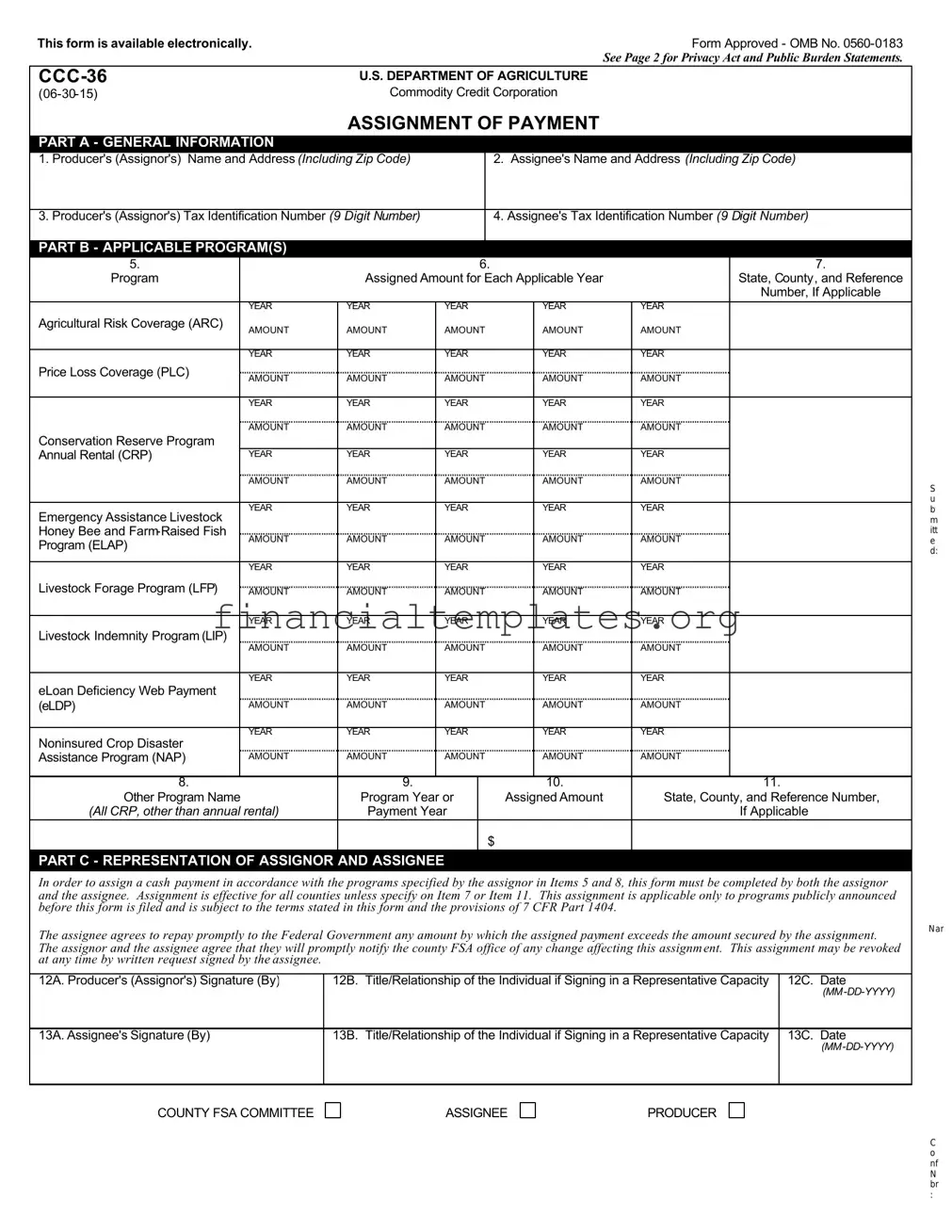

Get Assignment Of Payment Form

Understanding the Assignment of Payment form, a crucial document approved by the U.S. Department of Agriculture (USDA) under OMB No. 0560-0183, is essential for producers and assignees engaging with Commodity Credit Corporation (CCC) programs. This form, usable across various agricultural programs such as the Agricultural Risk Coverage (ARC), Price Loss Coverage (PLC), and the Conservation Reserve Program (CRP), among others, facilitates the transfer of payment rights from the original recipient (assignor) to a designated third party (assignee). Key components include general information detailing the names and tax identification numbers of both parties, specific programs and amounts assigned, and a comprehensive representation section ensuring both parties adhere to outlined agreements and notify the county FSA office of any changes. The stipulations for revocation highlight the possibility of altering the assignment under agreed conditions. The form also outlines provisions relating to assignments, including the handling of multiple assignees and the precedence of payment application, emphasizing its purpose in enabling smooth financial transactions within agricultural programs while maintaining accountability and compliance with federal regulations. Additionally, it underscores the USDA's commitment to preventing discrimination and ensuring equal opportunity, reflecting broader government policies on inclusivity and fairness in program administration.

Assignment Of Payment Example

This form is available electronically. |

|

|

|

|

|

|

|

|

Form Approved - OMB No. |

||||

|

|

|

|

|

|

|

|

|

|

|

See Page 2 for Privacy Act and Public Burden Statements. |

||

|

|

U.S. DEPARTMENT OF AGRICULTURE |

|

|

|

||||||||

|

|

Commodity Credit Corporation |

|

|

|

||||||||

|

|

|

|

ASSIGNMENT OF PAYMENT |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART A - GENERAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

||

|

1. Producer's (Assignor's) Name and Address (Including Zip Code) |

|

|

|

2. Assignee's Name and Address (Including Zip Code) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

3. Producer's (Assignor's) Tax Identification Number (9 Digit Number) |

|

|

|

4. Assignee's Tax Identification Number (9 Digit Number) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART B - APPLICABLE PROGRAM(S) |

|

|

|

|

|

|

|

|

|

|

||

5. |

|

|

|

|

6. |

|

|

|

|

7. |

|||

|

Program |

|

|

Assigned Amount for Each Applicable Year |

|

|

State, County, and Reference |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Number, If Applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

