Get Asb Bank Automatic Payment Form

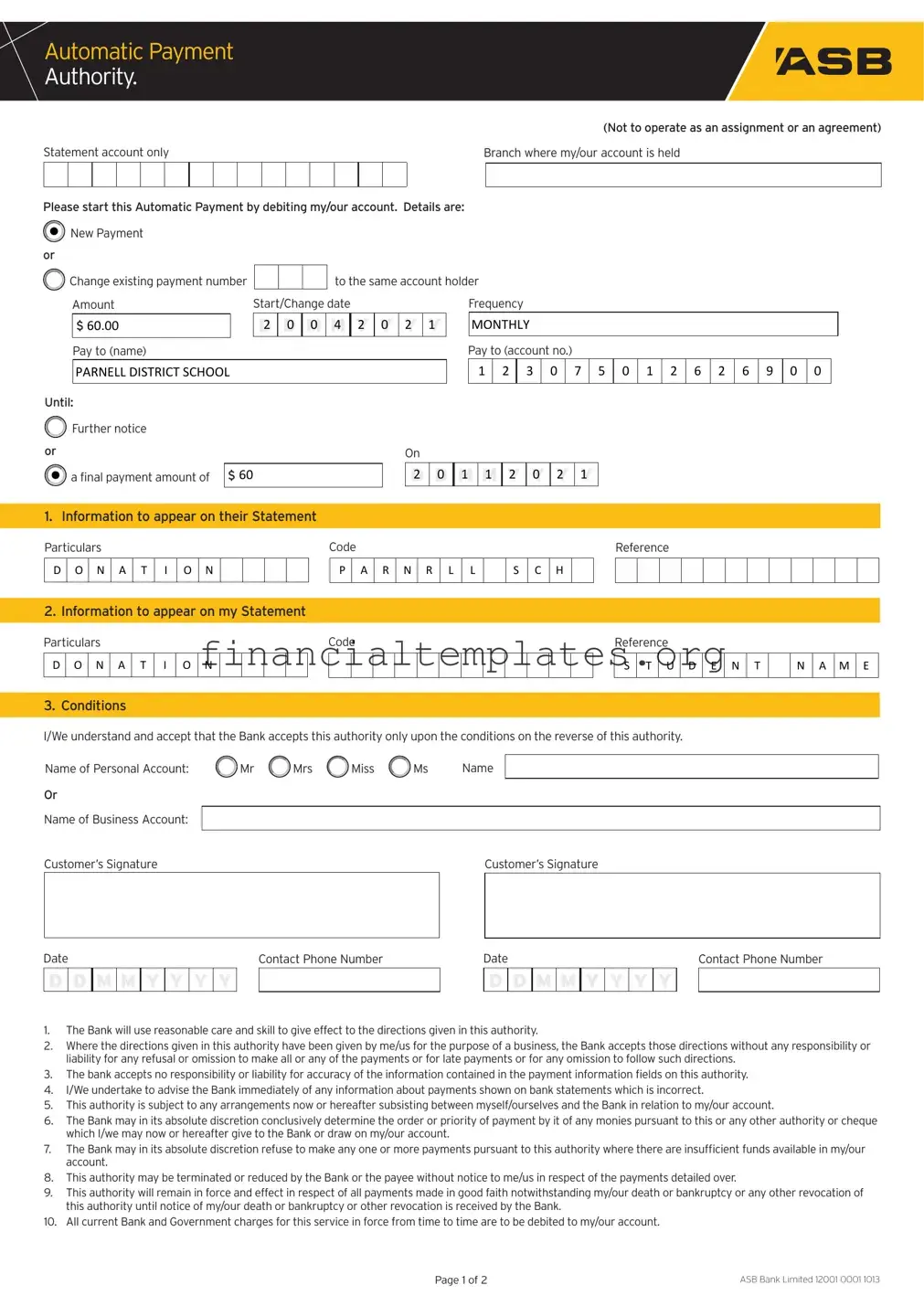

The Asb Bank Automatic Payment form serves a fundamental purpose in streamlining payments directly from one's bank account, facilitating transactions without the need for manual processing each time. It's a document that authorizes the bank to regularly transfer a specified amount of money from the account holder's account to pay for goods, services, or make donations as specified by the account holder, highlighting its utility in managing recurring payments effortlessly. This form caters to both new payments setup and alterations to existing payments, requiring details such as the payment amount, start or change date, frequency, and recipient’s information, ensuring a personalized approach to automated financial transactions. The form intricately specifies the information that will appear on both the payer’s and payee’s statements for clarity and record-keeping, underscoring the emphasis on transparency. Moreover, it sets out conditions underpinning the operation of the automatic payment authority, including the bank’s liability, accuracy of payment information, and circumstances under which the payments could be adjusted or ceased. This document, while facilitating ongoing transactions, places considerable importance on the mutual understanding between the bank and the account holder of the terms governing the authority, including instances of account discrepancies, priority of payments, and termination of the authority. It also makes note of the potential for bank and government charges associated with the service, aligning expectations on the financial responsibilities entailed in utilizing automatic payment services.

Asb Bank Automatic Payment Example

Automatic Payment

Authority.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not to operate as an assignment or an agreement) |

Statement account only |

|

|

|

|

|

|

|

|

|

|

|

Branch where my/our account is held |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please start this Automatic Payment by debiting my/our account. Details are: |

|

|

|||||||||||||||||||

|

New Payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

or |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Change existing payment number |

|

|

|

|

|

|

|

to the same account holder |

||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

Amount |

Start/Change date |

Frequency |

||||||||||||||||||

$60.00

Pay to (name)

D2 D0 M0 M4

Y2 Y0 Y2 Y1

MONTHLY

Pay to (account no.)

PARNELL DISTRICT SCHOOL

1 2 3 0 7 5 0 1 2

6 2 6 9 0 0

Until:

Further notice

Further notice

or

a final payment amount of $ 60

a final payment amount of $ 60

1. Information to appear on their Statement

On

