Get Child Tax Worksheet Form

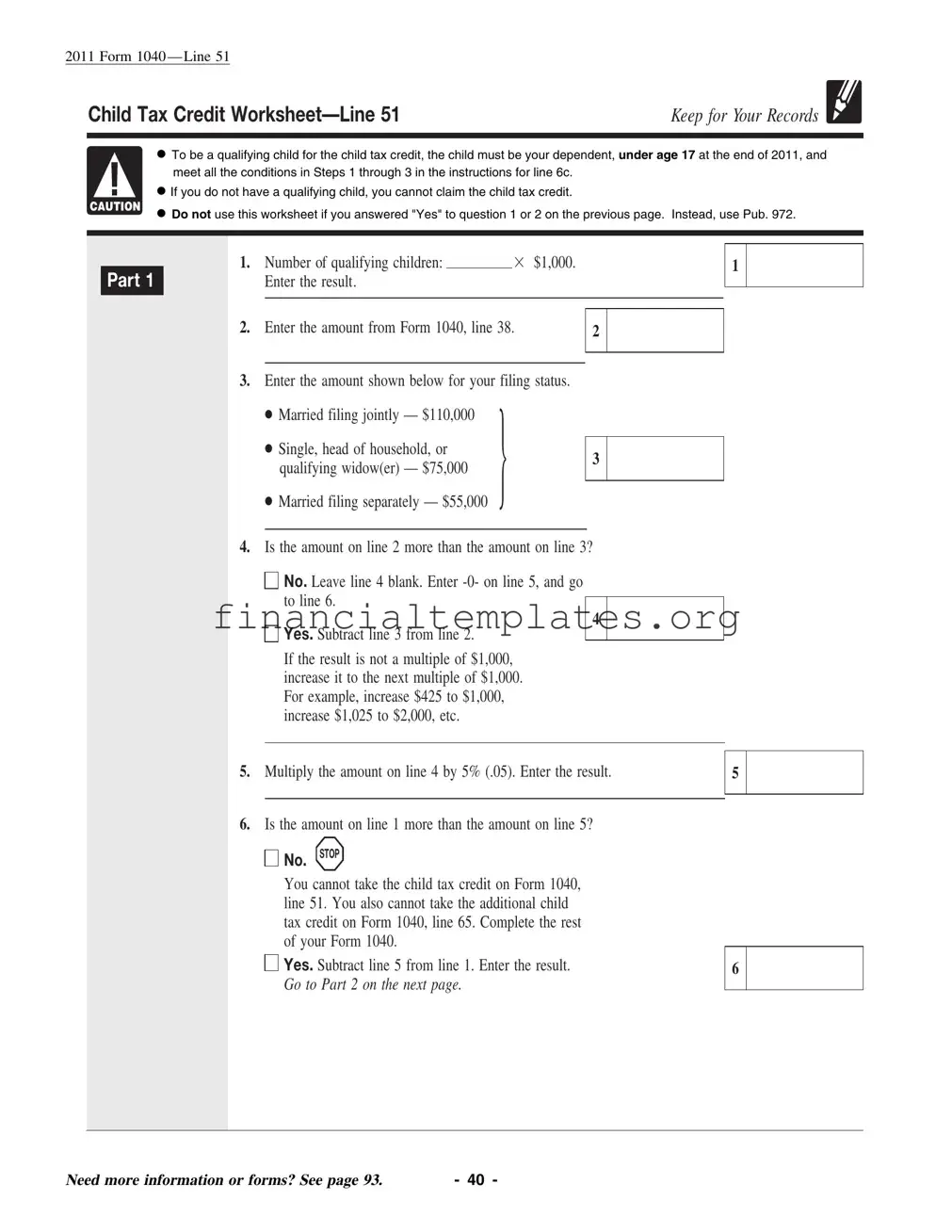

The Child Tax Worksheet, specifically lined out on Form 1040—Line 51 for the year 2011, serves as a pivotal tool for taxpayers aiming to calculate their eligibility and the exact amount they can claim for the child tax credit. Key to unlocking this tax benefit, the worksheet outlines a series of steps starting with ensuring the child in question is a qualifying dependent, aged 17 or younger at the year's end. The initial part of the worksheet focuses on determining the number of qualifying children and requires the taxpayer to compare their income against set thresholds based on their filing status—whether it's single, married filing jointly, or another status, which influences the phase-out of the credit. Taxpayers who exceed these income thresholds may see a reduction in their credit amount, calculated through a series of subtractions and multiplications specified in the worksheet. For those who find the amount on line 2 exceeds the income limit for their status, the form provides a straightforward calculation to adjust the credit accordingly. Moreover, the worksheet cautions against its use under certain conditions, directing individuals to Publication 972 for additional guidance. The subsequent section then guides taxpayers on how to apply the calculated credit against their overall tax liability, with clear instructions for navigating scenarios where the credit cannot be used or when an individual might also qualify for the additional child tax credit. Provided with this comprehensive worksheet, taxpayers are equipped to accurately apply for the child tax credit, potentially lowering their tax burden while adhering to the requisite legal standards.

Child Tax Worksheet Example

2011 Form 1040 — Line 51

CHILD TAX CREDIT |

Keep for Your Records |

●Tobeaaqualifyingchildchildfor forthe thechildchildtax credit,tax credit,the childthe mustchild bemustyourbedependent,your dependent,under underage 17 ageat the17endat theof 2011,end and

meetof 201110,all theandconditionsmeet all intheStepsconditions1 throughin Steps3 in the1 instructionsthrough 3 inonforthepagelineinstructions6c15.. for line 6c.

●If you do not have a qualifying child, you cannot claim the child tax credit.

●Do not use this worksheet if you answered “Yes” to question 1 or 2 on page 39. Instead, use Pub. 972.

CAUTION ●

DousenotPubuse972this. worksheet if you answered "Yes" to question 1 or 2 on the previous page. Instead, use Pub. 972.

