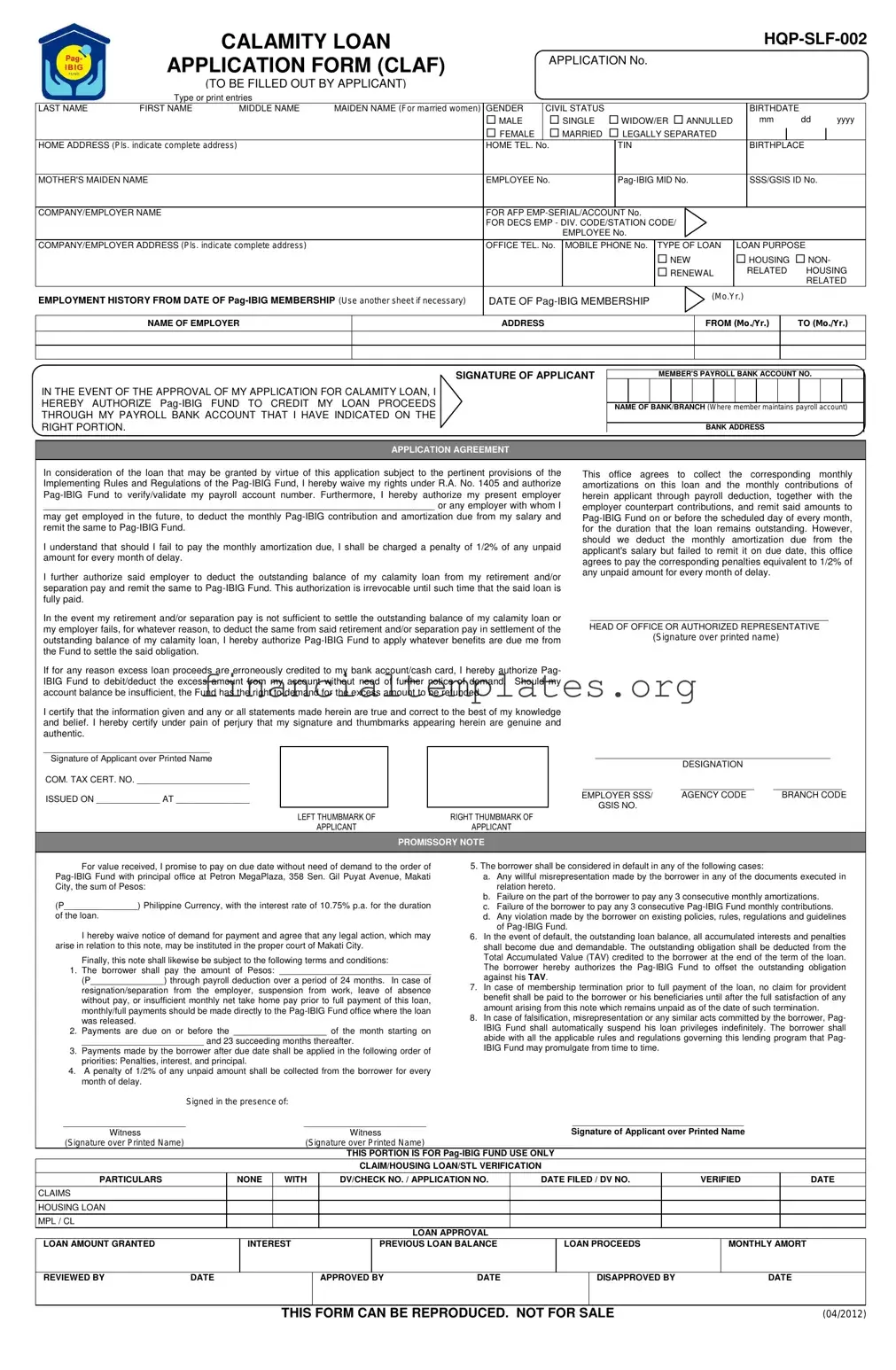

Get Calamity Application Loan Form

The Calamity Application Loan Form (CLAF), designated as HQP-SLF-002, is an essential document for individuals seeking financial assistance in the wake of natural disasters. This comprehensive form requires applicants to provide detailed personal information, including their last name, first name, middle name, maiden name (for married women), gender, civil status, birthdate, home address, telephone numbers, Tax Identification Number (TIN), birthplace, mother's maiden name, as well as their employment history and current employment details such as company/employer name, address, and contact information. Additionally, the form specifies the type of loan being applied for, the purpose of the loan, and contains sections for the declaration of the applicant's Pag-IBIG membership details, employment history, and an agreement section where applicants authorize Pag-IBIG Fund to credit loan proceeds to their designated bank accounts upon approval. It also includes the applicant's commitment to the terms of loan repayment and penalties for default. Moreover, the document outlines the requirements for loan application, including eligibility criteria, loan features like amount, interest rate, manner of release, availment period, loan term, and payment instructions. It also details the process for loan renewal in case of recurring calamities. This form serves as both an application and a binding agreement between the borrower and the Pag-IBIG Fund, ensuring that applicants are well-informed of their obligations and the terms under which the loan is granted. Through the utilization of this form, affected individuals can access needed financial support to aid in their recovery from the impacts of calamities, underpinning the form's significance in disaster response efforts.

Calamity Application Loan Example

CALAMITY LOAN

APPLICATION FORM (CLAF)

APPLICATION No.

(TO BE FILLED OUT BY APPLICANT)

|

Type or print entries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME |

FIRST NAME |

MIDDLE NAME |

MAIDEN NAME (For married women) |

GENDER |

CIVIL STATUS |

|

|

BIRTHDATE |

|

|

|

||||

|

|

|

|

MALE |

SINGLE WIDOW/ER ANNULLED |

|

mm |

dd |

yyyy |

||||||

|

|

|

|

FEMALE |

MARRIED LEGALLY SEPARATED |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||||

HOME ADDRESS (Pls. indicate complete address) |

|

|

HOME TEL. No. |

|

TIN |

|

|

BIRTHPLACE |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

MOTHER'S MAIDEN NAME |

|

|

EMPLOYEE No. |

|

|

|

SSS/GSIS ID No. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

