Get Application For Tax Clearance Form

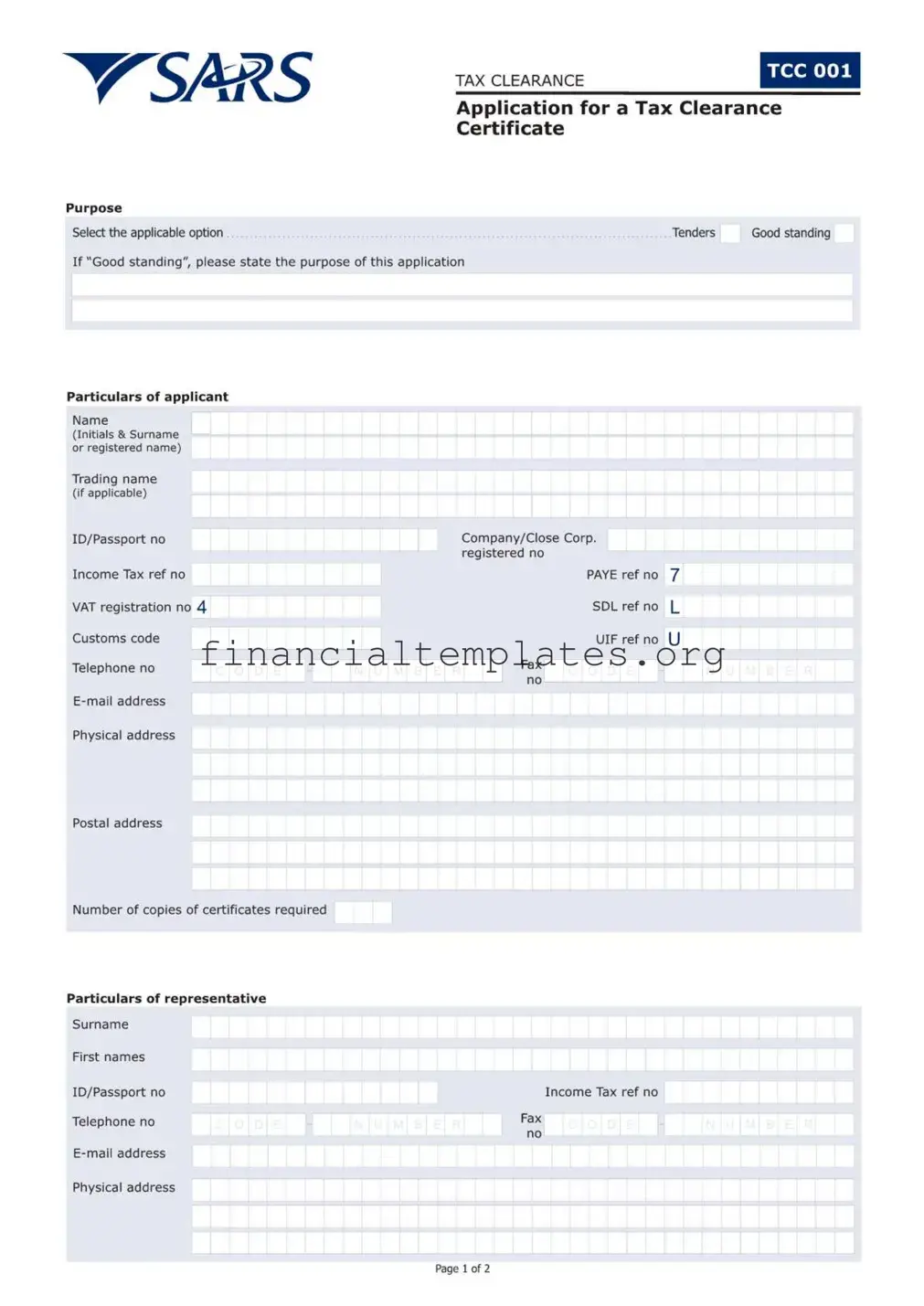

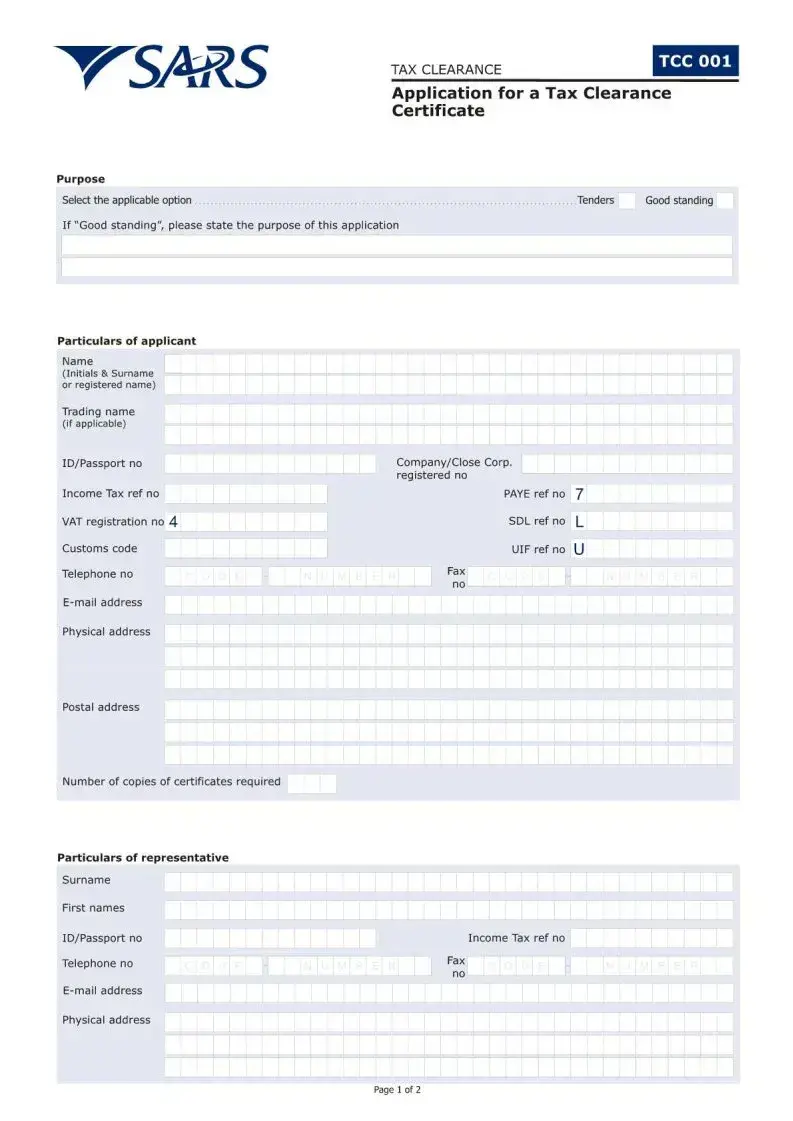

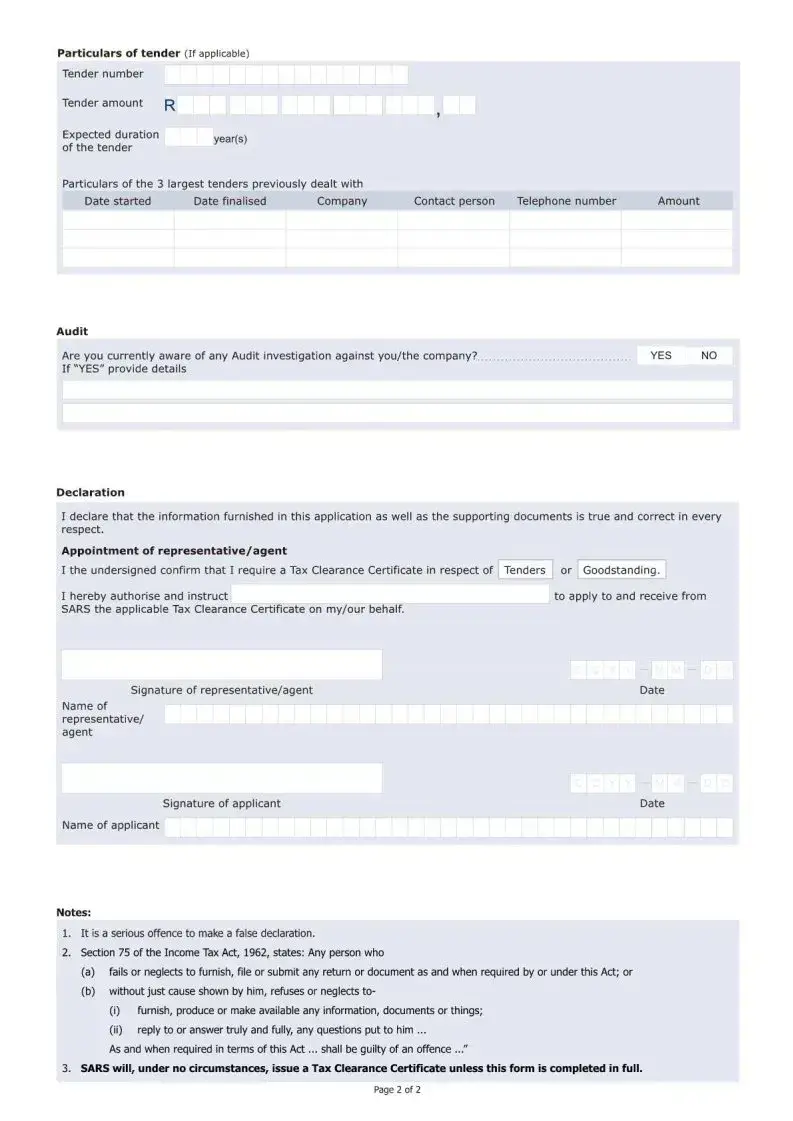

Navigating the complexities of tax compliance is a critical task for individuals and businesses aiming to maintain their good standing or partake in tender processes within a regulatory framework. The Application for Tax Clearance form, a pivotal document facilitated by the South African Revenue Service (SARS), serves as a gateway for such entities to demonstrate their adherence to tax obligations. This form, identified by its code TCC 001, encapsulates multiple sections including the purpose of the application, comprehensive particulars of the applicant and their representative, with an additional focus on tender-related details if applicable. Importantly, it addresses the applicant's history with the 3 largest tenders and probes into the current audit investigations to ensure transparency and accuracy in the applicant's financial declarations. The serious undertone of the process is underscored by a declaration segment where applicants affirm the truthfulness of their provided information and the legal consequences of failing to comply with tax requirements as stipulated in Section 75 of the Income Tax Act, 1962. These components collectively highlight the form's role not just as a procedure, but as an affirmation of an entity's fiscal responsibility and integrity. Completing this form accurately, and in its entirety, is presented as an unequivocal prerequisite by SARS to entertain any requests for issuing a Tax Clearance Certificate, thereby emphasizing the criticality of this document in facilitating lawful business operations and financial interactions.

