Get California Stop Payment Form

Navigating the complexities of construction project payments in California can be daunting, particularly when disputes arise over unpaid labor, services, equipment, or materials. The California Stop Payment Notice serves as a critical tool for those seeking to enforce their right to payment. Under the Civil Code Section 8044, this notice is a formal declaration requiring a project’s financier or owner to withhold funds enough to satisfy the claimant's demand, along with any potentially accruing interest, court costs, and reasonable litigation expenses. The form’s application varies slightly depending on whether the project is private or public, detailing specific filing requirements for each scenario. It also mandates that the claimant provide a detailed account of the labor, services, equipment, or materials furnished, the total value thereof, and any amounts already paid. This legal instrument not only safeguards the financial interests of contractors and suppliers but also outlines a clear process for conflict resolution in the construction sector. Understanding the nuances of this form, including when and how to properly file it, could significantly impact the timely resolution of payment disputes.

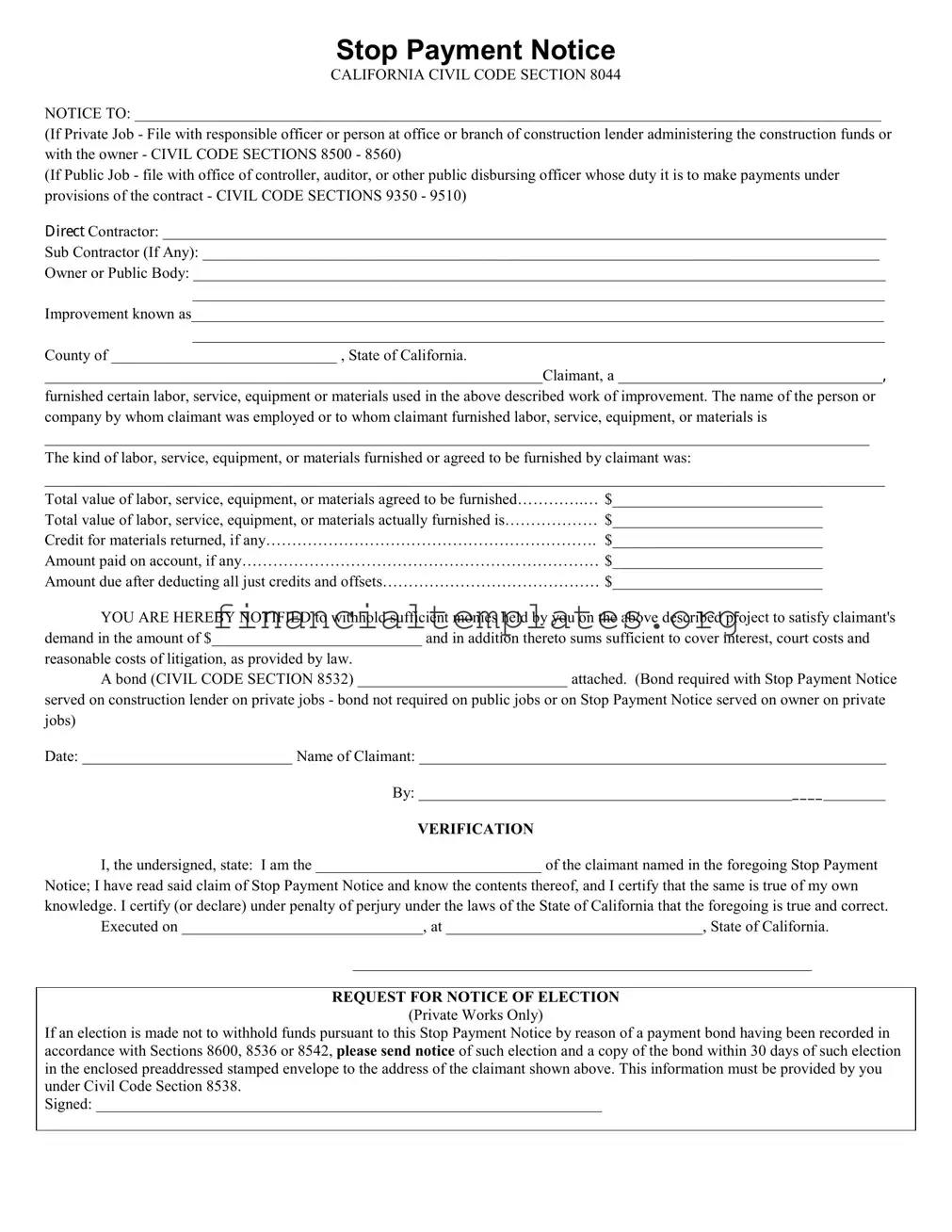

California Stop Payment Example

Stop Payment Notice

CALIFORNIA CIVIL CODE SECTION 8044

NOTICE TO: ________________________________________________________________________________________________

(If Private Job - File with responsible officer or person at office or branch of construction lender administering the construction funds or with the owner - CIVIL CODE SECTIONS 8500 - 8560)

(If Public Job - file with office of controller, auditor, or other public disbursing officer whose duty it is to make payments under provisions of the contract - CIVIL CODE SECTIONS 9350 - 9510)

'LUHFW Contractor: _____________________________________________________________________________________________

Sub Contractor (If Any): _______________________________________________________________________________________

Owner or Public Body: _________________________________________________________________________________________

_________________________________________________________________________________________

Improvement known as_________________________________________________________________________________________

_________________________________________________________________________________________

County of _____________________________ , State of California.

