Get Au 11 Tax Form

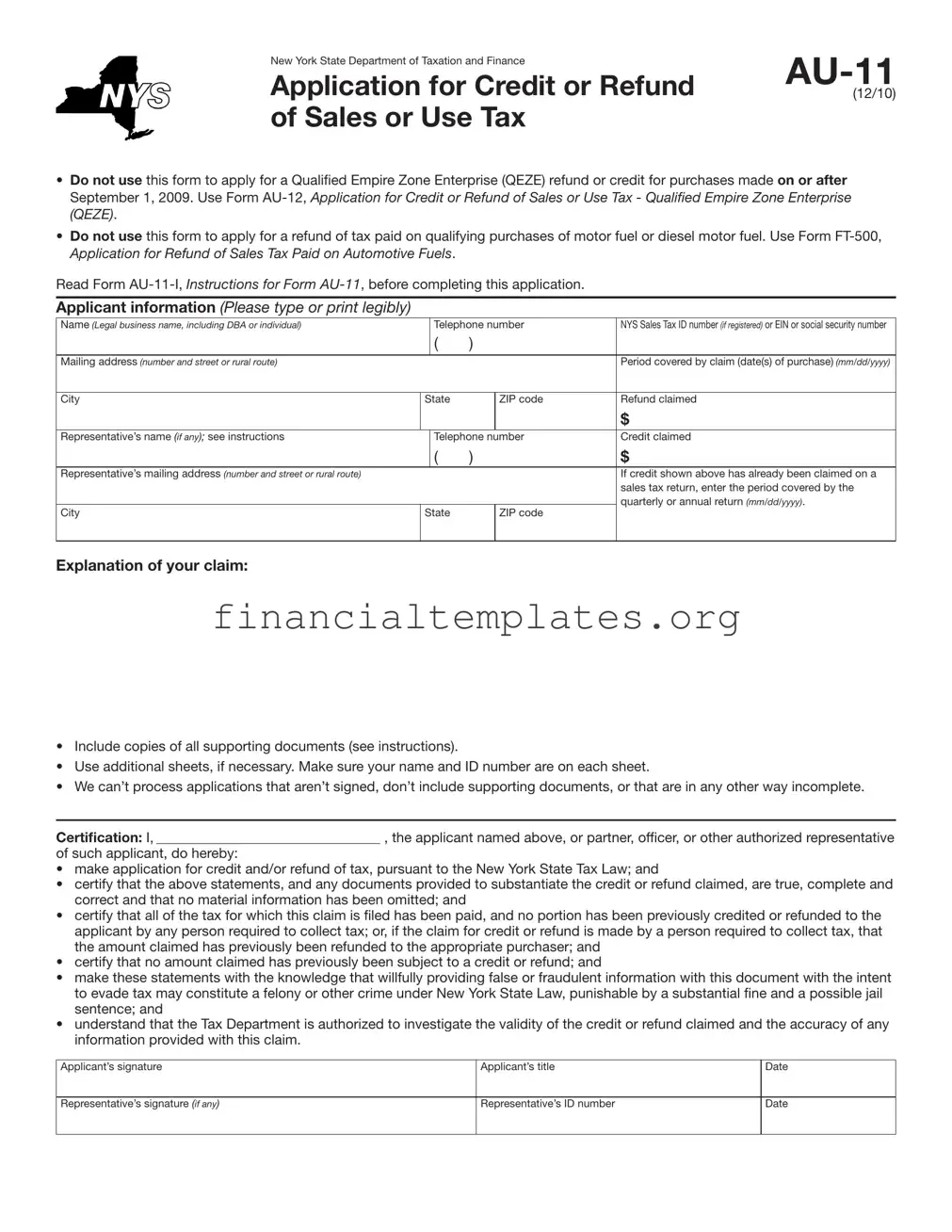

Understanding the intricacies of New York State's tax refund or credit claims can be a challenging endeavor, especially when dealing with the particulars of sales or use tax. Central to navigating this process is the AU-11 Tax Form, officially titled "Application for Credit or Refund of Sales or Use Tax," provided by the New York State Department of Taxation and Finance. This form serves individuals and businesses seeking to apply for a sales or use tax refund or credit. However, it's critical to note that it's not applicable for all types of refunds—for example, refunds or credits related to Qualified Empire Zone Enterprises (QEZE) for purchases made post-September 1, 2009, must use the AU-12 form, and those related to automotive fuels must use the FT-500 form. Applicants must fill out their information accurately, including legal names (for individuals or businesses), contact details, and the pertinent period for the claim. Essential to the application are the instructions under Form AU-11-I, which guide on completing the application effectively, stressing the need for legibility, inclusion of supporting documents, and adherence to submission guidelines. Claims require a careful assembly of evidence and a certification that all statements and documents submitted are truthful and comprehensive. Not adhering to these instructions may result in the ineligibility of the claim. The form embodies a crucial step for taxpayers in New York looking to recoup or credit sales or use taxes, further emphasizing the importance of meticulous record-keeping and an understanding of state tax law prerequisites.

Au 11 Tax Example

New York State Department of Taxation and Finance |

|

|

|

Application for Credit or Refund |

(12/10) |

of Sales or Use Tax |

|

•Do not use this form to apply for a Qualiied Empire Zone Enterprise (QEZE) refund or credit for purchases made on or after September 1, 2009. Use Form

•Do not use this form to apply for a refund of tax paid on qualifying purchases of motor fuel or diesel motor fuel. Use Form

Read Form

Applicant information (Please type or print legibly)

Name (Legal business name, including DBA or individual) |

|

Telephone number |

NYS Sales Tax ID number (if registered) or EIN or social security number |

||

|

|

( |

) |

