Get City Of Tempe Tax License Form

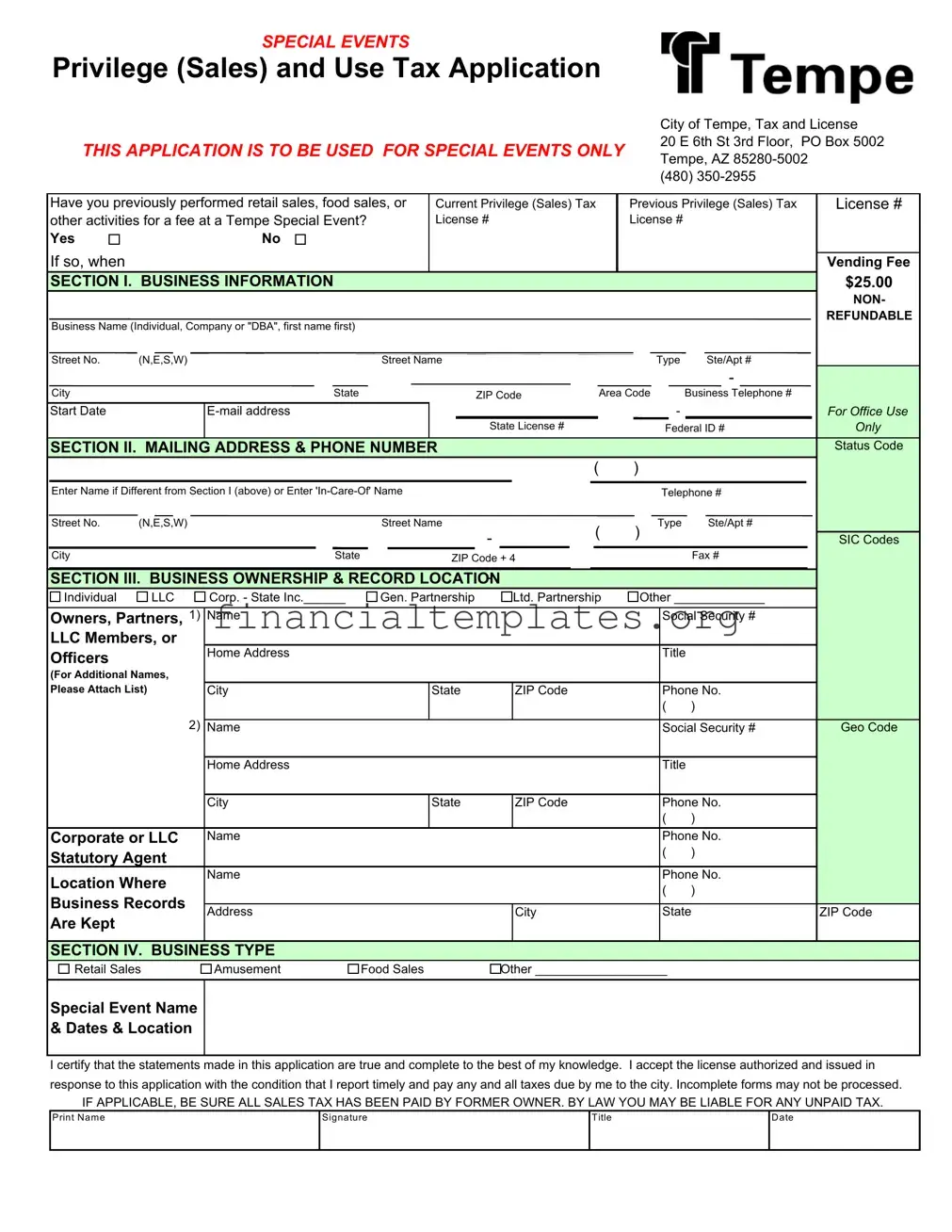

The City of Tempe, Arizona, offers a unique opportunity for vendors and businesses to participate in special events through a specially designed Privilege (Sales) and Use Tax Application. This specific form, which is intended solely for events classified as special, provides a bridge for entrepreneurs and entities to engage in retail sales, food sales, or similar activities in a regulated and structured manner. Located at the heart of the city's Tax and License division on East 6th Street, this application acts as the initial step for businesses aiming to operate within the vibrant environment of Tempe's special events. With a nominal $25.00 non-refundable vending fee, applicants are prompted to furnish comprehensive business information, ranging from basic identification details to more complex data regarding business ownership types and locations where business records are kept. Additionally, the form delves into the specifics of the business such as the nature of sales, the specifics of the special event including names, dates, and locations, thereby ensuring a well-rounded understanding of the applicant's operational blueprint. The emphasis on a complete and truthful submission is underscored by a certification by the applicant, binding them to accurately report and remit any taxes incurred. Moreover, the form cautions new owners about the importance of ensuring that all sales taxes have been settled by previous entities to avoid inheriting tax liabilities. This structured yet straightforward approach facilitates a smoother transaction between the city and businesses, ensuring all parties are aligned with regulatory and fiscal responsibilities.

City Of Tempe Tax License Example

SPECIAL EVENTS

Privilege (Sales) and Use Tax Application

THIS APPLICATION IS TO BE USED FOR SPECIAL EVENTS ONLY

City of Tempe, Tax and License

20 E 6th St 3rd Floor, PO Box 5002 Tempe, AZ

(480)

Have you previously performed retail sales, food sales, or |

Current Privilege (Sales) Tax |

Previous Privilege (Sales) Tax |

License # |

||||||||||||||||||||||||||||||||||||

other activities for a fee at a Tempe Special Event? |

License # |

|

|

|

|

|

License # |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Yes |

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

If so, when |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vending Fee |

|

SECTION I. BUSINESS INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$25.00 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NON- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REFUNDABLE |

Business Name (Individual, Company or "DBA", first name first) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Street No. |

(N,E,S,W) |

|

|

|

|

|

Street Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Type |

|

|

Ste/Apt # |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

||

City |

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

ZIP Code |

|

|

|

|

Area Code |

Business Telephone # |

|

