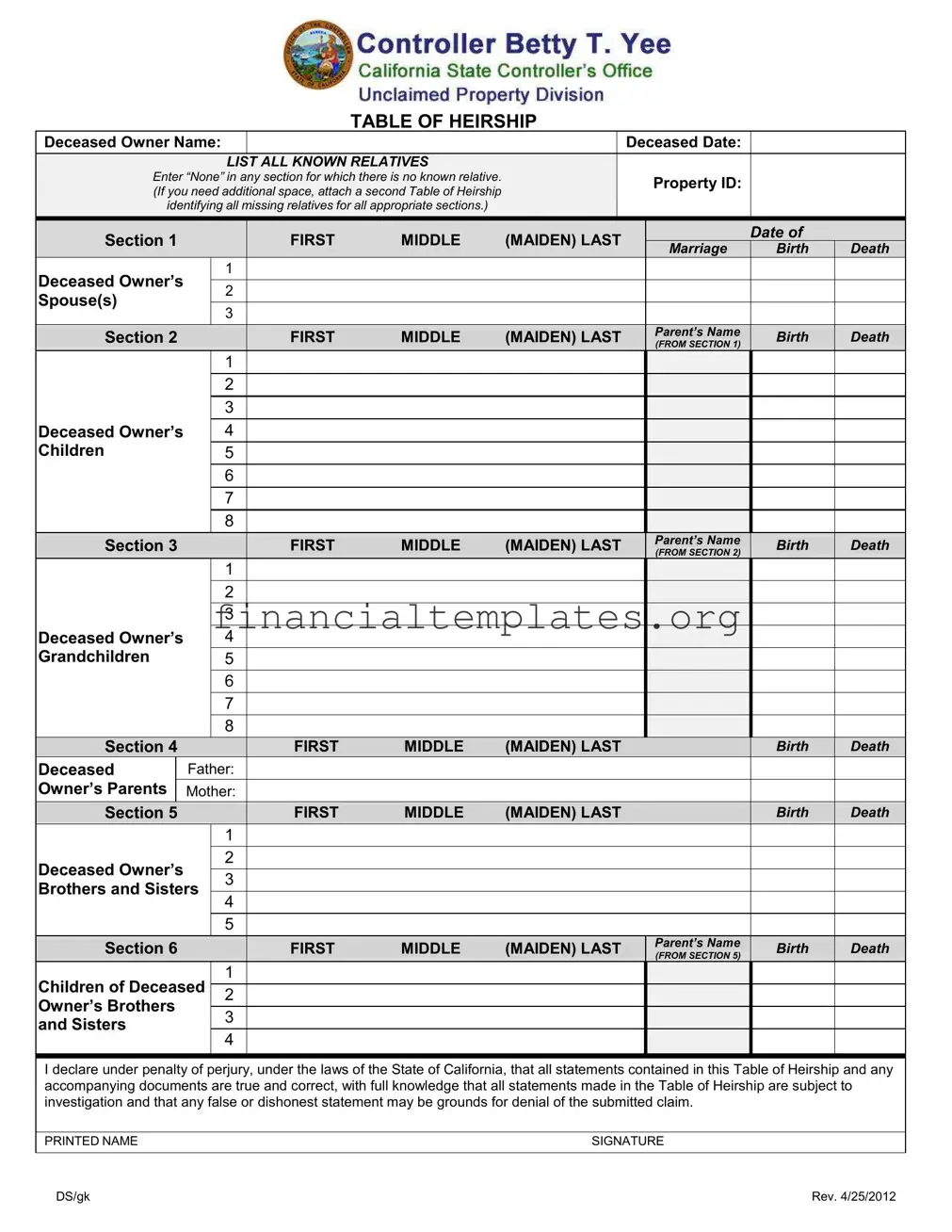

Get California Heirship Form

In the wake of losing a loved one, families often face not just emotional turmoil but also the daunting task of managing the deceased's estate. The California Heirship form plays a critical role in this process, providing a standardized way to declare rightful heirs to the deceased's assets. This document requires comprehensive information about the deceased, including their full name, date of death, and a detailed list of all known relatives, both living and deceased. It extends across several generations, encompassing spouses, children, grandchildren, parents, siblings, and even nieces and nephews, ensuring that every potential heir is accounted for. Information required includes full names (with maiden names where applicable), dates of birth, and dates of death for each relative. This meticulous documentation is crucial for those claiming ownership or rights to the deceased's property, enabling the fair distribution of assets according to state laws. Claimants must affirm the authenticity of the information provided under penalty of perjury, highlighting the form's significance in the legal process surrounding estate management. This makes the California Heirship form an indispensable tool for families navigating the complexities of estate settlement and inheritance distribution.

California Heirship Example

|

|

|

|

|

|

|

TABLE OF HEIRSHIP |

|

|

|

|

|

|

|

||

Deceased Owner Name: |

|

|

|

|

|

|

Deceased Date: |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIST ALL KNOWN RELATIVES |

|

|

|

|

|

|

|

|

|

|||

Enter “None” in any section for which there is no known relative. |

|

|

|

Property ID: |

|

|

|

|

||||||||

(If you need additional space, attach a second Table of Heirship |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||

identifying all missing relatives for all appropriate sections.) |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 1 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

|

Date of |

|

|

|||

|

|

|

|

|

|

Marriage |

|

Birth |

|

Death |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Deceased Owner’s |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 2 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

Parent’s Name |

|

Birth |

|

Death |

||

|

|

|

|

|

|

(FROM SECTION 1) |

|

|

||||||||

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

Deceased Owner’s |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Children |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

Section 3 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

Parent’s Name |

|

Birth |

|

Death |

||

|

|

|

|

|

|

(FROM SECTION 2) |

|

|

