Get City Of Tiffin Ohio Income Tax Form

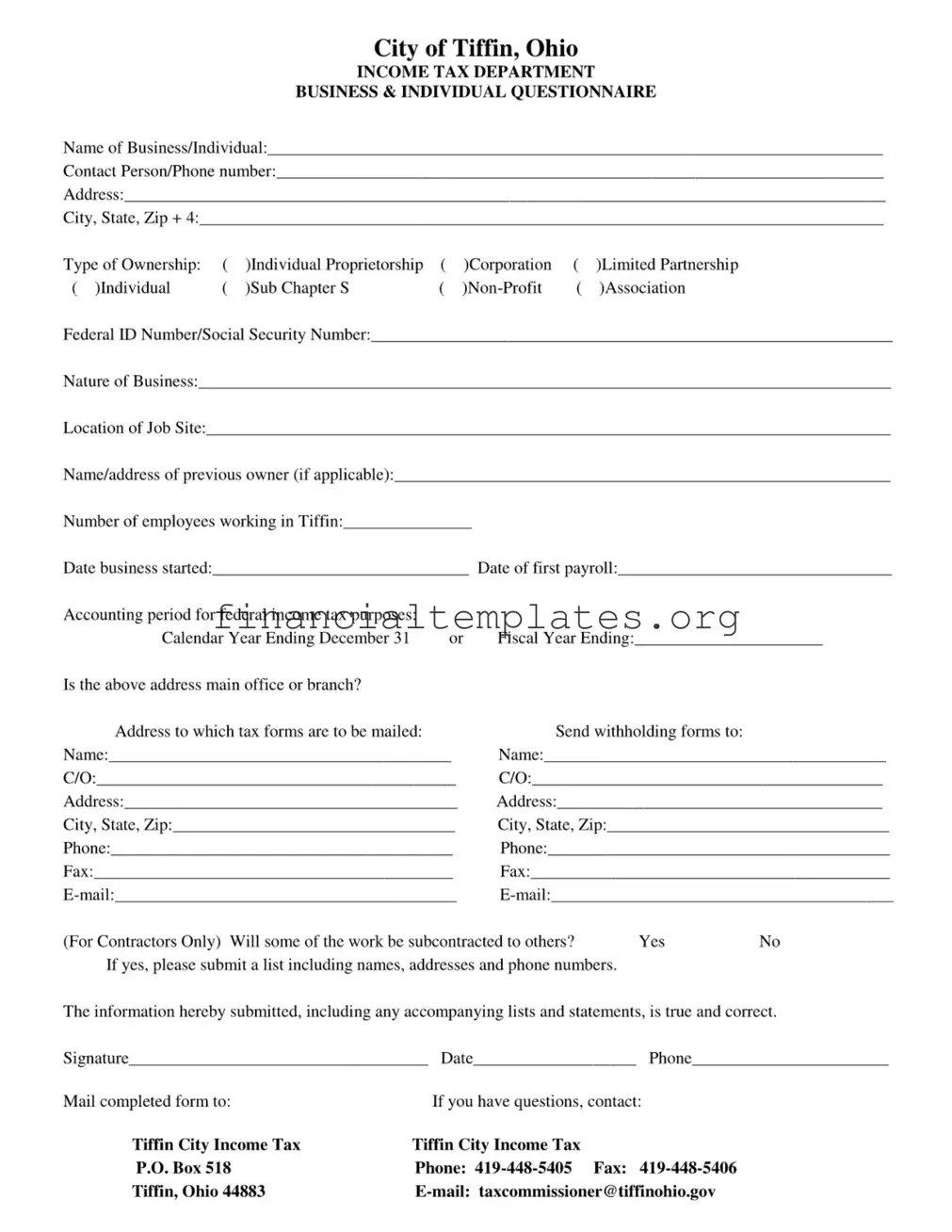

Navigating the complexities of local tax obligations can pose a daunting task for both businesses and individuals. Within the City of Tiffin, Ohio, the Income Tax Department has developed a comprehensive questionnaire to streamline the process of tax documentation and compliance. This form is meticulously designed to capture pertinent details relating to the tax entity—whether it's a business or an individual. From basic identification information such as name, contact details, and address, to more intricate details regarding the type of ownership, Federal ID number or Social Security Number, and the nature of the business, this form comprehensively covers various elements necessary for accurate tax assessment. Additionally, the form requires information on the location of the job site, the name and address of any previous owner (if applicable), the number of employees working in Tiffin, critical dates like the business start date and the date of the first payroll, and the accounting period for federal income tax purposes. It goes further to distinguish whether the address provided is the main office or a branch, and it allows for the specification of addresses where tax forms are to be sent and where withholding forms are to be mailed. For contractors, there’s an added request to submit a list of subcontractors if applicable. The form concludes with a declaration that the information provided is true and correct, which must be affirmed with a signature. This detailed questionnaire demonstrates the City of Tiffin's commitment to ensuring tax compliance through a well-structured and thorough approach, making it an essential tool for both individual taxpayers and business entities within the city.

City Of Tiffin Ohio Income Tax Example

Document Specifics

| Fact Number | Fact Description |

|---|---|

| 1 | The form is used for both business and individual income tax purposes in Tiffin, Ohio. |

| 2 | It collects basic information such as name, contact person, phone number, and address. |

| 3 | Types of ownership identified include sole proprietorship, partnership, S Corporation, non-profit, limited partnership, and association. |

| 4 | Applicants must provide their Federal ID Number or Social Security Number. |

| 5 | The form requests details on the nature of the business and the job site location. |

| 6 | There's a section for the number of employees working in Tiffin and the business's start date. |

| 7 | Businesses need to disclose their accounting period for federal income tax purposes. |

| 8 | It asks whether the provided address is the main office or a branch, and where tax forms should be mailed. |

| 9 | Contractors are required to indicate if any work will be subcontracted, including providing a list of subcontractors. |

| 10 | The form must be signed as a declaration that the information provided is true and correct. |

Guide to Writing City Of Tiffin Ohio Income Tax

