Get Car Loan Application Form

Embarking on the journey to acquire a new or used vehicle through financing involves completing a car loan application form—an integral step that initiates the evaluation of an applicant's eligibility for a loan. This comprehensive form collects essential details from the applicant, such as personal information (name, address, and social security number), contact details, employment data including job title, length of employment, salary, and monthly income, alongside housing information (whether the applicant owns or rents their home and the related monthly payments). It covers financial aspects like the desired loan type and amount, term of the loan, availability of a co-signer, and bankruptcy history, if any. Crucially, it asks for permission to perform electronic fund transfers and to obtain a consumer credit report, which is vital for the Enterprise Development Group (EDG) to assess creditworthiness. The form also includes sections for emergency contact information, financial references, and a detailed acknowledgment and agreement by the applicant regarding the terms of the loan application, including fees and authorization for EDG to verify the provided information and conduct a credit investigation. The process culminates with a checklist for internal use by EDG to ensure all necessary documents are collected both for the approval of the loan and its eventual disbursement, highlighting the structured approach toward managing and approving car loans.

Car Loan Application Example

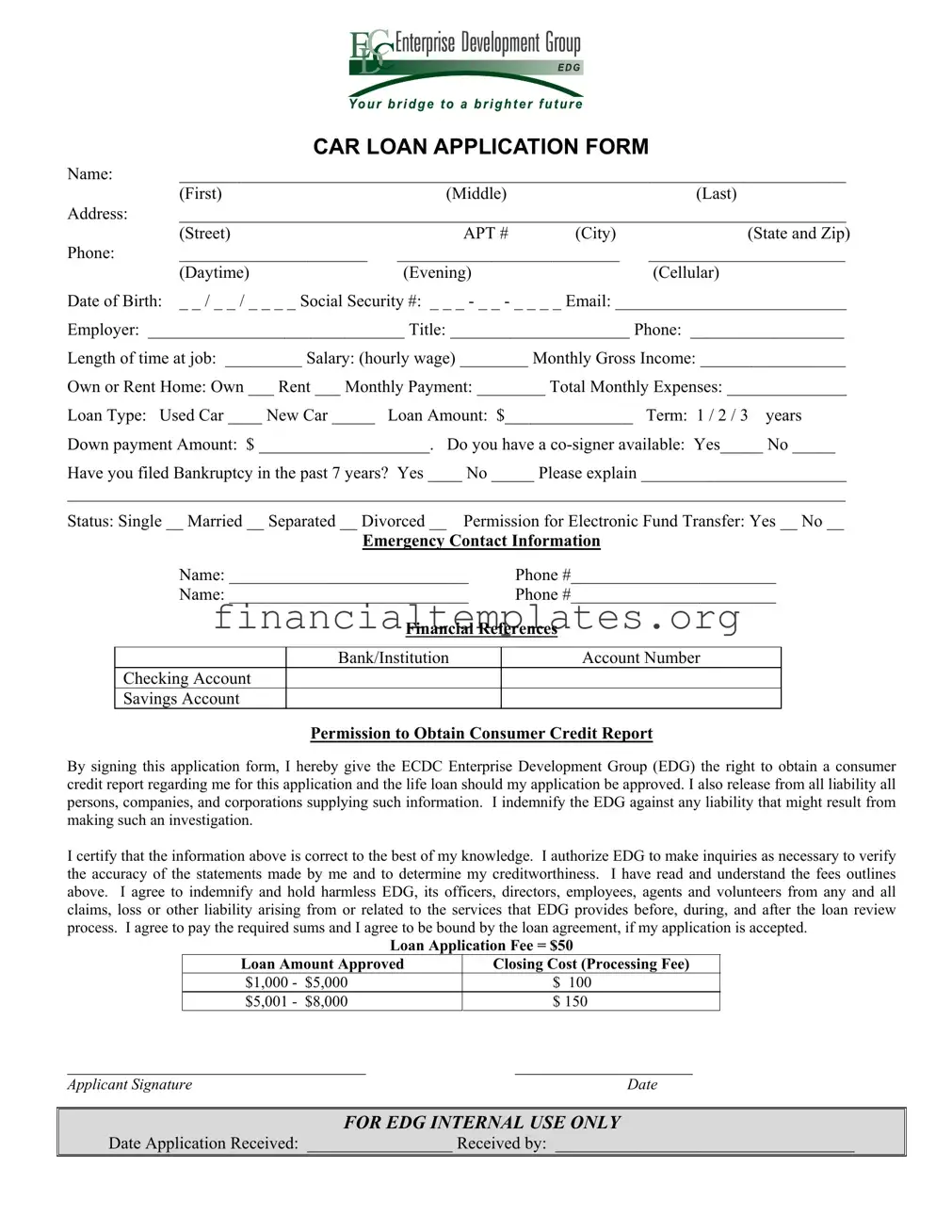

CAR LOAN APPLICATION FORM

Name: |

______________________________________________________________________________ |

|||

|

(First) |

(Middle) |

|

(Last) |

Address: |

______________________________________________________________________________ |

|||

|

(Street) |

APT # |

(City) |

(State and Zip) |

Phone: |

______________________ |

__________________________ |

_______________________ |

|

|

(Daytime) |

(Evening) |

|

(Cellular) |

Date of Birth: |

_ _ / _ _ / _ _ _ _ Social Security #: _ _ _ - _ _ - _ _ _ _ Email: ___________________________ |

|||

Employer: ______________________________ Title: _____________________ Phone: __________________

Length of time at job: _________ Salary: (hourly wage) ________ Monthly Gross Income: _________________

Own or Rent Home: Own ___ Rent ___ Monthly Payment: ________ Total Monthly Expenses: ______________

Loan Type: Used Car ____ New Car _____ Loan Amount: $_______________ Term: 1 / 2 / 3 years

Down payment Amount: $ ____________________. Do you have a

Have you filed Bankruptcy in the past 7 years? Yes ____ No _____ Please explain ________________________

