Get California Sales Tax Certificate Form

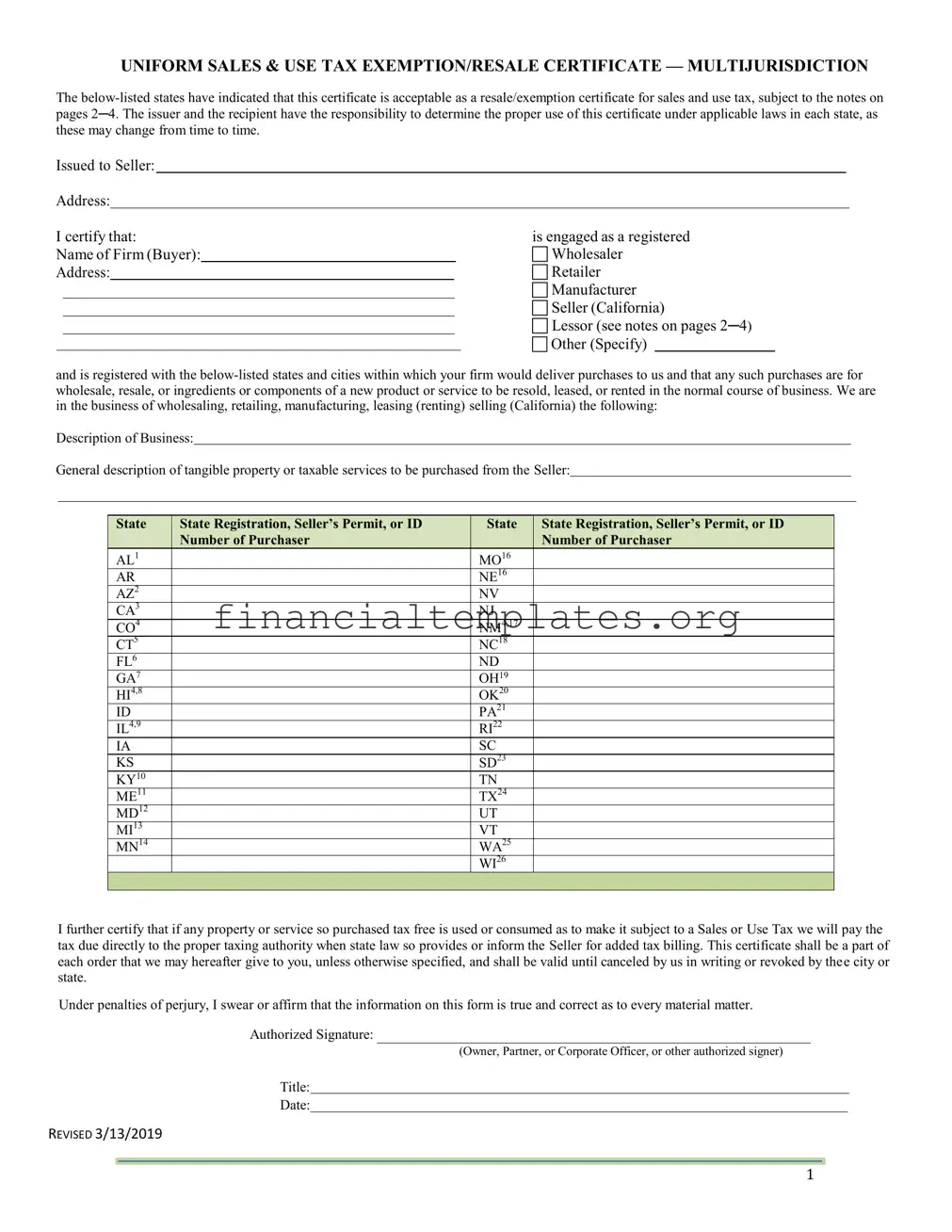

For businesses operating within California or dealing with sales and use tax, understanding and properly utilizing the California Sales Tax Certificate form is crucial. This document, formally known as the Uniform Sales & Use Tax Exemption/Resale Certificate — Multijurisdiction, serves a vital role in ensuring compliance with tax laws across multiple jurisdictions. Accepted by various states, including California, this certificate allows businesses to purchase goods without paying sales tax if those goods are intended for resale, or if they are ingredients or components of a new product. The weight of responsibility falls on both the issuer and the recipient to ascertain the certificate's appropriate application under the ever-evolving state laws. The certificate asks for detailed information, including the type of business (e.g., wholesaler, retailer, manufacturer), specific details about the items purchased, and the purchaser's sales tax permit numbers for states where they're registered. This form not only aids in preventing the unnecessary collection and payment of sales tax but also outlines specific guidelines and conditions under which the certificate is considered valid. It's also subject to certain provisions, like being updated or revoked under specific circumstances, thus stressing the importance of not just obtaining, but also correctly maintaining and understanding the implications of this certificate. Misuse or failure to comply with the nuanced requirements of different states can lead to penalties, making awareness and education around this form a non-negotiable aspect of business operations.