Filling out the City of Tiffin Ohio Income Tax form is a crucial step for both businesses and individuals to comply with local tax regulations. This form gathers essential info about your earnings and operations within Tiffin, ensuring you're taxed correctly. Let's break down the steps to complete this form accurately, making the process straightforward and efficient.

- Enter the Name of Business/Individual at the top of the form.

- Provide the Contact Person's name and Phone Number.

- Fill in the complete Address, including City, State, Zip + 4.

- Select the Type of Ownership by checking the appropriate box: Individual, Individual Proprietorship, Sub Chapter S, Corporation, Non-Profit, Limited Partnership, or Association.

- Enter your Federal ID Number or Social Security Number, depending on whether you are filling this out as a business or individual.

- Describe the Nature of Business.

- Specify the Location of Job Site.

- Provide the Name and Address of the previous owner if applicable.

- Indicate the Number of employees working in Tiffin.

- Enter the Date business started and the Date of first payroll.

- Select your Accounting period for federal income tax purposes by marking either Calendar Year Ending December 31 or Fiscal Year Ending, and specify the date if choosing Fiscal Year.

- State whether the provided address is the Main Office or Branch.

- For the address to which tax forms are to be mailed, input the Name, C/O (if applicable), and Address.

- Specially for withholding forms, indicate the Name, C/O (if applicable), Address, City, State, Zip, Phone, Fax, and E-mail.

- For contractors, mark whether some of the work will be subcontracted to others. If yes, attach a list including names, addresses, and phone numbers.

- Review the information provided, ensuring everything is true and correct, then sign and date the form.

- Provide your Phone Number again at the bottom.

- Mail the completed form to the address provided: Tiffin City Income Tax P.O. Box 518, Tiffin, Ohio 44883.

Once your form is received and processed, you'll be in good standing with the City of Tiffin's tax requirements. Should you have any questions during this process, don't hesitate to get in touch using the contact information provided on the form. Accurate and timely completion of this questionnaire helps ensure your tax obligations are met according to local laws.

Understanding City Of Tiffin Ohio Income Tax

- Who needs to fill out the City of Tiffin, Ohio Income Tax form?

- What information is required on the City of Tiffin Income Tax form?

- Where should the completed City of Tiffin, Ohio Income Tax form be mailed?

- Who can I contact if I have questions while filling out the form?

Both businesses and individuals conducting business within the City of Tiffin need to fill out the Income Tax form. This includes individual proprietors, Sub Chapter S Corporations, Non-Profits, Limited Partnerships, and Associations. If you are starting a new business, own an existing business, or are engaged in any economic activity within Tiffin, this form is necessary for tax purposes.