___________________________________________________________________________________________

Status: Single __ Married __ Separated __ Divorced __ Permission for Electronic Fund Transfer: Yes __ No __

Emergency Contact Information

Name: ____________________________ |

Phone #________________________ |

|

Name: ____________________________ |

Phone #________________________ |

|

|

Financial References |

|

|

|

|

|

Bank/Institution |

Account Number |

Checking Account |

|

|

Savings Account |

|

|

Permission to Obtain Consumer Credit Report

By signing this application form, I hereby give the ECDC Enterprise Development Group (EDG) the right to obtain a consumer credit report regarding me for this application and the life loan should my application be approved. I also release from all liability all persons, companies, and corporations supplying such information. I indemnify the EDG against any liability that might result from making such an investigation.

I certify that the information above is correct to the best of my knowledge. I authorize EDG to make inquiries as necessary to verify the accuracy of the statements made by me and to determine my creditworthiness. I have read and understand the fees outlines above. I agree to indemnify and hold harmless EDG, its officers, directors, employees, agents and volunteers from any and all claims, loss or other liability arising from or related to the services that EDG provides before, during, and after the loan review process. I agree to pay the required sums and I agree to be bound by the loan agreement, if my application is accepted.

|

Loan Application Fee = $50 |

|

|

Loan Amount Approved |

Closing Cost (Processing Fee) |

|

$1,000 - $5,000 |

$ 100 |

|

$5,001 - $8,000 |

$ 150 |

________________________________ |

___________________ |

|

Applicant Signature |

Date |

|

FOR EDG INTERNAL USE ONLY

Date Application Received: _________________ Received by: ___________________________________

FOR EDG INTERNAL USE ONLY

Approval Documentation

Checklist of Documents Submitted with Application

1.Car Loan Application _____

2.Car Loan Application Fee (payment receipt) _____

3.*Applicant’s (2) Forms of I.D. One of them must show status _____

4.Applicant’s (2) Pay Stubs _____

5.

More Forms Collected Internally for Loan Decision

6.Applicant’s Credit Report _____

7.Credit Evaluation Form _____

8.Interest Matrix Form _____

9.Debt Ratio Form (less than 50%) _____

Loan Amount Approved: $_________________ Term: ______ Interest: ______%

Loan Officer Approval: __________________________ Date: ______________

*Example:

*****************************************************************************

FOR EDG INTERNAL USE ONLY

Approval Documentation

Checklist of Documents Collected for Disbursement 10.Review Documents Collected for Approval

