Get Child Tax Credit Worksheet Form

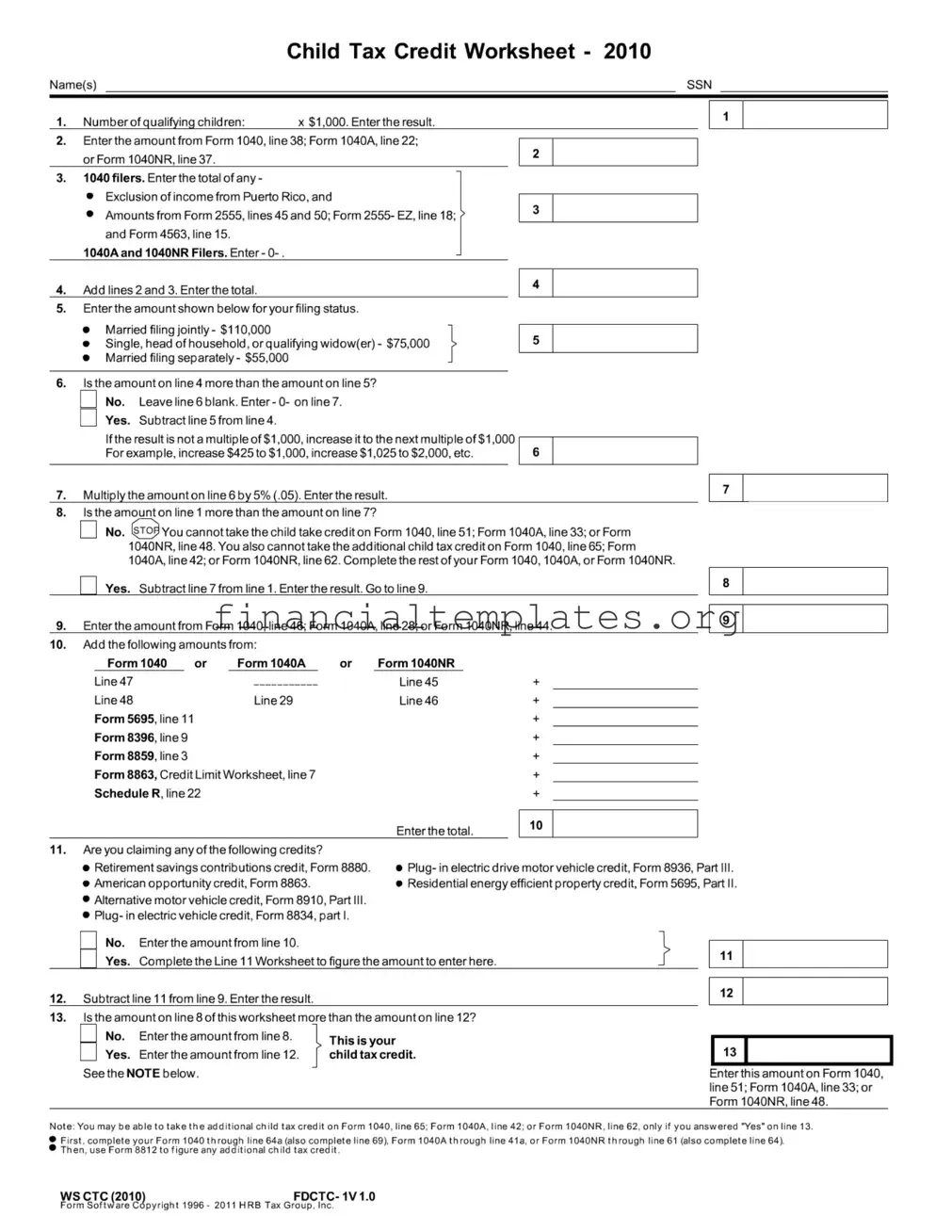

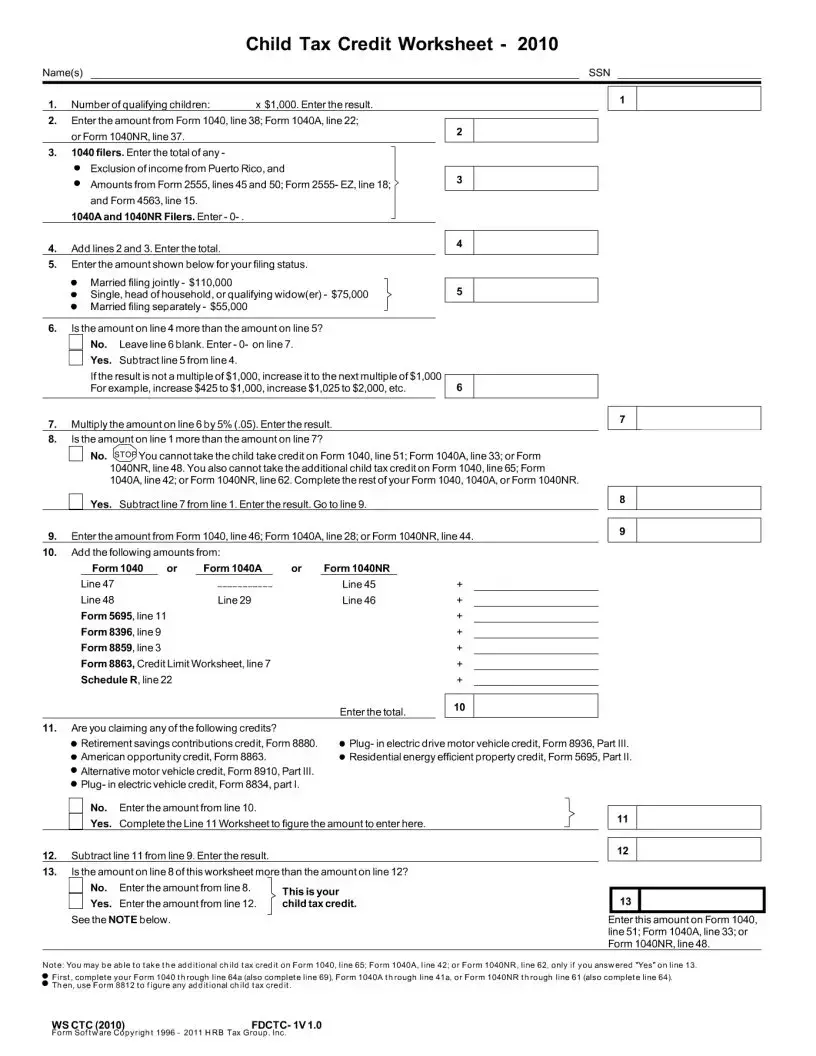

For many American families, navigating the intricacies of tax forms can be a daunting task, particularly when it comes to optimizing deductions and credits for dependents. The Child Tax Credit Worksheet form, serving as a crucial tool in 2010, was designed to guide taxpayers through the process of determining their eligibility for the Child Tax Credit—a benefit aimed at offering financial relief to families by reducing their tax liability on a per-child basis. This form begins with the straightforward task of counting qualifying children and calculating a base credit amount. Taxpayers are then instructed to report their adjusted gross income and to adjust this figure by adding specific types of income or deductions that are relevant only to certain types of filers. This adjusted gross figure is then compared against set income thresholds, which differ based on filing status, to determine if the credit amount needs to be reduced. For those with incomes exceeding these thresholds, the form provides a formula to calculate the reduced credit amount. Crucially, the worksheet navigates filers through various other credits and deductions they may be claiming, to ensure these do not overlap or negate their eligibility for the Child Tax Credit. Additionally, it lays out steps for those who find themselves eligible for the Additional Child Tax Credit—a refundable credit for taxpayers who receive less than the full Child Tax Credit amount. The thoroughness of this worksheet underscores the complexity of tax law, while also endeavoring to simplify the process of ensuring families receive every dollar of relief they are entitled to.