The form requires detailed information including the name of the business or individual, contact person and phone number, address, type of ownership, Federal ID Number or Social Security Number, nature of business, job site location, information about any previous owner if applicable, the number of employees working in Tiffin, start date of the business, the date of the first payroll, accounting period for federal income tax purposes, and whether the main address is a main office or a branch. Contractors are also asked if work will be subcontracted, requiring a list of subcontractors.

The completed form should be mailed to: Tiffin City Income Tax, P.O. Box 518, Tiffin, Ohio 44883. Ensure all provided information is accurate and complete before sending it to the specified address to avoid delays in processing your tax information.

If you have any questions or need assistance while filling out the City of Tiffin Income Tax form, you can contact the Tiffin City Income Tax department directly. While the specific contact details are not provided here, reaching out to the city's main contact lines should direct you to the Income Tax Department for help. It's crucial to seek guidance when needed to ensure the form is filled out correctly.

Common mistakes

When filling out the City of Tiffin, Ohio Income Tax form, several common errors can occur. Avoiding these mistakes ensures accurate processing and compliance with local tax regulations. Here's a breakdown of the frequent missteps:

- Failing to provide complete contact information: Not including a full address or omitting contact details can delay processing.

- Omitting the type of ownership: It’s crucial to specify whether your entity is an Individual, Sole Proprietorship, Corporation, etc., as this affects tax obligations.

- Incorrect Federal ID or Social Security Number: This error can result in processing delays and problems with tax records.

- Vagueness about the nature of the business: A clear description of the business activities is necessary for appropriate tax assessment.

- Not specifying the main office or branch address: Indicating whether the address provided is for the main office or a branch helps ensure that the tax forms are sent to the correct place.

- Leaving the accounting period section incomplete: Choosing between Calendar Year or Fiscal Year Ending and specifying the date is compulsory for record-keeping.

- Forgetting to mention the date business started and the date of first payroll: These dates are crucial for the tax department to determine the tax timeline.

- Incorrectly listing the number of employees working in Tiffin: This information helps in assessing the total tax due.

- Neglecting to submit a subcontractor list for contractors: If applicable, failing to include a list of subcontractors can lead to incomplete documentation.

- Not double-checking the form for accuracy and completeness before signing: This could lead to the submission of incorrect or incomplete information.

By paying careful attention to these areas, individuals and businesses can avoid delays and ensure that their tax obligations are met accurately and efficiently.

Documents used along the form

When dealing with tax-related matters, particularly in the context of the City of Tiffin, Ohio, various documents often come into play to ensure compliance and accuracy. Each form or document serves its unique function, facilitating different aspects of the income tax filing process. Understanding these documents is crucial for both individuals and businesses aiming to fulfill their tax obligations efficiently and effectively.

- W-2 Forms: Issued by employers, these forms report an employee's annual wages and the amount of taxes withheld from their paycheck. They are essential for individuals to report their income on tax returns.

- 1099 Forms: This series of forms is used to report various types of income other than wages, salaries, and tips. For instance, 1099-MISC is often used for independent contractors, while 1099-DIV reports dividends and distributions.

- W-9 Form: Request for Taxpayer Identification Number and Certification. This form is used to provide the correct Taxpayer Identification Number (TIN) to entities that are required to file information returns with the IRS.

- Form 1040: The standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns. It documents all sources of income and determines the amount of tax to be paid or refunded by the government.

- Schedule C: Profit or Loss from Business. Used by sole proprietors to report both income and expenses from a business they operated or a profession they practiced as a sole proprietor.

- Schedule E: Supplemental Income and Loss. This form is for reporting income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

- Quarterly Estimated Tax Payment Forms: These forms are used by individuals, including self-employed professionals and independent contractors, to pay their estimated taxes to the IRS quarterly.

- Extension Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form allows individuals more time to file their tax returns without incurring penalties, typically extending the deadline by six months.

- Local Earned Income Tax Return: A form used by residents to report income earned and taxes paid to a local municipality. This is important for Tiffin residents to ensure they comply with local tax laws.

Understanding and accurately completing these forms and documents is pivotal in navigating the complexities of tax obligations. Each document carries specific information that contributes to the broader financial picture of an individual or a business. Properly managing these forms not only ensures compliance but also maximizes potential tax advantages. Whether dealing with federal or local tax issues, these documents form the backbone of a comprehensive tax filing process.

