Blank Business Purchase and Sale Agreement Form

Entering into the process of buying or selling a business requires careful consideration and a clear understanding of all the elements involved to ensure the transaction proceeds smoothly and legally. At the heart of this process is the Business Purchase and Sale Agreement form, a crucial document that serves as the official record of the transaction, outlining the terms and conditions agreed upon by both parties. This comprehensive form covers various aspects, including the sale's price, the assets and liabilities being transferred, representations and warranties of both the buyer and the seller, conditions precedent to the sale, covenants of the parties involved, and the legal mechanisms for resolving disputes. Additionally, it details the responsibilities of each party concerning due diligence, confidentiality, and the transition of the business. The thorough nature of this form seeks to protect both parties' interests, reduce potential risks, and provide a clear roadmap for the successful transfer of the business. Understanding each component of the Business Purchase and Sale Agreement form is essential for anyone involved in the complex process of buying or selling a business.

Business Purchase and Sale Agreement Example

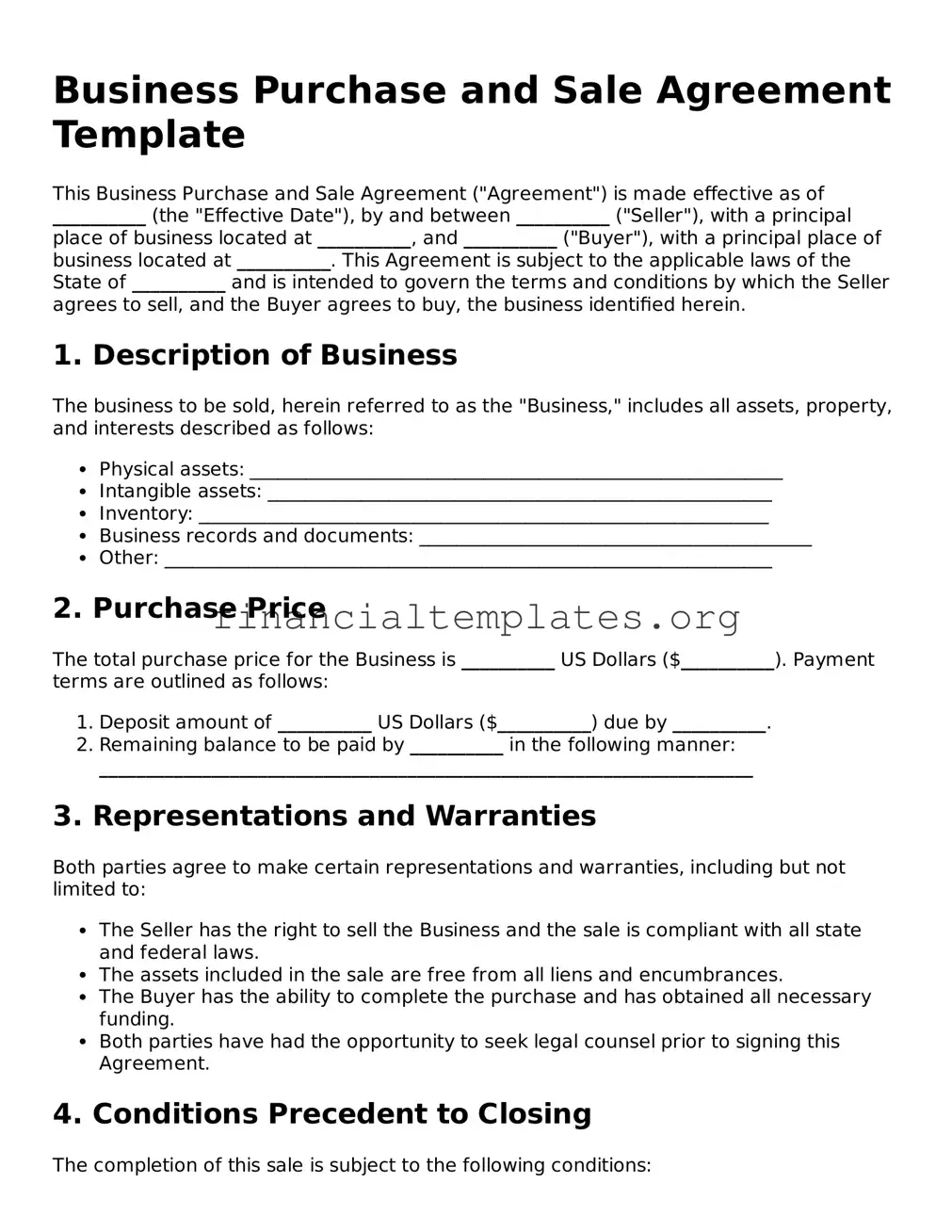

Business Purchase and Sale Agreement Template

This Business Purchase and Sale Agreement ("Agreement") is made effective as of __________ (the "Effective Date"), by and between __________ ("Seller"), with a principal place of business located at __________, and __________ ("Buyer"), with a principal place of business located at __________. This Agreement is subject to the applicable laws of the State of __________ and is intended to govern the terms and conditions by which the Seller agrees to sell, and the Buyer agrees to buy, the business identified herein.

1. Description of Business

The business to be sold, herein referred to as the "Business," includes all assets, property, and interests described as follows:

- Physical assets: _________________________________________________________

- Intangible assets: ______________________________________________________

- Inventory: _____________________________________________________________

- Business records and documents: __________________________________________

- Other: _________________________________________________________________

2. Purchase Price

The total purchase price for the Business is __________ US Dollars ($__________). Payment terms are outlined as follows:

- Deposit amount of __________ US Dollars ($__________) due by __________.

- Remaining balance to be paid by __________ in the following manner: ______________________________________________________________________

3. Representations and Warranties

Both parties agree to make certain representations and warranties, including but not limited to:

- The Seller has the right to sell the Business and the sale is compliant with all state and federal laws.

- The assets included in the sale are free from all liens and encumbrances.

- The Buyer has the ability to complete the purchase and has obtained all necessary funding.

- Both parties have had the opportunity to seek legal counsel prior to signing this Agreement.

