Get Arizona Tax Return Form

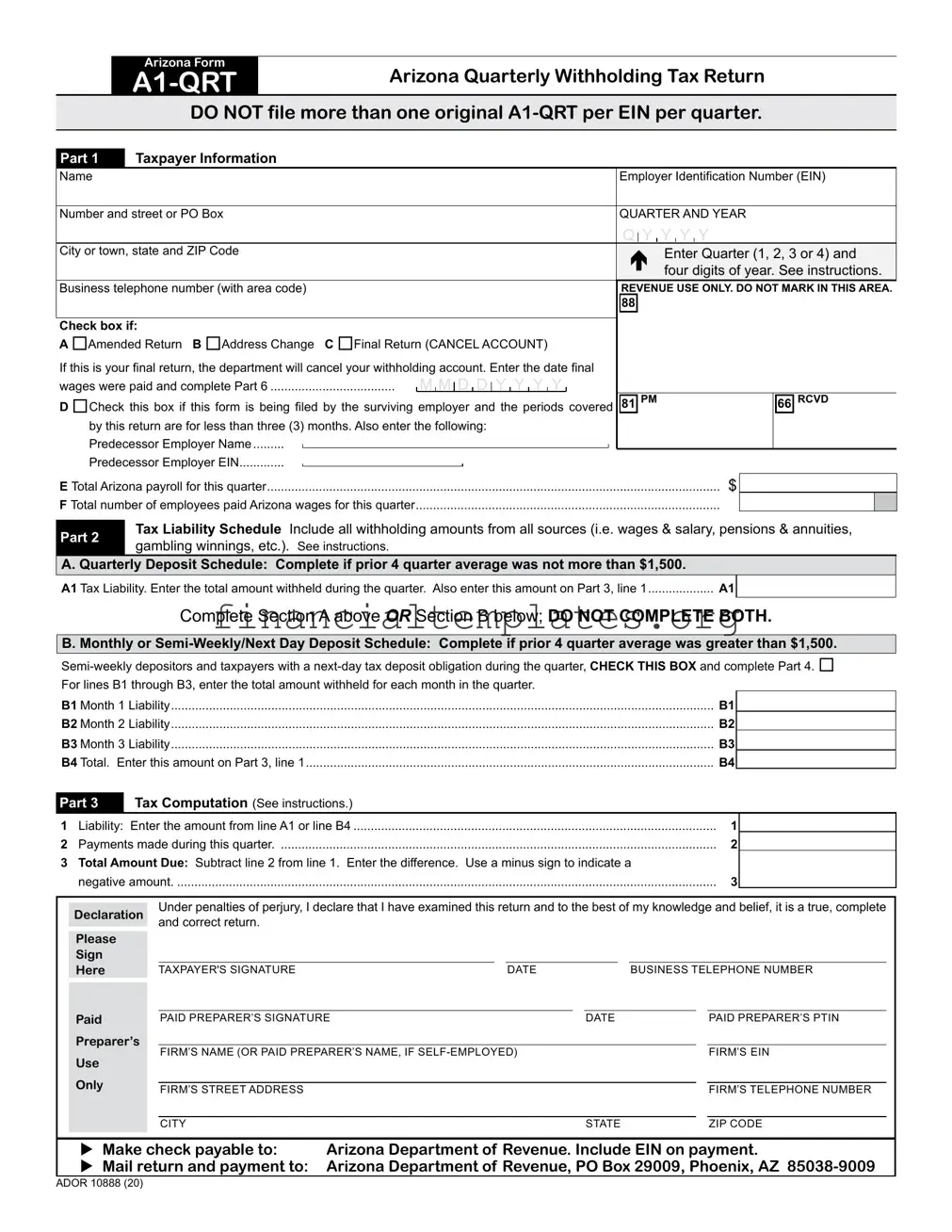

The Arizona Form A1-QRT, known as the Arizona Quarterly Withholding Tax Return, serves a crucial role for employers operating within the state. It is designed to reconcile and report the amount of income tax withheld from employees' wages during a given quarter. Employers are required to complete this form diligently, ensuring accurate taxpayer information such as the name, Employer Identification Number (EIN), and address are provided alongside the specific quarter and year being reported. The form distinguishes between different deposit schedules depending on the employer's previous quarterly withholdings, offering sections for those with an average not exceeding $1,500 and for those surpassing this average, thereby necessitating monthly, semi-weekly, or next-day deposit schedules. Additionally, the form facilitates amendments, address changes, and notifications of account cancellation through checked boxes for easy identification. Information pertaining to total Arizona payroll, the number of employees, tax liabilities, and computations for the quarter are systematically laid out for the employer's completion. Importantly, the declaration section at the end ensures accountability through required signatures. For employers who find themselves at the closure of business or undergoing significant changes, specific sections are provided to detail these occurrences. This comprehensive approach to reporting and reconciliation underscores the importance of the A1-QRT in maintaining tax compliance and facilitating smooth operational transitions for businesses within Arizona.

Arizona Tax Return Example

Arizona Form

Arizona Quarterly Withholding Tax Return

DO NOT file more than one original

Part 1

Taxpayer Information

Name |

|

|

|

|

|

|

|

|

|

Employer Identification Number (EIN) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number and street or PO Box |

|

|

|

|

|

|

|

|

|

QUARTER AND YEAR |

|||||||

|

|

|

|

|

|

|

|

|

|

|

Q |

|

Y Y Y Y |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

City or town, state and ZIP Code |

|

|

|

|

|

|

|

|

|

|

Enter Quarter (1, 2, 3 or 4) and |

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

four digits of year. See instructions. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business telephone number (with area code) |

|

|

|

|

|

|

|

|

|

REVENUE USE ONLY. DO NOT MARK IN THIS AREA. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check box if: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A Amended Return B Address Change |

C Final Return (CANCEL ACCOUNT) |

|

|

|

|

|

|

|

|||||||||

If this is your final return, the department will cancel your withholding account. Enter the date final |

|

|

|

|

|

|

|

||||||||||

wages were paid and complete Part 6 |

|

M M |

|

D D |

|

Y Y Y Y |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||||||

D Check this box if this form is being filed by the surviving employer and the periods covered |

81 PM |

|

|

66 RCVD |

|||||||||||||

by this return are for less than three (3) months. Also enter the following: |

|

|

|

|

|

||||||||||||

Predecessor Employer Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Predecessor Employer EIN |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

E Total Arizona payroll for this quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

........................................................................................F Total number of employees paid Arizona wages for this quarter |

|

|

|

||||||||||||||

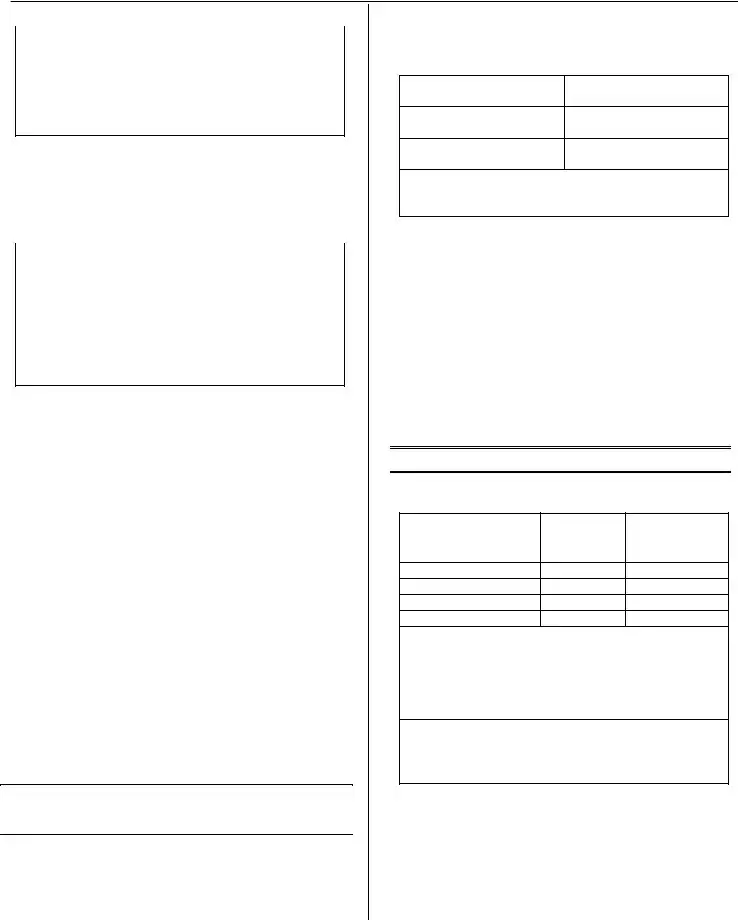

Part 2

Tax Liability Schedule Include all withholding amounts from all sources (i.e. wages & salary, pensions & annuities, gambling winnings, etc.). See instructions.