|

1. |

Number of qualifying children: |

|

$1,000. |

|

|

|

PART 1 |

|

Enter the result. |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

Enter the amount from Form 1040, line 38. |

|

|

|||

|

2 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.Enter the amount shown below for your filing status.

● Married filing jointly — $110,000 |

|

|

|

● Single, head of household, or |

|

|

|

3 |

|

||

qualifying widow(er) — $75,000 |

|

||

|

|

||

|

|

|

● Married filing separately — $55,000

4.Is the amount on line 2 more than the amount on line 3?

NO. Leave line 4 blank. Enter

NO. Leave line 4 blank. Enter

4

YES. Subtract line 3 from line 2.

If the result is not a multiple of $1,000, increase it to the next multiple of $1,000. For example, increase $425 to $1,000, increase $1,025 to $2,000, etc.

5.Multiply the amount on line 4 by 5% (.05). Enter the result.

6.Is the amount on line 1 more than the amount on line 5?

NO. STOP

You cannot take the child tax credit on Form 1040, line 51. You also cannot take the additional child tax credit on Form 1040, line 65. Complete the rest of your Form 1040.

YES. Subtract line 5 from line 1. Enter the result. Go to Part 2 on the next page.

1

5

6

Need more information or forms? See page 93. |

- 40 - |

2011 Form 1040 — Line 51 (continued)

CHILD TAX CREDIT |

Keep for Your Records |

|

|

Before you begin Part 2: Figure the amount of any credits you are claiming on Form 5695, Part I; Form 8834, Part I; Form 8910; Form 8936; or Schedule R.

PART 2 |

7. |

|

Enter the amount from Form 1040, line 46. |

|

|

|||||||||||

|

8. |

|

Add any amounts from: |

|

|

|

||||||||||

|

|

|

|

|

||||||||||||

|

|

|

Form 1040, line 47 |

|

|

|

|

|

||||||||

|

|

|

Form 1040, line 48 + |

|

|

|

|

|

||||||||

|

|

|

Form 1040, line 49 + |

|

|

|

|

|

||||||||

|

|

|

Form 1040, line 50 + |

|

|

|

|

|

||||||||

|

|

|

Form 5695, line 114 + |

|

|

|

|

|

||||||||

|

|

|

Form 8834, line 223 + |

|

|

|

|

|

||||||||

|

|

|

Form 8910, line 212 + |

|

|

|

|

|

||||||||

|

|

|

Form 8936, line 145 + |

|

|

|

|

|

||||||||

|

|

|

Schedule R, line 22 + |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|||||||

|

|

|

Enter the total. |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

Are the amounts on lines 7 and 8 the same? |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