||||||||

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

Deceased Owner’s |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Grandchildren |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

Section 4 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

|

|

Birth |

|

Death |

||

Deceased |

|

Father: |

|

|

|

|

|

|

|

|

|

|

|

|||

Owner’s Parents |

|

Mother: |

|

|

|

|

|

|

|

|

|

|

|

|||

Section 5 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

|

|

Birth |

|

Death |

||

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

Deceased Owner’s |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

||

Brothers and Sisters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 6 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

Parent’s Name |

|

Birth |

|

Death |

||

|

|

|

|

|

|

(FROM SECTION 5) |

|

|

||||||||

Children of Deceased |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Owner’s Brothers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

||

and Sisters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I declare under penalty of perjury, under the laws of the State of California, that all statements contained in this Table of Heirship and any accompanying documents are true and correct, with full knowledge that all statements made in the Table of Heirship are subject to investigation and that any false or dishonest statement may be grounds for denial of the submitted claim.

PRINTED NAME |

SIGNATURE |

|

|

DS/gk |

Rev. 4/25/2012 |

|

TABLE OF HEIRSHIP |

|

INSTRUCTIONS |

Deceased Owner Name |

Enter the name of the deceased person whose property you are claiming. |

|

|

Deceased Date |

Enter the date the deceased property owner died. |

|

|

Property ID |

Enter the Property ID found on the claim details page printed with your claim form. |

|

|

To ensure you receive the funds to which you are entitled, enter the requested information for yourself and all of the deceased property owner’s known relatives, both living and dead. In addition, provide a copy of all pages of the certified death certificate for all deceased relatives listed in all Sections above your name to whom you are directly related (such as, your grandmother/grandfather, mother/father, and/or son/daughter).

Include in this section all of the deceased property owner’s current or former spouses. Enter one spouse per line (living or dead). If the deceased owner never married, enter “None.”

Include in this section all of the deceased property owner’s current or former spouses. Enter one spouse per line (living or dead). If the deceased owner never married, enter “None.”

Enter the spouse’s first, middle, (maiden name, if applicable) and last name.

