Get City Of Carson Business Tax Permit Form

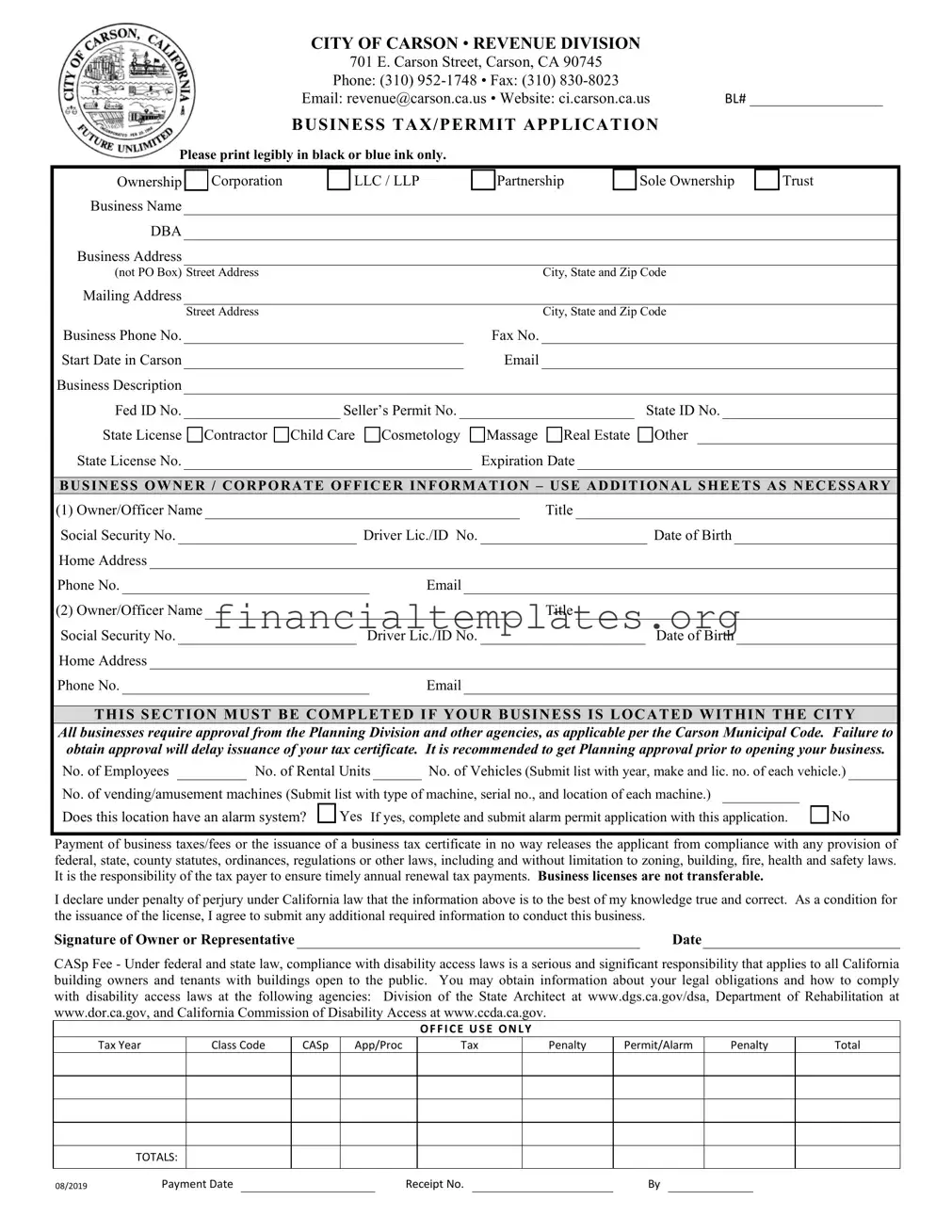

For businesses planning to operate within the vibrant City of Carson, understanding the intricacies of securing a Business Tax Permit is an essential first step towards legal and regulatory compliance. Located at 701 E. Carson Street, the City's Revenue Division offers a comprehensive application process, designed to be accessible and straightforward. Applicants are advised to fill out the form with precision, using black or blue ink only, to ensure clarity. This form encompasses various key sections, including detailed business information, owner or corporate officer details, and essential declarations. It insists on the adherence to local municipal codes, highlighting the necessity of obtaining prior approvals from the Planning Division among others, to facilitate a smoother operation. Notably, compliance with federal and state disability access laws is underscored, addressing the legal obligations building owners and tenants must meet. The form also clarifies the non-transferability of business licenses, asserting the expectation for businesses to renew their tax payments annually in a timely manner. Thus, through a careful compilation of relevant details and adherence to the specified requirements, businesses can set the stage for a thriving presence in Carson, contributing positively to its economic landscape.