|

|

|

|

|

|

|

|

Mailing address (number and street or rural route) |

|

|

|

|

Period covered by claim (date(s) of purchase) (mm/dd/yyyy) |

|

|

|

|

|

|

City |

State |

|

ZIP code |

Refund claimed |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Representative’s name (if any); see instructions |

|

Telephone number |

Credit claimed |

||

|

|

( |

) |

|

$ |

Representative’s mailing address (number and street or rural route) |

|

|

|

|

If credit shown above has already been claimed on a |

|

|

|

|

|

sales tax return, enter the period covered by the |

|

|

|

|

|

quarterly or annual return (mm/dd/yyyy). |

City |

State |

|

ZIP code |

|

|

|

|

|

|

|

|

Explanation of your claim:

•Include copies of all supporting documents (see instructions).

•Use additional sheets, if necessary. Make sure your name and ID number are on each sheet.

•We can’t process applications that aren’t signed, don’t include supporting documents, or that are in any other way incomplete.

Certification: I, |

|

, the applicant named above, or partner, oficer, or other authorized representative |

of such applicant, do hereby:

•make application for credit and/or refund of tax, pursuant to the New York State Tax Law; and

•certify that the above statements, and any documents provided to substantiate the credit or refund claimed, are true, complete and correct and that no material information has been omitted; and

•certify that all of the tax for which this claim is iled has been paid, and no portion has been previously credited or refunded to the applicant by any person required to collect tax; or, if the claim for credit or refund is made by a person required to collect tax, that the amount claimed has previously been refunded to the appropriate purchaser; and

•certify that no amount claimed has previously been subject to a credit or refund; and

•make these statements with the knowledge that willfully providing false or fraudulent information with this document with the intent to evade tax may constitute a felony or other crime under New York State Law, punishable by a substantial ine and a possible jail sentence; and

•understand that the Tax Department is authorized to investigate the validity of the credit or refund claimed and the accuracy of any information provided with this claim.