11.Purchase Order Showing Required Down Payment Amount (From Dealer) _____

12.Vehicle Appraisal Value (KBB, From Dealer) _____

13.Vehicle Mechanical Check (Form Available) _____

14.Vehicle CarFax Report (From Dealer) _____

16.Closing Cost (Payment Receipt) _____

17.Guarantee of Lien Perfection Form (Form Available) _____

18.Car Key ____

19.Electronic Funds Transfer Form With Void Check (Form Available) _____

20.Signed & Notarized Loan Agreement (Provided by Loan Officer) _____

21.Amortization Payment Schedule (Loan Officer Submits This) _____

Portfolio Manager’s Initials: ______ Date: ________________

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to apply for a car loan. |

| Applicant Information Required | Information needed includes name, address, contact info, Date of Birth, Social Security Number, and marital status. |

| Employment and Financial Information | Applicants must provide details about their employment, monthly income, housing costs, and total monthly expenses. |

| Loan Details | Applicants must specify the type of car (new or used), loan amount, term, down payment, and if a co-signer is available. |

| Credit Report Authorization | Applicants authorize ECDC Enterprise Development Group (EDG) to obtain a consumer credit report and indemnify EDG against any liability from the investigation. |

| Governing Laws | Any disputes or proceedings related to the loan application process are governed by the laws of the state where the application is filed. |

Guide to Writing Car Loan Application

Filling out a Car Loan Application form is a structured process that requires careful attention to detail. Understanding the step-by-step instructions ensures the application is both complete and accurate, paving the way for a smoother review and approval process. Following these guidelines will assist applicants in providing the necessary information to process their loan request.

- Start by writing your full name in the space provided, including your first, middle, and last names.

- Enter your complete address, including street name, apartment number if applicable, city, state, and zip code.

- Provide your contact numbers: daytime, evening, and cellular.

- Fill in your date of birth in the month/day/year (MM/DD/YYYY) format.

- Enter your Social Security number as requested.

- Provide a valid email address where you can be reached for further communication regarding this application.

- Detail your employment information, including the name of your employer, your job title, employer's phone number, your length of time at the job, hourly wage, and monthly gross income.

- Indicate whether you own or rent your home by checking the appropriate box and fill in your monthly payment amount.

- Enter the total amount of your monthly expenses.

- Choose the type of loan you are applying for: Used Car or New Car by checking the appropriate box.

- Specify the loan amount you are requesting.

- Indicate the term (in years) and down payment amount you are proposing.

- If available, specify whether you have a co-signer by checking Yes or No.

- Answer Yes or No to whether you have filed for bankruptcy in the past 7 years, providing an explanation if applicable.

- Indicate your marital status by checking the appropriate box.

- Give permission for Electronic Fund Transfer by checking Yes or No.

- Provide emergency contact information, including the names and phone numbers of two contacts.

- List at least one financial reference, including the bank/institution name, account number, and whether it's a checking or savings account.

- Sign and date the form, thereby giving the EDG the right to obtain a consumer credit report for the purpose of this application.

- Ensure you have attached the necessary additional documents as outlined in the Approval Documentation Checklist for both application submission and disbursement prerequisites.

After completing and submitting the form along with the required documentation and application fee, the lending institution will process your application. This involves verifying the information provided, assessing creditworthiness, and determining the loan amount you qualify for. The decision process may vary in time, so patience is key. If approved, you will be contacted to discuss the next steps, including loan terms and signing agreements. Ensuring accuracy and completeness when filling out the application form can help expedite this process.

Understanding Car Loan Application

-

What information do I need to provide in the Car Loan Application form?

The Car Loan Application form requires personal information such as your full name, address, and contact details, including your phone number and email address. It also requires employment details, including your job title, salary, and length of employment, as well as your housing status and monthly payments. Financial information needed includes your desired loan type, amount, term, and details on down payment. Finally, you must disclose if you've filed for bankruptcy in the last seven years, have a co-signer, and consent to obtaining a credit report and electronic fund transfers.

-

Is a co-signer necessary for my car loan application?

Whether you need a co-signer depends on your individual credit situation and the loan amount you are requesting. If you are applying for more than $8,000 with less than a 20% down payment, or if your credit history does not meet the lender’s requirements, having a co-signer available can increase your chances of loan approval. A co-signer with a stronger credit history can provide additional assurance to the lender.

-

How is the loan amount determined and what are the related fees?

The loan amount you can be approved for is based on several factors including your monthly gross income, total monthly expenses, credit history, and the down payment you can make. Additionally, there is a non-refundable loan application fee of $50. The closing cost, or processing fee, varies with the loan amount: $100 for loans between $1,000 and $5,000; and $150 for loans between $5,001 and $8,000. These fees help cover the administrative costs associated with processing your loan application.