4. Conditions Precedent to Closing

The completion of this sale is subject to the following conditions:

- Satisfactory completion of all due diligence by the Buyer.

- Approval of the sale by necessary governing bodies or regulatory authorities.

- No material adverse changes in the Business's financial condition.

- Compliance with all terms of the Agreement by both parties.

5. Closing Date

The closing of the sale of the Business shall take place on __________, or at another mutually agreed upon date and time.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of __________, without regard to its conflict of laws principles.

7. Signatures

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date first above written.

Buyer's Signature: ___________________________ Date: __________

Seller's Signature: __________________________ Date: __________

PDF Properties

| Fact | Description |

|---|---|

| Purpose | A Business Purchase and Sale Agreement is a legally binding document that outlines the terms and conditions under which a business will be sold and purchased. |

| Components | This agreement typically includes details like the sale price, the assets and liabilities being transferred, the date of sale, and any representations and warranties of the parties involved. |

| Governing Law | The agreement is governed by the state laws where the business transaction takes place. Different states might have specific clauses that need to be included. |

| Due Diligence | It allows the buyer to perform a due diligence review, ensuring the accuracy of the seller's information and evaluating the business's value and risks. |

| Confidentiality | These agreements often contain confidentiality clauses to protect sensitive information disclosed during the negotiation and due diligence phases. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties, ensuring all modifications are mutually agreed upon and documented. |

| Dispute Resolution | The agreement outlines how disputes related to the agreement will be resolved, including arbitration or litigation, and which state's laws will apply. |

Guide to Writing Business Purchase and Sale Agreement

When you're ready to buy or sell a business, completing a Business Purchase and Sale Agreement is a crucial step. This document lays the foundation for the transaction, detailing the terms and conditions agreed upon by both parties. It encompasses everything from the sale price to asset inventory, ensuring all aspects of the deal are clear and legally binding. The process might feel daunting, but by following a structured approach, you can navigate it with confidence.

Here's how to fill out the Business Purchase and Sale Agreement form:

- Begin by detailing the basic information of both the buyer and the seller. This includes names, addresses, and contact details. Be sure to verify the accuracy of all information provided.

- Next, describe the business being sold. Include the legal name, type of business, and its operational address. Clearly identifying the business helps prevent any misunderstandings.

- Outline the sale terms. This section delves into the financial aspects of the deal, specifying the total purchase price, the payment plan (if applicable), and any deposits made in advance.

