Get City Of Owensboro Tax Form

The City of Owensboro Tax Form, officially known as Form NP-1, plays a crucial role for businesses operating within Owensboro and Daviess County. Designed to calculate and report the Net Profit License Fee, the form caters to a wide range of business entities, including individuals, corporations, partnerships, and LLCs. It requires detailed information such as Social Security or Federal ID numbers, business type, and accounting figures to accurately assess the tax liability. This form is comprehensive, covering various aspects like changes of address, business discontinuation, employee status within the jurisdictions, and tax computation based on net profits. Critical to its completion are attached federal forms or schedules, emphasizing its reliance on federally reported income and adjustments. Businesses must adeptly navigate through worksheets designed to compute total net profits, taking into account income sources, adjustments for state income taxes, and non-deductible items. Additionally, entities selling alcoholic beverages have a separate section to file deductions. With tax rates, minimum license fees, penalties, and interest clearly outlined, the form serves as a detailed guide for businesses to comply with local tax obligations while also accommodating for apportionment factors such as payroll and sales revenue. This meticulous approach ensures that the occupational license fees are calculated with precision, reflecting both the activities within the City of Owensboro and Daviess County.

City Of Owensboro Tax Example

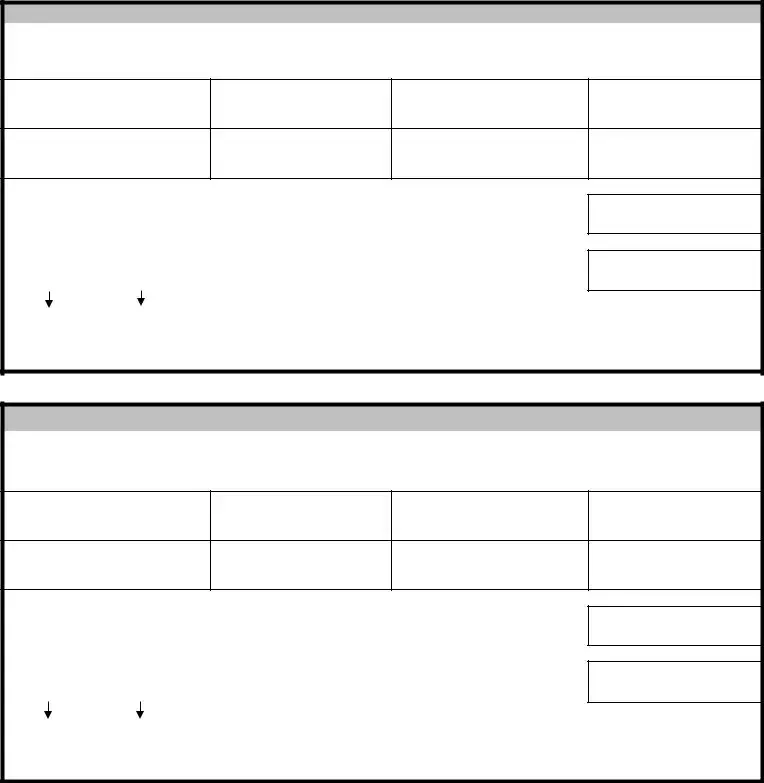

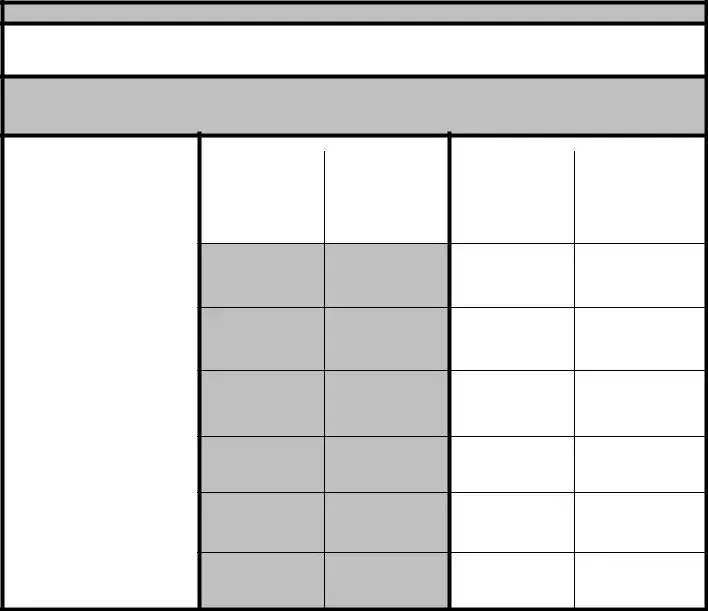

|

City of Owensboro/Daviess County Fiscal Court |

Social Security # or Federal ID# |

FORM |

Net Profit License Fee Return |

|

|

|

|

Account Number |

Name and Address |

Business Type |

|

|

____ Individual |

|

|

____ Corporation |

|

|

____ Partnership |

|

|

____ LLC/Individual |

|

|

____ LLC/Partnership |

|

Change of Address |

____ Other _______________ |

Period Ending |

||

|

|

|

____ Final return (Check only to inactivate the

____ No activity in jurisdictions during tax year. Account will remain open. (Check only if no activity in both jurisdictions) Zero Due

|

A) |

Business telephone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B) |

If business activity was discontinued within both jurisdictions during the year, state when: |