YES. |

|

STOP |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

You cannot take this credit because there is no tax |

|||||||||||||

|

|

|

to reduce. However, you may be able to take the |

|||||||||||||

|

|

|

additional child tax credit. See the TIP below. |

|||||||||||||

|

|

|

NO. Subtract line 8 from line 7. |

|

|

|

||||||||||

|

10. |

Is the amount on line 6 more than the amount on line 9? |

||||||||||||||

|

|

|

YES. Enter the amount from line 9. |

|

|

|||||||||||

|

|

|

Also, you may be able to take the |

This is your child tax |

||||||||||||

|

|

|

additional child tax credit. See the |

|||||||||||||

|

|

|

credit. |

|||||||||||||

|

|

|

TIP below. |

|||||||||||||

|

|

|

|

|

||||||||||||

|

|

|

NO. Enter the amount from line 6. |

|

|

|||||||||||

7

9

10

Enter this amount on Form 1040, line 51.

|

You may be able to take the ADDITIONAL CHILD TAX CREDIT |

|

TIP |

on Form 1040, line 65, if you answered “Yes” on line 9 OR |

|

line 10 above. |

||

|

●First, complete your Form 1040 through lines 64a and 64b.

●Then, use Form 8812 to figure any additional child tax credit.

- 41 - |

Need more information or forms? See page 93. |

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The Child Tax Credit Worksheet is specifically designed for the 2011 Form 1040, Line 51. |

| 2 | To claim the child tax credit, a child must be your dependent, under the age of 17 at the end of 2011, and meet all conditions listed in Steps 1 through 3 of the worksheet instructions. |

| 3 | Individuals without a qualifying child are ineligible to claim the child tax credit using this worksheet. |

| 4 | If "Yes" was answered to either question 1 or 2 on the specified page, the taxpayer is directed away from this worksheet to use Publication 972 instead. |

| 5 | Income thresholds for phase-outs are outlined by filing status within the worksheet, affecting the calculation of the credit. |

| 6 | Taxpayers may be directed to stop and not claim the child tax credit on Form 1040, Line 51 if specific conditions are met during the calculation process. |

| 7 | Additional guidance and calculations for the credit are provided in Part 2 of the worksheet, including steps for those who can’t take the credit due to having no tax liability. |

Guide to Writing Child Tax Worksheet

Filling out the Child Tax Worksheet is a crucial step for many parents and guardians during tax season. This worksheet helps determine if you're eligible for the child tax credit, a benefit that can significantly reduce your tax bill if you have qualifying children. This guide will walk you through the process step by step, ensuring you fill out the form correctly. Remember, you can't claim this credit if you don't have a qualifying child or if you're instructed to use Publication 972 instead. Ready to get started? Here's what you need to do:

- Identify the number of qualifying children: Enter the number and multiply by $1,000. This is your preliminary credit.

- Report your income: Enter the amount from Form 1040, line 38.

- Determine your filing status threshold:

- Married filing jointly — $110,000

- Single, head of household, or qualifying widow(er) — $75,000

- Married filing separately — $55,000

- Compare your income to the threshold: If line 2's amount is more than line 3's, subtract line 3 from line 2. Adjust this result to the nearest $1,000 if it's not already a multiple.

- Apply reduction formula: Multiply the result from the previous step by 5% (.05). Enter the result.

- Determine if you're eligible: If your initial credit (step 1) is more than the reduced amount (step 5), subtract step 5 from step 1 to find out your potential credit. If not, you can't take the child tax credit.

- Before starting Part 2, gather any additional applicable credits from forms such as Form 5695, Form 8834, or others as listed in the instructions.

- Enter your total tax from Form 1040, line 46.

- Add other credits: Combine amounts from lines 47, 48, 49, 50, and any other listed forms.

- Check if you have tax due after credits: Subtract the total credits (step 8) from your total tax (step 7). If there's no tax left to reduce, you might be eligible for the additional child tax credit instead.

- Final comparison: If the amount from step 6 is more than the result from step 9, enter the amount from step 9; this is your child tax credit. Otherwise, enter the amount from step 6.

- Claiming the credit: Enter the calculated child tax credit on Form 1040, line 51. Also, consider if you're eligible for the additional child tax credit and follow the instructions for Form 8812 if necessary.