Enter the spouse’s date of marriage to the deceased property owner.

Enter the spouse’s date of birth.

If the spouse is deceased, enter the spouse’s date of death.

Include in this section all of the deceased property owner’s children. Enter one child per line (living or dead). If the deceased owner did not have any children, enter “None.”

Include in this section all of the deceased property owner’s children. Enter one child per line (living or dead). If the deceased owner did not have any children, enter “None.”

Enter the child’s first, middle, (maiden name, if applicable) and last name.

Enter the first name of the child’s parent, as listed in Section 1.

Enter the child’s date of birth.

If the child is deceased, enter the child’s date of death.

Include in this section all of the deceased property owner’s grandchildren. Enter one grandchild per line (living or dead). If the deceased owner did not have any grandchildren, enter “None.”

Include in this section all of the deceased property owner’s grandchildren. Enter one grandchild per line (living or dead). If the deceased owner did not have any grandchildren, enter “None.”

Enter the grandchild’s first, middle, (maiden name, if applicable) and last name.

Enter the first name of grandchild’s parent, as listed in Section 2.

Enter the grandchild’s date of birth.

If the grandchild is deceased, enter the grandchild’s date of death.

Include in this section both of the deceased property owner’s parents (living or dead).

Include in this section both of the deceased property owner’s parents (living or dead).

Enter the parent’s first, middle, (maiden name, if applicable) and last name.

Enter the parent’s date of birth.

If the parent is deceased, enter the parent’s date of death.

Include in this section all of the deceased property owner’s brothers and sisters. Enter one

Include in this section all of the deceased property owner’s brothers and sisters. Enter one  brother or sister per line (living or dead). If the deceased owner did not have any brothers or sisters, enter “None.”

brother or sister per line (living or dead). If the deceased owner did not have any brothers or sisters, enter “None.”

Enter the brother or sister’s first, middle, (maiden name, if applicable) and last name.

Enter the brother or sister’s date of birth.

If the brother or sister is deceased, enter the brother or sister’s date of death.

Include in this section all of the deceased property owner’s nieces and nephews. Enter one niece or nephew per line (living or dead). If the deceased owner did not have any nieces or nephews, enter “None.”

Enter the niece or nephew’s first, middle, (maiden name, if applicable) and last name.

Enter the first name of the niece or nephew’s parent, as listed in Section 5.

Enter the niece or nephew’s date of birth.

If the niece or nephew is deceased, enter the niece or nephew’s date of death.

DS/gk |

Rev. 4/25/2012 |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The California Heirship form is used to claim property from a deceased property owner by identifying legal heirs. |

| Governing Law | The form is governed by the laws of the State of California and requires a declaration under penalty of perjury. |

| Sections of the Form | The form contains six sections for detailing the relationships of the deceased owner's relatives, including spouse(s), children, grandchildren, parents, siblings, and nieces/nephews. |

| Verification of Claims | All statements made in the Table of Heirship are subject to investigation to verify the authenticity of the claims. |

| Penalty for False Statements | Making false or dishonest statements may be grounds for denial of the submitted claim. |

| Additional Attachments Requirement | Certified death certificates for all deceased relatives listed must be attached for direct relations. |

| Property ID Specification | Claimants must enter the Property ID found on the claim details page to ensure proper processing. |

| Spouse(s) Information | This section is for the detailing of the deceased owner's current or former spouse(s), including their name(s), date(s) of marriage, birth, and death. |

| Children Information | Details of the deceased owner's children including names, birth, and death dates are provided, linking them to their parent stated in Section 1. |

| Other Relatives Information | The form also solicits information about grandchildren, parents, siblings, and nieces/nephews of the deceased owner with specific sections for each. |

Guide to Writing California Heirship

When a loved one passes away, handling their estate requires careful attention to detail. One crucial step may involve filling out the California Heirship form, which is used to establish the rightful heirs to the deceased's property. The form requests detailed information about the deceased and their family members. Following the instructions carefully is essential to ensure the process moves efficiently and correctly.