D2 D0 M1 M1 Y2 Y0 Y2 Y1

Particulars

D O N A T I O N

Code |

|

|

|

|

|

|

Reference |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P |

A |

R |

N |

R |

L |

L |

|

S |

C |

H |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Information to appear on my Statement

Particulars |

|

|

|

|

|

|

|

Code |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

O |

N |

A |

T |

I |

O |

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reference

S |

T |

U |

D |

E |

N |

T |

|

N |

A |

M |

E |

|

|

|

|

|

|

|

|

|

|

|

|

3. Conditions

I/We understand and accept that the Bank accepts this authority only upon the conditions on the reverse of this authority.

Name of Personal Account: |

Mr |

Mrs |

Miss |

Ms |

Name |

Or |

|

|

|

|

|

Name of Business Account: |

|

|

|

|

|

Customer’s Signature |

|

|

|

|

Customer’s Signature |

Date |

Contact Phone Number |

D D M M Y Y Y Y

Date |

Contact Phone Number |

D D M M Y Y Y Y

1.The Bank will use reasonable care and skill to give effect to the directions given in this authority.

2.Where the directions given in this authority have been given by me/us for the purpose of a business, the Bank accepts those directions without any responsibility or liability for any refusal or omission to make all or any of the payments or for late payments or for any omission to follow such directions.

3.The bank accepts no responsibility or liability for accuracy of the information contained in the payment information fields on this authority.

4.I/We undertake to advise the Bank immediately of any information about payments shown on bank statements which is incorrect.

5.This authority is subject to any arrangements now or hereafter subsisting between myself/ourselves and the Bank in relation to my/our account.

6.The Bank may in its absolute discretion conclusively determine the order or priority of payment by it of any monies pursuant to this or any other authority or cheque which I/we may now or hereafter give to the Bank or draw on my/our account.

7.The Bank may in its absolute discretion refuse to make any one or more payments pursuant to this authority where there are insufficient funds available in my/our account.

8.This authority may be terminated or reduced by the Bank or the payee without notice to me/us in respect of the payments detailed over.

9.This authority will remain in force and effect in respect of all payments made in good faith notwithstanding my/our death or bankruptcy or any other revocation of this authority until notice of my/our death or bankruptcy or other revocation is received by the Bank.

10.All current Bank and Government charges for this service in force from time to time are to be debited to my/our account.