YEAR |

|

YEAR |

|

YEAR |

|

YEAR |

|

||

|

Agricultural Risk Coverage (ARC) |

|

AMOUNT |

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

YEAR |

|

YEAR |

|

YEAR |

|

YEAR |

|

||

|

Price Loss Coverage (PLC) |

|

AMOUNT |

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

YEAR |

|

YEAR |

|

YEAR |

|

YEAR |

|

||

|

|

|

AMOUNT |

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

||

|

Conservation Reserve Program |

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Rental (CRP) |

|

YEAR |

YEAR |

|

YEAR |

|

YEAR |

|

YEAR |

|

||

|

|

|

AMOUNT |

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emergency Assistance Livestock |

|

YEAR |

YEAR |

|

YEAR |

|

YEAR |

|

YEAR |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Honey Bee and |

|

AMOUNT |

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

||

|

Program (ELAP) |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

YEAR |

|

YEAR |

|

YEAR |

|

YEAR |

|

||

|

Livestock Forage Program (LFP) |

|

AMOUNT |

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

YEAR |

|

YEAR |

|

YEAR |

|

YEAR |

|

||

|

Livestock Indemnity Program (LIP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMOUNT |

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

YEAR |

|

YEAR |

|

YEAR |

|

YEAR |

|

||

|

eLoan Deficiency Web Payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

(eLDP) |

|

AMOUNT |

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

YEAR |

|

YEAR |

|

YEAR |

|

YEAR |

|

||

|

Noninsured Crop Disaster |

|

|

|

|

|

|

|

|

|

|

|

|

|

Assistance Program (NAP) |

|

AMOUNT |

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

AMOUNT |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

9. |

|

|

|

|

|

10. |

|

|

11. |

|

|

Other Program Name |

|

Program Year or |

|

Assigned Amount |

|

State, County, and Reference Number, |

||||||

|

(All CRP, other than annual rental) |

Payment Year |

|

|

|

|

|

If Applicable |

|||||

|

|

|

|

|

|

|

$ |

|

|

|

|

||

|

PART C - REPRESENTATION OF ASSIGNOR AND ASSIGNEE |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In order to assign a cash payment in accordance with the programs specified by the assignor in Items 5 and 8, this form must be completed by both the assignor and the assignee. Assignment is effective for all counties unless specify on Item 7 or Item 11. This assignment is applicable only to programs publicly announced before this form is filed and is subject to the terms stated in this form and the provisions of 7 CFR Part 1404.

