Get Berks Tax Form

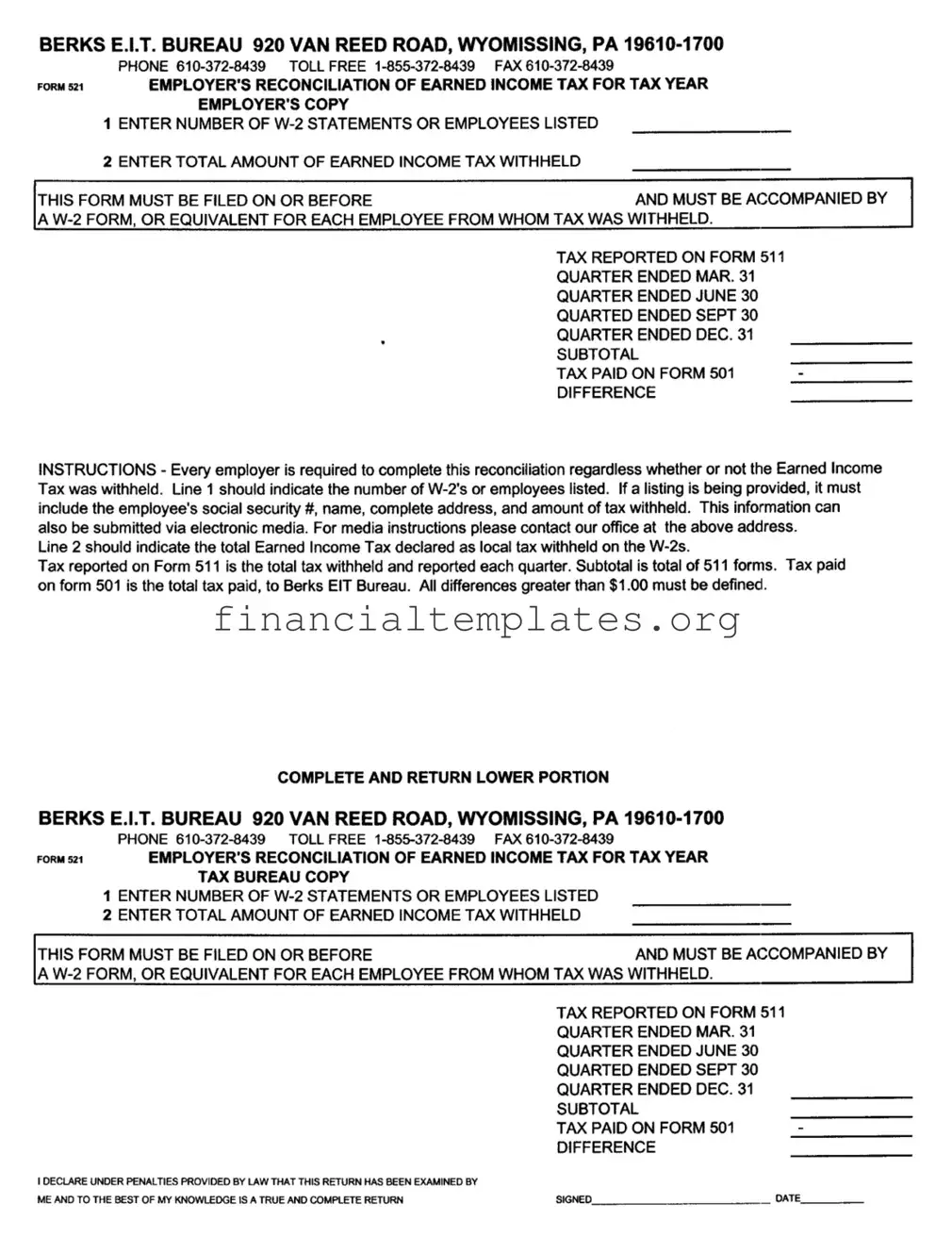

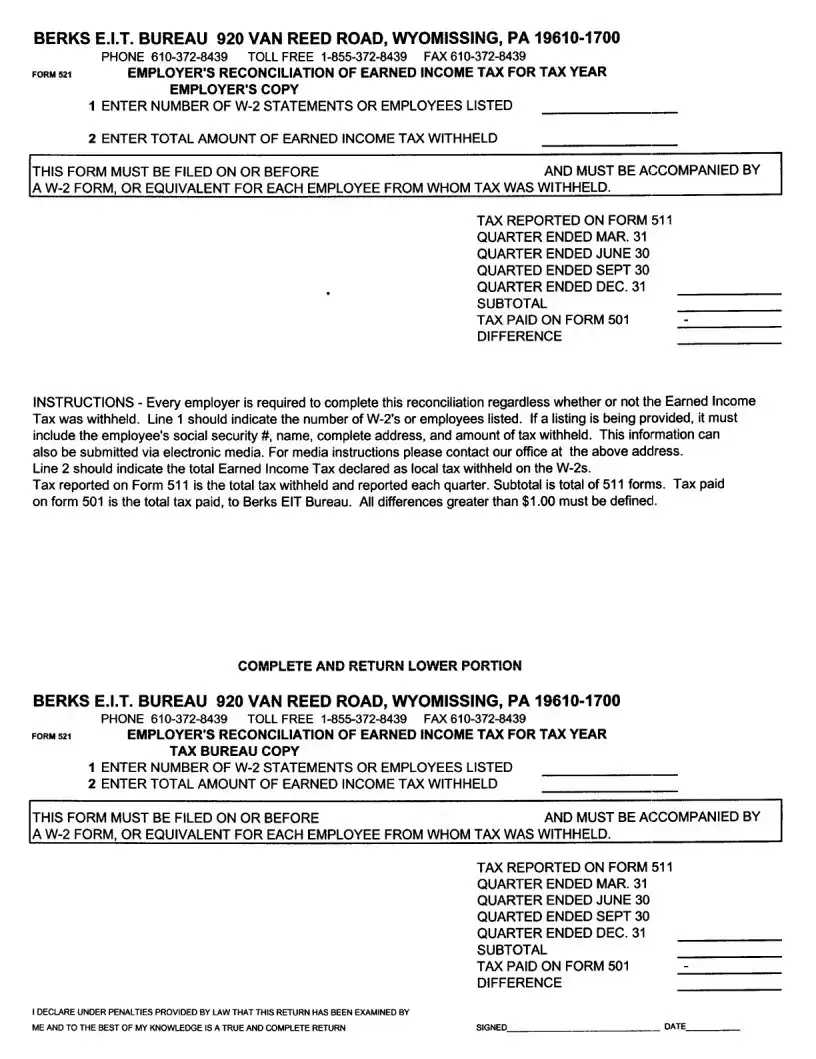

Filing taxes accurately and timely is essential for employers, and the Berks Tax Form serves as a crucial component in this process for those operating within the relevant jurisdiction. Known officially as the Employer’s Reconciliation of Earned Income Tax, Form 521, it plays a vital role in reconciling the amount of local earned income tax withheld from employees throughout the tax year. Employers are required to list the total number of W-2 statements or employees, alongside the aggregate amount of earned income tax withheld. This process necessitates a detailed breakdown of taxes withheld on a quarterly basis, reported on Form 511, and the total tax remitted via Form 501, highlighting any discrepancies exceeding one dollar. The form stipulates clear instructions for submission, including the necessity of accompanying W-2 forms or equivalents for each employee, ensuring employers provide comprehensive employee details such as social security numbers, names, complete addresses, and the specific amount of tax withheld. The Berks E.I.T. Bureau facilitates filing through both traditional and electronic media, offering assistance through direct contact for media submission guidelines, underscoring its commitment to streamline the reconciliation process. This form must be filed by the specified deadline to ensure compliance and avoid potential penalties, emphasizing the importance of accurate and prompt submission in the broader context of earned income tax reconciliation.

Berks Tax Example

Document Specifics

| Fact | Description |

|---|---|

| Purpose of Form | This form is used for the reconciliation of Earned Income Tax withheld by employers in the jurisdiction of the Berks E.I.T. Bureau. |

| Required Information | Employers must provide the number of W-2 statements or employees listed, and the total amount of Earned Income Tax withheld. |

| Submission Requirements | The form, along with a W-2 form or equivalent for each employee from whom tax was withheld, must be submitted by the specified due date. |

| Quarterly Reporting | Tax reported on Form 511 reflects the total tax withheld and reported each quarter, leading to a cumulative subtotal. |

| Tax Payment Verification | The subtotal of tax reported is compared to the total tax paid, as shown on Form 501, to identify any differences. |

| Governing Law | This form operates under the local tax laws of Wyomissing, PA, and pertains specifically to the Earned Income Tax requirements set forth by the Berks E.I.T. Bureau. |