________________________________________________________________Claimant, a __________________________________

furnished certain labor, service, equipment or materials used in the above described work of improvement. The name of the person or company by whom claimant was employed or to whom claimant furnished labor, service, equipment, or materials is

__________________________________________________________________________________________________________

The kind of labor, service, equipment, or materials furnished or agreed to be furnished by claimant was:

____________________________________________________________________________________________________________

Total value of labor, service, equipment, or materials agreed to be furnished………….… $___________________________

Total value of labor, service, equipment, or materials actually furnished is……………… $___________________________

Credit for materials returned, if any………………………………………………………. $___________________________

Amount paid on account, if any…………………………………………………………… $___________________________

Amount due after deducting all just credits and offsets…………………………………… $___________________________

YOU ARE HEREBY NOTIFIED to withhold sufficient monies held by you on the above described project to satisfy claimant's demand in the amount of $___________________________ and in addition thereto sums sufficient to cover interest, court costs and

reasonable costs of litigation, as provided by law.

A bond (CIVIL CODE SECTION 8532) ___________________________ attached. (Bond required with Stop Payment Notice

served on construction lender on private jobs - bond not required on public jobs or on Stop Payment Notice served on owner on private jobs)

Date: ___________________________ Name of Claimant: ____________________________________________________________

By: ________________________________________________BBBB ________

VERIFICATION

I, the undersigned, state: I am the _____________________________ of the claimant named in the foregoing Stop Payment

Notice; I have read said claim of Stop Payment Notice and know the contents thereof, and I certify that the same is true of my own knowledge. I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Executed on _______________________________, at _________________________________, State of California.

___________________________________________________________

REQUEST FOR NOTICE OF ELECTION

(Private Works Only)

If an election is made not to withhold funds pursuant to this Stop Payment Notice by reason of a payment bond having been recorded in accordance with Sections 8600, 8536 or 8542, please send notice of such election and a copy of the bond within 30 days of such election in the enclosed preaddressed stamped envelope to the address of the claimant shown above. This information must be provided by you under Civil Code Section 8538.