Application For Tax Clearance Example

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The form is used to apply for a Tax Clearance Certificate, necessary for tenders or confirming good standing with the South African Revenue Service (SARS). |

| Sections Included | It contains sections for applicant details, representative particulars, tender information, and previous tender details. |

| Legal Consequences | Making a false declaration on the form is considered a serious offence which can lead to legal consequences. |

| Governing Law | Section 75 of the Income Tax Act, 1962, outlines the legal obligations and consequences relative to submissions and declarations to SARS. |

| Completion Requirement | SARS mandates that the form must be fully completed to issue a Tax Clearance Certificate. |

| Audit Clause | Applicants must disclose any current audit investigations against them, with an option to provide details if applicable. |

Guide to Writing Application For Tax Clearance

Filling out an Application for Tax Clearance Certificate is a necessary step for individuals or companies needing to prove their tax status for various reasons, such as tender applications or confirming good standing with the South African Revenue Service (SARS). It is important to provide accurate and complete information to avoid potential legal consequences. The following steps will guide you through the process of completing the form accurately.

- Purpose: Start by specifying the reason you need a Tax Clearance Certificate—either for Tenders or Goodstanding.

- Particulars of Applicant: Fill in all the required details about the applicant, including name, tax reference number, and contact information.

- Particulars of Representative: If you have a representative or agent, provide their details in the designated section. This includes name, relationship to the applicant, and contact information.

- Particulars of Tender (If applicable): If the application relates to a specific tender, provide the relevant details. This includes the date started, date finalized, company, contact person, telephone number, and the amount of the 3 largest tenders previously dealt with.

- Audit: Indicate whether there is any current audit investigation against the applicant or the company. If yes, provide a brief description.

- Declaration: Acknowledge the declaration section by verifying that all the information provided on the form and in the supporting documents is true and correct.

- Appointment of Representative/Agent: If you are appointing a representative or agent, confirm this by including their information and specifying the authority given to them regarding the application for and receipt of the Tax Clearance Certificate from SARS.

- Review all the information provided for accuracy, then sign and date the form.

