Blank Business Bill of Sale Form

In the landscape of buying and selling a business, the Business Bill of Sale form stands as a pivotal document that facilitates a clear transition of ownership. This document not only confirms the sale but also provides detailed information about the transfer of various assets associated with the business such as equipment, inventory, and intellectual property. It acts as a formal agreement between the seller and the buyer, ensuring that both parties have a mutual understanding of the terms of the sale. Beyond serving as a receipt for the transaction, the business bill of sale plays a crucial role in the legal and financial aspects of the sale, offering protection and peace of mind to both the buyer and the seller. By documenting the specifics of what is being transferred, it helps to prevent potential disputes and discrepancies that could arise post-sale. For entrepreneurs ready to embark on the journey of purchasing or selling a business, understanding the importance and the intricacies of the Business Bill of Sale is of utmost importance.

Business Bill of Sale Example

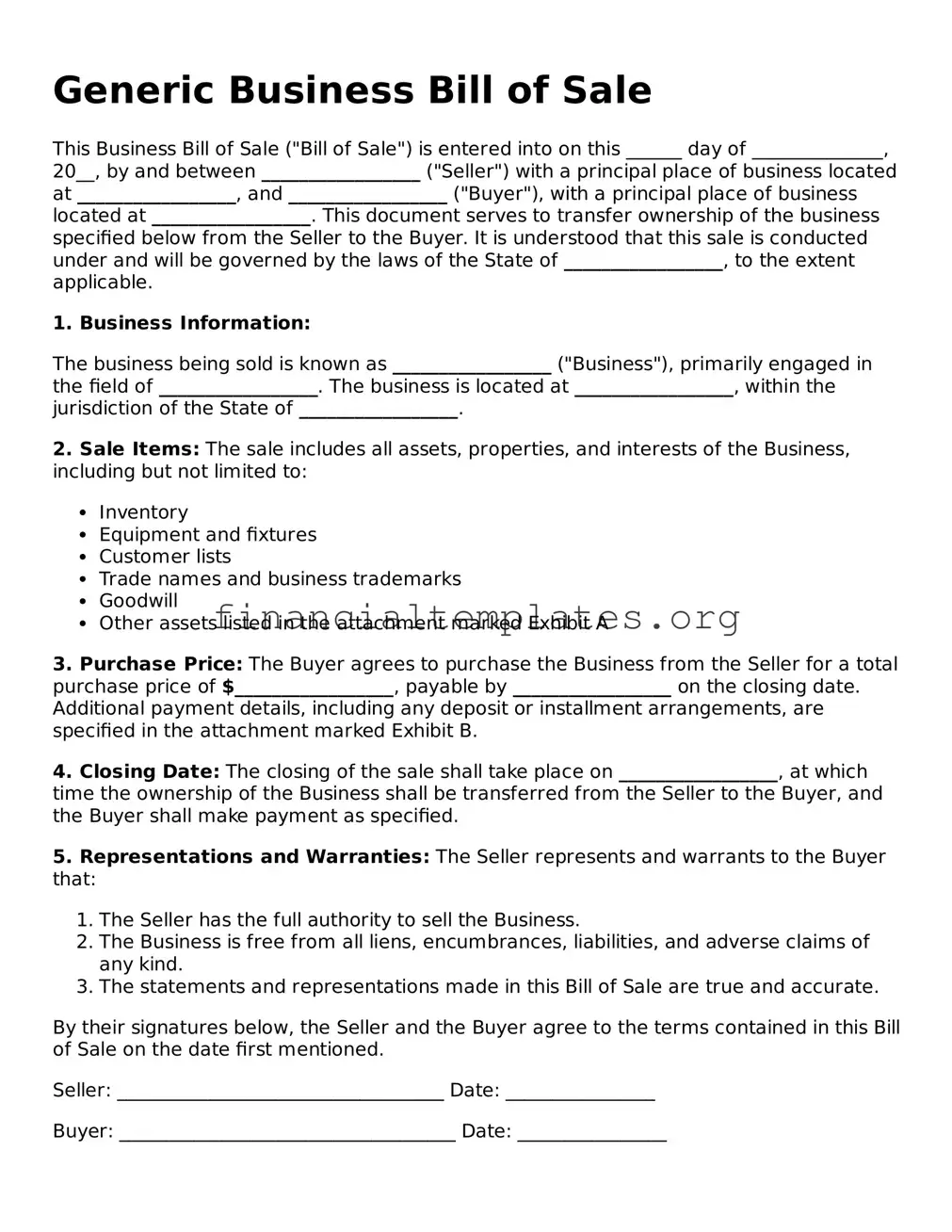

Generic Business Bill of Sale

This Business Bill of Sale ("Bill of Sale") is entered into on this ______ day of ______________, 20__, by and between _________________ ("Seller") with a principal place of business located at _________________, and _________________ ("Buyer"), with a principal place of business located at _________________. This document serves to transfer ownership of the business specified below from the Seller to the Buyer. It is understood that this sale is conducted under and will be governed by the laws of the State of _________________, to the extent applicable.

1. Business Information:

The business being sold is known as _________________ ("Business"), primarily engaged in the field of _________________. The business is located at _________________, within the jurisdiction of the State of _________________.

2. Sale Items: The sale includes all assets, properties, and interests of the Business, including but not limited to:

- Inventory

- Equipment and fixtures

- Customer lists

- Trade names and business trademarks

- Goodwill

- Other assets listed in the attachment marked Exhibit A

3. Purchase Price: The Buyer agrees to purchase the Business from the Seller for a total purchase price of $_________________, payable by _________________ on the closing date. Additional payment details, including any deposit or installment arrangements, are specified in the attachment marked Exhibit B.

4. Closing Date: The closing of the sale shall take place on _________________, at which time the ownership of the Business shall be transferred from the Seller to the Buyer, and the Buyer shall make payment as specified.

