Blank Bill of Sale Form

The completion of a Bill of Sale form serves as a pivotal moment in the process of buying and selling personal property, marking a clear transfer of ownership from one party to another. This critical document, often underestimated in its significance, stands as a legal record, confirming that a sale has occurred and detailing the terms of the agreement between the parties involved. Whether dealing with vehicles, boats, or even smaller items of personal property, the inclusion of essential information such as the description of the item sold, the sale price, and the date of the transaction, alongside the signatures of both buyer and seller, ensures the validity and enforceability of the transfer. Beyond its primary role in the sales process, the Bill of Sale also plays an important function in tax reporting, dispute resolution, and as proof of ownership, safeguarding the rights of all parties involved. Its utility extends to various contexts, requiring attention to specific forms and regulations that may differ by state or the type of property being sold, emphasizing the need for careful consideration and adherence to legal standards to ensure a smooth and legally sound transaction.

Bill of Sale Document Subtypes

- Bill of Sale for ATVs

- Airplane Bill of Sale

- All-Purpose Bill of Sale

- Bicycle Sale Bill

- Bill of Sale for a Dirt Bike

- Bill of Sale for a Motorcycle

- Bill of Sale for a Snowmobile

- Bill of Sale for a Tractor

- Bill of Sale for a Trailer

- Bill of Sale for an RV Purchase

- Bill of Sale for Artwork

- Bill of Sale for Equipment

- Bill of Sale for Golf Carts

- Bill of Sale for Guns

- Bill of Sale for Watercraft

- Business Transaction Receipt

- Car Bill of Sale

- Equine Bill of Sale

- Farm Animal Transaction Document

- Feline Sale Document

- Furniture Sale Receipt

- Manufactured Home Bill of Sale

- Puppy Bill of Sale

- Scooter Sale Bill

- Watercraft Sale Receipt

Bill of Sale Example

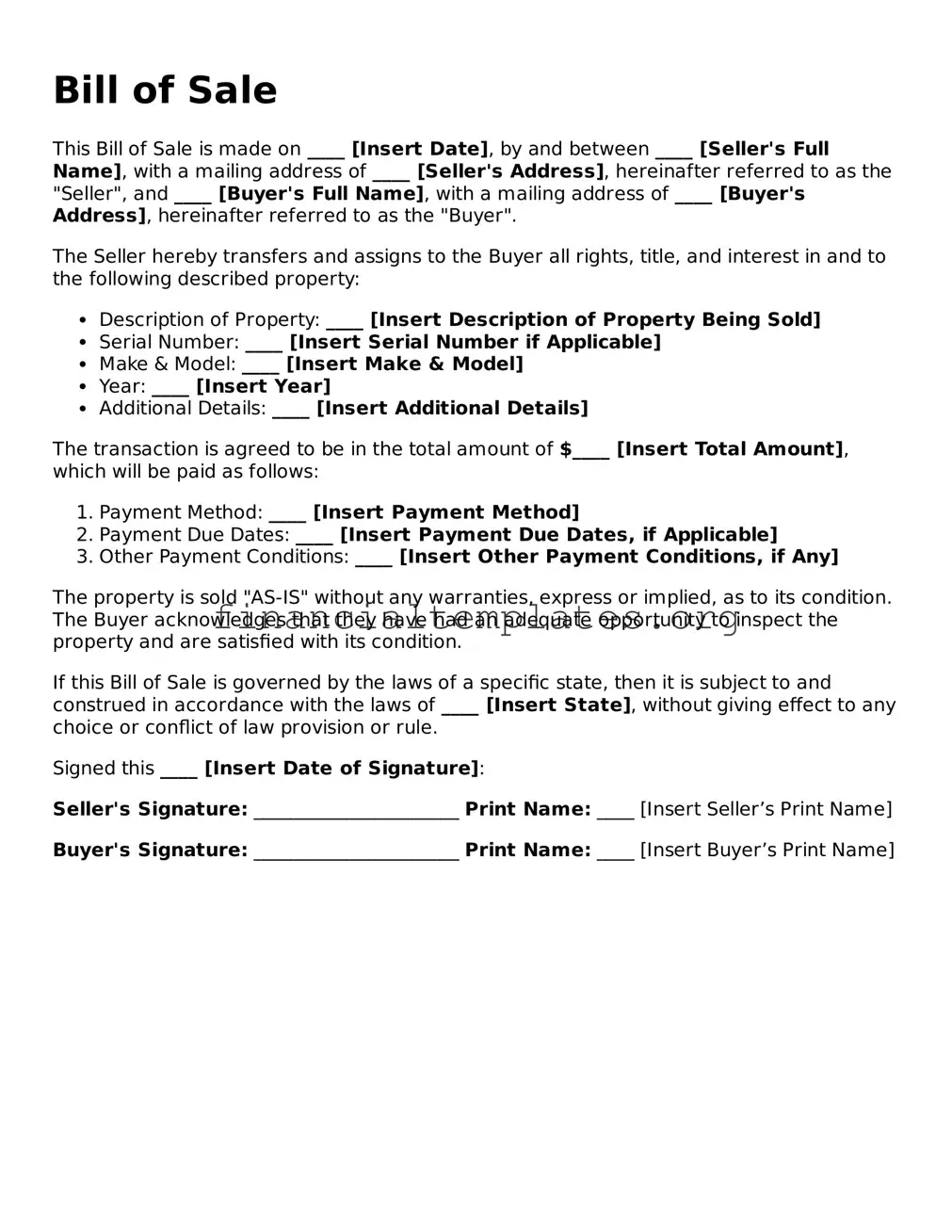

Bill of Sale

This Bill of Sale is made on ____ [Insert Date], by and between ____ [Seller's Full Name], with a mailing address of ____ [Seller's Address], hereinafter referred to as the "Seller", and ____ [Buyer's Full Name], with a mailing address of ____ [Buyer's Address], hereinafter referred to as the "Buyer".

The Seller hereby transfers and assigns to the Buyer all rights, title, and interest in and to the following described property:

- Description of Property: ____ [Insert Description of Property Being Sold]

- Serial Number: ____ [Insert Serial Number if Applicable]

- Make & Model: ____ [Insert Make & Model]

- Year: ____ [Insert Year]