City Of Carson Business Tax Permit Example

CITY OF CARSON • REVENUE DIVISION

|

|

|

|

|

|

701 E. Carson Street, Carson, CA 90745 |

|

|

|

|

|

||||||||

|

|

|

|

Phone: (310) |

|

|

|

|

|

||||||||||

|

|

|

Email: revenue@carson.ca.us • Website: ci.carson.ca.us |

BL# __________________ |

|||||||||||||||

|

|

|

BUSINESS TAX/PERMIT APPLICATION |

|

|

|

|||||||||||||

Please print legibly in black or blue ink only. |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Ownership |

|

Corporation |

|

|

|

LLC / LLP |

|

Partnership |

|

Sole Ownership |

|

Trust |

|||||||

Business Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DBA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(not PO Box) Street Address |

|

|

|

|

|

|

|

|

|

City, State and Zip Code |

|

|

|

||||||

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

|

|

|

|

|

City, State and Zip Code |

|

|

|

|||||

Business Phone No. |

|

|

|

|

|

|

|

|

|

Fax No. |

|

|

|

|

|

|

|

|

|

Start Date in Carson |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fed ID No. |

|

|

|

|

Seller’s Permit No. |

|

|

|

|

|

|

State ID No. |

|

|

|

||||

State License |

Contractor |

Child Care |

Cosmetology |

Massage |

Real Estate |

Other |

|

|

|

||||||||||

State License No. |

|

|

|

|

|

|

|

|

|

Expiration Date |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS OWNER / CORPORATE OFFICER INFORMATION – USE ADDITIONAL SHEETS AS NECESSARY

BUSINESS OWNER / CORPORATE OFFICER INFORMATION – USE ADDITIONAL SHEETS AS NECESSARY

(1) Owner/Officer Name |

|

|

|

|

|

Title |

|||||||

Social Security No. |

|

|

Driver Lic./ID No. |

|

|

|

|

Date of Birth |

|

||||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

||

Phone No. |

|

|

|

|

|

|

|

|

|

||||

(2) Owner/Officer Name |

|

|

|

|

|

Title |

|||||||

Social Security No. |

|

|

Driver Lic./ID No. |

|

|

|

|

Date of Birth |

|||||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

||

Phone No. |

|

|

|

|

|

|

|

|

|||||

THIS SECTION MUST BE COMPLETED IF YOUR BUSINESS IS LOCATED WITHIN THE CITY

All businesses require approval from the Planning Division and other agencies, as applicable per the Carson Municipal Code. Failure to obtain approval will delay issuance of your tax certificate. It is recommended to get Planning approval prior to opening your business.

No. of Employees |

|

No. of Rental Units |

|

No. of Vehicles (Submit list with year, make and lic. no. of each vehicle.) |

No. of vending/amusement machines (Submit list with type of machine, serial no., and location of each machine.)

Does this location have an alarm system? Yes If yes, complete and submit alarm permit application with this application.

No

Payment of business taxes/fees or the issuance of a business tax certificate in no way releases the applicant from compliance with any provision of federal, state, county statutes, ordinances, regulations or other laws, including and without limitation to zoning, building, fire, health and safety laws. It is the responsibility of the tax payer to ensure timely annual renewal tax payments. Business licenses are not transferable.

I declare under penalty of perjury under California law that the information above is to the best of my knowledge true and correct. As a condition for the issuance of the license, I agree to submit any additional required information to conduct this business.

Signature of Owner or Representative |

|

Date |

CASp Fee - Under federal and state law, compliance with disability access laws is a serious and significant responsibility that applies to all California building owners and tenants with buildings open to the public. You may obtain information about your legal obligations and how to comply with disability access laws at the following agencies: Division of the State Architect at www.dgs.ca.gov/dsa, Department of Rehabilitation at www.dor.ca.gov, and California Commission of Disability Access at www.ccda.ca.gov.