A. Quarterly Deposit Schedule: Complete if prior 4 quarter average was not more than $1,500.

A1 Tax Liability. Enter the total amount withheld during the quarter. Also enter this amount on Part 3, line 1 |

A1 |

Complete Section A above OR Section B below; DO NOT COMPLETE BOTH.

B. Monthly or

B1 Month 1 Liability |

B1 |

|

B2 Month 2 Liability |

B2 |

|

B3 Month 3 Liability |

B3 |

|

......................................................................................................................B4 Total. Enter this amount on Part 3, line 1 |

B4 |

|

Part 3

Tax Computation (See instructions.)

1 |

Liability: Enter the amount from line A1 or line B4 |

1 |

2 |

Payments made during this quarter |

2 |

3Total Amount Due: Subtract line 2 from line 1. Enter the difference. Use a minus sign to indicate a

negative amount |

3 |

Declaration

Please

Sign

Here

Paid

Preparer’s

Use

Only

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, it is a true, complete and correct return.

TAXPAYER'S SIGNATURE |

DATE |

|

|

BUSINESS TELEPHONE NUMBER |

||

|

|

|

|

|

|

|

PAID PREPARER’S SIGNATURE |

|

|

DATE |

|

|

PAID PREPARER’S PTIN |

|

|

|

|

|

|

|

FIRM’S NAME (OR PAID PREPARER’S NAME, IF |

|

|

|

|

FIRM’S EIN |

|

|

|

|

|

|

|

|

FIRM’S STREET ADDRESS |

|

|

|

|

|

FIRM’S TELEPHONE NUMBER |

|

|

|

|

|

|

|

CITY |

|

|

STATE |

|

|

ZIP CODE |

Make check payable to:

Mail return and payment to:

Arizona Department of Revenue. Include EIN on payment.

Arizona Department of Revenue, PO Box 29009, Phoenix, AZ

ADOR 10888 (20)

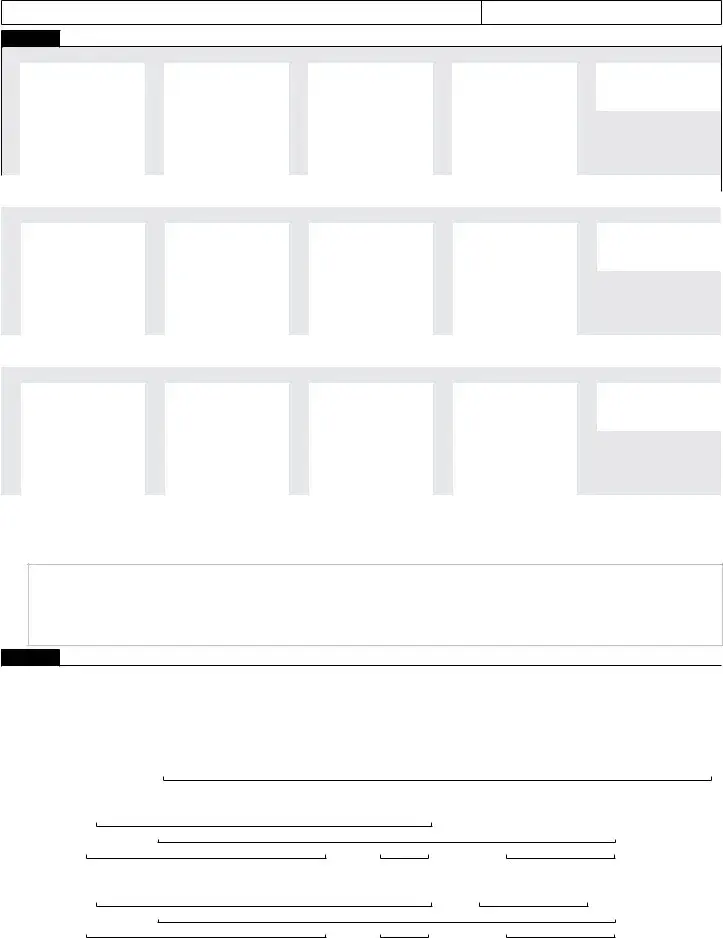

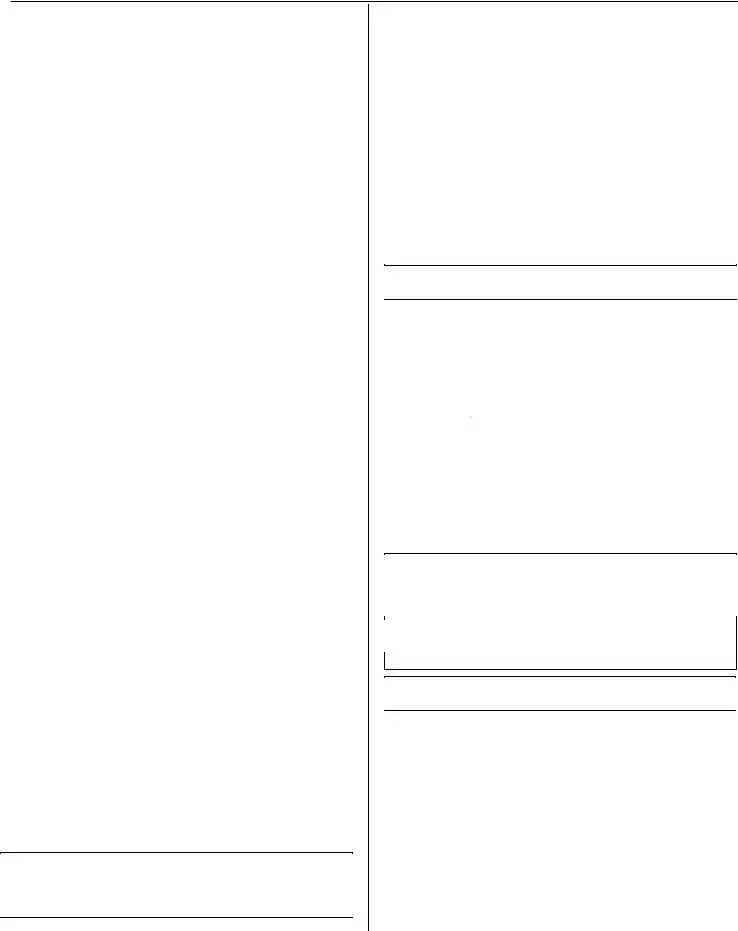

Name (as shown on page 1)

EIN

Part 4

A. First Month of Quarter (Days of the Month)

1 |

|

8 |

|

15 |

|

22 |

|

29 |

|

|

2 |

|

9 |

|

16 |

|

23 |

|

30 |

|

|

3 |

|

10 |

|

17 |

|

24 |

|

31 |

|

|

4 |

|

11 |

|

18 |

|

25 |

|

Check a box only if you |

||

5 |

|

12 |

|

19 |

|

26 |

|

had a |

||

6 |

|

13 |

|

20 |

|

27 |

|

|||

deposit obligation. |

||||||||||

7 |

|

14 |

|

21 |

|

28 |

|

|||

|

|

|||||||||

Month 1 Liability: Enter total here and on Part 2, line B1 |

|

|

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

B. Second Month of Quarter (Days of the Month) |

|

|

|

|

|

|

||||

1 |

|

8 |

|

15 |

|

22 |

|

29 |

|

|

2 |

|

9 |

|

16 |

|

23 |

|

30 |

|

|

3 |

|

10 |

|

17 |

|

24 |

|

31 |

|

|

4 |

|

11 |

|

18 |

|

25 |

|

Check a box only if you |

||

5 |

|

12 |

|

19 |

|

26 |

|

had a |

||

6 |

|

13 |

|

20 |

|

27 |

|

|||

deposit obligation. |

||||||||||

7 |

|

14 |

|

21 |

|

28 |

|

|||

|

|

|||||||||

Month 2 Liability: Enter total here and on Part 2, line B2 |

|

|

|

|

$ |

|

||||

|

|

|

|

|

|

|

||||

C. Third Month of Quarter (Days of the Month) |

|

|

|

|

|

|

||||

1 |

|

8 |

|

15 |

|

22 |

|

29 |

|

|

2 |

|

9 |

|

16 |

|

23 |

|

30 |

|

|

3 |

|

10 |

|

17 |

|

24 |

|

31 |

|

|

4 |

|

11 |

|

18 |

|

25 |

|

Check a box only if you |

||

5 |

|

12 |

|

19 |

|

26 |

|

had a |

||

6 |

|

13 |

|

20 |

|

27 |

|

|||

deposit obligation. |

||||||||||

7 |

|

14 |

|

21 |

|

28 |

|

|||

|

|

|||||||||

Month 3 Liability: Enter total here and on Part 2, line B3 |

|

|

|

|

$ |

|

||||

Part 5 |

Amended Form |

If you checked the box “Amended Return” in Part 1, explain why an amended Form

Part 6

Final Form

If you checked the box “Final Return” in Part 1, check the box that indicates why this is a final return:

1 Reorganization or change in business entity (example: from corporation to partnership).

2 Business sold.

3 Business stopped paying wages and will not have any employees in the future.

4 Business permanently closed.

5 Business has only leased or temporary agency employees.

6 Other (specify reason):

7 Check this box if records will be kept at a location different from the address shown in Part 1.

Name:

Number and Street:

City:State:

8 Check this box if there is a successor employer.

Name:

Number and Street:

City:State:

|

|

|

|

ADOR 10888 (20) |

AZ Form |

Page 2 of 2 |

|

|

|

Arizona Form |

Arizona Quarterly Withholding Tax Return |

||

|

|

|

For information or help, call one of these numbers:

Phoenix |

(602) |

From area codes 520 and 928, |

(800) |

Tax forms, instructions, and other tax information

If you need tax forms, instructions, and other tax information, go to the department’s website at www.azdor.gov.

