Get Clearance For Business Tax License Form

In the bustling city of Oakland, launching a new business or relocating an established one requires a critical step - obtaining a Zoning Clearance for Business Tax License. This procedure ensures that the proposed business activities align with the city's zoning regulations specific to the desired location. The form serves as a comprehensive guide for applicants, requiring detailed information such as the business address, applicant's personal details, and specifics about the business including type, proposed hours of operation, employee count, and whether the business will be home-based or involve manufacturing on the property. It further queries about the need for new or modified signage and any changes to the building structure, hinting at the extensive regulatory considerations businesses must navigate. While this clearance focuses on zoning permits alone, it underscores the necessity for potential business owners to consult with various city departments or county/state agencies, as additional permits related to building, fire, health, and others may be required before operations can begin. This initial step of obtaining zoning clearance underscores the commitment of both the city and aspiring business owners to maintain a regulatory environment that is safe, compliant, and conducive to economic growth.

Clearance For Business Tax License Example

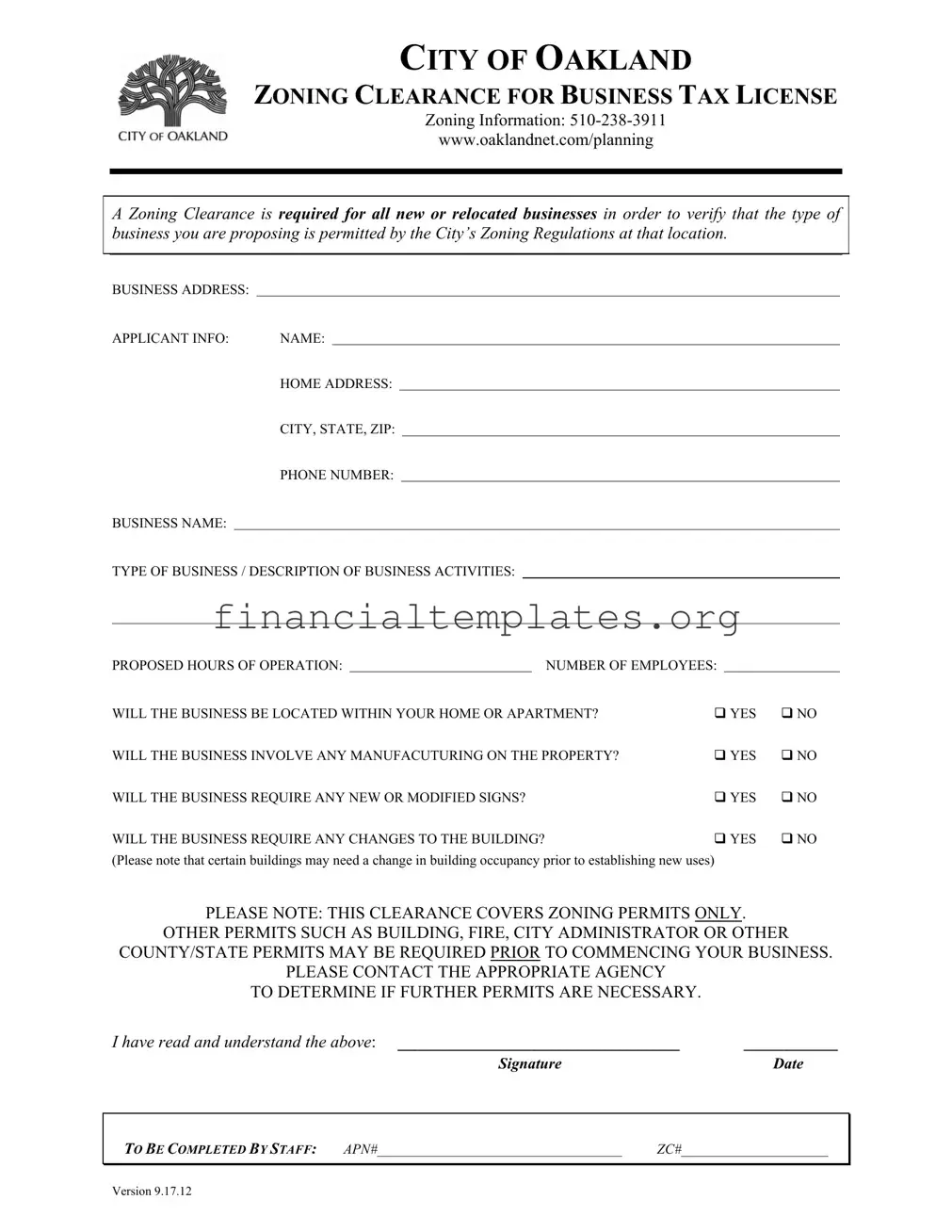

CITY OF OAKLAND

ZONING CLEARANCE FOR BUSINESS TAX LICENSE

Zoning Information:

www.oaklandnet.com/planning

A Zoning Clearance is required for all new or relocated businesses in order to verify that the type of business you are proposing is permitted by the City’s Zoning Regulations at that location.