OFFICE USE ONLY

Tax Year

Class Code

CASp

App/Proc

Tax

Penalty

Permit/Alarm

Penalty

Total

TOTALS:

08/2019 |

Payment Date |

|

Receipt No. |

|

By |

Document Specifics

| Fact Name | Description |

|---|---|

| Location | The form is for a business located in Carson, CA, addressed at 701 E. Carson Street. |

| Contact Information | Contact options include phone (310) 952-1748, fax (310) 830-8023, and email at revenue@carson.ca.us. |

| Business Types Covered | It accommodates various types of ownership, including Corporation, LLC/LLP, Partnership, Sole Ownership, and Trust. |

| Required Identification | Applicants must provide Federal ID, Seller’s Permit No., State ID, and specific State License information if applicable. |

| Additional Information Requirement | The form requires detailed owner or corporate officer information and mandates additional sheets if necessary. |

| Planning Division Approval | All businesses located within the city need Planning Division approval, as stated by the Carson Municipal Code. |

| Non-Transferable Licenses | Business licenses issued are not transferable. |

| Governing Laws | Acknowledges compliance with disability access laws under federal and state law, citing resources for legal obligations. |

Guide to Writing City Of Carson Business Tax Permit

Filling out the City of Carson Business Tax Permit form is an essential step in legally establishing your business within the city. This document helps to ensure your company adheres to municipal regulations and is properly registered for tax purposes. It requires a detailed account of your business, including type, location, and ownership details. Remember, accurate and honest completion of this form is crucial for securing your business tax permit without undue delay. Below are step-by-step instructions on how to fill out the form correctly.

- Use black or blue ink only to ensure the form is legible.

- Select the type of ownership that applies to your business (Corporation, LLC/LLP, Partnership, Sole Ownership, Trust).

- Fill in your Business Name and, if applicable, DBA (Doing Business As).

- Provide the Business Address, ensuring it is not a P.O. Box. Include Street Address, City, State, and Zip Code.

- Enter your Mailing Address, even if it is the same as the Business Address.

- Include both your Business Phone Number and Fax Number.

- Specify the Start Date of your business in Carson.

- Input a valid Email Address for business correspondence.

- Describe your business succinctly in the Business Description section.

- Provide your Federal ID Number (Fed ID No.), Seller’s Permit Number, State ID No., and relevant State License details (if applicable), including the type of license and its expiration date.

- For the BUSINESS OWNER / CORPORATE OFFICER INFORMATION section, use additional sheets if necessary, and provide details for at least one owner or officer, including Name, Title, Social Security No., Driver License/ID No., Date of Birth, Home Address, Phone No., and Email.

- If your business is located within the city, complete the section that requires the number of Employees, Rental Units, Vehicles (attach a list of vehicles), and vending/amusement machines (attach a list with the type, serial number, and location of each). Also, indicate whether your location has an alarm system and if yes, submit an alarm permit application alongside this form.

- Read and understand the compliance agreement, which includes compliance with federal, state, and local laws and the non-transferability of the business license.

- Sign and date the form, thus declaring the information provided is true and accurate under penalty of perjury under California law. Note the CASp Fee section for information on compliance with disability access laws.

- Finally, the OFFICE USE ONLY section will be filled out by the city official processing your form, so leave this part blank.

After submitting the form, it will be reviewed by the City of Carson's tax office. This review process includes checking for completeness and compliance with the city's regulations. Approval from the Planning Division and other relevant agencies may be required depending on your business type. Once approved, you will receive your Business Tax Certificate, allowing you to operate within Carson legally. Keep in mind, maintaining accurate records and renewing your permit annually is essential for continued compliance.

Understanding City Of Carson Business Tax Permit

-

What is the purpose of the City of Carson Business Tax Permit application?

The City of Carson Business Tax Permit application serves to register a business within Carson's jurisdiction, ensuring compliance with local tax obligations and regulations. It's a crucial step for any business owner to officially operate and be recognized by the city. This process also involves obtaining necessary approvals from city planning and other agencies to ensure the business meets all municipal codes.

-

Who needs to fill out this application?

Any individual or entity wishing to conduct business within the City of Carson, including corporations, LLCs/LLPs, partnerships, sole proprietors, and trusts, must complete this application. This requirement applies regardless of the business's size or industry.

-

What information is required on the form?

The application requires detailed information about the business, including but not limited to the business name and address, Federal and State ID numbers, owner/corporate officer details, and specific business details like the number of employees and whether the location has an alarm system. Additionally, it asks for the type of business and necessary state license numbers for regulated professions.

-

How does one submit the Business Tax Permit application?

Submission can be done by mail or in person at the contact address provided on the form. It's important to use black or blue ink only when filling out the form to ensure legibility. Additionally, ensuring that all required sections are completed and attaching any necessary additional sheets or documents is crucial for a smooth process.