COMPANY/EMPLOYER NAME |

|

|

FOR AFP |

|

|

|

|

|

|

|

|||||

|

|

|

|

FOR DECS EMP - DIV. CODE/STATION CODE/ |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

EMPLOYEE No. |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||||||||

COMPANY/EMPLOYER ADDRESS (Pls. indicate complete address) |

|

OFFICE TEL. No. |

MOBILE PHONE No. |

TYPE OF LOAN |

LOAN PURPOSE |

|

|||||||||

|

|

|

|

|

|

|

|

NEW |

|

HOUSING NON- |

|

||||

|

|

|

|

|

|

|

|

RENEWAL |

|

RELATED |

HOUSING |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

RELATED |

||

EMPLOYMENT HISTORY FROM DATE OF |

DATE OF |

(Mo.Yr.) |

|

|

|

||||||||||

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF EMPLOYER

ADDRESS

FROM (Mo./Yr.)

TO (Mo./Yr.)

SIGNATURE OF APPLICANT

IN THE EVENT OF THE APPROVAL OF MY APPLICATION FOR CALAMITY LOAN, I

HEREBY AUTHORIZE

THROUGH MY PAYROLL BANK ACCOUNT THAT I HAVE INDICATED ON THE

RIGHT PORTION.

MEMBER'S PAYROLL BANK ACCOUNT NO.

NAME OF BANK/BRANCH (Where member maintains payroll account)

BANK ADDRESS

APPLICATION AGREEMENT

In consideration of the loan that may be granted by virtue of this application subject to the pertinent provisions of the Implementing Rules and Regulations of the

__________________________________________________________________________ or any employer with whom I

may get employed in the future, to deduct the monthly

I understand that should I fail to pay the monthly amortization due, I shall be charged a penalty of 1/2% of any unpaid amount for every month of delay.

I further authorize said employer to deduct the outstanding balance of my calamity loan from my retirement and/or separation pay and remit the same to

This office agrees to collect the corresponding monthly amortizations on this loan and the monthly contributions of herein applicant through payroll deduction, together with the employer counterpart contributions, and remit said amounts to

In the event my retirement and/or separation pay is not sufficient to settle the outstanding balance of my calamity loan or my employer fails, for whatever reason, to deduct the same from said retirement and/or separation pay in settlement of the outstanding balance of my calamity loan, I hereby authorize

If for any reason excess loan proceeds are erroneously credited to my bank account/cash card, I hereby authorize Pag- IBIG Fund to debit/deduct the excess amount from my account without need of further notice of demand. Should my account balance be insufficient, the Fund has the right to demand for the excess amount to be refunded.