California Sales Tax Certificate Example

UNIFORM SALES & USE TAX EXEMPTION/RESALE CERTIFICATE — MULTIJURISDICTION

The

Issued to Seller:

Address:

I certify that: |

|

|

is engaged as a registered |

||||

Name of Firm (Buyer): |

|

|

|

Wholesaler |

|||

Address: |

|

|

Retailer |

||||

|

|

|

|

|

|

Manufacturer |

|

|

|

|

|

|

|

Seller (California) |

|

|

|

|

|

|

|

Lessor (see notes on pages 2─4) |

|

|

|

|

|

|

|

Other (Specify) |

|

and is registered with the

Description of Business:

General description of tangible property or taxable services to be purchased from the Seller:

State |

State Registration, Seller’s Permit, or ID |

State |

State Registration, Seller’s Permit, or ID |

|

Number of Purchaser |

|

Number of Purchaser |

AL1 |

|

MO16 |

|

AR |

|

NE16 |

|

AZ2 |

|

NV |

|

CA3 |

|

NJ |

|

CO4 |

|

NM4,17 |

|

CT5 |

|

NC18 |

|

FL6 |

|

ND |

|

GA7 |

|

OH19 |

|

HI4,8 |

|

OK20 |

|

ID |

|

PA21 |

|

IL4,9 |

|

RI22 |

|

IA |

|

SC |

|

KS |

|

SD23 |

|

KY10 |

|

TN |

|

ME11 |

|

TX24 |

|

MD12 |

|

UT |

|

MI13 |

|

VT |

|

MN14 |

|

WA25 |

|

|

|

WI26 |

|

|

|

|

|

I further certify that if any property or service so purchased tax free is used or consumed as to make it subject to a Sales or Use Tax we will pay the tax due directly to the proper taxing authority when state law so provides or inform the Seller for added tax billing. This certificate shall be a part of each order that we may hereafter give to you, unless otherwise specified, and shall be valid until canceled by us in writing or revoked by thee city or state.

Under penalties of perjury, I swear or affirm that the information on this form is true and correct as to every material matter.

Authorized Signature:

(Owner, Partner, or Corporate Officer, or other authorized signer)

Title:

Date:

REVISED 3/13/2019

1

INSTRUCTIONS REGARDING

UNIFORM SALES & USE TAX EXEMPTION CERTIFICATE

To Seller’s Customers:

In order to comply with most state and local sales tax law requirements, the Seller must have in its files a properly executed exemption certificate from all of its customers (Buyers) who claim a sales/use tax exemption. If the Seller does not have this certificate, it is obliged to collect the tax for the state in which the property or service is delivered.

If the Buyer is entitled to a sales tax exemption, the Buyer should complete the certificate and send it to the Seller at its earliest convenience. If the Buyer purchases tax free for a reason for which this form does not provide, the Buyer should send the Seller its special certificate or statement.

Caution to Seller:

In order for the certificate to be accepted in good faith by the Seller, Seller must exercise care that the property or service being sold is of a type normally sold wholesale, resold, leased, rented, or incorporated as an ingredient or component of a product manufactured by Buyer and then resold in the usual course of its business. A Seller failing to exercise care could be held liable for the sales tax due in some states or cities. Misuse of this certificate by Seller, lessee, or the representative thereof may be punishable by fine, imprisonment or loss of right to issue a certificate in some states or cities.

Notes:

1.Alabama: Each retailer shall be responsible for determining the validity of a purchaser’s claim for exemption.

2.Arizona: This certificate may be used only when making purchases of tangible personal property for resale in the ordinary

course of business, and not for any other statutory deduction or exemption. It is valid as a resale certificate only if it contains the purchaser’s name, address, signature, and Arizona transaction privilege tax (or other state sales tax) license number, as required by Arizona Revised Statutes §

3. California: a) This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to the provisions of Title 18, California Code of Regulations, Section 1668 (Sales and Use Tax Regulation 1668, Resale Certificate).

b)By use of this certificate, the purchaser certifies that the property is purchased for resale in the regular course of business in the form of tangible personal property, which includes property incorporated as an ingredient or component of an item manufactured for resale in the regular course of business.

c)When the applicable tax would be sales tax, it is the Seller who owes that tax unless the Seller takes a timely and valid resale certificate in good faith.

d)A valid resale certificate is effective until the issuer revokes the certificate.

4.Colorado, Hawaii, Illinois, and New Mexico: these states do not permit the use of this certificate to claim a resale exemption for the purchase of a taxable service for resale.

5.Connecticut: This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to Conn. Gen. State

6.Florida: Allows the Multistate Tax Commission’s Uniform Sales and Use Tax Exemption/Resale Certificate –

Multijurisdictional for

number from the Florida Department of Revenue at floridarevenue.com/taxes/certificates, or by calling

7.Georgia: The purchaser’s

purchaser is located outside Georgia, does not have nexus with Georgia, and the tangible personal property is delivered by drop shipment to the purchaser’s customer located in Georgia.