After submitting the completed Application for Tax Clearance Certificate to SARS, it is important to wait for the processing to be completed. SARS will review the application and, provided that everything is in order, will issue the Tax Clearance Certificate. This certificate serves as proof that the individual's or company’s tax affairs are in good standing, which is often a requirement for tender applications or for verifying tax compliance status. Remember, SARS will not issue a Tax Clearance Certificate unless the form is completed in full and all required supporting documents are provided. Mistakes or omissions can delay the process, so ensure all information is accurate and complete.

Understanding Application For Tax Clearance

Frequently Asked Questions about the Application for Tax Clearance Certificate

- What is the purpose of the Application for Tax Clearance Certificate?

- What information is required on the form?

- What are the consequences of providing false information on the Application for Tax Clearance Certificate?

- Will SARS issue a Tax Clearance Certificate if the form is not fully completed?

The Application for Tax Clearance Certificate, known as TCC 001, serves two main purposes. It is used by individuals or entities to apply for a clearance certificate indicating they are in good standing with the South African Revenue Service (SARS) for either tenders or for confirmation of good tax standing. This document is crucial for conducting business with the government and for ensuring compliance with tax obligations.

The form requires detailed information in several sections: the particulars of the applicant, the particulars of the representative (if applicable), and details related to tenders (if applicable), including information on the three largest tenders previously handled. Additionally, it asks whether the applicant is currently aware of any audit or investigation against them by SARS. A declaration stating that all information and supporting documents provided are true and correct must also be signed.

Providing false information on the Application for Tax Clearance Certificate is a serious offence. According to Section 75 of the Income Tax Act, 1962, failing to accurately furnish, file, or submit documents as required, or refusing or neglecting to provide truthful answers or supply necessary documentation, is considered an offence and may result in legal penalties. It is crucial to ensure all information provided on the form is accurate and truthful to avoid these consequences.

No, SARS strictly requires that the Application for Tax Clearance Certificate (TCC 001) be completed in full. Every section of the form must be accurately filled out, and all necessary supporting documents must be provided. Failure to do so will result in SARS not issuing the Tax Clearance Certificate, as the agency needs complete and accurate information to process the application and verify the applicant’s tax standing.

Common mistakes

When filling out the Application for Tax Clearance Certificate, several common mistakes can occur. These mistakes can delay the processing of the application or even result in rejection.

- Not completing the form in full: SARS requires every section of the form to be filled out to process the application. Leaving sections blank can lead to delays or rejection.

- Providing incorrect particulars for the applicant or representative: Details must match official documents. Mistakes here can raise questions about the validity of the application.

- Failing to declare current audits: If there is an ongoing audit investigation against the applicant or their company, not disclosing this information can have serious consequences.

- Misrepresenting information related to previous tenders: The section on the three largest tenders previously dealt with must be filled out accurately. Errors or omissions can be seen as deceitful.

- Incorrectly appointing a representative or agent: If the authority given to SARS to communicate with a representative or agent is not clearly authorised, this can delay processing.

- Forgetting to sign the declaration: The application requires a signature to confirm that the information provided is true and correct. An unsigned form is considered incomplete.

- Overlooking the importance of accurate contact details: Ensuring the telephone number and other contact information is correct is crucial for any follow-up or clarification.

Avoiding these mistakes requires careful attention to detail and a thorough review of the application before submission. Ensuring accuracy and completeness helps in the smooth processing of the tax clearance certificate application.

Documents used along the form

Filing for a Tax Clearance Certificate is a critical step for businesses and individuals aiming to prove their tax compliance. Beyond this essential document, several other forms and documents are often needed throughout this process. Each serves a unique purpose, complementing the Tax Clearance Certificate application to ensure comprehensive compliance and validation of an entity's tax status.

- Certificate of Good Standing: This document verifies that a company is in compliance with state regulations and has paid all its necessary dues. It's crucial for businesses maintaining or applying for professional licenses.

- Annual Business Reports: These reports provide a yearly snapshot of a company's financial and operational status. They may be required to corroborate the information on the tax clearance application.

- Proof of Payment of Outstanding Taxes: Documents evidencing payment of any owed taxes are critical. They serve as confirmation that the applicant has settled outstanding tax liabilities.

- Articles of Incorporation: For companies, the Articles of Incorporation establish the legal existence of the corporation. This document may be required to confirm the business's legal status and structure.

- Financial Statements: Current financial statements offer a detailed overview of a company's financial health. These can be requested to verify the accuracy of tax filings.

