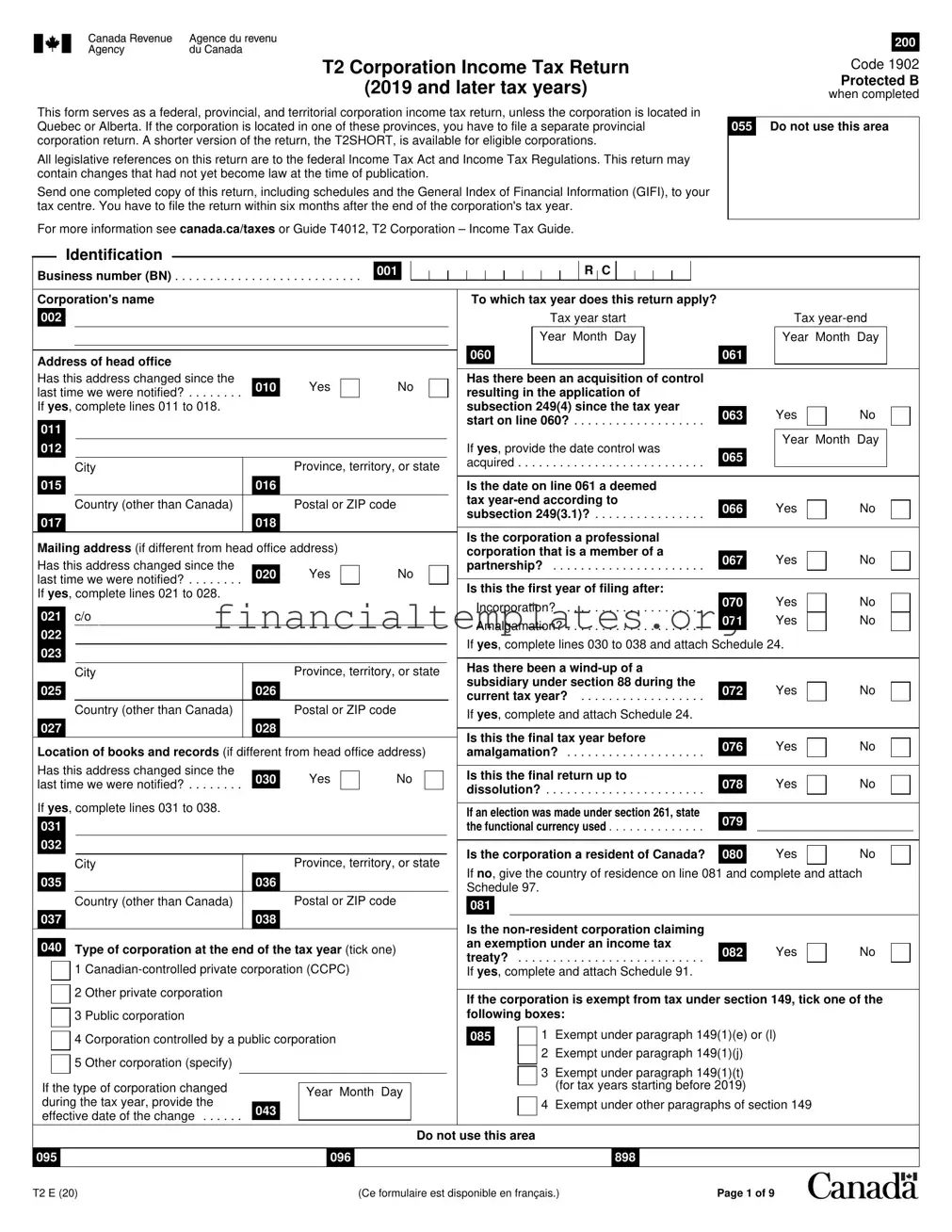

Get Canada T2 Tax Form

The Canada T2 Tax Form is crucial for corporations operating within the country, except for those located in Quebec or Alberta, which require a different provincial return. This comprehensive document acts as the federal, provincial, and territorial corporation income tax return for the tax years 2019 and onwards. It demands meticulous attention, as it entails submitting a completed copy to the assigned tax centre, inclusive of schedules and the General Index of Financial Information (GIFI), within six months following the corporation's tax year-end. The form accommodates various corporate identities by providing a T2SHORT version for qualifying companies, ensuring a tailored approach to each entity's fiscal responsibilities. The inclusion of legislative references underscores the necessity for adherence to the Income Tax Act and Regulations, acknowledging that amendments may arise post-publication. Navigation through this form is guided by mandatory disclosures, ranging from basic corporate information and financial statement data to detailed schedules reflecting the corporation's financial activities and status. Each section and schedule of the T2 Return has been designed with precision to capture essential information, aiding in the accurate assessment and computation of tax liabilities, while also considering changes in corporate structure or status. The form’s comprehensive nature highlights its significance in maintaining compliance with Canadian tax laws, serving as a critical tool in the corporate fiscal management landscape.