Once you've completed these steps, you'll have determined your eligibility for the child tax credit and how much you can claim. Always double-check your work for accuracy. If you're unsure about any part of the process or need more information, referring to the IRS instructions or seeking advice from a tax professional can be very helpful. Remember, taking advantage of tax credits like these can make a significant difference in your tax return, so it's worth taking the time to fill out the worksheet carefully.

Understanding Child Tax Worksheet

FAQ: Understanding the Child Tax Credit Worksheet Form

- What is the Child Tax Credit Worksheet?

The Child Tax Credit Worksheet is a form used in conjunction with the IRS Form 1040 to help taxpayers determine if they are eligible for the Child Tax Credit and how much credit they can claim for each qualifying child under the age of 17 at the end of the tax year. The worksheet guides through the eligibility criteria and calculation steps.

- Who counts as a qualifying child for the Child Tax Credit?

A qualifying child is one who is your dependent, under age 17 at the end of the tax year, and meets all conditions outlined in the instructions for the form. This includes relationship, residency, and support tests, among other requirements.

- Can I claim the Child Tax Credit if my income is above a certain amount?

Yes, but the credit may be reduced if your modified adjusted gross income (MAGI) is above certain thresholds, which vary based on your filing status. The worksheet includes steps to determine if your income affects your eligibility for the credit or reduces the amount you can claim.

- What happens if I'm not eligible for the Child Tax Credit?

If, after completing the worksheet, you find you're not eligible for the Child Tax Credit (either because of income limits or other factors), you may not claim this credit on Form 1040, Line 51. However, you might be eligible for the Additional Child Tax Credit and should refer to the instructions on utilizing Form 8812 to calculate that credit.

- How does the worksheet determine the amount of Child Tax Credit I can claim?

The Child Tax Credit Worksheet guides you through calculating the credit amount, starting with the number of qualifying children and adjusting based on your income and any other credits you are claiming. The calculations consider phase-out amounts if your income exceeds the specified levels for your filing status.

- What should I do if I answered "Yes" to question 1 or 2 on the previous page?

If you answered "Yes" to either of those questions, you are directed not to use this worksheet but to refer to Publication 972 for guidance. This publication provides additional details and instructions for taxpayers in more complex situations or who may be claiming the Child Tax Credit under special circumstances.

Common mistakes

When filling out the Child Tax Credit Worksheet, individuals often commit errors that can lead to incorrect calculations or missed credits. Here are ten common mistakes to avoid:

- Not verifying a child’s eligibility: It's crucial to confirm that the child meets all criteria, including age, dependency, and residency requirements.

- Incorrectly counting the number of qualifying children: Ensure you accurately count the number of children that qualify for the credit.

- Misinterpreting income limits: The income thresholds vary by filing status; misunderstanding these can lead to incorrect calculations on line 4.

- Omitting or inaccurately reporting income: On line 2, all income must be reported correctly to determine eligibility correctly.

- Miscalculating the phase-out amount: For those above the income threshold, incorrectly increasing the result to the next thousand can distort the phase-out calculation on line 4.

- Incorrect multiplication or arithmetic errors: Simple math errors in multiplication or subtraction can lead to incorrect amounts on lines 5 and 6.

- Overlooking additional credits: Before completing Part 2, failing to consider other credits claimed on forms like Form 5695 or Form 8834 can impact the final credit amount.

- Misreading tax liability information: Not accurately entering the amount from Form 1040, line 46, on line 7 can lead to errors in determining eligibility for the credit.

- Skipping the comparison between lines 7 and 8: Failing to adequately compare these lines can mistakenly lead one to stop the process prematurely or miscalculate the credit.

- Not leveraging the additional child tax credit: Individuals often miss claiming the additional child tax credit by not following the instructions provided if they answered "Yes" on lines 9 or 10.

Here are some strategies to avoid these mistakes:

- Double-check the child’s eligibility requirements before beginning.

- Review the correct filing status and associated income limits.

- Use a calculator to avoid arithmetic errors.

- Thoroughly read each instruction and cross-reference with the appropriate forms and lines mentioned.

- Consider consulting a tax professional if there’s confusion or uncertainty.