/ |

/ |

|

|

|

|||||||||

|

______ If sold, enter name and address of successor: |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

C) |

Did you have employees working in either jurisdiction during the tax year? ____ YES ____ NO |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make check payable |

FILING STATUS >>> ATTACH APPLICABLE FEDERAL FORM OR SCHEDULE(S) |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

and mail to: |

____Worksheet I |

Schedule C, Schedule E, Schedule F, |

||||||||||||

|

Occupational Tax Administrator |

____Worksheet P |

Form 1065, Schedule K, rental schedule(s) |

|||||||||||||

|

|

PO BOX 10008 |

____Worksheet C |

Form 1120, 1120A, 1120S, Schedule K, rental schedule(s) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

OWENSBORO, KY |

(See pages 3 thru 5 of Instructions) |

TAX COMPUTATION |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of |

|

Daviess |

||||||

|

PHONE: (270) |

|

|

|

|

Owensboro |

|

County |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COLUMN A |

|

COLUMN B |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) Total Net Profit from applicable Worksheet………………………. |

|

|

|

|

|

|

|

|

|

|

|

||||

|

2) Pre Apportionment adjustments (READ INSTRUCTIONS)…….. |

|

|

|

|

|

|

|

|

|

|

|

||||

|

3) Adjusted Net Profit (line 1 plus line 2)……………………………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4) Business Apportionment (Complete Worsheet Y if applicable)…………… |

|

|

% |

|

% |

||||||||||

|

5) Taxable Net Profit (line 3 multiplied by line 4)……………………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6) Occupational license fee Rate |

(If for period before 12/31/07 see Instructions to |

|

|

1.33% |

|

|

|

0.35% |

|

||||||

|

Determine Daviess County Rate for Column B) |

|

|

|

|

|

|

|||||||||

|

7) Total license fee Due (line 5 x line 6)……………………………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

8) Minimum License Fee (see instructions)…………………………. |

|

|

$47 |

|

|

|

|

$0 |

|

||||||

|

9) Enter the Larger amount from Line 7 or Line 8 …… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

10) Payments/Credits and first year registration fee……… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

11) If Line 10 is larger than Line 9, Difference is Refund Credit…… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

12) If Line 9 is larger than Line 10, Difference is License Fee Due |

|

|

|

|

|

|

|

|

|

|

|

||||

|

13) Penalty (5% per calendar month or portion thereof |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

not to exceed 25%) Minimum $25………… |

|

|

|

|

|

|

|

|

|

|

|

|||

|

14) Interest (1% per calendar month or fraction thereof)… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

15) Total Amount Due (add lines 12, 13 and 14)………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

16) Payment Amount (Add line 15 Column A to line 15 Column B)…………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETURN MUST BE SIGNED - I hereby certify, under penalty of perjury, that the statements made herein and any |

|

|

|

|

|

||||||||||

|

supporting schedules are true, correct, and complete to the best of my knowledge. |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Preparer's Signature |