Steps to Fill Out the California Heirship Form:

- Start by entering the Deceased Owner's Name at the top of the form. This should be the full legal name of the deceased individual whose estate is being claimed.

- Fill in the Deceased Date, the exact date when the deceased passed away.

- Proceed with the Property ID. This is a unique identifier found on the claim details page provided with your claim form.

- In Section 1, list all of the deceased's spouses. For each spouse (current or former), enter their full name, including the maiden name if applicable, the date of marriage to the deceased, their date of birth, and date of death if they are also deceased. Write "None" if the deceased was never married.

- In Section 2, detail the deceased's children. Include the child's full name, the name of the child's parent as listed in Section 1, and both the child's date of birth and date of death (if applicable). If there are no children, enter "None".

- For Section 3, provide information on the deceased's grandchildren. Similar to Section 2, include full names and birth/death dates, matching each grandchild with their parent's name as listed in Section 2. Use "None" if there are no grandchildren.

- In Section 4, list the deceased's parents' names, including maiden names where relevant, and their birth and death dates. This section accounts for both of the deceased's parents, regardless of their decedent status.

- Section 5 asks for details about the deceased's siblings. Enter each brother's or sister's full name, birth, and death dates. Again, write "None" if the deceased did not have any siblings.

- The final part, Section 6, is dedicated to nieces and nephews. List each one's full name, date of birth, and date of death where applicable, linking them to their parent listed in Section 5.

- After completing all sections, review the form to ensure accuracy. Then, sign and date the declaration at the bottom of the form, affirming under penalty of perjury that all provided information is true and correct.

- Remember to attach certified death certificates for any deceased relatives listed in the form whom you are directly related to.

Once filled, the California Heirship form becomes a vital document in claiming ownership or rights to the deceased's property. It is advisable to double-check all entries for accuracy before submission to avoid any potential delays or disputes in the estate settlement process.

Understanding California Heirship

What is the purpose of the California Heirship form?

Who needs to fill out the California Heirship form?

What information do you need to provide in the form?

- Details of any current or former spouse(s), including names, marriage date, and dates of birth and death.

- Children's information with corresponding parent names, and their birth and death dates.

- Grandchildren's details, tying them back to their parents listed in the form.

- Information on deceased's parents, brothers, sisters, and their children (nieces and nephews), including names and important dates.

Can you attach additional pages if there is not enough space on the form?

What legal implications does signing the California Heirship form have?

Where should the completed California Heirship form be submitted?

The California Heirship form plays a crucial role in the estate settlement process, particularly in situations where a deceased property owner did not leave a will. It is designed to methodically capture essential information regarding the deceased individual's family tree, including spouses, children, parents, siblings, and other relatives like grandchildren and nieces/nephews. This structured collection of heirship details aids in determining the rightful heirs to the deceased's estate, ensuring that the property and other assets are distributed according to the laws of intestate succession in California.

Individuals, often heirs or estate administrators, who are involved in the claim process of a deceased person's estate and where there is an absence of a will or other estate planning documents, need to fill out the California Heirship form. It serves as a critical document in providing a clear lineage of potential heirs, thereby assisting in the rightful distribution of the estate's assets under state law.

In filling out the California Heirship form, you are required to detail identifiable information regarding the deceased's known relatives across several sections. This includes:

Each section should be filled with accurate information or marked as "None" if there are no known relatives in that category. It's also important to attach a certified death certificate for all deceased individuals listed above your name in the form to whom you are directly related.

Yes, if the space provided on the California Heirship form is insufficient to list all known relatives, you are permitted to attach additional pages. These pages should follow the format of the original sections in the form to ensure consistency and clarity in presenting the deceased's family tree. It's crucial that these attachments are clearly labeled and securely attached to prevent any loss of information during processing.