The assignee agrees to repay promptly to the Federal Government any amount by which the assigned payment exceeds the amount secured by the assignment. The assignor and the assignee agree that they will promptly notify the county FSA office of any change affecting this assignment. This assignment may be revoked at any time by written request signed by the assignee.

12A. Producer's (Assignor's) Signature (By) |

12B. |

Title/Relationship of the Individual if Signing in a Representative Capacity |

12C. |

Date |

|

|

|

|

|

|

|

|

|

|

13A. Assignee's Signature (By) |

13B. |

Title/Relationship of the Individual if Signing in a Representative Capacity |

13C. |

Date |

|

|

|

|

|

|

|

|

|

|

S u b m itt e d:

Name

COUNTY FSA COMMITTEE

ASSIGNEE

PRODUCER

C o nf

N br

:

|

|

|

|

Page 2 of 2 |

|

|

PART D - REVOCATION OF ASSIGNMENT |

|

|

|

|

|

|

|

|

|

|

|

Assignment of payment authorization above is hereby revoked. |

|

|

||

|

14A. Assignee's Signature (By) |

14B. Title/Relationship of the Individual if Signing in a Representative Capacity |

14C. Date |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR COUNTY OFFICE USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

15. Receiving State and County |

|

16. Date Filed |

17. |

Time Filed |

|

|

|

|

|

|

SPECIAL PROVISIONS RELATING TO ASSIGNMENTS

A.Assignment is effective for all counties unless a specific county is entered in Item 7 or Item 11.

B.If the assignor assigns a specified value of payments to more than one assignee:

1.CCC and FSA will recognize assignments for each program per program year or group of years if

2.Assignments will be honored in chronological sequence based on the order of filing with the county FSA office.

C.The payment due the producer may be applied first against indebtedness owing by the producer to the United States, including debts arising after the execution of a Form

D.Neither the United States of America, the Commodity Credit Corporation, the Secretary of Agriculture, any disbursing officer, nor any other Government employee or official shall be subject to any suit or liable for payment of any amount if payment is inadvertently made to the assignor without regard to this assignment.

E.This assignment does not extend to any successor of the assignee, nor may the assignee

F.The assignee’s payment is subject to offset for any delinquent Federal debt owed by the assignee.

18A. COUNTY FSA OFFICE NAME AND ADDRESS (Including Zip Code)

18B. TELEPHONE NO. (Including area code):

NOTE: The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a – as amended). The authority for requesting the information identified on this form is 7 CFR Part 1404, the Commodity Credit Corporation Charter Act (15 U.S.C. 714 et seq.), and the Agricultural Act of 2014 (Pub. L.

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

COUNTY FSA OFFICE.

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers, employees, and applicants for employment on the basis of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited basis will apply to all programs and/or employment activities.) Persons with disabilities, who wish to file a program complaint, write to the address below or if you require alternative means of communication for program information (e.g., Braille, large print, audiotape, etc.) please contact USDA’s TARGET Center at (202)

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866)

S u b m itt e d:

Name

C o nf

N br

:

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Identification | CCC-36 U.S. Department of Agriculture Commodity Credit Corporation Assignment of Payment |

| Application Process | Both assignor and assignee must complete the form for the assignment of specified program payments. |

| Governing Law | Governed by 7 CFR Part 1404 and subject to the Commodity Credit Corporation Charter Act and the Agricultural Act of 2014. |

| Revocation | This assignment can be revoked at any time with a written request signed by the assignee. |

| Special Provisions and Restrictions | The assignment does not extend to any successor of the assignee, nor may the assignee re-assign this assignment. Assigned payments first apply against any indebtedness the producer owes to the U.S., and the assignee’s payment is subject to offset for any delinquent Federal debt. |