- Additional Details: ____ [Insert Additional Details]

The transaction is agreed to be in the total amount of $____ [Insert Total Amount], which will be paid as follows:

- Payment Method: ____ [Insert Payment Method]

- Payment Due Dates: ____ [Insert Payment Due Dates, if Applicable]

- Other Payment Conditions: ____ [Insert Other Payment Conditions, if Any]

The property is sold "AS-IS" without any warranties, express or implied, as to its condition. The Buyer acknowledges that they have had an adequate opportunity to inspect the property and are satisfied with its condition.

If this Bill of Sale is governed by the laws of a specific state, then it is subject to and construed in accordance with the laws of ____ [Insert State], without giving effect to any choice or conflict of law provision or rule.

Signed this ____ [Insert Date of Signature]:

Seller's Signature: ______________________ Print Name: ____ [Insert Seller’s Print Name]

Buyer's Signature: ______________________ Print Name: ____ [Insert Buyer’s Print Name]

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | Documents the sale or transfer of personal property from one party to another. |

| Components | Typically includes details about the buyer and seller, a description of the items sold, sale price, and date of sale. |

| State-Specific Variations | Some states require notarization or additional details like an odometer reading for vehicles. |

| Governing Law(s) | Varies by state, but generally governed by the state in which the sale occurs. |

Guide to Writing Bill of Sale

Once you've decided to sell or buy a personal property item, such as a vehicle or a piece of equipment, completing a Bill of Sale form is a critical step in the process. This document officially records the transaction and provides proof of purchase, which can be vital for registration, tax purposes, or resolving any disputes that might arise later on. The Bill of Sale form should be filled out accurately and thoroughly by both the seller and the buyer to ensure that all the details of the transaction are well-documented. Follow the steps below to fill out the form properly.

- Begin by entering the date of the sale at the top of the form. This should be the exact day the transaction is finalized and the property is handed over.

- Write the full legal names and addresses of both the seller and the buyer. Be sure to specify who is the seller and who is the buyer to avoid any confusion.

- Describe the item being sold. Include any relevant details such as make, model, year, color, condition, serial number, or any other identifying features. This ensures the exact item is clearly understood by both parties.

