Get Carefirst Eft Form

In today’s fast-moving healthcare environment, managing finances efficiently is crucial for providers, and that’s where tools like the CareFirst Electronic Funds Transfer (EFT) form come into play. This form, integral for initiating automatic deposits for providers, simplifies financial transactions by ensuring payments from CareFirst BlueCross BlueShield go directly into a designated bank account. The form is comprehensive, requiring details such as provider information, financial institution information, and specific reasons for submission, be it a new enrollment, a change, or a cancellation of enrollment. Providers must provide their Federal Tax Identification Number (TIN) or National Provider Identifier (NPI), alongside contact and banking details, to facilitate this electronic transfer. The requirement of attaching a voided check or a bank letter underscores the importance of verifying account details to prevent any discrepancies in payments. Furthermore, the form outlines instructions for providers to notify their banks to ensure the delivery of CORE-required minimum CCD+ data elements for successful EFT payment. By embracing this authorization agreement, providers agree to electronic deposits, thereby waiving the receipt of printed voucher summaries, which not only streamlines the payment process but also supports environmental sustainability by reducing paper use. This adoption marks a significant move towards leveraging technology to enhance operational efficiency in healthcare finance management.

Carefirst Eft Example

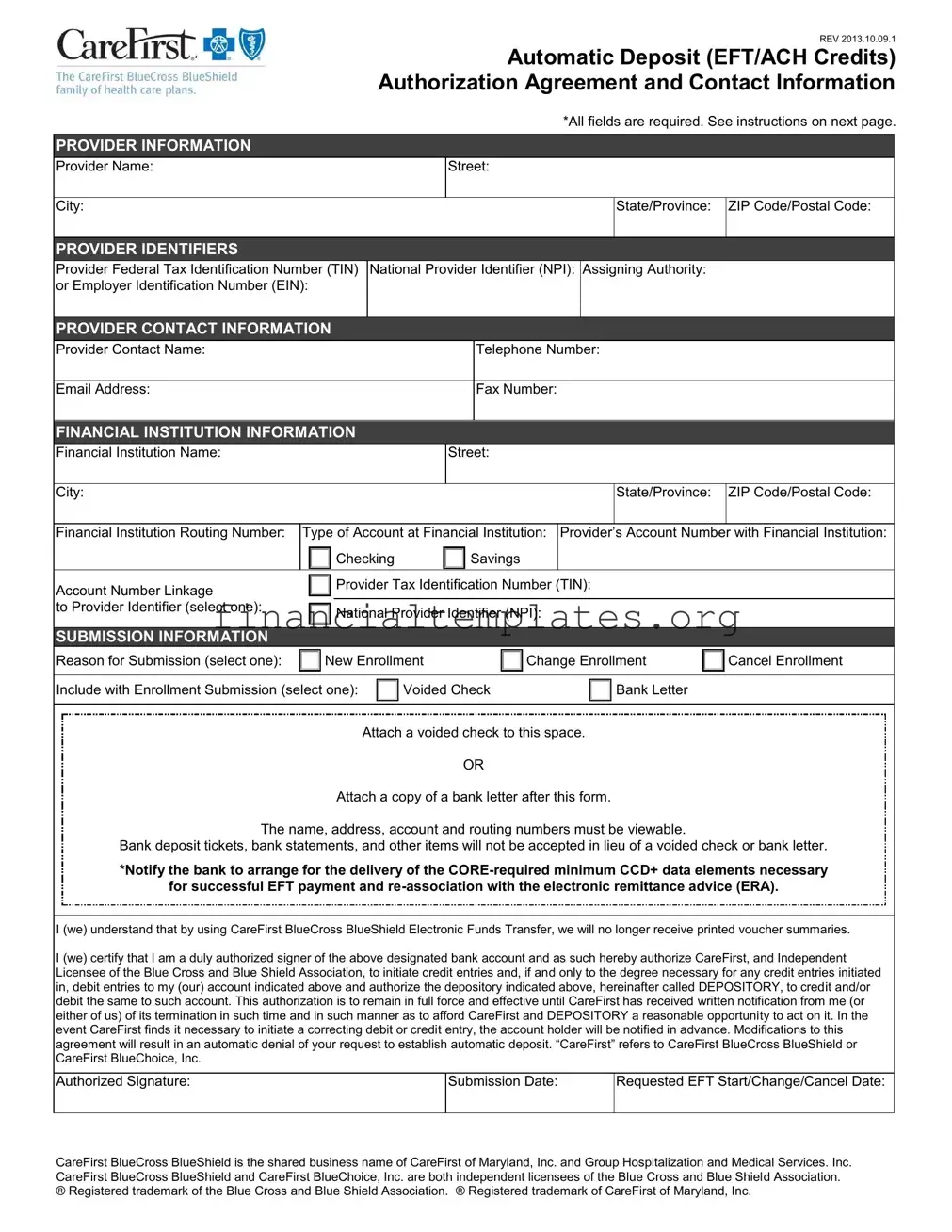

REV 2013.10.09.1

Automatic Deposit (EFT/ACH Credits)

Authorization Agreement and Contact Information

*All fields are required. See instructions on next page.

PROVIDER INFORMATION

Provider Name:

Street:

City:

State/Province:

ZIP Code/Postal Code:

PROVIDER IDENTIFIERS

Provider Federal Tax Identification Number (TIN) National Provider Identifier (NPI): Assigning Authority: or Employer Identification Number (EIN):

PROVIDER CONTACT INFORMATION

Provider Contact Name:

Telephone Number:

Email Address:

Fax Number:

FINANCIAL INSTITUTION INFORMATION

Financial Institution Name:

Street:

|

City: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State/Province: |

ZIP Code/Postal Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Institution Routing Number: |

Type of Account at Financial Institution: |

Provider’s |

