Get Arizona Joint Tax Application Form

Navigating through the various requirements for starting or maintaining a business in Arizona, the Joint Tax Application form emerges as an essential document, streamlining the process of registering for multiple tax responsibilities under one application. This document, crafted to be utilized by businesses of all sizes and structures, facilitates the application for Transaction Privilege Tax (TPT), Use Tax, and Withholding and Unemployment Taxes. Businesses are required to meticulously complete each section to avoid delays, with separate provisions for each tax type indicating the broad coverage of this unified application. Aimed at simplifying the bureaucratic process, it caters to a range of ownership types and provides a clear channel for addressing licensing questions and application submissions directly to the Arizona Department of Revenue and the Department of Economic Security. Additionally, the application includes segments for identifying business owners or corporate officers, outlining employment information, and even allows for the voluntary election of unemployment tax coverage, emphasizing the state's effort to accommodate diverse business needs within its economic landscape. The structured application process, complete with instructions for submission and fees calculation, underlines Arizona's commitment to fostering a conducive environment for business operation and growth.

Arizona Joint Tax Application Example

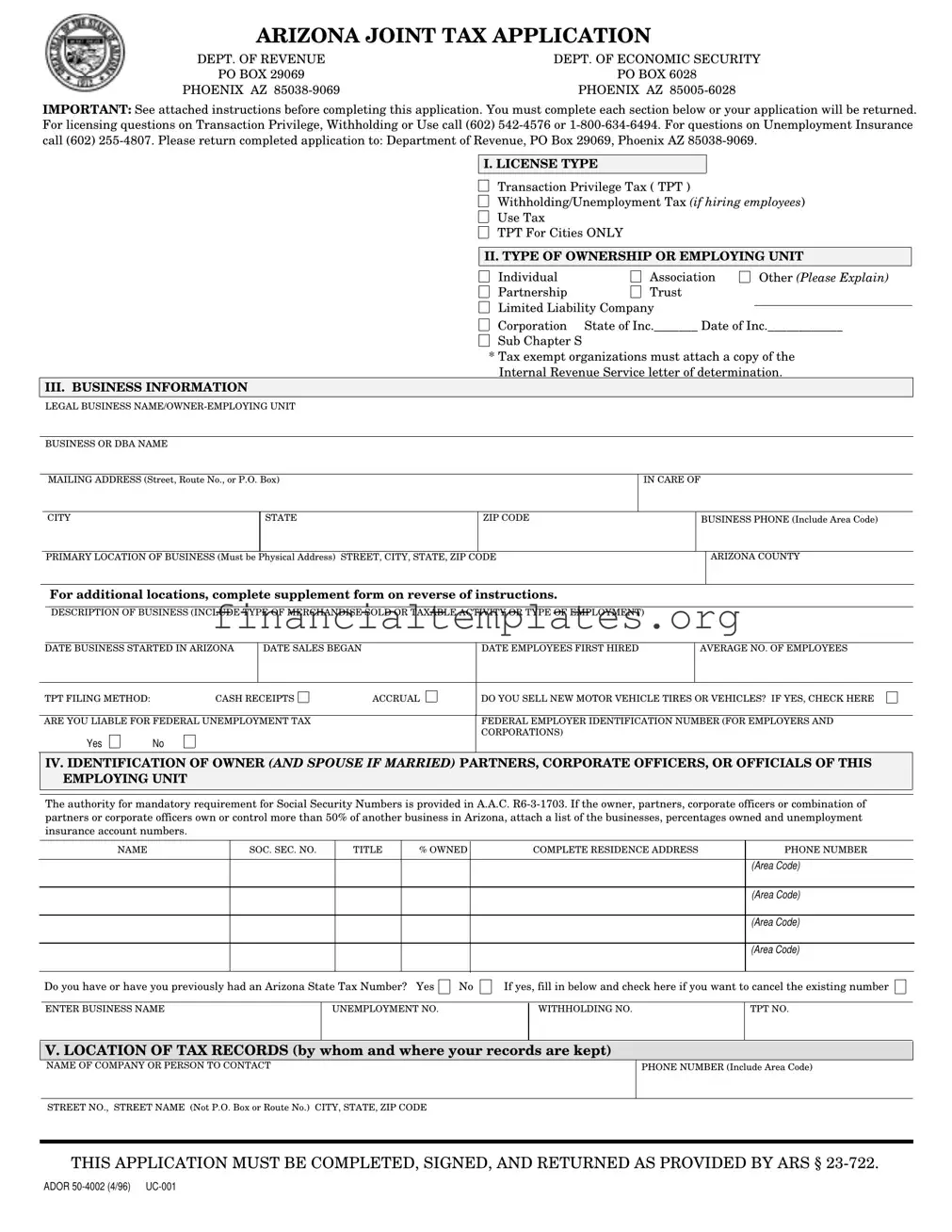

ARIZONA JOINT TAX APPLICATION

DEPT. OF REVENUE |

DEPT. OF ECONOMIC SECURITY |

|

PO BOX |

29069 |

PO BOX 6028 |

PHOENIX AZ |

PHOENIX AZ |

|

IMPORTANT: See attached instructions before completing this application. You must complete each section below or your application will be returned. For licensing questions on Transaction Privilege, Withholding or Use call (602)

I. LICENSE TYPE

Transaction Privilege Tax ( TPT )

Withholding/Unemployment Tax (if hiring employees)

Use Tax

TPT For Cities ONLY

II. TYPE OF OWNERSHIP OR EMPLOYING UNIT

Individual |

Association |

Partnership |

Trust |

Limited Liability Company

Other (Please Explain)

Corporation State of Inc._______ Date of Inc.____________

Sub Chapter S

* Tax exempt organizations must attach a copy of the Internal Revenue Service letter of determination.