Applicant’s signature |

Applicant’s title |

Date |

|

|

|

Representative’s signature (if any) |

Representative’s ID number |

Date |

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The AU-11 form is used to apply for a credit or refund of New York State sales or use tax. |

| Exclusions | This form should not be used for QEZE refunds or credits for purchases made after September 1, 2009, or for refunds of tax paid on qualifying motor fuel or diesel motor fuel purchases. |

| Required Information | Applicants must provide detailed information including legal business name or individual name, contact information, NYS Sales Tax ID, or EIN/SSN, and the period covered by the claim. |

| Documentation | Supporting documents are required for the application. Incomplete applications, or those without necessary documentation, cannot be processed. |

| Certification | Applicants must certify the tax for which the claim is filed has been paid, that no part of the amount claimed has previously been credited or refunded, and that all information provided is true and correct under penalty of law. |

Guide to Writing Au 11 Tax

Filling out the AU-11 Tax Form is a necessary step for certain individuals or businesses in New York State seeking a credit or refund of sales or use tax. This form is not to be used for QEZE refunds or credits for purchases made on or after September 1, 2009, nor for refunds of taxes paid on qualifying purchases of motor fuel or diesel motor fuel. It is vital to read the AU-11-I instructions before completing this form to ensure accuracy and completeness, as failure to comply with the instructions may result in the rejection of the application.

- Collect all necessary documents: Before starting, gather all supporting documentation related to your claim for credit or refund. This preparation will streamline the process.

- Enter applicant information: Type or print legibly the legal business name (including DBA or individual names), telephone number, NYS Sales Tax ID number (if registered), or EIN or social security number.

- Provide mailing address: Fill in the mailing address, city, state, and ZIP code. Ensure this information is accurate to avoid delays in processing.

- Specify the period covered by claim: Indicate the date(s) of purchase in the format (mm/dd/yyyy) for which you are seeking a refund or credit.

- Determine the refund or credit amount: Enter the dollar amount of the refund or credit being claimed.

- Appoint a representative (optional): If applicable, fill in the representative’s name, telephone number, and mailing address. Ensure you also fill in the period covered by the quarterly or annual return if the credit has already been claimed on a sales tax return.

- Detail the explanation of your claim: Use the space provided to explain your claim. Attach additional sheets if necessary, ensuring that your name and ID number are on each sheet. Include copies of all supporting documents.

- Complete the certification section: The applicant or an authorized representative (such as a partner or officer) must certify the application. Read each certification statement carefully, sign, and date the form.

- Review the form: Before submitting, double-check all entries and attached documents for completeness and accuracy. Missing or incorrect information can lead to delays or denial of the application.

- Submit the form and documents: After completing the form and ensuring all documents are attached, mail your application to the address provided in the instructions. Keep a copy of everything for your records.

Completing the AU-11 Tax Form accurately is crucial for a successful application for a credit or refund. Carefully follow each step and ensure all documentation is correct and complete to avoid any issues with the New York State Department of Taxation and Finance.

Understanding Au 11 Tax

What is the AU-11 Application for Credit or Refund of Sales or Use Tax?

The AU-11 form is a document provided by the New York State Department of Taxation and Finance that individuals or businesses can use to apply for a credit or refund of sales or use tax they have already paid. This form is not to be used for all refund or credit applications. Specifically, it should not be used for refunds related to qualifying purchases made under the Qualiied Empire Zone Enterprise (QEZE) program after September 1, 2009, or for refunds on the purchase of motor fuel or diesel motor fuel.

When should I use Form AU-11 instead of Form AU-12 or Form FT-500?

Use Form AU-11 when applying for a sales or use tax refund that doesn't fall under the QEZE program purchases post-September 1, 2009, or for refunds on automotive fuels. Form AU-12 is specifically for those applying for credits or refunds as a Qualified Empire Zone Enterprise, and Form FT-500 should be used for claims regarding motor fuel or diesel motor fuel taxes.

What information is required on the AU-11 form?