-

What happens after I submit my car loan application?

After submitting your car loan application, it undergoes a review process where the lender will verify the accuracy of the information provided, including employment and income verification, and assess your creditworthiness. This includes obtaining a consumer credit report. If more information is needed, you may be contacted. Upon approval, you will be notified of the loan amount, term, and interest rate. Before disbursement, you must submit additional documentation like vehicle appraisal, insurance, and sign a loan agreement.

- Application review and verification

- Creditworthiness assessment

- Approval notification

- Submission of additional documentation

- Loan disbursement

-

What permissions am I granting by signing the Car Loan Application form?

By signing the Car Loan Application form, you grant the lender permission to obtain a consumer credit report, which is a detailed breakdown of your credit history used to assess your creditworthiness. You also consent to the possibility of electronic fund transfers, which allows the lender to disburse the loan amount directly to your bank account or to collect payments automatically. Additionally, you agree to release all supplied information from liability and to hold the lender harmless against any liability that might result from investigating your application.

Common mistakes

When filling out a Car Loan Application form, people often make a range of mistakes. Identifying and avoiding these mistakes can streamline the application process and increase the chances of approval.

Not reviewing personal information for accuracy. This includes incorrectly entered names, addresses, or phone numbers.

Failing to accurately report income, including omitting certain streams of income or incorrectly calculating monthly gross income.

Incorrectly stating the loan type desired whether for a new or used car can lead to processing delays.

Leaving the down payment amount blank or entering a unrealistic figure.

Not accurately disclosing monthly expenses, which are crucial for determining the debt-to-income ratio.

Omitting employment details such as employer name, job title, or inaccurately stating the length of time at the current job.

Forgetting to indicate whether a co-signer is available, especially when needed due to credit history concerns.

Not giving permission for Electronic Fund Transfer or to obtain a consumer credit report, which are essential for loan processing.

Each of these mistakes can delay the loan approval process or affect the chances of obtaining the desired loan. Applicants should carefully review their application form before submission to ensure all information is complete and accurate. Not only do these steps help in portraying a responsible financial image, but they also demonstrate meticulousness in fulfilling requirements.

If an application is filled out correctly, it signals to lenders a certain level of reliability and attention to detail, potentially impacting the loan terms and rate offers positively. Avoiding these common mistakes is therefore not only about ensuring correctness but also about securing the best possible loan terms.

Documents used along the form

When applying for a car loan, a comprehensive set of documents and forms accompany the Car Loan Application Form to ensure a smooth and efficient processing experience. These documents are essential for verifying the applicant's identity, financial stability, and the vehicle's legitimacy and condition. They play a pivotal role in safeguarding the interests of both the lender and the borrower.

- Payment Receipt for Car Loan Application Fee: This document serves as proof that the application fee associated with the car loan has been paid. It is crucial for the processing of the application.

- Applicant’s Forms of Identification: Typically, two forms of ID are required, one of which must show the applicant's legal status. These can include a driver's license, passport, or state ID.

- Recent Pay Stubs: These are required to verify the applicant's current employment and income level, ensuring they have the means to repay the loan.

- Co-Signer Documents: If a co-signer is involved, especially for loans exceeding certain amounts or when the down payment is less than 20%, co-signer documents validate their identity and financial responsibility.

- Credit Report: Obtained by the lender, it evaluates the applicant’s credit history and creditworthiness, impacting the loan's interest rate and terms.

- Credit Evaluation Form: This internal document helps the lender assess the credit risk associated with the loan based on the applicant's credit report.

- Interest Matrix Form: It outlines different interest rates applicable based on various factors, such as loan amount, term length, and the applicant's credit score.

- Debt Ratio Form: This form calculates the applicant's debt-to-income ratio, ensuring that taking on new debt from the car loan will not overly burden the applicant's finances.

In addition to the above, following the initial approval stage, documents related to the purchase and guarantee of the vehicle, such as the purchase order, vehicle appraisal, and insurance documentation, become imperative. These additional steps and documents are designed to protect all parties involved, confirming the loan is a sound financial decision based on verified personal, income, and asset information. Thus, the process, though meticulous, is designed with the utmost attention to detail to guarantee fairness and accuracy in every car loan application.