By signing the California Heirship form, you are declaring, under penalty of perjury according to California law, that all information provided in the document and its attachments is true and accurate to the best of your knowledge. This declaration signifies that you understand information in the form is subject to further investigation and that any false or misleading statements can lead to the denial of the claim and potential legal consequences.

The completed California Heirship form, alongside the necessary documentation such as certified death certificates, should be submitted to the appropriate estate or claim handling authority, often the county probate court or a specific financial institution in charge of the deceased's assets. It's advisable to inquire directly with the entity managing the estate to ensure correct submission procedures, including mailing addresses or online portal options if available.

Common mistakes

When filling out the California Heirship form, it’s crucial to provide accurate and complete information about the deceased person's heirs. Unfortunately, some common mistakes can complicate the process or even invalidate the form. Here are six mistakes to avoid:

Not checking for and including all known relatives. People often overlook distant relatives or assume certain family members aren't important to list. Every known relative, no matter how distantly related, should be included to prevent legal complications later.

Failing to state “None” where applicable. If the deceased had no children, spouses, or other categories of relatives, it's essential to enter “None” in those sections. Leaving sections blank can cause confusion and may delay the process.

Incorrectly listing the names of spouses and relatives. Mixing up first, middle, maiden, and last names is a common error. Double-check each entry for accuracy, especially the maiden names, to ensure that all information aligns with legal documents.

Omitting dates of marriage, birth, and death. Each relative's life milestones are critical for establishing the heirship chain. Neglecting to provide accurate dates can invalidate claims to the deceased's property.

Not attaching additional pages for extended family. In cases where the deceased has a large family, one form might not be enough. It’s important to attach additional Tables of Heirship for any overflow of information, ensuring all relatives are accounted for.

Forgetting to include a copy of the death certificates. For all deceased relatives listed, copies of their death certificates must accompany the form. This oversight can be a significant stumbling block in validating the form.

Accuracy and attention to detail cannot be overemphasized when completing the California Heirship form. Avoiding these mistakes not only ensures compliance with legal requirements but also helps expedite the process of claiming the deceased property owner's assets.

Documents used along the form

When handling the estate of a loved one in California, the Table of Heirship form is a crucial document. It ensures that all known relatives of the deceased are properly identified. However, to efficiently process claims or handle estate matters, several other important documents are frequently used in conjunction with the Table of Heirship. Knowing about these documents can help streamline the process, making it less daunting during a difficult time.

- Certified Death Certificate: This is an official copy of the death record of the deceased. It is pivotal for confirming the death legally and is required for most estate and inheritance procedures.

- Will and Testament: This document outlines the deceased's final wishes regarding the distribution of their assets and guardianship arrangements, if applicable. It's fundamental in guiding the probate process.

- Trust Documents: If the deceased had established a trust, these documents are necessary to manage and distribute the estate according to the terms set by the trust.

- Letters of Administration or Letters Testamentary: Issued by a court, these documents authorize an individual, usually the executor or administrator, to conduct estate affairs such as asset distribution and debt payment.

- Property Deeds: Legal documents that prove ownership of real estate. They are necessary for transferring property titles from the deceased to the heirs or new owners.

- Financial Account Statements: Information regarding the deceased's bank accounts, investments, and other financial assets, essential for understanding the estate's value and how it may be distributed.

- Life Insurance Policies: Documents outlining the beneficiaries and coverage details of any life insurance policies taken out by the deceased, used to claim any due benefits.

Together with the Table of Heirship, these documents play a vital role in ensuring that the estate of the deceased is managed and distributed correctly and according to their wishes. Each document serves a specific purpose in the legal and administrative process, helping to clarify the rights and responsibilities of all involved parties. Properly organizing and presenting these documents can significantly ease the complexities often associated with estate handling.