5. Representations and Warranties: The Seller represents and warrants to the Buyer that:

- The Seller has the full authority to sell the Business.

- The Business is free from all liens, encumbrances, liabilities, and adverse claims of any kind.

- The statements and representations made in this Bill of Sale are true and accurate.

By their signatures below, the Seller and the Buyer agree to the terms contained in this Bill of Sale on the date first mentioned.

Seller: ___________________________________ Date: ________________

Buyer: ____________________________________ Date: ________________

PDF Properties

| Fact | Detail |

|---|---|

| Definition | A Business Bill of Sale form is a legal document that records the sale of a business from one party to another and transfers ownership of the business's assets. |

| Components | It typically includes details such as the names and addresses of the buyer and seller, a description of the assets being sold, the sale price, and the date of the sale. |

| Function | The form serves as a receipt for the transaction and can be used for tax purposes, to resolve disputes, and to record the change of ownership. |

| Witnesses | Depending on the state, witnesses or a notary public may be required to validate the Business Bill of Sale. |

| Governing Law | Each state has its own laws governing the sale of a business, and the Business Bill of Sale must comply with the relevant state laws where the transaction occurs. |

| Importance | It provides legal protection for both the buyer and the seller by documenting that the transaction took place and detailing its terms. |

| Customization | While there are standard forms, a Business Bill of Sale can be customized to include additional terms and conditions specific to the transaction. |

| State-Specific Forms | Many states offer specific forms that may include additional clauses or disclosures required by state law. |

| After Sale Responsibilities | The document may outline responsibilities of the buyer and seller following the sale, such as non-competition clauses and the transition of support for the business. |

Guide to Writing Business Bill of Sale

After making the decision to sell or purchase a business, the next step involves legally documenting the transaction. A Business Bill of Sale serves as a critical record, detailing the agreement between the buyer and the seller. It confirms that ownership of the business has been transferred and provides a comprehensive account of what was included in the sale. This document requires careful attention to detail to ensure that all the pertinent information is accurately captured. By following these steps, parties can efficiently complete the form, safeguarding their interests and facilitating a smooth transition.

- Gather all necessary information including the legal names of the buyer and seller, business name, and address.

