Get Bill Payment Checklist Form

Managing finances can often feel like a balancing act, especially when it comes to making sure bills are paid on time. This is where a Bill Payment Checklist comes into play. Designed to keep track of due dates, bill amounts, and payment statuses, this simple yet effective form can be a game-changer for individuals striving to stay on top of their monthly financial obligations. It offers a visual representation of what needs to be paid, how much is due, and when the payment needs to be made, ensuring that nothing slips through the cracks. The checklist is particularly useful for those looking to avoid late fees, maintain a good credit score, and achieve or maintain financial stability. Originating from a source aimed at helping individuals manage credit and debt, the form encapsulates the essence of organized financial management in a straightforward format, making it accessible for users at any financial literacy level.

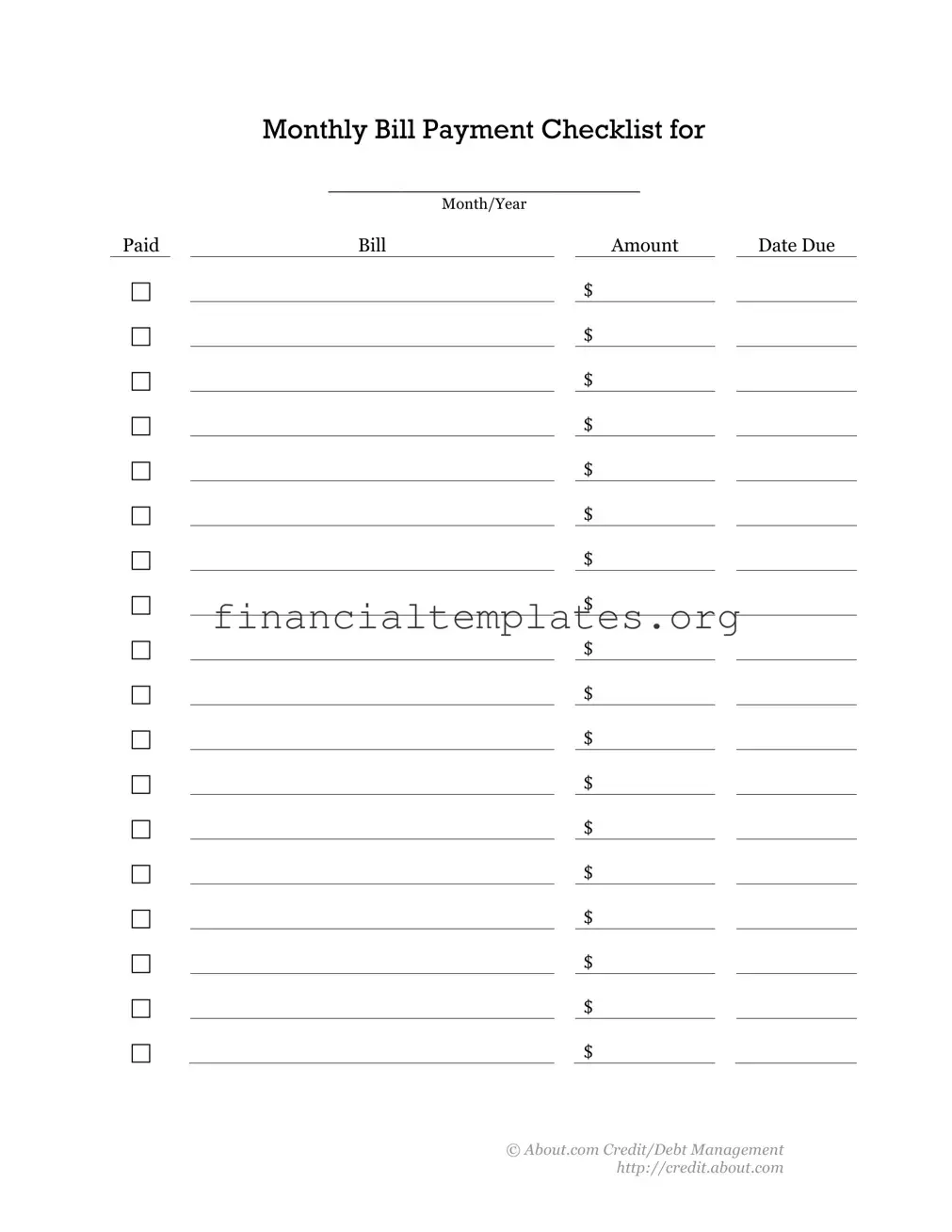

Bill Payment Checklist Example

PAID

Monthly Bill Payment Checklist for

__________________________

MONTH/YEAR

|

BILL |

|

AMOUNT |

|

DATE DUE |

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

©About.com Credit/Debt Management http://credit.about.com

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | Designed to help manage and organize monthly bill payments. |