Account Number |

with Financial Institution: |

|||||||||||||

|

|

|

|

|

|

Checking |

|

|

Savings |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Number Linkage |

|

|

|

|

Provider Tax Identification Number (TIN): |

|

|||||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to Provider Identifier (select one): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

National Provider Identifier (NPI): |

|

||||||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBMISSION INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Reason for Submission (select one): |

|

|

New Enrollment |

|

Change Enrollment |

|

Cancel Enrollment |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Include with Enrollment Submission (select one): |

|

Voided Check |

|

|

|

|

Bank Letter |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach a voided check to this space.

OR

Attach a copy of a bank letter after this form.

The name, address, account and routing numbers must be viewable.

Bank deposit tickets, bank statements, and other items will not be accepted in lieu of a voided check or bank letter.

*Notify the bank to arrange for the delivery of the

for successful EFT payment and

I (we) understand that by using CareFirst BlueCross BlueShield Electronic Funds Transfer, we will no longer receive printed voucher summaries.

I (we) certify that I am a duly authorized signer of the above designated bank account and as such hereby authorize CareFirst, and Independent Licensee of the Blue Cross and Blue Shield Association, to initiate credit entries and, if and only to the degree necessary for any credit entries initiated in, debit entries to my (our) account indicated above and authorize the depository indicated above, hereinafter called DEPOSITORY, to credit and/or debit the same to such account. This authorization is to remain in full force and effective until CareFirst has received written notification from me (or either of us) of its termination in such time and in such manner as to afford CareFirst and DEPOSITORY a reasonable opportunity to act on it. In the

event CareFirst finds it necessary to initiate a correcting debit or credit entry, the account holder will be notified in advance. Modifications to this agreement will result in an automatic denial of your request to establish automatic deposit. “CareFirst” refers to CareFirst BlueCross BlueShield or

CareFirst BlueChoice, Inc.