BUSINESS ADDRESS:

APPLICANT INFO:

NAME:

HOME ADDRESS:

CITY, STATE, ZIP:

PHONE NUMBER:

BUSINESS NAME:

TYPE OF BUSINESS / DESCRIPTION OF BUSINESS ACTIVITIES:

PROPOSED HOURS OF OPERATION: |

|

|

NUMBER OF EMPLOYEES: |

|

|

WILL THE BUSINESS BE LOCATED WITHIN YOUR HOME OR APARTMENT? |

YES |

NO |

|||

WILL THE BUSINESS INVOLVE ANY MANUFACUTURING ON THE PROPERTY? |

YES |

NO |

|||

WILL THE BUSINESS REQUIRE ANY NEW OR MODIFIED SIGNS? |

|

YES |

NO |

||

WILL THE BUSINESS REQUIRE ANY CHANGES TO THE BUILDING? |

|

YES |

NO |

||

(Please note that certain buildings may need a change in building occupancy prior to establishing new uses) |

|

|

|||

PLEASE NOTE: THIS CLEARANCE COVERS ZONING PERMITS ONLY.

OTHER PERMITS SUCH AS BUILDING, FIRE, CITY ADMINISTRATOR OR OTHER

COUNTY/STATE PERMITS MAY BE REQUIRED PRIOR TO COMMENCING YOUR BUSINESS.

PLEASE CONTACT THE APPROPRIATE AGENCY

TO DETERMINE IF FURTHER PERMITS ARE NECESSARY.

I have read and understand the above: _________________________________ |

___________ |

Signature |

Date |

TO BE COMPLETED BY STAFF: |

APN#___________________________________ |

ZC#_____________________ |

|

|

|

Version 9.17.12

Document Specifics

| Fact Name | Description |

|---|---|

| Objective | The Zoning Clearance form is mandatory for all new or relocated businesses in Oakland to ensure the proposed business activities are allowed under the City's Zoning Regulations at the specified location. |

| Applicability | This form applies to any individual seeking to establish a new business or relocate an existing business within the City of Oakland. |

| Information Required | Applicants must provide business and applicant information including the address, phone number, type of business, proposed hours of operation, number of employees, and details on manufacturing, signage, and building changes. |

| Home-Based Business | The form inquires if the business will be operated from a home or apartment, indicating special considerations or regulations may apply to home-based businesses. |

| Signage and Building Changes | Questions about manufacturing on the property, new or modified signs, and changes to the building are included to ensure compliance with zoning laws and to identify the need for additional permits. |

| Additional Permits Reminder | The clearance covers zoning permits only. Applicants are reminded they may need additional permits, such as building, fire, or other county/state permits before commencing business operations. |

| Governing Law | The form is governed by the City of Oakland's Zoning Regulations, which set forth the permitted uses of land and buildings within the city to ensure that business operations are compatible with local planning objectives. |

Guide to Writing Clearance For Business Tax License

Filling out the Clearance for Business Tax License form is a crucial step for ensuring that your business operations align with the zoning regulations of Oakland. This document essentially acts as a preliminary check, confirming that the location chosen for your business supports the type of activities you plan to engage in. It's the starting gate towards legitimizing your business presence and operations within this city. Understanding and meticulously filling out this form can save you from potential zoning disputes or legal inconveniences later on. Following these steps will guide you through this essential process.

- Start by jotting down the Business Address where your business will be located. This ensures that the zoning check is done accurately for your specified location.

- In the Applicant Info section, enter your Name. This should be the individual or entity taking responsibility for the business operations.

- Under the same section, fill out your Home Address, including City, State, and ZIP code. This information might be used for correspondence or verification purpose.

- Provide a reliable Phone Number where you or your business representatives can be reached for any follow-up details or clarification.

- For the Business Name, input the official name of your business as registered or intended for registration.

- Describe the Type of Business / Description of Business Activities you plan to undertake at the provided address. Be specific as this affects zoning clearance.

- Indicate your Proposed Hours of Operation. This information may be relevant in zones with restrictions on operational hours.