|||||||||||||||||

Start Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

For Office Use |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State License # |

|

|

|

|

|

|

|

|

|

|

|

Federal ID # |

Only |

|||||||||||

SECTION II. MAILING ADDRESS & PHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Status Code |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Enter Name if Different from Section I (above) or Enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone # |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Street No. |

(N,E,S,W) |

|

|

|

|

|

Street Name |

|

|

|

( |

|

|

) Type |

|

|

Ste/Apt # |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIC Codes |

City |

|

|

|

|

|

|

|

State |

|

|

|

|

ZIP Code + 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax # |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

SECTION III. BUSINESS OWNERSHIP & RECORD LOCATION- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Individual |

LLC |

Corp. - State Inc.______ |

|

Gen. Partnership |

|

|

Ltd. Partnership |

|

|

Other _____________ |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners, Partners, 1) |

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security # |

|

||||||||||||||||

LLC Members, or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Officers |

|

|

|

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(For Additional Names, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Please Attach List) |

City |

|

|

|

|

State |

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

Phone No. |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security # |

Geo Code |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

Phone No. |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate or LLC |

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone No. |

|

||||||||||||||||

Statutory Agent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Location Where |

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone No. |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

||||||

Business Records |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Address |

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|||||||||||||||||

Are Kept |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION IV. BUSINESS TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Retail Sales |

Amusement |

Food Sales |

|

|

|

Other ___________________ |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special Event Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

& Dates & Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify that the statements made in this application are true and complete to the best of my knowledge. I accept the license authorized and issued in response to this application with the condition that I report timely and pay any and all taxes due by me to the city. Incomplete forms may not be processed.

IF APPLICABLE, BE SURE ALL SALES TAX HAS BEEN PAID BY FORMER OWNER. BY LAW YOU MAY BE LIABLE FOR ANY UNPAID TAX.