Authorized Signature:

Submission Date:

Requested EFT Start/Change/Cancel Date:

CareFirst BlueCross BlueShield is the shared business name of CareFirst of Maryland, Inc. and Group Hospitalization and Medical Services. Inc. CareFirst BlueCross BlueShield and CareFirst BlueChoice, Inc. are both independent licensees of the Blue Cross and Blue Shield Association. ® Registered trademark of the Blue Cross and Blue Shield Association. ® Registered trademark of CareFirst of Maryland, Inc.

REV 2013.10.09.1

Automatic Deposit (EFT/ACH Credits)

Authorization Agreement and Contact Information

Instructions

1.Complete the form (type all responses). For information about a field on the form, refer to the field descriptions below.

2.Attach a voided check in the space provided on the form or attach a copy of a bank letter after the form.

3.Send the completed form via

What information do I need to provide to the bank?

You must contact your financial institution to arrange for the delivery of the

Effective Entry Date

Amount

Who do I contact if I have questions?

If you have questions regarding the EFT enrollment process, contact Availity Client Services at 1.800.AVAILITY (282.4548).

Field |

Description |

PROVIDER INFORMATION |

|

Provider Name |

Complete legal name of institution, corporate entity, practice or individual provider. |

|

|

Street |

The number and street name where a person or organization can be found. |

|

|

City |

City associated with provider address field. |

|

|

State/Province |

ISO |

|

applicable Country. |

|

|

ZIP Code/Postal Code |

System of |

|

U.S. in 1963 to improve mail delivery and exploit electronic reading and sorting |

|

capabilities. |

|

|

PROVIDER IDENTIFIERS |

|

Provider Federal Tax Identification Number |

A Federal Tax Identification Number, also known as an Employer Identification Number |

(TIN) or Employer Identification Number |

(EIN), is used to identify a business entity. |

(EIN) |

|

|

|

National Provider Identifier (NPI) |

A Health Insurance Portability and Accountability Act (HIPAA) Administrative |

|

Simplification Standard. The NPI is a unique identification number for covered healthcare |

|

providers. Covered healthcare providers and all health plans and healthcare |

|

clearinghouses must use the NPIs in the administrative and financial transactions |

|

adopted under HIPAA. The NPI is a |

|

digit number). This means that the numbers do not carry other information about |

|

healthcare providers, such as the state in which they live or their medical specialty. The |

|

NPI must be used in lieu of legacy provider identifiers in the HIPAA standards |

|

transactions. |

|

|

Assigning Authority |

Organization that issues and assigns the additional identifier requested on the form, e.g., |

|

Medicare, Medicaid. |

|

|

PROVIDER CONTACT INFORMATION |

|

Provider Contact Name |

Name of a contact in provider office for handling EFT issues. |

|

|

Telephone Number |

Associated with contact person. |

|

|

Email Address |

An electronic mail address at which the health plan might contact the provider. |

|

|

Fax Number |

A number at which the provider can be sent facsimiles. |

|

|

|

|

REV 2013.10.09.1 |

|

|

Automatic Deposit (EFT/ACH Credits) |

|

|

Authorization Agreement and Contact Information |

Instructions (continued) |

|

|

|

|

|

Field |

Description |

|

FINANCIAL INSTITUTION INFORMATION |

|

|

Financial Institution Name |

Official name of the provider’s financial institution. |

|

Street |

Street address associated with receiving depository financial institution name field. |

|

|

|

|

City |

City associated with receiving depository financial institution address field. |

|

|

|

|

State/Province |

ISO |

|

|

applicable Country. |

|

|

|

|

ZIP Code/Postal Code |

System of |

|

|

U.S. in 1963 to improve mail delivery and exploit electronic reading and sorting |

|

|

capabilities. |

|

|

|

|

Financial Institution Routing Number |

A |

|

|

which payments are to be deposited. |

|

|

|

|

Type of Account at Financial Institution |

The type of account the provider will use to receive EFT payments, e.g., Checking, |