Canada T2 Tax Example

200

T2 Corporation Income Tax Return

(2019 and later tax years)

This form serves as a federal, provincial, and territorial corporation income tax return, unless the corporation is located in Quebec or Alberta. If the corporation is located in one of these provinces, you have to file a separate provincial corporation return. A shorter version of the return, the T2SHORT, is available for eligible corporations.

All legislative references on this return are to the federal Income Tax Act and Income Tax Regulations. This return may contain changes that had not yet become law at the time of publication.

Send one completed copy of this return, including schedules and the General Index of Financial Information (GIFI), to your tax centre. You have to file the return within six months after the end of the corporation's tax year.

For more information see canada.ca/taxes or Guide T4012, T2 Corporation – Income Tax Guide.

Code 1902

Protected B

when completed

055Do not use this area

Identification

Business number (BN) |

001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Corporation's name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To which tax year does this return apply? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax year start |

|

|

|

Tax |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Month Day |

|

|

|

|

Year Month Day |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

060 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

061 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of head office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Has this address changed since the |

|

|

Yes |

|

|

|

|

No |

|

|

|

|

Has there been an acquisition of control |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

last time we were notified? |

|

|

|

|

|

|

|

|

|

resulting in the application of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

If yes, complete lines 011 to 018. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

subsection 249(4) since the tax year |

|

|

|

Yes |

|

|

No |

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

063 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

start on line 060? |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Month Day |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, provide the date control was |

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

065 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

City |

|

|

Province, territory, or state |

|

|

acquired |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

015 |

|

|

|

|

|

|

|

016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is the date on line 061 a deemed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

Country (other than Canada) |

|

|

Postal or ZIP code |

|

|

|

|

|

|

|

|

tax |

|

|

|

Yes |

|

|

No |

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

066 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

subsection 249(3.1)? |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

017 |

|

|

|

|

|

|

|

018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is the corporation a professional |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Mailing address (if different from head office address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

corporation that is a member of a |

|

|

|

Yes |

|

|

No |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

Has this address changed since the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

partnership? |

067 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

last time we were notified? |

020 |

|

Yes |

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

If yes, complete lines 021 to 028. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is this the first year of filing after: |

|

|

|

Yes |

|

|

No |

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incorporation? |

070 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

021 |

|

|

c/o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

071 |

|

|

Yes |

|

|

No |

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amalgamation? |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, complete lines 030 to 038 and attach Schedule 24. |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Has there been a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

City |

|

|

Province, territory, or state |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

subsidiary under section 88 during the |

|

|

|

Yes |

|

No |

|

|

|

|

||||||||||||||||||||||||||

|

025 |

|

|

|

|

|

|

|

026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

072 |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

current tax year? |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

Country (other than Canada) |

|

|

Postal or ZIP code |

|

|

|

|

|

|

|

|

If yes, complete and attach Schedule 24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

027 |

|

|

|

|

|

|

|

028 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is this the final tax year before |

|

|

|

Yes |

|

|

No |

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

Location of books and records (if different from head office address) |

|

|

076 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

amalgamation? |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

Has this address changed since the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Yes |

|

|

|

|

|

No |

|

|

|

|

|

Is this the final return up to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

last time we were notified? |

030 |

|

|

|

|

|

|

|

|

|

|

|

078 |

|

|

Yes |

|

|

No |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

dissolution? |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

If yes, complete lines 031 to 038. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If an election was made under section 261, state |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

079 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the functional currency used |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

032 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is the corporation a resident of Canada? |

080 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

City |

|

|

Province, territory, or state |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

If no, give the country of residence on line 081 and complete and attach |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

035 |

|

|

|

|

|

|

|

036 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 97. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

Country (other than Canada) |

|

|

Postal or ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

037 |

|

|

|

|

|

|

|

038 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

040 |

|

|

Type of corporation at the end of the tax year (tick one) |

|

|

|

|

|

|

|

|

an exemption under an income tax |

|

|

|

Yes |

|

|

No |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

082 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

treaty? |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, complete and attach Schedule 91. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