-

Is Planning Division approval necessary for all businesses?

Yes, obtaining approval from the Planning Division is a step all businesses must complete according to the Carson Municipal Code. This approval confirms that the business complies with local zoning and land use regulations. It's recommended to secure this approval before opening your business to avoid any delays in obtaining the business tax certificate.

-

What happens if information on the form is found to be incorrect after submission?

If after submitting the form, some information is discovered to be incorrect, it's imperative to contact the Revenue Division immediately to amend the details. Providing accurate information is crucial, as the application is submitted under penalty of perjury under California law. Amendments may require submitting additional documentation or information to verify the correct details.

-

Are business licenses transferable in Carson?

No, business licenses in Carson are not transferable. Each new owner or operator of a business must apply for their own business tax permit, as per the city's regulations. This ensures that all businesses are currently registered and meet the specific operational guidelines enforced by the city.

-

What is the CASp fee mentioned on the application?

The CASp fee refers to an assessment related to compliance with federal and state disability access laws. Payment of this fee is part of ensuring that the business premises are accessible to people with disabilities. Information on legal obligations and how to comply with these laws can be found through the agencies listed in the application.

-

How can an applicant ensure compliance with all federal, state, and local laws?

Applicants are responsible for ensuring their business complies with all applicable laws, including zoning, building, fire, health, and safety regulations. Consulting with legal counsel, reviewing information provided by state and federal agencies, and working closely with the City of Carson's Planning Division and other local authorities can help businesses meet these obligations. Regularly updating any changes in business operation or structure with the city is also essential for maintaining compliance.

Common mistakes

Filling out the City Of Carson Business Tax Permit form requires attention to detail and a clear understanding of the requirements. Unfortunately, many individuals make errors during this process, which can lead to delays or issues with obtaining the necessary permit for their business operations. Here are the four common mistakes:

Not using black or blue ink: The form specifically requests that all entries be made legibly in black or blue ink only. Using other colors or pencil can cause the form to be rejected or result in delays as the information may not be as durable or clear.

Failing to provide a physical business address: The application clearly states that a P.O. Box is not an acceptable address for the business location. This is a critical piece of information as it pertains to zoning and compliance checks. Overlooking this requirement can significantly delay the approval process.

Skipping the additional approval section for businesses located within the city: This section is crucial as it highlights the need for Planning Division approval among other agency checks in accordance with the Carson Municipal Code. Not seeking this approval prior to opening can not only delay the issuance of the tax certificate but also lead to legal complications.

Incorrect or incomplete owner/officer information: Each owner or corporate officer must provide detailed information, including a social security number and a driver's license or ID number. Omitting any detail, or not using additional sheets when necessary, hampers the verification process and could void the application.

Avoiding these common mistakes can streamline the process of obtaining a business tax permit in the City of Carson. It's critical for business owners to review their applications thoroughly before submission to ensure all the information is accurate and complete. Compliance with the specified requirements not only facilitates a smoother application process but also ensures that businesses can operate without unnecessary legal impediments.

Documents used along the form

When starting or managing a business in Carson, California, the City of Carson Business Tax Permit form is just the starting point. There are several other forms and documents that businesses often need to submit or keep on file as part of complying with local, state, and federal regulations. The following list outlines some of these essential documents and forms that accompany the business tax permit application process.

- Articles of Incorporation: This document is a requirement for corporations. It establishes the existence of a new corporation and includes details such as the corporation's name, purpose, and the number of shares it is authorized to issue.

- Operating Agreement (for LLCs): Although not always required by law, an operating agreement is crucial for LLCs. It outlines the business's financial and functional decisions including rules, regulations, and provisions for running the company.

- Seller’s Permit: Required for most businesses that sell goods in California. It allows the collection of sales tax on behalf of the state.

- Fictitious Business Name Statement: Often necessary if the business will operate under a name different from the owner’s name or the official corporate name, providing a public record of the business name and ownership.

- Fire Department Permit: May be required if the business uses materials that are flammable or if the public will occupy the business premises. This permit ensures that the business meets fire safety regulations.

- Health Department Permit: Essential for businesses involved in food preparation, handling, or selling. It confirms that the business complies with local health and safety standards.

- Building Permit: Necessary for new construction or significant renovations to ensure compliance with building codes and zoning regulations.

- Professional and Occupational Licenses: Certain professions require specific licenses to operate legally in California. These can range from cosmetology and real estate to contracting and legal practices.