|

|

Saving. |

|

|

|

|

Provider’s Account Number with Financial |

Provider’s account number at the financial institution to which EFT payments are to be |

|

Institution |

deposited. |

|

|

|

|

Account Number Linkage to Provider |

Provider preference for grouping (bulking) claim |

|

Identifier |

v5010 X12 835 remittance advice. Select one of the following options: |

|

|

Provider Tax Identification Number (TIN) – Enter a TIN in the field provided if you |

|

|

|

select this option. |

|

National Provider Identifier (NPI) – Enter an NPI in the field provided if you select |

|

|

|

this option. |

|

|

|

SUBMISSION INFORMATION |

|

|

Reason for Submission |

Select one of the following options: |

|

|

|

New Enrollment |

|

|

Change Enrollment |

|

|

Cancel Enrollment |

|

|

|

Include with Enrollment Submission |

Select one of the following options: |

|

|

Voided Check – A voided check is attached to provide confirmation of |

|

|

|

Identification/Account Numbers. |

|

Bank Letter – A letter on bank letterhead that formally certifies the account owners |

|

|

|

routing and account numbers. |

|

|

|

Authorized Signature |

The signature of an individual authorized by the provider or its agent to initiate, modify or |

|

|

terminate an enrollment. May be used with electronic and |

|

|

enrollment. |

|

|

|

|

Submission Date |

The date on which the enrollment is submitted. |

|

|

|

|

Requested EFT Start/Change/Cancel Date |

The date on which the requested action is to begin. |

|

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Revision Date | The form was last revised on October 9, 2013. |

| Mandatory Fields | All fields on the form are required to be completed for processing. |

| Provider Identifiers | Identification includes Provider Federal Tax Identification Number (TIN), National Provider Identifier (NPI), or Employer Identification Number (EIN). |

| Financial Institution Details | Details required include the name, address, and routing number of the financial institution, and the type and number of the provider's account. |

| Account Number Linkage | Providers must specify linking their account number to either their TIN or NPI. |

| Submission Reasons | Options available are New Enrollment, Change Enrollment, or Cancel Enrollment. |

| Documentation Requirement | A voided check or a bank letter is required for enrollment submission. |

| Authorization Statement | Providers must authorize CareFirst to initiate credit (and if necessary, correcting debit) entries and acknowledge this authorization remains effective until written termination notice is received. |

Guide to Writing Carefirst Eft

Filling out the CareFirst EFT form is a straightforward process designed to enable automatic deposits for transactions. By providing all the required information accurately, you can ensure that funds are transferred directly to your bank account without the need for manual handling. Whether you're setting up a new enrollment, making changes to your current details, or cancelling your enrollment, completing this form is the first step towards simplifying your financial transactions with CareFirst. Below are the steps you will need to follow to fill out the CareFirst EFT form.

- Provider Information: Start by entering the complete legal name of the institution, corporate entity, practice, or individual provider. Include the street, city, state or province, and ZIP code or postal code.

- Provider Identifiers: Input your Provider Federal Tax Identification Number (TIN) or Employer Identification Number (EIN), National Provider Identifier (NPI), and the assigning authority.

- Provider Contact Information: Fill in the contact name, telephone number, email address, and fax number of the provider’s contact person for handling EFT issues.

- Financial Institution Information: Enter the name of your financial institution along with the street, city, state or province, and ZIP code or postal code. Include the financial institution’s routing number, the type of account (checking or savings), and the provider’s account number.

- Account Number Linkage: Choose whether the account number is linked to the Provider Tax Identification Number (TIN) or National Provider Identifier (NPI). Provide the corresponding number based on your selection.

- Submission Information: Select the reason for your submission (new enrollment, change enrollment, cancel enrollment) and how you will include confirmation of your bank details (voided check or bank letter).

- Attach a voided check or a bank letter to the designated space in the form. Ensure the document contains the name, address, account, and routing numbers clearly.