2 Other private corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If the corporation is exempt from tax under section 149, tick one of the |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

3 Public corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

following boxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Exempt under paragraph 149(1)(e) or (l) |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

4 Corporation controlled by a public corporation |

|

|

|

|

|

|

|

|

|

085 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

5 Other corporation (specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Exempt under paragraph 149(1)(j) |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Exempt under paragraph 149(1)(t) |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

If the type of corporation changed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(for tax years starting before 2019) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

Year Month Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

during the tax year, provide the |

043 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Exempt under other paragraphs of section 149 |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

effective date of the change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not use this area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

095 |

|

|

|

|

|

|

|

|

|

|

096 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

898 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

T2 E (20) |

|

|

|

|

|

|

(Ce formulaire est disponible en français.) |

Page 1 of 9 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

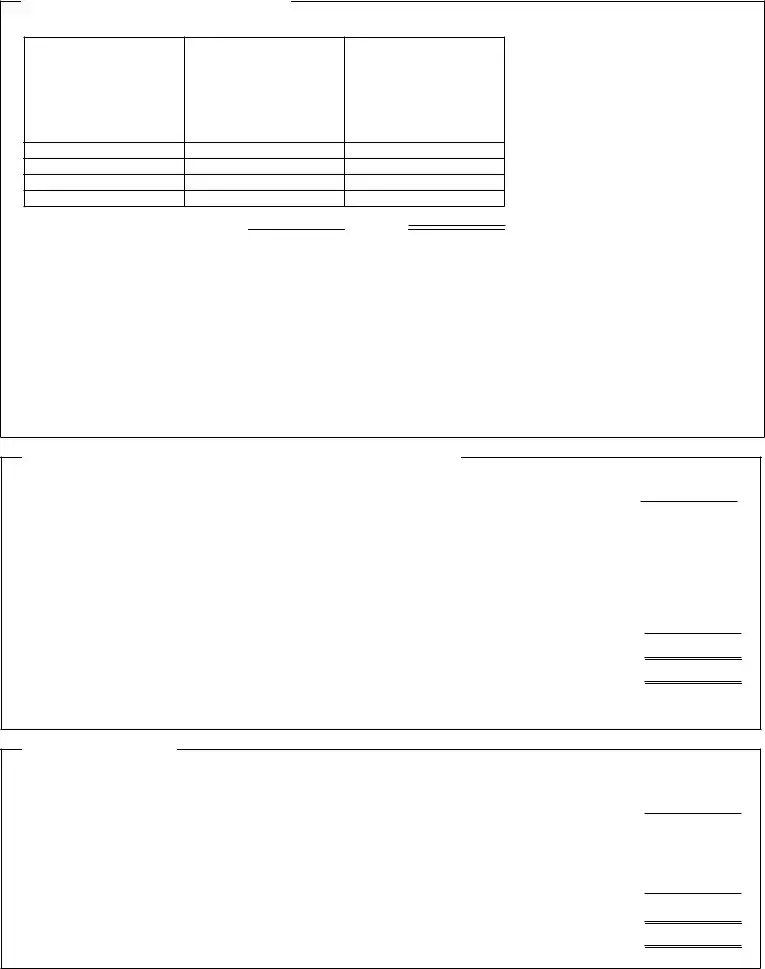

Attachments

Protected B when completed

Financial statement information: Use GIFI schedules 100, 125, and 141.

Schedules – Answer the following questions. For each yes response, attach the schedule to the T2 return, unless otherwise instructed.

Yes Schedule

Is the corporation related to any other corporations? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation an associated CCPC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation an associated CCPC that is claiming the expenditure limit? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Does the corporation have any

Has the corporation had any transactions, including section 85 transfers, with its shareholders, officers, or employees,

other than transactions in the ordinary course of business? Exclude

If you answered yes to the above question, and the transaction was between corporations not dealing at arm's length,

were all or substantially all of the assets of the transferor disposed of to the transferee? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Has the corporation paid any royalties, management fees, or other similar payments to residents of Canada? . . . . . . . . . . . . . . . . . .

Is the corporation claiming a deduction for payments to a type of employee benefit plan? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation claiming a loss or deduction from a tax shelter? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation a member of a partnership for which a partnership account number has been assigned? . . . . . . . . . . . . . . . . . . . .