Page 1 of 2 |

ASB BANK LIMITED 12001 0001 1013 |

FOR BANK USE ONLY

|

|

|

|

Date stamp |

Form Accepted by |

Details Alt/Loaded by |

|

||

|

|

|

|

|

Signature Verified by |

|

Checked to DBR of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 2 |

ASB BANK LIMITED 12001 0001 1013 |

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The form is used for setting up an Automatic Payment Authority, not to operate as an assignment or an agreement. |

| 2 | It allows for the addition of new payments or changes to existing payments to the same account holder. |

| 3 | Payments can be specified by amount, start/change date, and frequency, with an option for monthly payments highlighted. |

| 4 | Users must provide details for both the payer's and payee's statement information, including particulars, code, and reference. |

| 5 | The bank requires immediate notification from the customer regarding any inaccuracies shown on bank statements. |

| 6 | This authority is subject to existing arrangements between the customer and the Bank regarding the customer's account. |

| 7 | The Bank holds the discretion to refuse payments if there are insufficient funds in the customer's account. |

| 8 | Both the Bank and the payee can terminate or reduce this authority without notice to the customer. |

| 9 | This authority remains in effect for all payments made in good faith until the Bank receives notice of the customer's death, bankruptcy, or other revocation. |

| 10 | All current Bank and Government charges for this service are to be debited to the customer's account. |

Guide to Writing Asb Bank Automatic Payment

When setting up an automatic payment with ASB Bank, it's important to accurately complete the Automatic Payment Authority form. This process not only ensures that your payments are processed efficiently but also provides a hassle-free way to manage recurring expenses or donations. The steps outlined below guide you through filling out the form to either initiate a new automatic payment or amend an existing one. Remember, by submitting this form, you authorize ASB Bank to make payments on your behalf, under the conditions outlined by the bank.

- Locate the section labeled "Automatic Payment Authority." Here, indicate whether you're creating a New Payment or changing an existing payment by checking the appropriate box.

- Under "Details are," fill in the amount to be paid, for instance, "$60.00."

- Specify the start or change date for this payment by entering the day, month, and year in the format D2D0M0M4Y2Y0Y2Y1.

- Select the payment frequency by marking the relevant box. In this case, it's "MONTHLY."

- Under "Pay to," write the recipient's name, such as "PARNELL DISTRICT SCHOOL."

- Enter the recipient's account number in the designated field.

- Decide if the payment continues "Until Further notice" or until "a final payment amount of $" is reached. Fill in the final amount if applicable.

- In the section for "Information to appear on their Statement," input the desired particulars and the reference code reflecting the purpose of the payment, e.g., "DONATION," and the reference "PARNRLLSCH."

- Similarly, under "Information to appear on my Statement," input how you would like these transaction details to appear for your records.

- Review the conditions outlined by the bank regarding the automatic payment and ensure you understand and accept these conditions before proceeding.

- Fill out either the "Name of Personal Account" or "Name of Business Account" field, depending on which applies to your situation.

- Sign the form in the "Customer’s Signature" section and fill in the date and your contact phone number.

Once you have completed these steps, make sure to double-check all the information for accuracy to prevent any delays or issues with your automatic payments. After the form is fully completed and signed, submit it to your local ASB branch for processing. The bank will then take care of the rest, ensuring your payments are made as instructed, providing you with peace of mind and more time to focus on other important matters.

Understanding Asb Bank Automatic Payment

Welcome to the FAQ section for the ASB Bank Automatic Payment form. Below you'll find answers to some commonly asked questions regarding setting up or adjusting your automatic payment.

- How can I start a new automatic payment or change an existing one?

To start a new automatic payment or to change an existing one, you must indicate on the form whether it's a "New Payment" or a "Change existing payment" by ticking the appropriate box. Fill in the amount, start/change date, and frequency of your payment, along with the payee’s details and your account information from which the payment will be debited.

- What details are required for the payee and my account statements?

For the payee's statement, you need to provide the particulars, code, and reference which help identify the payment's purpose. Similarly, your statement requires particulars and code that describe the automatic payment, alongside a reference – often recommended to include the payee's name or an invoice number for your records.

- What are the conditions of setting up an automatic payment with ASB Bank?

The bank requires you to accept several conditions upon setting up an automatic payment. These conditions include the bank’s responsibility in executing your payment instructions, handling of payments for business purposes, accuracy of information, and immediate notification of incorrect statement entries. Additionally, your agreement is subject to existing arrangements between you and the bank, and the bank retains discretion over payment execution and prioritization.