- Provide the authorized signature, submission date, and the requested EFT start/change/cancel date at the bottom of the form.

- Finally, send the completed form, along with the attached document (voided check or bank letter), via email to EFTenrollment@availity.com or fax it to 904-470-4781.

After submitting the form, it’s essential to notify your bank to arrange for the delivery of the CORE-required minimum CCD+ data elements necessary for successful EFT payment and re-association with the electronic remittance advice (ERA). If you have any questions during this process, you can contact Availity Client Services for assistance. Completing and submitting this form correctly will expedite the enrollment process and get you started with receiving automatic deposits from CareFirst.

Understanding Carefirst Eft

- What is the purpose of the CareFirst EFT Authorization Agreement?

The CareFirst EFT Authorization Agreement is designed to authorize automatic deposits (EFT/ACH Credits) into a provider's bank account from CareFirst BlueCross BlueShield. This agreement allows for the seamless, electronic transfer of funds, thereby eliminating the need for physical checks and simplifying the payment process.

- Which fields are mandatory on the CareFirst EFT form?

All fields provided in the form are required to be completed. This includes provider information such as the legal name, address, and identifiers like Tax Identification Number (TIN) or National Provider Identifier (NPI); contact information; financial institution information, including account details; and submission information detailing the purpose and specifics of the request.

- How can I submit the completed CareFirst EFT form?

The completed CareFirst EFT form can be submitted via email to EFTenrollment@availity.com or through fax at 904-470-4781. Ensure that all required fields are properly filled and that the form is accompanied by a voided check or bank letter, as requested.

- What should I include with my CareFirst EFT enrollment submission?

For a successful enrollment submission, attach either a voided check to the space provided in the form or a bank letter following the form. This documentation is crucial for confirming the identification and account numbers of your financial institution.

- What is a voided check or bank letter, and why is it necessary?

A voided check or a bank letter is necessary to provide verification of your bank account details, including the account and routing numbers. A voided check is a check that has been cancelled and cannot be used for payment. A bank letter is an official document from your bank certifying your account ownership and details. Including one of these with your enrollment ensures accurate setup of your EFT payments.

- Who should I contact if I have questions about the EFT enrollment process?

For questions or further assistance with the EFT enrollment process, Availity Client Services can be contacted at 1.800.AVAILITY (282.4548). They are available to provide support and answer any queries related to the form or the submission process.

- What information do I need to provide to my bank regarding EFT payments?

You need to inform your financial institution about the delivery of the CORE-required minimum CCD+ data elements necessary for the successful re-association of the EFT payment and the electronic remittance advice (ERA). It includes details such as the Effective Entry Date, Amount, and Payment-Related Information.

- Can I cancel my EFT enrollment?

Yes, you can cancel your EFT enrollment. To do so, select "Cancel Enrollment" under the Reason for Submission in the form and ensure to provide all required information and notifications as per the cancellation process outlined in the form instructions.

- What is the significance of the authorized signature in the EFT form?

The authorized signature is a critical part of the EFT form as it signifies the approval of the individual authorized by the provider or its agent to initiate, modify, or terminate an enrollment for EFT payments. It acts as a formal consent to the terms and conditions set forth in the agreement.

Common mistakes

Filling out the form with incomplete or inaccurate provider information is a common mistake. The form requires the complete legal name of the provider, street address, city, state/province, and ZIP code/postal code. Additionally, either the Provider Federal Tax Identification Number (TIN) or Employer Identification Number (EIN), along with the National Provider Identifier (NPI) and Assigning Authority, must be accurately filled out. These details ensure that the payment is correctly attributed and prevents processing delays.

Another mistake often made is incorrectly entering the financial institution information. This section requires specific details such as the Financial Institution Name, Street, City, State/Province, ZIP Code/Postal Code, Financial Institution Routing Number, Type of Account (checking or savings), and Provider’s Account Number with Financial Institution. Entering incorrect information in this field can lead to payments being sent to the wrong account or financial institution, resulting in delayed payments.