I certify that the information given and any or all statements made herein are true and correct to the best of my knowledge and belief. I hereby certify under pain of perjury that my signature and thumbmarks appearing herein are genuine and authentic.

_____________________________________________

HEAD OF OFFICE OR AUTHORIZED REPRESENTATIVE

(Signature over printed name)

__________________________________

Signature of Applicant over Printed Name

COM. TAX CERT. NO. _______________________

ISSUED ON _____________ AT _______________

________________________________________________

DESIGNATION

______________ |

_______________ |

______________ |

EMPLOYER SSS/ |

AGENCY CODE |

BRANCH CODE |

GSIS NO. |

|

|

PROMISSORY NOTE

For value received, I promise to pay on due date without need of demand to the order of

(P_______________) Philippine Currency, with the interest rate of 10.75% p.a. for the duration

of the loan.

I hereby waive notice of demand for payment and agree that any legal action, which may arise in relation to this note, may be instituted in the proper court of Makati City.

Finally, this note shall likewise be subject to the following terms and conditions:

1.The borrower shall pay the amount of Pesos: _______________________________

(P_______________) through payroll deduction over a period of 24 months. In case of resignation/separation from the employer, suspension from work, leave of absence without pay, or insufficient monthly net take home pay prior to full payment of this loan, monthly/full payments should be made directly to the

2.Payments are due on or before the ___________________ of the month starting on

_________________________ and 23 succeeding months thereafter.

3.Payments made by the borrower after due date shall be applied in the following order of priorities: Penalties, interest, and principal.

4.A penalty of 1/2% of any unpaid amount shall be collected from the borrower for every month of delay.

5.The borrower shall be considered in default in any of the following cases:

a.Any willful misrepresentation made by the borrower in any of the documents executed in relation hereto.

b.Failure on the part of the borrower to pay any 3 consecutive monthly amortizations.

c.Failure of the borrower to pay any 3 consecutive

d.Any violation made by the borrower on existing policies, rules, regulations and guidelines of

6.In the event of default, the outstanding loan balance, all accumulated interests and penalties shall become due and demandable. The outstanding obligation shall be deducted from the Total Accumulated Value (TAV) credited to the borrower at the end of the term of the loan. The borrower hereby authorizes the

7.In case of membership termination prior to full payment of the loan, no claim for provident benefit shall be paid to the borrower or his beneficiaries until after the full satisfaction of any amount arising from this note which remains unpaid as of the date of such termination.

8.In case of falsification, misrepresentation or any similar acts committed by the borrower, Pag- IBIG Fund shall automatically suspend his loan privileges indefinitely. The borrower shall abide with all the applicable rules and regulations governing this lending program that Pag- IBIG Fund may promulgate from time to time.