| 2 | Includes checkboxes to track payment status. |

| 3 | Provides spaces for listing the month/year, bill, amount, and due date. |

| 4 | Facilitates financial planning and budgeting. |

| 5 | Can be used for any type of recurring monthly bills. |

| 6 | Not governed by state-specific laws; generally applicable. |

| 7 | Originated from a credit/debt management resource (About.com). |

| 8 | Designed for personal use and not for official financial reporting. |

| 9 | Useful tool for improving payment timeliness and avoiding late fees. |

Guide to Writing Bill Payment Checklist

Keeping track of monthly bills is a crucial step towards financial stability and peace of mind. A Bill Payment Checklist serves as a visual reminder of upcoming due dates and payments that have already been made, ensuring that everything is paid on time and no charges are incurred for late payments. The process of filling out this form might seem straightforward, but doing it methodically can enhance your control over your finances. Proceed with these steps to accurately fill out your Bill Payment Checklist.

- At the top of the form, where it says "Monthly Bill Payment Checklist for __________________________ MONTH/YEAR," fill in the current month and year. This will help you keep track of your payments for specific periods.

- Begin with the first bill you need to manage. In the space next to the first checkbox, write down the name of the bill. This could be anything from your electricity bill to your mortgage or rent.

- In the 'BILL AMOUNT' column, write down the amount that is due for this bill. Ensure you double-check the amount to avoid any mistakes.

- In the 'DATE DUE' column, jot down the due date of this bill. Knowing the due date is crucial to prioritize your payments and avoid late fees.

- Repeat steps 2-4 for each bill you have pending. Make sure you list them in order of their due dates, or in a sequence that makes the most sense for you, to ensure you don't miss any payments.

- Once a bill is paid, return to this checklist and mark the corresponding checkbox. This will give you a clear visualization of your financial commitments and what has been accomplished throughout the month.

After filling out the checklist, take a moment to review everything you've written. This step is a great practice in keeping your finances organized and can help prevent any overlooked bills. Updating this form becomes quicker and more intuitive over time, turning financial management into a habit rather than a chore. Remember, managing your bills shouldn't be a daunting task. With the Bill Payment Checklist, you're one step closer to mastering your monthly finances. Keep this form somewhere visible or easily accessible to ensure you regularly refer to and update it as needed.

Understanding Bill Payment Checklist

Frequently asked questions about the Bill Payment Checklist are a great way to ensure you're making the most out of this simple yet effective tool. Below, we tackle some of the most common inquiries to help streamline your bill management process.

- What is a Bill Payment Checklist?

A Bill Payment Checklist is a tool used to track and manage the payment of your monthly bills. This checklist provides a clear overview of each bill, including the amount due, the due date, and a checkbox to mark off once a bill has been paid. It’s an effective way to ensure you never miss a payment and stay on top of your financial obligations.

- How do I use the Bill Payment Checklist effectively?

To use the checklist effectively, start by listing all of your monthly bills, including their due dates and amounts. As each bill is paid, simply mark it as paid by checking the box next to the respective item. This method not only helps in confirming that bills have been dealt with but also provides a visual representation of your monthly payments at a glance.

- Can I customize the Bill Payment Checklist?

Yes, the Bill Payment Checklist is designed to be flexible and customizable to fit your personal or household financial needs. You can add or remove bill categories as needed, adjust due dates, or even adapt the checklist format to suit your preferences. While the template provided is a good starting point, tailoring it to your specific situation can maximize its effectiveness.

- Is the Bill Payment Checklist suitable for all types of bills?

Absolutely, the Bill Payment Checklist is versatile enough to accommodate all types of bills, whether they're utilities, credit card payments, loans, rent, or any other monthly expenses. It’s important to include every bill to maintain a comprehensive overview of your financial commitments.