Did the corporation, a foreign affiliate controlled by the corporation, or any other corporation or trust that did not deal at arm's length with the corporation have a beneficial interest in a

Did the corporation own any shares in one or more foreign affiliates in the tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Has the corporation made any payments to

the Income Tax Regulations? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Did the corporation have a total amount over CAN$1 million of reportable transactions with

For private corporations: Does the corporation have any shareholders who own 10% or more of the corporation's common

and/or preferred shares? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Has the corporation made payments to, or received amounts from, a retirement compensation plan arrangement during the year? Does the corporation earn income from one or more Internet web pages or websites? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the net income/loss shown on the financial statements different from the net income/loss for income tax purposes? . . . . . . . . . . .

Has the corporation made any charitable donations; gifts of cultural or ecological property; or gifts of medicine? . . . . . . . . . . . . . . . .

Has the corporation received any dividends or paid any taxable dividends for purposes of the dividend refund? . . . . . . . . . . . . . . . .

Is the corporation claiming any type of losses? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation claiming a provincial or territorial tax credit or does it have a

permanent establishment in more than one jurisdiction? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Has the corporation realized any capital gains or incurred any capital losses during the tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . .

i)Is the corporation a CCPC and reporting a) income or loss from property (other than dividends deductible on line 320 of the T2 return), b) income from a partnership, c) income from a foreign business, d) income from a personal services business, e) income referred to in clause 125(1)(a)(i)(C) or 125(1)(a)(i)(B), f) aggregate investment income as defined in subsection 129(4), or g) an amount assigned to it under subsection 125(3.2) or 125(8); or

ii)Is the corporation a member of a partnership and assigning its specified partnership business limit to a designated member under subsection 125(8)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Does the corporation have any property that is eligible for capital cost allowance? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Does the corporation have any

Is the corporation claiming deductible reserves? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation claiming a patronage dividend deduction? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation a credit union claiming a deduction for allocations in proportion to borrowing or a provincial credit union tax reduction? Is the corporation an investment corporation or a mutual fund corporation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation carrying on business in Canada as a

Is the corporation claiming any federal, provincial, or territorial foreign tax credits, or any federal logging tax credits? . . . . . . . . . . . .

Does the corporation have any Canadian manufacturing and processing profits? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation claiming an investment tax credit? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation claiming any scientific research and experimental development (SR&ED) expenditures? . . . . . . . . . . . . . . . . . . . .

Is the total taxable capital employed in Canada of the corporation and its related corporations over $10,000,000? . . . . . . . . . . . . . . .

Is the total taxable capital employed in Canada of the corporation and its associated corporations over $10,000,000? . . . . . . . . . . . .

Is the corporation subject to gross Part VI tax on capital of financial institutions? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation claiming a Part I tax credit? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation subject to Part IV.1 tax on dividends received on taxable preferred shares or Part VI.1 tax on dividends paid? . . .

Is the corporation agreeing to a transfer of the liability for Part VI.1 tax? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

For financial institutions: Is the corporation a member of a related group of financial institutions

with one or more members subject to gross Part VI tax? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation claiming a Canadian film or video production tax credit? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation claiming a film or video production services tax credit? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation claiming a Canadian journalism labour tax credit? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the corporation subject to Part XIII.1 tax? (Show your calculations on a sheet that you identify as Schedule 92.) . . . . . . . . . . . . . .

150

160

161

151

162

163

164

165

166

167

168

169

170

171

173

172

180

201

202

203

204

205

206

207

208

212

213

216

217

218

220

221

227

231

232

233

234

238

242

243

244

250

253

254

272

255

9

23

49

19

11

44

14

15

T5004

T5013

22

25

29

T106

50

88

1

2

3

4

5

6

7

8

12

13

16

17

18

20

21

27

31

T661

33/34/35

38

42

43

45

39

T1131

T1177

58

92

Page 2 of 9

Attachments (continued)

Protected B when completed

Did the corporation have any foreign affiliates in the tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Did the corporation own or hold specified foreign property where the total cost amount of all such property, at any time in the year, was more than CAN$100,000? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Did the corporation transfer or loan property to a

Did the corporation receive a distribution from or was it indebted to a

Has the corporation entered into an agreement to allocate assistance for SR&ED carried out in Canada? . . . . . . . . . . . . . . . . . . . . .