Withholding Tax Procedures and Rulings

These instructions may refer to the department’s withholding tax procedures and rulings for more information. To view or print these, go to our website and click on Reports & Legal Research then click on Legal Research and select a Document Type and Category from the drop down menus.

Publications

To view or print the department’s publications, go to our website and click on Reports & Legal Research. Then click on Publications.

General Information

Arizona law requires employers to withhold Arizona income tax from:

•The payment of wages, salary, or bonus to any employee whose compensation is for services performed within Arizona, unless those wages are exempt from Arizona income tax withholding;

•The premature withdrawal of state and local retirement contributions; and,

•Payments of prize winnings subject to federal withholding under Internal Revenue Code (IRC) §§ 1441 or 3402(q) from:

O The Arizona state lottery commission, or, O Arizona sanctioned horse or dog racing.

At the request of the individual receiving the payment, Arizona income tax may be withheld from the following:

•Retired or retainer pay for service in the military or naval forces of the United States;

•Payments under the United States civil service retirement system from the United States government service retirement and disability fund;

•Pensions;

•Traditional Individual Retirement Accounts;

•Any other annuity;

•Unemployment compensation; and,

•

Each employer remits the tax withheld to the department using the deposit schedule that applies to that employer.

NOTE: For additional information on withholding

NOTE: For additional information on withholding

requirements, refer to the Employer’s Instructions for the

requirements, refer to the Employer’s Instructions for the

Employee’s Arizona Withholding Election (Form

Employee’s Arizona Withholding Election (Form

Instructions).

Instructions).

Why is Form

An employer must withhold Arizona income tax from wages paid for services performed in Arizona. Tax must be withheld, unless those wages are exempt from Arizona withholding tax.

In addition, Arizona income tax bay be withheld from pensions and gambling winnings.

The employer must remit the tax withheld to the department, based on the deposit schedule that applies to that employer.

Employers must reconcile the amounts withheld during the quarter to the amounts paid during the quarter. Form

Form

•The payment transmittal form for payments made on a quarterly basis when those payments are made by check or money order; and,

•The written notification to the department that the business is cancelling its withholding registration.

NOTE: For details about other returns and forms that may be

NOTE: For details about other returns and forms that may be

required, see Withholding Tax Procedure (WTP)

required, see Withholding Tax Procedure (WTP)

Withholding Tax Forms and Returns to File and When to File

Withholding Tax Forms and Returns to File and When to File

Them.

Them.

Who Must File Form

All employers, except employers who remit on an annual basis, must file Form

•Quarterly

•Monthly

•

•Next day

Form

•The payment transmittal form for payments made on a quarterly basis when those payments are made by check or money order, and as,

•The written notification to the department that the business is cancelling its withholding registration.

NOTE: An employer must file Form

NOTE: An employer must file Form

quarter. This includes quarters in which the employer has not

quarter. This includes quarters in which the employer has not

withheld any Arizona tax. For those quarters, the employer

withheld any Arizona tax. For those quarters, the employer

must file a Form

must file a Form

liability. These returns must be filed until the employer

liability. These returns must be filed until the employer

cancels its withholding registration by filing a final Form A1-

cancels its withholding registration by filing a final Form A1-

QRT. The only exception is for employers that qualify to file

QRT. The only exception is for employers that qualify to file

and pay on an annual basis (Form

and pay on an annual basis (Form

Exception for annual payment return (Form

Certain employers may make their withholding payments on an annual basis and file an annual withholding tax return on Form

An employer may make its Arizona withholding payments on an annual basis if all of the following conditions are met:

•The employer has established a history of withholding activity by filing the quarterly tax return (Form

•The employer's withholding liability was an amount greater than zero for at least one of the four preceding calendar quarters.

•The average amount of Arizona income taxes withheld by the employer in the four preceding calendar quarters does not exceed $200. The employer will meet this average withholding requirement if the total amount withheld in the four preceding calendar quarters is $800 or less.

•The employer has timely filed Form

•The employer has filed Form

•The employer has filed the annual reconciliation tax return (Form

An employer may continue to make its Arizona withholding payments on an annual basis for the succeeding calendar year if all of the following conditions are met:

•The average amount of Arizona income taxes withheld by the employer in the four preceding calendar quarters does not exceed $200; and,

•The employer has timely filed the annual tax return and has timely made its annual Arizona withholding payment for the preceding calendar year.

If an employer does not meet all of the qualifying conditions to continue making its Arizona withholding payments on an annual basis for the succeeding calendar year, or, if that employer has an average withholding of greater than $200 for the four preceding calendar quarters:

•The employer must determine its Arizona withholding payment schedule for succeeding calendar quarters according to the instructions in the Arizona Withholding Liability/Payment Schedule section; and,

•The employer shall file the quarterly tax return (Form

What withholding payments are reconciled using this form?

All Arizona withholding amounts averaging more than $200 per quarter are reconciled using this form. Arizona law requires all amounts withheld to be treated as if the withholding was from wages paid to an employee.

NOTE: Arizona law states that all amounts withheld are to be

NOTE: Arizona law states that all amounts withheld are to be

treated as if the withholding was from wages paid to an

treated as if the withholding was from wages paid to an

employee. If you file federal Form 941 to report federal

employee. If you file federal Form 941 to report federal

withholding on Arizona wages and federal Form 945 to report

withholding on Arizona wages and federal Form 945 to report

federal withholding on Arizona

federal withholding on Arizona

Employer Identification Number (EIN), file one

Employer Identification Number (EIN), file one

reconcile the total Arizona withholding for the quarter. Do not

reconcile the total Arizona withholding for the quarter. Do not

file more than one original

file more than one original

same quarter.

same quarter.

File Form

Form

2

Arizona Form

NOTE: Employers that qualify to file and pay on an annual

NOTE: Employers that qualify to file and pay on an annual

basis (Form

basis (Form

Payroll Service Companies

You may use a Payroll Service Company (PSC) to file your Form

Arizona Withholding Deposit Schedules

For Arizona withholding tax purposes, several deposit schedules may apply. The schedule that an employer must use depends on the amount of Arizona tax withheld. These schedules are based on the average amount withheld during the prior 4 quarter period. The employer must compute this average at the start of each new quarter. The deposit schedule that may apply for one quarter may not be the same schedule that applies to the next quarter. Refer to A.A.C.

NOTE: Employers whose Arizona withholding tax liability for

NOTE: Employers whose Arizona withholding tax liability for

the 2020 calendar year is $5,000 or more must make Arizona

the 2020 calendar year is $5,000 or more must make Arizona

withholding tax payments using EFT. See the section “Payment

withholding tax payments using EFT. See the section “Payment

by Electronic Funds Transfer” on page 5 for additional

by Electronic Funds Transfer” on page 5 for additional

information.

information.