Phone |

Taxpayer's signature |

|

|

Date |

||||||||||

1

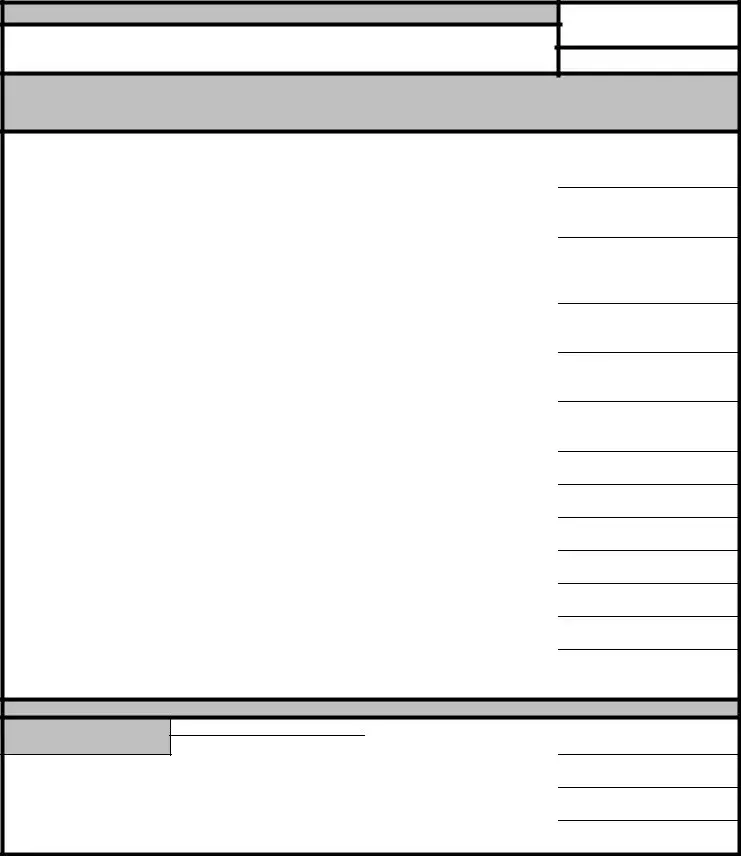

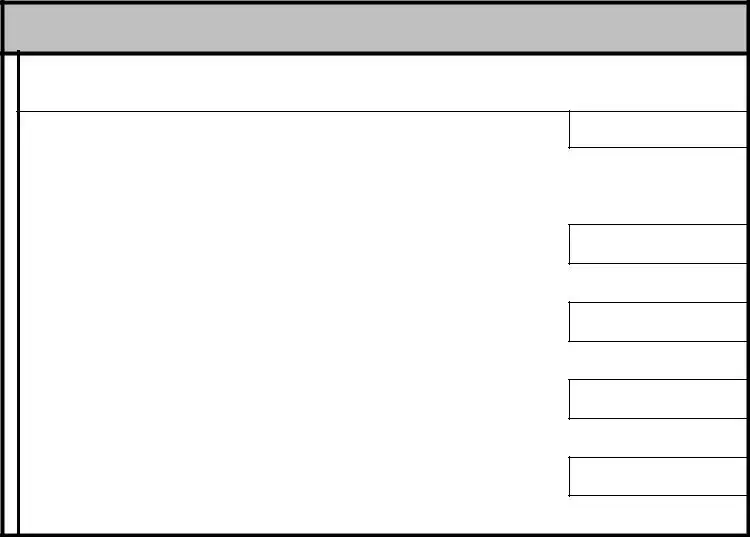

City of Owensboro

Daviess County Fiscal Court

WORKSHEET Y

BUSINESS APPORTIONMENT

PART I - CITY OF OWENSBORO (See Page 6 of Instructions)

|

|

|

DIVIDE↓ |

|

APPORTIONMENT FACTORS |

COLUMN A |

COLUMN B |

COLUMN C |

|

|

CITY OF OWENSBORO |

TOTAL EVERYWHERE |

A ÷ B = C |

|

1)PAYROLL FACTOR

Compensation paid or payable to employees (also complete Worksheet R)

2) SALES REVENUE FACTOR

Receipts from the sale, lease, or rental

of goods, services, or property

%

%

3) TOTAL PERCENTAGES ( Line 1 of Column C plus Line 2 of Column C)………………..

%

4) BUSINESS APPORTIONMENT Enter here and on FORM

%

HOW TO CALCULATE LINE 4; BUSINESS APPORTIONMENT:

If you had both a payroll factor and a sales revenue factor, then divide line 3 by two (2).

If you had a payroll factor or sales revenue factor, but not both, then enter the percentage from line 3.

PART II - DAVIESS COUNTY (See Page 7 of Instructions)

|

|

|

DIVIDE↓ |

|

APPORTIONMENT FACTORS |

COLUMN A |

COLUMN B |

COLUMN C |

|

|

DAVIESS COUNTY |

TOTAL EVERYWHERE |

A ÷ B = C |

|

1)PAYROLL FACTOR

Compensation paid or payable to employees (also complete Worksheet R)

2) SALES REVENUE FACTOR

Receipts from the sale, lease, or rental

of goods, services, or property

%

%

3) TOTAL PERCENTAGES ( Line 1 of Column C plus Line 2 of Column C)………………..

%

4) BUSINESS APPORTIONMENT Enter here and on FORM

%

HOW TO CALCULATE LINE 4; BUSINESS APPORTIONMENT:

If you had both a payroll factor and a sales revenue factor, then divide line 3 by two (2).

If you had a payroll factor or sales revenue factor, but not both, then enter the percentage from line 3.

2

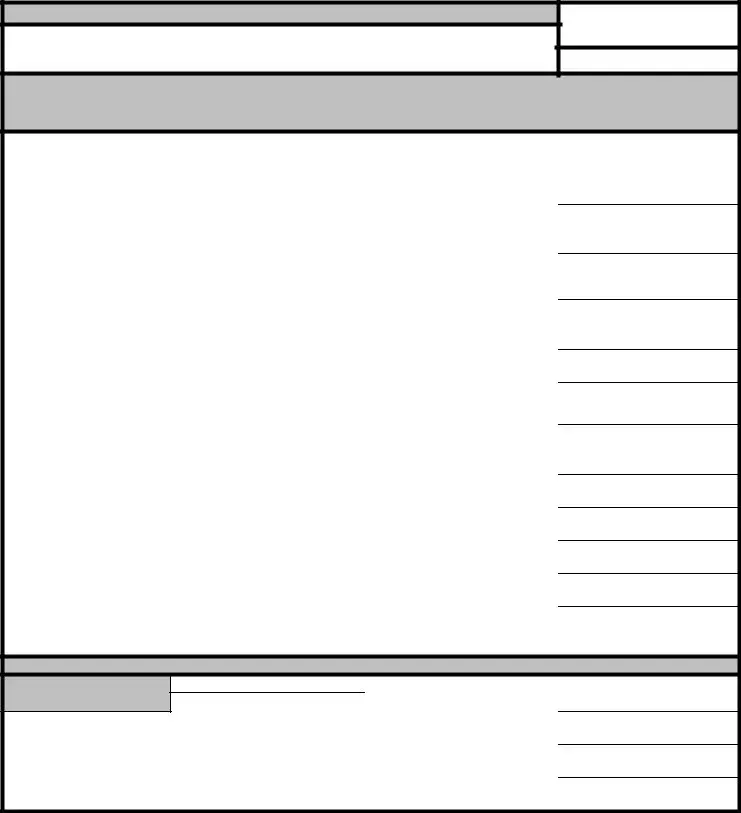

City of Owensboro

Daviess County Fiscal Court

****IMPORTANT****

This Worksheet along with copies of all applicable federal forms and schedules MUST

be attached to FORM

Federal ID # or

Social Security #

WORKSHEET I (See Page 8 of Instructions)