Has the corporation entered into an agreement to transfer qualified expenditures incurred in respect of SR&ED contracts? . . . . . . .

Has the corporation entered into an agreement with other associated corporations for salary or wages of

specified employees for SR&ED? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Did the corporation pay taxable dividends (other than capital gains dividends) in the tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Has the corporation made an election under subsection 89(11) not to be a CCPC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Has the corporation revoked any previous election made under subsection 89(11)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Did the corporation (CCPC or deposit insurance corporation (DIC)) pay eligible dividends, or did its

general rate income pool (GRIP) change in the tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Did the corporation (other than a CCPC or DIC) pay eligible dividends, or did its low rate income pool (LRIP)

change in the tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

271

259

260

261

262

263

264

265

266

267

268

269

T1134

T1135

T1141

T1142

T1145

T1146

T1174

55

T2002

T2002

53

54

Additional information

Did the corporation use the International Financial Reporting Standards (IFRS) when it prepared its financial statements? |

270 |

Yes |

||||

|

|

|||||

Is the corporation inactive? |

|

|

280 |

Yes |

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

||||

|

|

|

|

|||

|

|

|

|

|

|

|

Specify the principal products mined, manufactured, |

284 |

|

|

|

|

|

sold, constructed, or services provided, giving the |

286 |

|

|

|

|

|

approximate percentage of the total revenue that |

|

|

|

|

||

|

|

|

|

|

||

288 |

|

|

|

|

||

each product or service represents. |

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

Yes |

|

Did the corporation immigrate to Canada during the tax year? |

291 |

|||||

|

|

|||||

Did the corporation emigrate from Canada during the tax year? |

292 |

Yes |

||||

|

Yes |

|||||

293 |

||||||

Do you want to be considered as a quarterly instalment remitter if you are eligible? |

||||||

|

|

|||||

No

No

285%

287%

289%

No

No

No

If the corporation was eligible to remit instalments on a quarterly basis for part of the tax year, provide the date the |

|

|

294 |

corporation ceased to be eligible |

|

Year Month Day

If the corporation's major business activity is construction, did you have any subcontractors during the tax year? |

295 |

Yes |

|

|

No

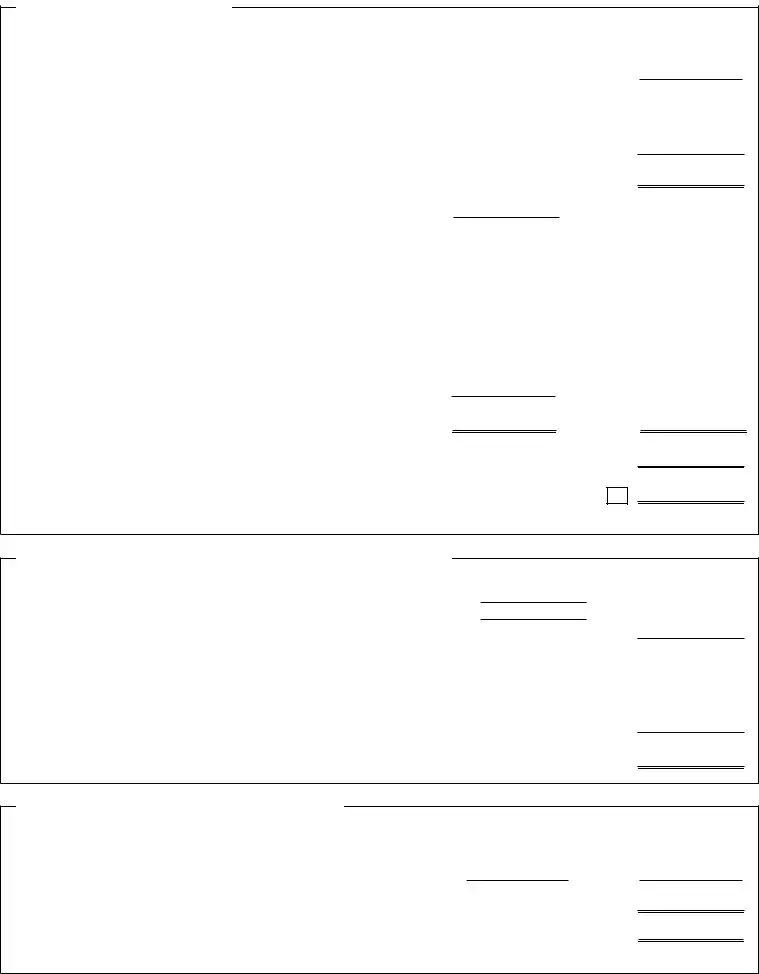

Taxable income

Net income or (loss) for income tax purposes from Schedule 1, financial statements, or GIFI |

|

|

|

|

|

|

|

300 |

. . . . |

. |

|

. . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deduct: |

|

|

|

|

|

|

|

|

311 |

|

|

|

|

|

|

|

|

Charitable donations from Schedule 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cultural gifts from Schedule 2 |