Similar forms

The Affidavit of Heirship bears resemblance to the Executor’s Deed in its purpose of facilitating property transfer after an individual's death. Both documents lay a structured foundation, identifying the deceased's heirs and legal claimants to their estate or specific assets. The Executor’s Deed navigates the procedural conveyance of property from the executor to the heirs or designated beneficiaries, underpinning the legal transition of real estate ownership, while the Affidavit of Heirship meticulously records the deceased’s familial lineage and potential heirs, ensuring rightful inheritance distribution. The elemental unifying factor is their roles in delineating succession lines, albeit through varying legal frameworks and requirements.

Similarly, the Trustee’s Deed intersects with the essence of the California Heirship form, as it operates within the premise of asset distribution upon someone's passing. Trustee's Deeds are executed to transfer property title held in a trust, reflecting decisions made prior by the deceased. This parallels the Heirship form’s objective of clarifying next of kin entitled to inherit, albeit the Trustee's Deed executes according to predetermined trust documents. This synergy lies in their mutual endeavor to ensure properties reach intended parties, guided by documented wishes or statutory heirship laws.

The Quitclaim Deed, while generally broader in application, aligns with the California Heirship form’s utility during post-mortem property transactions. Quitclaim deeds facilitate property transfers by relinquishing any interest the grantor may have in a property to a recipient, without making guarantees on the grantor's ownership rights. When heirs utilize this after inheritance determinations via the Heirship form, they can expedite the process of redistributing or consolidating property interests among themselves, showcasing a blend of simplicity and flexibility in post-inheritance management.

A Life Estate Deed, which stipulates property ownership conditions during an individual's lifetime before transferring to a remainderman post-death, shares the forward-looking attribute with the Heirship form. Both documents address the fate of property following an individual's demise from proactive stances — the former through an explicit property holding arrangement, the latter by identifying rightful heirs. The common ground between them is the goal of preempting disputes and ensuring property transitions according to the deceased’s lineage or explicit intentions.

The Warranty Deed, unlike the California Heirship form which clarifies potential heirs, directly transfers property ownership with guarantees about the grantor's title and the absence of undisclosed encumbrances. When heirs are determined via an Heirship form, property might subsequently be transferred through a Warranty Deed to ensure the recipient's full legal protection. This sequential interaction underscores a shared commitment to clear, undisputed property succession.

Last, the General Power of Attorney (GPA) document, which grants an individual the authority to make decisions on another's behalf, possesses a tangential relationship with the Heirship form. Although the GPA primarily addresses matters of living agency, it subtly intersects with inheritance considerations by empowering agents to act in estate-related capacities under certain conditions. This capability particularly resonates when navigating asset management or legal decisions pre-distribution, showcasing a linkage through the overarching theme of fiduciary duty.

Dos and Don'ts

Dealing with the California Heirship form can feel overwhelming, but it's an important document that outlines the rightful heirs and claims to a deceased person's property. To navigate this process smoothly, here are some do's and don'ts to keep in mind:

Do's:

Ensure all information is accurate and complete. The California Heirship form requires detailed information about the deceased's family structure, including spouses, children, parents, and other relatives. It’s imperative to cross-check dates and relationships to ensure correctness.

Enter "None" in sections that do not apply. If the deceased individual did not have any children, spouses, or any other relative as designated in the form sections, make sure to indicate this by writing "None." This clarifies that you have not accidentally omitted information.

Attach additional pages if needed. Often, the space provided on the form might not suffice, especially for larger families. If you run out of space while listing relatives, attach a second Table of Heirship, ensuring it's clearly labeled and includes all required details.

Provide copies of all relevant certified death certificates. For deceased relatives mentioned in your form, attaching certified death certificates is crucial. This serves as a formal verification of the details you’ve provided.

Don'ts:

Rush through filling out the form. Patience is key when dealing with official documents like the California Heirship form. Rushing can lead to mistakes or omissions that might complicate or delay the claims process.

Guess dates or information. If you’re unsure about specific dates or details, it's better to verify these through family records or official documents rather than guessing. Accuracy is crucial for the success of your claim.

Forget to sign and date the form. The form isn’t valid without your signature and the date of signing. Signing the document verifies that you believe all the information provided is true to the best of your knowledge.