To complete the AU-11 form, you'll need to provide your legal business name (including DBA or personal name), telephone number, New York State Sales Tax ID number (or EIN / social security number if you aren't registered for sales tax), mailing address, the period covered by your claim, and the amount of refund or credit you're claiming. You must also include an explanation of your claim, along with any supporting documents, and certify your statements at the end of the form.

How do I submit supporting documents with my AU-11 form?

When you fill out the AU-11 form, you must include copies of all documents that support your claim for a credit or refund. If you need more space, it's okay to use additional sheets of paper. Just make sure to include your name and ID number on each of these sheets. The form and the supporting documents provide the evidence needed to process your claim.

What happens if the AU-11 form is incomplete or unsigned?

An incomplete or unsigned AU-11 form, or one that lacks the necessary supporting documents, cannot be processed. The New York State Department of Taxation and Finance emphasizes that for applications to be considered, they must be fully completed, signed by the applicant or their authorized representative, and accompanied by all necessary supporting evidence. Ensuring your application is complete and accurate helps avoid delays in the review and processing of your claim.

What are the certifications required on the AU-11 form?

In certifying the AU-11 form, the applicant, or their authorized representative, affirms that all statements and documents provided are true, complete, and correct, with no material information omitted. They also certify that the tax for which the credit or refund is being claimed has been paid in full and that no part of it has been previously credited or refunded. Importantly, the applicant acknowledges that providing false or fraudulent information may constitute a felony under New York State Law, subject to fines and potential jail time. Certification also grants the Tax Department authority to investigate the claim.

Common mistakes

Filling out the AU-11 Tax Form for a claim of credit or refund on sales or use tax in New York can be a detailed process. To streamline this process and avoid common pitfalls, here are four mistakes that people often make when completing this form:

Not Using the Correct Form: Individuals often use the AU-11 form when other specific forms are required for their situation. For instance, the AU-11 form should not be used by Qualified Empire Zone Enterprises (QEZE) for purchases made after September 1, 2009—they must use the AU-12 form. Similarly, claims for refunds of tax paid on qualifying purchases of motor fuel or diesel motor fuel must be made using Form FT-500, not the AU-11.

Omitting Required Information: Failing to provide necessary information such as the New York State Sales Tax ID number, or the EIN/social security number, can lead to processing delays. Equally, leaving out the specific period covered by the claim or not providing detailed explanations and requisite supporting documents renders the application incomplete.

Not Attaching Supporting Documents: A critical step that is often overlooked is the inclusion of all supporting documents that substantiate the claim. The New York State Department of Taxation and Finance requires copies of such documents to process applications. Neglecting to attach these, or to ensure that one's name and ID number are on each additional sheet if used, can result in an unprocessed application.

Signing and Certifying the Claim: Each application must be signed by the applicant or their authorized representative. This signature certifies that all information provided is true, complete, and correct to the best of the signer's knowledge. The application must also affirm that the tax for which a refund or credit is claimed has been paid in full and that the claim has not been previously credited or refunded. Overlooking the certification section may nullify the application.

Addressing these common mistakes when filling out the AU-11 Tax Form is vital for ensuring that your application for credit or refund is processed efficiently by the New York State Department of Taxation and Finance.

Documents used along the form

When dealing with the complex task of handling taxes, especially when applying for credits or refunds with forms like the New York State Department of Taxation and Finance AU-11, other documents often become necessary to complete your submission accurately and thoroughly. These documents complement the AU-11 form by providing additional required information or by offering further clarification regarding the specifics of your claim. Understanding these forms can significantly streamline the process and ensure you meet all necessary criteria for your application.

- Form AU-12: This form, known as the Application for Credit or Refund of Sales or Use Tax - Qualified Empire Zone Enterprise (QEZE), is specifically designed for businesses that qualify under the Empire Zone program for purchases made on or after September 1, 2009. It’s used instead of the AU-11 for those specific entities looking to claim a refund or credit related to sales or use tax, highlighting its specialized nature for businesses within designated zones.