COMPUTATION OF TOTAL NET PROFIT

FOR BUSINESS ENTITIES REQUIRED TO FILE INDIVIDUAL U.S. INCOME TAX RETURN

1)

"Other Income" on Federal Form 1040 (Attach Page 1 of Form 1040 and Form 1099)

2)Net profit or (loss) per Federal Schedule C, or

3)Gain or (loss) on sales of business property used in a trade or business from Federal Form 4797 or Form 6252 reported on Schedule D of Form 1040 (Attach Form 4797 Pages 1 and 2 and/or Form 6252)

4)Rental income or (loss) per Federal Schedule E of Form 1040. Include all Rental Income.(See instructions for details)(Attach Schedule E)

5)Net farm profit or (loss) per Federal Schedule F, or Form 4835, of Form 1040 (Attach Schedule F Pages 1 and 2 or Form 4835 if applicable)

6)State income taxes and occupational license fees (taxes) based upon income deducted on the Federal Schedule

7)Other Items not Deductible(Attach full explanation and applicable schedule(s))

8)Total Income (Add lines 1 through 7)

9)Alcoholic Beverage Sales Deduction (Worksheet X, Line 3)

10)Local/other adjustments (Attach full explanation and applicable schedule(s))

11)Total adjustments (Add lines 9 and 10)

12)Total Net Profit (Subtract line 11 from line 8) Enter here and on line 1 Column A and Column B of FORM

City of Owensboro is less than $3,500 do not enter this amount in Column A; instead complete Worksheet E.

WORKSHEET X: ALCOHOLIC BEVERAGE SALES DEDUCTION

1)DIVIDE→

Kentucky Alcoholic Beverage Sales |

|

Total sales |

% |

2)Enter "Total Income" from line 8 of Worksheet I

3)Alcoholic Beverage Sales Deduction (multiply line 1 by line 2) Enter here and on line 9 above

3

City of Owensboro

Daviess County Fiscal Court

****IMPORTANT****

This Worksheet along with copies of all applicable federal forms and schedules MUST be attached to FORM

Federal ID # or

Social Security #

WORKSHEET C (See Page 9 of Instructions)

COMPUTATION OF TOTAL NET PROFIT

FOR BUSINESS ENTITIES REQUIRED TO FILE U.S. CORPORATE INCOME TAX RETURN

1)Taxable income or (loss) per Federal Form 1120 or 1120A or Ordinary income or (loss) per Federal Form 1120S (Attach the applicable 1120 or 1120A, Pages 1 and 2 or 1120S Pages 1, 2 and 3, Schedule of Other Deductions and rental schedule(s), if applicable)

2)State income taxes and occupational fees (taxes) based on income deducted on the Federal Form 1120, 1120A or 1120S (Attach schedule)

3)Net operating loss deducted on Form 1120 (add as positive number)

4)Additions from Schedule K of Form 1120S (See instructions) (Attach Schedule K of Form 1120S and rental schedule(s), if applicable)

5)Other Items Not Deductible(Attach full explanation and applicable schedule(s))

6)Total Income (Add lines 1 through 5)

7)Subtractions from Schedule K of Form 1120S (See instructions) (Attach Schedule K of Form 1120S and rental schedule(s), if applicable)

8)Alcoholic Beverage Sales Deduction (Worksheet X, Line 3)

9)Local/other adjustments (Attach full explanation and applicable schedule(s))

10)Total adjustments (Add lines 7 through 9)

11)Total Net Profit (Subtract line 10 from line 6) Enter here and on line 1 Column A and Column B of Form

City of Owensboro is less than $3,500 do not enter this amount in Column A; instead complete Worksheet E.

WORKSHEET X: ALCOHOLIC BEVERAGE SALES DEDUCTION

1)DIVIDE→

Kentucky Alcoholic Beverage Sales |

|

Total sales |

% |

2)Enter "Total Income" from line 6 of Worksheet C

3)Alcoholic Beverage Sales Deduction (multiply line 1 by line 2) Enter here and on line 8 above

