Get City Of Massillon Income Tax Form

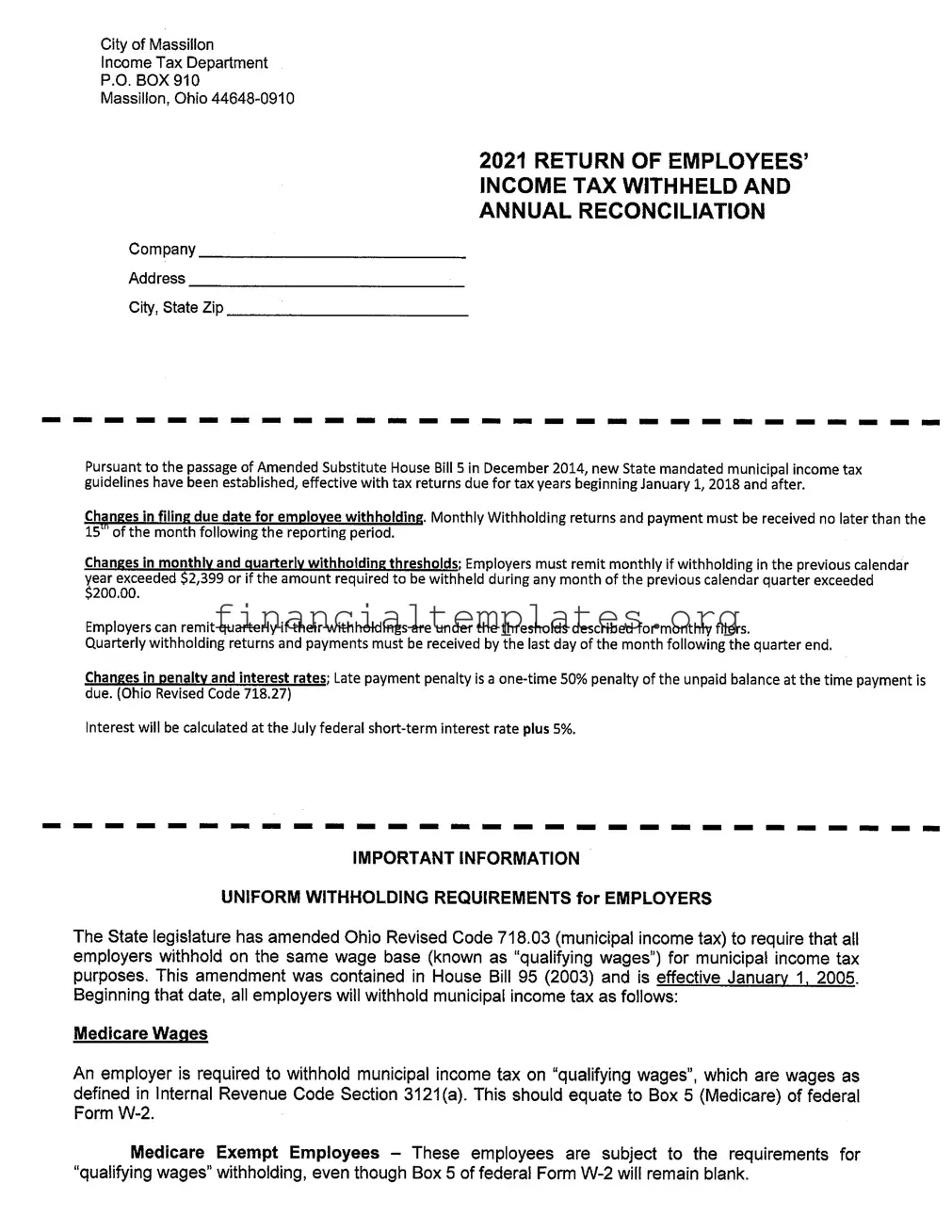

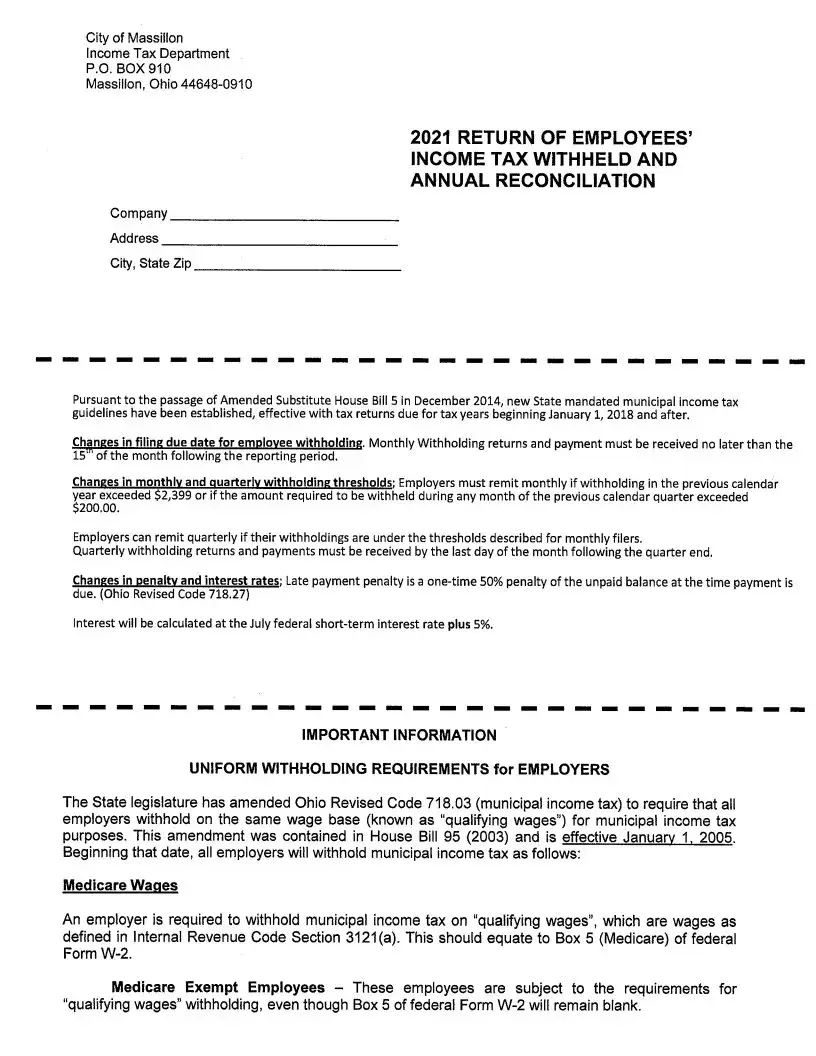

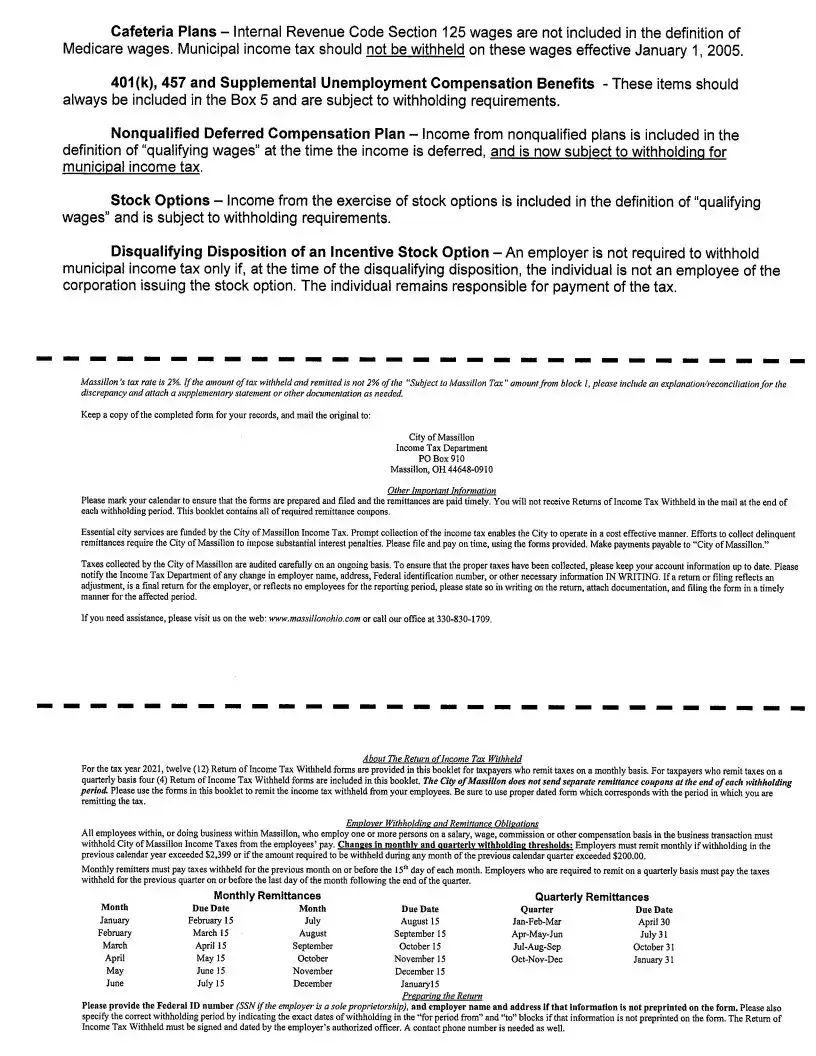

In an era where tax codes are increasingly complex and compliance is paramount, the City of Massillon, Ohio, ensures clarity and precision in the administration of its income tax through the meticulous design of its Income Tax form. This essential document, pivotal for both employers and the city’s Income Tax Department, provides a structured approach for the reporting and reconciliation of employee income tax withheld. Following the guidelines set forth by the Amended Substitute House Bill 5 in December 2014, the form adheres to the new state-mandated municipal income tax guidelines, which include key changes in filing due dates, monthly and quarterly withholding thresholds, and updates in penalty and interest rates for late payments. It delineates the obligations for employers to withhold municipal income taxes on "qualifying wages" as defined by the Internal Revenue Code Section 3121(a), conveying specific