- Power of Attorney: If an agent or representative is applying for a Tax Clearance Certificate on behalf of someone else, a Power of Attorney document is necessary. It legitimizes the representative's authority to act.

Together, these documents build a comprehensive case for the issuance of a Tax Clearance Certificate. They ensure that the application is backed by solid evidence of compliance and good standing, paving the way for successful business operations and engagements. Thus, preparing these documents in conjunction with the Application for Tax Clearance form is a proactive step towards streamlining the approval process.

Similar forms

An Employment Eligibility Verification Form (I-9) shares similarities with the Application for Tax Clearance form in its need for accurate and truthful personal information. Both documents require the applicant to declare that the information provided is true and correct, and both can lead to legal consequences if false information is submitted. While the Tax Clearance form is specific to tax obligations, the I-9 ensures compliance with employment eligibility laws in the U.S.

The Application for Employer Identification Number (EIN) is another document closely related to the Tax Clearance form, as both are integral to the tax identification processes within businesses. They seek to establish the legitimacy and tax obligations of entities or individuals. Completing either form inaccurately can result in significant penalties or investigations by tax authorities.

The W-9 form, Request for Taxpayer Identification Number and Certification, parallels the Tax Clearance form in its function to collect tax-related identification information. Both forms are crucial for tax reporting and compliance, although the W-9 is often used by contractors and freelancers in the U.S. to provide their tax information to those who will pay them.

A Business License Application also corresponds with aspects of the Tax Clearance form, particularly in terms of compliance and providing accurate business details. While the Tax Clearance form focuses on tax obligations, business licenses pertain to the legal operation within a specific locale. Both are necessary for the lawful operation of a business and require full and truthful disclosure of relevant information.

The Permit to Operate Application is akin to the Tax Clearance form in its regulatory nature, ensuring businesses or individuals meet specific standards before engaging in certain activities. While tax clearance focuses on fiscal responsibilities, permits often address health, safety, or environmental standards, showcasing the broader scope of regulatory compliance.

Disclosure of Ownership and Control Interest Statement forms, commonly used in healthcare and social service industries, share the emphasis on full disclosure of information as seen in the Tax Clearance form. These documents are designed to prevent fraud and ensure accountability, requiring detailed information about entities' or individuals' ownership or control interests.

The Request for Proposal (RFP) submission process, while not a form per se, necessitates a level of detail and truthfulness comparable to the Tax Clearance application, especially when submitting past performance details and financial qualifications, which might include tax clearance certificates as part of the vetting process.

The Tax Return form, for either individuals or businesses, is inherently connected to the Tax Clearance form. Both are critical pieces of the tax compliance puzzle. Filing tax returns accurately is a prerequisite for obtaining tax clearance in many jurisdictions, linking the documents in their purpose to ensure the taxpayer meets all fiscal obligations.

Financial Statement forms, used for a variety of purposes including loan applications and business assessments, require the same level of accuracy and completeness as the Tax Clearance form. Both kinds of documents need truthful representations of financial status and can have serious implications if falsified.

Lastly, the Change of Address form for tax authorities, while simple, shares the requirement for current and accurate information with the Tax Clearance form. Keeping address details up to date is crucial for receiving pertinent tax documents and notifications, including the clearance certificate.

Dos and Don'ts

When it comes to applying for a Tax Clearance Certificate, there are several important steps you need to follow to ensure the process goes smoothly. Paying attention to both what you should and shouldn't do can save you time and prevent potential issues. Here is a list of do's and don'ts when filling out the Application for Tax Clearance form.

Do:- Ensure Accuracy: Double-check all the information you provide on the form to ensure it is accurate. Accurate information is crucial for a successful application.

- Complete every section: It’s important to fill out every required section of the form. SARS will not issue a Tax Clearance Certificate unless the form is fully completed.

- Include Supporting Documents: Attach all necessary supporting documents that are relevant to your application. This will help in verifying the details provided.

- Be Honest: If there is an ongoing audit investigation, it is vital to disclose this information. Honesty in your application helps prevent legal issues.

- Leave Sections Blank: Do not skip any sections or leave them blank. Incomplete forms can lead to the rejection of your application.

- Make False Declarations: Avoid providing false information or making false declarations. This is considered a serious offence and can result in penalties.

- Ignore Instructions: Carefully read and follow all instructions provided with the application form. Ignoring instructions may lead to errors in your application.