|

Signed in the presence of: |

|

|

|

|

|

|

|

|

|||

_________________________ |

|

|

|

_________________________ |

___________________________________ |

|

|

|||||

Witness |

|

|

|

|

Witness |

|

Signature of Applicant over Printed Name |

|

||||

(Signature over Printed Name) |

|

|

|

(Signature over Printed Name) |

|

|

|

|

|

|

||

|

|

|

|

|

THIS PORTION IS FOR |

|

|

|

|

|||

|

|

|

|

|

CLAIM/HOUSING LOAN/STL VERIFICATION |

|

|

|

|

|||

PARTICULARS |

|

NONE |

WITH |

DV/CHECK NO. / APPLICATION NO. |

DATE FILED / DV NO. |

VERIFIED |

|

DATE |

||||

CLAIMS |

|

|

|

|

|

|

|

|

|

|

|

|

HOUSING LOAN |

|

|

|

|

|

|

|

|

|

|

|

|

MPL / CL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN APPROVAL |

|

|

|

|

|

|

LOAN AMOUNT GRANTED |

|

|

INTEREST |

|

PREVIOUS LOAN BALANCE |

|

LOAN PROCEEDS |

|

MONTHLY AMORT |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

REVIEWED BY |

DATE |

APPROVED BY |

DATE |

DISAPPROVED BY |

DATE |

THIS FORM CAN BE REPRODUCED. NOT FOR SALE |

(04/2012) |

CERTIFICATE OF NET PAY

NAME OF BORROWER

For the month of: __________________

Add: Allowances |

|

________________________ |

___________ |

________________________ |

___________ |

________________________ |

___________ |

________________________ |

___________ |

________________________ |

___________ |

________________________ |

___________ |

Gross Monthly Income |

___________ |

Less: Deductions |

|

________________________ |

___________ |

________________________ |

___________ |

________________________ |

___________ |

________________________ |

___________ |

________________________ |

___________ |

Total Deductions |

___________ |

|

|

Net Monthly Income |

___________ |

Issued this _______ day of ____________, 20__.

I certify under pain of perjury that the

_____________________________________________

HEAD OF OFFICE/AUTHORIZED REPRESENTATIVE

(Signature over printed name)

GUIDELINES AND INSTRUCTIONS

A.Who May File

Any

1.The member has made at least 24 monthly contributions.

2.The monthly net take home pay requirement of government employees shall be subject to the rules and regulations as provided for in the General Appropriations Act (GAA). On the other hand, the monthly net take home pay of employees working with the private sector shall be based on their respective company policies, if there is any.

3.Members with active Fund membership at the time of application with commitment from both the employee and employer to continuously remit contributions at least for the term of the loan.

4.For members who have withdrawn their membership contributions due to membership maturity, the reckoning date of the updated 24 monthly contributions shall be the first monthly contribution following the month the member qualified to withdraw his Pag- IBIG Fund contributions.

5.For members who have active contributions under both the

6.The member is a resident of the area which is declared under a state of calamity.

B.How to File

The applicant shall:

1.Secure the

2.Accomplish 1 copy of the application form.

3.Attach Certification from the Barangay Chairman that the member is a victim of the calamity together with Sangguniang Bayan Resolution declaring the area in a state of calamity.

4.Under PACSVAL/PDDTS/Cash Card releasing, attach photocopy of passbook or Automated Teller Machine (ATM) card reflecting the account name and bank account number.

5.Submit complete application, together with the required documents to any

C.Loan Features

1.Loan Amount

The loanable amount shall be 80% of the member’s Total Accumulated Value (TAV). For members with existing MPL, the outstanding loan balance shall be deducted from the proceeds of the calamity loan.

2.Interest

The loan shall bear an interest rate of 10.75% p.a. for the duration of the loan.

3.Manner of Release of Loan

The loan proceeds shall be released through a check payable to the borrower or shall be credited to the borrower’s bank account through the LANDBANK’s Payroll Credit Systems Validation (PACSVAL), Philippine Domestic Dollar Transfer System (PDDTS) facilities, Cash Card and other similar modes of payment.

4.Availment Period

The loan shall be availed of within 90 days from the occurrence of the calamity. |

|

5. Loan Term |

|

The loan shall be amortized over a period of 24 months with a grace period of |

5 |

months. |

|

6.Loan Payments

The loan shall be paid in equal monthly payments thru salary deduction in such

amounts as may fully cover the obligation over the loan period.

Payment shall be remitted to the Fund on or before the fifteenth (15th) day of each month, beginning on the third (3rd) month following the date on the DV/Check. For centralized accounts, remittances shall start on the sixth (6th) month from the date of the DV/Check.

The borrower may fully pay the outstanding balance of the loan prior to loan maturity.

In case of separation from employer, the borrower shall pay directly to any

A penalty of 1/2% of any unpaid amount shall be charged to the borrower for every month of delay.

Penalties shall be computed from the date any payment is due but shall be charged only upon full payment or loan renewal.

However, for

7.Application of Payment

Payments made after the due date shall be applied according to the following schedule of priorities:

a)Penalties

b)Interest

c)Principal

D.Loan Renewal

Should another calamity occur in the same area, a borrower may renew his calamity loan anytime. The outstanding balance of his existing loan, together with any accrued interests, penalties and charges, shall be deducted from the proceeds of the new loan.