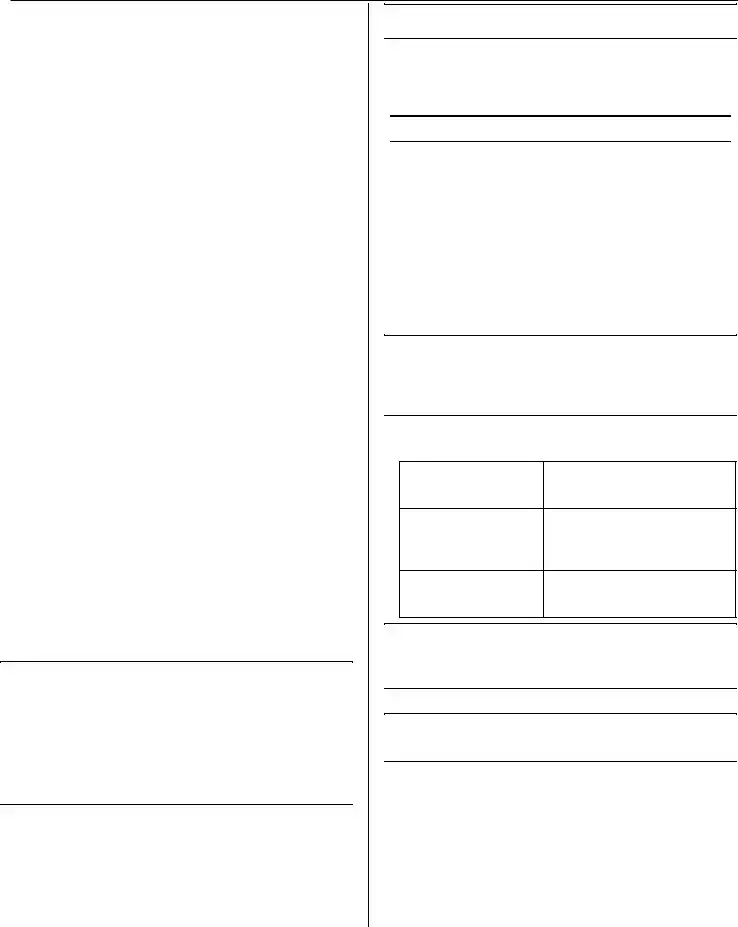

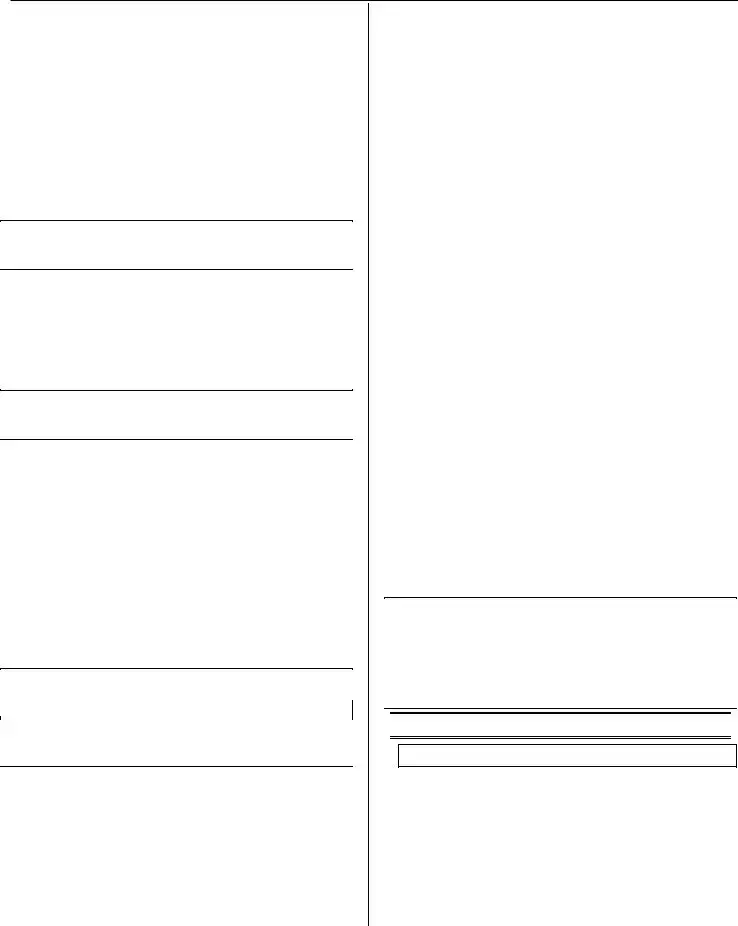

Explanation of Deposit Schedules

The Arizona deposit schedules are as follows:

Previous 4 Quarter |

Arizona Deposit Schedule |

Arizona Withholding |

|

Average |

|

$1,500 or less |

Quarterly |

|

(May deposit on an annual basis |

|

if 4 quarter average is $200 or |

|

less and other criteria met) |

More than $1,500 |

Same time as Federal |

|

(Monthly, |

|

Business Day) |

NOTE: For help in figuring out your quarterly averages and

NOTE: For help in figuring out your quarterly averages and

which deposit schedule to use, see WTP

which deposit schedule to use, see WTP

Withholding Tax Forms and Returns to File and When to File

Withholding Tax Forms and Returns to File and When to File

Them.

Them.

Annual Deposit Schedule

NOTE: An employer that uses the annual deposit schedule

NOTE: An employer that uses the annual deposit schedule

does not file Form

does not file Form

instead.

instead.

Some employers may qualify to make one annual Arizona withholding payment. The employer must have been in business for at least a year and must have established a specified filing and payment history. The employer must also have an average quarterly Arizona tax withholding of $200 or less for the 4 preceding calendar quarters. For complete details, see the instructions for the Annual Payment Withholding Tax Return, Arizona Form

The payment due date for the annual deposit schedule is:

Period in Which Wages |

Arizona Payment Due By |

Paid |

|

January – December |

January 31 of the following |

|

year |

If the due date falls on a Saturday, Sunday, or a legal holiday, the payment will be timely if made on the next banking day.

Quarterly Deposit Schedule

An employer that does not qualify to make one annual Arizona withholding payment and its income tax withheld during the prior 4 quarters was not greater than $1,500, must use the quarterly deposit schedule.

The payment due dates for the quarterly deposit schedule are:

Quarter in Which |

Arizona Payment Due By |

Wages Paid |

|

1st |

April 30 |

2nd |

July 31 |

3rd |

October 31 |

4th |

January 31 |

If the due date falls on a Saturday, Sunday, or a legal holiday, the payment will be considered timely if made on the next banking day.

Monthly or

When an employer’s prior 4 quarter average of Arizona income tax withheld is more than $1,500, the employer must pay its Arizona income tax withheld at the same time it pays its federal tax.

For federal purposes, there are two deposit schedules, monthly and

Federal Monthly Deposit Schedule

For federal purposes, this schedule applies when the total federal tax reported for the federal lookback period was $50,000 or less. Following the monthly deposit schedule, an employer must deposit its taxes for wages paid during the month by the 15th day of the following month. An Arizona employer whose prior 4 quarter average is more than $1,500, who uses this schedule for federal purposes must also deposit the Arizona tax withheld by the 15th day of the following month.

NOTE: If the due date falls on Saturday, Sunday, or a legal

NOTE: If the due date falls on Saturday, Sunday, or a legal

holiday, the payment is considered timely if made on the next

holiday, the payment is considered timely if made on the next

banking day.

banking day.

Federal

This schedule applies when the employer’s total federal tax reported for the federal lookback period was more than $50,000. An Arizona employer whose prior 4 quarter average is more than $1,500, who uses

3

Arizona Form

Day of the Week Wages |

Payment Due By |

Paid |

|

Wednesday, Thursday or |

The following Wednesday |

Friday |

|

Saturday, Sunday, Monday |

The following Friday |

or Tuesday |

|

If the due date falls on a Saturday, Sunday, or a legal holiday, the withholding payment is timely if made on the next banking day.

Federal Next Business Day Deposit

When the employer accumulates a federal tax liability of $100,000 or more on any day during a federal deposit period, the employer must deposit its tax by the close of the next business day. This applies whether the employer is a monthly or

An Arizona employer whose prior 4 quarter average is more than $1,500, that must deposit its federal tax by the close of the next business day, must also deposit its Arizona tax by the close of the next business day. If an employer is a monthly depositor, that employer will become a

General Instructions

What are the due dates for filing Form

Form

|

Quarter |

Form |

*Form A1- |

|

|

QRT Extended |

|

|

|

Due Date |

Due Date |

1 |

(January - March) |

April 30 |

May 10 |

2 |

(April - June) |

July 31 |

August 10 |

3 |

(July - September) |

October 31 |

November 10 |

4 (October - December) |

January 31 |

February 10 |

|

If any due date falls on a Saturday, Sunday or legal holiday, the return will be considered timely if it is filed by the next business day. (See General Tax Ruling [GTR]

*Extended due dates for Form

Electronic Filing of Withholding Tax Returns

Withholding returns shall be filed electronically for taxable years beginning from and after December 31, 2019, or when the department establishes an electronic filing program.

For 2020, the department currently has three methods to file Form

• An employer may register at https://efile.aztaxes.gov/AZFSETPortal [AZ Web File (ASFSET)] to

• An employer may register at https://aztaxes.gov/Home/Page (AZTaxes) and use the data input method to submit its return.

•Registered transmitters of AZ Web File (AZFSET) can

Any employer who is required to file its withholding return electronically may apply to the director for an annual waiver from the electronic filing requirement. The waiver may be granted, which may be renewed for one subsequent year, if any of the following apply:

•The employer has no computer.

•The employer has no internet access.

•Any other circumstance considered to be worthy by the director.

To request a waiver, submit Form 292, Electronic Filing and Payment Waiver Application, to the department. Form 292 is available at:

A waiver is not required if the withholding return cannot be electronically filed for reasons beyond the employer’s control, including situations in which the employer was instructed by the Internal Revenue Service (IRS), or the Arizona Department of Revenue (department) to file by paper.