Child Tax Credit Worksheet Example

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | The Child Tax Credit Worksheet is used to determine eligibility for the child tax credit. |

| 2 | For each qualifying child, a potential credit of $1,000 is factored into calculations. |

| 3 | Income thresholds vary based on filing status, affecting eligibility for the credit. |

| 4 | The worksheet helps filers adjust gross income with specific exclusions and add-ons. |

| 5 | If adjusted income exceeds a specified limit, a phased reduction of the credit begins. |

| 6 | Filers with no qualifying children or with income too high after adjustments cannot claim the credit. |

| 7 | Additional credits and deductions are considered in the comprehensive calculation on the worksheet. |

| 8 | A note at the end of the worksheet guides filers on claiming the additional child tax credit using Form 8812. |

Guide to Writing Child Tax Credit Worksheet

Filling out the Child Tax Credit Worksheet is an important step for many taxpayers to ensure they are claiming the correct amount of child tax credit on their tax returns. This credit can significantly reduce the amount of tax you may owe and, in some cases, increase your refund. The steps below will guide you through completing the form accurately.

- Write down the name(s) of the filer or filers at the very top of the worksheet where indicated.

- For line 1, count the number of qualifying children you have and multiply this number by $1,000. Enter the result on this line.

- Refer to your tax return to find the amount on Form 1040, line 38; Form 1040A, line 22; or Form 1040NR, line 37. Enter this amount on line 2 of the worksheet.

- On line 3, if you are a 1040 filer, sum up any exclusion of income from Puerto Rico and amounts from Form 2555, lines 45 and 50; Form 2555-EZ, line 18; and Form 4563, line 15. If you are a 1040A or 1040NR filer, enter -0-.

- Add the amounts on lines 2 and 3, and enter the total on line 4.

- On line 5, enter the amount shown for your filing status. The choices are Married filing jointly-$110,000; Single, head of household, or qualifying widow(er)- $75,000; or Married filing separately-$55,000.

- Determine if the amount on line 4 is more than the amount on line 5. If no, skip to line 7 and enter -0-. If yes, subtract line 5 from line 4. Adjust this result to the next multiple of $1,000 if it’s not already, and enter this on line 6.

- Multiply the amount on line 6 by 5% (.05). Enter the result on line 7.

- For line 8, check if the amount from line 1 is more than the amount on line 7. If no, you cannot take the child tax credit, and you must skip to completing the rest of your Form 1040, 1040A, or 1040NR. If yes, subtract line 7 from line 1 and go to line 9.

- Enter the amount from Form 1040, line 46; Form 1040A, line 28; or Form 1040NR, line 44 on line 9.

- On line 10, sum the following amounts from your tax forms as applicable and enter the total: Form 1040 lines 47 and 48; Form 1040A lines 29 and 46; Form 1040NR lines 45 and 62; and if applicable, Form 5695, line 11; Form 8396, line 9; Form 8859, line 3; Form 8863, Credit Limit Worksheet, line 7; Schedule R, line 22.

- For line 11, if you are claiming any of the listed credits such as the retirement savings contributions credit or the American opportunity credit, complete the Line 11 Worksheet to figure the amount to enter. Otherwise, transfer the amount from line 10.

- Subtract line 11 from line 9. Enter the result on line 12.

- Check if the amount on line 8 is more than the amount on line 12. If no, enter the amount from line 8 in the space provided; this is your child tax credit. If yes, enter the amount from line 12.

- Enter the determined child tax credit amount on Form 1040, line 51; Form 1040A, line 33; or Form 1040NR, line 48, as applicable.

After completing the Child Tax Credit Worksheet, you may also be eligible to claim the additional child tax credit using Form 8812 if you answered "Yes" on line 13. This step is crucial for maximizing your beneficial credits. Remember, these instructions assume the most common scenarios and might vary depending on specific tax situations. Always consult the IRS instructions or a tax professional if you're unsure about your particular tax situation.

Understanding Child Tax Credit Worksheet

Welcome to the FAQ section for the Child Tax Credit Worksheet. Here, we address common questions about filling out the form and understanding its components. This guide aims to help you navigate through the process with ease.

What is the purpose of the Child Tax Credit Worksheet?

This worksheet is designed to help determine the amount of child tax credit you can claim on your tax return. It takes into account the number of qualifying children, your income, and other tax credits you're claiming to calculate the credit you're eligible for.

How do I know if my child qualifies for the Child Tax Credit?