- State the sale price of the item in words and then in numbers to confirm the agreed amount. This is crucial for financial records and potential tax implications.

- Indicate any warranties or guarantees that the seller is providing with the sale. If the item is being sold "as is," specify this clearly to ensure the buyer understands they are accepting the item in its current condition.

- Include any additional terms of the sale that have been agreed upon. This might involve delivery details, payment plans, or other conditions specific to the transaction.

- Both the seller and the buyer must sign and date the form. Their signatures legally bind them to the terms of the sale as described in the document.

- If required by your state, have the form notarized to certify the authenticity of the signatures and the information provided.

After the form is fully completed and signed, both parties should keep a copy for their records. This document serves as a legal record of the sale and can protect both the buyer and the seller in case any questions or disputes arise later. It's recommended to review the form carefully before signing to ensure all the information is correct and fully understood.

Understanding Bill of Sale

-

What is a Bill of Sale?

A Bill of Sale is a legal document that records the transfer of ownership of an asset from a seller to a buyer. It is commonly used for the sale of vehicles, boats, motorcycles, and personal property such as furniture or electronics. The document provides proof of purchase and details the transaction between the two parties, including information about the item sold, the sale price, and the date of sale. Ensuring both the buyer's and seller's interests are protected, it serves as a receipt for the transaction.

-

Why do I need a Bill of Sale?

A Bill of Sale is crucial for several reasons. Firstly, it legally documents the transfer of ownership and can be used as proof of purchase. This is especially important for the buyer, as it establishes their legal rights to the property. For the seller, it releases them from liability and documents that they no longer hold ownership of the item. Secondly, it details the condition of the item at the time of sale, protecting the buyer from potential disputes about the item's condition after purchase. Lastly, it may be required for tax purposes or when registering or insuring the item.

-

What information should be included in a Bill of Sale?

- The date of sale.

- Names and addresses of the seller and buyer.

- A detailed description of the item being sold, including make, model, year, and serial number, if applicable.

- The sale price and payment method.

- Any warranties or "as is" condition statements.

- Signatures of both the buyer and seller.

This information ensures the document is clear, legal, and useful in protecting both parties' rights.

-

Do I need to notarize or register a Bill of Sale?

The requirements for notarization and registration of a Bill of Sale vary by state and the type of property being sold. For vehicles, many states require that the Bill of Sale be notarized and submitted to the state's Department of Motor Vehicles (DMV) as part of the vehicle registration process. For other types of personal property, notarization is often not required but can add an extra layer of legal protection. It's wise to consult with a legal advisor or your state's requirements to ensure you comply with all legal stipulations.

Common mistakes

When individuals fill out a Bill of Sale form, they often approach the task with the best intentions. However, a number of common mistakes can occur during this process, which can lead to potential legal complications or misunderstandings down the line. Noticing these errors early can save a great deal of time and prevent unnecessary stress. Here are five mistakes commonly made:

Not confirming the accuracy of all information listed: People sometimes rush through filling out forms and may not double-check the details. Ensuring that names, addresses, and especially the description of the item being sold are accurately recorded is crucial. These pieces of information are foundational to the Bill of Sale's integrity and legal standing.

Omitting important details about the item for sale: Every Bill of Sale should include a complete and detailed description of the item being sold. This includes make, model, year, condition, serial number, or any other distinguishing features. The absence of these details can lead to ambiguity and disputes in the future.

Forgetting to specify the sale terms: The terms of the sale, including the sale price, payment method, and any installment arrangements, must be clearly outlined. Neglecting to include these details can cause confusion or disagreements between the parties later on.

Failing to document the date of the sale: The date of the transaction is a pivotal detail that sometimes gets overlooked. Accurately recording when the transaction took place helps establish the timeline of ownership and is essential for both legal and record-keeping purposes.

Not obtaining signatures from all parties: A Bill of Sale must be signed by both the seller and the buyer to be considered legally binding. Sometimes, individuals forget to have all parties sign the document, which can significantly weaken its legal effectiveness and enforceability.

Attending to these details when completing a Bill of Sale can significantly smooth the path of any transaction and help protect the interests of all parties involved.