III. BUSINESS INFORMATION

LEGAL BUSINESS

BUSINESS OR DBA NAME

MAILING ADDRESS (Street, Route No., or P.O. Box)

IN CARE OF

CITY

STATE

ZIP CODE

BUSINESS PHONE (Include Area Code)

PRIMARY LOCATION OF BUSINESS (Must be Physical Address) STREET, CITY, STATE, ZIP CODE

ARIZONA COUNTY

For additional locations, complete supplement form on reverse of instructions.

DESCRIPTION OF BUSINESS (INCLUDE TYPE OF MERCHANDISE SOLD OR TAXABLE ACTIVITY OR TYPE OF EMPLOYMENT)

|

|

|

|

|

|

|

DATE BUSINESS STARTED IN ARIZONA |

DATE SALES BEGAN |

|

DATE EMPLOYEES FIRST HIRED |

AVERAGE NO. OF EMPLOYEES |

||

|

|

|

|

|

|

|

TPT FILING METHOD: |

CASH RECEIPTS |

ACCRUAL |

DO YOU SELL NEW MOTOR VEHICLE TIRES OR VEHICLES? IF YES, CHECK HERE |

|||

|

|

|

|

|||

ARE YOU LIABLE FOR FEDERAL UNEMPLOYMENT TAX |

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FOR EMPLOYERS AND |

||||

|

|

|

|

|

CORPORATIONS) |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

IV. IDENTIFICATION OF OWNER (AND SPOUSE IF MARRIED) PARTNERS, CORPORATE OFFICERS, OR OFFICIALS OF THIS EMPLOYING UNIT

The authority for mandatory requirement for Social Security Numbers is provided in A.A.C.

NAME |

SOC. SEC. NO. |

TITLE |

% OWNED |

COMPLETE RESIDENCE ADDRESS |

PHONE NUMBER |

(Area Code)

(Area Code)

(Area Code)

(Area Code)

Do you have or have you previously had an Arizona State Tax Number? Yes

No

If yes, fill in below and check here if you want to cancel the existing number

ENTER BUSINESS NAME

UNEMPLOYMENT NO.

WITHHOLDING NO.

TPT NO.

V. LOCATION OF TAX RECORDS (by whom and where your records are kept)

NAME OF COMPANY OR PERSON TO CONTACT

PHONE NUMBER (Include Area Code)

STREET NO., STREET NAME (Not P.O. Box or Route No.) CITY, STATE, ZIP CODE

THIS APPLICATION MUST BE COMPLETED, SIGNED, AND RETURNED AS PROVIDED BY ARS §

ADOR

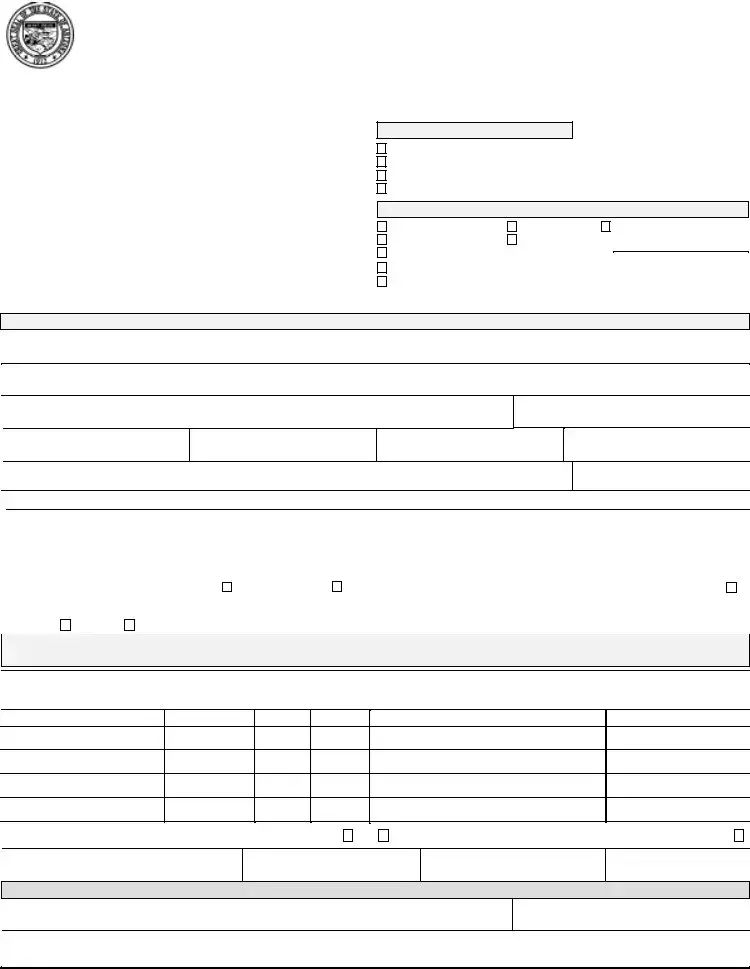

DES |

THIS BOX FOR AGENCY USE ONLY |

DOR |

|

|

|

NEW |

CHANGE |

REVISE |

REOPEN |

SIC __________ |

ACCT NO ______________ CTY CD __________ LIAB __________ TLAPSE________ |

||||

START ___________________________ LIAB EST _______________________________ |

||||

REPORTS |

|

S/E DATE |

KP |

|

TPT _______________________________________________________________

W H _______________________________________________________________

CITIES ____________ ___________ ___________ ___________ ___________

VI. PREVIOUS OWNERS (complete if you are acquiring an existing business)

Did you acquire all or part of an existing business? No |

Yes |

If yes, indicate date ________________________________ and whether you acquired: |

ALL business operations and locations in Arizona. |

You will receive the unemployment tax rate of the business you acquired. |

|

PART of the business.To apply for a portion of the prior owner's unemployment tax rate call to obtain form

NAME OF PREVIOUS OWNER

PREVIOUS OWNER'S PRESENT ADDRESS

PREVIOUS OWNER'S CURRENT PHONE NO.