Forgetting to properly select the submission information reason can also pose a problem. Providers must indicate whether the submission is for new enrollment, a change in enrollment, or to cancel enrollment. Additionally, it is crucial to include either a voided check or a bank letter with the enrollment submission for identification/account number verification. Failing to accurately select the correct option or omitting the required documentation can lead to the rejection of the entire application.

Lastly, neglecting to arrange for the delivery of CORE-required minimum CCD+ data elements necessary for successful EFT payment and re-association with the electronic remittance advice (ERA) is a critical error. Providers must ensure they contact their financial institution to arrange the delivery of these details, including the effective entry date, amount, and payment-related information. Overlooking this step can disrupt the smooth processing of payments and delay the benefits of EFT enrollment.

Documents used along the form

Managing healthcare payments involves synchronizing several pieces of information and documentation to ensure that transactions proceed smoothly and without error. The CareFirst Electronic Funds Transfer (EFT) form is one central document in this puzzle, enabling providers to receive payments directly to their bank accounts swiftly and securely. This document, while crucial, often needs to be complemented by additional forms and documents that together create a comprehensive financial management toolkit. Below is a list of these documents, each playing its unique role in the overall process.

- Electronic Remittance Advice (ERA) Authorization Form: This document sets up the electronic delivery of payment notices, detailing the payment transactions made via EFT, and helps providers reconcile their accounts.

- Provider Enrollment Application: Required for new providers to be recognized by a payer, this form includes critical provider business information, service locations, and billing details.

- W-9 Tax Form: Used to provide a provider's Tax Identification Number (TIN) or Social Security Number (SSN) to the payer for tax reporting purposes.

- Direct Deposit Authorization Form: Sometimes separate from the EFT setup document, this authorizes the direct deposit of funds into a specified account.

- Bank Verification Letter: Confirms the provider's bank account details, including routing and account numbers, and is sometimes required as an alternative or in addition to a voided check.

- Change of Information Form: Needed if a provider moves, changes banks, or undergoes any other significant change affecting payment or contact info.

- Claim Adjustment Request Form: For instances where a previous claim needs correction or adjustment, impacting the payment received.

- Privacy and Security Agreement Form: Ensures that the provider complies with HIPAA and other privacy laws concerning the handling of patient data and financial transactions.

- Credentialing Application: For providers to be formally recognized by a payer, this extensive document includes credential and qualification details.

- Dispute Resolution or Appeal Form: In the case of a disagreement with a payment or claim decision, this form initiates a review.

Together, these documents form a network that supports the efficient and secure management of healthcare payments. From the foundational EFT authorization that enables smooth, direct payments to forms ensuring compliance and accuracy in financial and operational data, each plays a vital role in fostering a positive financial relationship between providers and payers. Understanding and properly managing these documents can significantly enhance the operational efficiency and financial health of a healthcare provider's practice.

Similar forms

The Direct Deposit Authorization Form is quite similar to the CareFirst EFT Form. Both forms are designed to collect necessary banking details to set up electronic funds transfers directly into an account. They require the account holder's name, the financial institution's name and address, the bank routing number, and the account number. The main goal is to streamline payment processes, ensuring timely and direct deposit of funds into the account specified by the account holder.

Another document that shares similarities with the CareFirst EFT Form is the Payroll Direct Deposit Form often used by employers. This form collects employee banking information to deposit salaries directly into their bank accounts. Like the EFT Form, it requires identification of the account type (checking or savings), account and routing numbers, and often a voided check or bank letter to verify the account details. Both forms aim to make the transfer of funds more efficient and reduce the reliance on physical checks.

The Vendor Direct Deposit Authorization is also akin to the CareFirst EFT Form. Vendors provide their banking information on this form to receive payments for goods or services electronically. This form, like the CareFirst version, helps in speeding up the payment process, improving cash flow management for both parties by reducing the delay experienced with traditional cheque payments.