Documents used along the form

When completing a transaction, especially one involving the sale of items like vehicles, boats, or personal property, a Bill of Sale form plays a crucial role. However, to ensure the process is comprehensive and legally binding, other forms and documents are often required to accompany the Bill of Sale. These additional documents help provide a clearer understanding of the item's condition, the terms of the sale, and the responsibilities of each party.

- Title: The title is a document that proves ownership of the property, such as a vehicle or boat. When an item is sold, the title must be transferred to the new owner, making it an essential companion to the Bill of Sale.

- Warranty Document: A warranty document comes into play if the seller is providing any guarantees on the item's condition. This document outlines the specifics of the warranty, including what is covered, for how long, and under what conditions.

- Odometer Disclosure Statement: For the sale of vehicles, an Odometer Disclosure Statement is often required to accompany the Bill of Sale. This document provides the buyer with the known mileage of the vehicle at the time of sale, ensuring transparency regarding the vehicle's use.

- Promissory Note: If the buyer is paying for the item through installments, a Promissory Note is necessary. It details the repayment schedule, the interest rate, if applicable, and the consequences of failing to meet the payment terms.

Together with a Bill of Sale, these documents form a comprehensive package that helps protect the interests of both the buyer and the seller. They ensure that all parties are aware of the item's condition, the terms of the sale, and the legal obligations involved. Having these documents in order can make the transaction smoother and more transparent, providing peace of mind for everyone involved.

Similar forms

A Warranty Deed is similar to a Bill of Sale in that both serve as legal proof of a transfer of ownership. A Warranty Deed is specifically used for real estate transactions, guaranteeing that the seller holds clear title to the property and has the right to sell it. It reassures the buyer of the legitimacy of the transaction, akin to how a Bill of Sale reinforces the sale of personal property.

A Title Certificate is another document bearing resemblance to a Bill of Sale, as they both establish ownership. While a Bill of Sale confirms the transaction and transfer of ownership for various items, a Title Certificate applies primarily to vehicles and real estate, officially recording the owner's details in public records.

Similarly, a Quitclaim Deed, like a Bill of Sale, is used in transactions involving transfer of ownership. The difference lies in the details; a Quitclaim Deed transfers any ownership interest the grantor may have without making any guarantees about the title's clearness, whereas a Bill of Sale transfers ownership of personal property with or without warranties, depending on its form.

An Invoice provides evidence of a transaction, comparable to a Bill of Sale. Invoices are used in the sale of services or goods, showing detailed information about the transaction, including the price, date, and parties involved. While an Invoice may serve as proof of purchase, a Bill of Sale is a more formal representation of transferring ownership of personal property or vehicles.

The Receipt shares similarities with a Bill of Sale, mainly in function as proof of a transaction being completed. While a Receipt usually acknowledges payment, a Bill of Sale confirms the transfer of ownership and includes additional details about the transaction, such as a description of the item sold and warranty information.

A Promissory Note is akin to a Bill of Sale in that it records an agreement between two parties. However, while a Bill of Sale documents the sale and transfer of ownership of an item, a Promissory Note details the borrower's promise to pay back a debt to the lender, outlining the payment terms and interest rate.

A Sales Agreement, much like a Bill of Sale, is a formal document that outlines the terms of a transaction between a buyer and a seller. While a Bill of Sale typically marks the conclusion of a sale, confirming the transfer of ownership, a Sales Agreement can serve as a preliminary agreement, specifying the obligations and conditions before the sale is finalized.

A Lease Agreement shares the concept of transferring rights, similar to a Bill of Sale. However, instead of transferring ownership of property or goods, a Lease Agreement grants the use or temporary possession of property in exchange for rent. This agreement details the terms under which one party agrees to rent property owned by another party.

A Security Agreement parallels a Bill of Sale in its function of documenting an agreement between parties, particularly focusing on transactions involving collateral. It secures a loan by giving the lender an interest in the borrower's personal property, distinguishing it from a Bill of Sale which solely documents the sale and transfer of personal or real property without involving loans.

Dos and Don'ts

When preparing a Bill of Sale form, it's important to ensure that the document accurately reflects the transaction between the buyer and seller. This document is a key piece of any sale and should be filled out with attention to detail and accuracy. Here are seven do's and don'ts to consider:

- Do ensure that all information is complete and accurate. This includes the names and addresses of both the buyer and seller, as well as detailed information about the item being sold.