UNEMPLOYMENT NO.

WITHHOLDING NO.

TPT NO.

VII. EMPLOYMENT INFORMATION (complete only if applying for withholding/unemployment tax license)

Record of Arizona wages paid by calendar quarters for current and preceding calendar years.

YEAR

19

19

1ST QUARTER

2ND QUARTER

3RD QUARTER

4TH QUARTER

Weekly record of number of persons performing services in Arizona for current & preceding calendar year.

YEAR |

JANUARY |

FEBRUARY |

MARCH |

APRIL |

MAY |

JUNE |

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

JULY |

AUGUST |

SEPTEMBER |

OCTOBER |

NOVEMBER |

DECEMBER |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

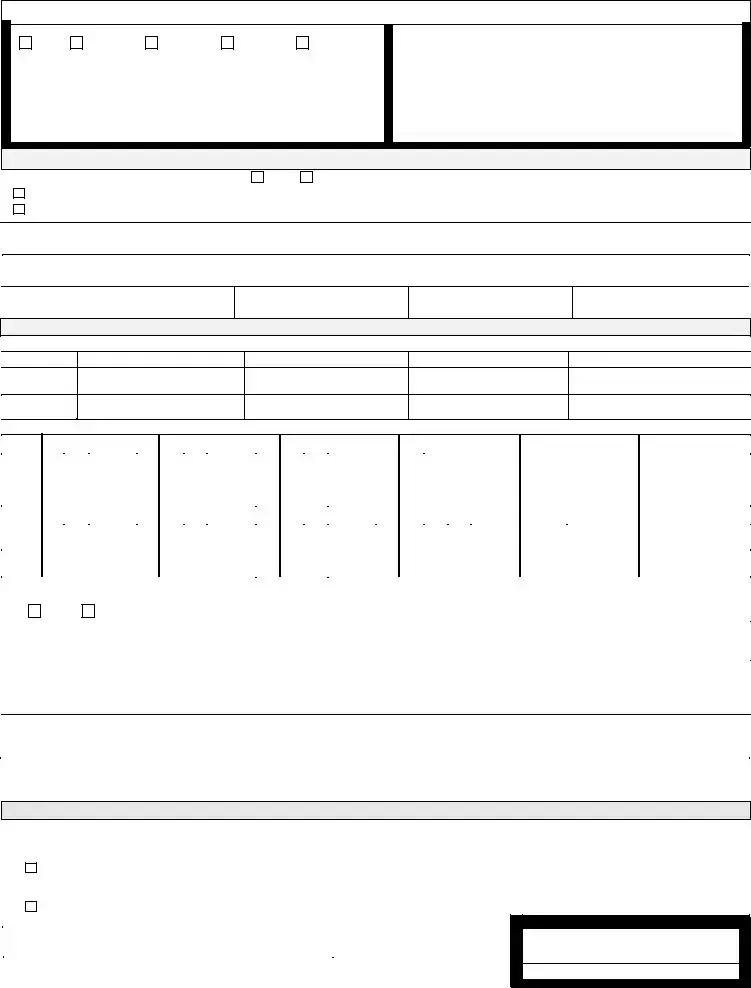

VIII. ARE INDIVIDUALS PERFORMING SERVICES THAT ARE EXCLUDED FROM WITHHOLDING OR UNEMPLOYMENT TAX? |

||||||||||||||||||||||||||

No |

Yes |

|

|

If yes, explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

IX. FEES FOR TRANSACTION PRIVILEGE TAX (no fee for withholding, use or unemployment) |

|

|

|

|

|

|

|

|

||||||||||||||||||

State Fees (# loc. x $12.00): |

City Fees (Total from Table): |

Total Fees: |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

X. SIGNATURE(S) required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This application must be signed by either a sole owner, two partners, two corporate officers, the trustee, receiver or personal representative of an estate.

UNDER PENALTY OF PERJURY I (WE) DECLARE THAT THE INFORMATION ON THIS DOCUMENT IS TRUE AND CORRECT.

TYPE OR PRINT NAME |

TITLE |

SIGNATURE |

DATE |

|

|

|

|

TYPE OR PRINT NAME |

TITLE |

SIGNATURE |

DATE |

XI. VOLUNTARY ELECTION OF UNEMPLOYMENT TAX COVERAGE

The undersigned, on behalf of the employing unit, voluntarily elects beginning January 1 of the current calendar year or the date employment started if later, and continuing for not less than two full calendar years to:

A. Become an employer subject to Title 23, Chapter 4, Arizona Revised Statutes, to the same extent as all other employers and extend unemployment tax coverage to my employees although not mandatory.