4

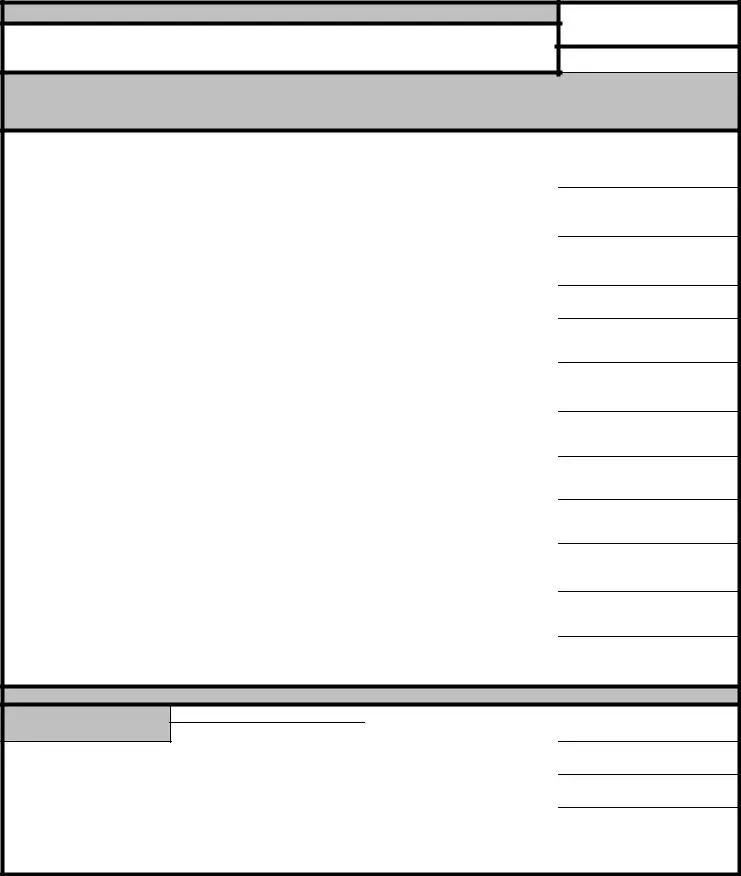

City of Owensboro

Daviess County Fiscal Court

****IMPORTANT****

This Worksheet along with copies of all applicable federal forms and schedules MUST be attached to FORM

Federal ID # or

Social Security #

WORKSHEET P (See page 10 of Instructions)

COMPUTATION OF TOTAL NET PROFIT

FOR BUSINESS ENTITIES REQUIRED TO FILE U.S. RETURN OF PARTNERSHIP INCOME TAX RETURN

1)Ordinary income or (loss) per Federal Form 1065 (Attach Form 1065, Pages 1, 2 and 3, Schedule of Other Deductions, and rental schedule(s), if applicable)

2)State income taxes and occupational fees (taxes) based on income deducted on the Federal Form 1065 (Attach schedule)

3)Additions from Schedule K of Form 1065 (See instructions) (Attach Schedule K of Form 1065 and rental schedule(s), if applicable)

4)Other Items not Deductible (Attach full explanation and applicable schedule(s))

5)Total income (Add lines 1 through 4)

6)Subtractions from Schedule K of Form 1065 (See instructions) (Attach Schedule K of Form 1065 and rental schedule(s), if applicable)

7)Alcoholic Beverage Sales Deduction (Worksheet X, Line 3)

8)Local/other adjustments (Attach full explanation and applicable schedule(s))

9)Professional expenses not reimbursed by the partnership (Attach schedule of expenses)

10)Total adjustments (Add lines 6 through 9)

11)Total Net Profit (Subtract line 10 from line 5) Enter here and on line 1 Column A and Column B of FORM

City of Owensboro are less than $3,500 do not enter this amount in Column A; instead complete Worksheet E.

WORKSHEET X: ALCOHOLIC BEVERAGE SALES DEDUCTION

1)DIVIDE→

Kentucky Alcoholic Beverage Sales |

|

Total sales |

% |

2)Enter "Total Income" from line 5 of Worksheet P

3)Alcoholic Beverage Sales Deduction (multiply line 1 by line 2) Enter here and on line 7 above

5

City of Owensboro

Daviess County Fiscal Court

****IMPORTANT****

This Worksheet MUST be attached to FORM

WORKSHEET R (See Page 11 of Instructions)

RECONCILIATION OF PAYROLL FACTOR

FOR BUSINESS ENTITIES COMPLETING THE PAYROLL APPORTIONMENT FACTOR

|

City of Owensboro |

Daviess County |

|

||

|

City of Owensboro |

Total Everywhere |

Daviess County |

Total Everywhere |

|

|

Payroll |

Payroll |

Payroll |

Payroll |

|

|

|

|

|

|

|

1) Compensation paid or payable to |

|

|

|

|

|

employees per Worksheet Y |

|

|

|

|

|

|

|

|

|

|

|

2)Prior year accrual adjustment

3)Other additions (attach schedule)

4)Subtotal (Add lines 1 through 3)

5)Current year accrual adjustment

6)Other subtractions

(attach schedule)

7) Compensation paid or payable to employees (line 4 minus lines 5 and 6)

6

City of Owensboro

WORKSHEET E (See Page 11 of Instructions)

1.

2.

3.

4.

5.

Only complete this worksheet if Gross Receipts/Sales Revenue in the City of Owensboro is less than $3,500, otherwise complete Worksheet C, I, or P, whichever is applicable.

Enter Gross Receipts/Sales Revenues earned in the City of Owensboro…………….…………

(Only enter amount if less than $3,500)(If amount is less than $600 and no compensation was paid to employees working in the City of Owensboro during the year, skip lines 2 through 5 of this worksheet and enter

Enter wages, salaries, and other employee compensation paid to employees working

in the City of Owensboro during the year…………………………………………………

If line 2 above is zero enter the amount from line 1 here, otherwise enter 0…………..………

If line 3 is zero or is equal to or greater than $3,500, STOP HERE. You are required to complete worksheet I, P or C, and Column A of Form

Multiply the amount from Line 3 of this worksheet by 1.33%. Enter result here and on