Documents used along the form

When preparing to file taxes, especially with considerations such as the Child Tax Credit, there are several forms and documents that may also be necessary or helpful. These documents ensure that taxpayers can accurately claim credits, include all relevant income, and adhere to IRS guidelines. Here's a concise overview of other forms and documents frequently used in conjunction with the Child Tax Worksheet form:

- Form 1040 (U.S. Individual Income Tax Return): This is the standard federal income tax form people use to report their income, claim tax deductions and credits, and calculate the amount of their tax refund or tax owed to the IRS.

- Form 8812 (Additional Child Tax Credit): For those who qualify for more than the allowable Child Tax Credit on Form 1040, this form helps calculate any remaining credit that could be refunded.

- Schedule 8812 (Credits for Qualifying Children and Other Dependents): This schedule accompanies Form 1040 and is used to calculate the Child Tax Credit and the Additional Child Tax Credit.

- Form 5695 (Residential Energy Credits): This form is used to calculate tax credits for specific energy-efficient home improvements, which can affect the overall tax situation and potential credits owed.

- Form 8834 (Qualified Electric Vehicle Credit): For individuals who have purchased a qualified electric vehicle, this form calculates the credit they can claim.

- Form 8910 (Alternative Motor Vehicle Credit): This form calculates the credit for taxpayers who have purchased vehicles that qualify for the alternative motor vehicle credit.

- Form 8936 (Qualified Plug-In Electric Drive Motor Vehicle Credit): Similar to Form 8834 but specific to plug-in electric drive vehicles, this form helps determine the credit amount for those purchases.

- Schedule R (Credit for the Elderly or the Disabled): For qualifying seniors or disabled individuals, this schedule calculates a potential tax credit, which can impact the overall tax situation.

Understanding and utilizing the correct forms and documents is crucial for accurately filing taxes and maximizing potential benefits. These forms interact with the Child Tax Credit Worksheet to provide comprehensive tax reporting and ensure that taxpayers receive all credits for which they qualify. By familiarizing themselves with these documents, taxpayers can navigate the complexities of tax season with greater ease and confidence.

Similar forms

The document similar to the Child Tax Worksheet is the Form 8812, also known as the "Additional Child Tax Credit." This form is designed to help determine if taxpayers are eligible to claim the additional child tax credit, which can be beneficial for those who weren't able to utilize the full amount of the child tax credit on their tax return. Form 8812 and the Child Tax Credit Worksheet share a common purpose: both are aimed at ensuring taxpayers accurately calculate and claim credits related to dependents, taking into account the number of qualifying children and the family's income.

Another relevant document is Form 1040 itself, which is the U.S. individual income tax return form. The Child Tax Credit Worksheet is directly related to line 51 of Form 1040, where the child tax credit is claimed. Understanding and accurately completing the Child Tax Worksheet is crucial for correctly filling out the Form 1040, as it helps to determine the amount of credit that taxpayers are eligible to deduct from their federal income tax based on their eligible dependents.

Form 5695, "Residential Energy Credits," although it focuses on credits for energy-efficient home improvements, shares similarities with the Child Tax Credit Worksheet in that it is used to calculate specific tax credits that taxpayers may be eligible for. Both forms require taxpayers to follow a series of steps to determine the credit amount they can claim, impacting their total tax liability. Essentially, they both guide taxpayers through eligibility criteria and calculations to ensure appropriate credits are claimed.

Similarly, Form 8834, "Qualified Plug-in Electric and Electric Vehicle Credit," is geared towards taxpayers who have purchased specific types of vehicles and are eligible for a tax credit. Like the Child Tax Credit Worksheet, Form 8834 requires detailed financial and eligibility information to accurately calculate the credit amount. Although it focuses on a different aspect of tax credits, the underlying principle of calculating a benefit based on eligibility criteria is a shared feature with the Child Tax Credit Worksheet.

Lastly, Schedule R, related to the "Credit for the Elderly or the Disabled," is akin to the Child Tax Credit Worksheet in that it serves taxpayers looking to claim a credit, specifically senior citizens or those disabled. Both documents necessitate careful consideration of the taxpayer’s specific situation and calculations based on criteria set forth by the IRS. Despite the difference in target demographic, Schedule R and the Child Tax Credit Worksheet operate under the same premise of providing tax relief to eligible individuals.