Signed: _________________________________________________________________

Document Specifics

| Fact | Description |

|---|---|

| Legal Framework | Governed by California Civil Code Sections 8044, 8500-8560 for private jobs, and Sections 9350-9510 for public jobs. |

| Filing Requirements (Private Job) | Must be filed with the responsible officer or person at the office or branch of the construction lender administering the construction funds or with the owner. |

| Filing Requirements (Public Job) | Must be filed with the office of the controller, auditor, or other public disbursing officer whose duty it is to make payments under the provisions of the contract. |

| Claimant Information | The claimant must provide detailed information about the labor, service, equipment, or materials furnished. |

| Financial Details | The notice must include the total value of the labor, service, equipment, or materials agreed to be furnished, actually furnished, any credits for returned materials, payments made on account, and the total amount due after credits and offsets. |

| Demand for Payment | The notice notifies the recipient to withhold sufficient monies to satisfy the claimant's demand, including interest, court costs, and reasonable costs of litigation. |

| Bond Requirement | A bond is required with Stop Payment Notice served on construction lenders on private jobs but not required on public jobs or on Stop Payment Notice served on the owner on private jobs. |

| Verification Process | The claimant must declare under penalty of perjury that the information provided in the Stop Payment Notice is true and correct. |

| Request for Notice of Election (Private Works Only) | Requires the receiver of the Stop Payment Notice to inform the claimant about the decision not to withhold funds due to a payment bond, in accordance with Sections 8600, 8536, or 8542. |

Guide to Writing California Stop Payment

Upon facing financial disputes or disagreements within a construction project in California, a Stop Payment Notice becomes a crucial document. This legal instrument serves as a formal request to halt the disbursement of funds, aiming to secure the claimant's interests until the issue is resolved. Completing this form accurately is essential for ensuring its effectiveness. Following are the steps to properly fill it out:

- Locate the section labeled "NOTICE TO" and specify whether it's a private job or a public job accordingly by filling in the appropriate entity or individual's information.

- Under "Direct Contractor," provide the full name of the primary contractor overseeing the project.

- If applicable, fill in the "Sub Contractor" field with the name of any subcontractor involved.

- In the "Owner or Public Body" section, input the information of the project's owner or the governing public entity.

- Describe the project in the "Improvement known as" section, including any relevant identifiers.

- Indicate the county and state of the project location in the designated area.

- Identify yourself as the claimant by listing your name and your role in the project (for example, supplier, laborer).

- Specify the name of the person or company that employed you or to whom you supplied goods or services.

- Detail the type of labor, service, equipment, or materials you provided in the stipulated section.

- Enter the total value agreed upon and the actual total value of the services or materials supplied, along with any credits for returned materials.

- Document the amount that has been paid to you, if any, and the outstanding amount due after all adjustments.

- Declare the sum you are requesting to be withheld by the entity mentioned at the beginning of the form to cover your claim.

- Check whether a bond is attached as per the requirements detailed in the form and indicate accordingly.

- Fill out the date and your name under "Name of Claimant".

- Sign your name where indicated, hereby verifying the information provided in the form.

- Complete the "VERIFICATION" section by stating your relationship to the claimant (e.g., owner, employee) and affirm the truthfulness of the form under penalty of perjury, including the location and date of signing.

- If this is a private work, fill out the "REQUEST FOR NOTICE OF ELECTION" section according to the instructions, including a signature and a request for notification regarding the withholding of funds or the posting of a payment bond.

After you have carefully completed the form, it's imperative to ensure its delivery to the appropriate party as delineated in the instructions for either private or public projects. This action marks the beginning of a legal process designed to protect your financial interests in the project. Be mindful that this step may lead to further legal proceedings, underscoring the importance of adhering to California's construction and civil laws throughout the dispute resolution process.

Understanding California Stop Payment

What is a Stop Payment Notice in California?

A Stop Payment Notice is a legal document used in California construction projects requiring a person, bank, or firm controlling construction funds to withhold an amount sufficient to satisfy a claimant's demand. This includes labor, services, equipment, or materials provided to a project. It applies to both private and public construction jobs, under specific sections of the California Civil Code.

When should a Stop Payment Notice be used?

It should be used when a party who has furnished labor, services, equipment, or materials to a construction project has not been fully paid. This notice acts as a way to secure the amount owed by legally encumbering the funds designated for the construction project.

Who can file a Stop Payment Notice?

Any individual or company that has provided labor, service, equipment, or materials to a construction project and has not received payment for their contribution can file a Stop Payment Notice. This includes direct contractors, subcontractors, and material suppliers.

How do you file a California Stop Payment Notice?