Document Specifics

| Fact Name | Description |

|---|---|

| Application Form Title | CALAMITY LOAN APPLICATION FORM (CLAF) HQP-SLF-002 |

| Eligibility Requirements | Member with at least 24 monthly contributions, active membership, and residence in a calamity-declared area. |

| Loan Amount Basis | 80% of the Total Accumulated Value (TAV). |

| Interest Rate | 10.75% per annum for the duration of the loan. |

| Manner of Loan Release | Through check or credit to the borrower’s bank account using various systems like PACSVAL, PDDTS, Cash Card. |

| Loan Availment Period | Within 90 days from the calamity occurrence. |

| Loan Term and Payments | Amortized over 24 months with a 5-month grace period, payable through salary deductions. |

| Application of Payments After Due Date | Payments are applied in order of penalties, interest, then principal. |

| Loan Renewal Policy | Loan can be renewed following another calamity, with outstanding balance deducted from the new loan proceeds. |

Guide to Writing Calamity Application Loan

Once you've been affected by a calamity, getting back on your feet financially is crucial. The Calamity Loan Application Form (CLAF) is designed to help you through these tough times. However, before you can receive this financial relief, you need to properly submit your application. The process may seem daunting at first, but by following these steps carefully, you can ensure your application is complete and submitted correctly.

- Start by securing a copy of the Calamity Loan Application Form (CLAF) from any Pag-IBIG Fund office or download it from their official website.

- Fill out the application number section at the top of the form. This will be your reference throughout the process.

- Type or print your personal details clearly in the designated areas. Include your last name, first name, middle name, and maiden name (if applicable).

- Indicate your gender, civil status, and date of birth in the specified format (mm dd yyyy).

- Provide your complete home address, home telephone number, birthplace, mother's maiden name, and your tax identification number (TIN).

- Enter your Pag-IBIG, SSS/GSIS ID numbers, and your employment details including your company/employer name, address, office telephone number, mobile phone number, employee number (if applicable), and type of loan you are applying for.

- If you're applying due to calamity, make sure to tick the correct options under "Type of Loan" and "Loan Purpose."

- Document your employment history related to your Pag-IBIG membership on a separate sheet if necessary, including the date of Pag-IBIG membership.

- Read and understand the declarations under the "Application Agreement" section. By signing, you agree to the terms stated including the authorization for payroll account verification and loan deductions from your salary.

- Provide your member's payroll bank account details, including the account number and the name and address of the bank branch.

- Sign the form and have your employer sign the form as well, indicating their name, designation, SSS/GSIS, and agency code.

- Complete the "Certificate of Net Pay" section with your financial details as required.

- Read through the "Guidelines and Instructions" carefully to ensure you understand the loan's terms, conditions, and submission requirements.

- Attach any required documents, such as the Certification from the Barangay Chairman and the Sangguniang Bayan Resolution.

- Lastly, submit your completed application form along with the required attachments to any Pag-IBIG Fund NCR/Provincial branch.

Following these steps meticulously will ensure that your calamity loan application is processed efficiently. It's important to provide accurate and complete information to avoid any delays. Once submitted, your application will be reviewed, and you will be notified of the next steps. Remember, this loan is designed to provide financial assistance during difficult times, so take the time to fill out the form correctly to access the help you need.

Understanding Calamity Application Loan

Who is eligible to apply for a Calamity Loan?

Members who have contributed at least 24 monthly contributions, comply with net take home pay requirements, have an active Fund membership, and live in areas declared under a state of calamity are eligible to apply.

How can one apply for a Calamity Loan?

To apply, secure a Calamity Loan Application Form (CLAF) from any Pag-IBIG Fund office, fill it out, attach the required documents including Certification from the Barangay Chairman and submit the complete set to any Pag-IBIG branch.

What documents are needed to apply?

Required documents include a completed application form, Certification from the Barangay Chairman, Sangguniang Bayan Resolution, and for PACSVAL/PDDTS/Cash Card releasing, a photocopy of passbook or ATM card showing the account name and number.

What is the loan amount one can avail?

The maximum loan amount is 80% of the member's Total Accumulated Value (TAV), minus any outstanding loan balance from previous loans.

What are the interest rates for the Calamity Loan?

The loan bears an interest rate of 10.75% per annum for the duration of the loan.