Line 9, Column A of Form

(Please attach completed Worksheet E to Form

7

Document Specifics

| Fact | Description |

|---|---|

| Form Designation | FORM NP-1 Net Profit License Fee Return |

| Filing Entities | Applicable to Individual, Corporation, Partnership, LLC/Individual, LLC/Partnership |

| Address Changes | Includes options for reporting a change of address |

| Period Endings Options | Options to mark the return as Final or report No activity |

| Business Activity Report | Question regarding discontinuation or sale of business within the jurisdiction |

| Employee Information Requirement | Inquires if the business had employees working in either jurisdiction during the tax year |

| Attachment and Filing Information | Details on applicable federal forms or schedules to attach and mailing address for submission |

| Governing Law | Subject to the regulations and tax laws of the City of Owensboro and Daviess County Fiscal Court |

Guide to Writing City Of Owensboro Tax

Filling out the City of Owensboro Tax Form requires attention to detail and thorough follow-through to ensure accurate reporting and compliance with local tax obligations. This form is designed for individuals and businesses to report their net profits and calculate the owed license fees accurately. The process involves filling out various sections that pertain to the entity's business type, income, and adjustments based on federal tax return schedules. It's essential to have all relevant financial documents on hand, including federal forms and any applicable schedules, to complete this form accurately and efficiently.

- Begin with your Social Security Number or Federal ID Number, ensuring it matches the number registered with the IRS.

- Enter your official Account Number as provided by the City of Owensboro.

- Fill in your Name and Address clearly. Check the box to indicate a change of address if applicable.

- Select your Business Type by checking the appropriate box (Individual, Corporation, Partnership, LLC/Individual, LLC/Partnership, or Other).

- If you’re filing a Final return to inactivate the account or there was No activity in the jurisdictions during the tax year, check the corresponding box and complete Question B.

- Enter your Business Telephone Number.

- Complete Section B by indicating if business activity was discontinued within both jurisdictions during the year; provide the date and, if sold, the successor’s name and address.

- Answer whether you had employees working in either jurisdiction during the tax year by checking YES or NO.

- Attach the applicable federal form or schedule based on your business entity type—Worksheet I for Schedules C, E, F, and 1099-MISC; Worksheet P for Form 1065 and rental schedules; Worksheet C for corporate income tax returns.

- Tax Computation: Enter your Total Net Profit from the applicable worksheet and follow through the calculations as instructed on the form to determine the taxable net profit, license fee rate, and total amount due.

- Sign the return. The form must be signed by both the preparer (if applicable) and the taxpayer, certifying under penalty of perjury that the information provided is correct.

- Mail the completed form and any attachments to the Occupational Tax Administrator at the address provided.

After submitting the form, it’s crucial to keep a copy for your records alongside the supporting documentation. This ensures you have the necessary records should there be any questions or audits from the City of Owensboro. Timeliness in submitting the form helps avoid penalties and interest that can accrue on late payments. For questions or assistance, reaching out to the Occupational Tax Administrator directly can provide additional guidance tailored to your situation.

Understanding City Of Owensboro Tax

-

What type of entities need to file the City Of Owensboro Tax Form NP-1?

Entities such as individuals, corporations, partnerships, and both individual and partnership LLCs are required to file the City Of Owensboro Tax Form NP-1. The form should also be used by any business entity that has a change of address or whose business activity has been discontinued or sold within the jurisdiction during the tax year.

-

How do I calculate the taxable net profit on the form?

To calculate the taxable net profit, entities must first determine their total net profit from the applicable worksheet provided with the form. Pre-apportionment adjustments, as outlined in the instructions, need to be made to this figure to arrive at the adjusted net profit. This adjusted figure is then subject to business apportionment percentages, which are calculated based on payroll and sales revenue factors within Owensboro and Daviess County. The apportioned profit is then multiplied by the occupational license fee rate to determine the total license fee due.

-

Are there any minimum license fees, and how do they apply?

Yes, the form specifies minimum license fees, which are $47 for the City of Owensboro and $0 for Daviess County. After calculating the total license fee due, if this amount is less than the minimum fee, the minimum fee applies instead. The purpose of the minimum fee is to ensure that all businesses contribute a basic level of support to municipal services.

-

What documentation is required to be attached to the Form NP-1?

All applicable federal forms and schedules must be attached to the Form NP-1. This includes, but is not limited to, Worksheet I Schedule C, E, F, and 1099-Misc for individual business entities; Worksheet P Form 1065 and accompanying schedules for partnerships; and Worksheet C Form 1120, 1120A, 1120S for corporations. Additionally, detailed explanations and schedules for any other items not deductible, local adjustments, or alcoholic beverage sales deductions must also be included. This ensures the Occupational Tax Administrator can accurately assess and process the tax return.

Common mistakes

When filling out the City of Owensboro Tax form, individuals and businesses may encounter complexities leading to common errors. Awareness and careful attention to the detailed instructions provided can help avoid these pitfalls and ensure the submission is accurate and compliant. Below are eight common mistakes to watch out for:

- Incorrect Business Type Selection: Not correctly identifying the business structure (e.g., Individual, Corporation, Partnership, LLC) can lead to inappropriate tax calculations and misinterpretations of the form's requirements.

- Failing to Check the "Change of Address" Box: If the business's address has changed and this box is not checked, correspondence and vital tax documents may not reach the intended recipient.

- Omitting Social Security Number or Federal ID#: These identifiers are crucial for processing the form. Leaving them blank can result in processing delays or the form being returned.