Miss adding your contact information. Despite filling out everything correctly, if you don’t provide a way for the estate administrators or officials to reach you, it could delay the process significantly.

Filling out the California Heirship form with diligence and care can significantly smoothen the estate management and inheritance process. Remember, this document not only helps in legally establishing heirs but also ensures that the deceased's assets are distributed according to the rightful claims.

Misconceptions

Understanding the California Heirship form involves navigating common misconceptions that can cloud the process. Being aware of these can help streamline the filing and ensure accuracy in claiming a deceased relative’s property. Below are seven misconceptions about the California Heirship form explained:

- It's only for claiming real estate. Many people mistakenly believe the California Heirship form is exclusively used for claiming real estate owned by the deceased. However, it applies to all types of property, including bank accounts, stocks, and personal property.

- Legal representation is required. While consulting a lawyer can be beneficial, especially in complex cases, it is not a requirement to complete or submit the Heirship form. Individuals can fill out and file the form on their own, provided they carefully follow the instructions and accurately report the necessary information.

- It guarantees immediate transfer of property. Filing the Heirship form is an important step in claiming ownership, but it does not result in the immediate transfer of property. The process can be lengthy and may involve additional legal and court procedures, depending on the case's complexity and other factors.

- Marriage automatically makes a spouse the heir. While spouses often have rights to their deceased spouse's property, the Heirship form still requires you to list all known relatives, including current or former spouses. This information helps determine the proper distribution of the assets according to state laws.

- "None" should never be entered on the form. If there are no known relatives in a specific category (for example, if the deceased did not have children or siblings), entering "None" is not only acceptable but necessary to accurately complete the form.

- All sections must be filled for the form to be valid. It's a common misconception that every section of the form must have entries for it to be considered valid. In reality, you should only complete sections that apply to your deceased relative's family structure. If additional space is needed, attaching a second Table of Heirship is recommended to provide comprehensive details.

- A death certificate is optional. Submitting a copy of the certified death certificate for all deceased relatives listed is a crucial requirement. This documentation is not optional and is necessary to verify the information provided on the Heirship form, aiding in the appropriate handling of the claim.

By addressing these misconceptions, individuals seeking to claim a deceased relative's property can approach the California Heirship form with a clearer understanding, potentially easing the process during a naturally difficult time.

Key takeaways

Filling out and using the California Heirship form is a crucial step in managing the estate of someone who has passed away. This process ensures that the assets of the deceased are distributed correctly. To navigate this process smoothly, here are four key takeaways:

- Accuracy is paramount. When completing the form, it's essential to provide accurate and detailed information about the deceased and their relatives. This includes full names (with maiden names where applicable), dates of birth, marriage, and death. Mistakes or inaccuracies can complicate or delay the claim process.

- Documentation is critical. Alongside the Heirship form, you must provide certified death certificates for all deceased individuals listed in the sections above your own. This provides official confirmation of the details entered on the form and is vital for the verification process.

- Comprehensive family details are required. The form asks for information not just about direct relatives like children and parents, but also about spouses, siblings, grandchildren, nieces, and nephews. If the deceased has no known relatives in any section, you must enter “None.” Including all known relatives ensures a thorough review of potential heirship claims.

- Significance of the declaration. By signing the form, you declare under penalty of perjury that all the information provided is true and accurate to the best of your knowledge. This underscores the importance of honesty in the submission process, as false statements can lead to legal repercussions or denial of the claim.

Understanding these key points can help in efficiently managing the assets of the deceased, ensuring rightful heirs receive their due inheritance according to California law.

Popular PDF Documents

City of Tiffin Ohio - Embrace digital communication by providing your email address, facilitating faster exchanges with Tiffin’s Income Tax Department.

Form 1099-a - Its issuance is a key step in the process of resolving tax matters after losing property to foreclosure.

Form 4506 - For those ineligible to use the IRS's free tax return transcript service, form 4506 is an alternative to access returns.