313 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ecological gifts from Schedule 2 |

314 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gifts of medicine made before March 22, 2017, from Schedule 2 |

315 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable dividends deductible under section 112 or 113, or subsection 138(6) |

|

|

|

|

|

|

|

|

320 |

|

|

|

|

|

|

|

|

from Schedule 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part VI.1 tax deduction* |

325 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

331 |

|

|

|

|

|

|

|

|

332 |

|

|

|

|

|

|

|

|

Net capital losses of previous tax years from Schedule 4 |

|

|

|

|

|

|

|

|

333 |

|

|

|

|

|

|

|

|

Restricted farm losses of previous tax years from Schedule 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farm losses of previous tax years from Schedule 4 |

334 |

|

|

|

|

|

|

|

335 |

|

|

|

|

|

|

|

|

Limited partnership losses of previous tax years from Schedule 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable capital gains or taxable dividends allocated from a central credit union |

340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prospector's and grubstaker's shares |

350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

► |

|

|

|

||||||

Subtotal (amount A minus amount B) (if negative, enter "0") |

||||||||

|

|

|

|

|

|

|

|

|

Section 110.5 additions or subparagraph 115(1)(a)(vii) additions |

|

|

|

|

|

|

|

355 |

. . . . |

. |

|

. . . . . . . . . . . . . . . |

|

|

|

|

|

Taxable income (amount C plus amount D) |

|

|

|

|

|

|

|

360 |

. . . . |

. |

|

. . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

370 |

|

Income exempt under paragraph 149(1)(t) (for tax years starting before 2019) |

|

|

|

|

|

|

|

|

. . . . |

. |

|

. . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable income for a corporation with exempt income under paragraph 149(1)(t) (line 360 minus line 370) |

||||||||

* This amount is equal to 3.5 times the Part VI.1 tax payable at line 724 on page 9. |