Please contact the department at azwebfilesupport@azdor.gov if you need assistance in electronically submitting your Arizona withholding return.

Filing an Original Return

File this form on a quarterly basis. File one Form

Submit Form

What to do if you close your business

When your business is sold, discontinued, converted to a new form, or all your employees are dismissed, you must notify the department by filing a final return and request the department close your withholding account. Until you request the department cancel your withholding account, your withholding return(s) will continue to be due.

To file your final Form

•Check box C “Final Return” to cancel your withholding account. Enter the date final wages were paid. Also complete Part 6.

•Check box D if this form is being filed by the surviving employer and the period(s) covered are for less than 3 months. Enter the Predecessor Employer Name and EIN in the spaces provided.

NOTE: To cancel your account, you must file a final Form A1-

NOTE: To cancel your account, you must file a final Form A1-

QRT and file a final Form

QRT and file a final Form

wages were paid. Refer to the instructions for Form

wages were paid. Refer to the instructions for Form

assistance in filing your final Form

assistance in filing your final Form

4

Arizona Form

Filing an Amended Return

If this is an amended Form

If you amend a return for a quarter in a prior calendar year, you must also file an amended Form

Unless the employer was granted a waiver to file its original return by paper, or was directed by the IRS or the department to file the original Form

NOTE: Amended Forms

NOTE: Amended Forms

AZTaxes.

AZTaxes.

Penalties and Interest

Late Filing Penalty

If you file late, a late filing penalty will be assessed. This penalty is 4½% (.045) of the tax required to be shown on the return for each month or fraction of a month the return is late. This penalty cannot exceed 25% (.25) of the tax found to be remaining due.

Late Payment Penalty

If the tax is paid late, a late payment penalty will be assessed. This penalty is ½ of 1% (.005) of the amount shown as tax for each month or fraction of a month for which the failure continues. The department charges this penalty from the original due date of the return until the date you pay the tax. This penalty cannot exceed a total of 10% (.10) of the unpaid tax.

NOTE: If you voluntarily file an amended return and pay the

NOTE: If you voluntarily file an amended return and pay the

additional tax due when you file your amended return, the

additional tax due when you file your amended return, the

department will not assess the late payment penalty.

department will not assess the late payment penalty.

Exceptions are:

Exceptions are:

• The taxpayer is under audit by the department.

• The taxpayer is under audit by the department.

• The amended return was filed on demand or request by the department.

• The amended return was filed on demand or request by the department.

NOTE: If the penalties in both A and B apply, the maximum

NOTE: If the penalties in both A and B apply, the maximum

combined penalty cannot be more than 25%.

combined penalty cannot be more than 25%.

Additional Failure to Pay Penalty

An additional penalty may be assessed if the amount of tax required to be withheld is not paid by the date set for its payment. This penalty is 25% (.25) of the amount of tax required to be withheld and paid to the department.

Payroll Service Company Penalty

A PSC must make withholding payments electronically. A PSC must also file Form

would be subject to four $25 penalties, totaling $100. If the PSC files a paper Form

Interest

The department charges interest on any tax not paid by the due date. The Arizona interest rate is the same as the federal rate imposed on individual taxpayers.

Payment of Tax

The entire amount of tax must be paid by the original due date of Form

NOTE: If the due date falls on a Saturday, Sunday, or a legal

NOTE: If the due date falls on a Saturday, Sunday, or a legal

holiday, the payment will be considered timely if made on the next

holiday, the payment will be considered timely if made on the next

business day.

business day.

Payment by Electronic Funds Transfer

Employers are required to pay their tax liability by electronic funds transfer (EFT) if the employer owes:

•$5,000 or more for any taxable year beginning from and after December 31, 2019, through December 31, 2020; or

•$500 or more for any taxable year beginning from and after December 31, 2020.

NOTE: If an employer was required to make its tax payments for

NOTE: If an employer was required to make its tax payments for

taxable year 2020 by EFT, it must also pay any additional tax due

taxable year 2020 by EFT, it must also pay any additional tax due

from an amended return by EFT,

from an amended return by EFT,

An employer may apply to the director for an annual waiver from the electronic payment requirement. The application must be received by December 31 of each year. The director may grant the waiver if any of the following applies:

•The employer has no computer.

•The employer has no internet access.

•Any other circumstance considered to be worthy by the director exists, including:

O Theemployerhasasustainedrecordoftimelypayments,and, O No delinquent tax account with the department.

To request a waiver, submit Form 292, Electronic Filing and Payment Waiver Application, to the department. Form 292 is available at:

NOTE: An employer who is required to pay by EFT but who fails

NOTE: An employer who is required to pay by EFT but who fails

to do so is subject to a penalty of 5% (.05) of the amount of the

to do so is subject to a penalty of 5% (.05) of the amount of the

payment not made by EFT. See A.R.S. §

payment not made by EFT. See A.R.S. §

For additional information on electronic funds transfer, refer to

For additional information on electronic funds transfer, refer to

A.R.S. §

A.R.S. §

(A.A.C.

(A.A.C.

How to Make EFT Payments

Employers making EFT payments must register with the department before their EFT payments may be accepted. An officer of the employer must complete the initial registration.

Employers may use AZTaxes.gov to make EFT payments:

•Payments can be made electronically from a checking or savings account. Login to your account on www.AZTaxes.gov and choose the

5

Arizona Form

•Payments can be made by American Express, Discover, MasterCard, or Visa credit cards. Login to your account on www.AZTaxes.gov and choose the credit card option. This will take you to the website of the credit card payment service provider. Follow the prompts to make your payment.

The service provider will charge a fee based on the amount of the tax payment. The service provider will disclose the amount of the fee during the transaction and you will be given the option to continue or cancel. If you accept the fee and complete the credit card transaction, a confirmation number will be generated. Please keep this confirmation number as proof of payment.

•EFT payments may also be made by ACH Credit. To register to make ACH Credit payments, go to the department’s website, www.azdor.gov. Click on “Forms”, then click “Other Forms.” Click on Form number 10366, Electronic Funds Transfer (EFT) Disclosure Agreement for ACH Credit filers. Click “Download.” Complete the form as instructed. Submit the completed application at least five business days before the first anticipated transaction as it may take that long to process the application.

Fax the completed form to the department at (602)

The payment will be electronically transferred into the department’s account, normally the next business day. The employers should consult with its bank for the timeframe required to make timely payments. NOTE: The employers may be charged a service fee.

NOTE: Employers using a foreign bank account to make EFT

NOTE: Employers using a foreign bank account to make EFT

payments cannot make EFT payments by ACH Debit. The

payments cannot make EFT payments by ACH Debit. The

department does not accept ACH Debit payments from a foreign

department does not accept ACH Debit payments from a foreign

bank account. If the employer wishes to make a payment from a

bank account. If the employer wishes to make a payment from a

foreign bank account by EFT, the payment MUST be made by

foreign bank account by EFT, the payment MUST be made by

ACH Credit. See the instructions for ACH Credit above to register

ACH Credit. See the instructions for ACH Credit above to register

and make ACH Credit payments.

and make ACH Credit payments.

Specific Instructions

Part 1 - Taxpayer Information

Name, Address, Phone Number and Address Change Box

Type or print the employer's name, address, and phone number in the spaces provided.

If the employer has a foreign address, enter the information in the following order: city, province or state, and country. Follow the country’s practice for entering the postal code. Do not

abbreviate the country’s name.

Employer Identification Number (EIN)

Enter the employer’s EIN. If the employer does not have an EIN, it must get one from the Internal Revenue Service. All returns, statements, or other documents filed with the department must have the employer’s EIN indicated on them. Employers that fail to include their EIN may be subject to a penalty.

Quarter and Year

Enter the quarter and the year for which Form

Quarter |

Months in Quarter |

1st |

January through March |

2nd |

April through June |

3rd |

July through September |

4th |

October through December |

Check Boxes:

A. Amended Return

If this is an amended Form

If you amend a return for a quarter in a prior calendar year, you must also file an amended Form

NOTE: An amended Form

NOTE: An amended Form

filed through https://efile.aztaxes.gov/AZFSETPortal by a

filed through https://efile.aztaxes.gov/AZFSETPortal by a

PSC or by an employer filing through a registered transmitter.

PSC or by an employer filing through a registered transmitter.

All other employers required to file an amended Form A1-

All other employers required to file an amended Form A1-

QRT must file a paper return.

QRT must file a paper return.

B. Address Change

If you changed your address since you last filed Form

C. Final Return

If this is a final return, check Box C, “Final Return (CANCEL ACCOUNT)” to request that the department cancel your withholding account. Enter the date final wages were paid. Complete Part 6 to indicate the reason for the cancellation. Complete the remainder of your return to report your Arizona income tax withholding liability for the period(s) in which your account was closed.