The Health Insurance Payment Authorization Form is another document that shares functionality with the CareFirst EFT Form. It authorizes insurance companies to deposit claim payments directly into the healthcare provider’s or policyholder's bank account. The necessity for accurate provider or policy holder's bank details, including the financial institution’s routing number and the account number, draws a direct parallel to the information requested in CareFirst’s form.

The Tax Refund Direct Deposit Authorization form is designed for taxpayers to receive their state or federal tax refunds electronically. Similar to the CareFirst EFT Form, it requests the taxpayer's banking information, ensuring a direct and secure transfer of their refund into their preferred bank account, which speeds up the refund process considerably compared to traditional mail checks.

An Electronic Rent Payment Authorization form allows tenants to set up automatic rent payments from their bank account. The form collects tenant banking information to automatically transfer rent payments to the landlord’s account. Both this form and the CareFirst EFT Form facilitate regular, scheduled payments, ensuring timely transactions without the physical exchange of cheques or cash.

The Automatic Loan Payment Authorization form is tailored for individuals who wish to automate the repayment of loans. Borrowers submit their banking details through this form, authorizing the lender to deduct loan payments directly from their bank account, similar to how the CareFirst EFT Form sets up for automatic deposits, streamlining the payment process and avoiding late payments.

A Utility Bill Direct Debit Authorization is yet another document sharing similarities with the CareFirst EFT Form. It is used by consumers to set up automatic payments for their utility bills, providing bank account information for this purpose. This form makes the payment of regular bills more convenient by automating the deduction process, paralleling the way the CareFirst form facilitates automatic insurance payment deposits.

The Student Loan Disbursement Authorization form is designed for students or their parents to receive loan amounts directly into a specified bank account. Like the CareFirst EFT Form, it gathers the bank account details necessary for the electronic transfer of funds, ensuring that the borrower receives their funds efficiently for educational expenses.

Lastly, the Investment Dividends Direct Deposit Form is used by investors to have their dividends deposited directly into a bank account. This form collects similar information as the CareFirst EFT Form, such as the investor's bank account and routing numbers, to facilitate the electronic transfer of dividends, highlighting the convenience and efficiency of receiving payments electronically.

Dos and Don'ts

When filling out the CareFirst EFT form effectively and accurately, it is crucial to adhere to both the do's and don'ts involved with the process. This ensures smooth transactions and prevents any potential complications with your enrollment.

Do:

- Ensure all fields are completed: Given that all fields are required as mentioned in the document, make sure no section of the form is left blank. Accurately fill out each part to avoid delays or denial of the request.

- Attach the correct document: Depending on your method of verification, attach either a voided check or a bank letter where specified. This serves as proof of your banking information and is essential for the processing of your EFT requests.

- Contact your financial institution: Prior to submission, it’s necessary to inform your bank about the delivery of CORE-required minimum CCD+ data elements crucial for successful EFT payment and re-association with the electronic remittance advice (ERA).

- Verify all information before submission: Double-check the accuracy of details like Provider Information, Financial Institution Information, and Account Numbers to ensure they are correct. Accurate information expedites the enrollment process.

Don't:

- Leave fields blank: As each field is required, omitting information can result in the automatic denial of your application. Ensure every section is filled out to proceed with your EFT setup.

- Use invalid documents for verification: Bank deposit tickets, bank statements, and other unrelated documents are not accepted for account verification. Only a voided check or bank letter should be attached as indicated.

- Ignore bank coordination: Neglecting to arrange for the delivery of necessary data elements with your bank can disrupt the link between the EFT payment and the ERA, leading to transaction issues.

- Sign without authority: Only an individual authorized by the provider or its agent has the legitimacy to initiate, modify, or terminate an enrollment. Unauthorized submissions can invalidate the process.