- Can the bank refuse to make a payment?

Yes, ASB Bank may, at its absolute discretion, refuse to make a payment if there are insufficient funds in your account. This decision is made to prevent overdrafts and additional fees on your account.

- What happens to my automatic payments in the event of my death, bankruptcy, or revocation of authority?

Your automatic payments will continue to be made in good faith until the bank receives notice of your death, bankruptcy, or another form of revocation. This ensures continuous payment to the payees you've designated until such events are officially communicated to the bank.

- Are there any charges associated with automatic payments?

Yes, all current bank and government charges applicable to the automatic payment service will be debited from your account. These charges vary and can be updated, so it's recommended to check the current fees directly with ASB Bank or through official banking materials.

If you have more specific questions or need further assistance, ASB Bank’s customer service team is readily available to provide support.

Common mistakes

Filling out any form related to bank transactions demands care and attention. However, errors are common and can lead to unnecessary delays and complications. When completing the ASB Bank Automatic Payment form, here are four common mistakes to be mindful of:

- Incorrect Account Information: One of the most critical yet frequently made mistakes is entering wrong account numbers, either of the payer or the payee. This can result in payments being delayed or sent to the wrong account, creating a hassle for both parties involved.

- Unclear Payment Instructions: Failing to specify clear and precise payment instructions, such as an ambiguous start/change date or incorrectly selecting the frequency of payment, can lead to payments not being processed as intended. This disorganization can disrupt the payment schedule and potentially incur late fees or service interruptions.

- Incomplete Details for Statement Descriptions: Often, individuals overlook the importance of filling in the detailed description for the transactions on their statement. Accurately providing these specifics, like the purpose of the payment, helps in keeping financial records organized and makes it easier to track payments and resolve any discrepancies that might arise.

- Overlooking Bank’s Conditions and Acknowledgments: The terms and conditions section on the reverse side of the authority form is habitually ignored. Not understanding or acknowledging these conditions can lead to unforeseen issues, such as the bank refusing to make a payment due to insufficient funds in the account, because the signer was not aware of the bank's right to do so under certain circumstances.

To ensure a smooth automatic payment setup with ASB Bank, double-checking all entered information for accuracy, clarity, and completeness is crucial. Steering clear of these common pitfalls will pave the way for a hassle-free transaction experience.

Documents used along the form

When setting up or managing Automatic Payments with ASB Bank, individuals and businesses often find themselves needing additional forms and documents to ensure a smooth and efficient transaction process. These supplementary materials serve to provide detailed information, authorize transactions, and comply with legal requirements, ensuring transparency and security in financial activities.

- Direct Debit Form: Authorizes another party to withdraw funds from your account. Commonly used for recurring bills or subscriptions.

- Account Opening Form: Required for new customers to establish an account with ASB Bank before setting up any automatic payments.

- Credit Application Form: For individuals or businesses that need credit approval before initiating transactions that exceed their current account balance.

- Change of Details Form: Allows account holders to update personal or business information, ensuring that all transactions are processed accurately.

- Stop Payment Request Form: Used to halt a scheduled automatic payment before it is processed, which can be crucial for preventing unwanted or fraudulent transactions.

- Internet Banking Registration Form: Enables account holders to manage their automatic payments and other banking needs online, offering convenience and flexibility.

- Transaction Dispute Form: For challenging transactions that account holders believe were incorrect, unauthorized, or fraudulent.

- Closed Account Notification Form: Informs the bank and other relevant parties that an account has been closed, terminating any automatic payments linked to it.

- Foreign Exchange Transaction Form: Necessary for transactions involving currency conversion, ensuring that automatic payments to foreign entities are executed at agreed-upon exchange rates.

These forms and documents work in conjunction with the ASB Bank Automatic Payment form to streamline financial operations, ensuring that payments are made timely and securely. Understanding and utilizing the appropriate forms when needed can significantly enhance the efficiency and safety of financial transactions involving automatic payments.

Similar forms

The Direct Debit Authorization Form is closely related to the ASB Bank Automatic Payment Form. Like the ASB form, it allows a person or business to give permission to a bank to withdraw funds from their account regularly to pay for a service or settle an invoice. Both documents specify the amount, frequency, and details of the payee, ensuring that payments are made automatically without requiring manual intervention each time. This similarity simplifies recurring transactions for both payer and payee.