Guide to Writing Assignment Of Payment

After gathering all the required information, you are ready to fill out the Assignment of Payment form, CCC-36. This form facilitates the assignment of payment from the producer (assignor) to another party (assignee). It is crucial for transferring payment under specified agricultural programs. Carefully read and provide accurate information to ensure the process is completed without delays. Below are the step-by-step instructions for completing this form.

- General Information

- Enter the Producer's (Assignor's) Name and Address, including the zip code.

- Provide the Assignee's Name and Address, also including the zip code.

- Fill in the Producer's (Assignor's) Tax Identification Number, a 9-digit number.

- Insert the Assignee's Tax Identification Number, another 9-digit number.

- Applicable Program(s)

- Under the sections of applicable programs such as ARC, PLC, CRP, etc., specify the program assigned, amount for each applicable year, and state, county, and reference number if applicable.

- For other programs not listed, provide the Other Program Name, Program Year or Assigned Amount, and state, county, and reference number.

- Representation of Assignor and Assignee

- Ensure both the assignor and the assignee read the statement which clarifies that this form is for the assignment of cash payments under the specified programs.

- Both the assignor and assignee must agree to notify the county FSA office of any change affecting this assignment.

- Indicate that the assignment is effective for all counties unless a specific county is mentioned on Item 7 or Item 11.

- Signature and Dates

- The assignor must sign and date in the relevant sections (12A and 12C), and if applicable, provide the title/relationship if signing in a representative capacity (12B).

- Similarly, the assignee must sign and date in the indicated areas (13A and 13C), providing the title/relationship if necessary (13B).

- If revoking an assignment, the assignee must fill out Part D, including signature, title/relationship, and date (14A, 14B, and 14C).

- For County Office Use Only

- This section is reserved for the county office and includes the receiving state and county, date filed, and time filed.

After completing the form, return it to your county FSA office. The office personnel will process your form according to the instructions and guidelines provided by the USDA. Keeping a copy of the completed form for your records is advisable.

Understanding Assignment Of Payment

What is an Assignment of Payment form used for?

An Assignment of Payment form, specifically the CCC-36 form issued by the U.S. Department of Agriculture (USDA), is used by producers, referred to as assignors, to assign payments from various USDA programs to another party, known as the assignee. These payments can be related to a variety of programs such as the Agricultural Risk Coverage (ARC), Price Loss Coverage (PLC), Conservation Reserve Program (CRP), and others. The form requires detailed information about both the assignor and the assignee, including their tax identification numbers and addresses. Once effectively completed and filed, the specified payments are directed to the assignee instead of the assignor.

Who can be an assignee on the Assignment of Payment form?

An assignee can be any individual or entity that the producer (assignor) chooses to receive the payment from the applicable USDA programs. This decision might be based on a variety of financial arrangements, such as loans, services, or goods provided to the assignor by the assignee. It’s crucial that the assignee's name and address, including their tax identification number, are properly filled out on the form. Both parties must agree on the assignment and adhere to the specified terms, including repaying any excess payments to the Federal Government.

Can an assignment be revoked or changed once it's filed?

Yes, an assignment can be revoked at any time through a written request signed by the assignee. This allows for flexibility in financial arrangements between the producer and the assignee. However, any changes affecting the assignment must be promptly reported to the county FSA office by both the assignor and the assignee. Once the revocation of the assignment is processed, future payments will no longer be directed to the originally designated assignee.

Are there any conditions or limitations to assigning payments?

The assignment of payments is subject to several conditions and limitations. The form itself specifies that the assignment is only applicable to programs that were publicly announced before the form was filed. Moreover, the payment can first be applied against any indebtedness the producer owes to the United States before being subject to assignment. The assignment does not extend to any successors of the assignee and cannot be re-assigned. Additionally, the assignee’s payment may be offset for any delinquent Federal debt owed by the assignee.