Misconceptions

Understanding the nuances of electronic transactions can be complex, and the CareFirst Electronic Funds Transfer (EFT) form is no exception. It's crucial to dispel common misconceptions to ensure a smooth and efficient processing experience for providers. Here are six common misconceptions about the CareFirst EFT form and their clarifications.

All fields are optional as long as the provider's name and account information are provided: Contrary to this belief, the CareFirst EFT form clearly states that all fields are required. This comprehensive approach is designed to prevent processing delays and ensure accurate transaction identification.

A bank statement is sufficient for enrollment submission: The form specifies that a voided check or a bank letter must be attached. Bank statements, deposit tickets, or other documents are not acceptable substitutes. This requirement is intended to verify the account and routing numbers directly.

The form can be submitted without a provider's Tax Identification Number (TIN) or Employer Identification Number (EIN) if they provide their National Provider Identifier (NPI): Despite the critical role of the NPI, the form mandates the inclusion of the provider's TIN or EIN. This dual identification system enhances the specificity of the transaction and aids in its proper management.

Providers can choose any linkage option for payment without considering remittance advice preferences: The linkage to the provider identifier must mirror the provider's preference for v5010 X12 835 remittance advice. This alignment is critical for ensuring that EFT payments and electronic remittance advice (ERA) are correctly associated.

Once submitted, the EFT form's details cannot be modified: Although modifications are indeed subject to scrutiny, the form allows for changes or cancellations of enrollment. Providers must clearly indicate their intention for a new enrollment, change, or cancellation. It is essential to understand that these actions require proper notification and adherence to procedures to be effectively processed.

The form provides immediate activation of EFT transactions: The requested EFT start/change/cancel date section on the form does not guarantee immediate implementation. The effectiveness of any action taken on the form is contingent upon CareFirst's receipt and processing of the form. Providers should allow a reasonable time frame for these requests to be completed.

Dispelling these misconceptions is crucial for providers aiming to utilize the EFT services of CareFirst efficiently. By closely adhering to the form's requirements and understanding its procedural stipulations, providers can ensure a smoother transaction process and enhance their financial operations.

Key takeaways

When dealing with CareFirst's Electronic Funds Transfer (EFT) form, understanding the key components is crucial for smooth and accurate processing. Below are six key takeaways to guide you through the process:

- Complete all fields: The form mandates that all fields be filled out. This includes comprehensive provider information, financial institution details, and your submission intentions, such as whether it’s for new enrollment, a change to existing enrollment, or cancellation.

- Attachment requirements: Depending on your circumstance, you will need to attach either a voided check or a bank letter to your submission. This document is essential for verifying the financial institution’s routing number and your account number.

- Provider Identifier selection: You must choose between linking the EFT payments to your Provider Tax Identification Number (TIN) or your National Provider Identifier (NPI). This choice affects how payments are grouped and associated with your account.

- Digital submission availability: The form and any attachments can be sent via email or fax, offering convenience and flexibility in how you submit your enrollment or changes.

- Important contact information provided: For any questions or clarifications needed during the enrollment process, the form specifies contact details for Availity Client Services, ensuring support is readily available.

- Notification for corrections: In cases where CareFirst needs to initiate a correcting debit or credit entry to your account, you will be proactively notified, ensuring transparency and allowing for any necessary preparations or adjustments on your end.

By following these guidelines and ensuring accuracy in your submission, you can facilitate a smoother transaction process with CareFirst’s EFT system, leading to more efficient and reliable payment transactions for your provided services.

Popular PDF Documents

Tax Lump Sum - It’s essential for taxpayers who received a lump-sum distribution and want to explore a different tax treatment.

Are 100 Disabled Veterans Exempt From Property Taxes - Late payments attract penalties, calculated as a percentage of the fees due, increasing the longer the delay in submission beyond the deadline.

1099-div Form 2022 - Accurate reporting of 1099-DIV information is crucial for calculating potential deductions and credits related to investment income.