- Detail the purchase price, payment method, and any terms related to the transaction such as deposits or installment plans.

- Include a comprehensive list of all assets being sold. This may encompass tangible assets like inventory and equipment, as well as intangible assets such as customer lists and goodwill.

- Identify any liabilities or obligations being assumed by the buyer. It is vital to clearly state which, if any, debts or responsibilities related to the business operations will transfer with the sale.

- Specify the date when the sale will become effective, ensuring both parties are aware of the official transfer of ownership.

- Both the buyer and the seller must sign and date the document. If applicable, witnesses or a notary public can add their signatures to validate the agreement.

- It is advisable for both parties to retain copies of the completed Business Bill of Sale for their records.

Completing the Business Bill of Sale is a pivotal step in the process of a business transaction. It not only formalizes the sale but also serves as a key document for record-keeping and potential future reference. Should any disputes or questions arise concerning what was sold or the terms of the sale, this document provides clear evidence of the agreement that was reached.

Understanding Business Bill of Sale

-

What exactly is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the sale of a business from one party (the seller) to another (the buyer). It acts as a receipt for the transaction and typically includes details such as the names of the parties involved, the business being sold, the sale price, and the date of sale. This document serves as proof that the business ownership has been transferred.

-

Why is a Business Bill of Sale important?

This form is crucial for both the buyer and the seller. For the buyer, it serves as legal evidence of obtaining the ownership of the business and its assets. For the seller, it provides a record that they have transferred the rights and responsibilities of the business to someone else. Additionally, this document can be important for tax purposes and may be required by banks or other financial institutions during transactions involving the business.

-

What information should be included in a Business Bill of Sale?

The document should clearly list the business's name, details about the transaction (including the sale price), a description of what is being sold (such as assets, inventory, and intellectual property), the names and addresses of the buyer and seller, the date of the sale, and any terms and conditions of the sale. Both parties should also sign the document, ideally in the presence of a witness or notary public for additional legal validity.

-

Is a witness or notary required for a Business Bill of Sale?

While the requirements can vary by jurisdiction, having a witness or notary public sign the Business Bill of Sale can add a level of legal protection and authenticity to the document. This step is highly recommended to ensure that the signatures are verified and that the transaction is recognized as legitimate by third parties.

-

Can a Business Bill of Sale be used for any type of business?

Yes, a Business Bill of Sale can be used for the sale of various types of businesses, whether they are service-oriented, retail, manufacturing, or online. However, the specifics of what is being sold (like physical assets or digital properties) should be clearly detailed in the document to avoid any confusion or disputes later on.

-

How does a Business Bill of Sale differ from a Purchase Agreement?

A Business Bill of Sale documents the transaction and serves as proof of sale after the fact. In contrast, a Purchase Agreement is a contract that outlines the terms and conditions of the sale before it is finalized. The Purchase Agreement may specify contingencies, due diligence requirements, and other stipulations that must be met before the sale can proceed. Both documents play important roles in the sale of a business.

-

What happens if you don't use a Business Bill of Sale?

Not using a Business Bill of Sale can lead to significant risks and complications. Without this document, there might be no formal proof of the sale or transfer of ownership. This lack of documentation can result in legal disputes, difficulties in completing financial transactions, and issues with tax authorities. It's crucial to have this document to provide clarity and protection for all parties involved.

-

Does a Business Bill of Sale need to be filed or registered anywhere?

The requirements for filing or registering a Business Bill of Sale vary by location and the type of business involved. While in many cases, the document does not need to be filed with a government agency, it should be kept on record by both the buyer and the seller. In certain situations, such as transferring a liquor license or other regulated activities, additional filings might be necessary.

-

Are there templates available for a Business Bill of Sale?

Yes, there are templates available for drafting a Business Bill of Sale. These can serve as a starting point to ensure that all the essential elements are included. However, it might be beneficial to consult with a legal professional to ensure that the document meets the specific needs of your transaction and complies with local laws and regulations.

-

Can modifications be made to a Business Bill of Sale after it's signed?