- Do verify that the description of the item is detailed and precise. Include make, model, year, color, condition, and serial numbers if applicable.

- Do confirm the sale price and ensure that it's clearly stated in the form. This helps avoid any misunderstandings about the financial terms of the agreement.

- Do date the document at the time of the sale. The date is crucial for record-keeping and legal purposes.

- Do ensure both parties sign the document. Signatures are essential as they indicate that both the buyer and seller agree to the terms and conditions of the sale.

- Don't leave any fields blank. If a section does not apply, indicate this with "N/A" (not applicable) to show that you did not overlook the field.

- Don't forget to provide a copy to both the buyer and seller. Having a copy is important for both parties' records.

Adhering to these guidelines can help facilitate a smooth and legally sound transaction. A Bill of Sale form is more than just paperwork; it's a record that protects both parties and validates the sale. Approach this document with the meticulousness it deserves.

Misconceptions

Understanding the Bill of Sale form is crucial for both buyers and sellers in a transaction. However, several misconceptions can complicate the process. Here are five common misunderstandings, clearly explained:

It serves the same purpose as a receipt: Many people think a Bill of Sale is just an elaborate receipt. However, it's much more than that. While a receipt only shows that a payment has been made, a Bill of Sale proves a transfer of ownership has occurred. It includes detailed information about the item sold, the sale date, and the parties involved.

Only motor vehicles require a Bill of Sale: This is a common misconception. Although cars, motorcycles, and boats frequently come with a Bill of Sale, this document is vital for a wide range of transactions. It can be used for transferring ownership of personal property like furniture, electronics, or even animals.

Legal jargon is a must for it to be valid: Some might think that for a Bill of Sale to be legally binding, it needs to be filled with legal terms. This isn't true. Clarity and simplicity often make a Bill of Sale more effective. All it needs to be valid is a description of the item being sold, the sale price, and information about the buyer and seller.

A Bill of Sale is only necessary when required by law: While some states do require a Bill of Sale for certain transactions, relying solely on this requirement is misguided. This document provides legal protection for both the buyer and the seller. It's beneficial to have, even when the law doesn't demand it, as it records the details of the transaction.

The Bill of Sale must be drafted by a legal professional to be valid: People often believe that a lawyer or a legal document preparer must create a Bill of Sale for it to be valid. This is not the case. Individuals can draft their own Bill of Sale. Irrespective of who drafts it, ensuring it includes all necessary information is what's important for its validity.

Key takeaways

When completing and applying a Bill of Sale form, several factors need to be taken into account to ensure both the buyer’s and seller’s interests are protected. Here are key takeaways:

- Accuracy is paramount. Every detail entered in the Bill of Sale must be accurate, including the full legal names of both the buyer and the seller, a clear description of the item being sold, and the sale price.

- Legal requirements vary by location. Before drafting a Bill of Sale, verify the legal requirements in your state or country. Some regions require the document to be notarized or witnessed.

- Include a detailed description of the item. The description should include make, model, year, color, condition, serial number, or any other identifying characteristics to ensure the item is distinctly recognized.

- Specify payment details. Clearly state the sale price, accepted payment methods, and payment schedule if applicable. This includes any arrangements for a deposit or installment payments.

- As-is condition should be noted. If the item is sold "as-is," specify this in the document to indicate that the buyer accepts the item in its current state and the seller is not liable for future repairs or defects.

- Signatures are essential. Both the buyer and the seller must sign the Bill of Sale. Their signatures formally execute the agreement, making it legally binding.

- Keep copies of the document. After signing, both parties should keep copies of the Bill of Sale. This record proves ownership and can be crucial for tax purposes or in the event of a dispute.

- Witnesses add an extra layer of security. While not always legally required, having a witness sign the document can provide additional proof of the sale’s authenticity and the agreement’s validity.

Popular Documents

North Carolina Estimated Tax Payments - A direct line to obtaining further assistance or forms via the North Carolina Department of Revenue’s contact information simplifies taxpayer support.

IRS 5472 - Acts as a preventative measure against the misuse of the U.S. tax system through undisclosed foreign transactions.