- What should I do if I miss a payment?

If you miss a payment, it's crucial to address the situation as soon as possible. Contact the biller immediately to discuss your options, which may include making the payment with a late fee or arranging a payment plan. Note the missed payment on your checklist and adjust its status once resolved. Taking swift action can help minimize any negative impact on your financial health.

- Why is it important to mark bills as paid on the checklist?

Marking bills as paid on your checklist is more than just a way to track payments. It serves as a confirmation that you have fulfilled a financial obligation, reducing the risk of accidental non-payment or double payments. Additionally, it helps in budgeting by providing a clear picture of your remaining financial commitments for the month.

- Can the Bill Payment Checklist help with budgeting?

Yes, the Bill Payment Checklist can be an invaluable budgeting aide. By listing all your monthly financial obligations, you can better understand your spending patterns and identify areas where you might be able to cut costs or reallocate funds. Over time, using the checklist to monitor bill payments can provide insights that lead to more effective budget management.

- Should I keep past checklists?

Keeping records of past checklists can be incredibly beneficial. It allows you to track your financial habits, assess how your spending and payment patterns have evolved, and identify any recurring issues with bill payments. These insights can be instrumental in refining your budget and financial strategies moving forward.

- How often should I update my Bill Payment Checklist?

Your checklist should be updated monthly or whenever there is a change in your billing information. At the beginning of each month, prepare a new checklist for that period and make adjustments as necessary to account for any new bills or changes in payment amounts or due dates. Consistent updates ensure your checklist remains an accurate tool for financial management.

- Where can I find a template for a Bill Payment Checklist?

Templates for a Bill Payment Checklist can be found online, including the one provided by About.com Credit/Debt Management. These templates serve as a good foundation, but don’t hesitate to customize them to better suit your specific needs. A personalized checklist can enhance its effectiveness as a bill management tool.

Common mistakes

When managing finances, using a Bill Payment Checklist can be incredibly helpful. However, there are common mistakes that can hinder its effectiveness. Being aware of these errors can ensure that your financial management is both efficient and accurate.

Not writing the name of the month and year at the top of the form can lead to confusion, especially when tracking past payments or planning for future finances.

Leaving the BILL AMOUNT field blank or not updating it if the amount changes can result in underpayments or late fees.

Forgetting to fill in the DATE DUE can lead to missed payments, impacting your credit score negatively.

Failure to check off the PAID box once a bill is settled can create confusion, leading one to mistakenly think a bill is still outstanding.

Ignoring to regularly review and update the checklist for any changes in billing amounts or due dates can disrupt your payment schedule.

Not using a systematic approach to organize bills, such as in order of their due dates, can increase the risk of overlooking an upcoming payment.

Overlooking the importance of backing up the information in case the paper form is lost or damaged can lead to significant inconveniences and inaccuracies in tracking payments.

Not allocating a specific time each month to review and pay the bills listed on the checklist can lead to late payments or missed bills.

Failing to validate the accuracy of each entry against actual bills or bank statements can result in discrepancies that may go unnoticed until they escalate into larger issues.

Addressing these common mistakes can greatly enhance the utility of a Bill Payment Checklist, ensuring that your financial obligations are met in a timely and organized manner. Being mindful of the details can save one from unnecessary financial stress and complications.

Documents used along the form

A Bill Payment Checklist is a useful tool for managing one's finances, ensuring that all bills are paid on time, and helping to avoid late fees and penalties. While this form is a crucial part of personal financial management, there are several other forms and documents that individuals often use in conjunction with it to maintain a comprehensive view of their financial health and obligations. These additional documents aid in tracking expenditures, planning for future expenses, and ensuring fiscal responsibility.

- Budget Planner: A document that helps individuals plan and allocate their income towards different expenses, savings, and debt repayments. It's a broader overview of one’s financial situation, often used alongside the Bill Payment Checklist to ensure that bill payments are accounted for within the monthly budget.

- Expense Tracker: This tool records all expenditures over a period, categorizing them to identify where money is being spent. It's invaluable for spotting trends in spending behavior, which can inform adjustments to ensure bills are prioritized.

- Income Statement: A summary of one's income sources and amounts over a specific period. It is crucial for ensuring that the income side of the budget is accurate and up-to-date, which affects the ability to meet bill payment obligations.