Guide to Writing Berks Tax

When it comes time to reconcile the Earned Income Tax for your employees, the Berks Tax form 521 is a crucial document that ensures accuracy and compliance. Employers must complete this form annually, providing a comprehensive summary of taxes withheld from employees' earnings. The document is not only a means to finalize the year's tax withholdings but also serves as a check to ensure that the correct amounts have been withheld and paid to the Berks E.I.T. Bureau. Remember, this form must be submitted promptly along with a W-2 form, or its equivalent, for every employee from whom taxes were withheld. Accuracy is key, as all discrepancies over $1.00 must be clearly explained.

- Begin by providing the total number of W-2 statements or employees listed. If you are submitting a list, ensure it includes each employee's social security number, full name, complete address, and the exact amount of tax withheld. Alternatively, this employee information can be sent through electronic media. For guidance on submitting electronically, reach out to the Berks E.I.T. Bureau using the contact information provided.

- Enter the total Earned Income Tax withheld, as reported on the W-2 forms, into Line 2. This is the cumulative local tax withheld from employees throughout the tax year.

- Report the total tax withheld and reported each quarter on Form 511 for the quarters ending March 31, June 30, September 30, and December 31. Sum these amounts to provide the subtotal of taxes reported.

- Include the total tax amount paid on Form 501, which represents the total tax payments made to the Berks E.I.T. Bureau.

- Calculate the difference, if any, between the total taxes withheld (as indicated in the subtotal of 511 forms) and the total tax payments made (as reported on Form 501). All differences greater than $1.00 must be defined and explained.

- Complete the lower portion of the form, which includes your declaration of accuracy under penalty of law. This affirms that the return has been examined thoroughly and is both true and complete to the best of your knowledge. Sign and date the form.

After filling out the form with the necessary details, ensure you double-check all the information for accuracy. All sections must be filled out thoroughly to avoid complications. Once completed, return the lower portion of the form to the Berks E.I.T. Bureau at the address provided. Timely and accurate completion of this form contributes to the smooth processing of tax reconciliations, benefiting both employers and employees.

Understanding Berks Tax

What is the Berks Tax Form 521 used for?

The Berks Tax Form 521 is used by employers for the reconciliation of Earned Income Tax (EIT) withheld from their employees throughout the tax year. This form must accompany a W-2 form, or equivalent, for each employee from whom tax was withheld. It ensures that the total amount of local earned income tax reported and withheld matches the total taxes reported quarterly on Form 511 and paid via Form 501. This form helps in maintaining accuracy in tax reporting and payments to the Berks E.I.T. Bureau.

When must the Form 521 be filed?

The specific due date for filing Form 521 isn't provided in the given details, but it stresses the importance of timely submission. Generally, such forms are required to be filed annually, often early in the year following the tax year it pertains to. Employers should contact the Berks E.I.T. Bureau or consult their documentation to confirm the exact filing deadline. It is critical for employers to file on time to avoid penalties.

What information needs to be included for each employee?

For each employee, the employer must provide the employee's social security number, name, complete address, and the amount of tax withheld. This detailed information ensures correct tax processing for each individual. Additionally, employers have the option to submit this information via electronic media. Employers interested in electronic submission should contact the Berks E.I.T. Bureau for specific media instructions.

How are discrepancies in the amount of tax withheld handled?

When filling out Form 521, any discrepancies greater than $1.00 between the total tax withheld throughout the year and the tax paid (as reported on Forms 511 and 501) must be clearly defined in the "Difference" section of the form. This could include explaining any overpayments or underpayments. Accurately reporting and explaining these differences is crucial for the proper reconciliation of Earned Income Taxes withheld from employees.

What should an employer do if they have not withheld any Earned Income Tax?

Even if an employer has not withheld any Earned Income Tax during the tax year, they are still required to complete the reconciliation process using Form 521. This requirement ensures that the Berks E.I.T. Bureau has accurate records of all employers within their jurisdiction. Completing the form, in this case, would involve indicating zero withholding and providing the necessary documentation for each employee as outlined in the instructions. This step is integral to maintaining compliance with local tax regulations.

Common mistakes

Filling out tax forms can be a daunting task, and the Berks Tax Form 521, used for the Employer's Reconciliation of Earned Income Tax, is no exception. There are common pitfalls that can lead to errors, which might delay processing or result in penalties. It's crucial for employers to approach this task with attention to detail to ensure compliance and accuracy.