The notice must be filed with the appropriate office depending on the nature of the job. For private jobs, it's filed with the construction lender's office or the property owner. For public jobs, it should be submitted to the office of the controller, auditor, or other public disbursing officer responsible for payments under the contract.

Is a bond required with a Stop Payment Notice?

Yes, a bond is required when serving a Stop Payment Notice on a construction lender for private jobs. However, a bond is not necessary for public jobs or when the notice is served directly on the owner for private jobs.

What information must be included in a Stop Payment Notice?

The notice must detail the claimant's role, the labor, services, equipment, or materials provided, the total value provided, payments received, and the amount still owed. It must also include a request to withhold sufficient funds to cover the claim plus potential interest, court costs, and reasonable costs of litigation.

What happens after filing a Stop Payment Notice?

Once filed, the notice requires the entity controlling the construction funds to withhold enough money to satisfy the claimant's demand until the dispute is resolved either through payment or legal action.

Can a Stop Payment Notice be contested?

Yes, the party receiving the notice can dispute the claim. They may challenge the accuracy of the claimed amounts or argue that the claimant has not fulfilled their contractual obligations. This typically involves legal proceedings.

What is the VERIFICATION section of the Stop Payment Notice?

This section is a declaration by the claimant stating they are knowledgeable about the notice's content and certify its truthfulness under penalty of perjury. It must be executed in the State of California.

What is the purpose of the REQUEST FOR NOTICE OF ELECTION section?

In private works, this section requires the notified party to inform the claimant if they decide not to withhold funds due to a payment bond being recorded, as per specified Civil Code Sections. This must be communicated within 30 days, including a copy of the bond.

Common mistakes

When dealing with the California Stop Payment form, attention to detail is crucial to ensuring the process effectively protects your rights. Here are common mistakes people often make during this critical step:

Failing to accurately identify the proper recipient of the notice, which varies depending on the project being private or public. This mistake can result in the notice not reaching the correct party, thereby delaying or invalidating your claim.

Not including the full and correct names of the parties involved (Direct Contractor, Sub Contractor, Owner, or Public Body), which can lead to confusion and impede the progress of the claim.

Omitting details about the improvement known as description, including its accurate location. This information is critical for establishing the context and domain of the work performed.

Incorrectly stating the claimant's role or the services provided, such as labor, service, equipment, or materials. These specifics are fundamental to highlighting the claimant's contribution to the project.

Miscalculating the total value of the labor, service, equipment, or materials agreed to be furnished versus those actually furnished. This error can significantly affect the amount being claimed.

Omitting credits for materials returned or payments received, which could result in overclaiming and potentially complicate or invalidate the notice.

Not sufficiently itemizing and calculating the accurate amount due after deducting all just credits and offsets, leading to incorrect claim amounts.

Neglecting to attach a bond when required, as specified under Civil Code Section 8532, particularly for notices served on construction lenders on private jobs. The absence of the bond can render the notice ineffective.

Incorrect or incomplete execution of verification by the claimant, including dating and signing inaccurately, which are essential formalities for establishing the veracity of the claim.

Avoiding these mistakes is key to leveraging the Stop Payment Notice effectively. Always ensure to double-check the form for compliance with the California Civil Code requirements, paying special attention to the specifics of your role and contributions to the project.

Documents used along the form

When dealing with construction projects in California, various forms and documents often accompany the California Stop Payment form to ensure all legal and financial protections are in place. These documents play a critical role in managing risks, ensuring compliance with state laws, and facilitating smooth operations between all parties involved.

- Conditional Waiver and Release Upon Progress Payment: This form is used when a payment is made and accepted by a contractor or supplier. It waives and releases the claimant's right to a mechanics lien for the work completed up to the date of the payment, conditional upon the payment clearing.

- Unconditional Waiver and Release Upon Progress Payment: This document is utilized after a progress payment has successfully cleared. It serves as an unconditional waiver and release of any mechanics lien rights for work completed up to the point of the specified payment.

- Preliminary Notice: Required to be served by subcontractors and material suppliers not in direct contract with the property owner. This notice should be sent within 20 days of beginning work or delivering materials to preserve the right to file a mechanics lien.