Once a Business Bill of Sale is signed, it is considered final. Any modifications to the terms of the sale would require the agreement of both parties and potentially a new document or an amendment to the original. It’s important to ensure that the document accurately reflects the agreement before signing.

Common mistakes

When filling out a Business Bill of Sale form, accuracy is key to ensuring that the sale process is legally binding and reflects the true intention of both parties involved. There are some common mistakes that people tend to make during this process. Being aware of these mistakes can help in avoiding potential issues down the line.

Not providing complete details of the parties involved - It's crucial to include full names, addresses, and contact information of both the buyer and the seller. This clarifies who the agreement is between and how to contact them if questions or disputes arise.

Leaving out a detailed description of the business being sold - The form should clearly describe what is being sold, including assets, inventory, and any physical or intellectual property. A vague description can lead to confusion and potential legal challenges later.

Failing to include the sale price and payment terms - It's essential that the document specifies the sale amount agreed upon by the parties and the terms of payment (e.g., cash, installment). Without this, the enforceability of the sale might be questioned.

Omitting any contingent liabilities or ongoing obligations - If the business sale includes the assumption of debts or obligations by the buyer, these must be explicitly mentioned. Not doing so can lead to disputes about who is responsible for these liabilities.

Not getting the form notarized or witnessed if required - Depending on state laws, a Business Bill of Sale form may need to be notarized or signed in the presence of witnesses to be legally binding. Skipping this step can invalidate the document.

By paying attention to these details, both buyers and sellers can ensure that the Business Bill of Sale form accurately reflects the terms of their agreement and that their rights are protected. It's often beneficial to consult with a legal professional who can provide guidance specific to your situation and help avoid these common mistakes.

Documents used along the form

When transferring ownership of a business, a Business Bill of Sale form is crucial, but it's typically just one component in a suite of documents that solidify the transaction. To ensure a smooth and legally compliant transfer, several other forms and documents are often utilized alongside the Business Bill of Sale. These documents can vary depending on the nature of the business, the jurisdiction, and specific terms agreed upon by the parties involved. However, certain forms are commonly required to address various legal, financial, and operational aspects of the business sale.

- Asset Purchase Agreement: This comprehensive document outlines the specifics of the transaction, including which business assets and liabilities are being bought and sold. It serves as a detailed record of the agreement between the buyer and seller, covering terms, conditions, and any exclusions from the sale.

- Non-Disclosure Agreement (NDA): Often used in the initial stages of negotiation, an NDA ensures that confidential information exchanged during the negotiations remains private. It protects sensitive business information, trade secrets, and client data.

- Non-Compete Agreement: To prevent the seller from starting a new, competing business within a certain geographic area and time frame, a Non-Compete Agreement may be included. This helps safeguard the buyer’s investment in the newly acquired business.

- Promissory Note: If the buyer is not paying the full purchase price upfront and instead making payments over time, a Promissory Note is necessary. This document details the loan's terms, including repayment schedule, interest rate, and maturity date.

- Bill of Sale for each major asset: In addition to the general Business Bill of Sale, specific Bills of Sale for major assets (e.g., real estate, vehicles, and high-value equipment) might be required to record the transfer of these items specifically and legally.

- Employee Agreement Forms: If the business has employees who will be staying on post-transfer, new Employee Agreement Forms may need to be signed. These forms outline the terms of employment, including roles, salaries, and benefits, under the new ownership.

In conclusion, a Business Bill of Sale form plays a pivotal role in the sale and transfer of a business. However, it does not stand alone. The complementary documents listed provide a framework that addresses legal, financial, and operational considerations. Together, they contribute to the efficiency, legality, and overall success of the business transition process. Ensuring these documents are correctly executed and tailored to the specific transaction is crucial for both parties involved in the sale.

Similar forms

A Business Bill of Sale form, while unique, shares similarities with several other legal documents, each facilitating different facets of business and personal transactions. First, consider the Warranty Deed, commonly used in real estate transactions. Like the Business Bill of Sale, a Warranty Deed represents a transfer of ownership, but it specifically pertains to real property, assuring the buyer that the property is free from any undisclosed encumbrances. Both documents serve as pivotal proofs of ownership and transfer, establishing the rights transferred from seller to buyer, albeit in different contexts.