Print Name

Signature

Title

Date

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | This form is specifically designed for special events in the City of Tempe. |

| 2 | The application process is managed by the City of Tempe, Tax and License division. |

| 3 | Applicants can contact the division at their office or by calling (480) 350-2955. |

| 4 | A non-refundable vending fee of $25.00 is required with the application. |

| 5 | Applicants must provide details about their business, including business name, address, and contact information. |

| 6 | The form requires information about the business ownership type, such as Individual, LLC, Corporation, Partnership, etc. |

| 7 | Details of the business owners, partners, LLC members, or officers must be provided, including names and social security numbers. |

| 8 | Applicants must specify the type of business activity (e.g., retail sales, amusement, food sales) for the special event. |

| 9 | The form includes a certification that all statements made in the application are true and a commitment to abide by tax obligations. |

| 10 | The form warns that the new owner may be liable for any unpaid sales tax by the former owner if not duly paid. |

Guide to Writing City Of Tempe Tax License

Filling out the City of Tempe Tax License form is a necessary step for those looking to participate in special events within the city, engaging in activities such as retail sales or food sales. This process involves providing detailed business information, mailing address, business ownership details, and specifics related to the nature of the business. Ensuring accuracy and completeness in this application is crucial for compliance and smooth operation within the City of Tempe. Below are the step-by-step instructions to guide you through filling out the form.

- Locate the section labeled "Have you previously performed retail sales, food sales, or other activities for a fee at a Tempe Special Event?" Check Yes or No as applicable, and if yes, provide the relevant Previous Privilege (Sales) Tax License # and specify when.

- Under SECTION I. BUSINESS INFORMATION, enter your Business Name (Individual, Company, or "DBA"), with the first name listed first.

- Fill in your business location details including Street Number, Street Name, Type, Ste/Apt #, City, State, and ZIP Code.

- Provide the Business Telephone Number, including the Area Code, and your Email Address in the designated fields.

- Enter the Start Date for when the business commenced or will commence operations.

- For official use, note that the State License # and Federal ID # fields are to be filled out by office personnel.

- In SECTION II. MAILING ADDRESS & PHONE NUMBER, enter the Name if it differs from Section I or an 'In-Care-Of' Name along with a different Telephone Number if applicable.

- Complete your mailing address including Street Number, Street Name, Type, Ste/Apt #, City, State, ZIP Code + 4, and Fax Number.

- For SECTION III. BUSINESS OWNERSHIP & RECORD LOCATION, select your business's ownership structure (Individual, LLC, Corp., etc.) and fill in the state of incorporation if a Corp.

- Details of Owners, Partners, LLC Members, or Officers including Name, Social Security #, Home Address, Title, City, State, ZIP Code, and Phone Number are to be provided. Attach a separate list if there are additional names.

- Specify the Corporate or LLC Name, Statutory Agent, and the Location Where Business Records Are Kept including the Name, Phone Number, address, City, State, and ZIP Code.

- In SECTION IV. BUSINESS TYPE, select the type of business you are operating (Retail Sales, Amusement, Food Sales, or Other) and provide the Special Event Name & Dates & Location.

- Ensure to certify the application by signing and printing your Name, providing your Title, and dating the form under the statement of certification.

Once completed, review the form for accuracy and completeness to avoid processing delays. Remember, the vending fee for special events is $25.00 and is non-refundable. Ensure you've attached any additional lists or documents required before submitting the form to the City of Tempe, Tax and License Division. Submitting this form is a commitment to comply with city regulations, timely reporting, and payment of taxes due for your business's operation during the special event.

Understanding City Of Tempe Tax License

Please find below a list of frequently asked questions (FAQs) about completing and submitting the City of Tempe Tax License form for special events.

- What is the purpose of this form?

This form is specifically designed for individuals or businesses planning to conduct retail sales, food sales, or offer any services for a fee at special events in the City of Tempe. It acts as an application for obtaining the necessary Privilege (Sales) and Use Tax License.

- What is the cost to apply?

The application comes with a non-refundable vending fee of $25.00. This fee is required when submitting your application.

- Who needs to fill out this form?

Any individual or business entity that intends to participate in special events within the City of Tempe by performing retail sales, food vending, or any other for-profit activity must complete and submit this form.

- What information do I need to provide in Section I?

Section I requires the provision of your business information, including the business name (Individual, Company, or DBA), your street address, telephone number, email address, and the starting date of your business.

- Is the State License # and Federal ID # mandatory?

Yes, for office use, it's essential to provide both your State License Number and Federal Identification Number, if applicable, to comply with the city's regulations and tax obligations.

- How do I specify my business ownership in Section III?

In Section III, you must identify the nature of your business ownership—whether it's an Individual, LLC, Corporation, General or Limited Partnership, or other. Additionally, details about owners, partners, LLC members, or officers, including their names, social security numbers, home addresses, titles, and phone numbers, must be provided.