How will the loan proceeds be released?

Loan proceeds will be disbursed either through a check payable to the borrower or credited to the borrower's bank account using various electronic transfer systems.

What is the repayment period for the Calamity Loan?

The loan must be repaid over 24 months with a grace period of 5 months before commencement of the repayment.

How are loan payments made?

Payments are made in equal monthly amounts through salary deduction, beginning on the third month following loan disbursement, or the sixth month for centralized accounts. The borrower may also choose to fully pay the outstanding balance prior to maturity.

What if a member fails to pay on time?

A penalty of 1/2% of the unpaid amount is charged for every month of delay. Payments done after the due date are applied first to penalties, then interest, and finally the principal amount.

Can a loan be renewed in case of another calamity?

Yes, members facing a new calamity within the same area can apply for a new loan. The balance of any existing loan, along with accrued interests and penalties, will be deducted from the new loan proceeds.

Common mistakes

When people fill out the Calamity Loan Application Form (CLAF), common mistakes can lead to delays or even the rejection of their application. Identifying and avoiding these mistakes is crucial to ensuring the processing of the loan application goes smoothly. Here's a detailed look at seven common errors:

- Missing Personal Information: Applicants often overlook certain fields like middle name, maiden name for married women, or the complete home address. Every piece of information is essential for the processing of your application.

- Inaccurate Financial Details: Filling in your financial details, such as your Pag-IBIG MID No. or your employee number, inaccurately can lead to complications. Double-check these numbers for accuracy.

- Incorrect Loan Type Selection: Selecting the wrong type of loan or loan purpose is a mistake that can cause misunderstanding regarding your needs and delay the approval process.

- Employment History Gaps: Failing to accurately report your employment history, including dates of Pag-IBIG membership, can raise questions about your eligibility or your capacity to repay the loan.

- Not Signing the Application: An unsigned application is considered incomplete. Make sure to sign the form to certify that all provided information is true and correct to the best of your knowledge.

- Leaving the Authorization Section Blank: This section requires your attention as it involves authorizing Pag-IBIG Fund to verify or validate your payroll account number, among other authorizations. A blank section may halt the processing of your application.

- Failing to Attach Required Documents: Your application needs to be accompanied by certain documents like a certificate from the Barangay Chairman or other proof of being a victim of calamity. Missing documents can result in application denial.

To avoid these mistakes, applicants should:

- Review each section of the form thoroughly.

- Ensure that all requested information is provided accurately.

- Check and re-check financial details and personal information for errors.

- Sign all necessary sections and include all required attachments before submission.

By keeping these common mistakes in mind and taking steps to avoid them, applicants can increase their chances of having their calamity loan application processed quickly and smoothly.

Documents used along the form

When applying for a Calamity Loan, it’s essential to provide comprehensive documentation to support your application. Beyond the Calamity Loan Application Form (CLAF), several other documents play a crucial role in ensuring the application process is smooth and efficient. Here’s a list of documents often used in conjunction with the CLAF, offering a brief description of each to guide applicants through their loan application journey.

- Certificate of Employment and Compensation: This document verifies your current employment and outlines your salary details. It serves as proof of income and employment stability, which are key factors in the loan approval process.

- Latest Payslip: A payslip from the most recent pay period provides real-time evidence of your earnings and deductions. It complements the Certificate of Employment by offering a snapshot of your current financial situation.

- Barangay Certification: In the context of a Calamity Loan, a certification from the local barangay confirming that you were affected by the calamity and reside in the declared calamity area is necessary. This document validates your eligibility for the calamity loan.

- Proof of Residency: Documents such as utility bills (electricity, water, or internet) with your name and address or a rental agreement can serve as proof of residency, confirming your physical address and that you live in an area affected by the calamity.

- Photocopy of Valid ID: Valid identification (government-issued ID cards, driver’s license, passport, etc.) is required to confirm your identity as part of the loan application process.

- Bank Account Verification Slip: For the loan proceeds to be credited to your account, a verification slip or a photocopy of a bank passbook or ATM card showing the account name and number is necessary. This ensures the secure and accurate transfer of funds.

- Authorization Letter: If someone else is submitting the loan application or collecting the loan proceeds on your behalf, an authorization letter accompanied by a photocopy of your valid ID and the representative’s ID is required. This letter grants permission to the representative to act on your behalf.