REVISED 3/13/2019

2

8.Hawaii: allows this certificate to be used by the seller to claim a lower general excise tax rate or no general excise tax, rather than the buyer claiming an exemption. The no tax situation occurs when the purchaser of imported goods certifies to the seller, who originally imported the goods into Hawaii, that the purchaser will resell the imported goods at wholesale. If the lower rate or

9.Illinois: Use of this certificate in Illinois is subject to the provisions of 86 Ill. Adm. Code Ch.I, Sec. 130.1405. Illinois does not have an exemption for sales of property for subsequent lease or rental, nor does the use of this certificate for claiming resale purchases of services have any application in Illinois.

The registration number to be supplied next to Illinois on page 1 of this certificate must be the Illinois registration or resale number; no other state’s registration number is acceptable.

“Good faith” is not the standard of care to be exercised by a retailer in Illinois. A retailer in Illinois is not required to determine whether the purchaser actually intends to resell the item. Instead, a retailer must confirm that the purchaser has a valid registration or resale number at the time of purchase. If a purchaser fails to provide a certificate of resale at the time of sale in Illinois, the seller must charge the purchaser tax.

While there is no statutory requirement that blanket certificates of resale be renewed at certain intervals, blanket certificates should be updated periodically, and no less frequently than every three years.

10.Kentucky: a) Kentucky does not permit the use of this certificate to claim resale exclusion for the purchase of a taxable service.

b)This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to the provisions of Kentucky Revised Statute 139.270 (Good Faith).

c)The use of this certificate by the purchaser constitutes the issuance of a blanket certificate in accordance with Kentucky Administrative Regulation 103 KAR 31:111.

11.Maine: This state does not have an exemption for sales of property for subsequent lease or rental.

12.Maryland: This certificate is not valid as an exemption certificate. However, vendors may accept resale certificates that bear the

exemption number issued to a religious organization. Exemption certifications issued to religious organizations consist of 8 digits, the first two of which are always “29”. Maryland registration, exemption, and direct pay numbers may be verified on the website of the Comptroller of the Treasury at www.marylandtaxes.com.

13.Michigan: This certificate is effective for a period of four years unless a lesser period is mutually agreed to and stated on this certificate. It covers all exempt transfers when accepted by the seller in “good faith” as defined by Michigan statute.

14.Minnesota: a) Minnesota does not allow a resale certificate for purchases of taxable services for resale in most situations.

b)Minnesota allows an exemption for items used only once during production and not used again.

15. |

Missouri: |

a) Purchasers who improperly purchase property or services |

|

|

pay the tax, interest, additions to tax, or penalty. |

b)Even if property is delivered outside Missouri, facts and circumstances may subject it to Missouri tax, contrary to the second sentence of the first paragraph of the above instructions.

16. Nebraska: A blanket certificate is valid for 3 years from the date of issuance.

17.New Mexico: For transactions occurring on or after July 1, 1998, New Mexico will accept this certificate in lieu of a New Mexico nontaxable transaction certificate and as evidence of the deductibility of a sale of tangible personal property provided:

a)this certificate was not issued by the State of New Mexico;

b)the buyer is not required to be registered in New Mexico; and

c)the buyer is purchasing tangible personal property for resale or incorporation as an ingredient or component of a manufactured product.

18.North Carolina: This certificate is not valid as an exemption certificate if signed by a person such as a contractor who intends to use the property. Its use is subject to G.S.

REVISED 3/13/2019

3

19. Ohio: a) The buyer must specify which one of the reasons for exemption on the certificate applies. This may be done by circling or underlining the appropriate reason or writing it on the form above the state registration section. Failure to specify the exemption reason will, on audit, result in disallowance of the certificate.

b)In order to be valid, the buyer must sign and deliver the certificate to the seller before or during the period for filing the return.

20Oklahoma: Oklahoma would allow this certificate in lieu of a copy of the purchaser’s sales tax permit as one of the elements of “properly completed documents” which is one of the three requirements which must be met prior to the vendor being relieved of liability. The other two requirements are that the vendor must have the certificate in his possession at the time the sale is made and must accept the documentation in good faith. The specific documentation required under OAC

a)Sales tax permit information may consist of:

(i)A copy of the purchaser’s sales tax permit; or

(ii)In lieu of a copy of the permit, obtain the following:

*Sales tax permit number; and

*The name and address of the purchaser;

b)A statement that the purchaser is engaged in the business of reselling the articles purchased;

c)A statement that the articles purchased is purchased for resale;

d)The signature of the purchaser or a person authorized to legally bind the purchaser; and

e)Certification on the face of the invoice, bill, or sales slip, or on separate letter, that said purchaser is engaged in reselling the articles purchased.