- Not Including All W-2 Statements or Employees Listed: It's mandatory to enter the number of W-2 statements or employees for whom tax was withheld. Failing to include every W-2 statement or not listing all employees can lead to discrepancies in the total Earned Income Tax reported.

- Incorrect Total Earned Income Tax Withheld: Line 2 requires the total amount of Earned Income Tax withheld to be reported. Errors can occur if this total does not accurately reflect the sum of local tax withheld on the W-2 forms for all listed employees.

- Omission of Employee Details: When providing a listing of employees, each entry must include the employee's social security number, name, complete address, and the amount of tax withheld. Missing details can invalidate the submission.

- Failure to Report Quarterly Tax Amounts Accurately: The form requires the total tax withheld to be reported each quarter, along with the subtotal of 511 forms and the total tax paid as per Form 501. Mistakes in calculating or reporting these amounts can lead to a difference that requires explanation.

- Not Defining Differences Greater Than $1.00: If there is a difference of more than $1.00 between the subtotal of taxes reported on Form 511 and the total tax paid on Form 501, it must be clearly defined. Failure to do so can result in queries or the need for amendment.

- Missing the Filing Deadline: This form must be filed by the specified deadline and must be accompanied by a W-2 form, or equivalent, for each employee from whom tax was withheld. Late submissions can lead to penalties or late fees.

Understanding and avoiding these common mistakes can significantly ease the process of completing the Berks Tax Form 521. Employers are encouraged to double-check their submissions for these and other potential errors before filing. Additionally, seeking assistance from a professional or reaching out directly to the Berks E.I.T. Bureau for guidance can be invaluable in ensuring that the submitted forms are accurate and complete.

Documents used along the form

When filing the Berks Tax Form 521, employers undertake a critical reconciliation process for Earned Income Tax (EIT) withheld from their employees. This form is a cornerstone document but often necessitates additional forms and documents to ensure accurate and compliant tax reporting. Below are four key documents often used alongside the Berks Tax Form 521, each serving a unique purpose in the broader tax filing landscape.

- Form W-2, Wage and Tax Statement: This crucial document details each employee's annual wages and the amount of taxes withheld from their paycheck. Employers must provide a W-2 form to every employee from whom income tax was withheld, serving as a primary document that complements the Berks Tax Form 521.

- Form 511, Quarterly Earnings Tax Return: Throughout the financial year, employers are required to report and pay earned income tax on a quarterly basis using Form 511. This form tracks the total tax withheld and reported each quarter, directly influencing the final reconciliation process on Form 521.

- Form 501, Employer’s Quarterly Return of Earned Income Tax Withheld: Similar to Form 511, Form 501 is used to report the actual tax paid to the Berks EIT Bureau each quarter. The cumulative total from these forms helps reconcile any differences in tax withheld versus tax paid when completing Form 521.

- Employee’s Social Security Number, Name, and Address Listing: Although not a formal IRS form, providing a detailed list of employees, including their social security numbers, names, complete addresses, and the amount of tax withheld is essential. This document supports the information provided in Form 521 and helps ensure accuracy in reporting individual employee earnings and withholdings.

Together with the Berks Tax Form 521, these documents form a comprehensive suite of tools for employers to accurately report Earned Income Tax, ensuring compliance with local tax obligations. The synergy between these documents facilitates a smoother reconciliation process, enabling businesses to fulfill their tax duties efficiently and effectively.

Similar forms

The Internal Revenue Service (IRS) Form W-2, commonly known as the Wage and Tax Statement, has a close resemblance to the Berks Tax form, particularly in its purpose of reporting income and taxes withheld. Similar to the Berks Tax form which collects details about the earned income tax withheld by an employer, the W-2 form captures an employee's annual wages and the amount of taxes withheld from their paycheck for federal and state tax purposes. Both documents serve as essential tools for reconciling the tax withheld from the employee's income with the actual tax liability.

IRS Form 941, the Employer's Quarterly Federal Tax Return, shares similarities with the Berks Tax form in its periodic reporting requirement. While Form 941 is used to report wages paid, federal income tax withheld, and both the employer's and employee's share of social security and Medicare taxes on a quarterly basis, the Berks form focuses on local earned income tax reconciliation for employers. Both forms are pivotal for ensuring tax compliance and accurate payroll tax reporting by employers.