A qualifying child must be under 17 years of age at the end of the tax year, be a U.S. citizen, national, or resident, and must have lived with you for more than half of the tax year. Additionally, the child must not have provided over half of their own support for the year.

What should I enter in the "Number of qualifying children" section?

Enter the total number of children that meet the criteria for qualifying children. Multiply this number by $1,000 and enter the result in the space provided on the form.

Where can I find the amounts to enter from my Form 1040 or Form 1040A?

You can find the required amounts on your Form 1040, line 38; Form 1040A, line 22; or Form 1040NR, line 37. These lines represent your adjusted gross income, which is used in calculating eligibility for the credit.

What if my income is higher than the limit listed on the form?

If your income exceeds the thresholds based on your filing status, you may need to complete additional steps on the worksheet to determine if your credit amount is reduced. The worksheet guides you through this process, which involves calculating a reduction based on your income over the limit.

Can I still claim the Child Tax Credit if I'm filing separately from my spouse?

Yes, you can still claim the credit if you're married filing separately, but the income limit for this filing status is lower ($55,000) compared to other statuses. This means your credit may be reduced at a lower income level than if you were filing together or under a different status.

What happens if I can't claim the Child Tax Credit?

If you're not eligible to claim the Child Tax Credit because the amount on line 1 is not more than the amount on line 7, or due to other factors, you might still be able to claim the Additional Child Tax Credit using Form 8812, depending on your specific circumstances.

How does the phase-out affect the credit amount?

The phase-out begins at the income limits specified for your filing status. If your income is above the threshold, the credit amount is reduced by 5% of the amount by which your income exceeds the limit. This reduction continues until it reaches zero, meaning higher income earners may receive a reduced credit or no credit at all.

Where do I enter the calculated Child Tax Credit on my tax return?

Enter the credit amount from line 8 or line 12 of the Child Tax Credit Worksheet on your Form 1040, line 51; Form 1040A, line 33; or Form 1040NR, line 48. Be sure to also check if you're eligible for the Additional Child Tax Credit, which could provide further tax relief.

Common mistakes

When completing the Child Tax Credit Worksheet, attention to detail is crucial. Here are some common mistakes that should be avoided to ensure the correct calculation of your Child Tax Credit:

- Not accurately counting the number of qualifying children: Each child adds $1,000 to the credit. Overlooking a child or adding one incorrectly can significantly impact the total credit amount.

- Incorrectly reporting income: The income entered from Form 1040, 1040A, or 1040NR is crucial for calculating the credit correctly. Errors here can lead to miscalculations in the credit amount.

- Omitting income adjustments for specific filers: Failing to include income exclusions and amounts from forms like 2555 and 4563 if required, or incorrectly adding these when not applicable, can affect the credit calculation.

- Misinterpreting filing status income limits: Each filing status has a different income limit that affects the credit. Incorrectly applying these limits can lead to an erroneous credit calculation.

- Improper calculation of reduced credit for higher incomes: The worksheet guides filers in adjusting the credit for those with incomes above certain thresholds. Missteps in this calculation can either inflate or decrease the credit incorrectly.

- Incorrect multiplication by 5% (.05) when required: This step is crucial for certain filers and inaccuracies here can skew the final credit figure.

- Failing to accurately complete related forms: The child tax credit often requires information from other tax forms. Overlooking or incorrectly filling out these forms can result in errors on the Child Tax Credit Worksheet.

- Skipping or incorrectly completing the Line 11 Worksheet: For those claiming additional specific credits, the Line 11 Worksheet is vital. Errors or omissions here can lead to incorrectly calculated child tax credit.

In addition to these specific errors, it is always important to double-check the entire form before submission. Ensuring that every line is correctly filled out according to your individual tax situation can help maximize your benefits and minimize delays or corrections down the line.

Documents used along the form

When filing for the Child Tax Credit, aside from the Child Tax Credit Worksheet, filers often need to interact with multiple other documents to ensure they qualify for the credit and correctly apply it to their tax return. Understanding these documents can streamline the process and ensure accuracy in filing.

- Form 1040: The U.S. Individual Income Tax Return form is the starting point for personal tax filing. It helps taxpayers calculate their total income, tax deductions, and credits, including the child tax credit.