- What information is required about the Special Event?

You are required to fill in detailed information regarding the Special Event, including the event's name, the dates it will take place, and its location. This information is crucial for the City to process your application accurately.

- What certifications do I need to make?

By signing the application, you certify that all statements made within the form are true and complete to the best of your knowledge. Additionally, you agree to report and pay any and all taxes due to the city timely.

- What happens if the form is incomplete?

An incomplete form may not be processed. It is vital to ensure all required information is provided, including the payment of the vending fee and any necessary additional information.

If further assistance is required, please contact the City of Tempe, Tax and License division, at (480) 350-2955.

Common mistakes

Filling out the City of Tempe Tax License form for special events can be a meticulous task. To ensure accuracy and compliance, individuals often overlook key aspects of the application process. Here are nine common mistakes made during this process:

- Not verifying previous license information: Applicants sometimes forget to check whether they have performed sales or other activities that require a tax license at past Tempe Special Events. This oversight can affect the taxation process and obligations.

- Omitting the non-refundable vending fee: The application clearly states a $25.00 non-refundable vending fee, which applicants occasionally overlook. This fee is crucial for the processing of the application.

- Incomplete business information: Failing to provide comprehensive business information, including the "DBA" (Doing Business As) name, can lead to processing delays. Accurate and complete details are essential for the city's records.

- Incorrect or incomplete mailing address: Applicants must provide a mailing address that may differ from the business location. Missing or inaccurate information here can lead to communication issues.

- Overlooking business ownership details: The form requires detailed information about business ownership. Neglecting to fill this section accurately—including names, social security numbers, and addresses of all owners—can result in processing delays or denials.

- Failure to specify business type: Not clearly indicating the business type (retail sales, amusement, food sales, etc.) can create ambiguity and potentially affect tax calculations and obligations.

- Underspecifying special event details: The application requires specifics about the special event, including names, dates, and locations. Inadequate details can hinder the license approval process.

- Forgetting to certify the application: The certification at the end of the application, affirming the truthfulness and completeness of the information provided, is often overlooked. This step is not only procedural but also legally binding.

- Ignoring previous owner's tax obligations: There's a caution note about ensuring all sales tax has been paid by the former owner if applicable. Applicants sometimes miss this, potentially inheriting unpaid tax liabilities.

Addressing and double-checking these common mistakes can significantly streamline the process, ensuring that all requirements are met for a successful application. The City of Tempe, through its Tax and License division, emphasizes accuracy and completeness to facilitate a smooth operational workflow for special events. Awareness and attentiveness to these areas can aid in avoiding unnecessary delays or complications.

Documents used along the form

In the intricate process of engaging with city regulations, particularly for those organizing or participating in special events in Tempe, understanding and completing the City of Tempe Tax License form is a crucial step. However, this form is often just one piece of a larger puzzle. A variety of other forms and documents usually accompany the City of Tempe Tax License form, each serving a distinct purpose in ensuring compliance and facilitating the smooth operation of events. Let's take a closer look at some of these commonly associated forms and documents.

- Application for Special Event Permit: This form is a necessity for event planners seeking authorization to host an event within the city. It covers aspects like event details, expected attendance, and site plans.

- Business License Application: Individuals or entities intending to conduct ongoing business activities in Tempe, beyond special events, are required to fill out this form to legally operate in the city.

- Sales Tax Reporting Form: Post-event, this document is crucial for reporting and remitting the sales tax collected during the event, ensuring compliance with local tax obligations.

- Food Vendor Permit: For events involving food sales, this permit is essential. It ensures that all food vendors comply with health and safety regulations.

- Temporary Liquor License Application: Events planning to serve alcohol must obtain this license, which involves specific criteria and conditions set by the city.

- Noise Permit: If an event expects to exceed standard noise levels, this permit is necessary to ensure harmony with local noise ordinances.

- Fire Safety Inspection Request: This document is often required for events to ensure compliance with fire safety standards, especially in cases where large crowds are expected or fireworks are involved.

- Insurance Certification: Events often need to provide proof of insurance, covering various liabilities and potential damages that could occur during the event.

- Site Map or Event Layout Plan: While not a form, providing a detailed plan of the event site is essential for various approvals, illustrating the arrangement of vendor booths, stages, and emergency exits.