Form PA-W3, the Pennsylvania Employer Quarterly Return of Income Tax Withheld, like the Berks Tax form, is tailored for reporting state-level income tax withholding. Employers use Form PA-W3 to reconcile the state income tax withheld from employees' wages each quarter, echoing the Berks form's role in reconciling local earned income tax. Both documents aid in the accurate calculation and reporting of taxes withheld, ensuring that employers meet their tax reporting obligations at their respective jurisdictional levels.

The Unemployment Compensation (UC) Quarterly Tax Return is another document with similarities to the Berks Tax form, focusing instead on unemployment tax contributions rather than income tax withheld. Employers report their wages paid and unemployment taxes due each quarter, akin to the way earned income tax details are provided in the Berks Tax reconciliation. Both forms play a crucial role in funding governmental programs, whether for unemployment benefits or local infrastructure through tax revenue.

Form 940, the Employer's Annual Federal Unemployment (FUTA) Tax Return, compares to the Berks Tax form by handling a different aspect of employment taxation on an annual basis. Form 940 calculates the employer's federal unemployment tax liability on the wages paid. The principle of reconciling taxes collected from the operational activity of employees underlines both the FUTA tax and the local earned income tax obligations covered by the Berks document.

Form 1042, the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, has parallels with the Berks form in its approach to withholding tax, albeit focusing on nonresident aliens and foreign entities. Just as the Berks form is critical for local tax compliance through the reconciliation of earned income tax, Form 1042 ensures compliance with U.S. tax law on payments made to non-U.S. persons, highlighting the breadth of tax reporting responsibilities for different entities and jurisdictions.

The Quarterly Federal Excise Tax Return, or Form 720, shares the concept of periodic tax reporting with the Berks Tax form, but diverges in focusing on goods and services subject to excise taxes. The principle of reporting tax obligations on a regular basis underpins both documents, ensuring ongoing compliance and remittance of taxes that support federal, state, or local government functions.

Local Services Tax (LST) returns, required in some Pennsylvania jurisdictions, demonstrate parallels to the Berks Tax form by focusing on a specific tax that benefits local services. Employers are responsible for withholding the LST from employees and reporting those withholdings, similar to the way earned income tax withholdings are reported on the Berks form. Both forms facilitate the funding of essential community services through tax revenue.

Form 1099-MISC, Miscellaneous Income, and its successor, Form 1099-NEC, for reporting non-employee compensation, share a kindred purpose with the Berks Tax form in tax reporting. Although primarily used for independent contractors rather than traditional employees, these forms involve the reporting of payments and, in some cases, federal tax withholdings, paralleling the Berks form's focus on income tax withheld by employers but applied to a different type of worker.

Finally, the Schedule H (Form 1040), Household Employment Taxes, resembles the Berks Tax form in its application for employers, albeit in a domestic context. Users of Schedule H must report taxes related to household employees, similar to how the Berks form is used for reconciling earned income taxes for business employees. Both documents underscore the responsibility of employers to accurately report and remit taxes on wages paid.

Dos and Don'ts

Filing tax forms can often feel like navigating through a maze, especially when dealing with specifics such as the Berks Tax form. To assist in this process, it is crucial to be aware of the dos and don'ts that ensure accuracy and compliance. This guidance aims to streamline your experience and prevent common mistakes.

Do:

- Verify all information: Before submitting, ensure that all details, including the number of W-2 statements or employees listed and the total amount of Earned Income Tax withheld, are correct. Inaccuracies can lead to processing delays or incorrect tax assessments.

- Include all required documents: It's imperative to accompany the form with a W-2 form, or equivalent, for each employee from whom tax was withheld. This ensures a comprehensive reconciliation of Earned Income Taxes.

- Address discrepancies: If there is a difference greater than $1.00 between the subtotal tax reported and the tax paid, provide a clear explanation. This transparency helps in avoiding any misunderstanding or audit by the tax bureau.

- Contact the Berks E.I.T. Bureau for assistance: Should you have any questions or require clarification on filling out the form or on electronic submission instructions, don't hesitate to reach out to the Berks E.I.T. Bureau. Utilizing available resources can prevent errors.

Don't:

- Delay submission: Filing your form past the stipulated deadline can result in penalties. Ensuring timely submission helps in maintaining compliance and avoiding unnecessary fines.