- Not Attaching Required Federal Forms or Schedules: Depending on the business type, specific federal documentation must be attached. Overlooking this requirement can lead to incomplete filing and potential penalties.

- Incorrect Calculations in the Tax Computation Section: Math errors in calculating net profit, adjustments, or the tax due can lead to either an overpayment or an underpayment of taxes.

- Miscalculating Business Apportionment: This affects the taxable net profit. Incorrect apportionment may result in an inaccurate tax obligation.

- Selecting the Wrong Filing Status: Misunderstanding the filing status options, such as 'Final Return' and 'No Activity', can lead to unnecessary inquiries or the inactivation of the account when unintended.

- Signatures Missing: The form requires signatures from both the preparer and the taxpayer. Missing signatures may deem the form unfiled.

It is vital to review the form meticulously before submission to prevent these errors. For those uncertain about any aspect of the tax form, consulting with a tax professional is highly recommended. This proactive approach can minimize the risk of errors and ensure adherence to City of Owensboro's tax obligations.

Documents used along the form

When working with the City of Owensboro Tax forms, various other documents and forms often complement the filing process. These materials help ensure accurate and comprehensive reporting, catering to different business structures and financial scenarios. Below is a list of these forms and brief descriptions of each.

- Form 1040: This is the standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns. It gathers information about the taxpayer's income, deductions, and credits to calculate their tax liability or refund.

- Schedule C: Used by sole proprietors to report income or loss from a business they operated or a profession they practiced as a sole proprietor.

- Schedule E: Utilized to report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

- Schedule F: Employed by farmers to report farm income and expenses.

- Form 1065: Required for partnership businesses. It reports the income, gains, losses, deductions, credits, etc., of a partnership.

- Schedule K: Part of Form 1065 for partnerships, summarizing the partners' share of income, deductions, credits, etc.

- Form 1120: The U.S. Corporation Income Tax Return, which is used by C corporations to report their income, gains, losses, deductions, and credits, as well as to figure out their income tax liability.

- Form 1120S: Filed by S corporations for tax returns. It reports the income, losses, and dividends of shareholders.

- Form 4797: Used to report the sale or exchange of certain types of property, primarily business property.

- Form 1099-Misc: Miscellaneous Income form. It is used by businesses to report payments made in the course of a trade or business to others for services.

Together, these forms ensure that businesses and individuals in Owensboro can report their financial activities accurately. They cover a wide array of financial situations, from sole proprietorships to partnerships and corporations. By providing detailed financial information, these documents help in the precise calculation of taxes owed or refunds due, ensuring compliance with tax laws.

Similar forms

The City of Owensboro Tax Form NP-1 shares similarities with the IRS Form 1040, which is used by individuals in the United States to file their annual income tax returns. Both forms require the taxpayer to report income, calculate deductions, and determine the tax owed or to be refunded. They also necessitate the inclusion of a Social Security Number or Federal Identification Number for identification purposes. Additionally, both forms allow taxpayers to attach schedules or worksheets that detail specific types of income or deductions, further aligning their functional aspects.

Similar to the U.S. Corporate Income Tax Return, known as Form 1120, the City of Owensboro Tax Form requires corporations to provide detailed financial information. This includes reporting total income, deducting allowable expenses, and calculating the net taxable income. Both forms are designed for entities with complex structures or multiple revenue streams and incorporate the need for attachments that explain certain deductions or income types, illustrating the parallels in reporting financial activities on both local and federal levels.

The U.S. Return of Partnership Income, Form 1065, resembles the City of Owensboro Tax Form in its requirement for partnerships to report income, deductions, and tax liabilities. Both forms necessitate the inclusion of supplementary schedules to detail specific types of income, such as rental income or net profit from business operations. These forms are integral for entities operating as partnerships, ensuring that comprehensive financial data is captured for tax purposes.

The City of Owensboro Tax Form and Schedule C (Profit or Loss from Business) share common ground in their need for individual business owners or sole proprietors to report profits or losses. Each form requires detailed financial information about business revenues, expenses, and net income to accurately assess tax obligations. This illustrates the need for thorough financial disclosure regardless of the tax jurisdiction, ensuring that individual business activities are transparently reported.

The Schedule E (Supplemental Income and Loss) bears resemblance to the Owensboro Tax Form in its function for reporting income from rental real estate, royalties, partnerships, S corporations, trusts, and estates. Both documents require taxpayers to disclose income or loss from such properties or entities, affecting their overall tax situation. This demonstrates the parallel requirement for taxpayers to provide a comprehensive view of their income sources beyond regular business or employment earnings.

Form 1120S, used by S corporations, aligns with the City of Owensboro Tax Form in the way it captures a corporation's income, deductions, profits, and losses. S corporations use Form 1120S to report their financial activities to the IRS, similar to how businesses in Owensboro report to the local tax authorities. Both necessitate detailed accounting of business operations and provide mechanisms for income to be passed through to the shareholders or partners, highlighting the integration of business and personal tax considerations.

Schedule K-1 (Form 1065) is designed for partners in a partnership to report their share of the partnership's income, deductions, credits, etc. It correlates with the Owensboro Tax Form in how it distributes income and deductions across entities or individuals, affecting their tax responsibilities. Both documents play a crucial role in ensuring the accurate reporting of income from pass-through entities, allowing for transparent financial accounting and taxation processes.