B. Extend coverage to all employees performing services excluded from coverage as shown in Section IX above.

SIGNATURE/TITLE |

DATE |

|

|

ADOR |

UC - 001 |

AGENCY USE ONLY

APPROVED/DATE

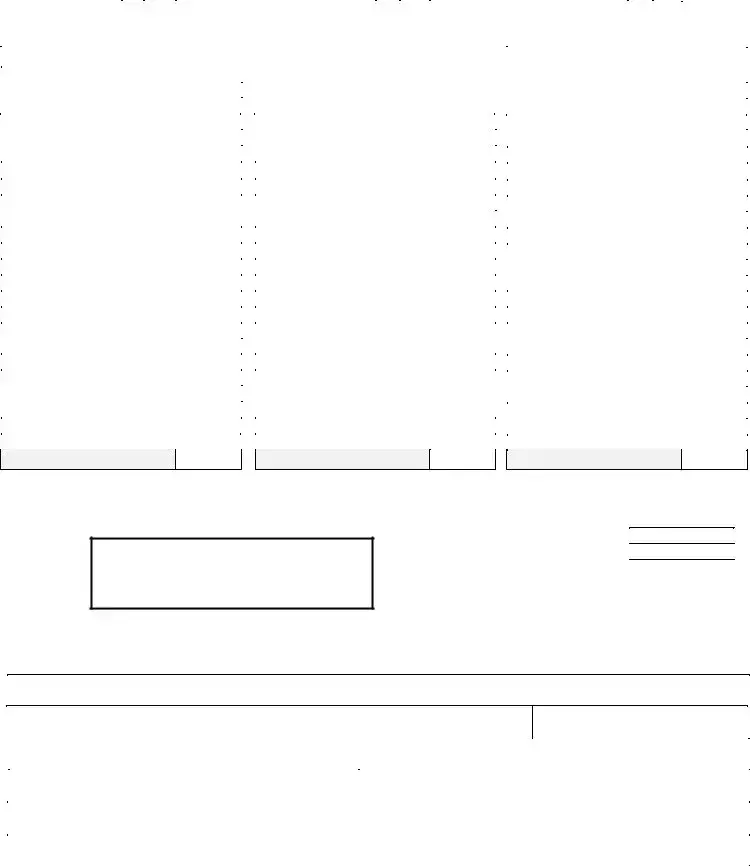

INSTRUCTIONS FOR JOINT TAX APPLICATION

IMPORTANT: You must complete each of the following sections or your application will be returned

USE THIS APPLICATION TO:

·License New Business: A new business with no previous owners.

·Change Ownership: If purchasing an existing business or changing business entity (sole owner to corporation, etc.).

If you need to update a license, add a business location, or make other

changes: Request an update card or provide a written notification of the change (a form is not necessary). Please include fees of $12 per location plus applicable city fee(s).

I.LICENSE TYPE

Transaction Privilege Tax (TPT): Anyone involved in an activity taxable under the TPT statutes must apply for a TPT License before engaging in business.

·For TPT, you are required to obtain a separate license for each business or rental location. This may be accomplished in one of the following ways:

·Each location may be licensed as a separate business with a separate license number for purpose of reporting sales and use taxes individually. Therefore a separate application is needed for each location.

Multiple locations may be licensed under a consolidated license number, provided the ownership is the same, to allow filing of a single tax return. If applying for a new license, list the various business locations as instructed below. If already licensed and you are adding locations, do not use this application to consolidate an existing license. Request on update form.

Please Note: Applicants in the construction contracting business may be required to submit bonds for TPT tax before a transaction privilege license is issued. The amount of bond required is based on the type of construction performed. Please see the Department of Revenue Taxpayer Bonds brochure for more information.

In addition, bonds are required for new license holders for construction contracts over $50,000, before building permits can be issued. TPT license holders who are delinquent in payment of tax or returns are also subject to bonding.

Withholding & Unemployment Taxes: Employers paying wages or salaries to employees for services performed in the State must apply for a Withholding number & Unemployment number.

Use Tax:

TPT for cities only: This type of license is needed if your business activity is subject to city TPT that is collected by the state, but the activity is not taxed at the state level.

Many of the larger cities in Arizona administer and collect their own privilege taxes. Please contact those cities directly to

obtain information about licensing requirements.

II.TYPE OF OWNERSHIP OR EMPLOYMENT UNIT

Check as applicable. Corporation must provide the state and date of incorporation.

III.BUSINESS INFORMATION

·Enter the Legal Business Name of the Owner or Employing Unit (Name of corporation as listed in its articles of incorporation, or individual & spouse, or partners, or organization owning or controlling the business).

·Enter the name of the Business/DBA (doing business as) name, if same as above, enter "same."

·Enter mailing address where all correspondence is to be sent. You may use

your home address, corporate headquarters, or accounting firm's address, etc. If mailing addresses differ for licenses (for instance withholding and unemployment insurance), please use cover letter to explain.

·If you wish correspondence to be sent to a name other than the owner, enter the name of the department or accountancy firm in the "In care of" box to ensure delivery by the postal service.

·Enter the street address for the primary location(s) of the business. For additional

business location(s) complete the supplemental form on the reverse side of the instructions.

·Describe the major business activity:

principal product you manufacture, commodity sold, or services performed. Your description of the business is very important because it determines your transaction privilege tax rate and provides a basis for state economic forecasting.

·Enter the date the business started in Arizona.

·Enter the date sales began in Arizona.

·Enter the date employees were first hired in Arizona and the average number of employees.

·Cash/Accrual Methods: Cash method requires the payment of tax based on sales receipts actually received during the period covered on the tax return. When filing under the accrual method, the tax is calculated on the sales billed rather than receipts.

·Sellers of new motor vehicles and motor vehicle tires in the state, for

·Indicate whether you are liable for FUTA

and enter your Federal Employer Identification number.

·Taxpayers are required to provide their taxpayer identification number (TIN) on all returns and documents. A TIN is defined as the federal employer identification number (EIN), or social security number (SSN) depending upon how income tax is reported. Employers must provide their federal EIN. A penalty of $5 will be assessed for each document filed without a TIN.

IV. IDENTIFICATION OF OWNER(S)

Enter as many as applicable; attach a separate sheet if additional space is needed.

V.LOCATION OF TAX RECORDS

Complete as indicated.

VI. PREVIOUS OWNERS

Complete this section if you acquired an existing business.

VII. EMPLOYMENT INFORMATION

Enter total gross wages paid for each quarter the business has operated. Enter the number of persons performing services each week the business operated.

VIII. COMPLETE AS APPLICABLE

IX. FEES

There are no fees for Withholding, Unemployment, or Use Tax registrations. To calculate the fees for TPT ($12) licenses, calculate the State fees by multiplying the number of locations in the state by $12. To calculate the city(ies) fee, use the table on the reverse of instructions. First, indicate the number of businesses or physical locations for each of the cities for which the Department of Revenue licenses and collects. Then multiply by the city fee for each city in which you will do business. Add the columns to determine the total city fees. Fill in the totals for state fees and city fees on the application form and total to determine the amount due. Make checks payable to the Arizona Department of

Revenue. Be sure to return the instruction/fees sheet with your application.