Absent strict compliance with these requirements, Oklahoma holds a seller liable for sales tax due on sales where the claimed exemption is found to be invalid, for whatever reason, unless the Tax Commission determines that purchaser should be pursued for collection of the tax resulting from improper presentation of a certificate.

21.Pennsylvania: This certificate is not valid as an exemption certificate. It is valid as a resale certificate only if it contains the purchaser’s Pennsylvania Sales and Use Tax

22.Rhode Island: Rhode Island allows this certificate to be used to claim a resale exemption only when the item will be resold in the same form. It does not permit this certificate to be used to claim any other type of exemption.

23.South Dakota: Services which are purchased by a service provider and delivered to a current customer in conjunction with the services contracted to be provided to the customer are claimed to be for resale. Receipts from the sale of a service for resalele by the purchaser are not subject to sales tax if the purchaser furnishes a resale certificate which the seller accepts in good faith. In order for the transaction to be a sale for resale, the following conditions must be present:

(a)The service is purchased for or on behalf of a current customer;

(b)The purchaser of the service does not use the service in any manner; and

(c)The service is delivered or resold to the customer without any alteration or change.

24..Texas: Items purchased for resale must be for resale within the geographical limits of the United States, its territories, and possessions.

25.Washington: a) Blanket resale certificates must be renewed at intervals not to exceed four years;

b)This certificate may be used to document exempt sales of “chemicals to be used in processing ann article to be produced for sale.”

c)Buyer acknowledges that the misuse of the tax due, in addition to the tax, interest, and any other penalties imposed by law.

26.Wisconsin: Wisconsin allows this certificate to be used to claim a resale exemption only. It does not permit this certificate to be used to claim any other type of exemption.

REVISED 3/13/2019

4

Frequently Asked Questions

Uniform Sales and Use Tax Certificate – Multijurisdictional

•To whom do I give this certificate?

•Can I register for multiple states simultaneously?

•I have received this certificate from my customer. What do I do with it?

•Am I the Buyer or the Seller?

•What is the purpose of this certificate?

•How do I fill out the certificate?

•What information goes on the line next to each state abbreviation?

•What if I don’t have an ID number for any (or some) state(s)?

•Who should use this certificate?

•Can I use this certificate?

•Which states accept the certificate?

•I am based in, buying from, or selling into Maine. Can I use this certificate?

•I am a drop shipper. Can I use this certificate?

•Do I have to fill this certificate out for every purchase?

•Can this certificate be used as a blanket certificate?

•Who determines whether this certificate will be accepted?

•I have been asked to accept this certificate. How do I know whether I should accept it?

•Is there a more recent version of this certificate?

•To whom should I talk to for more information?

To whom do I give this certificate?

If you are purchasing goods for resale, you will give this certificate to your vendor, so that your vendor will not charge you sales tax.

If you are selling goods for resale, and you have received this certificate from your buyer, you will keep the certificate on file.

Can I register for multiple states simultaneously?

Click on the link for more information: www.sstregister.org

I have received this certificate from my customer. What do I do with it?

Once you have examined the certificate and you have accepted it in good faith, you will keep it on file as prescribed by applicable state laws. The relevant state will generally be the state where you are located, or the state where the sales transaction took place.

Am I the Buyer or the Seller?

If you are purchasing goods for resale, you are the Buyer. If you are selling goods to a buyer who is purchasing them for resale, you are the Seller.

What is the purpose of this certificate?

This certificate is to be used as supporting documentation that the Seller should not collect sales tax because the good or service sold, or the Buyer, is exempt from the tax.

How do I fill out the certificate?

The individual filling out the certificate is referred to as the Buyer. The first two lines, “Issued to Seller” and

REVISED 3/13/2019

5

“Address”, should be filled in with the name and address of the Seller. The rest of the information refers to the Buyer (name and address of Buyer, business engaged in, description of business, property or services to be purchased). The line next to each state abbreviation should be filled out with the relevant state ID number.

What information goes on the line next to each state abbreviation?

The line next to each state abbreviation should be filled in with the relevant state ID number. This will be an identification number issued by the state (see next FAQ for an exception). For example, on the line next to AL, provide the ID number issued by Alabama.) The relevant ID number may be given various names in the various states. Some of the terms for this ID number are State Registration, Seller’s Permit, or ID Number. Regardless of the name, this will be a number that has been issued by the state to the Buyer (see next FAQ for an exception). This number is generally associated with the reseller’s authority to collect and remit sales tax.

What if I don’t have an ID number for any (or some) state(s)?

The states vary in their rules regarding requirements for a reseller exemption. Some states require that the reseller (Buyer) be registered to collect sales tax in the state where the reseller makes its purchase. Other states will accept the certificate if an ID number is provided for some other state (e.g., the home state of the Buyer). You should check with the relevant state to determine whether you meet the requirements of that state.

Who should use this certificate?