conditions for withholding on varied forms of compensation including Medicare wages, 401(k) plans, and stock options among others. The document also outlines the recalibrated tax rate, emphasizing the importance of accuracy and timeliness in submissions to prevent penalties. Essential for powering the city's operations through prompt tax collection, this form also serves as a liaison between the city and its business entities, promoting a culture of compliance and facilitating the smooth operation of city services. Thus, the City of Massillon Income Tax form stands as a testament to the city's commitment to operational efficiency and fiscal responsibility.

City Of Massillon Income Tax Example

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Governing Law | Amended Substitute House Bill 5, Ohio Revised Code 718 |

| Effective Date for Changes | January 1, 2018 |

| Withholding Thresholds | Monthly if over $2,399 annually or $200 monthly; Quarterly otherwise |

| Withholding on Qualifying Wages | Based on Internal Revenue Code Section 3121(a), effective January 1, 2005 |

| Tax Rate | 2% |

| Late Payment Penalty | 50% of unpaid balance |

| Interest Calculation | July federal short-term rate plus 5% |

| Submission Information | Forms and payments must be mailed to City of Massillon Income Tax Department, P.O. Box 910, Massillon, Ohio 44648-0910 |

| Employer Obligation | Must withhold taxes for employees within or doing business in Massillon |

| Return Periods and Due Dates | Monthly By 15th following month; Quarterly by last day following quarter |

Guide to Writing City Of Massillon Income Tax

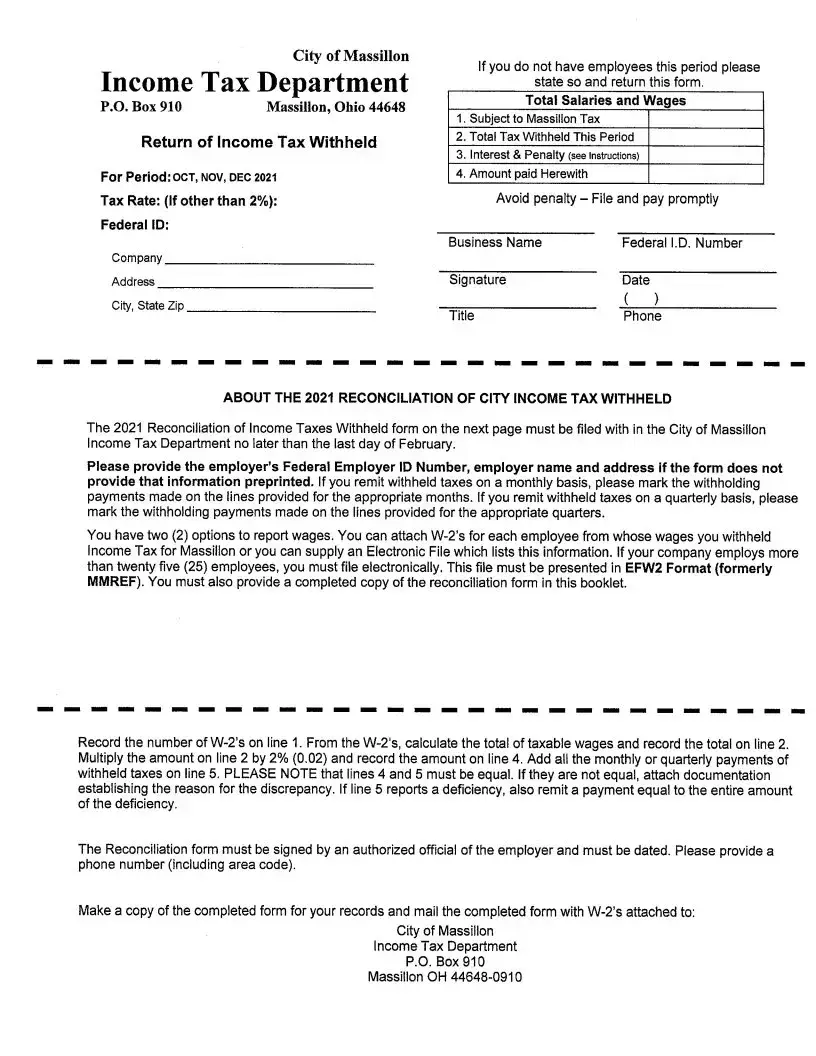

Filling out the City of Massillon Income Tax form is an essential process for employers within the city boundaries, ensuring that the correct amount of income tax is withheld from employees’ wages and remitted to the City of Massillon. These taxes are vital for funding city services, so it is important to complete and submit these forms accurately and on time. The following steps will guide you through completing the Return of Employees' Income Tax Withheld and Annual Reconciliation for the tax year 2021.