- Form FT-500: This is employed when seeking a refund for taxes paid on automotive fuels, such as motor fuel or diesel. The FT-500, Application for Refund of Sales Tax Paid on Automotive Fuels, caters exclusively to the recovery of taxes paid in this specific area, thus segregating it from broader use cases covered under the AU-11. The form requires detailed information on the fuel purchases and proof of taxes paid to support the refund claim.

- Form AU-11-I: As the Instructions for Form AU-11, this document is crucial for anyone completing the AU-11 form. It provides step-by-step guidance on how to accurately fill out the AU-11, ensuring applicants include all necessary information, adhere to the correct procedures, and attach all relevant supporting documents. It acts as a roadmap to avoid common mistakes and omissions that could delay the processing of a tax credit or refund claim.

- Supporting Documents: While not a form per se, the collection of supporting documents (receipts, invoices, detailed statements) is indispensable alongside the AU-11 form. These documents serve as the foundation of the claim, offering concrete evidence for the purchases made and the taxes paid, which justify the credit or refund being requested. Ensuring these are clear, organized, and directly relevant to the claim cannot be overstated in its importance.

Gathering and correctly filling out these forms, together with preparing all necessary supporting documentation, is vital in navigating the complexities of applying for sales or use tax refunds or credits in New York State. By understanding each document's unique purpose and requirements, individuals and businesses can more effectively manage their tax responsibilities, potentially reclaiming funds that are rightfully theirs. This process, while meticulous, supports the efficient and fair administration of tax laws, benefiting the state and its taxpayers alike.

Similar forms

The AU-12, Application for Credit or Refund of Sales or Use Tax - Qualified Empire Zone Enterprise (QEZE), is closely related to the AU-11 form. Both forms are used in New York State for taxpayers seeking refunds or credits, but they cater to different audiences. The AU-12 specifically targets businesses within qualified Empire Zones, offering them a specialized avenue for tax relief tied to their geographical and economic situation, demonstrating a focused support mechanism for businesses in designated areas.

Form FT-500, Application for Refund of Sales Tax Paid on Automotive Fuels, shares a common purpose with the AU-11 form, as both are designed to facilitate tax refunds. However, the FT-500 is exclusively used for claims related to automotive fuels, highlighting the diverse range of tax relief applications available and showcasing the specific routes taxpayers must take depending on the nature of their purchases.

The IRS Form 1040, U.S. Individual Income Tax Return, while serving a different tier of taxation – income tax versus sales/use tax – parallels the AU-11 in its foundational aim of reporting and adjusting tax obligations. Both forms are critical in ensuring individuals or entities accurately report their financial activities, though they operate within different scopes of tax law.

Form 941, Employer’s Quarterly Federal Tax Return, is an IRS form that, like the AU-11, involves periodic financial reporting and potential adjustments to tax liabilities, but it focuses on payroll taxes. It showcases the broader spectrum of tax responsibilities businesses face and the varied methods through which these obligations are managed and rectified.

The Schedule C (Form 1040), Profit or Loss from Business, is another IRS form that parallels the AU-11 in function, designed for self-employed individuals to report income or loss from a business. Both forms play a vital role in the overall tax reporting landscape, allowing for accurate financial reflection and adjustments to tax liabilities based on business activities.

Form W-2, Wage and Tax Statement, though primarily a document furnished by employers to employees, shares a conceptual link with the AU-11 in the realm of tax reporting and documentation. It underlines the necessity of detailed financial records in managing and substantiating tax-related claims across different categories of tax administration.

Form IT-201, Resident Income Tax Return for New York State residents, and the AU-11 share the broader objective of reconciling tax liabilities with actual activities, albeit in different tax realms. The IT-201 caters to personal income taxes, emphasizing the universal principle of accurate tax reporting and adjustment mechanisms.