A Buyer who is a reseller of tangible property or taxable services from a Seller located in one of the states listed may be able to use this certificate for sales tax exemption. States vary in their policies for use of this certificate. Questions regarding your specific eligibility to use this certificate should be addressed to the revenue department of the relevant state.

Can I use this certificate?

The states vary in their rules for use of this certificate. You should check with the relevant state to determine whether you can use this certificate. The relevant state may be the state where the Seller is located, where the transaction takes place, or where the Buyer is located. The footnotes to the certificate provide some guidance; however, the Multistate Tax Commission cannot guarantee that any state will accept this certificate. States may change their policies without informing the Multistate Tax Commission.

Which states accept the certificate?

States listed on the certificate accepted this certificate as of July, 2000. States may change their policies for acceptance of the certificate without notifying the Multistate Tax Commission. You may check with the relevant state to determine the current status of the state’s acceptance policy. See next FAQ.

I am based in, buying from, or selling into Maine. Can I use this certificate?

Please contact Maine Revenue Services. See: Sales Instructional Bulletin 54

www.maine.gov/revenue/salesuse/Bull5410092013.pdf

I am a drop shipper. Can I use this certificate?

If you are the Buyer and your Seller ships directly to your customers, you may be able to use this certificate because you are a reseller. However, your Seller may be unwilling to accept this certificate if you are not registered to collect sales tax in the state(s) where your customers are located.

If you are the Seller, and you have nexus with the state(s) into which you are shipping to your Buyer’s customers, you may be required by that state(s) to remit sales tax on those sales if your Buyer is not registered to collect sales tax.

REVISED 3/13/2019

6

Do I have to fill this certificate out for every purchase?

In many cases, this certificate can be used as a blanket certificate, so that you will only need to fill it out once for each of your Sellers. Some states require periodic replacement with a fresh certificate (see notes on certificate). To make filling out the certificate easier, you should fill out your information and all information that does not change, then make photocopies, and then fill out the information that is specific to the transaction.

Can this certificate be used as a blanket certificate?

In many states this certificate can be used as a blanket certificate. You should verify this with the applicable state. A blanket certificate is one that can be kept on file for multiple transactions between a specific Buyer and specific Seller.

Who determines whether this certificate will be accepted?

The Seller will determine whether it will accept the certificate from the Buyer generally according to a good faith standard. The applicable state will determine whether a certificate is acceptable for the purpose of demonstrating that sales tax was properly exempted. The applicable state will generally be the state where the Seller is located or the state where the sales transaction took place, or where the Buyer is located. The Multistate Tax Commission does not determine whether this certificate will be accepted either by the Seller or the applicable state.

I have been asked to accept this certificate. How do I know whether I should accept it?

You should contact your state revenue department if you are not familiar with the policies regarding acceptance of resale exemption certificates.

In order for the certificate to be accepted in good faith by the Seller, Seller must exercise care that the property or service being sold is of a type normally sold wholesale, resold, leased, rented or incorporated as an ingredient or component of a product manufactured by Buyer and then resold in the usual course of its business. A Seller failing to exercise care could be held liable for the sales tax due in some states.

Is there a more recent version of this certificate?

No. The most recent version is posted on our website. You may have seen a version that has been modified in an unauthorized manner. You should not use any version other than the one available on our website.

Whom should I talk to for more information?

For information regarding whether the certificate will be accepted in the applicable state, you should talk to the revenue department of that state. The Multistate Tax Commission’s Member States webpage has links to revenue department websites. For other questions that have not been addressed by these FAQs, you may contact Elliott Dubin at the Multistate Tax Commission,

REVISED 3/13/2019

7

Document Specifics

| Fact Number | Fact Details |

|---|---|

| 1 | The form is used across multiple jurisdictions as indicated by the states listed within the document. |

| 2 | It serves as a resale or exemption certificate for sales and use tax purposes. |

| 3 | The certificate places the responsibility on both the issuer and the recipient to determine the proper use under applicable laws of each state. |

| 4 | Governing law for California is specified as Title 18, California Code of Regulations, Section 1668. |

| 5 | The certificate must contain details such as the name and address of the buyer, and the nature of the business (e.g., wholesaler, retailer). |

| 6 | It is intended for purchases made for resale, lease, or as ingredients or components of a new product. |

| 7 | There is an affirmation that if the purchased property is used in a manner making it subject to sales or use tax, the tax will be paid directly to the taxing authority. |

| 8 | Validity extends until the certificate is canceled by the issuer in writing or revoked by the city or state. |

| 9 | The document includes a declaration that the information provided is accurate under penalties of perjury. |

| 10 | State-specific notes provide additional guidelines on the application and limitations of the certificate. |

Guide to Writing California Sales Tax Certificate

Filling out the California Sales Tax Certificate form correctly is an important step for businesses to ensure compliance with state tax regulations. This form, also known as the Uniform Sales & Use Tax Exemption/Resale Certificate, allows businesses to purchase goods without paying sales tax if those goods are to be resold or are used as components in products or services that will be resold. It's essential for both the seller and the buyer to understand their responsibilities in this process. The buyer must provide accurate information and the seller must keep the certificate on file to justify not charging sales tax. Here’s a step-by-step guide to completing the form:

- Identify the seller: Start by providing the seller's name and address in the space provided under "Issued to Seller." This information acknowledges who is receiving the certificate from the buyer.

