traditional IRA |

|

Roth IRA |

||||

|

|

|

|

Archer MSA Savings |

|

Coverdell Education Savings |

|

|

HSA Savings |

|

SEP IRA |

|||

Name of financial institution

Financial Institution Routing Transit Number (if known)

Your account number

CTORG05

ACCOUNT 3 Owner of account Type of account

MyRA

Checking

Archer MSA Savings

|

|

|

Taxpayer |

|

Spouse |

|||

|

|

|

|

|

|

|

||

Traditional Savings |

|

|

Traditional IRA |

|

||||

Coverdell Education Savings |

|

|

HSA Savings |

|

||||

Joint

Roth IRA SEP IRA

Name of financial institution

Financial Institution Routing Transit Number (if known)

Your account number

Would you like to purchase Series I Savings bonds with a portion of your refund? If so, please answer the following:

Amount used for bond purchases for yourself (and spouse if filing jointly). |

|

|

|

|

|

|

Amount used to buy bonds for someone else (or yourself only or spouse only if filing jointly). |

|

|

|

|

||

|

|

|

|

|||

Owner's name |

X if name is for |

Bond purchase Amount |

||||

|

name if applicable |

a beneficiary |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the best of my knowledge the information enclosed in this client tax organizer is correct and includes all income, deductions, and other information necessary for the preparation of this year's income tax returns for which I have adequate records.

Taxpayer |

Date |

Spouse |

Date |

CTORG06

Document Specifics

| Fact Name | Detail |

|---|---|

| Organizer Purpose | The Client Tax Organizer form is designed to be completed before the client's appointment to ensure a comprehensive review of the client's tax situation. |

| Previous Year Clients | Clients from the previous year are encouraged to use the proforma Organizer provided to them, ensuring consistency and accuracy in their tax preparation. |

| Document Requirements | New clients are asked to bring last year's tax return, and all clients must bring all relevant statements, such as W-2s, 1099s, and any government name and address labels. |

| Income and Deduction Questions | The form includes comprehensive questions to help identify all possible income sources and deductions, including employment, self-employment, property income, and expenses related to healthcare, investments, and education. |

| Special Considerations | Clients are asked about various personal and financial changes that could affect their tax situation, such as marriages, births, and significant purchases or expenses. |

| Direct Deposit Option | The form offers clients the option to have their refund(s) directly deposited into up to three different accounts, with detailed information required for each. |

Guide to Writing Client Tax Organizer

Before proceeding with your tax preparation meeting, completing the Client Tax Organizer form is a crucial step. This preparation not only streamlines the tax filing process but also ensures that you maximize your deductions and accurately report all necessary information. Whether you are a returning client availing of the proforma Organizer or a new client tackling this form for the first time, following these structured steps will help you organize your financial information effectively. After completing the form, you will have gathered all the essential documents and information, making the tax filing process smoother and more efficient.

- Start with the Personal Information section by entering your full name, Social Security Number, date of birth, occupation, work and home phone numbers, street address, city, state, zip code, email address, and indicate if you or your spouse are blind, disabled, or wish to contribute to the Presidential Campaign Fund. Select your marital status and provide the date of your spouse's death if applicable.

- Under Dependents, list all dependents including children and others by providing their name, relationship to you, date of birth, Social Security Number, the number of months lived with you, and indicate if they are disabled, a full-time student, their gross income, and if they have an ID Protection PIN.

- Prepare to bring required documents to your appointment, including last year's tax return (for new clients), all income statements such as W-2s, 1098s, 1099s, and a government-issued name and address label.

- Answer questions about income (e.g., self-employment, hobby income, income from raising animals or crops, rental income, etc.) to help determine your maximum deductions.

- Provide details about healthcare coverage, including whether you, your spouse, and dependents had health insurance during the tax season, and include Forms 1095-A, B, or C if applicable. Answer other questions related to children under 19 or students with unearned income, new vehicles, and energy property installations, indicating "Yes" or "No" as appropriate.

- Attach all required documents for income sections: W-2s for wage and salary income, 1099-INT for interest income, 1099-DIV for dividend income, etc.

- For each section that applies to you, such as Property Sold, IRA Contributions, Pension and Annuity Income, and so on, provide all requested details like dates, amounts, and payer information.

- List any instances of Other Income including alimony received, child support, scholarships, unemployment compensation, and more.

- Document your expenses and deductions meticulously in sections dealing with medical and dental expenses, taxes paid, interest expense, casualty and theft loss, charitable contributions, child and dependent care expenses, and job-related moving expenses, among others.

- Detail your business mileage and business travel expenses, if applicable, including whether you have written records and providing totals for personal versus business miles, along with any other related business expenses.