- Document the inventory included in the sale. List all tangible and intangible assets such as equipment, inventory, trademarks, and customer lists. Quantify items where possible and ensure both parties agree on what is included.

- Address the assumption of liabilities. Clearly state which, if any, liabilities the buyer will assume from the seller. This might cover loans, leases, or other legal obligations tied to the business.

- Specify any conditions precedent. These are conditions that must be met before the transaction can be finalized, such as obtaining financing, securing leases, or receiving necessary approvals.

- Detail the closing date and location. Set a clear timeline for when the sale will be concluded, where the final documents will be signed, and the keys handed over.

- Include a non-compete clause, if applicable. This prevents the seller from starting a new, competing business within a certain timeframe and geographic area. It protects the buyer's investment in the newly acquired business.

- Define the warranties and representations made by the seller. This section provides assurances regarding the status of the business, such as its legal standing, financial health, and any other material facts.

- Lastly, review the agreement for accuracy and completeness. Both parties should then sign and date the document, ideally in the presence of a witness or notary public for added legality.

Once the form is filled out and signed, the next steps typically involve executing the conditions precedent, preparing for the closing day, and, if applicable, notifying employees, suppliers, and customers about the ownership change. The transition period that follows may require adjustments and cooperation from both parties to ensure a smooth changeover. Remember, each deal is unique, and it may be beneficial to consult with legal or financial professionals throughout this process.

Understanding Business Purchase and Sale Agreement

-

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of a business entity or its assets. This comprehensive agreement includes details such as the sale price, the assets and liabilities being transferred, the closing date, and any representations and warranties made by both the buyer and the seller.

-

When do I need a Business Purchase and Sale Agreement?

This agreement is essential whenever you decide to buy or sell a business or its significant assets. It ensures that all parties have a clear understanding of their rights and obligations, minimizing potential disputes. Whether the transaction involves a corporation, a partnership, or a sole proprietorship, this agreement serves as a key document in the sale process.

-

What should be included in this agreement?

- The names and details of the buyer and seller.

- A detailed description of the business being sold.

- The sale price and the payment terms.

- A list of assets and liabilities included in the sale.

- Any conditions precedent to the closing of the transaction.

- The expected closing date of the sale.

- Guarantees and warranties made by both parties.

- Non-compete clauses, if applicable.

-

Who prepares the Business Purchase and Sale Agreement?

Usually, the buyer's lawyer drafts the initial version of the Business Purchase and Sale Agreement, which is then reviewed and revised by the seller's lawyer. This document is a result of negotiations between the buyer and the seller, and both parties should have legal counsel to ensure their interests are adequately protected.

-

Can the terms of the agreement be changed after it has been signed?

After the agreement has been signed, any changes to the terms require mutual consent from both parties. Any alterations should be documented in writing and attached to the original agreement as amendments.

-

What happens if there is a breach of the agreement?

In the event of a breach, the non-breaching party has the right to seek remedies as outlined in the agreement. Remedies may include damages, specific performance, or termination of the agreement. The specific consequences depend on the nature of the breach and the remedies agreed upon by both parties within the document.

-

How does a Business Purchase and Sale Agreement protect my interests?

This agreement safeguards your interests by clearly defining the terms of the transaction, including the responsibilities of each party, the timeline for the sale, and any representations and warranties. It serves as a blueprint for the transaction, providing a clear pathway to transfer ownership and reducing the likelihood of disputes.

-

Is a lawyer required to execute a Business Purchase and Sale Agreement?

While not legally required, it is strongly advised to engage a lawyer when entering into a Business Purchase and Sale Agreement. A lawyer can provide invaluable guidance, ensuring that the agreement complies with the law, that your rights are protected, and that you fully understand all terms and conditions.

-

How is the sale price determined?

The sale price is typically determined through negotiations between the buyer and the seller. Factors that influence the price include the business's current financial performance, its future earnings potential, the value of its assets, and market conditions. Professional appraisers may be consulted to provide an objective valuation of the business.

-

What due diligence is required before signing the agreement?

Before signing the agreement, the buyer must conduct comprehensive due diligence to verify the accuracy of the seller's information and to understand the liabilities and risks associated with the business. Due diligence involves reviewing financial statements, contracts, legal compliance, and other relevant business documents. This process helps the buyer make an informed decision and negotiate the agreement's terms more effectively.