- Start by gathering necessary documents, including your Federal Identification Number (EIN) and the totals of all employees' salaries and wages that are subject to Massillon's income tax.

- Enter the Federal ID at the designated space on the form.

- Write the Company Address, including City, State, and Zip code.

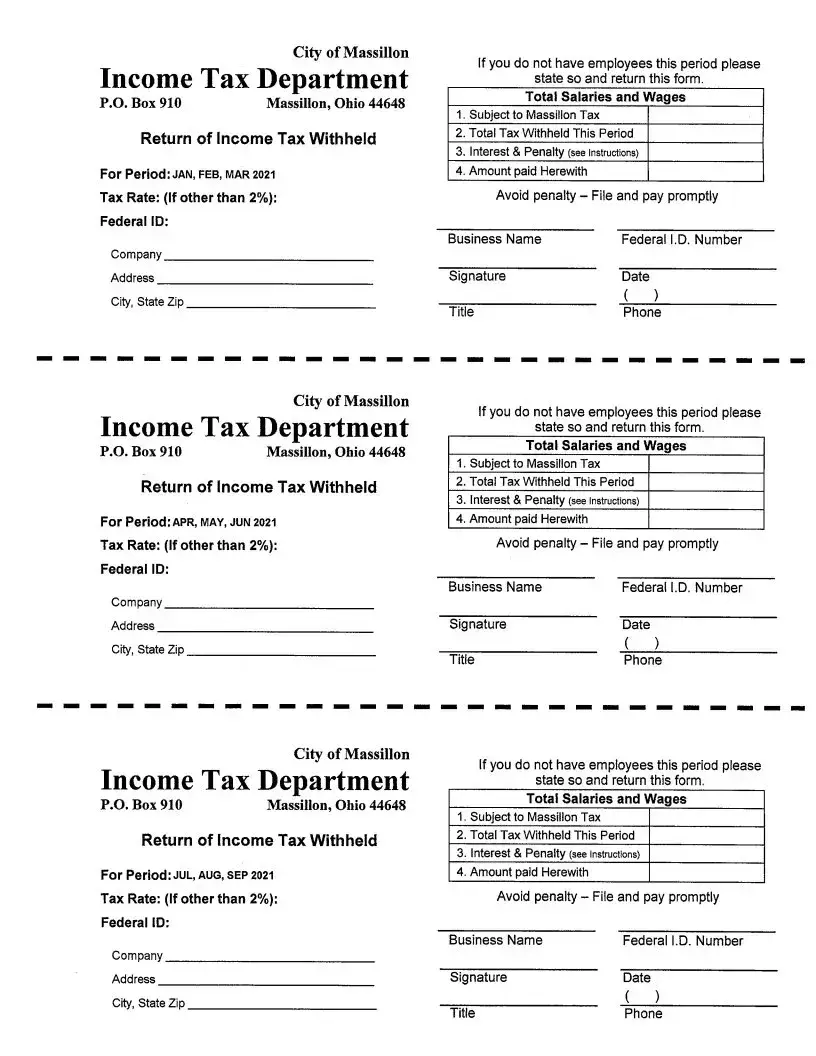

- For the section labeled "Return of Income Tax Withheld For Period:", specify the correct withholding period by entering the months (e.g., Jan, Feb, Mar 2021) you are reporting for.

- If your business had no employees during the reporting period, clearly state this on the form and return it to the address provided.

- In the "Total Salaries and Wages" section:

- Enter the total amount of wages subject to Massillon tax in the space marked 1. Subject to Massillon Tax.

- Next, fill in the total tax withheld during the period in the space marked 2. Total Tax Withheld This Period.

- If applicable, calculate and enter any interest and penalties due to late submission or payment in the space marked 3. Interest & Penalty.

- Write the total amount paid with this form in the space marked 4. Amount paid Herewith.

- Ensure that all calculations are correct to avoid discrepancies, as the tax rate for this form is set at 2%. If your calculations result in a different tax rate, provide a detailed explanation and attach any necessary documentation.

- Sign the form at the bottom where indicated. Include the title of the signing officer, the Federal ID number, and the date of signing. Also, provide a contact phone number for any queries.

- Finally, ensure a copy of the completed form is kept for your records. Mail the original form to the City of Massillon Income Tax Department, P.O. Box 910, Massillon, OH 44648-0910.

- Mark your calendar for future due dates to prepare and file subsequent forms in a timely manner. This practice helps to avoid penalties and interest on late payments.