NOTE: You must also file a final Form

NOTE: You must also file a final Form

instructions for Form

instructions for Form

Form

Form

D. Surviving Employer

If you file this return as the surviving employer and the period(s) covered by this return are for less than 3 months, check Box D. Also, enter the Predecessor Employer Name and EIN in the spaces provided.

Line E - Total Arizona Payroll for the Quarter

Enter the total gross Arizona payroll for this calendar quarter. Total gross Arizona payroll means the amounts considered wages for federal income tax withholding purposes.

6

Arizona Form

Line F – Total Number of Employees paid Arizona Wages for this Quarter

Enter the number of employees whose compensation for this calendar quarter was subject to Arizona withholding.

Include in this number:

•Employees who had Arizona withholding deducted from their compensation during this calendar quarter, and

•Employees whose compensation was for services performed in Arizona but the employee(s) filed an election to not have any Arizona withholding deducted from their compensation.

Do not include in this number:

•Annuity recipients,

•Independent contractors,

•Pension recipients, or,

•Employees whose Arizona compensation is excluded from withholding by Arizona law.

Part 2 - Tax Liability Schedule

Complete section A, Quarterly Deposit Schedule, or section B, Monthly or

Include all withholding amounts from all sources. Arizona law requires all amounts withheld from pensions and annuities, gambling winnings, unemployment compensation, etc., be treated as if the withholding was from wages paid to an employee. File one Form

Section A

Complete section A if the average amount of your Arizona tax withheld for the prior 4 quarters was greater than $200, but not more than $1,500.

Line A1

Enter the tax amount withheld for the quarter on line A1. Also, enter this amount in Part 3, line 1. Do not complete Section B. Continue to Part 3. Do not complete Part 4.

NOTE: If you are a monthly depositor and incur a

NOTE: If you are a monthly depositor and incur a

deposit requirement during the quarter, you become a semi-

deposit requirement during the quarter, you become a semi-

weekly depositor for the remainder of the quarter, and for the

weekly depositor for the remainder of the quarter, and for the

following calendar year.

following calendar year.

Section B

Complete section B if the average amount of your Arizona tax withheld for the prior 4 quarters was greater than $1,500.

Arizona employers whose prior 4 quarter average of Arizona income tax withheld is more than $1,500 must pay its Arizona income tax withheld to the department at the same time it pays its federal income tax withheld: monthly,

If you are a

Complete Part 4 only for the months in which you had a semi- weekly deposit or had a

Lines B1 through B3

Enter the tax amount withheld for each month of the quarter. If you are a

Line B4

Total the amounts on lines B1 through B3. Enter the total. This is the total amount withheld for the quarter.

Part 3 - Tax Computation

Line 1 - Liability (Arizona Tax Withheld or Amount Required to be Withheld During the Quarter)

•Quarterly Depositors

Enter the amount from Part 2, Section A, line A1.

•Monthly and

Line 2 - Payments Made during the Quarter

Enter the total amount of payments made for this quarter. If no payments were made prior to filing this return, enter “0”.

Do not include any payment that is made with this return (or for this return, if you are making a payment for an amount due for this return).

Line 3 - Total Amount Due

Subtract the amount on line 2 from the amount on line 1. Enter the difference.

If line 3 is a positive number, this is the amount of tax due. See the section, Payment of Tax, Penalties, and Interest, below for details on paying your tax due. If you owe any penalty or interest, the department will calculate these amounts and mail a billing notice after the return is processed. The entire amount of tax must be paid by the due date of Form

If you are filing an amended return and that return shows a balance due, enclose the amount due with the amended return, unless your payment must be made by EFT. The department will send you a bill for any interest or penalty due once the amended return is processed.

If line 3 is a negative number (an amount less than zero), this is the overpayment for the quarter. Use a minus sign to indicate a negative amount. After the return is processed and payments are confirmed, the overpayment will be applied to any outstanding liabilities, possibly in another tax type. If the overpayment exceeds the outstanding liabilities or the employer has no outstanding liabilities, a refund check will be issued and mailed to the employer. A refund will not be issued once the overpayment is applied to a liability.

Payment of Tax, Penalties, and Interest

The entire amount of tax, penalties, and interest is due by the original due date of the return.

If payment is due, and the employer is required to pay by EFT, see the Section, How to Make EFT Payments, for instructions on paying your tax liability by EFT.

If payment is due, and the employer is not required to pay by EFT, you may elect to pay by EFT. Or you may pay by check or money order. If paying by check or money order, make the check or money order payable to the Arizona Department of Revenue.

Arizona Form

NOTE: If this is an amended Form

NOTE: If this is an amended Form

required to make 2020 withholding payments by EFT, you must

required to make 2020 withholding payments by EFT, you must

also pay any additional withholding tax due from the amended

also pay any additional withholding tax due from the amended

return by EFT.

return by EFT.

Part 4 –

Schedule

If you checked the box in Part 2, Schedule B, complete Part 4 for each month you are required to make withholding deposits on a

Enter the amount of Arizona withholding tax liability on the day (of the month) the liability was incurred. Do not enter the amount of the withholding payment(s). Enter the total withholding liability for the month on the line labeled “Month 1, 2, or 3.”

EXAMPLE: Taxpayer R is a

EXAMPLE: Taxpayer R is a

incurred an Arizona tax withholding liability on the following

incurred an Arizona tax withholding liability on the following

dates in January 2020: January 3 - $1,500; January 17 -

dates in January 2020: January 3 - $1,500; January 17 -

$1,750; and January 31 - $1,600. In Schedule A, R enters

$1,750; and January 31 - $1,600. In Schedule A, R enters

$1,500 on line 3; R enters $1,750 on line 17; and R enters

$1,500 on line 3; R enters $1,750 on line 17; and R enters

$1,600 on line 31. On the line labeled “Month 1 Liability.” R

$1,600 on line 31. On the line labeled “Month 1 Liability.” R

enters the total tax liability for January 2020 - $4,850. R also

enters the total tax liability for January 2020 - $4,850. R also

enters this amount on Part 2, Schedule B, line B1.

enters this amount on Part 2, Schedule B, line B1.

Taxpayers with

EXAMPLE: Taxpayer R incurred an Arizona withholding tax

EXAMPLE: Taxpayer R incurred an Arizona withholding tax

liability on the following dates in February 2020: February 14

liability on the following dates in February 2020: February 14

- $2,350, and February 28 - $1,950. In addition, R incurred a

- $2,350, and February 28 - $1,950. In addition, R incurred a

federal

federal

enters $2,350 on line 14, and checks the box on line 14 to

enters $2,350 on line 14, and checks the box on line 14 to

indicate it incurred a

indicate it incurred a

28 liability on line 28 and does not check the box on line 28

28 liability on line 28 and does not check the box on line 28

because it did not incur a

because it did not incur a

liability for February 2020 - $4,300 on the line labeled “Month

liability for February 2020 - $4,300 on the line labeled “Month

2 Liability”. R also enters this amount on Part 2, Schedule B,

2 Liability”. R also enters this amount on Part 2, Schedule B,

line B2.

line B2.

Part 5 - Amended Return Information

If this is an amended return, explain why you are amending Form

Part 6 – Final Form

Lines 1 through 6 -

If you checked the Box C, “Final Return (CANCEL ACCOUNT)”, check the box that explains why this is your final return. If the reason is not provided, check “Other” and enter your own explanation.

Line 7 –

Check the box and provide name and location of your records if they will be kept at a different location from the address you provided in Part 1.

7

Line 8 –

Check the box and provide the name and address of the successor employer, if any.

Who Must Sign Form

The following persons are authorized to sign the return for each type of business entity.

•Sole proprietorship - The individual who owns the business.

•Corporation [including a limited liability company (LLC) treated as a corporation] - The president, vice president, or other principal officer duly authorized to sign.

•Partnership (including an LLC treated as a partnership) or unincorporated organization - A responsible and duly authorized member, partner, or officer having knowledge of its affairs.

•Single member LLC treated as a disregarded entity for federal income tax purposes - The owner of the LLC or a principal officer duly authorized to sign.

•Trust or estate - The fiduciary.

Form

8

Arizona Form

Paid Preparer Use Only

Paid preparers: Sign and date the return. Complete the firm name and address lines (the paid preparer’s name and address, if

Paid preparers must provide a Tax Identification Number (TIN). Paid preparers that fail to include their TIN may be subject to a penalty.