The Schedule F (Profit or Loss from Farming) shares similarities with the Owensboro Tax Form in catering to a specific group of taxpayers - in this case, farmers. Both forms require the reporting of income and expenses related to their operations, illustrating the necessity for specialized forms in addressing the distinct characteristics of different types of business activities. They ensure that the unique aspects of farming operations are accounted for in the tax reporting process, reflecting the diversity of income sources within tax legislation.

Dos and Don'ts

Filling out the City Of Owensboro Tax form can be a straightforward process when you know what to do and what to avoid. Below is a guide list of seven dos and don'ts that will help ensure your form is complete and accurate.

- Do double-check the Social Security number or Federal ID number at the top of the form. An incorrect number can lead to processing delays or misfiled taxes.

- Don't skip over the business type section. Whether you're filing as an individual, corporation, partnership, or LLC, checking the correct box is crucial for accurate tax assessment.

- Do accurately report all net profit figures from applicable worksheets. These values are central to determining your tax liabilities.

- Don't leave the business apportionment portion blank if it applies to you. This calculation is essential for determining the portion of income subject to City Of Owensboro taxes.

- Do attach all required federal forms or schedules as indicated on the tax form. These supporting documents are necessary for verifying reported income and deductions.

- Don't forget to enter the correct license fee due, including any minimum license fee requirements. This mistake can result in underpayment penalties.

- Do sign the return before mailing it. An unsigned return is not valid and will not be processed until corrected, potentially leading to late filing penalties.

By following these simple guidelines, you can fill out the City Of Owensboro Tax form correctly and avoid common pitfalls that delay processing and could lead to penalties. Always take the time to review your entries thoroughly before submission.

Misconceptions

There are several misconceptions surrounding the City of Owensboro Tax Form that can lead to errors in tax preparation and filing. Understanding these inaccuracies is crucial for taxpayers to comply effectively with local tax laws.

- Misconception 1: Social Security and Federal ID numbers are interchangeable on the form.

In actuality, the appropriate identification number must be used depending on the entity type. Individual filers should use their Social Security Number, while businesses must provide their Federal ID Number.

- Misconception 2: All businesses must pay the same rate.

Different occupational license fee rates apply depending on the business type and the tax period. It's not a one-size-fits-all rate.

- Misconception 3: The minimum license fee applies to all businesses.

While most businesses are subject to a minimum fee, exemptions can apply under certain conditions, making it important to understand the specific rules.

- Misconception 4: Only revenue generated within Owensboro is taxable.

Businesses must report total net profit, but the taxable amount is determined after apportionment based on business activities within the city and county.

- Misconception 5: No activity equates to no filing requirement.

Even if a business had no taxable activity, it must still file the form to report this status and avoid potential penalties for non-filing.

- Misconception 6: Federal tax forms do not need to be attached.

The requirement to attach applicable federal forms and schedules is clearly stated and is a critical part of the filing process for verification and calculation purposes.

- Misconception 7: The form only applies to businesses with physical locations in Owensboro.

Businesses operating or generating income within the city and county jurisdiction through employees or business activities must file, regardless of physical presence.

- Misconception 8: Electronic filing options are available.

As of the instructions provided, submissions must be mailed to the specified address, indicating a lack of electronic filing options for this specific form.

- Misconception 9: Penalties only apply to late payments.

Penalties can also be imposed for late filings, incorrect filings, or failure to file, emphasizing the importance of timely and accurate compliance.

- Misconception 10: Changes of address do not need to be reported.

A change of address must be indicated on the form to ensure that records are up to date and communications are received.

Correcting these misconceptions is vital for accurate tax reporting and compliance. Taxpayers should refer to the most current forms and instructions or consult with a professional for guidance specific to their situation.

Key takeaways

Filling out the City of Owensboro Tax form correctly is vital for businesses operating within the Owensboro/Daviess County area. Here are four key takeaways to ensure accuracy and compliance:

- It's essential to select the correct business type at the beginning of the form. Options include Individual, Corporation, Partnership, LLC/Individual, LLC/Partnership, and Other. This choice impacts which sections of the form and which tax regulations apply to your submission.

- Accurately reporting the Federal ID# or Social Security# is crucial for identity verification and proper tax records maintenance. This number should match the one registered with the IRS for your business.

- Attach all relevant federal forms (e.g., Worksheet I for individuals and Schedules C, E, F, 1099-Misc, Worksheet P for partnerships, or Worksheet C for corporations) to complement the information provided in the Owensboro Tax form. This documentation is necessary for validating the reported net profits and deductions.

- Proper computation of the Business Apportionment is required, as it impacts the net profit subject to tax. This calculation relies on payroll and sales revenue factors both within the city of Owensboro and in total, which determines the portion of business activities subjected to local taxation.

This summarization streamlines the process of completing the Owensboro Tax form, intending to mitigate errors and facilitate a smoother filing. Ensuring these factors are correctly accounted for can help avoid unnecessary delays or complications with local tax obligations.

Popular PDF Documents

For Payment - An essential document for businesses keen on adopting digital payment methods, ensuring a seamless transfer of funds with minimal effort.

IRS 8960 - IRS 8960 must be filed with your tax return if you have applicable net investment income.

Where to Report Interest Income on 1040 - Schedule B 1040 divides the reporting into two parts: one for interest received, like from savings accounts, and another for dividends from stock investments.