Similar forms

The City of Tiffin, Ohio Income Tax form shares similarities with the IRS Form 1040, which is the U.S. Individual Income Tax Return. Both documents require taxpayers to provide personal identification information, including Social Security numbers for individuals or Federal ID numbers for businesses. They also gather detailed financial information to assess the proper amount of tax due. The key purpose of both forms is to calculate income tax obligations based on earnings and allowable deductions, though the scope of the 1040 form is federal, while the City of Tiffin form focuses on local tax responsibilities.

Comparable to the IRS Schedule C (Profit or Loss from Business), the City of Tiffin Income Tax form necessitates detailed information from business operators. Schedule C is designed for sole proprietors to report business income and expenses to determine taxable profit, mirroring the Tiffin form’s requirement for business narrative, including the nature of the business, number of employees, and a job site location which mirrors the Schedule C's detailing of business activities and associated financial information.

Form W-9 (Request for Taxpayer Identification Number and Certification) is another document bearing resemblance to the City of Tiffin Income Tax form, especially in the sections requesting Federal ID Number or Social Security Number. Both forms serve as a means to verify the taxpayer’s identity and ensure accurate tax reporting, with the W-9 often used in business transactions to report income paid to contractors, relevant to the Tiffin form’s section on subcontracted work.

The IRS Form 8822 (Change of Address) parallels the City of Tiffin form in their mutual requirement for current address information and the procedure to update it. This ensures that all tax correspondence and documents are accurately directed, maintaining up-to-date communication channels between the taxpayer and the tax authority. This similarity emphasizes the importance of current contact information in managing tax obligations thoroughly and efficiently.

Similarly, Form SS-4 (Application for Employer Identification Number) shares common features with the City of Tiffin Income Tax form, particularly in regards to the setup and identification of businesses. Form SS-4 is necessary for obtaining an EIN that businesses need for tax filing and reporting purposes, closely aligning with the Tiffin form's section on type of ownership and Federal ID Number, which also facilitates tax identity and responsibilities.

The questionnaire aspect of the City of Tiffin Income Tax form is akin to the IRS Form 433-B (Collection Information Statement for Businesses), which gathers extensive information about a business’s financial condition. Both forms require thorough disclosure of operational details, including nature and location of the business, ownership type, and contact information for tax purposes, hence assisting in the accurate assessment and collection of taxes.

On a local scale, the form mirrors various State Business Registration forms which are necessary for business licensing and tax registration within a state. These forms often require similar information about the business, such as legal structure, owner information, and EIN/SSN, to ensure compliance with state tax laws, akin to the City of Tiffin's process for local tax compliance.

Last but not least, the complexity and necessity for accuracy in filling out the City of Tiffin Income Tax form bear a general resemblance to construction contract documents. Just as contractors must detail subcontracted work, names, and contacts, such documents demand precision in specifying project scope, stakeholder information, and timelines, ensuring clear expectations and legal responsibilities among parties involved in a project, which echoes the thoroughness expected in tax documentation.

Dos and Don'ts

When completing the City of Tiffin, Ohio Income Tax form, certain guidelines should be followed to ensure the form is submitted correctly. Here are some important dos and don'ts to keep in mind:

Do:- Review the entire form before starting to ensure you understand what information is required.

- Use a blue or black ink pen if filling out the form by hand to ensure the information is legible and can be scanned properly.

- Include accurate contact information, ensuring that your name, business name (if applicable), phone number, and address are up to date.

- Double-check the Federal ID Number/Social Security Number provided to make sure it matches your records exactly. Errors here can cause significant issues.

- Provide a detailed description of the nature of the business or the source of personal income as clearly as possible.

- Ensure dates are correct, including the date the business started and the date of the first payroll, where applicable.

- Specify the accounting period accurately, indicating whether you follow a calendar year or a fiscal year.

- Sign and date the form to certify that the information is true and correct to the best of your knowledge.

- Contact the City of Tiffin Income Tax Department if you have any questions or need clarification on how to fill out the form.

- Mail the completed form to the correct address provided to avoid any delays in processing.

- Leave any fields blank unless specified that it’s optional or not applicable to your situation.

- Use pencil or colors other than blue or black ink if completing the form by hand, as this can make the form hard to read.

- Guesstimate dates or financial information; ensure all data provided is accurate and verified.