The TIN for a paid preparer may be one of the following:

•The preparer’s PTIN,

•The EIN for the business, or,

•The individual preparer’s social security number (SSN), if

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose of Form A1-QRT | Form A1-QRT is utilized for the purpose of reconciling Arizona income tax withheld from wages, pensions, and gambling winnings, serving both as a quarterly tax reconciliation form and as a payment transmittal for quarterly payments made by check or money order. |

| Filing Requirement | All employers, with the exception of those who remit withholding tax on an annual basis, are mandated to file Form A1-QRT to reconcile their withholding deposits on a quarterly basis, including quarters where no Arizona tax was withheld, until such a time the withholding registration is cancelled via a final Form A1-QRT submission. |

| Electronic Filing Mandate | For taxable periods beginning after December 31, 2019, or upon the establishment of an electronic filing system by the department, filing of withholding returns, including Form A1-QRT, must be done electronically, with the department offering three electronic filing methods as of 2020. |

| Deposit Schedules | Depending on the prior four-quarter average of Arizona income tax withheld, employers must follow specific deposit schedules which might be Quarterly, Monthly, or Semi-Weekly/Next Day Deposit Schedules, aligning with Federal deposit requirements for averages greater than $1,500. |

| Annual Deposit Schedule Eligibility | Employers meeting specific conditions, including an average quarterly Arizona tax withholding of $200 or less for the preceding four quarters and a specified filing and payment history, may qualify to make one annual Arizona withholding payment using Form A1-APR instead of Form A1-QRT. |

Guide to Writing Arizona Tax Return

Successfully handling your company's Arizona Quarterly Withholding Tax Return (Form A1-QRT) is crucial for meeting state tax obligations and avoiding penalties. This form reconciles the amounts withheld from employee wages with the total amounts deposited during the quarter. Whether you're making regular deposits or adjusting previous submissions, accurately completing this form is essential for compliance. Follow these steps to ensure your Form A1-QRT is filled out correctly and submitted on time.

- Part 1 - Taxpayer Information:

- Enter the legal name of your business.

- Fill in your Employer Identification Number (EIN).

- Provide the business address including number, street, city or town, state, and ZIP code.

- Specify the quarter and year by entering the desired quarter (1, 2, 3, or 4) and the four digits of the year accurately.

- Include your business's telephone number, including the area code.

- If applicable, check the box for any of the following: Amended Return, Address Change, or Final Return. If it's a final return, enter the date final wages were paid and complete Part 6 accordingly.

- Part 2 - Tax Liability Schedule:

- If your prior 4 quarter average was not more than $1,500, fill out Section A. Enter the total amount withheld during the quarter in A1 and also on Part 3, line 1.

- If your prior 4 quarter average was greater than $1,500 or you are a semi-weekly depositor, check the box for Semi-weekly/Next Day Deposit Schedule and complete Part 4. Then for B1 through B3, enter the total amount withheld for each month in the quarter. The sum of these amounts goes on line B4.

- Part 3 - Tax Computation:

- On line 1, enter the amount from line A1 or B4, depending on which section you completed.

- On line 2, list the total payments made during this quarter.

- For line 3, subtract line 2 from line 1 to determine the total amount due. Use a minus sign if this results in a negative amount.

- Declaration and Signature: Under the declaration section, the taxpayer or authorized representative must sign and date the form, affirming that the information provided is accurate to the best of their knowledge. If a paid preparer was used, they must also sign, date, and provide their PTIN along with their firm’s information.

- Make your payment: If you owe taxes, make your check payable to the Arizona Department of Revenue and include your EIN on the payment. Mail your return and payment to the designated address.

- Part 4 and Part 5 (If Applicable): Complete these sections if you are a semi-weekly/next day depositor or if you are filing an amended return, respectively. For final returns, ensure Part 6 is filled out to specify the reason for the final submission and provide any necessary details such as new recordkeeping addresses or information about a successor employer.

Consider reviewing the form instructions and the Arizona Department of Revenue’s website for further guidance on completing the A1-QRT. Timely and accurate filing ensures compliance with Arizona's tax regulations, helping to avoid audits, penalties, or interest due to errors or omissions.

Understanding Arizona Tax Return

What is the purpose of Form A1-QRT and who must file it?

Form A1-QRT, also known as the Arizona Quarterly Withholding Tax Return, is a mandatory filing for employers operating within Arizona. Its primary purpose is to reconcile the amount of Arizona income tax withheld from employees' wages during a quarter with the payments made during that period. This form serves multiple purposes, including functioning as the payment transmittal for quarterly tax payments when made by check or money order, and notifying the Arizona Department of Revenue that a business is ending its withholding registration. All employers, except those who submit payments annually, must file Form A1-QRT for each calendar quarter. This requirement applies even for quarters with zero withholding liability.

How are withholding payments reconciled using Form A1-QRT?

All Arizona withholding amounts, especially those averaging more than $200 per quarter, are reconciled using Form A1-QRT. The law treats all amounts withheld as if they were from wages paid to an employee. Employers must file a Form A1-QRT for every quarter, including those in which no Arizona income tax was withheld, by reporting a zero withholding liability. This process continues until an employer cancels their withholding registration with a final Form A1-QRT submission. Importantly, do not file more than one original A1-QRT per Employer Identification Number (EIN) for the same quarter.

What are the due dates for filing Form A1-QRT?

The due dates for filing Form A1-QRT correspond with the end of each fiscal quarter: April 30 for the first quarter, July 31 for the second, October 31 for the third, and January 31 for the fourth quarter. If a due date lands on a weekend or legal holiday, the filing is considered timely if submitted by the next business day. Employers who have made all their payments on time during the previous quarter can benefit from an extended 10-day grace period for filing their A1-QRT.

Can I use a Payroll Service Company (PSC) to file Form A1-QRT?

Yes, employers have the option to use a Payroll Service Company (PSC) to file Form A1-QRT on their behalf. If you choose to employ a PSC for this purpose, remember that the company must file your A1-QRT electronically. This service can simplify the filing process and help ensure accuracy and timeliness, allowing employers to focus on other aspects of their business operations.

What determines my deposit schedule for withholding taxes?

Your deposit schedule for Arizona withholding taxes is determined by the average amount of tax withheld during the previous four quarters. If the average was $1,500 or less, you are on a quarterly deposit schedule. However, if your average exceeded $1,500, you must follow the same deposit schedule as your federal taxes, which could be monthly, semi-weekly, or the next business day, depending on the total tax reported in the federal lookback period. It is crucial to reassess your deposit schedule at the start of each quarter to ensure compliance with the current requirements.

Common mistakes

Filling out more than one original Form A1-QRT per Employer Identification Number (EIN) per quarter is a common mistake. Taxpayers should ensure they file a single original form for each EIN to avoid complications. This is crucial especially if the business experiences changes or needs to amend previously submitted information.

Not properly selecting the correct deposit schedule (Quarterly, Monthly, Semi-Weekly/Next Day) according to the prior 4 quarter average. If the previous average was not more than $1,500, the Quarterly Deposit Schedule applies. Otherwise, for averages greater than $1,500, the business should follow the Monthly or Semi-Weekly/Next-Day Deposit Schedule. It's vital to check the correct box to avoid underpayment or late payment penalties.

Incorrectly reporting the total amount withheld during the quarter on Part 3, line 1, can lead to discrepancies. The amount from line A1 or B4 must match the liability entered. Misreporting these figures could either inflate the tax liability or underreport the accurate amount due, leading to potential audits or fines.

Omitting the signature and date on the declaration section signifies non-compliance with the attestation that the return is true, complete, and correct. The lack of a taxpayer's signature or the paid preparer’s details, including the date, renders the return incomplete and subject to rejection or a request for resubmission.

Forgetting to check and complete relevant boxes in Part 1 for amended return, address change, or final return scenarios. This might lead to mishandling or incorrect processing of the return by the Arizona Department of Revenue. Specifically, if it’s the final return, indicating the reason and the final wages payment date is essential.

Remember: Accuracy and attention to detail when completing the Arizona Quarterly Withholding Tax Return, Form A1-QRT, are paramount. Avoiding these mistakes ensures compliance, timely processing, and prevents possible penalties or added scrutiny from the tax authority.

Documents used along the form

When managing Arizona tax responsibilities, especially for businesses or individuals with complex situations, a thorough understanding of not only Arizona Form A1-QRT but also additional requisite forms and documents is crucial. The following is a detailed list of forms and documents that are often used together with the Arizona Tax Return form to ensure compliance and thoroughness in tax matters.

- Arizona Form A-4: This is an Employee’s Arizona Withholding Election form. Employees use this form to choose their state income tax withholding percentage.

- Arizona Form A1-R: Used for Annual Withholding Tax Reconciliation, which employers must file annually to report the total wages paid and Arizona income tax withheld from their employees’ wages.

- Arizona Form A1-APR: Employers who qualify and choose to pay their withholding tax on an annual basis use this Annual Payment Withholding Tax Return form.

- Arizona Form 1099-G: This document is issued to individuals by the government to report certain types of payments, including unemployment compensation and state or local income tax refunds.

- Arizona Form 1099-MISC: Employers use this form to report miscellaneous income, such as rents, royalties, or payments for services performed by someone who is not an employee.