Dos and Don'ts

When filling out the Child Tax Worksheet form, it's essential to follow guidelines carefully to ensure accuracy and compliance with IRS rules. Here are key dos and don'ts to keep in mind:

- Do carefully review the eligibility criteria for a qualifying child to ensure that your dependent fits the IRS definition, including age restrictions and dependency status.

- Do use the correct filing status and income information from your Form 1040 to accurately complete the income thresholds section.

- Do round up to the nearest $1,000 if the difference between your income and the set threshold is not a multiple of $1,000, as instructed.

- Do not attempt to claim the child tax credit if you do not have a qualifying child under the age of 17 at the end of the tax year.

- Do not use the Child Tax Credit Worksheet if you answered "Yes" to question 1 or 2 on page 39; use Pub. 972 instead as indicated.

- Do not ignore the instructions for lines involving other tax credits and deductions that may affect your ability to claim the child tax credit or the additional child tax credit.

Following these guidelines ensures you correctly navigate the Child Tax Credit Worksheet, maximizing your benefits while adhering to IRS regulations.

Misconceptions

When it comes to tax forms and credits, it's easy to fall prey to misunderstandings, especially with something as important as the Child Tax Credit Worksheet. Let's clear up four common misconceptions:

- Only children under age 17 qualify for the credit: It's true that to qualify for the Child Tax Credit, a child must be under the age of 17 by the end of the tax year. However, this does not mean children who turn 17 during the year automatically disqualify. If the child was 16 or younger at the end of the year, they could still be eligible.

- The Child Tax Credit is available to all taxpayers with children: Not every taxpayer with children qualifies for the Child Tax Credit. There are specific criteria that need to be met, including age limits, dependency status, and residency requirements. Additionally, the credit begins to phase out at certain income thresholds, which are determined by your filing status. For example, for Married Filing Jointly, the phase-out begins at $110,000.

- If your income is too high, you automatically can't get any credit: While it's true that high-income earners will see a reduction in their Child Tax Credit, it doesn't necessarily disappear entirely at first. The credit reduces gradually, meaning that if your income exceeds the threshold amounts, your credit will reduce by 5% (.05) of the amount by which your Adjusted Gross Income (AGI) surpasses these limits until it potentially phases out completely.

- You can claim the Child Tax Credit for every child no matter what: The IRS has a clear definition of a "qualifying child" for the purpose of the Child Tax Credit. The child must meet several tests, including relation, age, residency, support, and joint return tests. For instance, the child must have lived with you for more than half of the tax year and not have provided over half of their own support during the year.

Understanding the specifics of the Child Tax Credit can lead to significant tax savings and avoid potential mistakes on tax returns. For further clarification or to address personal circumstances, consulting with a tax professional or visiting the IRS website is always a good approach.

Key takeaways

When navigating the Child Tax Credit Worksheet, it's crucial to understand the eligibility criteria to accurately claim this benefit. Here are six key takeaways that individuals filling out this form should keep in mind:

- A child must be a dependent, under the age of 17 at the end of the year, and meet all the requirements listed in the instructions to qualify for the child tax credit.

- If you do not have a qualifying child based on these standards, you cannot claim the child tax credit.

- For those who answered "Yes" to specific questions relating to their situation, as outlined in the form, an alternative publication (Pub. 972) is recommended over the Child Tax Credit Worksheet.

- Income thresholds vary by filing status and affect the credit amount. For example, married individuals filing jointly have a different threshold compared to single filers or those married filing separately.

- The worksheet entails a step-by-step calculation process that determines if the taxpayer's income exceeds a certain limit, which might reduce or eliminate the credit.

- In cases where the calculated child tax credit exceeds the taxpayer's liability, they may be directed to see if they qualify for the Additional Child Tax Credit, which could provide a refund even if they owe no tax.

Understanding these details ensures that taxpayers can accurately assess their eligibility and claim the child tax credit, providing vital financial support for families. Always remember, for more detailed instructions or unique situations, referring to official IRS publications or seeking professional advice is advisable.

Popular PDF Documents

Georgia Hotel Tax - The form serves as a necessary check to ensure that tax exemptions are granted to qualifying stays only.

Inherited Money Taxable - Completion of this form is under penalty of perjury, attesting to its accuracy and completeness.

IRS 4136 - Fuel distributors and users alike should be familiar with form 4136 to understand potential tax benefits.