To obtain licensing for cities not listed on the form, please contact the city directly.

X.SIGNATURES

The application must be signed only by individuals legally responsible for the business, not agents or representatives.

XI. VOLUNTARY ELECTION OF UN- EMPLOYMENT TAX COVERAGE

Complete and sign this portion of the application ONLY if you wish to provide unemployment coverage to your employees, and you believe you are not REQUIRED to provide coverage. Refer to "A Guide to Arizona Employment Tax Requirements" or "Employers' Handbook" for requirements.

ADOR

CITIES OR TOWNS LICENSED BY THE STATE

|

C |

F |

TOTAL |

|

|

C |

F |

TOTAL |

|

|

C |

F |

TOTAL |

|

O |

|

|

O |

|

|

O |

||||||

CITY/TOWN |

E |

FEES |

|

CITY/TOWN |

E |

FEES |

|

CITY/TOWN |

E |

||||

D |

|

D |

|

D |

FEES |

||||||||

|

E |

|

|

|

E |

|

|

|

E |

||||

|

E |

|

|

|

E |

|

|

|

E |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

APACHE JUNCTION |

AJ |

2.00 |

|

|

GLOBE |

GL |

2.00 |

|

|

SAFFORD |

SF |

2.00 |

|

BENSON |

BS |

5.00 |

|

|

GOODYEAR |

GY |

5.00 |

|

|

SAHUARITA |

SA |

5.00 |

|

BISBEE |

BB |

1.00 |

|

|

GUADALUPE |

GU |

2.00 |

|

|

SAN LUIS |

SU |

2.00 |

|

BUCKEYE |

BE |

2.00 |

|

|

HAYDEN |

HY |

5.00 |

|

|

SEDONA |

SE |

2.00 |

|

BULLHEAD CITY |

BH |

2.00 |

|

|

HOLBROOK |

HB |

1.00 |

|

|

SHOW LOW |

SL |

2.00 |

|

CAMP VERDE |

CE |

2.00 |

|

|

HUACHUCA CITY |

HC |

2.00 |

|

|

SIERRA VISTA |

SR |

1.00 |

|

CAREFREE |

CA |

10.00 |

|

|

JEROME |

JO |

2.00 |

|

|

SNOWFLAKE |

SN |

2.00 |

|

CASA GRANDE |

CG |

2.00 |

|

|

KEARNY |

KN |

2.00 |

|

|

SOMERTON |

SO |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAVE CREEK |

CK |

20.00 |

|

|

KINGMAN |

KM |

2.00 |

|

|

SOUTH TUCSON |

ST |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHINO VALLEY |

CV |

2.00 |

|

|

LAKE HAVASU |

LH |

5.00 |

|

|

SPRINGERVILLE |

SV |

5.00 |

|

CLARKDALE |

CD |

2.00 |

|

|

LITCHFIELD PARK |

LP |

2.00 |

|

|

ST. JOHNS |

SJ |

2.00 |

|

CLIFTON |

CF |

2.00 |

|

|

MAMMOTH |

MH |

2.00 |

|

|

SUPERIOR |

SI |

2.00 |

|

COLORADO CITY |

CC |

2.00 |

|

|

MARANA |

MA |

5.00 |

|

|

SURPRISE |

SP |

10.00 |

|

COOLIDGE |

CL |

2.00 |

|

|

MIAMI |

MM |

2.00 |

|

|

TAYLOR |

TL |

2.00 |

|

COTTONWOOD |

CW |

2.00 |

|

|

ORO VALLEY |

OR |

12.00 |

|

|

THATCHER |

TC |

2.00 |

|

DOUGLAS |

DL |

5.00 |

|

|

PAGE |

PG |

2.00 |

|

|

TOLLESON |

TN |

2.00 |

|

DUNCAN |

DC |

2.00 |

|

|

PARADISE VALLEY |

PV |

2.00 |

|

|

TOMBSTONE |

TS |

1.00 |

|

EAGAR |

EG |

10.00 |

|

|

PARKER |

PK |

2.00 |

|

|

WELLTON |

WT |

2.00 |

|

EL MIRAGE |

EM |

2.00 |

|

|

PAYSON |

PS |

2.00 |

|

|

WICKENBURG |

WB |

2.00 |

|

ELOY |

EL |

10.00 |

|

|

PIMA |

PM |

2.00 |

|

|

WILLCOX |

WC |

1.00 |

|

FLORENCE |

FL |

2.00 |

|

|

PINETOP/LAKESIDE |

PP |

2.00 |

|

|

WILLIAMS |

WL |

2.00 |

|

FOUNTAIN HILLS |

FH |

2.00 |

|

|

PRESCOTT VALLEY |

PL |

2.00 |

|

|

WINKELMAN |

WM |

2.00 |

|

FREDONIA |

FD |

10.00 |

|

|

QUARTZSITE |

QZ |

2.00 |

|

|

WINSLOW |

WS |

10.00 |

|

GILA BEND |

GI |

2.00 |

|

|

QUEEN CREEK |

QC |

2.00 |

|

|

YOUNGTOWN |

YT |

10.00 |

|

GILBERT |

GB |

2.00 |

|

|

|

|

|

|

|

YUMA |

YM |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

TOTAL

TOTAL

FOR CITIES NOT LISTED, PLEASE CONTACT THE CITY DIRECTLY

PLEASE NOTE:

City fees are subject to change occasionally.

You will be billed for the difference.

Total of City Fees: State Fees $12.00 x No. Loc.:

TOTAL FEES:

FOR ADDITIONAL LOCATIONS, COMPLETE THE FOLLOWING:

Name Doing Business As at this Location

Physical Location (not P.O. Box or Rte. No.)