- Debt Repayment Plan: A schedule that outlines how one intends to pay off debt, including monthly payment amounts, interest rates, and the expected timeline for repayment. This document often works in tandem with the Bill Payment Checklist to manage debt obligations efficiently.

- Financial Goals Worksheet: A planning document where individuals can outline their short-term, medium-term, and long-term financial goals. Using this with a Bill Payment Checklist helps to align bill payments with broader financial objectives, ensuring that payment strategies contribute to these goals.

- Emergency Fund Tracker: This form tracks the growth of an emergency savings fund, designed to cover unexpected expenses without impacting the ability to pay regular bills. An Emergency Fund Tracker complements the Bill Payment Checklist by securing a financial buffer.

In the complex web of personal financial management, the interplay between these documents and the Bill Payment Checklist creates a dynamic system that supports individuals in achieving financial stability and health. By employing these tools in concert, individuals can gain a comprehensive understanding of their financial standing, make informed decisions, and navigate their financial journey with confidence.

Similar forms

A Budget Planner is a document that shares a fundamental resemblance with the Bill Payment Checklist, primarily in its purpose of facilitating financial organization. Where the Bill Payment Checklist helps track when and what bills are due in a given month, a Budget Planner broadens this scope to include detailed projections of income versus expenditures over a similar period. Both documents are crucial for maintaining a clear view of one's financial health, ensuring timely bill payments, and avoiding overspending by laying out anticipated monthly financial activities.

The Debt Repayment Plan is another document closely related to the Bill Payment Checklist. It is specifically designed for individuals working to pay off debts. This plan not only lists the debts owed but also includes a schedule for their repayment, similar to how the Bill Payment Checklist organizes bill payments by due dates. Both documents are essential for staying on track with financial obligations and for formulating a strategy to improve one's financial situation by methodically reducing debt.

An Expense Tracker is akin to the Bill Payment Checklist in its role of monitoring financial outflows but focuses more broadly on all expenses, not just bills. It provides a detailed record of where money is going each month across various categories, enabling a meticulous review of spending habits. The core similarity lies in their mutual goal of promoting financial discipline, with the former capturing every monetary expenditure and the latter focusing specifically on the timely settlement of bills.

The Financial Calendar is closely related to the Bill Payment Checklist by serving as a visual representation of financial deadlines throughout the year. It marks important dates such as bill due dates, tax deadlines, and payment reminders, providing an annual view that complements the monthly focus of the Bill Payment Checklist. Both tools are indispensable for effective financial planning, ensuring individuals are aware of and can prepare for upcoming financial responsibilities in advance.

A Savings Goal Tracker is, in essence, a motivational tool that operates on principles similar to those of the Bill Payment Checklist, but with a focus on future financial aspirations rather than immediate obligations. It helps users set, monitor, and achieve specific savings targets over time. While the Bill Payment Checklist ensures current financial commitments are met, the Savings Goal Tracker encourages the proactive accumulation of wealth for future use, encompassing both sides of smart financial management.

The Investment Tracking Sheet is a document designed for individuals who have ventured into investments, paralleling the Bill Payment Checklist by providing an organized method to monitor performance and deadlines associated with investments, such as dividend payments or maturity dates. Both documents assist in keeping an accurate record of financial dealings, albeit with different focuses: maintaining timely bill payments versus tracking investment growth and responsibilities.

The Financial Goal Planning Sheet shares similarities with the Bill Payment Checklist by facilitating a structured approach to achieving financial objectives. It helps users identify and articulate short-term and long-term financial goals, much like how the Bill Payment Checklist aids in the management of monthly financial liabilities. Both documents are crucial for strategic financial planning, enabling individuals to navigate their present financial landscape while also preparing for future aspirations.

Dos and Don'ts

When managing your finances, using a Bill Payment Checklist is an effective way to keep track of your monthly obligations. It’s crucial to approach this task with attention and diligence. To assist you, here’s a guide containing tips on what to do and what not to do while filling out your Bill Payment Checklist form.

What You Should Do

- Verify each bill's due date and amount to ensure correctness before recording it on the checklist.

- Mark off each bill as you pay it, using a checkbox or a similar method, to maintain a clear record of your paid and pending bills.