- Alarm Permit: This permit is required if the business location is equipped with an alarm system, as mentioned in the business tax permit form. It allows emergency services to be aware of and properly respond to alarms from the property.

Navigating through the requirements and ensuring all the necessary paperwork is in order can be challenging. Still, it’s an integral part of maintaining a legitimate and compliant business in the city of Carson. Many of these documents require renewal, and staying ahead of deadlines prevents fines and disruptions. While the City of Carson Business Tax Permit is a critical first step, it's just part of a broader checklist that each business owner must complete to meet all legal obligations.

Similar forms

The City of Carson Business Tax Permit form shares similarities with the Business License Application forms used in other cities. Just like the City of Carson form, these applications generally require detailed business information, such as the business name, address, and the nature of the business. They also ask for owner or corporate officer information, illustrating a common need across municipalities to identify the people responsible for a business. This ensures businesses operate legally and are easily contactable.

Likewise, the Seller's Permit Application issued by state governments parallels the Carson form in its necessity for businesses to report their operational specifics, including their federal and seller's permit numbers. This parallel arises because both documents are essential for the regulatory oversight of businesses, ensuring they are authorized to sell goods or services and are accountable for sales tax collection. The emphasis on compliance with tax obligations is a mutual concern of both documents.

The Federal Employer Identification Number (EIN) Application also mirrors the Carson form as it requires businesses to provide detailed ownership and entity type information. Just like the Carson form requires a federal ID number, the EIN application requires similar identifying information to register the business with the Internal Revenue Service, highlighting the importance of proper identification and accountability in both federal and municipal contexts.

Occupational Licensing Applications, for professions such as real estate, cosmetology, and child care, share similarities with the City of Carson's requirement for state licensing information. Both document types require proof of state-sanctioned credentials to ensure that businesses and professionals adhere to specific industry standards and legal obligations, safeguarding public interest and safety.

The Zoning Permit Application found in many municipalities resembles the Carson form's requirement for Planning Division approval. Both types of applications serve to ensure that business operations align with local land use and zoning regulations. This step is crucial in preventing incompatible business activities within certain areas, maintaining the community's structural integrity.

Building Permit Applications also share common ground with the Carson Business Tax Permit form in terms of requiring approval from city planning or building departments. This similarity highlights the importance of ensuring that any physical modifications or constructions for business purposes meet local building codes and safety standards, a concern for both types of applications.

The Home Occupation Permit Applications required by cities for home-based businesses parallel the Carson form in ensuring that businesses operate in compliance with local regulations. Both forms consider the impact of the business on its surrounding environment, requiring additional scrutiny for businesses operated from residential premises to ensure they do not disturb their neighborhoods.

Alarm Permit Applications, which are sometimes required alongside business permits, are reminiscent of the Carson form's section on alarm systems. This commonality underscores the importance of emergency preparedness and the need for businesses to comply with local safety standards, including the regulation of alarm systems to ensure they are used correctly and do not burden emergency response services unnecessarily.

The Environmental Health Permit Applications for businesses that handle food, waste, or other materials potentially impacting public health resemble parts of the Carson form that might trigger review by health and safety agencies. These documents collectively aim to protect the community by ensuring businesses meet health and sanitation standards, highlighting a shared commitment to public welfare.

Finally, the ADA Compliance Certification forms that businesses may need to complete in addition to local permits share the concern with the Carson form's mention of compliance with disability access laws. Both document types reflect the legal and ethical obligation of businesses to be accessible to all customers, emphasizing inclusivity and the importance of adhering to federal and state accessibility standards.

Dos and Don'ts

When filling out the City Of Carson Business Tax Permit form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are some dos and don'ts to help guide you through the process:

- Do print legibly in black or blue ink only to ensure that all information is readable.

- Do complete all sections of the form that are applicable to your business type to avoid delays in processing.

- Do provide accurate information for the business owner or corporate officer, including additional sheets if necessary, to comply with identification and contact requirements.

- Do obtain approval from the Planning Division and other necessary agencies as per the Carson Municipal Code before opening your business, to facilitate the issuance of your tax certificate.

- Do declare under penalty of perjury that the information provided is, to the best of your knowledge, true and correct, to uphold the integrity of the application process.

- Do pay attention to the obligations regarding disability access laws under federal and state law, acknowledging the seriousness of compliance for buildings open to the public.

- Don't use a P.O. Box as the business address; the form requires a physical street address to ensure locality and delivery of necessary documents.