Telephone No.

|

City |

County |

State |

ZIP Code |

|

Avg. No. of Employees |

|

|

|

|

|

|

|

|

|

|

Name Doing Business As at this Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical Location (not P.O. Box or Rte. No.) |

|

|

|

Telephone No. |

|

||

|

|

|

|

|

|

|

|

|

City |

County |

State |

ZIP Code |

|

Avg. No. of Employees |

|

|

|

|

|

|

|

|

|

If more space is needed, please attach additional sheet.

ADOR

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose of the Form | Used for licensing new businesses, changing ownership, or updating existing business information with the Arizona Department of Revenue and Department of Economic Security. |

| Governing Laws | Governed by Arizona Revised Statutes and the Arizona Administrative Code, specifically under ARS § 23-722 for unemployment insurance coverage and other related tax liabilities. |

| Mandatory Sections | All sections must be completed for the application to be processed; incomplete applications will be returned. |

| Licensing for Different Taxes | Includes applications for Transaction Privilege Tax, Use Tax, Withholding/Unemployment Tax, and TPT for specific cities administered by the state. |

| Fee Structure | No fees for Withholding, Unemployment, or Use Tax registrations. TPT licenses require a fee of $12 per location plus applicable city fees. |

| Signature Requirement | The application must be signed by legally responsible individuals, such as a sole owner, partners, or corporate officers. |

Guide to Writing Arizona Joint Tax Application

When it's time to get your business up and running in Arizona, filling out the Joint Tax Application is a crucial step. This document is essential for registering your business with the Arizona Department of Revenue and the Department of Economic Security if you plan on hiring employees. Whether you're setting up a new company, taking ownership of an existing one, or simply need to make official changes to your business's tax information, this form covers multiple bases including Transaction Privilege Tax, Use Tax, Withholding, and Unemployment Insurance.

Here are the steps to fill out the Arizona Joint Tax Application form correctly:

- Review the form and attached instructions thoroughly before starting. Understanding every section will help you fill it out accurately.

- Decide the license type you need: Transaction Privilege Tax, Withholding/Unemployment Tax, Use Tax, or TPT for Cities ONLY.

- Select the type of ownership or employing unit your business falls under, such as Individual, Corporation, LLC, etc. If you choose Corporation, remember to provide the state of incorporation and the incorporation date.

- Enter all relevant business information, including the legal business name/owner-employing unit, DBA name if applicable, mailbox address, and the physical primary business location.

- Clearly describe the nature of your business, the type of merchandise sold or services offered, the date the business started in Arizona, sales start date, employee hiring start date, and average number of employees.

- Choose the correct TPT filing method for your business: Cash Receipts or Accrual.

- Indicate if your business sells new motor vehicle tires or vehicles, which requires checking the corresponding box.

- Provide identification information for the owner(s), partner(s), and/or corporate officer(s), including names, Social Security Numbers, titles, ownership percentages, complete residence addresses, and phone numbers.

- If applicable, list any previous Arizona State Tax Numbers under the business name and indicate if you want to cancel the existing number.

- Specify where the tax records are located by giving the contact name, phone number, and physical address (not a P.O. Box).

- If your business is acquiring an existing business, complete the section regarding previous owners and indicate whether it's a partial or complete acquisition.

- Fill out the employment information section if applying for withholding/unemployment tax license (include wages paid by quarters and weekly records of number of people performing services).

- Answer whether individuals performing services are excluded from withholding or unemployment tax, and if so, provide an explanation.

- Calculate and enter the fees for TPT; note that there are no fees for withholding, use, or unemployment tax applications.

- Ensure the application is signed as required, adhering to the specific signing guidelines mentioned on the form.

- If opting for voluntary election of unemployment tax coverage, complete Section XI with the necessary information and signature.

After carefully completing all sections and reviewing your information for accuracy, mail the completed application to the Department of Revenue at the provided address. This sets the foundation for your business's compliance with Arizona's tax obligations, allowing you to focus on growing and managing your business.

Understanding Arizona Joint Tax Application

What is the Arizona Joint Tax Application used for?

The Arizona Joint Tax Application is designed to streamline various tax registration processes for businesses within the state. Businesses use this application to apply for licenses such as the Transaction Privilege Tax (TPT), Use Tax, and for employer withholding and unemployment taxes if they have employees. The form serves as a comprehensive tool to register a new business, change ownership details of an existing business, or update business information. It consolidates the process, making it easier for business owners to comply with state tax requirements.

How do I determine the type of ownership or employing unit for my business on the application form?

When completing the section on the type of ownership or employing unit, applicants must select the legal structure or formation of their business. The options include Individual, Association, Partnership, Trust, Limited Liability Company, Corporation, and other forms not specified that require further explanation. The choice dictates the kind of information that needs to be provided, such as the state and date of incorporation for corporations.

What is the Transaction Privilege Tax (TPT), and who needs to obtain a TPT License?

The Transaction Privilege Tax (TPT) is a tax levied on businesses conducting various taxable activities within Arizona. It is a requirement for anyone engaged in activities that fall under the TPT statutes to obtain a TPT License before starting business operations. This includes selling tangible personal property at retail, leasing tangible personal property, and other specified business activities. The license must be acquired for each business or rental location, ensuring that all taxable activities are properly registered and taxed according to state laws.

Can I use the Arizona Joint Tax Application to consolidate licenses for multiple business locations?

Yes, businesses operating in multiple locations under the same ownership can apply for a consolidated TPT license number. This allows for the filing of a single tax return for multiple locations, simplifying the reporting process. However, each location may also be licensed as a separate business with distinct license numbers if preferred for individual reporting of sales and use taxes. Businesses interested in consolidation should specify this when filling out the application, adhering to the guidelines provided for listing various business locations.

What are the fees associated with the Arizona Joint Tax Application, and how are they calculated?