- Ignore the instructions for subcontracted work if you are a contractor. Submit all necessary information, including names and contact details of subcontractors, if applicable.

- Forget to include your signature and the date, as an unsigned form is considered incomplete and will not be processed.

- Overlook the need to provide a separate mailing address if tax forms should be sent to a different location than the main office address.

- Assume information will be automatically updated if there are changes after the form has been submitted. Notify the Income Tax Department of any changes.

- Send the form to the wrong department or address, which could delay processing times.

- Rush through filling out the form without checking for errors. Take the time to review everything before submission.

- Forget to keep a copy of the completed form for your records.

Misconceptions

There are several misconceptions about completing the City of Tiffin, Ohio, Income Tax form that individuals and businesses might have. Clarifying these misunderstandings can help ensure the process is completed accurately and efficiently.

- Misconception 1: All businesses are treated the same regardless of their structure.

This is not accurate. The form asks for the type of ownership because different types of businesses may have different tax implications. Whether you operate as an individual proprietorship, a subchapter S corporation, a non-profit, a limited partnership, or an association affects how your income is taxed at the city level.

- Misconception 2: The form is only concerned with businesses physically located in Tiffin.

While the form does ask for the location of the job site and the number of employees working in Tiffin, this doesn't mean only businesses with a physical presence in Tiffin are required to report. Businesses outside the city that conduct activities or have employees working within city limits may also need to complete this form.

- Misconception 3: The income reported is for the calendar year only.

It's often assumed that financial details must be reported based on the calendar year. However, the form accommodates businesses that operate on a fiscal year basis. You're asked to specify your accounting period for federal income tax purposes, allowing you to report based on either the calendar year ending December 31 or a fiscal year ending on another date.

- Misconception 4: Only primary business locations need to be disclosed.

Another common misunderstanding is that the questionnaire only requires information about the primary business location. Yet, it explicitly asks whether the address provided is for the main office or a branch, and also requires the address to which tax forms are to be mailed, indicating that various locations associated with the business might need to be reported, including where tax communications should be sent.

Understanding these nuances is crucial for correctly completing the City of Tiffin, Ohio, Income Tax form. By addressing these common misconceptions, businesses and individuals can better navigate the tax reporting process, ensuring compliance with local tax obligations.

Key takeaways

Filling out the City of Tiffin, Ohio Income Tax form is essential for individuals and businesses engaging in financial activities within the city. Here are key takeaways to ensure accuracy and compliance:

- Complete Identification Information: It's crucial to provide accurate details about the name of the business or individual, the contact person, and the phone number. This step ensures that all correspondences and documents are correctly addressed.

- Address and Type of Ownership: You are required to fill in the full address and specify the type of ownership such as individual, proprietorship, corporation, non-profit, limited partnership, sub chapter S, or an association. This categorization helps in understanding the tax entity and obligations.

- Provide Federal ID or Social Security Number: Each entity must disclose their Federal ID number or an individual's Social Security Number. This identifier is necessary for tax processing and verification purposes.

- Business Specifics: Detailing the nature of the business, the location of the job site, and the name and address of any previous owner if applicable, allows the Income Tax Department to better understand your business operations within Tiffin, Ohio.

- Employment and Accounting Information: Indicating the number of employees working in Tiffin, the date business started, and the accounting period for federal income tax purposes (Calendar Year Ending December 31 or Fiscal Year Ending) are fundamental elements to comply with local tax regulations.

- Additional Contact Information: Providing specific addresses for where tax forms should be mailed, and to whom withholding forms should be sent, ensures timely and accurate delivery of necessary tax documentation. This section is critical for maintaining open and effective communication with the City of Tiffin Income Tax Department.

It is important to answer truthfully and provide thorough information, including a list of subcontractors if you're a contractor, to avoid any compliance issues. Once completed, signing the form confirms that all provided information is true and correct, making it a legally binding document. For any uncertainties or questions, it's advisable to contact the Tiffin City Income Tax Department directly.

Popular PDF Documents

Dlstfd - A breakdown of the total payments received since the last statement is available to help you track your progress.

Ach Form to Receive Payment - The form allows for the selection between checking, savings, or lockbox accounts for receiving payments.

K-1 Self Employment Earnings Box 14 C - It includes reporting of foreign transactions, investments, and other financial interests of the partnership affecting individual tax situations.