- Fill in the Number of Employees expected to work at your business. This can impact parking and traffic considerations.

- Answer whether the business will be operated from your Home or Apartment by selecting Yes or No.

- Indicate Yes or No to whether your business will involve any Manufacturing on the Property. Zoning laws often have specific stipulations for manufacturing activities.

- Determine if your business will require any new or modified signs and answer accordingly. Signage can be subjected to zoning and aesthetic regulations.

- Assess if there will be any changes to the building to accommodate your business and mark Yes or No. Significant modifications might require additional permits.

- Before signing, carefully read the note indicating that this clearance covers zoning permits only, and acknowledgment might be necessary from other agencies. This is vital to ensure that all your legal bases are covered.

- Sign the form and put the date to indicate that you have understood and provided true information to the best of your knowledge.

After completing and submitting this form, the pertinent city staff will review your application in relation to zoning regulations. If everything is in order, you'll receive your Zoning Clearance, marking one of the first approvals in the journey of establishing your new or relocated business in Oakland. Remember, this step is about fitting your business within the city's blueprint for development and safety – it lays the groundwork for a compliant and successful establishment.

Understanding Clearance For Business Tax License

What is a Zoning Clearance for Business Tax License?

A Zoning Clearance for Business Tax License is a mandatory approval required for all new or relocated businesses in the City of Oakland. It confirms that the proposed business activities are allowed under the city's zoning regulations at the specified location.

Who needs to obtain this clearance?

Any individual or entity planning to start a new business or relocate an existing business within the City of Oakland must obtain this clearance. It ensures the business complies with local zoning laws.

How can I apply for Zoning Clearance?

To apply, you must submit the required form providing details about the business address, applicant information, type of business, proposed hours of operation, number of employees, and specific business operations such as manufacturing, signage, or building changes. The form is available on the City of Oakland's website or at the zoning office.

Does this clearance cover all the permits I need to start my business?

No, the Zoning Clearance only covers zoning permits. You may need additional permits such as building, fire, or other county/state permits depending on your business activities. It's crucial to contact the appropriate agency to determine if further permits are necessary.

What information do I need to provide in the application?

Information required includes the business address, applicant's name and contact details, business name, description of business activities, proposed hours of operation, number of employees, and specific questions regarding the business location, manufacturing activities, signage, and any changes to the building.

Can I operate my business from home or an apartment in Oakland?

Yes, you can operate your business from a home or apartment, but you must indicate this on the application form. Zoning Clearance will confirm whether your home business complies with local zoning regulations.

What happens if I need to change my business operations after obtaining the clearance?

If your business undergoes changes that affect the information provided in your Zoning Clearance application, such as change in business activities, hours of operation, or number of employees, you may need to seek a new clearance to ensure continued compliance with zoning regulations.

Where can I get help if I have questions about the Zoning Clearance process?

For questions or assistance with the Zoning Clearance process, you can contact the City of Oakland's zoning information line at 510-238-3911 or visit the official website at www.oaklandnet.com/planning. Staff there can provide guidance and answer any queries you might have.

Common mistakes

Filling out forms for any official purpose, including the Clearance for Business Tax License, is an essential step for new or relocating businesses in cities like Oakland. It can be relatively straightforward but errors can occur. Here are six common mistakes people make:

- Incorrect or Incomplete Business Address: The address should be full and precise, including suite or unit numbers if applicable. Errors or omissions can cause delays.

- Not Specifying the Type of Business Accurately: A clear, detailed description of the business activities helps verify the zoning compliance. Vague descriptions may require additional clarification.

- Omitting Proposed Hours of Operation: This information is crucial for zoning verification. It is important to include the days and hours your business will operate.

- Forgetting to Indicate the Number of Employees: This could impact zoning clearances, as certain areas may have restrictions on the number of employees due to parking and traffic considerations.

- Neglecting to Answer Yes/No Questions: Each question, such as whether the business will include manufacturing or modifying the building, needs a clear yes or no. These answers guide the need for other permits and inspections.

- Overlooking the Signature and Date Section: The form is not valid until it is signed and dated. This might seem obvious, but it is a common oversight that can invalidate the submission.

Beyond these common errors, it’s essential to remember:

- Zoning clearance covers only the zoning permits. Other permissions might be necessary.

- Contacting the appropriate city agencies for further permits should not be overlooked.

- Accuracy, clarity, and completeness of every section prevent delays and complications.

Ultimately, taking the time to review and double-check a Clearance for Business Tax License form can save new or relocating businesses in Oakland considerable time and effort by ensuring compliance with local zoning regulations from the outset.