- Arizona Form W-2: The Wage and Tax Statement form, which employers must provide to employees and the IRS at the end of the year, detailing the employee's income and taxes withheld.

- Arizona Form 202: Application for Extension of Time for Filing State Income Tax Returns. Businesses or individuals expecting a delay in filing their tax returns use this form to request an extension.

- Arizona Form 140: This is the Individual Income Tax Return form for Arizona residents. It is used to file an annual income tax return.

- Arizona Form 202: Application for Extension of Time for Filing State Income Tax Returns. Individuals and businesses utilize this when they need an extension beyond the due date to file their taxes.

- Arizona Form 300: Payment Voucher for Income Tax Returns. This is used together with payments for taxes owed on filed returns.

- Arizona Form 285: General Disclosure/Representation Authorization Form. This grants permission for a representative to obtain confidential tax information.

Each of these forms and documents plays a vital role in ensuring accurate reporting and compliance with Arizona's tax laws. Whether you are an employer handling payroll taxes or an individual preparing for tax season, understanding the purpose and requirements of these forms will help streamline the tax filing process.

Similar forms

The Arizona Tax Return form, specifically the Arizona Quarterly Withholding Tax Return (Form A1-QRT), provides an excellent illustration of a document that integrates multiple components of financial data, much like several other key financial documents used within the United States. By comparing this form to other financial documents, one can appreciate its complexity and the essential role it plays in tax administration and compliance.

Firstly, the 1040 U.S. Individual Income Tax Return shares similarities with the Arizona Form A1-QRT, as both require detailed taxpayer information, including income and deductions. Both forms calculate tax liability and potential refunds or amounts due. Where the 1040 form focuses on individual taxpayers on an annual basis, the A1-QRT targets employers' quarterly payroll tax withholding.

The W-2 Wage and Tax Statement also bears a resemblance to the Arizona Form A1-QRT. Employers issue Form W-2 to employees and the IRS to report annual wages and taxes withheld. Like the A1-QRT, the W-2 captures details on income and taxes withheld, albeit from a different perspective - annually and employee-focused, versus quarterly and employer-focused.

Form 941, the Employer's Quarterly Federal Tax Return, is another document closely aligned with Arizona's A1-QRT. Both are quarterly filings, with Form 941 detailing federal income, social security, and Medicare taxes employers have withheld. Each serves as a reconciliation of taxes withheld from employees’ wages, highlighting the employers' role in tax collection and remittance.

State Unemployment Tax Act (SUTA) filings, although varying by state, offer another comparison. Similar to the A1-QRT, these documents require employers to report wages and calculate taxes due for unemployment insurance. The focus is on payroll and employment, underscoring the relationship between labor and tax obligations.

The Annual Federal Unemployment Tax Act (FUTA) Tax Return, Form 940, also shares similarities with the A1-QRT. Both address employer responsibilities regarding employment taxes, albeit the A1-QRT is more frequent and focuses on state-level taxes, while Form 940 addresses federal unemployment taxes annually.

Form 1099-MISC, Misc Income, is used to report various types of non-employee compensation to the IRS. Like the A1-QRT, it deals with reporting income and associated taxes, though from the perspective of independent contractors and other non-traditional employment relationships, expanding the scope of what is considered taxable income.

Last but not least, the W-4 Employee’s Withholding Certificate, while not a return or a tax calculation form, indirectly influences the data entered on the A1-QRT. By determining the amount of federal income tax to withhold from employees' paychecks, the W-4 has a downstream effect on the quarterly tax liability reported on the A1-QRT, illustrating the interconnected nature of tax documentation.

Understanding these documents and how they interact with one another is crucial for both individuals and businesses navigating the complexities of tax compliance. Each form, while serving unique purposes, plays an integral role in ensuring the accurate collection and remittance of taxes, ultimately funding public goods and services.

Dos and Don'ts

When completing the Arizona Tax Return form, it's critical to ensure accuracy and compliance. Below are guidelines to follow:

- Do ensure you file for each quarter, even if no tax was withheld. This includes reporting zero (0) withholding liability if applicable.

- Do not submit more than one original A1-QRT form per EIN per quarter.

- Do choose the correct deposit schedule based on your prior 4 quarter average withholding.

- Do not complete both Section A and Section B on the Tax Liability Schedule. Only one section should be completed based on your deposit schedule.

- Do sign and date the return. An unsigned return can lead to processing delays or be considered invalid.

- Do not mark in the "REVENUE USE ONLY" area. This section is reserved for official use.

- Do include all required information, such as your Employer Identification Number (EIN) and business address.

- Do not forget to include your contact information, ensuring the department can reach you if necessary.

- Do use the amended return box wisely if you need to correct previously submitted information, ensuring you clearly explain why an amended Form A1-QRT is being filed.

Compliance and attention to detail when filling out the Arizona Tax Return form A1-QRT are essential to avoid processing issues, penalties, or other complications.

Misconceptions

Many misconceptions surround the Arizona Form A1-QRT, which can lead to errors and misunderstandings among filers. Below are ten common misconceptions corrected to ensure accurate filing:

- Every employer needs to file Form A1-QRT regardless of their withholding amount. This is incorrect. Only employers who have a withholding obligation, except those eligible to file and pay on an annual basis using Form A1-APR, need to file A1-QRT.

- Zero withholding means you don't need to file Form A1-QRT. This is a misconception. Employers must file Form A1-QRT for every quarter, even if no Arizona income tax was withheld during that period, until they cancel their withholding registration with a final Form A1-QRT.

- Form A1-QRT is used solely for reporting wages paid. This is not accurate. The form reconciles all Arizona withholding amounts, including those from wages, salaries, pensions, annuities, and gambling winnings.

- The form can be filed multiple times per quarter if corrections are needed. Incorrect. Only one original A1-QRT should be filed per EIN per quarter. For corrections, an amended return is filed.

- Payment schedules are the same for every employer. This is false. The deposit schedule - whether quarterly, monthly, or semi-weekly - is determined by the average amount withheld in the prior four quarters.

- Electronic filing is optional for all employers. Misleading. While the document suggests electronic filing is encouraged, for taxable years beginning after December 31, 2019, returns shall be filed electronically as mandated or when an electronic filing system is available.

- You cannot use a payroll service company (PSC) to file Form A1-QRT. This is incorrect. Employers may use a PSC, and the PSC must file electronically if this service is chosen.

- Amended returns and final returns are the same. Not true. An amended return is filed to correct information on a previously filed A1-QRT. A final return is filed when an employer is terminating its withholding account.

- The form is only for businesses with employees. Incorrect. It applies to all entities with an Arizona withholding obligation, including those making certain non-wage payments that require withholding.

- Filing Form A1-QRT is separate from federal withholding tax requirements. Misunderstood. While it's a state requirement, the form's deposit schedules and liability computations are influenced by federal deposit schedules and requirements.

Understanding these distinctions is crucial for accurate compliance and avoiding penalties associated with the Arizona Form A1-QRT. Employers should review the form's instructions thoroughly and consult the Arizona Department of Revenue's resources or a tax professional if they have specific questions or concerns about their filing obligations.

Key takeaways

When dealing with the Arizona Quarterly Withholding Tax Return (Form A1-QRT), it’s important to keep in mind the following key points:

- Filing more than one original A1-QRT per Employer Identification Number (EIN) per quarter is not allowed.

- Employers must accurately report the quarter and year for which they are filing, using the designated section for entering the quarter (1, 2, 3, or 4) followed by the four digits of the year.

- It is crucial to check the appropriate box in Part 1 if filing an amended return, noting an address change, indicating a final return (which results in account cancellation), or if filing as a surviving employer for a period of less than three months.

- Employers must include all withholding amounts from various sources like wages, pensions, annuities, and gambling winnings in the Tax Liability Schedule.

- Depending on their prior 4-quarter average withholding amount, employers will follow either a quarterly or a monthly/semi-weekly/next day deposit schedule.

- Form A1-QRT serves several purposes: it acts as the payment transmittal for quarterly payments made via check or money order, it assists in reconciling amounts withheld during the quarter with amounts paid, and it serves as a written notice for cancelling withholding registration.

- The form needs to be filed every quarter, even if no Arizona income tax was withheld during that period. For such cases, employers should file showing zero withholding liability.

- Employers meeting certain conditions may make annual withholding payments and file using Form A1-APR, eliminating the need for quarterly filings of Form A1-QRT.

Understanding each section and requirement of the Form A1-QRT is vital to ensure compliance with Arizona state tax laws and to avoid common mistakes that could lead to penalties or processing delays. Always refer to the latest instructions released by the Arizona Department of Revenue to accommodate any updates or changes in filing procedures.

Popular PDF Documents

What Is a Pay Off Letter - Your mortgage's finish line is in sight. The Loan Payoff Request form will guide you there.

Irs 1040A - The 1040A form is an intermediary option between the 1040EZ and the full 1040 form.