- Mechanics Lien Claim: If unpaid for provided labor, services, equipment, or materials, a claimant may file a mechanics lien against the property. This legal claim ensures they have a secured interest in the property until receiving payment.

- Notice of Completion: Filed by the property owner with the county recorder's office, this document signifies the completion of the construction project. Filing this notice shortens the time frame in which a claimant can file a mechanics lien.

- Release of Stop Payment Notice: This form is used to release a previously filed stop payment notice. It's typically executed once the claimant has received full payment or resolved the payment issue through other means.

Utilizing these documents effectively requires understanding their purposes and knowing the correct timing for their use. Incorporating them into the workflow of construction projects helps ensure that parties are adequately protected and that the project can proceed with fewer financial and legal hurdles.

Similar forms

The Mechanic's Lien is one document that is similar to the California Stop Payment Notice in several ways. Both serve as legal claims against property for unpaid labor, services, equipment, or materials provided for the property's improvement. They must be filed within a specific period and notify parties of the claimant's intention to seek payment for contributions to a construction project. The main difference lies in their enforcement; a Mechanic's Lien attaches to the property's title, potentially leading to a forced sale, whereas a Stop Payment Notice aims to freeze funds before they are disbursed.

A Payment Bond Claim is another document related to the California Stop Payment Notice. This claim is made against a bond posted by the contractor at the start of a construction project as a guarantee for payment to subcontractors and material suppliers. Like the Stop Payment Notice, it is used to ensure that those who provided labor or materials to a project are compensated. The crucial distinction between these two is the security against which the claim is made; a Payment Bond Claim is against the bond, while the Stop Payment Notice targets the project's financing.

The Preliminary Notice is a prerequisite document in many cases before filing a California Stop Payment Notice or a Mechanic's Lien. It serves as a preliminary alert to the property owner, general contractor, and lender about the claimant's involvement in the project and their right to file a lien or stop payment notice if not paid. While it doesn’t secure a right to funds or property itself, this notice is crucial for preserving the right to file more powerful claims like the Stop Payment Notice if payment is not received.

Finally, the Conditional Waiver and Release upon Progress Payment is somewhat akin to the Stop Payment Notice in its function in the payment process of construction projects. This document is a receipt indicating that the claimant has received a progress payment and waives their right to file a claim for the amount specified in the payment, but only conditionally upon the check clearing. The similarity to the Stop Payment Notice lies in the management of financial transactions and risk between parties; however, it signifies receipt of payment rather than a demand for it.

Dos and Don'ts

When filling out a California Stop Payment form, it's important to pay close attention to both the information being requested and the way it is presented. Here are seven dos and don'ts to consider:

- Do ensure that you accurately fill in all required fields, including the names of the direct contractor, subcontractor (if applicable), owner or public body, and the description of the project and location.

- Do provide a detailed description of the labor, service, equipment, or materials you furnished or agreed to furnish, including the total value and any credits or payments made.

- Don't leave out information about the total value of services or materials provided and the amount still owed to you after deductions. This clarity is crucial for the validity of your claim.

- Do carefully review the section pertaining to the bond requirement. Remember, a bond is needed when the Stop Payment Notice is served on a construction lender on private jobs but is not required on public jobs or when served on the owner on private jobs.

- Do sign and date the form where indicated, and make sure the form is verified under penalty of perjury. This adds legal weight to your claim.

- Don't forget to request a notice of election and a copy of the bond within 30 days if an election is made not to withhold funds due to a payment bond being recorded. This is applicable only to private works.

- Don't overlook providing a return address and ensuring enclosed preaddressed stamped envelopes are included if you're requesting a notice of election. This facilitates the communication process.

By following these guidelines, individuals can more effectively utilize the California Stop Payment form to protect their financial interests in construction projects. Attention to detail and adherence to the specified requirements are key to ensuring that your stop payment notice is both valid and enforceable.

Misconceptions

When discussing the California Stop Payment form, several misconceptions commonly arise. Clearing up these misunderstandings can help individuals and entities understand their rights and obligations under the law.