Form CU-7, Sales and Use Tax Return, commonly used in other jurisdictions for reporting collected sales tax, parallels the intentions behind the AU-11. While the CU-7 is more about reporting and remitting taxes collected from consumers, it aligns with the AU-11's purpose of ensuring accurate tax treatment and facilitating adjustments if necessary.

The Form 2290, Heavy Highway Vehicle Use Tax Return, is a federal form tailored to a specific tax duty, much like the AU-11 form's targeted approach to sales and use tax issues. Both forms address niche areas of tax law, illustrating the tailored approaches required for different tax responsibilities.

Lastly, the Application for Extension of Time to File (various forms across different jurisdictions and tax types) compares to the AU-11 by offering taxpayers mechanisms to adjust their engagements with tax authorities. Whether seeking an extension to file or adjust tax liabilities, these forms collectively highlight the flexibility and responsiveness of tax systems to individual and business circumstances.

Dos and Don'ts

When filling out the AU-11 Tax Form for a credit or refund of Sales or Use Tax, it's important to follow some key do's and don'ts to ensure the process goes smoothly. Below are essential tips to help you complete the form correctly.

Do's:

- Read Form AU-11-I, Instructions for Form AU-11, thoroughly before starting your application. This will help you understand the requirements and avoid common mistakes.

- Type or print legibly in the applicant information section to avoid any confusion or delays in processing your application.

- Include copies of all supporting documents as required by the instructions, using additional sheets if necessary. Ensure your name and ID number are on each sheet to keep your information organized.

- Sign the application form. An unsigned form cannot be processed, making this a crucial final step.

Don'ts:

- Do not use this form to apply for a Qualified Empire Zone Enterprise (QEZE) refund or credit for purchases made on or after September 1, 2009. Instead, use Form AU-12 for such requests.

- Do not use this form to apply for a refund of tax paid on qualifying purchases of motor fuel or diesel motor fuel. For those purposes, Form FT-500 is the appropriate document.

- Do not attempt to submit the application without including all supporting documents needed to substantiate your claim. Incomplete applications cannot be processed.

- Do not leave out any material information or provide false or fraudulent information. Doing so may constitute a felony or other crime under New York State Law, punishable by a fine and possible jail sentence.

Misconceptions

When it comes to navigating the complexities of tax forms, there is often a lot of confusion about what forms to use, when to use them, and the many requirements that come with them. The New York State Department of Taxation and Finance's AU-11 form is no exception. Let's address and debunk eight common misconceptions about the AU-11 Application for Credit or Refund of Sales or Use Tax.

- AU-11 is for all tax refund claims: This form is specifically for requesting a credit or refund of sales or use tax. It's not suitable for all types of tax refund or credit applications, such as Qualified Empire Zone Enterprise (QEZE) refunds or credits for purchases made after September 1, 2009, for which you should use Form AU-12.

- Anyone can file AU-11: This form is designated for individuals or businesses that have made qualifying purchases leading to overpaid sales or use taxes. It's crucial that the applicant has a direct relationship with the tax paid to be eligible for a refund or credit. Therefore, not just "anyone" can file it.

- Form AU-11 can be used for fuel purchase refunds: Contrary to this belief, for refunds of tax paid on qualifying purchases of motor fuel or diesel motor fuel, Form FT-500 should be used instead. The AU-11 form does not cater to automotive fuel tax refunds.

- No supporting documents are needed: This is a critical mistake. The form clearly requires that copies of all supporting documents be included with the application. Lack of proper documentation can lead to the rejection of the claim.

- Applications can be submitted without a signature: Every AU-11 application must be signed by the applicant or an authorized representative. The signature certifies the truthfulness and accuracy of the information provided, including the claim for credit or refund. Unsigned applications are considered incomplete and will not be processed.

- Credits or refunds can be claimed multiple times for the same tax paid: You can only claim a credit or refund once for the same tax payment. The certification section of the form requires applicants to affirm that the tax for which they are filing has not been previously credited or refunded.