What is required to complete the Assignment of Payment form?

To complete the form, detailed information must be provided for both the assignor and assignee, including names, addresses, and tax identification numbers. The specific programs and amounts to be assigned must be clearly indicated. Both parties must sign the form, and if signing in a representative capacity, the title or relationship of the individual to the assignor or assignee must be noted. The process is finalized when the form is filed with the county FSA office. Providing accurate and complete information is not only necessary for the form’s acceptance but also to ensure that the assignment of payment is processed smoothly and effectively.

Common mistakes

When filling out the Assignment of Payment form, especially for the U.S. Department of Agriculture (USDA) programs, people often make mistakes that can potentially delay or hinder the processing of their forms. Below are common errors that should be avoided to ensure the assignment process is completed accurately and efficiently.

-

Not providing complete Producer's (Assignor's) Name and Address, including Zip Code, can lead to processing delays. It’s essential to include all details to ensure the form is correctly linked to the producer.

-

Entering incorrect or incomplete Tax Identification Numbers for both the assignor and assignee. These 9-digit numbers are critical for identifying the parties involved in the transaction.

-

Omitting details in the Applicable Program(s) section, such as the specific program assigned, amount for each applicable year, and the state, county, and reference number if applicable. Each program has unique requirements and benefits, making accurate identification vital.

-

Failure to specify the county when the assignment is effective for specific counties only. This information must be clearly stated in Items 7 or 11 to avoid any misunderstanding.

-

Incorrectly signing the form or signing in the wrong capacity can invalidate the document. Ensure that both the assignor and assignee sign accurately according to their roles, including the correct date.

-

Not updating the FSA office of any changes affecting the assignment. It’s the responsibility of both the assignor and assignee to promptly notify their county FSA office of any changes to keep the assignment relevant and accurate.

-

Neglecting the revocation section when intending to revoke the assignment. If circumstances change and the assignment needs to be revoked, the form provides a specific section that must be completed correctly to ensure the revocation is recognized.

-

Overlooking the special provisions and conditions stated on the form can lead to misunderstanding and misuse of the form. These provisions outline the terms under which the assignment operates and specify scenarios such as the priority of multiple assignments and the effect of federal debt on payments.

By paying attention to these details and ensuring all information is accurate and complete, applicants can avoid common pitfalls that may complicate or delay the assignment process.

Documents used along the form

When handling the Assignment of Payment form, in the context of agricultural or farm-related financial transactions, there are several other key documents and forms that often accompany it. These documents ensure a smooth transaction process, compliance with legal requirements, and clear communication between parties involved.

- W-9 Form - Request for Taxpayer Identification Number and Certification: This form is crucial for verifying the tax identification number of the assignee. It helps in ensuring that all tax-related matters are handled appropriately, especially when payments are assigned from one party to another.

- Form CCC-36 - Continuation Sheet for Assignment of Payment: This additional form is used when more space is needed to list the programs or details for the assignment of payment. It serves as an extension of the primary Assignment of Payment form, providing extra space for comprehensive program information or multiple assignments.

- Privacy Act Statement: Although not a form, this document is often provided to inform the assignor and assignee about the use of their personal information. It outlines how the information collected on the Assignment of Payment form will be used, stored, and protected, in compliance with the Privacy Act of 1974.

- Direct Deposit Form: To facilitate the electronic transfer of payments, a Direct Deposit form may be required. This form collects banking information to enable the U.S. Department of Agriculture or related agencies to deposit payments directly into the assignee's bank account, expediting the payment process.

Together, these documents play a vital role in administering and processing the assignment of payments within agricultural programs. They ensure that all parties have a clear understanding of their responsibilities and that the assignment is carried out in a legally compliant and efficient manner.