- Don't neglect to include the required details about your business, such as the number of employees, rental units, vehicles, or vending/amusement machines, which are crucial for proper assessment and approval.

- Don't forget to complete the section about alarm systems if applicable, as failure to do so might necessitate additional steps or cause delays.

- Don't overlook the necessity of attaching additional sheets for detailed owner or corporate officer information if the space provided is insufficient, to avoid incomplete submissions.

- Don't assume payment of business taxes or fees or the issuance of a tax certificate absolves you from compliance with local, state, or federal laws, as ongoing compliance is required.

- Don't transfer the business license without understanding that licenses are not transferable and that new owners must apply for their own permit, to maintain regulatory consistency.

Misconceptions

When it comes to navigating local government requirements for businesses, the process can sometimes seem overwhelming. This is particularly true with the City of Carson Business Tax Permit form. There are several misconceptions surrounding this document that can confuse or mislead applicants. By clarifying these misconceptions, businesses can more effectively comply with local laws and ensure a smoother operation within the City of Carson.

- Misconception 1: The business tax permit is optional for small businesses.

Some believe that if their business is small enough, they do not need to apply for a business tax permit. This understanding is not accurate. All businesses operating within the City of Carson, regardless of size, are required to obtain a business tax permit. This includes sole proprietorships, home-based businesses, and online businesses.

- Misconception 2: Business licenses and business tax permits are the same.

It's a common misunderstanding that a business license and a business tax permit are interchangeable. However, they serve different purposes. A business license gives you the right to operate your business within a particular locality, whereas a business tax permit is related to the collection of taxes by the business on behalf of the city. The City of Carson requires businesses to obtain both documents to comply with local regulations.

- Misconception 3: Once obtained, the permit does not require renewal.

Some business owners mistakenly think that once they have obtained a business tax permit, it does not need to be renewed. However, the City of Carson requires annual renewal of the business tax permit. Failure to renew on time can result in penalties, fines, and even the revocation of the permit. It is the business owner's responsibility to ensure that their permits are kept up to date.

- Misconception 4: The application process is lengthy and complicated.

Although dealing with bureaucratic processes can be daunting, the City of Carson has streamlined the business tax permit application process to be as efficient as possible. Completing the application thoroughly and accurately, understanding the required approvals, such as from the Planning Division, and preparing the necessary documentation in advance can simplify and expedite the process. City staff are also available to assist applicants through email or phone.

Understanding these misconceptions and taking the correct steps to comply with the City of Carson's requirements can make the process of obtaining and maintaining a business tax permit much more straightforward. Always ensure to check the most current guidelines and seek assistance directly from city officials if any clarifications are needed.

Key takeaways

When preparing to fill out the City of Carson Business Tax Permit form, it's important to note the following key takeaways to ensure a smooth and compliant process:

- Complete the application using black or blue ink only and ensure all information is printed legibly to avoid any misunderstandings or processing delays.

- Clearly specify the type of ownership of the business, such as Corporation, LLC/LLP, Partnership, Sole Ownership, or Trust, as this will impact various legal and tax obligations.

- A DBA (Doing Business As) name should be included if your business operates under a name different from its legal name, enhancing brand recognition and legal compliance.

- Provide a physical business address instead of a P.O. Box for the purposes of veracity and regulatory compliance.

- The form requires detailed owner or corporate officer information, including Social Security Number and Driver’s License/ID number, emphasizing the need for accuracy and privacy in handling this sensitive information.

- It is mandatory for businesses located within the City of Carson to obtain approval from the Planning Division and other relevant agencies as determined by the Carson Municipal Code, underlining the importance of early preparation to avoid operational delays.

- Payment of business taxes and fees, along with compliance with federal, state, county, and local laws, including zoning, building, fire, health, and safety regulations, is stressed as a critical responsibility of the business owner.

- The form highlights the necessity for annual renewal of the business tax payments and reminds applicants that business licenses are not transferable, underscoring the importance of ongoing compliance and the personal nature of the business tax permit.

Remember, compliance with disability access laws is also a significant part of your legal obligations as a business owner. Information regarding legal obligations and compliance can be obtained from specified agencies like the Division of the State Architect, Department of Rehabilitation, and California Commission of Disability Access. Ensuring familiarity with these requirements will help in maintaining a compliant and inclusive business environment.

Popular PDF Documents

Determination of Heirship Oklahoma - Designed to assert the rightful heirs and their respective shares of an estate according to Oklahoma law.

How to Update Address With Irs - Form 8822-B is the designated document for informing the IRS about changes in your business location or contact details.