A Standing Order Mandate shares similarities with the ASB Bank form by acting as an instruction to a bank to send payments at regular intervals to another account. It details the payment amount, frequency, and recipient information, similar to the ASB form. However, standing orders are set up directly between bank accounts, and the account holder controls them, providing a straightforward way to manage recurring payments, like rent or subscription services.

The Electronic Funds Transfer (EFT) Authorization Form closely resembles the ASB Bank Automatic Payment Form. It provides the necessary authorization for transferring funds electronically from one account to another. Both documents include crucial details such as the amount, frequency, and recipient account information. EFTs cover a wide range of electronic payment types, making this form versatile for various transactions, from payroll to bill payments.

The Credit Card Authorization Form is another document that shares similarities with the ASB form, allowing merchants to charge a customer's credit card for goods or services. This document, like the ASB form, details the payment amount and frequency, but it's specifically designed for credit card transactions. It serves as a pre-approval from the cardholder to process recurring or one-time charges, ensuring a smooth transaction process for ongoing services or payments.

The Payroll Deduction Authorization form is akin to the ASB Bank form in its function to facilitate regular deductions from an employee's paycheck. It typically specifies the deduction amount, frequency, and purpose, similar to how the ASB form outlines automatic payments to third parties. This similarity is crucial for setting up consistent deductions for benefits, contributions, or loan repayments directly from an employee's salary.

Online Bill Pay Setup Forms offered by many banks or service providers mirror the ASB Bank Automatic Payment Form's purpose by enabling customers to automate the payment process for recurring bills. These forms capture information about the payee, the payment schedule, and the account from which funds should be debited. This streamlines the bill payment process, ensuring timely payments without manual intervention each month.

An Insurance Premium Auto-Debit Form is also similar to the ASB form. It allows policyholders to automate their premium payments, ensuring they don't lapse due to missed payments. Both documents require the account holder's authorization, specifying payment frequencies, amounts, and recipient details. This automated process helps maintain continuous coverage without the need for policyholders to remember to make manual payments.

Finally, the Loan Repayment Direct Debit Form resembles the ASB Bank Automatic Payment Form. It authorizes a financial institution to automatically deduct loan repayments from a borrower's bank account at regular intervals. Both share the purpose of ensuring timely payments for a financial obligation, detailing the amount, frequency, and timing of deductions, reducing the risk of late or missed payments and simplifying the management of financial commitments.

Dos and Don'ts

When filling out the ASB Bank Automatic Payment form, there are several important do's and don'ts to keep in mind to ensure the process is completed accurately and efficiently:

Do:- Double-check all personal and account details you enter, such as your account number, to avoid any processing delays or payments being sent to the wrong account.

- Clearly specify the payment amount and frequency. This ensures that the recipient receives the expected funds on the schedule you intend.

- Include specific details for the payment to appear on both your statement and the recipient’s statement, such as donation codes or reference names. This helps both parties track and confirm the payments easily.

- Read and understand the conditions on the reverse side of the form; this will help you know your rights and responsibilities related to the automatic payments.

- Leave any fields incomplete unless they are not applicable to your payment setup. Incomplete forms could lead to processing delays or the bank not being able to setup your automatic payment.

- Forget to sign and date the form. An unsigned form is considered invalid and will not be processed by the bank.

- Ignore the importance of reviewing the bank’s terms and conditions related to automatic payments. Knowing these can help you manage your payments more effectively and avoid potential issues.

- Fail to inform the bank immediately if there are any inaccuracies in the information appearing on your bank statements related to automatic payments. Prompt communication can prevent future errors.

Misconceptions

When navigating the intricacies of bank forms like the ASB Bank Automatic Payment form, it's easy to fall prey to misconceptions. Here, we're going to clear up some of the most common misunderstandings related to this important financial tool.

- Misconception #1: This form can operate as an assignment or agreement.

Actually, it's designed only to authorize automatic payments from your account, not to serve as a legal agreement or assignment of payments to another party. - Misconception #2: It’s overly complicated to set up an Automatic Payment.

Setting up is as simple as providing your account details, the payment details, the start date, and the frequency of your payments. The form guides you through each step, making the process straightforward. - Misconception #3: You cannot change the payment amount or recipient details once set up.