Similar forms

The Bill of Sale document holds a resemblance to the Assignment of Payment form in that both outline the transfer of rights or property from one party to another. Specifically, a Bill of Sale is used to confirm the transfer of ownership of tangible items, similar to how the Assignment of Payment form facilitates the transfer of the right to receive payment under certain agricultural programs. Both documents serve as legal proof of the transaction and outline the details of the parties involved, the item or rights being transferred, and any other conditions applicable to the agreement.

The Lien Release form shares similarities with the Assignment of Payment form by dealing with rights over certain assets. In a Lien Release, the holder of a claim or encumbrance on property agrees to relinquish those rights, often after a debt has been repaid. Similarly, the Assignment of Payment form involves the transfer of rights to receive payment, essentially allowing the assignee to step into the shoes of the original party. Both documents involve modifications to the rights associated with property or payments, affecting how these can be claimed in the future.

The Power of Attorney document is akin to the Assignment of Payment form as it involves granting another person the authority to act on one's behalf. While a Power of Attorney can cover a broad range of actions, the Assignment of Payment is more specialized, focusing solely on the right to receive payment under specified conditions. Nevertheless, both documents enable one party to make decisions or perform actions that affect the rights or assets of another, based on the terms laid out within the legal form.

Contract Assignments resemble the Assignment of Payment form in their focus on transferring obligations or benefits from one party to another. With a Contract Assignment, obligations, benefits, and rights under a contract are transferred from the assignor to the assignee, similarly to how payment rights under specific agricultural programs are transferred with the CCC-36 form. These documents ensure that the newly entitled party is recognized legally for purposes such as receiving benefits or fulfilling obligations outlined in the original agreement.

The Quitclaim Deed, while typically associated with real estate, also mirrors the Assignment of Payment in the aspect of transferring rights without a warranty. Just as a Quitclaim Deed conveys a person's interest or title in property to another without guaranteeing the validity of that interest, the Assignment of Payment form transfers the right to receive payments without guaranteeing the amount that will be paid out. Both documents change the ownership or rights to assets under specific conditions.

The Mortgage Assignment is another document similar to the Assignment of Payment form, used when an original lender transfers the mortgage to another lender. This process is akin to how payment rights from agricultural programs are transferred from a producer to another party through the Assignment of Payment form. Both types of assignments ensure that the new party receives the rights initially held by the original owner under the terms agreed upon.

The Promissory Note resembles the Assignment of Payment form in terms of specifying a financial arrangement between parties. A Promissory Note is a commitment by one party to pay a certain amount to another, akin to the assignment which details the right to receive certain payments. Although the contexts differ, both documents formalize agreements related to the transfer or receipt of money according to predefined conditions.

The Deed of Trust shares common ground with the Assignment of Payment form by involving rights or claims on assets. In a Deed of Trust, a borrower transfers the legal title of a property to a trustee as security for a loan, which reflects the concept of assigning rights or benefits for securing interests. Both documents facilitate the handling of assets or rights under particular agreements, serving as protection for the parties involved.

Lastly, the novation agreement parallels the Assignment of Payment form, as both involve the alteration of original agreements by substituting a new party. In novation, all parties must agree to replace the original contract with a new one, where the Assignment of Payment specifically deals with transferring the right to receive payment to a new entity. Though their applications differ, both processes require consent from relevant parties to modify the terms of an initial agreement.

Dos and Don'ts

When filling out the Assignment of Payment form, here are some key points to consider:

- Ensure all provided information is accurate and complete to prevent delays or issues with the assignment process.

- Review the form for any program-specific requirements that need to be met for the assignment to be valid.

- Include both the assignor’s and the assignee’s Tax Identification Numbers, as they are crucial for processing the form.

- Sign and date the form as required to authenticate the assignment agreement between the assignor and assignee.

- Notify the county FSA office promptly of any changes affecting the assignment to maintain its validity.

Avoid the following when completing the form:

- Leaving sections of the form blank. Incomplete forms may result in rejection or unnecessary delays.

- Submitting the form without reviewing the special provisions and understanding the implications of the assignment.

- Attempting to extend the assignment to successors of the assignee or re-assigning the assignment, as this is not permitted.