Applying for a Calamity Loan requires not just completing the CLAF but also compiling a set of supporting documents that substantiate your application. These additional forms and documents are instrumental in verifying the information provided in your loan application, ensuring a seamless and efficient processing experience. It’s advisable to prepare these documents in advance, ensuring they are complete and accurate before submission. This diligence not only expedites the loan application process but also enhances your chances of a successful loan approval.

Similar forms

The Calamity Application Loan form closely resembles a Personal Loan Application form. Much like the calamity loan document, a personal loan form collects comprehensive personal information including the applicant's name, contact details, employment history, and financial information. Both documents usually require information on the purpose of the loan, along with declarations or agreements regarding the repayment of the loan, including the applicant's consent to deduct payments directly from their salary or bank account.

Similarly, a Mortgage Application form shares key characteristics with the calamity loan document. It involves submitting detailed personal, employment, and financial data to assess the applicant's capability to repay the borrowed amount. In both cases, the applicant must agree to specific terms regarding the payment process, interest rates, and penalties for delayed payments. There’s also often a promissory note or agreement section where the applicant commits to repay the borrowed amounts under specified conditions.

Student Loan Application forms are also similar in structure and content to the calamity loan form. Both require applicants to input detailed personal information, and possibly financial and employment history, to determine eligibility. Student loan forms, like calamity loan forms, may include authorizations for direct bank account crediting for the disbursement of funds, and agreements on repayment methods, including payroll deductions or direct bank debits.

An Employment History form, while not a loan application, shares similarities with the calamity loan document regarding the collection of detailed employment history. Both documents require thorough information about the applicant's employer, employment duration, and possibly salary information to assess the applicant's stability and ability to repay the loan. This information aids in evaluating the financial responsibility and reliability of the applicant.

Credit Card Application forms parallel calamity loan forms in needing thorough personal, financial, and sometimes employment information. Applicants must disclose their financial status, agree to credit checks, and understand the terms regarding interest rates, penalties, and repayment methods. Both forms may include clauses related to the authorization to verify financial information or direct action in case of default on payments.

Finally, a Business Loan Application form can be likened to the calamity loan form in terms of its structure and requirements for detailed financial information from the applicant. Business loan applications, akin to calamity loans, require information on the purpose of the loan and involve agreeing to terms on interest rates, repayment schedules, and penalties for late payments. Both documents serve to ensure the applicant understands their obligations and the consequences of failure to meet them.

The variety of these documents, despite their differing purposes—from personal financial assistance, home purchasing, academic endeavors, to business investments—illustrate the widespread need for individuals to provide comprehensive personal and financial information when seeking to borrow funds. The calamity loan form encapsulates this commonality through its detailed collection of applicants' information and agreement to repayment terms, highlighting its similarity across various types of loan and application forms.

Dos and Don'ts

When completing the Calamity Loan Application Form, there are essential dos and don'ts that applicants should keep in mind to ensure a smooth and error-free application process. These guidelines are crucial for prompt processing and approval of your calamity loan application.

- Do ensure that all entries on the form are typed or clearly printed to avoid misinterpretation of your information.

- Do double-check that the member's payroll bank account number and bank details provided are accurate and active to facilitate the smooth crediting of the loan proceeds.

- Do attach the required certification from the Barangay Chairman and the Sangguniang Bayan Resolution declaring the area in a state of calamity, as these documents are critical for your application's eligibility.

- Do sign the application form and make sure that all required fields are duly accomplished before submission; incomplete forms may lead to application delays or denial.

- Don't leave any mandatory fields blank. If a particular section does not apply to you, mark it with N/A (Not Applicable) instead of leaving it empty.

- Don't submit your application without checking for the correct and complete supporting documents as required by the guidelines.

- Don't falsify any information or documents submitted as part of your application. Doing so may not only result in the refusal of your current application but could also affect future transactions with the fund.

- Don't wait until the last minute to submit your application, especially given the 90-day period from the occurrence of the calamity. Late submissions may not be entertained.