- Include information about any estimated tax paid for both federal and state taxes, specifying the due date and the date paid.

- Lastly, indicate if you would like to direct deposit your refund by providing account details, or if you prefer to purchase savings bonds.

By carefully following these steps and providing thorough and accurate information on your Client Tax Organizer form, you are setting the groundwork for an efficient and smooth tax filing process. This organized approach helps ensure that all aspects of your financial life are accounted for, potentially leading to optimal tax outcomes.

Understanding Client Tax Organizer

What is the purpose of the Client Tax Organizer form?

The Client Tax Organizer form is designed to help organize and prepare all the necessary information required for completing an accurate tax return. It ensures that clients provide their accountants with all relevant personal, income, and expense information needed for tax filing. Completing this organizer prior to the appointment helps in maximizing deductions and ensuring compliance with tax laws.

Do I need to complete the entire organizer if I am a returning client?

Returning clients are advised to use the proforma Organizer provided. This version will contain some information from the prior year's submission, potentially simplifying the process. However, it's important to review and update all sections to reflect any changes in your personal information, dependents, income, and deductions for the current tax year.

What documents should I bring to my tax preparation appointment?

You should bring the following documents to ensure a comprehensive tax return preparation:

- Last year's tax return for new clients.

- All income statements, including W-2s, 1099s, and 1098s.

- Any documentation for deductions and credits including bills, receipts, and relevant statements.

- Government name and address label, if applicable.

What should I do if I received income from self-employment or hobby income?

If you received income from self-employment or hobby activities, indicate 'Yes' on the form and provide additional documentation regarding the income. This may include profit and loss statements, expense receipts, and other relevant records. You may be contacted for further instructions to accurately report this income.

How do I report changes in personal circumstances such as marriage or the birth of a child?

Report any changes in your personal circumstances, like marriage, divorce, the birth of a child, or a death in the immediate family, in the relevant sections of the organizer. These changes can significantly affect your tax situation, possibly altering your filing status, dependents, and eligibility for certain tax benefits.

What is the importance of the Identity Protection PIN?

The Identity Protection PIN (IP PIN) is a six-digit number assigned by the IRS to victims of identity theft. Its purpose is to prevent unauthorized filing of tax returns under your Social Security Number. If you or your spouse have been issued an IP PIN, it is crucial to include this number in your tax organizer form to ensure the security of your tax filing.

Can I directly deposit my refund into multiple accounts?

Yes, the IRS allows you to deposit your federal tax refund into up to three different bank accounts. You must provide the account type, the name of the financial institution, and the account numbers for each account you wish to use. This option can help in managing your finances by allocating funds to savings, checking, or investment accounts as per your preference.

Common mistakes

One common mistake is the incomplete provision of personal information, such as forgetting to include a spouse's Social Security Number or date of birth. This information is vital for accurately assessing tax liabilities and benefits.

Another error involves inaccurately reporting dependents. For instance, not indicating full months a child lived with you or overlooking to declare a dependent as a full-time student or disabled if applicable. These details can significantly affect tax deductions and credits.

Often, clients overlook or incorrectly report income sources. Neglecting to mention hobby income, rental income, or earnings from freelancing can lead to underreported income and potential penalties.

There's a tendency to misreport or completely miss out on deductions and credits. From medical expenses to charitable contributions, accurately documenting these amounts ensures you're maximizing potential tax savings.

Failing to report previous state or federal correspondence is a big oversight. Such communications can contain important information about audits, adjustments, or errors that need to be considered in the current tax filing.

Incorrectly or not including valuable information about life changes, such as marriage, divorce, or the birth of a child, can also lead to errors. These events can have significant tax implications.

Forgetting to declare investments or incorrectly reporting them is another frequent mistake. Whether it's failing to report the sale of stocks or incorrectly documenting the cost basis of investments sold, these errors can result in inaccurate tax calculations.

Lastly, not utilizing or misunderstanding the identity protection PIN (Personal Identification Number) provided by the IRS for victims of identity theft is a critical error. This PIN is crucial for protecting one's tax filings and must be accurately reported if issued.

In conclusion, these common mistakes highlight the complexity of tax preparation and underscore the importance of thoroughness and accuracy when completing the Client Tax Organizer form. Ensuring that every piece of information is complete and accurate can help avoid delays or issues with tax returns.

Documents used along the form

When preparing for a tax appointment, alongside the Client Tax Organizer form, clients are often required to provide additional forms and documents that support or provide further details regarding their financial situation over the tax year. These documents are essential for ensuring accuracy in filing tax returns, understanding tax liabilities, and maximizing potential refunds or deductions.