- Form 2555 or Form 2555-EZ: These forms are used by taxpayers to claim the Foreign Earned Income Exclusion. Relevant sections of these forms are considered when calculating the child tax credit to adjust for any excluded foreign income.

- Form 8812: Additional Child Tax Credit form is necessary for those who qualify for more than the allowable claim on their standard tax return. This form calculates the remaining amount of child tax credit that can be claimed.

- Form 8863: Education Credits form is used to claim the American opportunity and lifetime learning education credits. Portions of this form intersect with the Child Tax Credit Worksheet when calculating the total credits a taxpayer is eligible for.

Each of these forms plays a pivotal role in ensuring taxpayers accurately claim the child tax credit among other potential tax benefits and obligations. Proper completion and understanding of these documents help in maximizing tax returns while complying with tax laws.

Similar forms

The Earned Income Tax Credit (EITC) form shares similarities with the Child Tax Credit Worksheet in that both are designed to assist taxpayers in determining their eligibility for certain tax benefits based on specific eligibility criteria. For the EITC, factors such as income level, filing status, and the number of qualifying children play crucial roles in the calculation process, mirroring how the Child Tax Credit Worksheet requires taxpayers to consider the number of qualifying children and income to determine the credit amount. Both forms necessitate the taxpayer to follow a step-by-step calculation process to ascertain the credit amount they are entitled to, ensuring that taxpayers accurately apply tax provisions to their benefit.

Form 8863, known as the Education Credits form, is utilized to calculate the American Opportunity and Lifetime Learning educational credits. This form is similar to the Child Tax Credit Worksheet because it involves evaluating eligibility through set criteria, including expenses paid and the taxpayer's income. Both forms guide the taxpayer through a series of calculations to determine the applicable credit, placing an emphasis on qualifying expenses (tuition and related expenses for Form 8863, and number of qualifying children for the Child Tax Credit Worksheet). They play pivotal roles in helping taxpayers reduce their tax liability based on expenditures related to family and education.

The Additional Child Tax Credit form, or Form 8812, is another document closely aligned with the Child Tax Credit Worksheet. Form 8812 is specifically designed for taxpayers who receive less than the full amount of the Child Tax Credit and may be eligible for a refundable Additional Child Tax Credit. The connection between the Child Tax Credit Worksheet and Form 8812 is direct as taxpayers often use the Worksheet to determine initial eligibility and the credit amount before proceeding to Form 8812 for any residual benefit. This sequence underscores the built-in continuity within the tax code for maximizing taxpayer benefits associated with child dependents.

Finally, the Deduction for Exemptions Worksheet, although not tied to a specific IRS form number, is an analogous document used in determining eligibility for personal and dependency exemptions. Similar to the Child Tax Credit Worksheet, this worksheet also requires taxpayers to assess their income and personal circumstances (in this case, the number of dependents) to calculate potential deductions. Both worksheets function under the principle of leveraging taxpayer-specific information to facilitate reductions in taxable income, illustrating the broader mechanism within the tax system for adjusting liability based on family size and financial situation.

Dos and Don'ts

When filling out the Child Tax Credit Worksheet, it’s important to approach the form with accuracy and attention to detail to ensure you maximize your benefits while remaining compliant with tax laws. Below are key do’s and don’ts to consider during this process:

- Do carefully review the instructions before starting. Understanding the requirements can help avoid common mistakes.

- Do ensure accuracy when reporting the number of qualifying children. Each child can significantly impact the total credit.

- Do use the correct income amounts from your tax forms (Form 1040, Form 1040A, or Form 1040NR) as specified in steps 2 and 9.

- Don't overlook the income thresholds that affect your filing status. These thresholds can influence your eligibility and the credit amount.

- Don't guess or estimate figures. Use precise amounts from the relevant tax documents to fill out the worksheet.

- Don't ignore the additional credits that might apply to you, such as the retirement savings contributions credit or the American opportunity credit.

By following these guidelines, taxpayers can more effectively navigate the Child Tax Credit Worksheet, potentially reducing the risk of errors and optimizing the child tax credit’s financial benefit. Remember to double-check your calculations and consider consulting a tax professional if you encounter complex situations or have specific questions.