- Omit employee information: Each employee from whom tax was withheld must be accounted for, including their social security number, name, complete address, and the amount of tax withheld. Skipping or partially filling this information might lead to inaccuracies in records.

- Ignore electronic media submission guidelines: If you opt to submit employee listings via electronic media, strictly follow the instructions provided by the Berks E.I.T. Bureau. Failure to comply with their guidelines could lead to rejection of the submission.

- Overlook the declaration statement: The declaration under penalties provided by law requires your attention and honesty. It's crucial to review the tax return thoroughly and ensure its accuracy to the best of your knowledge before signing and dating.

Navigating tax obligations with diligence and care not only aligns with legal requirements but also contributes to the smooth functioning of both the employer’s operations and the tax bureau’s processing. Keeping abreast of these dos and don'ts when filling out the Berks Tax form can significantly ease the submission process, paving the way for a compliant and hassle-free tax season.

Misconceptions

Understanding the Berks Tax form can often be confusing, leading to several misconceptions among employers. Here are seven common misunderstandings and their explanations:

- The form is too complicated.

Though it seems daunting at first glance, the Berks Tax form is straightforward once you understand its sections and what information goes where. Instructions are provided to clarify the required data.

- It’s optional for employers.

All employers are required to complete the reconciliation if they have employees from whom Earned Income Tax was withheld, making it an essential part of tax filing responsibilities.

- Electronic submission isn’t allowed.

Contrary to this belief, employers can submit employee information electronically. The form even provides instructions for electronic media submission, making the process more convenient for those who prefer digital methods.

- W-2s aren’t necessary if you provide a list of employees.

Each employee from whom tax was withheld must have a corresponding W-2 form or equivalent submitted along with the reconciliation, even if a detailed list is provided.

- The form only needs to be filed if there’s a discrepancy.

This form must be filed regardless of whether the Earned Income Tax was withheld correctly or if there are discrepancies. All employers are required to reconcile Earned Income Tax withheld from employees annually.

- All discrepancies are unacceptable.

While accuracy is critical, the instructions specify that differences greater than $1.00 must be defined, implying that minor discrepancies might not necessitate correction.

- Tax reported on Form 511 and Tax paid on Form 501 are typically the same.

Though one might assume these figures should match perfectly, they often don’t. Tax reported is the amount withheld from employees each quarter, while Tax paid reflects the total amount actually remitted to the Berks E.I.T. Bureau. Variances can occur due to several reasons, including administrative errors or adjustments.

Correcting these misunderstandings can simplify the tax filing process, ensuring compliance and reducing errors. The key is to carefully read the instructions provided and reach out for clarification when necessary.

Key takeaways

Filling out the Berks Tax Form 521 is a critical process for employers in adhering to local tax regulations. Here are nine essential takeaways to ensure compliance and accuracy:

- Employers are mandated to reconcile Earned Income Tax (EIT) regardless of whether tax was withheld.

- The reconciliation process requires Employers to report the number of W-2 statements or employees listed, which is indicated on Line 1 of the form.

- Total Earned Income Tax withheld, which needs to be detailed on Line 2, represents the sum declared as local tax withheld on the W-2s.

- Submissions must include a W-2 Form, or an equivalent document, for each employee from whom tax was withheld.

- Employee details such as social security number, name, complete address, and amount of tax withheld should be thoroughly provided if a listing is being submitted.

- The form supports submission via electronic media, offering an alternative for those who prefer digital data transmission. For detailed instructions, contacting the Berks E.I.T. Bureau is recommended.

- The form captures quarterly details of tax withheld and paid, with sections dedicated to tax reported on Form 511 each quarter, and a subtotal that aggregates this information.

- Any discrepancy greater than $1.00 between the total tax withheld and the total tax paid (as reported on Form 501) must be clearly defined.

- Accuracy and honesty are paramount, as the form concludes with a declaration that the information provided is true and complete to the best of the filer’s knowledge, under penalty of law.

Understanding these key takeaways helps ensure that employers properly fulfill their tax reporting obligations, supporting the smooth operations of both the Berks E.I.T. Bureau and the employers themselves. It is crucial to approach this task with diligence and precision to ensure compliance with local tax laws.

Popular PDF Documents

Hawaii Department of Taxation - All payments to be made payable to “HAWAII STATE TAX COLLECTOR.”

IRS 8829 - By using IRS 8829, teleworkers can navigate the complexities of tax deductions related to home office space and resources.