- W-2 Forms: Issued by employers, these forms report the employee's annual wages and the amount of taxes withheld from their paycheck. It is crucial for accurately reporting income.

- Form 1099: This form varies (1099-MISC, 1099-DIV, 1099-INT, etc.) depending on the type of income received. They are used to report income outside of wages, salaries, and tips. This could include independent contractor income, interest, dividends, or government payments.

- Form 1095-A, B, or C: These forms provide information about health insurance coverage. They are necessary to verify that you, your spouse, and dependents had health coverage during the tax year, which could affect your tax return.

- Schedule K-1 (Form 1065, 1120S, or 1041): This form reports income from partnerships, S corporations, estates, and trusts. It is essential for individuals who receive income from any of these sources to report their share of the entity's income, deductions, and credits.

- Receipts for Charitable Donations: To claim any deductions for charitable contributions, receipts or written acknowledgments from the charitable organization, detailing the amount of the contribution and the date it was made, are necessary.

In summary, while the Client Tax Organizer form collects crucial initial information, the completion and accuracy of a tax return rely on various supporting documents. These documents help paint a comprehensive picture of an individual’s financial activities over the tax year and are indispensable in ensuring compliance with tax laws and regulations.

Similar forms

The Client Tax Organizer form bears resemblance to a Personal Financial Statement form in how it meticulously gathers an individual's financial positions, albeit for different purposes. While the Tax Organizer focuses on collating details necessary for tax preparation, such as income, deductions, and relevant personal information, a Personal Financial Statement captures an individual’s assets, liabilities, and net worth, often used by financial institutions for loan applications. Both documents serve to paint a comprehensive picture of an individual's financial status, necessitating detailed and accurate information.

Similarly, a New Patient Form used in healthcare settings shares commonalities with the Client Tax Organizer, as both require personal identity details, contact information, and specific status indicators (such as disability or insurance coverage). However, the New Patient Form extends into medical history and health insurance details, emphasizing the importance of individual circumstances and needs in service provision. Both forms centralize critical personal information to enable professionals to offer tailored services effectively.

W-4 Forms, issued by employers for tax withholding purposes, also parallel the Client Tax Organizer in collecting personal and financial information to ensure correct tax treatment. Both documents require individuals to report their marital status and dependents, which directly affect their tax liabilities and potential refunds. These forms are essential in managing one’s tax responsibilities and optimizing the tax-withholding process to prevent underpayment or overpayment of taxes.

Rental Application Forms mirror the Client Tax Organizer in their requirement for detailed personal information, financial status, and sometimes dependents’ information, to evaluate suitability and reliability. Although serving for a different purpose—securing a lease agreement rather than preparing taxes—both forms critically assess an individual’s background and financial capability, highlighting the importance of accuracy and completeness in submissions.

Similarly, the FAFSA (Free Application for Federal Student Aid) shares the aim of evaluating an individual’s financial situation to determine eligibility for aid, like the Tax Organizer assesses tax liability or refund eligibility. Both require detailed financial information, including income, investments, and dependents, to make accurate assessments that will directly impact the individual's financial responsibilities or benefits.

The Identity Theft Affidavit form, though more specific in focus, intersects with the Client Tax Organizer in its handling of sensitive personal and financial information, particularly in situations where an individual’s identity has been compromised. Both forms are crucial in rectifying or preventing financial discrepancies and require a high level of detail and accuracy to ensure proper processing.

Last, Estate Planning Documents, including wills, trusts, and powers of attorney, although far broader in scope and application than the Client Tax Organizer, similarly necessitate comprehensive personal and financial information. These documents ensure proper management and distribution of an individual’s estate in accordance with their wishes, underlining the same core principle of preparative detail and individual specificity found in tax organization.

Dos and Don'ts

When completing the Client Tax Organizer form, accuracy and thoroughness are vital. Below are four key dos and don'ts to ensure the process goes smoothly:

- Do gather all necessary documents before starting. This includes last year's tax return for new clients, all statements like W-2s, 1099s, and documentation of any deductions or credits you're planning to claim.

- Do double-check your Social Security Number and that of your spouse and dependents to prevent processing delays or errors.

- Do provide detailed information about your income, deductions, and any life changes such as marriage, birth of a child, or a change in employment status.

- Do contact a professional if you encounter questions or situations that are unclear. Situations marked with an asterisk (*) such as self-employment or receiving income from hobbies may require additional documentation or special handling.

- Don't rush through filling out the form. Missing or incorrect information can lead to delays or inaccuracies in your tax return.

- Don't forget to sign and date the form. An unsigned tax form is considered incomplete and will not be processed.

- Don't overlook the importance of declaring all income sources, including smaller or occasional earnings, as these are still subject to taxation.