|

|

|

|

|

|

|

|

A

B

C

D

Z

Page 3 of 9

|

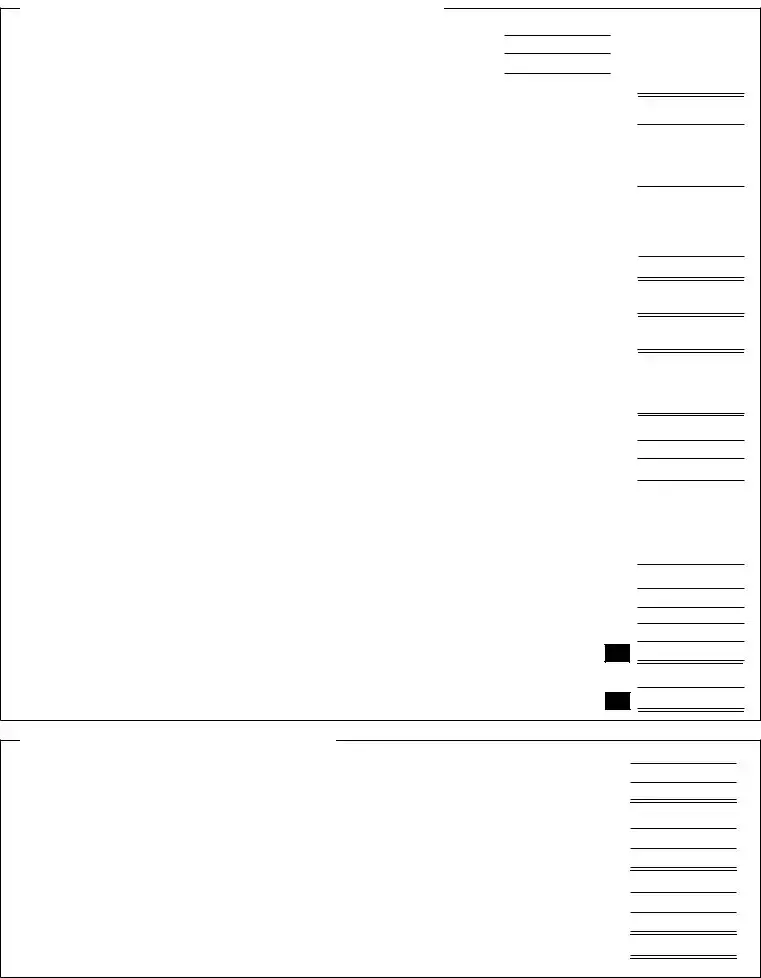

Small business deduction |

|

Protected B when completed |

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

Income eligible for the small business deduction from Schedule 7 |

400 |

|

|

A |

||

|

|

|

|

|||

Taxable income from line 360 on page 3, minus 100/28 of the amount on line 632* on page 8, minus 4 times the amount on |

|

|

|

|

||

405 |

|

|

B |

|||

line 636** on page 8, and minus any amount that, because of federal law, is exempt from Part I tax |

|

|

||||

Business limit (see notes 1 and 2 below) |

410 |

|

|

C |

||

Notes:

1.For CCPCs that are not associated, enter $500,000 on line 410. However, if the corporation's tax year is less than 51 weeks, prorate this amount by the number of days in the tax year divided by 365, and enter the result on line 410.

2.For associated CCPCs, use Schedule 23 to calculate the amount to be entered on line 410.

Business limit reduction

Taxable capital business limit reduction

Amount C |

|

× |

|

415 |

*** |

|

D |

|

= |

|||||

|

11,250 |

|

|

|

|

|

|

|

|

|||||

Passive income business limit reduction |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

– 50,000 = . . . |

||||||

Adjusted aggregate investment income from Schedule 7 **** |

. . . . . |

. . . |

417 |

|

|

|||||||||

Amount C |

|

× Amount F |

|

|

|

= |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|||||||

100,000

The greater of amount E and amount G |

422 |

|

|

|

|

Reduced business limit for tax years starting before 2019 (amount C minus amount E) (if negative, enter "0") |

425 |

|

|

|

|

Reduced business limit for tax years starting after 2018 (amount C minus amount H) (if negative, enter "0") |

426 |

|

Business limit the CCPC assigns under subsection 125(3.2) (from line 515 on page 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

427 |

Reduced business limit after assignment for tax years starting before 2019 (amount I minus amount K) |

|

|

428 |

Reduced business limit after assignment for tax years starting after 2018 (amount J minus amount K) |

|

Small business deduction |

|

Tax years starting before 2019 |

|

E

F

G

H

I

J

K

L

M

Amount A, B, C, or L, whichever is the least

Amount A, B, C, or L, whichever is the least

Amount A, B, C, or L, whichever is the least

× |

Number of days in the tax year |

× 17.5% |

= |

|||

before January 1, 2018 |

||||||

|

Number of days in the tax year |

|

|

|

|

|

× |

Number of days in the tax year after |

× |

|

= |

||

December 31, 2017, and before January 1, 2019 |

18% |

|||||

|

Number of days in the tax year |

|

|

|

|

|

× |

Number of days in the tax year |

|

|

× |

|

= |

after December 31, 2018 |

19% |

|||||

Number of days in the tax year

1

2

3

Tax years starting after 2018 |

|

|

Amount A, B, C, or M, whichever is the least |

× |

19% = |

|

|

Small business deduction (total of amounts 1 to 4) |

430 |

|

|

Enter amount N at amount J on page 8. |

|

4

N

*Calculate the amount of foreign

**Calculate the amount of foreign business income tax credit deductible on line 636 without reference to the corporation tax reductions under section 123.4.

***Large corporations

•If the corporation is not associated with any corporations in both the current and previous tax years, the amount to be entered on line 415 is: (total taxable capital employed in Canada for the prior year minus $10,000,000) x 0.225%.

•If the corporation is not associated with any corporations in the current tax year, but was associated in the previous tax year, the amount to be entered on line 415 is: (total taxable capital employed in Canada for the current year minus $10,000,000) x 0.225%.

•For corporations associated in the current tax year, see Schedule 23 for the special rules that apply.

****Enter the total adjusted aggregate investment income of the corporation and all associated corporations for each tax year that ended in the preceding calendar year. Each corporation with such income has to file a Schedule 7. For a corporation's first tax year that starts after 2018, this amount is reported at line 744 of the corresponding Schedule 7. Otherwise, this amount is the total of all amounts reported at line 745 of the corresponding Schedule 7 of the corporation for each tax year that ended in the preceding calendar year.