One misconception is that a stop payment notice can be used for any type of construction project. In reality, California Civil Code specifies different procedures and requirements for private and public construction projects. The form itself highlights this distinction, directing individuals to file with different entities based on the project's nature.

Another common misunderstanding is that the stop payment notice serves as an immediate freeze on all construction funds. Actually, the notice requires the withholding of "sufficient monies" to cover the claimant's demand, interest, court costs, and reasonable costs of litigation. This means that not all funds may be frozen, and the action does not immediately halt the project's financial transactions.

Many believe that the filing of a stop payment notice alone guarantees payment. However, the notice is just the first step in a process that may involve further legal action, including litigation, to resolve the claim. The notice is intended to secure funds to satisfy the claim if it is upheld, not to automatically provide payment to the claimant.

There is a misconception that bonds are always required when a stop payment notice is served. The form clarifies that bonds are required with stop payment notices served on construction lenders on private jobs. In contrast, bonds are not required on public jobs or when the notice is served directly on the owner on private jobs.

Another incorrect belief is that the stop payment notice can substitute for a mechanics lien. Although both are mechanisms to secure payment, they operate differently and have separate requirements and implications. For example, a mechanics lien attaches to the property itself, while a stop payment notice seeks to withhold funds from the owner or lender.

Finally, some people assume that any dispute regarding payment can be addressed through a stop payment notice. However, the form requires claimants to specify the labor, services, equipment, or materials furnished and their value. This means the notice is specifically for disputes regarding unpaid work or materials supplied to a project and may not be applicable for other types of disputes.

Understanding these aspects of the California Stop Payment form is crucial for anyone involved in the state's construction industry. By clarifying these misconceptions, individuals and companies can better navigate the legal landscape related to construction payments.

Key takeaways

Filling out and using the California Stop Payment form is essential for ensuring that those who supply labor, services, equipment, or materials to a construction project are paid for their contributions. To navigate this process smoothly, here are nine key takeaways:

- The California Civil Code Sections 8044 and 8500-8560 (Private Job) and Sections 9350-9510 (Public Job) provide the legal foundation for the Stop Payment Notice on construction projects.

- It is necessary to identify the project accurately, including details such as the construction project's name, location (county and state), and the parties involved (owner, direct contractor, subcontractor, if any).

- Clearly outline the specifics of the labor, services, equipment, or materials provided, including the type and the total value agreed upon and actually delivered. This ensures clarity on the contribution to the project.

- A crucial step involves stating the total amount due, after accounting for any payments received and materials returned. This includes calculating just credits and offsets accurately.

- The form requires the claimant to notify the responsible entity, either the owner or public body managing the project funds, to withhold enough money to cover the claimed amount, plus any legal costs and interest as stipulated by law.

- For private jobs, a bond is required when the Stop Payment Notice is served on the construction lender. However, no bond is needed for public jobs or when served on the owner for private jobs. This is an essential distinction in securing your claim.

- Completing the verification section is mandatory, as it is a declaration under penalty of perjury that the information provided in the Stop Payment Notice is true and correct, based on personal knowledge.

- In situations where there is an election not to withhold funds due to a payment bond being recorded, the claimant can request a notice of such election along with a copy of the bond. This is applicable only to private works and must adhere to Civil Code Section 8538.

- The form, alongside its requirements and verifications, serves not only as a means to secure payment but also as a legal document that may necessitate further legal action if the obligations are not met. Thus, accuracy, thoroughness, and timely submission are paramount.

Understanding and properly utilizing the California Stop Payment notice can significantly aid individuals and companies in the construction industry in safeguarding their financial interests.

Popular PDF Documents

Allocation of Refund (Including Savings Bond Purchases) - It removes the need for manually depositing a tax refund check and then redistributing the funds.

Nevada Income Tax Return - Late submissions face penalties, calculated as a percentage of the tax owed, increasing the later the payment is made.

Carefirst Eft Enrollment - With just a few steps to complete the CareFirst EFT form, you can significantly improve how your payments are processed and received.