- Ignoring the requirement to repay to the Federal Government any amount by which the assigned payment exceeds the amount secured by the assignment.

- Forgetting to update the county FSA office with any changes that could affect the assignment, as lack of communication can lead to complications.

Misconceptions

When it comes to the Assignment of Payment form, particularly the CCC-36 used by the U.S. Department of Agriculture (USDA), several misconceptions can lead to confusion. Let's clear up some of these misunderstandings to ensure everyone is on the same page.

Electronic Availability: Many people assume that all government forms must be submitted in hard copy. However, the Assignment of Payment form is available electronically, making the process more convenient for both assignors and assignees.

Approved Programs Only: There's a misconception that the form can be used to assign payments for any USDA program. In reality, assignments are only applicable to the programs publicly announced before the form is filed, as stated within the form's guidelines.

Repayment Responsibility: Some might mistakenly believe that once assigned, all payment responsibilities are transferred to the assignee. It's important to note that the assignee agrees to repay promptly to the Federal Government any amount by which the assigned payment exceeds the amount secured by the assignment, highlighting the importance of accurate assignments.

Assignment Revocation: Another common misconception is that once an assignment is made, it cannot be revoked. The form clearly allows for revocation at any time by written request signed by the assignee, offering flexibility to both parties involved.

Applicability Across Counties: It's incorrectly assumed that an assignment is only effective in the county where it's filed. Unless specified, the assignment is effective for all counties, broadening the scope of applicability.

Extension and Re-assignment: Some might believe that the assignment extends to successors of the assignee or that the assignee can re-assign the payment. This assignment does not extend to any successor of the assignee, nor may the assignee re-assign it, ensuring control and preventing complications.

Information Disclosure: There's a general concern regarding the confidentiality of information provided on the form. While it's true that the information collected may be disclosed to authorized entities, these disclosures are strictly governed and protected under the Privacy Act of 1974, ensuring the privacy of individuals' information.

Understanding these aspects of the Assignment of Payment form can streamline the process for all parties involved, ensuring clarity and efficiency in the assignment of payments under USDA programs.

Key takeaways

When filling out and using the Assignment Of Payment form, it's important to navigate the process correctly to ensure the assignment is carried out efficiently and legally. Here are key takeaways to guide individuals through this process:

- Ensure the form is completed electronically for efficiency, as this mode is available and preferred.

- Double-check that the form has a valid OMB Number (0560-0183) to confirm its authenticity and approval for use.

- Include accurate general information for both the assignor (producer) and assignee, such as names, addresses (with Zip Codes), and the tax identification numbers which are essential for processing.

- Clearly specify the applicable programs from which payments are being assigned, including the Agricultural Risk Coverage (ARC), Price Loss Coverage (PLC), Conservation Reserve Program (CRP), and others, along with the assigned amount for each applicable year.

- Understand that this form facilitates the assignment of cash payments as specified by the assignor, across various agricultural programs publicly announced before the form's filing.

- Be aware that the assignment is effective for all counties unless a specific county is indicated in the designated areas on the form.

- The assignee is responsible for repaying any amount to the Federal Government that exceeds the assigned payment amount.

- Both the assignor and assignee must agree to notify the county FSA office promptly of any changes affecting the assignment.

- Keep in mind that the assignment can be revoked at any time by the assignee through a written request that needs to be signed.

- Note that the assignee’s payment is subject to offset for any delinquent Federal debt owed by the assignee.

- Remember to return the completed form to the county FSA office to ensure the assignment is processed in a timely manner.

These guidelines highlight the importance of accuracy, responsibility, and timeliness when dealing with the Assignment Of Payment form to ensure a smooth transaction process for both the assignor and the assignee within the agricultural sector. Compliance with these takeaways can facilitate a successful assignment of payments under the specified programs.

Popular PDF Documents

IRS 6251 - The form takes into account various adjustments, preferences, and items not typically taxed under ordinary income.

I Received a 1042-s What Do I Do - In some cases, it applies to certain gambling winnings earned by nonresidents.