- Forget to Sign the Form: Ensure the form is signed by the appropriate party, whether it's by the applicant or their authorized representative. An unsigned form will not be processed.

Misconceptions

When it comes to applying for a Tax Clearance Certificate (TCC) with the Application for Tax Clearance form, there are plenty of misconceptions that can lead to confusion. Understanding these misconceptions is key to ensuring a smooth application process. Here’s a list of 10 common misunderstandings and the truth behind each.

- Only businesses need a Tax Clearance Certificate. Individuals may also require a Tax Clearance Certificate for various reasons, such as emigration or for specific financial transactions. It's not solely for businesses engaging in tender processes.

- Getting a Tax Clearance Certificate is an instant process. While the South African Revenue Service (SARS) strives to process applications efficiently, it may take time to issue a Tax Clearance Certificate. This duration can vary depending on the complexity of your tax status and the volume of applications being processed.

- If your taxes are up to date, a Tax Clearance Certificate is guaranteed. Being current with your taxes is a vital requirement, but SARS also considers other aspects of your tax compliance, such as the accuracy of the information provided and any ongoing audits or investigations.

- Completing the application form is all you need to do. Along with the application form, you may need to submit additional documents supporting your tax status and compliance. SARS will specify what is needed based on your circumstances.

- The Tax Clearance Certificate is valid indefinitely. Tax Clearance Certificates have an expiration date. The validity period can depend on what the certificate is for, such as tenders or good standing, and it's essential to note this expiry date to ensure your certificate is valid when needed.

- Any mistake on the form can easily be corrected after submission. Mistakes on the application can lead to delays or even the refusal of a Tax Clearance Certificate. It's crucial to review your application thoroughly before submitting it to avoid such issues.

- You can only apply for a Tax Clearance Certificate for current tax compliance. Besides verifying current tax compliance, you can request a Tax Clearance Certificate to cover specific past periods, especially relevant in cases involving tenders or audits.

- There's no need to declare ongoing audits if you’re not at fault. It is mandatory to disclose any ongoing audits or investigations against you or your company, regardless of fault. Failure to do so can result in penalties or a refusal to issue a Tax Clearance Certificate.

- A representative or agent cannot handle the application process on your behalf. You can authorize a representative or agent to apply for and receive a Tax Clearance Certificate on your behalf. This requires completing the relevant section of the application form and may necessitate additional documentation.

- SARS will issue a Tax Clearance Certificate even if the form is not fully completed. As clearly stated in the application notes, SARS will not issue a Tax Clearance Certificate unless the form is completed in full. Ensuring every section is accurately filled out is essential for the successful issuance of your certificate.

Understanding and addressing these misconceptions before you apply for a Tax Clearance Certificate can greatly improve your chances of a smooth and successful application process.

Key takeaways

When applying for a Tax Clearance Certificate with the South African Revenue Service (SARS), the Application For Tax Clearance TCC 001 form must be thoroughly completed. Here are key takeaways to ensure a smooth application process:

- Ensure all sections of the form are filled out accurately, including the "Purpose," "Particulars of the applicant," "Particulars of representative," and if applicable, "Particulars of tender." Any inaccuracies can delay the process.

- Be ready to disclose information about the three largest tenders you have previously dealt with, including dates, company names, contact information, and amounts. This information is crucial for assessing your application.

- If there is an ongoing audit or investigation against you or your company, you must declare it in the form. Failure to disclose such information can result in legal repercussions.

- An essential part of the application is the declaration that all information provided, along with supporting documents, is true and correct. It is a serious offence to make a false declaration, potentially leading to legal action.

- Appointment of a representative or agent must be clearly confirmed within the form if you require someone else to apply and receive the Tax Clearance Certificate on your behalf.

- Note that SARS will not issue a Tax Clearance Certificate unless the form is completed in full. This emphasizes the importance of thoroughly reviewing the application before submission.

Understanding these key points can significantly enhance the process of applying for a Tax Clearance Certificate, ensuring compliance with tax laws and regulations. Remember, making a false declaration or failing to provide required information can have severe consequences under the Income Tax Act of 1962.

Popular PDF Documents

Irs Form 1024 - Mistakes on the IRS 1024 form can delay the exemption process, highlighting the need for careful completion.

1065 Vs 1120 - Alerts shareholders to any alternative minimum tax items that may impact their individual tax calculations.

Alternative Minimum Tax Credit - Offers a pathway for financial relief and adjustment for those impacted by the AMT in prior years.