Similar forms

A Mortgage Application is notably similar to a Car Loan Application form, as both involve the process of requesting financial assistance to make a significant purchase. Just like a Car Loan Application, a Mortgage Application requires detailed personal information, employment history, income level, and a statement of assets and liabilities. Applicants must also consent to a credit check, a standard procedure to assess their creditworthiness, which is crucial in determining the terms of the loan, including interest rates.

An Employment Application shares similarities with a Car Loan Application because it collects personal information and employment history. While the primary purpose differs—with one seeking a job and the other financial credit—both forms often require the applicant to provide references and past income details. These applications serve as a means to evaluate the applicant's reliability and capability, whether for employment suitability or financial repayment capacity.

A Credit Card Application is quite similar to a Car Loan Application as it involves applying for financial credit. Both applications require the applicant's personal information, employment details, income, and often a consent to credit checks. This information helps the lender assess the applicant's creditworthiness, which determines their eligibility for the credit card or loan, the borrowing limit, and the interest rate offered.

A Rental Application form mirrors a Car Loan Application in that both require applicants to provide personal details, employment and income verification, and sometimes references. Landlords use rental applications to assess potential tenants' capability to meet monthly rent obligations, much like lenders use car loan applications to decide an applicant's ability to repay a loan. Additionally, both may involve background checks to ensure reliability and trustworthiness.

A Business Loan Application shares key elements with a Car Loan Application, primarily in the gathering of financial information and evaluating creditworthiness. Both forms require detailed information about the applicant's financial status, including income, debts, and assets. Business loan applications also need a detailed business plan, similar to how car loan applications may require information about the vehicle's make, model, and condition.

Student Loan Applications are akin to Car Loan Applications in their fundamental purpose of providing financial assistance. Applicants must provide personal information, financial details, and sometimes a cosigner to vouch for them, similar to certain car loan scenarios. Both processes include assessing the applicant's and the cosigner’s credit history to determine the loan's terms and eligibility.

The process of applying for a Membership Card for exclusive clubs or subscriptions can sometimes resemble applying for a car loan. Applicants provide personal information and may need to share financial information or references depending on the exclusivity of the membership. Both applications serve as a gateway to accessing benefits offered by the entity, contingent upon the applicant’s background and, for the car loan, their creditworthiness.

An Insurance Policy Application is parallel to a Car Loan Application form in several ways. Applicants are required to disclose personal details, financial information, and sometimes health-related information, depending on the type of insurance. Just like car loan applications, the information provided helps the insurer assess risk and determine the policy's terms and conditions, including premiums, much like interest rates in loan applications.

Grant Applications, especially for educational or research purposes, share commonalities with Car Loan Applications since both involve requesting funds based on eligibility and need. Grant applications require detailed personal information, proposals or statements of purpose, and often financial information to assess the applicant’s need and how the funds will be utilized, parallels to the financial assessment in loan applications.

Similarly, a Lease Application for equipment or property, much like a Car Loan Application, involves applying for the right to use assets in exchange for regular payments. These applications gather comprehensive information on the applicant's financial standing, creditworthiness, and sometimes the purpose of leasing the asset. The approval process determines the terms of the lease, reminiscent of how a car loan application's approval sets the loan's terms.

Dos and Don'ts

Applying for a car loan can feel overwhelming, but being prepared and knowledgeable about the process can make it smoother. When filling out a Car Loan Application form, there are crucial dos and don'ts to consider ensuring your application is viewed positively.

Things to Do:

- Fill out the form completely and accurately. Ensure all personal information, such as your name, address, and employment details, are current and match any identification documents.

- Double-check your social security number and date of birth. Mistakes here can lead to unnecessary delays or even a declined application.

- Provide a detailed employment history. Lenders value stability, so include the length of time at your current job and your salary to demonstrate financial security.

- Be honest about your financial situation. Including your monthly expenses and total monthly income accurately will help the lender assess your repayment capability.

- Review loan type and terms carefully. Understand the difference between choosing a new or used car and decide on the loan term that suits your budget.

- Sign and date the application. This might seem obvious, but an unsigned application is incomplete. Your signature also certifies that all information provided is true to the best of your knowledge.

Things Not to Do:

- Don’t leave sections blank. If a section does not apply to you, write “N/A” to indicate this. Blank sections can lead to misunderstandings or suggest you overlooked them.

- Avoid giving estimated information. Ensure all numbers, especially regarding your income and expenses, are accurate. Estimates can lead to complications later on.