Common mistakes

When it comes to navigating the process of buying or selling a business, the Business Purchase and Sale Agreement form is crucial. It lays the groundwork for the transaction, detailing every aspect of the sale. However, even with the best intentions, people can make mistakes when filling out this important document. Here are seven common errors to be aware of:

Not Reviewing the Form in Detail: It's essential to read every section carefully to understand the obligations and rights conferred upon each party. Skipping or glossing over sections can lead to misunderstandings or overlooked terms that could be crucial to the agreement.

Failing to Specify Payment Terms Clearly: Accurate, clear definitions of the payment terms, including the amount, method, and timeline, are vital. Ambiguities here can lead to disputes or financial discrepancies during the transaction process.

Omitting Necessary Attachments or Schedules: Often, additional documents are required to complete the agreement, detailing assets, inventory, or specific terms. Forgetting these attachments can invalidate the agreement or leave vital terms unaddressed.

Incorrect or Incomplete Information: Entering the wrong information or leaving sections blank can have serious consequences. It's important to verify each detail, from the legal names of the parties to the description of the business being bought or sold.

Neglecting to Outline the Responsibilities of Each Party: Both the buyer and seller have specific duties that must be fulfilled for the transaction to proceed smoothly. These should be laid out explicitly to avoid confusion and ensure accountability.

Not Specifying Dispute Resolution Mechanisms: In case disagreements arise, the agreement should have a clear process for resolution. Failing to include this can lead to prolonged and costly legal battles.

Lack of Legal Review: Perhaps the most significant mistake is not having the document reviewed by a legal professional. An experienced lawyer can catch errors, omissions, or terms that might not be in your best interest, ensuring that the agreement protects your rights and intentions.

Completing a Business Purchase and Sale Agreement is a detailed process that requires attention to detail and often, professional guidance. Avoiding these mistakes can protect against future conflicts and ensure that the transaction is conducted fairly and efficiently for both parties involved.

Documents used along the form

When individuals are in the process of buying or selling a business, a Business Purchase and Sale Agreement form is a crucial document that outlines the terms of the sale, including the purchase price, closing date, and other important details. However, this agreement does not stand alone. Several other forms and documents are commonly used alongside it to ensure a smooth and comprehensive transition of the business from the seller to the buyer. These additional documents play key roles in providing further details, protections, and legal compliance for both parties involved in the transaction.

- Bill of Sale: This document serves as proof that the business and its assets have been transferred from the seller to the buyer. It lists all the assets included in the sale, ensuring there's a clear record of what was sold. The Bill of Sale acts as a receipt for the business transaction.

- Non-Competition Agreement: Often used in business sales to prevent the seller from starting or participating in a similar business within a certain geographical area for a specified period. This helps protect the buyer’s investment in the acquired business by reducing direct competition.

- Asset Purchase Agreement: In situations where only specific assets of a business are being bought and sold, rather than the entire business entity, an Asset Purchase Agreement is used. It details which assets are being acquired and any liabilities being assumed by the buyer, offering a clear distinction from a total business purchase.

- Employment Agreement: If the buyer is planning to retain any of the seller's employees, Employment Agreements may be drafted. These agreements outline the terms of employment, including salary, benefits, and job responsibilities, to ensure a seamless transition for the employees involved.

Together with the Business Purchase and Sale Agreement form, these documents contribute to a transparent, lawful, and efficient business transaction. They help both parties to articulate their expectations, responsibilities, and the specifics of the business being transferred. For individuals navigating through the complexities of buying or selling a business, understanding these documents and their functions is pivotal in safeguarding their interests and facilitating a successful transfer.

Similar forms

The Asset Purchase Agreement shares similarities with a Business Purchase and Sale Agreement, as both involve transactions of business assets. However, the Asset Purchase Agreement specifically details the sale and transfer of the business's tangible and intangible assets, excluding liabilities unless explicitly stated. This distinction allows buyers to select specific assets and avoid assuming unwanted liabilities. It's particularly useful for buying parts of a business or its assets rather than the entire entity.