Contrary to this belief, the form does allow for changes to existing payments, including the payment amount and the payee details, ensuring flexibility in managing your finances. - Misconception #4: Automatic Payments can only be made to businesses.

This is not true. Payments can be made to individuals or organizations, offering you convenience irrespective of the payment's nature. - Misconception #5: The bank guarantees the accuracy of your payment instructions.

The responsibility lies with you to ensure the payment details are accurate. While the bank will use reasonable care, it does not assume liability for inaccuracies in the instructions you provide. - Misconception #6: The bank will immediately correct any errors in payments.

While the bank will take care to process payments correctly, it is up to you to notify them of any discrepancies in your bank statements related to automatic payments. The bank's role in rectifying errors is conditional upon your prompt reporting. - Misconception #7: Setting up an Automatic Payment ensures the payment will always be made on time.

Payments are subject to sufficient funds being available in your account. If funds are insufficient, the bank may refuse to make the payment, highlighting the need for prudent account management. - Misconception #8: Automatic Payments are irrevocable.

You or the bank can terminate or amend the payments without prior notice, providing a level of control over your financial transactions. - Misconception #9: The bank can use this authority to prioritize payment orders.

In fact, the bank may determine the order of payments at its discretion. This means your automatic payment might not always be prioritized in the way you expect, emphasizing the importance of maintaining a healthy account balance.

Understanding these facets of the ASB Bank Automatic Payment form is essential for effective financial management. It enables you to leverage the convenience of automatic payments while maintaining control over your financial commitments and expectations.

Key takeaways

Filling out an ASB Bank Automatic Payment form can seem like a walk through a financial garden. Here we unveil the essentials, adopting a stroll that's both enlightening and free of the tangled vines of complexity. This journey reveals the crucial touchpoints for effectively navigating the paperwork and ensuring that automatic payments serve their intended purpose without unwelcome surprises.

Understand the form's purpose: The ASB Bank Automatic Payment form isn't just another piece of paperwork; it's a directive for the bank to make regular payments on your behalf from your account to a specified recipient. It's designed to be straightforward, creating a seamless bridge between your financial obligations and their fulfilment.

Specify payment details with precision: Clear details regarding the payment amount, start/change date, and frequency are non-negotiable. Whether it's a new payment setup or an adjustment to an existing one, clarity here ensures the bank acts in alignment with your intentions.

Recipient information is key: Providing accurate information about the payee, including their name and account number, is essential. Mistakes can divert your funds to unintended quarters, making diligence your best friend in this section.

Communication on bank statements: You have the opportunity to specify what information appears on both the recipient’s and your own bank statements. This customization aids in tracking transactions and ensuring they're easily identifiable amongst your financial records.

Conditions and acceptance: The bank lays out clear conditions for accepting this authority, including their responsibility (or lack thereof) regarding the exactness of payment execution and any potential liability. Familiarizing yourself with these terms can demystify what the bank can and cannot do on your behalf.

Obligation to notify the bank of inaccuracies: Should discrepancies arise on your bank statements, it is your responsibility to notify the bank posthaste. Prompt communication can rectify issues before they blossom into larger financial headaches.

Subject to existing arrangements: The authority granted by this form operates within the umbrella of your overall relationship with the bank. This means it's influenced by any other agreements or arrangements you have with them, shaping the context in which automatic payments are processed.

Bank’s discretion on payment execution: The bank reserves the right to determine the order and priority of payments and may refuse a payment if funds are insufficient. They also hold the authority to terminate or modify this agreement as needed, underscoring the importance of keeping a vigilant eye on your account balance and agreement status.

By knitting together these threads of understanding, filling out the ASB Bank Automatic Payment form becomes less daunting and more of a measured step toward financial organization. Like any tool, its effectiveness is in how it's employed; armed with these insights, you're better positioned to wield it with confidence and precision.

Popular PDF Documents

It-201 Resident Income Tax Return - New York’s 529 college savings program distributions and deductions can be reviewed and amended on this form.

What Kind of Power of Attorneys Are There - A legal instrument permitting a representative to take care of tax submissions and processes.

Does Wisconsin Have Sales Tax - With its comprehensive coverage, the form stands as a testament to the state's initiative in providing tax relief to businesses engaged in qualifying activities.