- Name of Firm (Buyer): Enter the legal name of your business as it's registered with the state.

- Select your business type: Check the appropriate box that describes your business, such as wholesaler, retailer, manufacturer, etc.

- Description of Business: Provide a brief description of what your business does, focusing on the nature of the goods or services you sell.

- General Description of Tangible Property or Taxable Services to be Purchased: Describe the items you plan to purchase without sales tax. Be as specific as possible while still covering all potential purchases under this certificate.

- State Registration, Seller’s Permit, or ID Number of Purchaser: In the section provided, list the states and corresponding registration or permit numbers where you're registered to collect and remit sales tax. Include California and any other state where you do business and are making tax-exempt purchases for resale.

- Certification Statement: Read the certification statement carefully. By signing, you are affirming that all the information on the form is correct and that you understand the conditions under which the certificate is issued.

- Authorized Signature: The form must be signed by an owner, partner, corporate officer, or another individual with the authority to legally bind the company.

- Title: Indicate the title or position of the person signing the form.

- Date: Enter the date the form is being completed and signed.

Once the form is filled out, it should be sent to the seller to keep on file. Remember, this certificate remains valid until it is revoked in writing by your business or invalidated by the state. Keeping a copy for your records is also a good practice in case of an audit. It's the responsibility of the buyer to ensure that all purchases made under this certificate meet the eligibility criteria for sales tax exemption in each state listed.

Understanding California Sales Tax Certificate

To whom do I give this certificate? If you are a buyer purchasing goods intended for resale, you should provide this certificate to the seller to prevent them from charging you sales tax. Sellers receiving this certificate from their buyers should keep the certificate on file as evidence that the sale was tax-exempt under applicable state laws.

Can I register for multiple states simultaneously? Yes, you can register for multiple states simultaneously. For detailed information and to complete this process, please visit www.sstregister.org.

I have received this certificate from my customer. What do I do with it? As a seller, upon receiving this certificate, you should ensure it is filled out correctly and accepted in good faith. Then, keep it on file in accordance with state regulations. The state of importance is usually where the transaction occurs or where your business is located.

Am I the Buyer or the Seller? If you are acquiring goods for the purpose of resale, you are the Buyer. Conversely, if you are selling goods to someone who intends to resell them, you are considered the Seller in the context of this certificate.

What is the purpose of this certificate? This certificate supports the fact that a sale is exempt from sales tax. This can be due to the nature of the goods or services being sold, or because the Buyer is entitled to a sales tax exemption.

How do I fill out the certificate? The entity filling out the certificate is the Buyer. They must provide specific details such as the seller’s information, nature of the business, and a description of the goods or services purchased. The form must also include the Buyer's state registration or seller’s permit numbers for states in which they are registered.

What information goes on the line next to each state abbreviation? Next to each state abbreviation, you should enter your state registration, seller’s permit, or ID number for each state where you are registered to conduct business and claim tax exemptions.

What if I don’t have an ID number for any (or some) state(s)? If you do not have an ID number for a specific state, you cannot use this certificate to claim exemption from sales tax in that state. You may need to explore other forms or registration options suited for your business requirements.

Who should use this certificate? This certificate is intended for use by individuals or businesses that are buying goods for resale, leasing, or as ingredients or components of new products to be resold. It is an official declaration to vendors that the purchaser is entitled to make tax-exempt purchases under specific state laws.

Common mistakes

Filling out the California Sales Tax Certificate form accurately is crucial for businesses seeking to apply for a resale or exemption certificate. However, several common mistakes can lead to issues such as delays or even the rejection of the application. Here are six mistakes to avoid:

Not specifying the type of business: The form requires the buyer to indicate the nature of their business, such as wholesaler, retailer, or manufacturer. Leaving this section blank or incorrectly specifying your business type can invalidate the certificate.

Incomplete buyer information: Failing to provide comprehensive details about the buyer, including the full name of the firm and the address, can lead to processing delays or a rejected application.

Omitting the description of goods: The certificate asks for a general description of tangible property or taxable services to be purchased. A vague or missing description may result in the certificate being considered incomplete.

Incorrect state registration or seller’s permit numbers: Buyers must include their registration, seller’s permit, or ID number for states involved. Entering incorrect numbers or leaving them blank jeopardizes the certificate's validity.

Not signing or dating the document: The certificate must be signed and dated by an authorized individual, such as an owner, partner, or corporate officer. An unsigned or undated certificate is not valid.

Failing to renew or update the certificate: A valid resale certificate is effective until the issuer revokes it. However, businesses often forget to renew or update their certificates, which can lead to complications during tax audits or transactions.