- Update the checklist promptly if there are any changes in bill amounts or due dates to avoid discrepancies.

- Review the checklist at the beginning and end of each month to ensure all bills are accounted for and paid on time.

What You Shouldn't Do

- Don’t leave the MONTH/YEAR section blank; always specify the month and year to which the bills pertain to keep your financial records organized.

- Don't overlook small bills or irregular payments; include all financial obligations to get a complete picture of your monthly expenses.

- Avoid guessing bill amounts or due dates; double-check your bills or contact your creditors for the most accurate information.

- Refrain from using pencil or erasable pens when filling out the form to prevent alterations or accidental loss of information.

By following these guidelines, you can effectively manage your bills, avoid late payments, and maintain a good financial standing. Remember, staying organized is key to managing your monthly payments successfully.

Misconceptions

There are several misconceptions about the use of a Bill Payment Checklist form, an essential tool for managing personal finances and ensuring timely payments. These misconceptions can often lead individuals to misuse the form or forgo its benefits entirely. Here are four common misunderstandings:

It's only for those struggling financially: Some people believe that a Bill Payment Checklist is only necessary for those who are facing financial difficulties or are poor at managing their money. This is not the case. The checklist is a proactive tool beneficial for anyone wanting to organize their bill payments, regardless of their financial status. It helps in avoiding late fees, maintaining a good credit score, and ensuring financial obligations are met promptly.

It's too time-consuming: Another common misconception is that filling out and maintaining a Bill Payment Checklist takes up too much time. In reality, the initial setup may require some time to gather all the relevant information, but ongoing maintenance is minimal. Regular updates only involve checking off paid bills and noting upcoming due dates, a process that saves time in the long run by keeping financial tasks organized.

Digital alternatives are always better: In an age where digital tools and apps are prevalent for managing finances, some may view a physical or printable checklist as outdated. However, a tangible checklist offers a visual representation of one’s financial commitments and can complement digital tools by providing a quick, at-a-glance overview of monthly obligations. It's especially useful for people who benefit from physical reminders.

It doesn't help with financial planning: There's a belief that a Bill Payment Checklist is merely a tool for recording what has already been paid, rather than aiding in financial planning. This is incorrect. By outlining all monthly bills, one can plan for upcoming expenses, identify areas for potential savings, and better allocate their budget. It’s a foundational tool for managing personal finances, allowing for a clearer understanding of one’s financial health and planning future expenses.

Dispelling these misconceptions is crucial for individuals to recognize the value of a Bill Payment Checklist. By correctly understanding and utilizing this tool, one can significantly improve their approach to managing personal finances, leading to reduced financial stress and improved financial well-being.

Key takeaways

Keeping track of bills and ensuring they are paid on time is crucial for maintaining a good credit score and avoiding late fees. A Bill Payment Checklist can greatly assist in organizing this process. Below are key takeaways on how to effectively fill out and use a Bill Payment Checklist.

- First and foremost, clearly write the month and year at the top of the checklist. This helps in keeping a precise record of payments for each period.

- For each bill, jot down the amount due in the BILL AMOUNT column. Knowing the exact amounts due for each bill can help in financial planning for the month.

- In the DATE DUE column, record the due date for each bill. This is critical for prioritizing which bills need to be paid first and can help avoid incurring late fees.

- As each bill is paid, mark the corresponding checkbox under PAID. This visual indication of what has been completed can provide a sense of accomplishment and clarity on what's left to handle.

- Review the checklist regularly, preferably weekly, to update any changes or add any new bills. This practice ensures all bills are accounted for and managed appropriately.

- At the end of the month, review the checklist to ensure all bills have been paid. Any unchecked items should be investigated to avoid missed payments.

By using a Bill Payment Checklist, individuals can streamline their bill management process, reduce the risk of missed payments, and maintain better financial health. The checklist provided by About.com Credit/Debt Management is a simple yet effective tool for achieving such organization.

Popular PDF Documents

Irs Form 703 - Streamlines the calculation of taxable amounts from pensions for IRS reporting.

Alternative Minimum Tax Credit - Provides a systematic way to adjust tax liabilities in light of previous AMT contributions.

IRS 8962 - Form 8962 is filled out to adjust the amount of health care tax credit you're eligible for based on your income.