No fees are required for Withholding, Unemployment, or Use Tax registrations. However, there is a fee associated with the Transaction Privilege Tax (TPT) license. To calculate this fee, applicants should multiply $12 by the number of business locations within the state to determine the state fees. Additionally, city fees must be calculated based on the table provided in the application instructions, which varies depending on the city or town where the business operates. The total fee is the sum of state fees and city fees. It's important for applicants to include the appropriate fees when submitting their application to ensure proper processing.

Common mistakes

-

Not completing every required section: The form clearly states that all sections must be completed. Failure to do so will result in the application being returned. This means that every segment asking for information about license type, business information, identification of owners, and so forth, needs to be fully filled out.

-

Misunderstanding the type of ownership: The form offers multiple choices for the type of ownership or employing unit, including individual, partnership, corporation, and others. A common mistake is selecting the wrong category, which could lead to issues in the registration process.

-

Incorrect business information: Providing wrong or outdated business information, such as the legal business name or mailing address, can lead to significant delays. This section is critical for ensuring accurate communication and proper licensing.

-

Forgetting to indicate if selling new motor vehicles tires: This part is often overlooked but is essential for tax purposes. Sellers of new motor vehicle tires must report and pay waste tire fees, which require additional forms.

-

Failure to provide identification information for all owners or partners: The form requires detailed information for each owner, partner, or corporate officer, including social security numbers. Missing data for any member can halt the application process.

-

Not specifying the location of tax records adequately: Applicants must specify where and by whom their tax records are kept. Vague or incomplete information makes it difficult for tax authorities to verify compliance.

-

Incorrect calculation of fees for the Transaction Privilege Tax (TPT): The form requires applicants to calculate state and city fees based on the number of locations. Misunderstanding how to calculate these fees can lead to incorrect payment amounts.

-

Omitting previous owner information for acquired businesses: If acquiring an existing business, providing information about the previous owner is necessary. This mistake can affect the unemployment tax rate and other tax considerations.

-

Not specifying the employment information accurately: This section requires detailed information about wages paid and the number of employees. Providing incorrect figures or omitting this information can affect tax liabilities and employer responsibilities under unemployment insurance.

It's essential for applicants to review their application carefully and verify that all information is accurate and complete before submission. Additionally, consulting the attached instructions can provide clarity and further guidance on filling out the form correctly.

Documents used along the form

When businesses complete the Arizona Joint Tax Application, they often need several other forms and documents to ensure comprehensive compliance with state tax obligations. These additional forms play a crucial role in meeting the requirements for various tax and business registration processes in Arizona.

- Form TPT-1 (Transaction Privilege Tax Return): This form is used by businesses to report and pay tax collected from customers. It's a periodic tax return, typically filed monthly, quarterly, or annually, depending on the business's filing frequency.

- Form UC-001 (Unemployment Tax and Wage Report): Required for reporting wages paid to employees. It helps determine unemployment tax liability. This form is mandatory for employers and is used to report employee wages and calculate unemployment insurance tax.

- Form 10193 (Application for Transaction Privilege Tax Exemption Certificate): For businesses that purchase goods for resale, manufacturing, or other exempt purposes. This certificate allows them to buy goods without paying sales tax.

- Form 5000 (Arizona Resale Certificate): Similar to Form 10193, this certificate is used by retailers when purchasing items for resale. It requires the buyer to provide information to the seller indicating that the transaction is exempt from sales tax.

- Form JT-1 (Joint Tax Application for a New Business): This is the form you file if starting a new business that will require a new TPT license, not an update or change to an existing license. It's integral for registering a new business with both the Department of Revenue and the Arizona Department of Economic Security.

- Form A-4 (Employee's Arizona Withholding Election): Used by employees to determine their state income tax withholding preferences. Employers must keep these forms on file and consider them when withholding Arizona state income tax from employee's paychecks.

- Articles of Incorporation (for Corporations) or Articles of Organization (for LLCs): Not a form per se, but essential documents filed with the Arizona Corporation Commission. They officially establish a business as a legal entity in the state. These documents detail basic information about the business, such as its name, principal address, and the names of its principals.

The completion and submission of these forms and documents, in conjunction with the Arizona Joint Tax Application, are fundamental steps for businesses ensuring compliance with state regulations. Each document serves a specific purpose in the broader framework of business operations and tax responsibilities in Arizona.

Similar forms

The Arizona Joint Tax Application form is quite nuanced, touching on various aspects of business operation and taxation very much like a Business License Application form. The Business License Application is required for legal operation within a city or municipality and often entails detailing aspects of the business such as location, type of business, ownership information, and expected operational scope. Similar to the Joint Tax Application, it's a critical step in establishing a business's legal footing within a particular jurisdiction, ensuring compliance with local business operation standards and tax obligations.

Another document bearing resemblance to the Arizona Joint Tax Application is the Employer Identification Number (EIN) Application Form (SS-4). This form is essential for any business entity to legally hire employees, open business bank accounts, and importantly, pay federal taxes. While the Arizona form encompasses state-specific tax registrations, including transaction privilege sales tax and unemployment insurance, the EIN application registers the business at the federal level. Both forms are vital in laying the groundwork for a business's financial operations and compliance with tax laws.

The Seller's Permit Application also mirrors the Joint Tax Application, particularly in its focus on sales and use tax obligations. Businesses intending to sell or lease tangible personal property that would ordinarily be subject to sales tax must obtain a seller's permit. Like the aspects covered under the Transaction Privilege Tax in the Arizona document, this permit regulates the collection, reporting, and payment of applicable sales and use taxes, ensuring businesses collect state and local taxes from customers and remit them properly.

Comparably, the Workers' Compensation Insurance Application is akin to the Arizona Joint Tax Application because both deal with aspects of employer responsibilities towards employees. While the Arizona form includes sections for withholding and unemployment tax -- essentially preparing an employer to fulfill their tax obligations to their employees and the state -- the Workers' Compensation application is about ensuring that the employer is prepared to provide insurance in the event of a workplace injury. Both documents signify steps towards employer compliance in safeguarding both the administrative and physical well-being of their workforce.