The Assignment of Contract echoes the nature of the Business Bill of Sale in its function of transferring rights. This document is used when one party in a contract wishes to transfer its rights and obligations to another party, effectively stepping out of the contractual obligations and handing them over to someone else. Like the Business Bill of Sale, which ensures a business's assets are legally transferred, the Assignment of Contract is about transferring obligations and benefits, highlighting the importance of clarity in the transition of responsibilities or assets.

Also akin to the Business Bill of Sale is the Vehicle Bill of Sale. This document specifically records the sale and transfer of a vehicle from the seller to the buyer, similar to how a Business Bill of Sale documents the transfer of a business. Both outline critical details like the sale price and descriptions of the item(s) being sold, ensuring that both parties have clear evidence of the transaction’s terms and conditions.

Promissory Notes bear resemblance as well. These are written promises to pay a specified sum of money to a certain individual or entity, either at a determined future date or on demand. Like a Business Bill of Sale, which solidifies the agreement to transfer business assets, a Promissory Note enshrines the commitment to repay a debt under agreed-upon terms. Both documents are legally binding and hold parties accountable for upholding their ends of the deal.

The Non-Disclosure Agreement (NDA), while primarily a tool for protecting confidential information, shares a fundamental similarity with the Business Bill of Sale: the establishment of a legal relationship between parties. In the case of the NDA, this relationship involves the sharing and protection of proprietary information; for the Business Bill of Sale, it's about the transfer of asset ownership. Both create enforceable obligations that protect the interests of the parties involved.

Lastly, the Employment Agreement, though it mainly governs the relationship between employers and employees, parallels the Business Bill of Sale in its function of delineating the terms of an important transaction. It specifies the rights, responsibilities, and duties of each party in a professional relationship, just as the Business Bill of Sale specifies the terms of a business asset's transfer. This ensures a mutual understanding and agreement on the transaction's terms, facilitating a smoother transition and preventing future disputes.

Through these comparisons, it’s evident how a Business Bill of Sale intertwines with various legal documents, each serving a unique purpose yet fundamentally designed to clarify and protect the rights and obligations of the parties involved. Understanding these similarities helps in recognizing the broader legal ecosystem in which the Business Bill of Sale operates, ensuring smoother transactions and partnerships in both business operations and personal affairs.

Dos and Don'ts

When filling out the Business Bill of Sale form, it is essential to ensure that the information provided is accurate and complete. Below are guidelines on what you should and shouldn't do during the process.

Do:

- Review the form beforehand to understand all the required fields.

- Gather all necessary information, including business identification numbers and accurate descriptions of the items being sold.

- Use clear and concise language to avoid any misunderstandings.

- Ensure that both the buyer and seller details are completed in full, including contact information.

- Verify the accuracy of the sale amount and item descriptions.

- Include any warranties or guarantees related to the sale.

- Ensure both parties sign and date the form to make it legally binding.

- Keep a copy of the completed form for your records.

- Consult with a professional if you have any uncertainties about the form.

- Check to make sure all financial information is reported accurately.

Don't:

- Leave any fields blank; if a section does not apply, mark it as N/A.

- Use vague language that might be open to interpretation.

- Forget to specify the date of the sale.

- Overlook the need for witness signatures if required.

- Rely solely on verbal agreements; ensure all conditions are documented in the form.

- Use pencil or any erasable ink; always use blue or black ink for clarity and permanence.

- Fail to disclose any known defects or issues with the items being sold.

- Ignore local or state requirements that may need to be included in the bill of sale.

- Submit the form without reviewing it for mistakes or omissions.

- Assume that the bill of sale does not need to be notarized; in some cases, it may be required.

Misconceptions

A Business Bill of Sale is crucial in the transfer of a business, but there are many misconceptions that can confuse both buyers and sellers. Understanding these can help ensure that the transaction proceeds smoothly and legally. Here are ten common misunderstandings:

All business assets are automatically included in the sale. This is not true. The Business Bill of Sale should specifically list all assets being transferred. Without detailed listings, some assets may be inadvertently left out of the transaction.