Misconceptions

When it comes to navigating financial assistance in times of need, the Calamity Loan Application Form (CLAF) emerges as a beacon of hope. However, numerous misconceptions surround its application process, eligibility, and conditions, often leading to confusion and hesitation among potential applicants. Let's debunk some of these myths and shed light on the actual facts:

- Misconception 1: "You need to have no other loans with Pag-IBIG to qualify."

- Misconception 2: "The application is too complicated and not worth the effort."

- Misconception 3: "It’s only for natural disasters."

- Misconception 4: "Approval takes months."

- Misconception 5: "You must have been a member for at least 5 years."

- Misconception 6: "You can only apply if your entire community is affected."

- Misconception 7: "The loan amount is fixed for everyone."

- Misconception 8: "Only those employed by the government can apply."

- Misconception 9: "The loan must be paid back immediately."

This is not accurate. While the Calamity Loan Application does consider your financial standing with Pag-IBIG, having an existing loan does not automatically disqualify you. What matters is your ability to meet the required contributions and the terms for the calamity loan itself.

Though the form may seem daunting at first glance, the actual process is straightforward. It aims to gather comprehensive information to ensure fair processing. Applicants are often pleasantly surprised by the manageable steps involved.

While it's commonly activated following natural calamities, the scope of what's considered a "calamity" can include other emergencies declared by local authorities, not just natural disasters like floods or earthquakes.

Many assume the review and approval process to be lengthy, but in reality, it's designed for relatively quick turnaround times to aid members in times of disaster. Efficiency in processing is a priority, given the urgent nature of the needs it addresses.

This is incorrect. The requirement is for the member to have made at least 24 monthly contributions, which equals two years – not five. It makes the loan accessible to more members facing calamities.

Eligibility focuses on the individual member being a resident of a declared calamity area, not on the extent of damage or number of people affected. Personal impact and residency are the key criteria.

Loan amounts are not one-size-fits-all; they're calculated as 80% of a member's Total Accumulated Value (TAV), taking into account your savings and loan history with Pag-IBIG, which makes the benefit personally tailored.

Both government and private sector employees can apply, provided they meet the membership and contribution requirements. The form is inclusive, catering to a wide range of working Filipinos.

The repayment terms are considerate of the borrower's situation, offering a grace period and a repayment period spread over 24 months, which is meant to give borrowers ample time to recover financially.

Understanding the facts about the Calamity Loan Application can empower more individuals to seek assistance confidently during difficult times. Knowing the truth behind these misconceptions ensures that eligible members can make informed decisions and utilize the support available to them through Pag-IBIG Fund's calamity loan feature.

Key takeaways

Filling out the Calamity Loan Application Form (CLAF) efficiently and correctly is crucial for accessing necessary funds during difficult times. Here are five key takeaways to assist applicants in this process:

- Eligibility is a must. Applicants must have made at least 24 monthly contributions to Pag-IBIG, have an active membership, and reside in an area declared to be in a state of calamity.

- Preparation is key. Before submitting the CLAF, applicants should secure and fill out the form, obtain a certification from the Barangay Chairman confirming they are a victim of the calamity, and prepare a copy of their ATM card or bank passbook showing the account name and number.

- Understand the loan specifics. The loan amount can be up to 80% of the member's Total Accumulated Value (TAV), bearing an interest rate of 10.75% p.a., and must be availed within 90 days from the calamity's occurrence. It's amortized over 24 months with a 5-month grace period before commencement of payment.

- The application process includes submitting the completed application form and required documents to any Pag-IBIG Fund branch. The completeness of documents is crucial for the processing of loans.

- Loan repayment terms are vital. Payments are to be made through salary deductions and should start on the third month following the loan disbursement. It's important to note that a penalty of 1/2% per month is charged for any delay in payment, but this can be avoided if payments are made on or before the due date.

By meticulously following the application process and understanding the loan's terms and conditions, beneficiaries can utilize the CLAF to alleviate their financial burdens during calamitous events efficiently.

Popular PDF Documents

Nj St-50 - This form assists New Jersey businesses in reporting their gross receipts for a given quarter, providing a clear financial overview.

Form 1040 Vs 1040a - Detailed questionnaire collecting personal information, including legal and contact details, and filing status to ensure accurate tax reporting.

IRS 720 - Failing to file Form 720 when required can lead to penalties, making it important for businesses to stay informed and compliant.