Documents used along the form

When launching or relocating a business, obtaining a Zoning Clearance for Business Tax License stands as a pivotal initial step within a series of necessary documentations and compliance efforts. This form, vital for ensuring your business aligns with local zoning regulations, is one amongst several documents business owners might encounter during the preparatory phase of their entrepreneurial journey. Understanding each document's role not only simplifies the process but also accelerates the venture from planning to operation.

- Business License Application: This form is the official request for permission to operate a business within a city or county, providing critical information about the business and its operations.

- Employer Identification Number (EIN) Application: Issued by the IRS, the EIN or Federal Tax Identification Number is essential for tax purposes, enabling businesses to hire employees, open business bank accounts, and more.

- Building Permit Application: If your business requires construction, remodeling, or significant alterations to an existing building, this application is necessary to ensure all changes adhere to local building codes and regulations.

- Fire Department Permit: Businesses that handle flammable materials, operate certain types of equipment, or invite public assembly may require inspection and approval from the local fire department for safety compliance.

- Sign Permit: Many municipalities demand a permit before erecting or modifying business signage to ensure it conforms to zoning and aesthetic guidelines.

- Certificate of Occupancy: This document confirms that a building is safe and ready for occupancy, adhering to local building, safety, and zoning codes - crucial for new or extensively modified structures.

- Health Department Permit: Required for businesses involved in food preparation, handling, or storage, this permit confirms adherence to public health regulations.

- Alcohol Beverage License: For businesses intending to sell alcohol, this license is required and involves a thorough application process to ensure compliance with state and local laws.

- Special Use Permits: Depending on the nature of the business and its location, special use permits may be required for operations that fall outside of the general zoning rules, such as nightclubs or certain home-based businesses.

- Sales Tax Permit: Most states require businesses that sell goods or taxable services to obtain this permit, enabling them to collect sales tax on transactions.

Although the list above outlines many of the common forms and documents associated with establishing a business, it's imperative to consult with local government agencies or a professional advisor specific to your industry and location. Each business situation varies, and staying informed about the requirements pertinent to your venture ensures a smoother establishment process, allowing you to focus on growth and success.

Similar forms

The "Application for Building Permit" shares similarities with the Clearance For Business Tax License form since both are essential steps in preparing for new or modified business operations. The Application for Building Permit is focused on ensuring that all construction or modifications meet local building codes and safety standards. Like the zoning clearance, it serves as a preventive check to safeguard community standards before any physical changes are made to a property. Both forms require detailed information about the proposed project, including the location, the nature of the work, and identification of the applicant.

The "Fire Safety Inspection Form" is akin to the zoning clearance in that it is a prerequisite for certain business operations to ensure compliance with safety regulations. This form assesses a business's adherence to fire codes and safety practices, much like how the zoning clearance checks the compatibility of a business with local zoning laws. Both forms are part of a broader regulatory framework intended to prevent hazards and promote the well-being of the community. They require information on the business premises and operations, underscoring the need for regulatory compliance across different facets of business setup and maintenance.

Similar to the Clearance For Business Tax License form, the "Seller's Permit Application" is a document that businesses need to legally operate in many jurisdictions, focusing on the authorization to sell goods and collect sales tax. This permit is crucial for businesses dealing in goods and services subject to sales tax, while the zoning clearance ensures that the location and type of business meet local zoning requirements. Both permits are foundational to the legal operation of a business, addressing regulatory compliance from both zoning and taxation perspectives.

The "Occupational License Application" is another document paralleling the Clearance for Business Tax License in function and necessity, targeting professionals and businesses in regulated industries. It ensures that individuals and entities meet specific qualifications and standards to offer certain services, similar to how the zoning clearance certifies that a business location conforms to municipal zoning regulations. Both licensing processes aim to protect the public by enforcing standards and are often prerequisites to launching various types of professional services and businesses.

The "Environmental Impact Assessment Form" is conceptually related to the Clearance For Business Tax License form because it evaluates the potential effects of proposed business activities on the environment. While the former focuses on zoning and the appropriateness of a business in a specific location, the Environmental Impact Assessment looks at broader implications for the environment, including pollution, resource use, and ecological disturbances. Both documents are part of the regulatory framework designed to ensure that new businesses or activities do not adversely impact their surroundings and comply with local regulations and standards.

Dos and Don'ts

When navigating the process of completing the Clearance For Business Tax License form for the City of Oakland, attention to detail and thoroughness cannot be overstressed. Here is a clear list of dos and don'ts to guide you through correctly filling out the form.