Remember, accuracy in filing and timely submission of the City of Massillon Income Tax forms are crucial in fulfilling your tax obligations and supporting the funded city services efficiently. If you require assistance or have any questions, the City of Massillon Income Tax Department website and contact information are resources available to help guide you through the process.

Understanding City Of Massillon Income Tax

Who needs to file the City of Massillon Income Tax form?

Any employer within or doing business within Massillon, Ohio, who employs one or more persons on a salary, wage, commission, or other compensation basis must file the City of Massillon Income Tax form for withholding taxes from their employees' pay.

When are the City of Massillon Income Tax forms due?

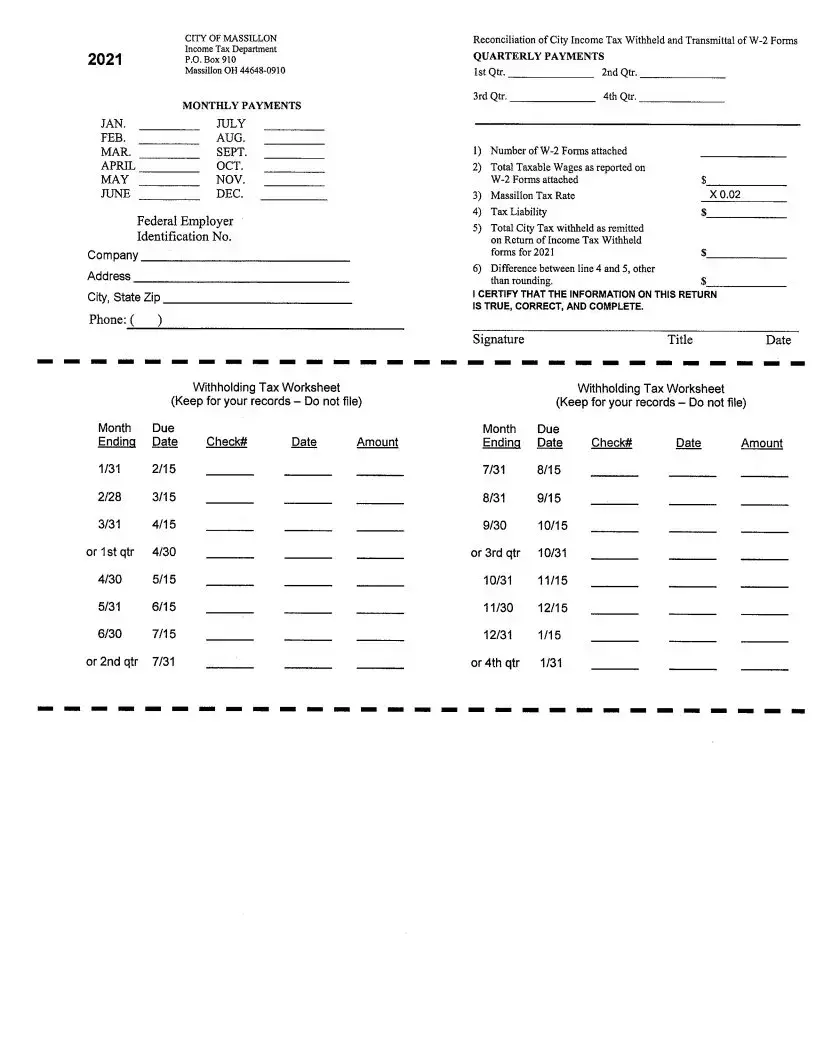

Employers must submit monthly withholding returns and payments by the 15th of the month following the reporting period. For quarterly remitters, the returns and payments are due by the last day of the month following the quarter's end. Specifically, for January through March, the due date is April 30; April through June, July 31; July through September, October 31; and October through December, January 31 of the following year.

What constitutes "qualifying wages" for the purpose of withholding?

Qualifying wages are based on the definition of wages in Internal Revenue Code Section 3121(a), generally equating to Box 5 (Medicare Wages) on federal Form W-2. Notably, certain income types like 401(k), 457, and Supplemental Unemployment Compensation Benefits are included, whereas Cafeteria Plan benefits are exempt.

What are the penalties for late payment?

Employers face a one-time 50% penalty of the unpaid balance due at the time of payment. In addition, interest accrues at the federal short-term rate plus 5%, as stipulated in Ohio Revised Code 718.27.

Can employers remit taxes quarterly?

Yes, employers can remit quarterly if their withholdings in the previous calendar year did not exceed $2,399 or if the amount required to be withheld did not exceed $200.00 in any month of the previous calendar quarter. Otherwise, they must remit monthly.

How does an employer know if they should withhold tax on certain compensations like stock options or nonqualified deferred compensation plans?

Income from nonqualified deferred compensation plans and the exercise of stock options are included in qualifying wages for withholding purposes. Employers should withhold municipal income tax on these earnings where applicable. If there's a disqualifying disposition of incentive stock options, withholding is only not required if the individual is no longer an employee at the time.