Each of these documents plays a vital role in the orchestrating and execution of special events in Tempe, ensuring adherence to legal and safety requirements. Understanding the purpose and requirement of each can provide clarity and direction for event organizers, facilitating a thorough and compliant approach to event planning and management. These documents, in conjunction with the City of Tempe Tax License form, ensure events operate smoothly, providing both participants and attendees with safe and enjoyable experiences.

Similar forms

One document similar to the City of Tempe Tax License form for special events is the Business License Application form used by many municipalities across the United States. This form is a crucial step for business owners looking to legitimize their operations within a specific locality. Just like the Tempe document, it collects essential information about the business, such as the business name, address, type of ownership (e.g., Individual, LLC, Corporation), and the nature of the business. Both documents serve a regulatory function, ensuring businesses comply with local laws and regulations, and often include a section for acknowledging the accuracy of the information provided and the applicant's acceptance of local governmental authority.

Another document that shares similarities with the City of Tempe Tax License form is the Seller's Permit Application form required by state governments for businesses engaging in sales. This document is necessary for the collection of sales tax on behalf of the state. Like the Tempe form, it requests detailed business information, including federal ID numbers and details about the business's ownership structure. Both forms are vital for tax purposes, ensuring that the appropriate taxes are collected and remitted to the correct government entity, thereby facilitating compliance with tax regulations.

The Event Permit Application found in various cities and towns parallels the Tempe form in its focus on specific events. This application typically pertains to the authorization of public and private events held within municipal boundaries. Both applications require information regarding the event's nature, location, and dates, highlighting the need for local authorities to manage and approve public gatherings. Such management ensures events do not disrupt local communities and are in line with safety and regulatory standards.

Similarly, the Food Vendor License Application, required for food sales at events or mobile food units, has much in common with the Tempe form. It requires vendors to provide details about their operation, including the type of food sold, business ownership information, and event-specific data if applicable. Both forms are integral to health and safety oversight, ensuring that food sales at events meet the necessary health standards and regulations, thus safeguarding public health.

The Alcohol Beverage License Application also echoes the City of Tempe's form, particularly when alcohol sales are part of an event's offering. Such applications necessitate detailed business information, alongside specifics about the event, including the serving times and types of alcohol to be sold. Both documents play a role in regulating commerce within a jurisdiction, ensuring that businesses adhere to local laws, especially concerning alcohol sales, which are tightly regulated.

The Home Occupation Permit Application, required for businesses operating out of a home, shares the City of Tempe form’s emphasis on detailed business information, including the nature of the business and the location. While focused on residential-based business operations, both forms ensure that businesses, regardless of where they operate, comply with local zoning and business operation laws, thereby maintaining community standards and regulations.

Lastly, the Special Use Permit Application, often required for the temporary use of land or property in a way not permitted by the current zoning, resembles the Tempe form in its intent to regulate special activities. It includes provisions for describing the event or usage, dates, and location, just like the Tempe form. Both ensure that special uses or events comply with local planning and zoning laws, balancing the needs of the community with those of businesses or individuals seeking to use property in non-traditional ways.

Each of these documents, though diverse in their specific focus—ranging from business operations, food and alcohol sales, to zoning and land use—shares the underlying purpose of the City of Tempe Tax License form: to regulate and facilitate compliance with local laws, ensuring businesses and events operate responsibly within their communities.

Dos and Don'ts

When filling out the City of Tempe Tax License form, especially for those managing or participating in special events, it's important to approach the task with care. This document is not just paperwork; it's a part of your event's legal framework and, if not handled properly, can lead to unnecessary headaches. Here are some dos and don'ts to help streamline the process:

- Do carefully read all sections of the application before starting to fill it out. Understanding each requirement will save time and reduce errors.

- Do make sure to fill in all required fields with accurate information. Inaccuracies can cause delays or even result in non-issuance of the license.

- Do check the box that correctly indicates whether you have previously conducted sales at a Tempe Special Event. This history can affect your application.

- Do include the non-refundable vending fee of $25.00. It's crucial for the processing of your application.

- Don't forget to provide your Federal ID number and, if applicable, your State License number. These identifiers are essential for tax purposes.

- Don't overlook the section regarding business ownership and record location. Accurate details are necessary for proper registration and future reference.