- Do ensure that all required fields are completed accurately. This includes the business address, applicant information, and details about the type of business and its operations.

- Do verify that the business activities you propose are allowed under the city’s Zoning Regulations for the specified location.

- Do provide a detailed description of the business activities to avoid any ambiguity.

- Do indicate clearly whether the business will be located within a home or apartment, as different regulations may apply.

- Don’t forget to specify if the business will involve manufacturing on the property, require new or modified signs, or necessitate changes to the building. These factors are critical for zoning clearance.

- Don’t overlook the requirement for additional permits beyond zoning clearance, such as building, fire, city administrator, or other county/state permits. Make sure to contact the appropriate agency to determine these needs.

- Don’t sign the form without thoroughly reading and understanding the implications of what you are agreeing to. This includes recognizing that the clearance covers zoning permits only.

- Don’t assume the process ends with this form; ongoing communication with city staff may be necessary to resolve any issues and to obtain your business tax license.

Completing the Zoning Clearance for Business Tax License form is a critical step in establishing your business in the City of Oakland. By following these guidelines, applicants can navigate the process more smoothly and avoid common pitfalls, ensuring compliance with local regulations and helping to expedite the approval process.

Misconceptions

Only new businesses need a Zoning Clearance. This is incorrect. Both new and relocated businesses must obtain Zoning Clearance to ensure the proposed business complies with local Zoning Regulations.

Zoning Clearance is the only permit needed to start a business. This is not true. While Zoning Clearance verifies that a business’s location complies with city zoning laws, additional permits such as building, fire, and other county or state permits may also be required.

All types of businesses are allowed in any zoning area. Actually, the City’s Zoning Regulations specify which types of businesses can operate in certain areas. Zoning Clearance confirms whether a proposed business meets these regulations.

Home-based businesses do not require Zoning Clearance. This misconception is false. Even if a business is located within a home or apartment, it still needs Zoning Clearance to verify compliance with zoning rules specific to home-based businesses.

Manufacturing businesses are not allowed in residential zones. This statement can be misleading. Whether a manufacturing business can operate within a residential zone depends on city zoning laws. The Zoning Clearance process determines if such an operation is permissible.

External changes to the building don’t require additional permits. This is incorrect. If a business requires changes to a building’s structure or exterior, it may need more than just a Zoning Clearance. Additional permits for building modifications are often required.

The Zoning Clearance process is lengthy and complex. While the process mandates thorough review, it is structured to be as straightforward as possible. Businesses are encouraged to contact zoning information services for guidance, making the process more manageable.

Key takeaways

When seeking to establish or relocate a business within the City of Oakland, understanding the process for obtaining the necessary clearances and permits is crucial for compliance with local regulations. Specifically, the Zoning Clearance for Business Tax License form serves as a foundational step in this journey. Below are key takeaways to guide applicants through this process efficiently and effectively.

- Understanding the Purpose: The primary function of the Zoning Clearance for Business Tax License is to ensure that the proposed business is in alignment with the City of Oakland's Zoning Regulations. It verifies that the location chosen for the business is suitable for the type of activities to be conducted there.

- Comprehensive Information is Critical: Applicants must provide detailed information regarding the business, including but not limited to, the business address, the type of business or nature of business activities, proposed hours of operation, and the number of employees. This information helps city officials to accurately assess the compatibility of the business with local zoning laws.

- Home-Based and Manufacturing Considerations: The form inquires explicitly about whether the business will be operated from a home or apartment and if it involves any manufacturing on the property. These factors can significantly impact the zoning clearance process, as residential areas and manufacturing activities have specific regulations governing them.

- Multifaceted Permitting Process: Applicants must be aware that the Zoning Clearance covers only zoning permits. Additional permits, such as building, fire, city administrator, or other county/state permits, may be required before initiating business operations. It is the responsibility of the applicant to contact the appropriate agencies to determine if further permits are necessary. This step is vital to avoid any legal or operational issues down the line.

By meticulously filling out the Zoning Clearance for Business Tax License form and comprehending its role within the broader context of city regulations, business owners pave the way for a smoother establishment or relocation process. It underscores the importance of due diligence, thorough preparation, and proactive engagement with city officials and regulations.

Popular PDF Documents

Ohio Sales Tax Due Dates - The comprehensive nature of the UST 1 form ensures that all aspects of sales tax collection and reporting are covered, minimizing taxation errors.

IRS W-8BEN-E - The W-8BEN-E form is critical for international trade and investment, enabling foreign entities to participate more fully in the U.S. economy.