What should an employer do if they don't have employees in a given period?

If an employer does not have employees during a specific period, they should state so on the return form and submit it to the City of Massillon Income Tax Department. This action ensures compliance and keeps their account status up-to-date.

Common mistakes

-

Not Providing Complete Employer Information: A common mistake is filling out the form without including the full employer name, address, and the Federal ID number, especially if it's not pre-printed on the form. This information is crucial for the City of Massillon Income Tax Department to identify the employer submitting the tax withheld for employees.

-

Failing to Specify the Correct Withholding Period: Incorrectly indicating or not specifying the exact dates of the withholding period (“for period from” and “to”) can lead to processing delays. It’s important to accurately fill these fields for each period taxes are remitted to ensure they are applied correctly.

-

Incorrect Calculation of Taxes Withheld: Not withholding the correct amount of tax, which is 2% of the "Subject to Massillon Tax" amount, is a frequent error. Employers need to carefully calculate the tax to be withheld and remitted, including for items like Medicare wages, 401(k) contributions, and stock options, as they constitute "qualifying wages." Any discrepancy should be explained and accompanied by a supplementary statement or documentation.

-

Omitting Signature and Contact Information: The form must be signed and dated by the employer's authorized officer, and a contact phone number must be provided. This omission can deem the form incomplete and delay its processing. Verification through these details is part of the form's compliance requirements.

-

Failure to Report No Employees Properly: If there are no employees during a given period, employers often fail to state so on the form and return it. This misstep can lead to unnecessary follow-up by the tax department to clarify payroll records for the period in question.

Documents used along the form

Filing the City of Massillon Income Tax form is an important obligation for employers within the area, ensuring that local taxes are correctly withheld and remitted. Alongside this form, there are several other documents and forms that are commonly used to complement the tax filing process. These documents play a crucial role in ensuring compliance with tax laws and regulations, making the task of filing taxes more straightforward for employers.

- W-2 Forms: These documents report the annual wages and the amount of taxes withheld from an employee's paycheck. Employers must send out W-2 forms to their employees and file these with the IRS. The information from W-2 forms is essential for filling out the City of Massillon Income Tax form as it provides the necessary details regarding the total salaries and wages subject to Massillon tax.

- 1099 Forms: For independent contractors or freelancers, 1099 forms are used instead of W-2 forms. These documents are crucial for reporting any payments made to non-employees. Employers need to ensure that any 1099-MISC forms, specifically those related to services rendered within Massillon, are accounted for when calculating the city income tax owed.

- Quarterly Federal Tax Return (Form 941): Employers use this form to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. Additionally, Form 941 helps report the employer's portion of social security or Medicare tax. This form supports the City of Massillon Income Tax form by ensuring that federal withholding requirements are met and substantiated.

- State of Ohio Employer's Withholding Tax Return (Form IT 501): Used to report state income tax withheld from employees, this form complements the City of Massillon form by ensuring state tax compliance. Aligning state and local tax filings can help employers accurately report withholdings.

- Annual Federal Unemployment (FUTA) Tax Return (Form 940): This is used to report the employer's federal unemployment tax. While this form doesn’t directly impact the City of Massillon Income Tax form, it is part of comprehensive tax compliance for employers, ensuring they fulfill all federal tax obligations.

- Record of Federal Tax Liability (Form 945): Employers use Form 945 to report withheld federal income tax from nonpayroll payments, including pensions, military retirement, and gambling winnings. This form ensures that any miscellaneous income subject to federal tax withholding is correctly reported, which may also affect the overall tax reporting process for an employer.

Understanding and properly utilizing these forms in conjunction with the City of Massillon Income Tax form is essential for employers to maintain tax compliance. Each document holds its role within the broader context of tax reporting and compliance, ensuring employers fulfill their obligations accurately and timely. For businesses operating within Massillon, Ohio, staying informed and prepared with these documents can significantly ease the burden of tax season.

Similar forms

The City of Massillon Income Tax form shares similarities with the IRS Form 941, "Employer's Quarterly Federal Tax Return." Both forms are crucial for reporting wages paid, taxes withheld from employees, and the employer's portion of social security or Medicare tax. They serve as a reconciliation between what an employer has withheld from employees' paychecks and what is actually owed to the government. The specifics, such as the tax rates and thresholds, may differ, but the core function of reconciling wages and withheld taxes links these two forms closely together.

Forms similar to the City of Massillon Income Tax form also include the IRS Form W-2, "Wage and Tax Statement." This form is given to employees annually and details the amount of taxes withheld from their paychecks throughout the year. Although the W-2 is more of a summary form for the employee's benefit and the Massillon form is for municipal tax collection purposes, both deal with the recording and reporting of withheld income taxes, making them fundamentally connected in their objective to ensure accurate taxation.