To ensure smooth business operations and compliance with state tax laws, it is important for businesses to pay close attention to the details when filling out the California Sales Tax Certificate form. Avoiding these common mistakes can help prevent unnecessary delays or legal challenges related to your business's tax-exempt purchases.

Documents used along the form

When you're dealing with the California Sales Tax Certificate form, it's important to know that there are other forms and documents that you might need to use alongside it. These additional documents can help ensure that all aspects of sales, use tax exemption, and resale activities are properly documented and legally compliant. Here's a breakdown of some of those essential forms and documents:

- Seller's Permit Application: This form is needed for businesses to legally sell or lease tangible goods in California. It registers the business with the California Department of Tax and Fee Administration (CDTFA) for sales tax collection.

- Resale Certificate: Similar to the Sales Tax Certificate, this document is used by purchasers to inform sellers that the purchase is for resale, and thus, exempt from sales tax.

- Exemption Certificate for Purchases for Resale: This certificate is specifically used to claim exemption from tax when the property being purchased will be resold in the purchaser's regular course of business.

- Use Tax Return: This form is for businesses and individuals who need to report purchases subject to use tax. It's used when sales tax hasn't been paid to a California seller.

- Special Events Certification: Vendors and sellers participating in temporary events like flea markets or craft fairs need this document to report and pay sales tax collected during the event.

- Consumer's Use Tax Account Application: For consumers who frequently purchase goods without paying California sales tax (e.g., from out-of-state vendors), this account allows them to report and pay use tax directly to the CDTFA.

- Request for Copy of Tax Return: This form allows businesses to request a copy of previously filed sales and use tax returns, useful for record-keeping and compliance checks.

- Business Taxes Statement: Required for reporting various state taxes, this document may include sales and use tax information among other tax obligations of a business.

- Sales and Use Tax Records Adjustment Notice: If there are adjustments to be made to previously reported sales and use tax, this notice is filed along with the necessary documentation to correct the record.

- Application for Refund or Credit: Businesses or individuals can use this form to apply for a refund or credit for overpaid sales taxes, provided they meet the eligibility criteria.

Each of these documents plays a crucial role in ensuring compliance with California's sales and use tax laws and regulations. Whether you're a seller collecting tax, a buyer claiming a resale exemption, or a taxpayer filing returns, it's important to use the correct forms and understand their purposes. By staying informed and organized, you can navigate the complexities of tax obligations with confidence.

Similar forms

The California Sales Tax Certificate form shares similarities with the Seller's Permit application in various states. Like the Sales Tax Certificate, a Seller's Permit application is crucial for businesses engaged in sales within a state, as it grants them the authorization to sell goods or services. Both documents require detailed information about the business, including business type (wholesale, retail, manufacturing, etc.) and a general description of the products or services sold. Additionally, both serve as verification that the company is registered and eligible to conduct sales, either through resale or direct sales, ensuring compliance with state tax laws.

Another analogous document is the Streamlined Sales and Use Tax Agreement Certificate of Exemption. This certificate, similar to the California Sales Tax Certificate, is used by businesses to purchase goods or services tax-free, on the premise that the purchased items will be resold. Both certificates necessitate the buyer to provide substantial proof of intent to resell the goods or use them as components in manufacturing or in offering taxable services, thus exempting them from paying sales tax at the point of purchase. The responsibility to validate the appropriate use of these certificates under applicable laws rests on both the issuer and the recipient.

The Use Tax Certificate is another related document. While the Sales Tax Certificate is used for transactions where sales tax is not collected at the time of purchase with the intention of resale, the Use Tax Certificate applies to goods purchased tax-free for use, storage, or consumption within the state. In essence, both certificates are about tax obligation - the former avoids initial sales tax on resale items, whereas the latter concerns items not meant for resale but instead for the purchaser's use, making them subject to use tax if sales tax wasn't initially charged.

Resale Certificates for specific states bear resemblance as well. These are tailored to each state's regulations, similar to the uniform Sales & Use Tax Exemption/Resale Certificate but are specific to a single jurisdiction. They serve the same primary function of allowing businesses to buy goods or services without paying sales tax when those goods are intended for resale. Required information typically includes the purchaser's name, business type, and a valid state seller's permit or resale license number, all aimed at certifying the buyer's eligibility for tax exemption under state laws.

Lastly, the Direct Pay Permit is akin to the California Sales Tax Certificate but serves a slightly different purpose. With a Direct Pay Permit, the holder is authorized to purchase tangible personal property or taxable services tax-free at the point of purchase and then directly remit the use tax to the state. This contrasts with the Sales Tax Certificate, where the emphasis is on resale without initial tax payment. However, both share the commonality of providing businesses a form of tax relief or deferment under specific conditions, governed by state tax regulations.

Dos and Don'ts

When filling out the California Sales Tax Certificate form, it's critical to follow best practices to ensure accuracy and compliance. Below are four dos and four don'ts to guide you through the process.