Dos and Don'ts

When approaching the Arizona Joint Tax Application form, precision, diligence, and thoroughness are paramount to ensure a successful submission. While the form's instructions provide a foundation, additional guidance can help streamline the process, ensuring all legal and regulatory requirements are met meticulously. Below are tailored do's and don'ts designed to optimize the completion of this document, favoring clarity, accuracy, and compliance.

Do:

Review all instructions attached to the application carefully before filling out the form, ensuring a comprehensive understanding of each section and its requirements.

Provide accurate and up-to-date information for every section, especially regarding the business's legal name, type of ownership, and precise business activity description.

Ensure that all required fields are completed. If a section does not apply, mark it as "N/A" (Not Applicable) rather than leaving it blank, to indicate that you have reviewed it.

Include supplemental documentation as necessary, such as a copy of the Internal Revenue Service letter of determination for tax-exempt organizations, or a separate sheet listing additional owners or locations if space is insufficient.

Double-check calculations for fees related to the Transaction Privilege Tax (TPT) and city fees, ensuring the total amount due is correct. Be prepared to make adjustments if city fees have changed since the publication of the form.

Don't:

Rush through the application without understanding each requirement. Mistakes or omissions can delay the processing of your form or lead to its rejection.

Forget to sign the form. The application must be signed by individuals legally responsible for the business, such as the sole owner, partners, or corporate officers, without which it is considered incomplete.

Use a P.O. Box address for the primary location of the business. The form explicitly asks for a physical address, which is crucial for proper processing and compliance.

Overlook the necessity to attach lists of additional businesses, percentages owned, and unemployment insurance account numbers if applicable, which are essential for comprehensive and compliant submissions.

Ignore the section on previous owners if acquiring an existing business. Complete transparency is required to accurately transfer responsibilities and entitlements.

Attention to detail, thoroughness in providing comprehensive information, and adherence to the instructions will facilitate a smoother application process. The Arizona Joint Tax Application form represents a critical step in legitimizing business operations within the state, necessitating an approach marked by diligence and precision to ensure conformity with state laws and regulations.

Misconceptions

When filling out or looking into the Arizona Joint Tax Application form, there can be a mix of information and misunderstandings floating around. It's crucial to clear up these misconceptions to ensure the process goes smoothly. Here are five common misconceptions about the Arizona Joint Tax Application form and the facts you should know:

Only for Big Businesses: Many people think that the Arizona Joint Tax Application is only for large or established businesses. However, this form is necessary for all businesses, regardless of size, that are engaging in activities taxable under the Transaction Privilege Tax (TPT) statutes or hiring employees in Arizona.

It’s Complicated: While dealing with any tax-related form can seem daunting, the Arizona Joint Tax Application is designed to be straightforward. It provides clear instructions for each section to guide applicants through the process. There's also support available for any questions or concerns you might have.

Doesn’t Cover Online Businesses: Another common misconception is that this form isn't required for online businesses. If your online business sells to Arizona residents and meets certain criteria, you might need to apply for a TPT License and possibly a Use Tax Registration Certificate.

One-Time Process: Some might think that once they've filled out and submitted this application, they won't have to deal with it again. However, if there are significant changes in your business, such as a change in ownership or the addition of new locations, you may need to update your information or reapply.

No Fees Involved: While there are no fees for Withholding, Unemployment, or Use Tax registrations, there is a misconception that applying for a TPT License is also free of charge. In reality, there is a $12 fee per location for a TPT License, plus applicable city fees.

Understanding these points helps demystify the application process and highlights the importance of this form for anyone conducting business in Arizona. Whether you're just starting or have been in business for a while, making sure you've accurately completed the Arizona Joint Tax Application is key to compliance with state regulations.

Key takeaways

Filling out the Arizona Joint Tax Application form is an essential step for businesses operating within the state, whether you're starting a new venture, hiring employees, or changing ownership. Making sure you understand the key components of this application will help streamline the process and ensure compliance with Arizona state regulations. Here are five key takeaways to keep in mind:

- Complete Every Section: The application explicitly requires every section to be filled out. Incomplete applications are returned, delaying the licensing process. It's crucial to read through each portion carefully and provide all requested information to avoid unnecessary setbacks.

- Understand the License Types: The form caters to various licenses, including Transaction Privilege Tax (TPT), Withholding/Unemployment Tax, and Use Tax. Depending on your business activities, you may need to apply for one or more of these licenses. For instance, TPT is mandatory for most sales-related activities, whereas Unemployment Tax applies if you're hiring employees.

- Identify Your Business Accurately: The form asks for detailed business information, including the legal business name and the type of ownership or employing unit. This information is vital for tax purposes and must reflect your official business documents.

- Know Your Tax Obligations: The form instructs applicants on specific tax obligations, such as waste tire fees for sellers of new motor vehicles and tires, and the requirement to report and pay based on the cash receipts or accrual method. It's important to check the applicable boxes and understand these obligations to maintain compliance.

- Signatures Are Mandatory: The application must be signed by individuals legally responsible for the business. This is a declaration under penalty of perjury that the information provided is true and correct. Without the proper signatures, the application cannot be processed.

Finally, while the form does point out that there are no fees for obtaining Withholding, Unemployment, or Use Tax registrations, TPT licenses do incur a fee calculated based on the number of business locations. Being thorough and precise when completing your Arizona Joint Tax Application form not only expedites the process but also helps establish your business on a firm legal foundation from the start.

Popular PDF Documents

What Is Amt Depreciation - Understanding and accurately completing IRS 6251 can avoid unnecessary audits or questions from the IRS about AMT.

IRS 1040-SR - 1040-SR provides a standard deduction chart that is higher for seniors, helping them potentially reduce their taxable income.