A Bill of Sale is akin to the Business Purchase and Sale Agreement in that it documents the transfer of ownership of goods from a seller to a buyer. However, the Bill of Sale is simpler and more straightforward, typically used for the sale of personal property such as vehicles or equipment. Unlike the more comprehensive Business Purchase and Sale Agreement, a Bill of Sale may not cover terms related to ongoing operations, warranties, or the transfer of liabilities and contracts.

The Stock Purchase Agreement is another document with a relationship to the Business Purchase and Sale Agreement, focusing on the transfer of ownership of a corporation's stock from the seller to the buyer. In contrast to acquiring the business's assets, purchasing stock transfers the ownership of the company as a whole, including its liabilities. This approach is sometimes preferred for its simplicity in transferring the entire entity, but it can carry more risk due to potential hidden liabilities.

A Merger Agreement is also similar as it outlines the terms under which two companies combine to form a single entity. This agreement contains elements found in a Business Purchase and Sale Agreement, especially in cases where one company is significantly larger and effectively "buys out" the smaller company. However, the merger process involves not just the purchase of assets or stock but also the integration of operations, staff, and corporate cultures.

Non-Disclosure Agreements (NDAs) can frequently accompany a Business Purchase and Sale Agreement. While an NDA on its own doesn't facilitate the transfer of business assets or stock, it plays a crucial role in the process by ensuring confidentiality around the sale. Details of the business operations, financial health, and trade secrets are protected under an NDA, allowing parties to negotiate freely without risk of information leakage.

A Partnership Agreement might intersect with the themes of a Business Purchase and Sale Agreement when a business sale results in a new partnership or alters an existing one. These agreements outline the terms of partnership among business owners, including contributions, profit distribution, and management responsibilities. The sale or acquisition of a business could necessitate revisions to or the formation of a Partnership Agreement to reflect the new ownership structure.

An Employment Agreement might be relevant in situations where key personnel are crucial to the ongoing success of a business being purchased. These agreements can be part of business sale transactions, ensuring that critical staff remain with the business under agreed terms. Unlike the broader Business Purchase and Sale Agreement, Employment Agreements focus on the conditions of employment, including roles, responsibilities, compensation, and confidentiality obligations.

Lastly, a Franchise Agreement has similarities when the business being sold is a franchise. This specialized agreement outlines the relationship between the franchisor and the franchisee, setting terms for operating the franchise, using trademarks, and accessing proprietary business methods. The Business Purchase and Sale Agreement for a franchise would also need to address the transfer of the franchise rights and compliance with the Franchise Agreement's terms.

Dos and Don'ts

When navigating through the process of completing a Business Purchase and Sale Agreement, certain practices can ensure a smooth transaction while others might lead to complications. Below is a list curated to guide you in understanding what to do and what to avoid.

Do:

- Thoroughly review the entire document before filling it out to ensure you understand all the terms and requirements.

- Provide accurate and complete information for every field to prevent any legal issues post-sale.

- Consult with a legal professional if any part of the agreement is unclear. Their expertise can prevent future misunderstandings.

- Ensure that all parties involved in the sale thoroughly review the agreement before signing.

- Use clear, precise language to avoid any ambiguity that could lead to disputes.

- Attach any necessary documents that are referenced within the agreement to provide complete context.

- Keep a signed copy of the agreement in a safe place for future reference in case any issues arise.

- Verify that both the buyer and seller understand their obligations and rights as stated in the agreement.

Don't:

- Rush through the process without giving due attention to each section of the agreement.

- Omit any information that could later invalidate the agreement or cause legal complications.

- Assume that standard terms will apply without confirming that they are appropriate for your specific transaction.

- Sign the agreement without having all the necessary approvals and consents from related parties.

- Forget to check that the final agreement includes any verbal agreements made during negotiation.

- Use vague or ambiguous terms that could be interpreted in more than one way.

- Underestimate the importance of having a professional review the agreement. Even small oversights can lead to significant repercussions.

- Overlook the details of the payment plan, as misunderstandings regarding financial transactions are common sources of conflict.

By adhering to these dos and don'ts, individuals can reduce the risk of encountering legal problems after the transaction. Proper preparation and attention to detail in filling out the Business Purchase and Sale Agreement form are crucial steps towards a successful business transaction. Remember, when in doubt, consulting with a professional is always a wise decision.