Intellectual property is always included. Intellectual property rights such as trademarks, patents, and copyrights need to be explicitly mentioned in the bill of sale if they are to be transferred along with the business.

The Business Bill of Sale is the only document needed. Often, additional documents are required to complete the sale, such as a non-compete agreement or lease transfer agreements for property.

It serves as proof of ownership. While it does document the sale, the Business Bill of Sale alone might not serve as the definitive proof of ownership without additional supporting documents and registrations specific to the business type and location.

A lawyer is not necessary for the transaction. While not always legally required, consulting with a lawyer can help avoid potential problems by ensuring that the bill of sale complies with all state laws and covers all necessary details.

It’s the same as a property bill of sale. A Business Bill of Sale covers the sale of a business as a whole, including assets, while a property bill of sale would cover only physical property. The contents, scope, and complexity of these documents can vastly differ.

The seller’s liabilities are automatically transferred to the buyer. The transfer of liabilities needs to be explicitly agreed upon and usually involves additional legal agreements beyond the Business Bill of Sale.

Verbal agreements are sufficient for a business sale. Even though verbal agreements may be legally binding in some cases, without a written Business Bill of Sale, proving the terms of the sale or even the sale itself can be nearly impossible.

Any standard template will work. Given the uniqueness of each business, a one-size-fits-all approach can miss critical aspects. It’s important to tailor the Business Bill of Sale to the specific transaction.

The buyer doesn’t need to perform due diligence if there’s a Business Bill of Sale. The bill of sale represents the agreement to transfer ownership, but thorough due diligence is essential for the buyer to understand the assets, liabilities, and overall condition of the business being purchased.

Understanding these misconceptions and ensuring that your Business Bill of Sale is correctly drafted can make the difference between a smooth transition and potential legal problems down the road. Whether you’re a seller or a buyer, taking the time to get this document right is a crucial step in the process of transferring a business.

Key takeaways

When navigated properly, a Business Bill of Sale form serves as a critical document in the transaction process, providing proof of purchase and transfer of ownership of a business from the seller to the buyer. Here are 10 key points to consider:

- Complete all required fields accurately: It’s essential to provide precise information about the business, including its legal name, description, and location, to ensure the document’s validity.

- Detail the assets being sold: Clearly list all assets included in the sale, such as inventory, equipment, and intangible assets like trademarks or customer lists, to avoid any confusion or disputes.

- Include the sale price: The document must state the total purchase price of the business or its assets, broken down if necessary, to clarify the agreement entirely.

- Verify the identities of the parties: Confirm the legal identities of both the buyer and the seller to ensure they have the authority to engage in the transaction.

- Signatures are crucial: The Business Bill of Sale needs to be signed by both parties to be legally binding. Witness signatures or a notary’s seal may also be required, depending on your state’s laws.

- Date the document: Record the date when the Business Bill of Sale is signed. This date often marks the transfer of ownership and liabilities.

- State any warranties or "as-is" condition: Clearly mention if the business is being sold with warranties regarding its condition or if it's being sold "as-is", which means the buyer accepts the business in its current state, including all faults.

- Keep copies for record-keeping: Both the buyer and seller should keep signed copies of the Business Bill of Sale for their records and future reference, such as for tax purposes or resolving any disputes.

- Understand your local laws: Laws concerning the sale of a business can vary significantly by location. It’s important to familiarize yourself with the requirements specific to your city or state.

- Involve a legal professional if necessary: Given the complexity and importance of this transaction, consulting a legal professional can provide peace of mind and ensure that the Business Bill of Sale meets all legal criteria.

Other Types of Business Bill of Sale Templates:

Bill of Sale for Bike - Prior to signing, both parties should review the details carefully, ensuring accuracy and mutual agreement.

Free Motorcycle Bill of Sale - Personal information, such as addresses and contact details of both buyer and seller, is also incorporated for identification and future reference.