Do:- Review the instructions carefully before beginning to fill out the form to ensure you understand the requirements and purposes of each section.

- Complete all required fields accurately, including your business name, address, and type of business. Incomplete forms may be rejected or cause delays.

- Include your State Registration, Seller’s Permit, or ID Number for California and any other states where you're registered. This verifies your eligibility for sales tax exemption.

- Sign and date the form as the authorized representative of your business. An unsigned form is not valid and will not be accepted.

- Use the form for unauthorized purposes. It’s designed for sales and use tax exemption/resale and must not be used to avoid tax on personal purchases.

- Guess on details or leave sections blank. If you're unsure about what to include, seek clarification before submitting the form to avoid mistakes.

- Forget to update the certificate when your information changes or if the form expires. Regular updates ensure ongoing compliance.

- Misrepresent your business’s intent. Claiming exemption for goods not intended for resale or for a different business purpose than listed can lead to penalties.

Following these guidelines helps ensure that your California Sales Tax Certificate form is filled out correctly and complies with applicable regulations, avoiding unnecessary complications or legal issues.

Misconceptions

Understanding the California Sales Tax Certificate form is crucial for businesses to navigate the complexities of sales and use tax regulations. However, there are several misconceptions surrounding its use and requirements. Here are six common misunderstandings:

- It serves as an exemption certificate in all states: This is not true for every state. For instance, in California, the form is used as a resale certificate under specific regulations and does not serve as a general exemption certificate.

- It automatically exempts all purchases from sales tax: The certificate only applies to items purchased for resale, lease, or as components of a new product or service to be resold. The buyer is responsible for ensuring the purchased items qualify under their state’s laws.

- Submission guarantees no sales tax will be charged: Sellers are required to verify that the goods or services sold qualify for exemption based on the nature of the sale. Incorrect or incomplete certificates may not absolve the buyer from sales tax liability.

- One certificate works for all transactions: While the certificate can act as a blanket document for ongoing transactions with a seller, individual states may have different requirements or expiration periods for these certificates.

- It is only for tangible personal property: Although primarily used for tangible personal property, specific states allow the certificate’s use for certain services or other exceptions outlined in their regulations.

- No need for renewal or updates: Some states require that resale certificates be updated or renewed periodically to remain valid. Failing to do so might result in the buyer needing to pay sales tax on otherwise exempt purchases.

It's essential for both buyers and sellers to comprehend the intricacies of the California Sales Tax Certificate form to ensure compliance and avoid potential penalties. This includes understanding state-specific rules and regularly verifying that all transactions meet the legal requirements for tax exemptions or exclusions.

Key takeaways

Understanding the California Sales Tax Certificate form, formally known as the Uniform Sales & Use Tax Exemption/Resale Certificate – Multijurisdiction, is crucial for businesses engaged in selling goods that are intended for resale. Here are key takeaways to ensure compliance and proper use:

- Businesses should determine the applicability of this certificate under the laws of each state, recognizing that regulations can change, affecting the certificate's use.

- The certificate asks for specifics such as whether the purchaser is a wholesaler, retailer, manufacturer, lessor, or other, highlighting the need to accurately identify the nature of the purchasing firm.

- This form requires the purchaser to provide a description of the business and the tangible personal property or taxable services to be bought from the seller, ensuring a match with the business activity.

- It is essential for purchasers to provide their state registration, seller's permit, or ID number for states where they are registered, indicating tax compliance in those jurisdictions.

- Purchasers must affirm that any goods or services bought tax-free but later used in a manner making them taxable, will result in the tax being paid directly to the taxing authority, underscoring the responsibility to remain compliant post-purchase.

- The certificate must be part of each order given to the seller unless otherwise specified, showing its ongoing relevance to the buyer-seller relationship.

- By signing the certificate, the authorized individual attests to the accuracy of the information provided, under penalty of perjury, emphasizing the legal ramifications of submitting false information.

- The certificate is not valid as an exemption certificate in certain states, including California, Colorado, Connecticut, and others, where it is specifically limited to use as a resale certificate and subject to state regulations.

- Sellers are cautioned to ensure the goods or services sold are eligible for resale by the purchaser. Failure to exercise due diligence could leave the seller liable for uncollected sales tax.

- Misuse of this certificate can lead to penalties, including fines or imprisonment in some states or cities, highlighting the importance of its proper and lawful use.

This certificate plays a vital role in the transaction between sellers and purchasers who are engaged in the resale of goods and services. Both parties must understand their responsibilities to ensure compliance with applicable sales and use tax laws.

Popular PDF Documents

Zanesville City Tax - It aids in identifying businesses that contribute to the local economy through employment and commercial activities.

Trillium Drug Program Application Online - Instructions and necessary information for seniors applying for the $2 co-payment option under the Ontario Drug Benefit program, including income thresholds for eligibility.