- There’s no need to specify if the credit has already been claimed on a tax return: If credit for the tax in question has already been claimed on a sales tax return, it is mandatory to mention the period covered by that return. This information is critical to avoid duplicate credit or refund claims.

- The Tax Department won’t verify the information: The certification section clearly states that the Tax Department is authorized to investigate the validity of the credit or refund claimed. Applicants should provide accurate information and be prepared for possible verification checks.

Understanding and correctly applying the guidelines of the AU-11 form can significantly streamline the process of claiming a sales or use tax credit or refund. It's always advisable to read the instructions carefully and ensure that all sections of the form are accurately completed and accompanied by the necessary documentation to support your claim.

Key takeaways

When navigating the complexities of the New York State Department of Taxation and Finance AU-11 Application for Credit or Refund of Sales or Use Tax, there are several key points to keep in mind. This form serves as a vital tool for individuals and businesses looking to claim a credit or refund for sales or use tax. To ensure a smooth process and optimize the chances of your application being approved, consider the following guidelines:

- Appropriate Use of Form AU-11: It’s crucial to understand that the AU-11 form is not applicable for all tax refund or credit scenarios. Specifically, it should not be used for refunds related to Qualified Empire Zone Enterprise (QEZE) purchases post-September 1, 2009—Form AU-12 is designated for that purpose. Similarly, claims for refunds on motor fuel or diesel motor fuel taxes fall under Form FT-500. Ensuring you're working with the correct form from the start can save considerable time and effort.

- Preparation Is Key: Before diving into the form, it's advisable to thoroughly review the AU-11-I instructions. These guidelines provide invaluable insights into the application process, helping you avoid common pitfalls and omissions that could delay your claim.

- Legibility Matters: Whether you’re typing or hand-printing the information, clarity is paramount. Incomplete or illegible applications are prone to rejections or extended processing times.

- Personal and Business Information: Provide accurate and complete information regarding the applicant. This includes the legal name, whether it’s a business (including DBA) or an individual, and relevant identification numbers (NYS Sales Tax ID, EIN, or Social Security Number).

- Period of Claim: Clearly indicate the specific dates of the purchases you’re claiming for. Accurate dates are essential for a valid application.

- Claim Details: Remember to specify whether you’re applying for a refund, a credit, or both. If a credit was previously claimed on a sales tax return, ensure the period covered is correctly documented.

- Documentation Is Crucial: Applications must be accompanied by robust supporting documentation. This includes copies of receipts, invoices, and any other relevant records. Failure to include these documents can result in the denial of your claim.

- Additional Information: If your claim's explanation exceeds the provided space, you're allowed to attach additional sheets. However, every added page must include your name and ID number for reference.

- Accuracy and Honesty: The certification statement underscores the importance of submitting truthful and complete information. Falsifying information not only undermines your claim but could also lead to legal repercussions.

- Authorization and Signatures: Applications require the applicant's signature, confirming the accuracy of the information provided and agreement with the terms. If a representative is acting on your behalf, their information and signature are also necessary.

- Understanding the Review Process: The New York State Tax Department reserves the right to thoroughly review your claim. This includes the validation of the credit or refund requested and the examination of any submitted documentation. Awareness of this process can help set realistic expectations regarding the time frame for resolution.

Filing the AU-11 form can be a straightforward process when approached with diligence and attention to detail. By adhering to the guidelines provided, applicants can navigate their tax refund or credit claims efficiently, minimizing the chances of delays or rejections.

Popular PDF Documents

IRS W-8BEN-E - The W-8BEN-E form is regularly updated by the IRS, so it’s important to use the most current version when certifying foreign status.

IRS 1065 - Form 1065’s comprehensive nature ensures that all financial aspects of a partnership are accounted for during tax season.

Kentucky Composite Return - This authorization can be tailored to specific tax years or types of tax, according to the taxpayer's needs.