Misconceptions

When it comes to understanding the Child Tax Credit Worksheet, several misconceptions often arise. Clarifying these misunderstandings is crucial for accurately completing your taxes and ensuring you receive any credits to which you're entitled. Here's a list of common misconceptions:

- All children qualify for the Child Tax Credit.

This assumption is incorrect. Eligibility for the credit depends not just on having a child but on several criteria, including the child's relationship to you, their age, their residency, and how they support themselves during the year.

- The Child Tax Credit amount is the same for every family.

The truth is, the credit amount can vary. The base amount is $1,000 per qualifying child, but the actual credit you're eligible for can be reduced based on your income level.

- Income from Puerto Rico doesn't affect the Child Tax Credit.

In fact, if you're filing Form 1040, income exclusions from Puerto Rico or amounts from specific forms like 2555 or 4563 can impact the computation of your total income, potentially affecting the Child Tax Credit.

- If your income is too high, you automatically can't get the Child Tax Credit.

While high income can phase out the credit, it does not outright eliminate eligibility for everyone. The worksheet includes steps to adjust the credit based on income, potentially still allowing for a partial credit.

- Filing status doesn't significantly impact the Child Tax Credit.

On the contrary, your filing status (married filing jointly, single, etc.) sets different income thresholds that determine the phase-out of the credit. Therefore, it plays a critical role in calculating the credit.

- You can claim the Child Tax Credit for all dependents.

This is not accurate; only children who meet specific criteria qualify. Other dependents, like elderly parents, do not qualify for this particular credit.

- If part of the credit gets phased out, you lose all of it.

This understanding is not right. Even if your income exceeds the threshold, the worksheet helps calculate a reduced credit rather than eliminating it entirely.

- Claiming the Child Tax Credit is always straightforward.

Given the complexities involved, including various incomes, phase-out thresholds, and additional credits, understanding and claiming the Child Tax Credit can be quite intricate. The worksheet is a tool designed to navigate these complexities.

By debunking these misconceptions, taxpayers can better navigate the process of claiming the Child Tax Credit, ensuring they maximize their eligible benefits come tax time.

Key takeaways

Understanding the Child Tax Credit Worksheet is essential for accurately claiming the child tax credit on your tax return. Here are key takeaways to guide you through the process:

- The first step involves counting the number of qualifying children and multiplying by $1,000. This forms the basis of your potential child tax credit.

- You will need to refer to your Form 1040, 1040A, or 1040NR to find the relevant line that details your income, which is crucial for determining eligibility.

- Certain income exclusions and amounts from specific forms like Form 2555 or Form 4563 must be considered and may alter the final calculation for filers with these circumstances.

- The worksheet requires you to compare your modified adjusted gross income (as calculated on the form) to predetermined income thresholds, which vary depending on your filing status. These thresholds are crucial in determining the reduction, if any, to your child tax credit.

- If your income exceeds the threshold for your filing status, you must calculate the reduction in your credit. This involves subtracting the threshold amount from your income, adjusting to the nearest $1,000 if not already a multiple thereof, and then applying a percentage to find the reduction amount.

- Eligibility for the child tax credit or the additional child tax credit is directly influenced by whether your calculated credit (after reductions based on income) exceeds other tax liabilities listed on your tax form.

- The worksheet guides you through adjusting your eligible credit based on other credits you are claiming, ensuring that your total credits do not exceed your total tax liability.

- For those eligible for the additional child tax credit, the worksheet instructs on next steps, including completing Form 8812 to determine the exact amount of the additional credit.

Overall, carefully following the Child Tax Credit Worksheet instructions ensures accurate computation of the child tax credit, potentially leading to significant tax savings.

Popular PDF Documents

2024 Ev Rebate - The form requires detailed information about the vehicle, including its identification number and date of service.

940 Taxes - Failure to accurately complete Schedule A can lead to underpayment or overpayment of FUTA taxes, affecting an employer’s financial standing.

Arkansas Sales Tax - Guarantees a consistent approach to tax reporting, benefiting both businesses and the state.