- Don't submit the application without double-checking that all sales tax by the former owner has been paid. Failure to do so might leave you liable for their unpaid taxes.

- Don't ignore the certification section at the end of the form. Signing and dating certify that you've provided true and complete information and agree to comply with city taxes.

Remember, while completing this form is a critical step in organizing a special event in Tempe, it's also your responsibility to ensure all information is presented accurately and completely. Following these dos and don'ts will not only make the process smoother but will also help in avoiding potential legal issues down the line.

Misconceptions

When engaging with the City of Tempe Tax License form for special events, various misconceptions can arise, often leading to confusion and potential missteps. It's crucial to clear up these misunderstandings to ensure compliance and smooth operation of your event.

- One-time operation exempts from needing a license: Even if you plan to conduct sales at just a single event, a tax license is mandatory for conducting any retail sales, food sales, or other taxable activities.

- The $25.00 fee is refundable: The vending fee indicated on the form is non-refundable, regardless of the event's success or even if it's canceled.

- Existing state or federal licenses cover city requirements: Holding a state license or having a federal ID number does not exempt you from the need for a city tax license to operate legally in Tempe for special events.

- Personal information is optional: The form requires detailed information regarding business ownership, including Social Security numbers and home addresses of owners, partners, or LLC members, which is necessary for processing.

- Immediate processing of submitted forms: The form warns that incomplete applications may not be processed, indicating that accurate and complete submission is crucial and processing time should be anticipated.

- No need for previous license details if not available: If you have previously obtained a Privilege (Sales) Tax License, details of that license must be furnished, illustrating a need for historical compliance information.

- All sales at special events are taxed equally: The form distinguishes between retail sales, amusement, and food sales, hinting at a nuanced approach to taxation depending on the nature of the sale.

- Digital signatures are acceptable: The form requires a print name, signature, title, and date at the end, implying the need for a physical signature to authenticate the document.

- Assignment of liability for unpaid taxes is negotiable: The explicit mention that new owners may be liable for unpaid taxes by former owners underscores a non-negotiable legal principle regarding the transfer of liability.

Understanding these nuances ensures that individuals and businesses can navigate the requirements of the City of Tempe Tax License form more effectively, promoting compliance and contributing to the success of their special events.

Key takeaways

Filling out and using the City Of Tempe Tax License form correctly is crucial for vendors and business owners looking to participate in special events within the city. Here are key takeaways to ensure the process is handled efficiently and accurately:

- Application Specificity: It’s important to note that this application is exclusively for special events. Vendors planning to sell food, goods, or services at these events must use this particular form for tax purposes in the City of Tempe.

- Non-refundable Vending Fee: An upfront fee of $25.00 is required when submitting the application. This fee is non-refundable, making it essential for applicants to ensure they meet all criteria and complete the form correctly to avoid financial loss.

- Previous Activity Inquiry: The form asks whether the applicant has previously performed retail sales, food sales, or other activities for a fee at a Tempe special event. Accurate disclosure of past activities can influence the processing of the current application.

- Comprehensive Business Information: Section I of the form requires detailed business information, including the business name (or DBA), street address, contact details, start date, state license number, and federal ID number. Providing complete and accurate information is vital for the application’s acceptance and subsequent tax obligations.

- Ownership and Records: Applicants must disclose the business’s ownership structure (e.g., individual, LLC, corporation) and the location where business records are kept. This information is necessary for legal and tax purposes, ensuring that the city can accurately assess tax liabilities and maintain proper records.

- Certification: By signing the application, the applicant certifies that all statements made are true and complete to the best of their knowledge. Accepting the license issued means agreeing to report and pay any taxes due timely. It’s a legal commitment that underscores the importance of accuracy and honesty in the application process.

Properly completing the City Of Tempe Tax License form is a straightforward but crucial step for vendors participating in special events. It ensures compliance with local tax laws and contributes to the successful operation of events within Tempe.

Popular PDF Documents

Wage and Tax Statement - While the W-2 form can seem complex, it's designed to provide a comprehensive overview of your taxable income and deductions.

1041 Instructions - It facilitates transparency in how an estate or trust's income is managed and taxed, protecting beneficiary rights.

IRS Schedule J 1040 - Understanding the nuances of Schedule J can unlock potential tax benefits, crucial for individuals in sectors like farming and fishing where income is less predictable.