Misconceptions

When navigating the complexities of buying or selling a business, a Business Purchase and Sale Agreement plays a pivotal role. However, misconceptions surrounding this document can lead to confusion and missteps. Let's clarify some of the most common misunderstandings:

It's just a formality: Many believe that the Business Purchase and Sale Agreement is merely a procedural step rather than a crucial document. In reality, this agreement outlines the entire agreement between buyer and seller, detailing the terms of sale, assets being purchased, liabilities being assumed, and conditions of the sale. It's foundational for a successful transaction.

All agreements are the same: Each business sale is unique, necessitating a customized agreement. While templates can serve as a starting point, the details of the agreement must be tailored to the specific transaction, including considerations for the industry, size of the business, and specific assets and liabilities involved.

Legal representation isn't necessary: Given the complexities and legal ramifications of a Business Purchase and Sale Agreement, professional legal counsel is crucial. Attorneys can help navigate legal requirements, identify potential issues, and negotiate terms that protect their client’s interests.

Price is the only important term: While the purchase price is undoubtedly important, numerous other terms significantly impact the transaction. These include payment terms, contingencies, non-compete clauses, and warranties. Each term needs to be carefully considered and negotiated.

Verbal agreements are sufficient: Relying on verbal agreements in a business sale is risky and unenforceable. The Business Purchase and Sale Agreement needs to be in writing and signed by both parties to be legally binding.

Diligence is optional: Due diligence is a critical phase before finalizing a Business Purchase and Sale Agreement. This process involves verifying the financial, legal, and operational aspects of the business to ensure there are no surprises after the sale.

It only benefits the seller: This agreement is designed to protect both parties. For the seller, it secures the purchase price and outlines the terms of the sale. For the buyer, it provides assurances about the state of the business and any obligations the seller will fulfill post-transaction.

Understanding and addressing these misconceptions about the Business Purchase and Sale Agreement is essential for anyone involved in buying or selling a business. By doing so, both parties can navigate the process more effectively, ensuring a smoother transition and minimizing potential disputes.

Key takeaways

When engaging in the transfer of ownership of a business, the Business Purchase and Sale Agreement is a pivotal document that outlines the terms and conditions of the sale. This form isn't just a piece of paperwork; it's the roadmap for the transaction, protecting both buyer and seller. Here are key takeaways you should consider while filling out and utilizing this vital document:

- Thoroughly understand all components of the agreement. This document covers essential elements such as the purchase price, payment terms, and the closing date. Each section should be read carefully and understood fully.

- Ensure accuracy in the representation of assets. The form should clearly list all assets being sold, including tangible and intangible ones, to prevent misunderstandings or disputes later on.

- Carefully outline the terms of payment. Payment terms, including any installment plans or financing conditions, need to be precise to ensure a smooth transaction process.

- Include non-compete clauses if applicable. To protect the buyer’s investment, non-compete clauses prevent the seller from starting a new, competing business within a certain radius and time frame.

- Specify contingencies. These are conditions that must be met for the transaction to proceed, such as obtaining financing or passing inspections. Clearly outline these to avoid future complications.

- Consider warranties and representations. Both parties make certain guarantees regarding the business and its assets. Be specific about these warranties to safeguard against potential legal issues.

- Detail the closing process. Clarify what will happen on the closing date, including the final exchange of payment and transfer of assets. This helps to manage expectations and ensure a smooth conclusion to the deal.

- Seek legal advice. Lastly, considering the complexities and legal ramifications, consulting with a lawyer to review the agreement before signing is highly recommended. This can prevent potential legal entanglements or misunderstandings.

Using the Business Purchase and Sale Agreement effectively requires attention to detail and an understanding of the legal and financial stakes involved. By focusing on these key takeaways, parties can navigate the sale more smoothly, ensuring a fair and beneficial outcome for everyone involved.

Popular Documents

Contractor Payment Form - A streamlined approach for subcontractors to submit payment requests, which simplifies the process of detailing work completed, adjustments, and retainage calculations.

Annual Summary and Transmittal of U.S. Information Returns - Understanding the role of the 1096 form is crucial for tax professionals and business owners alike.

Az Tpt Form - Businesses must provide both their state license number and taxpayer identification number when submitting the TPT-1 form to avoid processing delays.