Another analogous document is the IRS Form W-3, "Transmittal of Wage and Tax Statements." This form accompanies the W-2 forms when employers send them to the Social Security Administration. Like the City of Massillon Income Tax form, the W-3 plays a key role in compiling and summarizing tax withholding information on a larger scale, ensuring that the reported amounts are transmitted accurately and in totality for tax purposes.

The IRS Form 940, "Employer's Annual Federal Unemployment (FUTA) Tax Return," although focused on unemployment tax, bears resemblance in its purpose of reconciling taxes owed by the employer over the course of the year. Both the Form 940 and the City of Massillon form require employers to calculate the total tax due, report any deposits made during the year, and pay any balance owed, highlighting their shared goal of annual tax settlement.

State Unemployment Tax Act (SUTA) forms, which vary by state, also share commonalities with the City of Massillon's Income Tax form. SUTA forms are used by employers to report wages paid and unemployment taxes withheld at the state level. The principle of employers reporting on the monies withheld from their employees and paying those funds to the relevant tax authority closely aligns the objectives of both SUTA forms and the Massillon form.

The IRS Form 1099-MISC, "Miscellaneous Income," and the newly instituted Form 1099-NEC, "Nonemployee Compensation," for reporting payments to non-employees, share a conceptual connection with the City of Massillon Income Tax form in their underlying principle of tax reporting and withholding. While the 1099 forms primarily deal with contractor and miscellaneous payments outside of traditional wages, they, like the Massillon form, are essential in the accurate reporting and taxation process.

Ohio Form IT 3, "Transmittal of Wage and Tax Statements," is directly related in its function of reporting employees' income and taxes withheld at the state level. Both Ohio's IT 3 and Massillon's tax form are integral to ensuring that the appropriate tax amounts are withheld from employees' pay and then reported and paid to the tax authorities, reinforcing the necessity of accuracy in tax documentation and compliance.

The IRS Form 944, "Employer's Annual Federal Tax Return," is designed for smaller employers to report their tax liabilities annually rather than quarterly. This form and the City of Massillon Income Tax form are similar in that they both aim to reconcile the total taxes withheld from employees throughout the year with the total taxes due, albeit on different scales and for different tax authorities.

The Ohio Employer's Quarterly Municipal Tax Withholding Statement is another document sharing characteristics with the City of Massillon Income Tax form. Both are geared towards the periodic reporting of income taxes withheld on behalf of employees, ensuring that local municipalities receive timely and accurate tax payments to support municipal services and infrastructure.

Finally, the IRS Form 1120, "U.S. Corporation Income Tax Return," while primarily for corporate income tax, involves principles of income reporting and tax calculation that resemble the processes found in the City of Massillon Income Tax form. Both forms require the detailed reporting of income and taxes, highlighting the pervasive nature of governmental requirements for transparency and accuracy in tax-related matters across different levels of tax collection and reporting.

Dos and Don'ts

When it comes to fulfilling your duties as a taxpayer in Massillon, it's essential to approach the City Of Massillon Income Tax form with careful attention. Here is a comprehensive list of recommended practices to ensure accuracy and avoid common pitfalls.

What You Should Do:- Verify all preprinted information: Ensure the Federal ID number, and your employer name and address are accurate. If any details have changed or are incorrect, make the necessary updates.

- Specify the withholding period correctly: Clearly indicate the exact dates of the withholding in the “for period from” and “to” blocks, especially if this information is not preprinted on your form.

- Sign and date the form: The Return of Income Tax Withheld must be authenticated with the signature of the employer’s authorized officer. Don't forget to provide a contact phone number for potential queries.

- Provide accurate calculations: Ensure the total salaries and wages, subject to Massillon tax, and total tax withheld are accurately calculated and reported.

- Include necessary documentation: If there's a discrepancy in the amount of tax withheld, or if certain wages are exempt from withholding, attach a detailed explanation or supplementary statement.

- Update employer information: Notify the Income Tax Department in writing of any changes in employer name, address, Federal identification number, or other crucial information.

- File and pay on time: Adhere strictly to the submission and payment deadlines to avoid penalties and interest charges.

- Ignore the filing deadlines: Late submissions can lead to severe penalties and interest, affecting your financial obligations to the city.

- Omit signing the form: An unsigned form is considered incomplete and can delay processing or lead to fines.

- Miscalculate taxes withheld: Inaccurate calculations can trigger audits or further scrutiny from the tax department.

- Disregard instructions for exempt wages: Wages not subject to withholding, such as certain cafeteria plan benefits, should be correctly understood and excluded where applicable.

- Forget to attach necessary explanations: Any discrepancy in withheld taxes without proper documentation can complicate the filing process.

- Fail to report changes in business information: Keeping your account up to date is crucial for accurate records and communication.