Page 4 of 9

Protected B when completed

Small business deduction (continued)

Specified corporate income and assignment under subsection 125(3.2)

|

O |

|

P |

|

Q |

|||

Business number of |

Income paid under |

Business limit assigned to |

||||||

the corporation |

clause 125(1)(a)(i)(B) to the |

corporation identified in |

||||||

receiving the |

corporation identified in |

column O 4 |

||||||

assigned amount |

column O 3 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

490 |

|

|

500 |

|

|

505 |

|

|

|

|

|

|

|

|

|

|

1.

2.

3.

4.

Total |

510 |

|

|

Total |

515 |

Notes:

3.This amount is [as defined in subsection 125(7) specified corporate income (a)(i)] the total of all amounts each of which is income from an active business of the corporation for the year from the provision of services or property to a private corporation (directly or indirectly, in any manner whatever) if

(A)at any time in the year, the corporation (or one of its shareholders) or a person who does not deal at arm's length with the corporation (or one of its shareholders) holds a direct or indirect interest in the private corporation, and

(B)it is not the case that all or substantially all of the corporation's income for the year from an active business is from the provision of services or property to

(I)persons (other than the private corporation) with which the corporation deals at arm's length, or

(II)partnerships with which the corporation deals at arm's length, other than a partnership in which a person that does not deal at arm's length with the corporation holds a direct or indirect interest.

4.The amount of the business limit you assign to a CCPC cannot be greater than the amount determined by the formula A – B, where A is the amount of income referred to in column P in respect of that CCPC and B is the portion of the amount described in A that is deductible by you in respect of the amount of income referred to in clauses 125(1)(a)(i)(A) or (B) for the year. The amount on line 515 cannot be greater than the amount on line 425 (426 for tax years starting after 2018).

General tax reduction for

Taxable income from page 3 (line 360 or amount Z, whichever applies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Lesser of amounts 9B and 9H from Part 9 of Schedule 27 |

|

|

|

|

|

B |

. . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

C |

||

Amount 13K from Part 13 of Schedule 27 |

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

D |

||

Personal services business income |

|

432 |

|

|

|

|

. . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

Amount from line 400, 405, 410, or 427 (428 instead of 427 for tax years starting after 2018) |

|

|

E |

|||

on page 4, whichever is the least |

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

F |

||

Aggregate investment income from line 440 on page 6* . . |

|

|

|

|

|

|

.Subtotal. . . . . . .(.add. . . amounts. . . . . . . .B. to F). . . |

|

► |

||||

|

|

|||||

|

|

|

|

|

|

|

Amount A minus amount G (if negative, enter "0") . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

General tax reduction for

Enter amount I on line 638 on page 8.

* Except for a corporation that is, throughout the year, a cooperative corporation (within the meaning assigned by subsection 136(2)) or a credit union.

A

G

H

I

General tax reduction

Do not complete this area if you are a

Taxable income from page 3 (line 360 or amount Z, whichever applies) |

. . . . . . . . . |

||||

Lesser of amounts 9B and 9H from Part 9 of Schedule 27 |

|

|

|

|

K |

. . . . . . . . . . . . . . . . . . . . . . . . |

|

|

L |

||

Amount 13K from Part 13 of Schedule 27 |

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . |

|

|

M |

||

Personal services business income |

|

434 |

|

|

|

. . . . . . . . . . . . . . . . . . . |

|

|

|

► |

|

|

Subtotal (add amounts K to M) |

|

|||

|

|

|

|

|

|

Amount J minus amount N (if negative, enter "0") . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

General tax reduction – Amount O multiplied by 13% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter amount P on line 639 on page 8.

J

N

O P

Page 5 of 9

Protected B when completed

Refundable portion of Part I tax

Aggregate investment income |

|

|

|

|

|

|

|

|

|

|

|

440 |

|

|

|

× 30 2/3% = |

|

|

|

|

|

from Schedule 7 |

. . . |

|

|

|

|

. . . . . . . . . . . . . . . . . . |

|

. . . . . . . . . . . |

||

Foreign |

. . . . . . . . . . . . . . . . . . . |

|

|

|

B |

|||||

Foreign investment income |

|

|

|

|

|

|

|

|

|

|

|

445 |

|

|

|

× 8% = |

|

|

|

C |

|

from Schedule 7 |

. . . |

|

|