- Don't hesitate to report any changes in your financial situation, such as the acquisition of foreign assets or significant changes in deductions, as they can have implications on your tax liability or refund.

Completing the Client Tax Organizer form accurately and comprehensively is crucial for ensuring that your tax return is filed correctly and you receive any refunds due to you in a timely manner. Remember, when in doubt, seeking guidance from a tax professional can help clarify complex issues and avoid mistakes.

Misconceptions

When it comes to preparing for tax season, the Client Tax Organizer form plays a crucial role in ensuring that all pertinent information is neatly organized and ready for review. However, there are several misconceptions surrounding this document that can lead to confusion. By addressing these misconceptions, taxpayers can better understand how to effectively use the Client Tax Organizer form to their advantage.

Misconception 1: The Client Tax Organizer form is only for individual use and doesn't accommodate joint filers. This is not accurate. The form includes sections not only for personal information about the taxpayer but also about the spouse, allowing married couples to file jointly by providing comprehensive details about both parties. It prompts for marital status and includes provisions for including a spouse's personal information, income, and deductions, ensuring that joint filers can accurately compile and report their combined tax information.

Misconception 2: Once submitted, information on the Client Tax Organizer form cannot be updated. This belief is incorrect. Taxpayers are encouraged to update their Client Tax Organizer form as new information becomes available or as corrections need to be made. Tax professionals understand that financial situations can change, and additional documentation or amendments to previously provided information may be necessary. The primary goal of the form is to facilitate thorough and accurate tax preparation, which can include updating information as required.

Misconception 3: Only income information is required on the Client Tax Organizer form. While income details are essential, the form is designed to collect a wide variety of financial information, not just income. It includes sections for deductions, credits, expenses, investments, and even foreign assets, among others. This comprehensive approach ensures that taxpayers provide a full picture of their financial situation, enabling tax professionals to identify all applicable tax breaks and obligations.

Misconception 4: The form is too complicated for those without a finance background. Despite its comprehensive nature, the Client Tax Organizer form is structured in a user-friendly manner, guiding taxpayers through each section with clear instructions. It breaks down complex tax information into manageable sections, making it easier for individuals, regardless of their financial expertise, to complete. Moreover, tax professionals are available to assist with any questions or concerns, ensuring that taxpayers can effectively utilize the form to organize their tax-related information.

By clearing up these misconceptions, taxpayers can approach the Client Tax Organizer form with confidence, knowing that it is a valuable tool designed to streamline the tax preparation process for both individuals and tax professionals alike.

Key takeaways

When the time comes to tackle your taxes, the Client Tax Organizer form can be a lifeline in ensuring you've got all your ducks in a row. Here are some key things to keep in mind to make the process as smooth as possible:

- Gather necessary documents before you start: Before filling out the form, ensure you have all relevant documentation at hand, including last year's tax return (for new clients), W-2s, 1098s, and 1099s, among others.

- Double-check personal information: It might seem basic, but ensuring that all personal details like Social Security numbers, date of birth, and contact information are accurate can save you a lot of hassle down the line.

- Report any changes in your family circumstances: Whether it’s a marriage, divorce, or a new child in the family, these can significantly impact your tax situation.

- Understand the specifics of your dependents: Information about your dependents, including their income and whether they are full-time students, is crucial for accurately completing your tax return.

- List all sources of income: Besides the obvious W-2s or 1099s, remember to report income from freelancing, dividends, rental properties, and any other sources.

- Don’t forget deductions and credits: Expenses like student loan interest, medical bills, charity donations, and business-related costs can lower your tax bill, so it’s worth keeping track of these throughout the year.

- Include information on properties: Whether it’s your primary residence or a vacation home, details about properties you’ve bought or sold can affect your return.

- Account for all investments: Sales of stocks, bonds, and other investments must be reported, including the sale price and date of purchase.

- Detail your healthcare coverage: Having continuous health insurance coverage might save you from paying penalties, and details of your healthcare expenses and coverages are required.

- Opt for direct deposit: If you’re expecting a refund, opting for direct deposit can get the money into your account quicker than a traditional check.

Remember, organizing your information with a Client Tax Organizer not only makes your tax prep easier but also helps ensure you’re taking advantage of every tax benefit available to you. So, take the time to fill it out carefully and consult with a tax professional if you’re unsure about any part of the process.

Popular PDF Documents

Arizona Tpt - Features a comprehensive list of allowable deduction codes tailored to diverse business activities for accurate tax deductions.

IRS 7200 - It assists employers by providing immediate financial relief through advanced tax credit payments.

Hawaii Department of Revenue - When businesses in Hawaii change their operation scale affecting taxes, Form BB-1X ensures accurate tax recording.