- Overlook the need for keeping a copy: Retain a copy of the completed form for your records to safeguard against any future discrepancies or questions.

By adhering to these guidelines,employers can ensure they meet their tax obligations efficiently and accurately, supporting the vital services funded by the City of Massillon Income Tax.

Misconceptions

When navigating the complexities of the City of Massillon Income Tax form, individuals and businesses might encounter several areas of misunderstanding. It's essential to address these misconceptions directly to ensure accurate filing and compliance with municipal tax requirements.

Misconception 1: All Wages are Subject to the Same Withholding Requirements

Many assume that all forms of compensation are treated equally under the City of Massillon's withholding tax guidelines. However, specific types of compensation have unique requirements. For instance, "qualifying wages" for municipal income tax purposes are defined according to the Internal Revenue Code Section 3121(a), which generally equates to Box 5 (Medicare) on federal Form W-2. Importantly, not all wages fall into this category. For example, contributions to cafeteria plans, as outlined in Internal Revenue Code Section 125, are not deemed as qualifying wages and thus aren't subjected to municipal income tax withholding.

Misconception 2: If an Employee is Exempt from Medicare, They are Automatically Exempt from Municipal Income Tax Withholding

Another common error is the belief that employees exempt from Medicare taxes—evidenced by a blank Box 5 on Form W-2—are also exempt from city income tax withholding. This is not accurate. Despite Medicare exemption, these employees still have their earnings classified as "qualifying wages" for the purposes of municipal income tax, necessitating appropriate withholding.

Misconception 3: The Withholding Rate is Flexible

There's a confusion that employers can withhold income tax at a rate different from the city's specified rate if they calculate the total owed tax differently. However, Massillon's tax rate is a fixed 2%. If the tax withheld and remitted does not align with this percentage of the "Subject to Massillon Tax" amount, the discrepancy must be clearly explained and documented. This misunderstanding may arise from not realizing that the tax rate is established by the municipality and does not fluctuate with employer discretion.

Misconception 4: All Employers Must File on a Monthly Basis

Finally, some employers may mistakenly believe that all Massillon income tax withholding must be remitted monthly. While monthly filing is required for those who exceeded a withholding threshold of $2,399 in the previous calendar year or $200 in any month of the previous quarter, there are provisions for quarterly filing. Employers whose withholdings fall below these thresholds are permitted to file on a quarterly basis. Understanding the specific criteria for filing frequency is essential for compliance and avoiding unnecessary administrative burdens.

Clearing up these misconceptions helps employers and employees alike navigate the responsibilities and requirements of tax withholding within the City of Massillon efficiently. Enhanced awareness and understanding ensure that all parties are in compliance with the city's tax regulations, thereby supporting the essential city services funded through these tax revenues.

Key takeaways

Filling out and using the City of Massillon Income Tax form is an essential task for employers within or doing business in Massillon, Ohio. Here are six key takeaways to ensure compliance and accuracy:

- All employers are mandated to withhold municipal income tax from employees' qualifying wages, as outlined by state and federal guidelines. Qualifying wages are primarily based on the Medicare wage definition, but there are specific exclusions and inclusions, such as cafeteria plan benefits being excluded, and 401(k) contributions being included.

- Employers must determine their withholding frequency—monthly or quarterly—based on the amount withheld in the previous year or the amount required to be withheld during any month of the prior quarter. This distinction is crucial for staying compliant with submission deadlines.

- The due date for monthly withholding returns and payments is the 15th of the month following the reporting period. For quarterly filers, submissions are due by the last day of the month after the quarter ends. Timely filing is critical to avoid penalties.

- A one-time late payment penalty of 50% of the unpaid balance can be imposed, along with interest set at the July federal short-term rate plus 5%. This underscores the importance of timely tax remittance.

- It's essential for employers to report any changes in their information, including employer name, address, or Federal identification number, to the Massillon Income Tax Department in writing. Keeping account information up to date helps ensure accurate taxation and compliance.

- Employers should carefully fill out the Return of Income Tax Withheld form, ensuring all necessary information, such as the Federal ID number and the correct withholding period, is accurately reported. The form must be signed and dated by an authorized officer of the company.

Employers are encouraged to keep copies of all forms submitted for their records and to maintain meticulous documentation of all salaries, wages, and taxes withheld. This diligent record-keeping aids in the smooth operation of city services funded by income taxes and helps prevent discrepancies during audits.

For any questions or assistance, employers are advised to visit the city’s website or contact the Massillon Income Tax Department directly. By following these guidelines, employers can contribute to the effective and efficient collection of income taxes, which is vital for the community's wellbeing.

Popular PDF Documents

Revenue Portal Login - Questions regarding outstanding student loans from the NYS Higher Education Services Corporation are included to assess financial responsibility.

Joint Tactical Airstrike Request - Provides a clear, formalized process for requesting joint tactical airstrikes, underscoring the importance of air-ground integration.