- Don’t forget to list a co-signer if you have one. A co-signer can be beneficial if you have a less-than-perfect credit history or need assistance qualifying for the loan.

- Refrain from withholding information about previous bankruptcies. Being upfront about financial challenges demonstrates responsibility and transparency.

- Resist the urge to rush through the form. Take your time to read each section carefully to avoid mistakes that could delay the process.

- Don’t ignore the fine print. Understanding all conditions, including those related to the electronic fund transfer and the consumer credit report, is crucial. This fine print can have significant implications for your obligations and rights.

Following these guidelines can ease the car loan application process, minimizing the chance for errors and improving the likelihood of approval. Remember, preparation and attention to detail are your best tools in successfully applying for a loan.

Misconceptions

When diving into the world of car financing, it's easy to encounter a handful of misconceptions that can make the process seem more daunting than it actually is. Understanding these common myths about the Car Loan Application form can help ease this journey.

- Misconception 1: Your credit score is the only factor that will affect your loan approval. While it's true that your credit score plays a significant role in the loan approval process, lenders also consider other factors detailed in the application form. This includes your employment history, monthly income, and overall financial stability. Each of these components helps the lender gauge your ability to repay the loan.

- Misconception 2: The required down payment amount is non-negotiable. Many applicants believe the down payment amount listed on their application form is set in stone. However, this figure can often be negotiated with your lender, especially if you have a good credit score or solid financial standing. The key is to communicate openly with your lender about your capabilities and constraints.

- Misconception 3: Applying for a car loan with a co-signer is a sign of weak financial health. This is far from the truth. Having a co-signer can actually be a strategic move, irrespective of your financial health. A co-signer can not only increase your chances of approval but might also help secure a lower interest rate, making your loan more affordable in the long run.

- Misconception 4: The loan application fee is always required up front. While the application mentions a loan application fee, it's not always mandatory to pay this fee upfront. Some lenders might allow you to incorporate this fee into your loan, or waive it completely, depending on their policies and your negotiation. It's important to ask and explore your options.

Approaching the Car Loan Application form with a clear understanding of these misconceptions can transform a potentially overwhelming experience into a manageable and even empowering process. Remember, knowledge is power, especially when it comes to navigating financial decisions.

Key takeaways

When embarking on the journey of securing a car loan, understanding the application process and its requirements is paramount. Below are key takeaways that applicants should consider while filling out and using the Car Loan Application form:

- Applicants must provide comprehensive personal information, including full name, address, contact numbers, and social security number, ensuring accuracy for identity verification and contact purposes.

- Employment details, such as the applicant's employer, job title, length of employment, salary, and monthly gross income, are crucial for assessing the applicant's ability to repay the loan.

- Details regarding housing status (own or rent) and monthly payments help lenders gauge financial stability and monthly expense commitments.

- Choosing between a new or used car loan and specifying the desired loan amount, term, and down payment amount allows lenders to tailor the loan to the applicant's needs and financial capacity.

- Applicants are asked about their co-signer availability and bankruptcy history, which can significantly impact loan approval and terms.

- Providing emergency contact information and financial references, such as bank accounts, supports the application's credibility and offers additional assurance to the lender.

- The application includes a crucial permission section for electronic fund transfer and obtaining a consumer credit report. This authorization allows the lender to thoroughly assess the applicant's creditworthiness and proceed with necessary financial transactions.

- A non-refundable loan application fee is required, with the cost dependent on the loan amount. This fee covers the processing and evaluation of the application.

- Applicants must carefully review and sign the declaration and agreement section, confirming the accuracy of the information provided and agreeing to terms, including indemnification of the lender and understanding associated fees and obligations.

Completing the Car Loan Application form accurately and understanding each section's significance are vital steps in the loan application process. It ensures that applicants clearly communicate their financial situation and loan requirements, facilitating a smoother review process and increasing the likelihood of loan approval. Applicants are encouraged to gather necessary documents and review the form's instructions carefully to avoid delays or issues in the loan approval process.

Popular PDF Documents

IRS 8868 - While form 8868 provides a filing extension, organizations should aim to complete their returns as promptly as possible.

Nevada Sales Tax Return - Keeping meticulous records is not only a requirement but crucial for possible audits by the Department of Taxation.

IRS 8801 - It ensures a fair tax process by allowing past AMT payments to influence future tax liabilities positively.